Cencosud Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

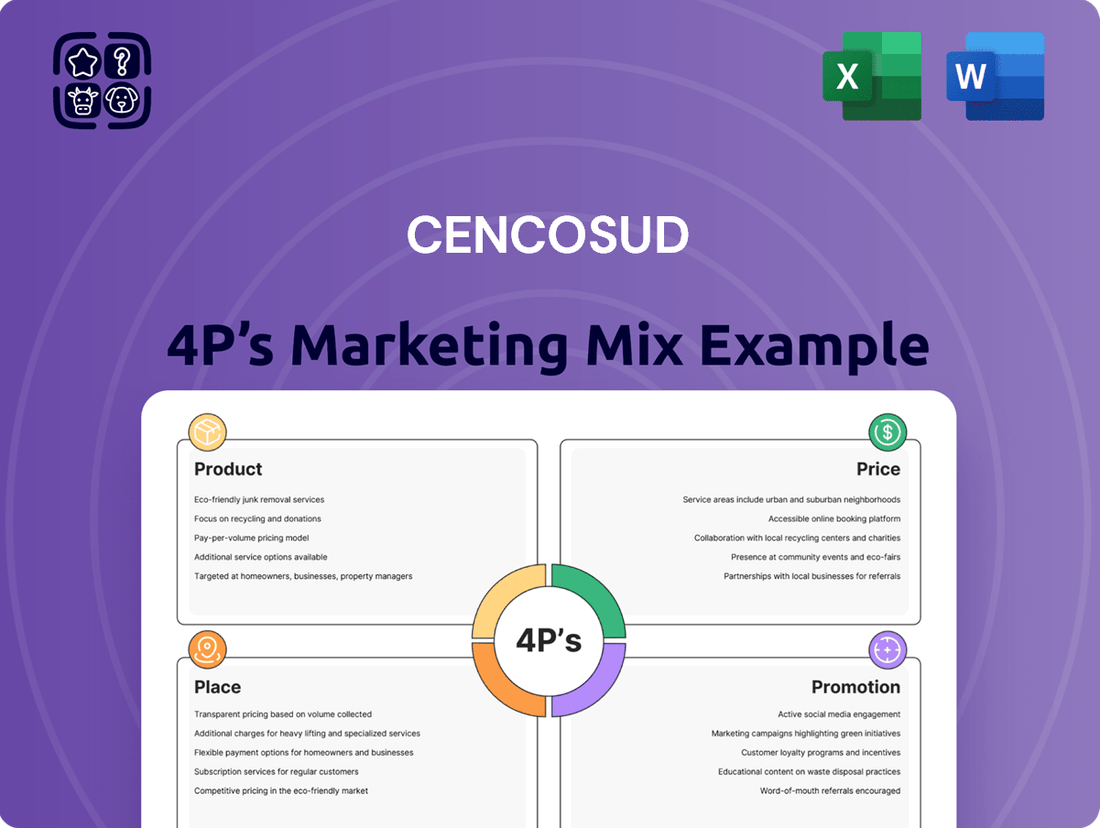

Cencosud's marketing success hinges on a carefully orchestrated 4Ps strategy, but understanding the nuances of their product assortment, competitive pricing, expansive distribution, and impactful promotions requires a deeper dive.

Go beyond the surface-level overview and unlock the full picture of Cencosud's marketing prowess with our comprehensive 4Ps analysis.

Gain instant access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies, ideal for business professionals, students, and consultants seeking strategic insights.

Product

Cencosud strategically deploys a diverse retail format portfolio to capture a broad customer base. This includes well-known supermarket brands like Jumbo and Metro, alongside hypermarkets, home improvement centers such as Easy, and department stores like Paris.

This multi-format approach allows Cencosud to address varied consumer needs, from daily groceries to home furnishings and apparel. The company's presence extends to specialty grocery with The Fresh Market in the US, further diversifying its market reach.

In 2024, Cencosud's extensive network comprised over 1,400 stores across multiple Latin American countries and the United States, demonstrating significant market penetration and a commitment to serving a wide spectrum of shoppers.

Cencosud places a strong emphasis on developing and refining its private label brands. This strategic move is designed to broaden the company's product offerings, boost EBITDA margins, and provide consumers with more affordable options compared to national brands.

