Cencosud Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

Unlock the strategic blueprint behind Cencosud's diversified retail empire. This comprehensive Business Model Canvas details how they connect with vast customer segments across multiple sectors, from supermarkets to home improvement. Discover their key partnerships and revenue streams that fuel their regional dominance.

Ready to dissect Cencosud's success? Download the full Business Model Canvas to gain a crystal-clear understanding of their value propositions, cost structure, and competitive advantages. It's the perfect tool for anyone looking to learn from a retail giant's proven strategies.

Partnerships

Cencosud's operational success hinges on its extensive network of suppliers, providing everything from fresh groceries to building materials. These crucial relationships ensure Cencosud can offer a wide variety of quality products at competitive prices across its different retail formats.

In 2024, Cencosud's commitment to supplier collaboration is evident in its ongoing efforts to optimize supply chains and foster innovation. Strong supplier partnerships are fundamental to Cencosud's ability to maintain product availability and support the growth of its private label brands, which are increasingly important to its sales strategy.

Cencosud's financial services segment relies heavily on partnerships with banks and other financial institutions. These collaborations are crucial for offering private label credit cards and consumer loans, directly supporting Cencosud's retail operations. A prime example is Cencosud Brazil's commercial partnership with Bradesco Bank for credit card services.

These strategic alliances allow Cencosud to extend attractive financing options to its customer base, thereby boosting sales and fostering greater customer loyalty. Furthermore, working with financial partners helps Cencosud efficiently manage its payment processing infrastructure, ensuring smooth transactions for millions of customers across its various retail formats.

Cencosud actively collaborates with technology and e-commerce partners to bolster its digital ecosystem and omnichannel approach. These alliances are crucial for expanding online sales, refining customer interactions, and fostering digital advancements. For instance, Cencosud’s digital transformation efforts in 2024 have seen increased investment in platforms that streamline online ordering and delivery processes.

These partnerships are fundamental to Cencosud's strategy of providing a seamless customer journey across both physical and digital channels. By integrating with leading technology providers, Cencosud enhances its data analytics capabilities, allowing for more personalized customer experiences and optimized inventory management, a key focus in its 2024 operational plans.

Furthermore, Cencosud Ventures plays a significant role by investing in promising startups that complement and strengthen its digital infrastructure. These investments, particularly those made in 2024, target innovative solutions in areas like artificial intelligence for customer service and advanced logistics for last-mile delivery, directly contributing to Cencosud's competitive edge in the evolving retail landscape.

Real Estate Developers and Landlords

Cencosud collaborates with real estate developers and landlords to secure advantageous locations for its retail operations and shopping centers. These partnerships are crucial for both the development of new retail spaces and the enhancement of existing properties, directly supporting Cencosud's expansion strategies.

In 2024, Cencosud continued to leverage these relationships to optimize its physical footprint. For instance, its ongoing investments in modernizing and expanding its shopping malls across Latin America, such as the recent renovations at Costanera Center in Chile, rely heavily on strong ties with developers and landlords to ensure seamless project execution and prime retail positioning.

- Strategic Location Acquisition: Partnerships facilitate access to high-traffic areas and desirable urban or suburban zones, essential for maximizing customer reach.

- Development and Expansion: Collaborations enable Cencosud to participate in the creation of new retail environments and the enlargement of existing shopping centers, adapting to market demands.

- Portfolio Optimization: By working with landlords, Cencosud can ensure its retail spaces are modern, well-maintained, and aligned with current consumer trends, thereby enhancing the overall value of its property portfolio.

Logistics and Distribution Partners

Cencosud relies heavily on its logistics and distribution partners to ensure efficient operations. These partnerships are crucial for managing its extensive supply chain, from sourcing products to delivering them to over 1,000 stores across Latin America and to e-commerce customers. For instance, in 2024, Cencosud continued to invest in modernizing its logistics infrastructure, aiming to reduce delivery times and costs. This includes leveraging advanced warehousing technologies and optimizing delivery routes.

Key to Cencosud's strategy is the selection of partners who can handle the complexities of retail distribution, including last-mile delivery and managing fluctuating inventory levels. These collaborations allow Cencosud to maintain product availability and customer satisfaction, especially as online sales continue to grow. The company’s commitment to enhancing logistics capabilities is a direct response to evolving consumer expectations for speed and reliability in product delivery.