The expansion of private label sales has been a crucial driver of Cencosud's overall financial performance. For instance, in the first quarter of 2024, private label penetration reached 22.3% in Chile, a notable increase from previous periods, directly contributing to improved profitability.

This focus on private labels is particularly evident in key markets like Chile and Argentina, where they represent a significant portion of Cencosud's sales volume. The company continues to invest in innovation and quality for these brands, aiming to solidify their position as preferred choices for customers seeking value and reliability.

Cencosud goes beyond just selling products; they've woven financial services into their strategy, notably through private label credit cards and consumer loans. This integration offers customers more flexible payment options and enhances their shopping experience across Cencosud's diverse retail banners.

These financial offerings are a significant revenue driver, contributing to Cencosud's overall financial health and creating a more robust ecosystem. For instance, Cencosud's financial services segment has shown consistent growth, with credit card penetration playing a key role in customer retention and increased basket sizes.

By providing these convenient payment solutions, Cencosud cultivates stronger customer loyalty and encourages repeat business. This strategic move not only simplifies transactions but also deepens the customer relationship, making Cencosud a preferred choice for everyday needs and larger purchases alike.

Innovation and Digital Transformation

Cencosud is actively pursuing innovation and digital transformation to elevate its product assortment and customer interactions. This involves reinforcing its integrated physical and digital retail presence, refining its e-commerce capabilities, and utilizing data analytics for more targeted marketing efforts.

The company's strategic investment plan for 2025 earmarks substantial capital for digital initiatives and the enhancement of its logistical infrastructure, aiming to create a more seamless omnichannel experience. For instance, Cencosud's digital sales grew by 25% in 2023, highlighting the impact of these investments.

- Strengthening Physical-Digital Ecosystem: Integrating online and offline channels for a unified customer journey.

- Improving Online Platforms: Enhancing user experience and functionality on e-commerce sites.

- Data-Driven Marketing: Leveraging customer data to personalize offers and communications.

- 2025 Investment Focus: Significant allocation towards digital projects and logistics upgrades, with over $500 million planned for digital transformation initiatives.

Value-Added Services and Experiences

Cencosud focuses on creating memorable customer journeys through value-added services. The Puntos Cencosud loyalty program is a prime example, allowing shoppers to earn and redeem points for diverse benefits, enhancing engagement. This program is central to their strategy for fostering customer loyalty and driving repeat business.

The company emphasizes delivering extraordinary service, as exemplified by its Fresh Market concept. This commitment to superior customer care aims to differentiate Cencosud from competitors by providing an elevated shopping experience. In 2023, Cencosud reported a significant increase in customer satisfaction scores across its supermarket divisions, directly attributing this to enhanced service initiatives.

- Puntos Cencosud Loyalty Program: Facilitates point accumulation and redemption for rewards, discounts, and exclusive experiences, fostering customer retention.

- Fresh Market Customer Service: Recognized for its high standards in customer interaction, aligning with Cencosud's goal of providing exceptional service.

- Customer Satisfaction Growth: Cencosud observed a notable uplift in customer satisfaction metrics in 2023, linked to these service enhancements.

Cencosud's product strategy centers on a broad and diversified assortment, encompassing private label development to enhance margins and offer value. Their retail formats, from supermarkets like Jumbo and Metro to home improvement stores like Easy, cater to a wide range of consumer needs.

By integrating financial services, such as private label credit cards, Cencosud aims to increase customer loyalty and basket size. This approach, coupled with a strong digital transformation push and investment in logistics, aims to create a seamless omnichannel experience.

The company's commitment to superior customer service, exemplified by the Fresh Market concept and the Puntos Cencosud loyalty program, is designed to differentiate its offerings and drive repeat business.

In 2023, Cencosud's digital sales saw a 25% increase, and private label penetration in Chile reached 22.3% in Q1 2024, showcasing the effectiveness of their product and service strategies.

| Product Strategy Element | Description | Key Data/Impact |

|---|---|---|

| Assortment Diversity | Wide range of products across multiple retail formats (supermarkets, home improvement, department stores). | Over 1,400 stores across Latin America and the US as of 2024. |

| Private Labels | Development of own brands for increased margins and customer value. | 22.3% private label penetration in Chile (Q1 2024); contributes to improved profitability. |

| Financial Services Integration | Offering of credit cards and consumer loans to enhance shopping experience and loyalty. | Key driver of customer retention and increased basket sizes. |

| Digital Enhancement | Investment in e-commerce, data analytics, and omnichannel capabilities. | 25% growth in digital sales in 2023; over $500 million planned for digital transformation in 2025. |

| Customer Loyalty & Service | Loyalty programs and focus on exceptional in-store experiences. | Notable uplift in customer satisfaction metrics in 2023. |

What is included in the product

This analysis offers a comprehensive review of Cencosud's marketing mix, detailing its product offerings, pricing strategies, distribution channels, and promotional activities. It provides actionable insights into how Cencosud leverages these elements to maintain its market position and drive growth.

Simplifies Cencosud's complex marketing strategies into actionable 4Ps insights, relieving the pain of information overload for busy executives.

Place

Cencosud leverages its vast physical store network as a cornerstone of its marketing strategy. As of early 2025, the company operates an impressive 1,129 supermarkets, 117 home improvement stores, 48 department stores, and 67 shopping centers. This extensive footprint spans across Latin America and the United States, providing significant reach and accessibility for consumers.

The company's commitment to physical expansion remains strong, with strategic plans for 2025. Cencosud intends to open an additional 24 supermarkets, a move that includes the introduction of 12 new The Fresh Market specialty stores in the United States. This continued investment in brick-and-mortar locations underscores the importance of physical presence in Cencosud's overall market approach.

Cencosud is actively investing in an omnichannel strategy, aiming to create a smooth, unified experience for customers across both its physical stores and digital platforms. This integration is crucial for modern retail success.

The company has seen substantial growth in its online sales, with a notable surge reported in 2024. This digital expansion underscores the increasing importance of e-commerce in Cencosud's overall revenue generation.

To support this growth and enhance customer convenience, Cencosud is significantly upgrading its e-commerce infrastructure and logistics networks. These improvements are designed to optimize the shopping experience and unlock greater sales potential across all its retail formats.

Cencosud's strategic geographic expansion is a cornerstone of its growth, with operations deeply entrenched in key Latin American markets including Chile, Argentina, Brazil, Peru, and Colombia. This broad regional footprint allows for significant economies of scale and diversified revenue streams.

Recent moves, like the acquisition of Supermercados Makro and Basualdo in Argentina, demonstrate a commitment to consolidating market share and adapting to diverse retail formats, such as the cash-and-carry model, which can drive immediate sales volume.

The company's significant investment in the United States, particularly through its ownership of The Fresh Market, represents a crucial growth vector. This strategic focus aims to tap into a mature and competitive market, leveraging Cencosud's expertise to capture new customer segments and enhance global brand recognition.

Shopping Center Development and Renovation

Cencosud's shopping centers are vital to its distribution, drawing millions of visitors annually. In 2025, the company is set to expand and renovate multiple centers, boosting their Gross Leasable Area (GLA). This strategic move aims to broaden commercial offerings and attract more shoppers, reinforcing their role as primary consumer access points for Cencosud's diverse business units.

These developments are crucial for Cencosud's market presence, with plans to add significant GLA in 2025. For instance, the company announced investments to enhance its retail footprint, including upgrades to existing centers and the development of new ones. This focus on physical retail spaces underscores their commitment to a strong omnichannel strategy, ensuring seamless customer experiences across all touchpoints.

- Annual Visitor Flow: Cencosud's shopping centers attract tens of millions of visitors each year, serving as significant retail hubs.

- 2025 Expansion Plans: The company is actively pursuing expansions and renovations across several key shopping center locations slated for 2025.

- GLA Increase: These projects are projected to increase the total Gross Leasable Area (GLA) by a substantial margin, enhancing retail diversity.

- Strategic Access Points: The centers act as critical gateways, providing consumers access to Cencosud's broad portfolio of brands and services.