- Strategic Partnerships: Collaborations with established logistics providers are essential for Cencosud's widespread retail presence.

- Supply Chain Optimization: These partners enable efficient inventory management and timely product replenishment across all channels.

- Investment in Capabilities: Cencosud's ongoing investment in logistics technology and infrastructure, including in 2024, aims to improve delivery speed and reduce operational costs.

- Customer Delivery: Ensuring direct-to-customer delivery is a core function supported by these vital distribution networks.

Cencosud's strategic partnerships extend to technology providers, crucial for its digital transformation and omnichannel strategy. In 2024, these collaborations focused on enhancing e-commerce platforms and data analytics to personalize customer experiences. For example, investments in AI for customer service and advanced logistics in 2024 by Cencosud Ventures underscore this commitment.

These alliances are vital for Cencosud's goal of providing a seamless customer journey across physical and digital touchpoints. By integrating with leading tech firms, Cencosud improves its data capabilities, leading to better inventory management and more tailored customer interactions, a key operational focus for 2024.

What is included in the product

This Business Model Canvas offers a strategic overview of Cencosud's diversified retail operations, detailing its customer segments, value propositions across various formats, and key resources.

It highlights Cencosud's extensive network of channels, customer relationships, and revenue streams, providing insights into its competitive advantages and operational structure.

Cencosud's Business Model Canvas offers a clear, structured way to identify and address operational inefficiencies, acting as a pain point reliever by visually mapping key activities and resources.

Activities

Retail Operations Management is the engine driving Cencosud's diverse store network, encompassing supermarkets like Jumbo and Wong, home improvement via Easy, and department stores such as Paris. This core activity focuses on ensuring smooth daily operations, from stocking shelves and presenting products effectively to managing sales transactions and providing excellent customer service within each format.

In 2023, Cencosud's retail operations were a significant contributor to its overall performance, with the company reporting consolidated net revenue of approximately CLP 20.6 trillion (around USD 22.7 billion). This revenue reflects the vast scale of their operational activities across multiple countries and store types, highlighting the critical importance of efficient management.

Cencosud's key activities in supply chain and logistics optimization are critical for its retail operations. The company focuses on efficient procurement, warehousing, and distribution networks spanning multiple countries, ensuring product availability for its diverse customer base.

In 2024, Cencosud continued to enhance its logistics infrastructure. For instance, its food rescue program, aimed at reducing waste and contributing to sustainability, saw significant expansion, diverting thousands of tons of food from landfills across its South American operations by mid-year.

Cencosud's financial services are a cornerstone activity, primarily focused on operating its private label credit cards and offering consumer loans. This segment is crucial for fostering customer loyalty within its retail operations and creating valuable, recurring revenue streams beyond traditional product sales.

In 2024, Cencosud continued to leverage its financial services arm to deepen customer relationships. For instance, its credit card operations, managed through entities like Cencosud Shopping, aim to increase purchase frequency and average ticket size among its cardholders, directly contributing to the overall sales performance of its retail banners.

Digital Transformation and E-commerce Development

Cencosud is actively enhancing its digital presence by investing significantly in its omnichannel ecosystem. This focus includes bolstering e-commerce platforms and expanding digital capabilities to meet evolving consumer demands.

The company is committed to driving online sales growth and broadening the availability of digital payment options. These efforts are central to Cencosud's strategy for digital transformation and e-commerce development.

- Omnichannel Ecosystem Strengthening: Cencosud prioritizes integrating its online and offline channels for a seamless customer experience.

- E-commerce Platform Investment: Significant capital is allocated to improving and expanding its digital sales platforms.

- Digital Capabilities Expansion: Cencosud is building out its internal digital expertise and technological infrastructure.

- Retail Media Initiatives: The company is developing its retail media networks to generate new revenue streams and enhance customer engagement.

Shopping Center Management and Development

Cencosud's key activities heavily revolve around the strategic management and ongoing development of its Cenco Malls portfolio. This encompasses a multifaceted approach to ensure the centers remain vibrant and profitable hubs.

A core function is attracting and retaining a diverse mix of tenants, from major anchor stores to specialized boutiques, thereby optimizing the leasable area. This tenant mix is crucial for driving foot traffic and sales within the malls. Cencosud also focuses on enhancing the customer experience through continuous upgrades and the introduction of new amenities and services.