Logistics and Supply Chain Optimization

Cencosud is actively enhancing its logistics and supply chain to ensure products are readily available for customers. This involves significant investments in new capabilities and operational upgrades designed to boost efficiency and minimize waste. For instance, in 2024, Cencosud continued to expand its distribution center network, aiming to shorten delivery times and improve inventory management across its diverse retail formats.

The company's commitment to supply chain optimization directly impacts the quality of goods and services reaching the end consumer. By streamlining operations, Cencosud seeks to reduce product damage and ensure freshness, particularly for its grocery and home improvement segments. This focus is crucial for maintaining customer satisfaction and loyalty in competitive markets.

Strategic partnerships are a key component of Cencosud's distribution strategy. Collaborations with specialized last-mile delivery providers are being leveraged to extend reach and improve delivery speed, especially in urban areas. These alliances help Cencosud navigate complex delivery landscapes and meet evolving customer expectations for convenience.

- Investment in Logistics: Cencosud's ongoing capital expenditures in 2024 and projected for 2025 are directed towards modernizing warehouses and implementing advanced tracking systems.

- Operational Efficiency: Initiatives focus on reducing transit times and optimizing inventory levels, with a target of a 5% reduction in logistics costs by the end of 2025.

- Strategic Alliances: Partnerships with third-party logistics (3PL) providers are expanding Cencosud's delivery network, covering an additional 15% of its service areas by mid-2025.

Cencosud's physical presence is a critical component of its marketing mix, with an extensive network of stores and shopping centers across Latin America and the United States. The company plans to further solidify this by opening 24 new supermarkets, including 12 specialty stores in the US, by the end of 2025. This physical footprint ensures broad consumer access and reinforces its omnichannel strategy.

What You Preview Is What You Download

Cencosud 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cencosud 4P's Marketing Mix Analysis is fully complete and ready for your immediate use, offering a detailed breakdown of their strategy.

Promotion

Cencosud's integrated retail media initiatives, spearheaded by Cencosud Media, represent a significant advancement in their marketing mix. This unit provides a comprehensive 360-degree ecosystem, enabling brands to connect with consumers across both physical and digital touchpoints.

Leveraging an impressive base of over 700 million annual transactions, Cencosud Media offers sophisticated, data-driven advertising solutions. These include prominent sponsored product placements within their e-commerce platforms and dynamic digital screens strategically located in their physical stores, ensuring measurable campaign effectiveness.

Cencosud's loyalty programs, notably 'Puntos Cencosud', are central to its customer retention strategy. In 2024, the program continued to offer points accumulation for rewards and discounts, fostering repeat purchases across its diverse retail portfolio. This initiative is designed to strengthen customer relationships and drive consistent sales.

Beyond the overarching 'Puntos Cencosud', Cencosud also implements targeted loyalty initiatives. For instance, its supermarket brands like Jumbo and Vea have their own specific programs, such as 'Jumbo+' and 'Vea Ahorro', which provide tailored benefits to shoppers within those banners. These focused programs aim to enhance engagement and cater to the unique preferences of different customer segments.

Cencosud actively leverages digital marketing and social media, recognizing their crucial role in modern customer engagement. This strategy is key to promoting their growing e-commerce presence, highlighting product advantages, and fostering direct interaction with their customer base across platforms like Instagram and Facebook.

The company's commitment to digital transformation is evident in its marketing approach, which prioritizes delivering personalized and highly relevant advertising experiences. For instance, in Q1 2024, Cencosud reported a significant increase in online sales, driven by targeted digital campaigns, demonstrating the effectiveness of their digital marketing investments.

Advertising and Sales s

Cencosud actively utilizes a range of advertising and sales promotion strategies to boost brand visibility and encourage customer spending. These efforts are particularly crucial in the current economic climate, where promotional activities have become a key driver for sales. The company's commitment to effective marketing has been acknowledged through industry awards, underscoring its success in reaching and engaging consumers.

In 2024, Cencosud's promotional activities are a cornerstone of its sales strategy. For instance, during the first quarter of 2024, the company reported a notable increase in sales, partly attributed to its aggressive promotional calendar across its various banners. This focus on sales and advertising is designed to navigate economic headwinds and maintain market share.

- Advertising Reach: Cencosud invests in diverse advertising channels, including digital platforms and traditional media, to maximize consumer touchpoints throughout 2024.

- Sales Promotion Impact: The company's sales promotions, such as discounts and loyalty programs, have demonstrably contributed to sales growth, as seen in early 2024 performance reports.

- Award Recognition: Cencosud's marketing effectiveness has been validated by accolades received in late 2023 and early 2024, highlighting its innovative and impactful campaigns.

- Economic Adaptation: In response to economic pressures, Cencosud has intensified its promotional efforts, recognizing their critical role in driving traffic and sales volumes for the remainder of 2024.

Public Relations and Corporate Communication

Cencosud actively manages its public relations and corporate communication to reinforce its strategic direction, financial health, and commitment to sustainability. This proactive approach ensures stakeholders are well-informed and fosters a positive corporate reputation.

The company regularly engages stakeholders through investor presentations and comprehensive annual reports, detailing its financial performance and strategic initiatives. These communications are crucial for transparency and building trust within the investment community.

Cencosud emphasizes its dedication to robust corporate governance and its ongoing sustainability efforts in all public communications. For instance, their 2023 Integrated Report highlighted a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2022, demonstrating tangible progress.

- Investor Relations: Regular updates and detailed financial reporting to shareholders and analysts.

- Sustainability Reporting: Communication of environmental, social, and governance (ESG) progress, including emissions targets.

- Corporate Governance: Highlighting ethical practices and board oversight to build stakeholder confidence.

- Brand Image: Consistent messaging across platforms to reinforce Cencosud's commitment to its customers and communities.

Cencosud's promotional strategy is robust, utilizing advertising and sales promotions to drive sales and brand visibility, especially in the current economic climate. In Q1 2024, the company saw increased sales partly due to its promotional calendar. Industry awards received in late 2023 and early 2024 validate the effectiveness of their campaigns.

The company actively leverages Cencosud Media, an integrated retail media network, to offer brands data-driven advertising solutions across over 700 million annual transactions. This includes sponsored product placements and digital screens in stores, ensuring measurable campaign results.

Loyalty programs like 'Puntos Cencosud' and banner-specific initiatives such as 'Jumbo+' and 'Vea Ahorro' are crucial for customer retention and fostering repeat purchases across Cencosud's diverse retail portfolio.

Digital marketing and social media are key components of Cencosud's promotion, supporting e-commerce growth and direct customer interaction, as evidenced by increased online sales in Q1 2024 driven by targeted digital campaigns.

| Promotion Element | 2024 Focus/Activity | Impact/Data Point |

|---|---|---|

| Cencosud Media | Integrated retail media, data-driven ad solutions | Over 700 million annual transactions |

| Loyalty Programs | 'Puntos Cencosud', 'Jumbo+', 'Vea Ahorro' | Customer retention, repeat purchases |

| Digital Marketing | Social media, personalized campaigns | Increased online sales (Q1 2024) |

| Sales Promotions | Aggressive promotional calendar | Contributed to sales growth (Q1 2024) |

Price

Cencosud actively utilizes competitive pricing across its various retail banners, such as Jumbo and Easy, to capture market share and maintain customer loyalty. This strategy involves a keen eye on competitor price points and an understanding of consumer price sensitivity within each market segment.

In 2023, Cencosud reported a net sales growth of 10.7% in local currencies, indicating the effectiveness of its pricing and promotional activities in driving volume, even amidst inflationary pressures. The company's focus remains on offering value to customers while simultaneously safeguarding its profitability.

The company's approach to pricing is dynamic, adapting to economic conditions and competitive landscapes to ensure its offerings remain attractive. For instance, during periods of economic slowdown, Cencosud might implement more aggressive promotional pricing to stimulate demand and protect its market position.

Cencosud's private label strategy, particularly within its supermarket divisions like Jumbo and Disco, emphasizes value-based pricing. This approach allows them to offer consumers a compelling alternative to national brands, often at a lower price point while maintaining perceived quality. For instance, in 2024, private label penetration in key Latin American markets where Cencosud operates saw continued growth, with some categories exceeding 20% of sales, indicating strong customer acceptance of these value propositions.