In 2024, Cencosud continued its expansion efforts, aiming to bolster its retail real estate presence. For instance, the company has been actively investing in upgrading existing properties and exploring opportunities for new developments to cater to evolving consumer preferences and market demands.

- Tenant Acquisition and Optimization: Cencosud actively seeks out diverse and desirable tenants to fill its retail spaces, ensuring a balanced and appealing mix for shoppers.

- Leasable Area Maximization: The company focuses on efficiently utilizing and optimizing the available square footage within its shopping centers to generate maximum rental income.

- New Development and Expansion: Cencosud is committed to expanding its footprint by developing new commercial spaces and enhancing existing ones to improve customer experience and attract more visitors.

Cencosud's key activities are centered on managing its extensive retail operations across various formats, including supermarkets, home improvement, and department stores. This involves efficient supply chain and logistics to ensure product availability and a strong focus on optimizing its omnichannel strategy by enhancing e-commerce platforms and digital payment options.

Furthermore, Cencosud actively develops its financial services, particularly its private label credit cards, to boost customer loyalty and generate recurring revenue. The company also concentrates on the strategic management and expansion of its Cenco Malls portfolio, focusing on tenant optimization and enhancing the overall shopping experience.

| Key Activity | 2023 Performance Metric | 2024 Focus/Initiative |

|---|---|---|

| Retail Operations | Consolidated Net Revenue: CLP 20.6 trillion (approx. USD 22.7 billion) | Continued expansion of food rescue programs to reduce waste. |

| Supply Chain & Logistics | Vast distribution networks across multiple South American countries. | Enhancing logistics infrastructure and sustainability efforts. |

| Financial Services | Operation of private label credit cards and consumer loans. | Deepening customer relationships through credit card offerings. |

| Digital Presence/Omnichannel | Investment in e-commerce platforms and digital capabilities. | Driving online sales growth and expanding digital payment options. |

| Mall Management | Optimizing leasable area and tenant mix in shopping centers. | Investing in property upgrades and exploring new developments. |