This focus on value directly impacts Cencosud's profitability and product mix. By controlling the production and branding of private labels, the company captures a larger margin compared to reselling national brands. In the first half of 2024, Cencosud reported a notable increase in gross margin, partly attributed to the expanding contribution of their private label offerings, which helps optimize their overall product portfolio and financial performance.

Cencosud's loyalty programs, like Puntos Cencosud, directly impact price by allowing customers to earn points and redeem them for discounts. This strategy makes products more affordable for frequent shoppers, encouraging repeat business and building stronger customer relationships.

Financial Services and Credit Options

Cencosud enhances product accessibility through its proprietary credit cards and consumer loans, directly impacting purchasing decisions by offering convenient financing. These financial services are a key component of their customer value proposition. For instance, in 2023, Cencosud's financial services segment, which includes credit offerings, played a significant role in driving sales across its retail operations.

The integration of financial services into the marketing mix makes Cencosud's diverse product range more attainable for a broader customer base. This strategy not only boosts immediate sales but also fosters customer loyalty by providing essential financial tools.

- Increased Purchasing Power: Cencosud's credit options empower customers to buy now and pay later, expanding their immediate buying capacity.

- Customer Loyalty: Offering in-house financing builds a stronger relationship with customers, encouraging repeat business.

- Sales Conversion: The availability of credit directly addresses potential affordability barriers, leading to higher conversion rates.

- Revenue Diversification: Financial services contribute an additional revenue stream beyond direct product sales.

Dynamic Pricing and Market Adaptation

Cencosud's pricing strategy is highly adaptable, keenly attuned to the unique economic landscapes of each market it operates in. For instance, in Argentina, the company actively manages the persistent inflationary pressures, adjusting prices to maintain competitiveness and profitability. This dynamic approach ensures that pricing remains relevant and effective, even amidst significant economic volatility.

The company's commitment to operational efficiency and stringent cost control directly underpins its pricing decisions. By optimizing its supply chain and internal processes, Cencosud can absorb some cost increases and maintain more stable pricing for consumers, while still pursuing profitable growth. This focus on efficiency is crucial for navigating diverse market conditions.

- Inflationary Impact: Cencosud's ability to manage pricing in high-inflation environments like Argentina is a key differentiator.

- Operational Efficiency: Cost control measures directly influence pricing flexibility and profitability targets.

- Profitable Growth: The pricing strategy aims to balance market competitiveness with sustained financial performance.

- Market Adaptation: Pricing is not static but evolves based on local economic factors and consumer purchasing power.

Cencosud's pricing strategy is multifaceted, balancing competitive positioning with value creation through private labels and loyalty programs. The company leverages dynamic pricing to navigate diverse economic conditions, particularly in markets like Argentina experiencing high inflation. By integrating financial services, Cencosud enhances product accessibility and customer purchasing power, directly impacting sales conversion and fostering loyalty.

| Pricing Strategy Element | Description | Impact | 2024/2025 Data/Observation |

|---|---|---|---|

| Competitive Pricing | Matching or undercutting competitor prices across banners like Jumbo and Easy. | Market share capture, customer retention. | Continual monitoring of competitor pricing in key Latin American markets. |

| Private Label Value Pricing | Offering Cencosud's own brands at lower price points than national brands. | Increased gross margins, customer value perception. | Private label penetration in key markets saw continued growth in 2024, exceeding 20% in some categories. |

| Loyalty Programs (Puntos Cencosud) | Rewarding customers with points redeemable for discounts. | Encourages repeat purchases, builds customer relationships. | Integral to driving consistent customer traffic and sales volume. |

| Financial Services Integration | Proprietary credit cards and consumer loans for purchases. | Boosts immediate sales, enhances affordability, diversifies revenue. | Financial services segment played a significant role in driving sales across retail operations in 2023. |

| Dynamic Pricing & Inflation Management | Adjusting prices based on economic conditions and inflation. | Maintains competitiveness and profitability in volatile markets. | Active price management in Argentina to counter persistent inflationary pressures. |

4P's Marketing Mix Analysis Data Sources

Our Cencosud 4P's analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside real-time e-commerce data and competitive pricing intelligence. We also incorporate insights from industry reports and Cencosud's own brand websites and promotional materials.