Preview Before You Purchase

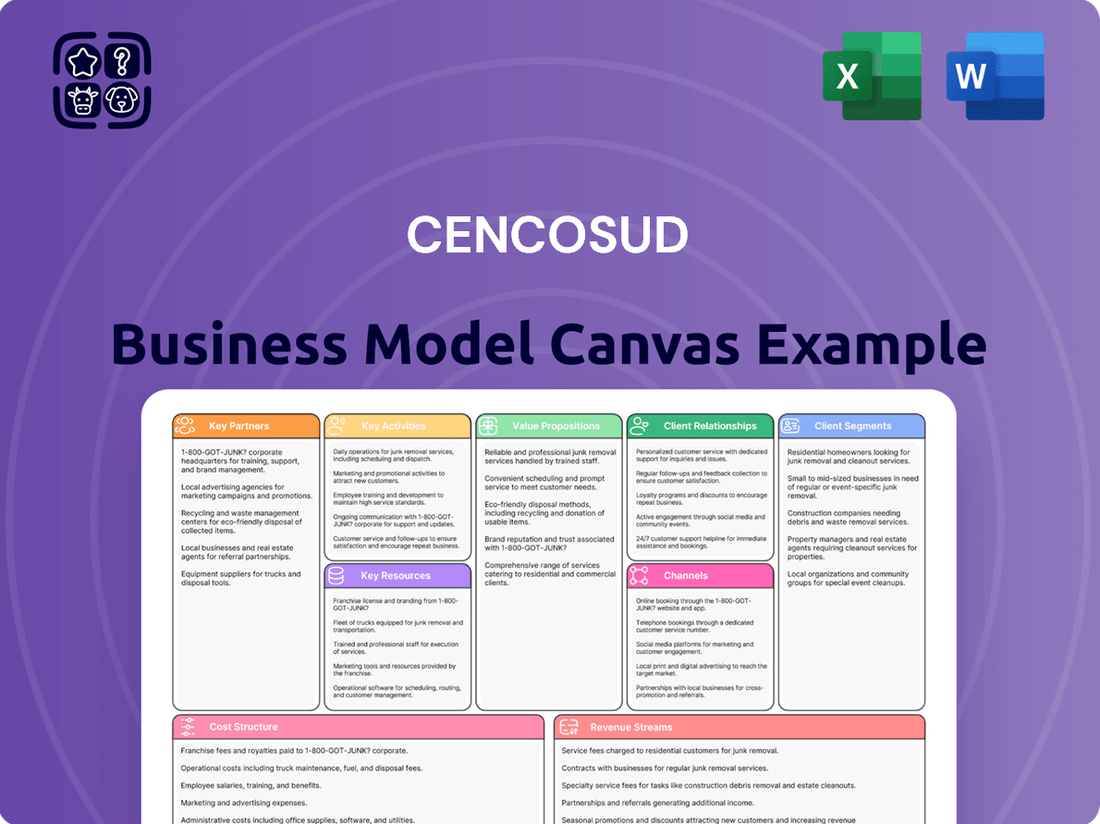

Business Model Canvas

The Cencosud Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, professionally structured analysis, not a generic sample or mockup. Once your order is confirmed, you will gain full access to this exact Business Model Canvas, ready for your immediate use and analysis.

Resources

Cencosud's extensive retail store network is a cornerstone of its business model, boasting approximately 1,180 stores and shopping centers. This significant physical footprint spans across numerous Latin American countries and extends into the United States, ensuring broad market reach.

This vast network provides Cencosud with exceptional accessibility for its diverse customer base. By having a strong presence in key markets, the company can effectively cater to local demands and preferences, driving customer engagement and loyalty.

Cencosud leverages a robust mix of recognized retail brands and its own private labels to drive its business. Well-known banners like Jumbo, Santa Isabel, Easy, Paris, Wong, Metro, and The Fresh Market are cornerstones of its market presence.

The company's commitment to private labels is evident in its growing portfolio, which includes brands like Cuisine&Co. This strategy enhances product differentiation and fosters stronger customer loyalty by offering unique value propositions.

Cencosud's human capital is a powerhouse, boasting over 110,000 employees across its diverse operations. This vast workforce is the engine driving Cencosud's success in retail, financial services, and its ongoing digital transformation efforts.

The collective expertise within this employee base is invaluable. It fuels the company's ability to innovate, optimize customer experiences, and navigate the complexities of the modern retail landscape, directly impacting financial performance.

Digital Infrastructure and Technology

Cencosud's digital infrastructure, encompassing robust e-commerce platforms and advanced data analytics, is a core asset. In 2024, the company continued to invest heavily in these areas to personalize customer interactions and streamline operations. This digital ecosystem is crucial for understanding consumer behavior and optimizing inventory management across its diverse retail formats.

The development of digital payment solutions, such as CencoPay, further strengthens Cencosud's digital capabilities. These integrated payment systems not only enhance customer convenience but also provide valuable transaction data. This data is instrumental in refining marketing strategies and identifying new growth opportunities within the rapidly evolving retail landscape.

- E-commerce Platforms: Cencosud's online presence, including its various country-specific websites and apps, facilitates direct customer engagement and sales.

- Data Analytics: Sophisticated tools are employed to analyze customer purchasing patterns, website traffic, and operational metrics, driving informed decision-making.

- Digital Payment Solutions: CencoPay and other integrated payment technologies simplify transactions and capture valuable financial data.

Financial Capital and Strong Balance Sheet

Cencosud's robust financial capital and a strong balance sheet are fundamental to its business model, enabling significant investments in expansion and digital transformation. The company's financial health directly supports its ability to fund new store openings and enhance its e-commerce capabilities.

In 2024, Cencosud demonstrated considerable financial strength, reporting substantial revenues that provide a solid foundation for future growth initiatives. This financial prowess is crucial for executing strategic plans, including the planned substantial investments slated for 2025.

- Financial Strength: Cencosud's ability to generate significant revenue underpins its capacity for strategic investments.

- Investment Capacity: The company's strong balance sheet allows for funding of new store openings and digital projects.

- 2025 Investment Plans: Cencosud has outlined substantial investment plans for 2025, leveraging its financial resources.

Cencosud's key resources are its extensive physical store network, strong brand portfolio, dedicated workforce, advanced digital infrastructure, and robust financial capital. These elements collectively enable the company to serve a broad customer base, drive sales, and pursue strategic growth initiatives.

The company's approximately 1,180 stores and shopping centers across Latin America and the US provide unparalleled market access. This vast retail footprint is complemented by a portfolio of well-recognized brands like Jumbo and Paris, alongside a growing selection of private labels, enhancing product differentiation and customer loyalty.

Cencosud's over 110,000 employees are critical for innovation and customer experience. Furthermore, its investment in digital platforms and payment solutions like CencoPay in 2024 is vital for data analytics and personalized customer engagement, supporting its ongoing digital transformation.

Financially, Cencosud's strength, evidenced by substantial 2024 revenues, provides the capacity for significant investments, including those planned for 2025. This financial stability is key to funding expansion and enhancing its digital capabilities.

| Key Resource | Description | Impact |

|---|---|---|

| Physical Store Network | Approx. 1,180 stores and shopping centers in Latin America and the US. | Broad market reach, customer accessibility. |

| Brand Portfolio | Recognized brands (Jumbo, Paris) and private labels (Cuisine&Co). | Product differentiation, customer loyalty. |

| Human Capital | Over 110,000 employees. | Drives innovation, customer experience, digital transformation. |

| Digital Infrastructure | E-commerce platforms, data analytics, CencoPay. | Personalized interactions, operational efficiency, data insights. |

| Financial Capital | Strong balance sheet, substantial 2024 revenues. | Enables investment in expansion and digital initiatives. |

Value Propositions

Cencosud’s diverse product assortment, spanning groceries, home improvement, apparel, and financial services across its various retail formats, creates a compelling one-stop shopping proposition. This breadth of offerings caters to a wide array of customer needs, enhancing convenience and fostering customer loyalty.

In 2023, Cencosud reported net sales of approximately CLP 18,548 billion (around USD 20.7 billion), reflecting the significant volume and variety of goods and services it provides to consumers across Latin America.

Cencosud focuses on offering competitive prices across its diverse retail formats, a strategy that proved crucial in 2024 amidst inflationary pressures and shifting consumer spending habits. The company actively employs promotional activities, including discounts and loyalty programs, to draw in shoppers and encourage repeat business, especially when economic conditions are tough.

Cencosud is committed to providing a unified shopping journey, integrating its brick-and-mortar locations with robust digital platforms. This means customers can easily transition between browsing online and picking up items in-store, or utilize convenient click-and-collect services.

The company actively partners with specialized last-mile delivery providers to ensure efficient and timely fulfillment of online orders, extending its reach and customer convenience. This omnichannel approach is crucial in today's retail landscape, where flexibility and accessibility are paramount for customer satisfaction and loyalty.

In 2024, Cencosud reported significant growth in its e-commerce sales, which now represent a substantial portion of its overall revenue, underscoring the success of its integrated strategy. For instance, its digital channels saw a year-over-year increase of over 20% in customer engagement and transaction volume.

Customer Loyalty Programs and Financial Services

Cencosud leverages private label credit cards and loyalty programs to cultivate deep customer relationships and boost spending. These initiatives provide tangible financial benefits, effectively increasing customer purchasing power and encouraging repeat business.

In 2024, Cencosud's loyalty program, "Mi Cencosud," continued to be a cornerstone of its customer engagement strategy. The program boasted millions of active members across its various banners, driving a significant portion of total sales. For instance, a substantial percentage of transactions within its retail divisions were linked to loyalty accounts, highlighting the program's impact on customer retention and transaction volume.

- Enhanced Purchasing Power: Cencosud's credit cards offer exclusive discounts, deferred payment options, and cashback rewards, directly improving customers' ability to shop.

- Data-Driven Insights: Loyalty program data allows Cencosud to understand customer behavior, enabling personalized offers and targeted marketing campaigns.

- Increased Customer Lifetime Value: By fostering loyalty and providing financial tools, Cencosud aims to maximize the long-term value derived from each customer relationship.

Convenience and Accessibility

Cencosud’s extensive network of stores and shopping centers, strategically positioned across major Latin American markets and the United States, ensures convenient access to its diverse range of products and services. This widespread presence caters to a broad customer base, making everyday shopping and leisure activities easily attainable.

For instance, as of the first quarter of 2024, Cencosud operated over 1,500 stores, encompassing supermarkets, home improvement centers, department stores, and shopping malls. This vast retail footprint, with a significant concentration in Chile, Argentina, Brazil, Peru, and Colombia, underscores the company's commitment to accessibility for millions of consumers.

- Extensive Retail Footprint: Cencosud's network includes over 1,500 stores across Latin America and the US as of Q1 2024.

- Strategic Locations: Stores and shopping centers are situated in key urban and suburban areas, optimizing customer reach.

- Diverse Offerings: The accessibility extends across various retail formats, including supermarkets, department stores, and home improvement centers, meeting a wide array of consumer needs.

Cencosud's value proposition centers on providing a comprehensive and convenient shopping experience through its diverse retail formats and integrated digital platforms. The company emphasizes competitive pricing, enhanced by loyalty programs and private label credit cards that boost customer purchasing power and foster long-term relationships.

In 2024, Cencosud's e-commerce channels demonstrated robust growth, with customer engagement and transaction volumes increasing by over 20% year-over-year. This digital expansion complements its extensive physical store network, which comprised over 1,500 locations across Latin America and the United States as of Q1 2024, ensuring broad accessibility.

The company's "Mi Cencosud" loyalty program continues to be a key driver of customer retention and sales, with millions of active members contributing significantly to overall transactions. This focus on customer loyalty and data-driven insights allows for personalized offers, further strengthening customer lifetime value.

| Value Proposition Aspect | Description | Supporting Data/Fact (2024 unless otherwise noted) |

|---|---|---|

| One-Stop Shopping | Diverse product assortment across groceries, home improvement, apparel, and financial services. | Net sales of ~CLP 18,548 billion (USD 20.7 billion) in 2023, reflecting broad offering volume. |

| Competitive Pricing & Promotions | Strategy to offer competitive prices, supported by promotions and loyalty programs. | Crucial in 2024 amidst inflationary pressures; loyalty programs drive repeat business. |

| Omnichannel Experience | Seamless integration of brick-and-mortar and digital platforms. | Over 20% year-over-year increase in e-commerce customer engagement and transaction volume in 2024. |

| Customer Loyalty & Financial Tools | Leveraging private label credit cards and loyalty programs to enhance customer relationships and spending. | "Mi Cencosud" loyalty program has millions of active members, driving significant sales. |

| Extensive Retail Footprint | Strategically located stores and shopping centers for convenient access. | Operated over 1,500 stores across Latin America and the US as of Q1 2024. |

Customer Relationships

Cencosud leverages personalized loyalty programs, often tied to its private label credit cards, to cultivate strong customer relationships. These programs are designed to offer tailored benefits and promotions, directly influenced by individual purchasing patterns, which encourages repeat business and deeper engagement.

Cencosud prioritizes exceptional customer service across all its channels, from physical stores to digital platforms, striving for high satisfaction. In 2024, the company continued to invest in employee training, including a significant focus on inclusive practices to better serve its diverse customer base. This commitment aims to foster loyalty and repeat business.

Cencosud actively engages its communities through sustainability efforts, notably its food rescue programs which, in 2024, diverted thousands of tons of food from landfills across its Latin American operations. This commitment fosters strong, positive relationships with customers by demonstrating a shared value for social responsibility and environmental stewardship.

Digital Interaction and Feedback Channels

Cencosud actively engages customers through its digital platforms, including websites and social media, facilitating feedback and information access. This approach enhances the omnichannel experience by creating direct lines of communication.

These digital channels are crucial for building stronger customer relationships, allowing for quick responses to inquiries and the collection of valuable insights. For instance, in 2023, Cencosud reported a significant increase in digital engagement across its brands, with online customer service interactions growing by over 15% compared to the previous year.

- Digital Engagement Growth: Cencosud's online platforms saw a 15% year-over-year increase in customer interactions in 2023.

- Feedback Integration: Customer feedback gathered digitally directly informs service improvements and product offerings.

- Omnichannel Synergy: Digital interactions are designed to complement in-store experiences, creating a seamless journey for the customer.

In-store Experience and Events

Cencosud goes beyond mere sales by cultivating memorable in-store experiences. They actively organize events, like the notable Paris Parade, designed to foster stronger customer relationships and deepen brand loyalty.

- Enhanced Engagement: Events like the Paris Parade create unique, non-transactional interactions that build emotional connections with customers.

- Brand Affinity: These experiences aim to make customers feel more attached to Cencosud's brands, encouraging repeat business and positive word-of-mouth.

- Customer Retention: By offering more than just products, Cencosud invests in keeping customers engaged and returning to their stores and platforms.

Cencosud focuses on building lasting relationships through personalized loyalty programs and exceptional customer service across all touchpoints. Their commitment extends to community engagement, particularly through sustainability initiatives like food rescue, which resonated strongly in 2024.

Digital channels are vital for feedback and direct communication, complementing in-store experiences. In 2023, Cencosud saw a significant 15% rise in digital customer interactions, highlighting the growing importance of these platforms for fostering loyalty and gathering insights.

Memorable in-store events, such as the Paris Parade, create emotional connections that go beyond transactions, aiming to deepen brand affinity and customer retention.

| Customer Relationship Strategy | Key Initiatives | Impact/Data Point |

|---|---|---|

| Loyalty Programs | Private label credit cards, tailored benefits based on purchasing patterns | Encourages repeat business and deeper engagement. |

| Customer Service | Investment in employee training, focus on inclusive practices (2024) | Aims for high satisfaction and fosters loyalty. |

| Community Engagement | Food rescue programs (thousands of tons diverted in 2024 across Latin America) | Demonstrates shared values, strengthening positive relationships. |

| Digital Channels | Websites, social media, direct communication, feedback integration | 15% increase in digital customer interactions (2023), enhances omnichannel experience. |

| In-Store Experiences | Events like Paris Parade | Builds emotional connections and brand affinity, boosting retention. |

Channels

Cencosud's physical retail stores are its backbone, encompassing supermarkets like Jumbo and Santa Isabel, home improvement outlets such as Easy, and department stores like Paris. These brick-and-mortar locations are crucial for direct customer interaction and product accessibility across its operating regions.

In 2024, Cencosud continued to leverage its extensive physical store network, which remains a primary revenue driver. For instance, the company operates hundreds of supermarkets and hypermarkets across South America, serving millions of customers weekly and facilitating impulse purchases and immediate product availability.

Cencosud's shopping centers, branded as Cenco Malls, are vital channels, drawing millions of visitors across Latin America. These centers not only house Cencosud's own retail banners like Jumbo and Easy but also host a diverse range of third-party tenants, creating a comprehensive retail ecosystem. In 2023, Cencosud reported that its shopping centers generated significant revenue, contributing substantially to the company's overall performance.

These malls are designed to be more than just retail spaces; they function as entertainment and lifestyle hubs, offering a complete experience for consumers. This strategy helps drive foot traffic and sales for all occupants. For instance, the company's commitment to enhancing the customer experience in its malls is a key driver of their success, as evidenced by consistent visitor numbers and sales growth reported in their 2024 financial updates.

Cencosud significantly enhances its customer reach and convenience through robust e-commerce platforms and dedicated mobile applications for its diverse retail banners. These digital channels facilitate seamless online purchasing, options for click-and-collect, and foster deeper customer engagement.

In 2023, Cencosud reported a substantial increase in its digital sales, which represented a growing percentage of its overall revenue. For instance, its Chilean operations saw a significant uptick in online transactions, driven by user-friendly interfaces and expanded delivery networks.

The company's mobile applications are designed to offer personalized promotions, loyalty program integration, and efficient in-app purchasing, further solidifying its omnichannel strategy. This digital focus is crucial for adapting to evolving consumer behavior and maintaining a competitive edge in the retail landscape.

Financial Services Branches and Digital Platforms

Cencosud's financial services are a key component, leveraging its retail presence. These services are accessible through physical branches located within its supermarkets and department stores, providing a convenient touchpoint for customers. This integrated approach allows for seamless cross-selling of financial products.

The company also heavily invests in its digital platforms to expand reach and offer modern banking solutions. This includes managing private label credit cards and providing consumer loans, directly catering to the financing needs of its shoppers. By 2024, Cencosud's financial arm, often operating under brands like Cencosud Shopping, continued to be a significant contributor to its overall revenue streams.

- Branch Network Integration: Financial services are embedded within Cencosud's retail stores, creating a synergistic customer experience.

- Digital Expansion: A growing emphasis on online platforms and mobile applications for loan applications and credit card management.

- Product Offerings: Primarily focuses on private label credit cards and consumer loans tailored to its customer base.

- Revenue Contribution: Financial services represent a substantial and growing segment of Cencosud's total income.

Strategic Alliances with Last-Mile Delivery Services

Cencosud's strategic alliances with last-mile delivery services are crucial for its e-commerce expansion, particularly in markets like Brazil and the United States. These partnerships ensure that online orders reach customers' homes efficiently. For instance, in 2024, Cencosud continued to leverage these collaborations to improve delivery times and customer satisfaction across its digital platforms.

These alliances allow Cencosud to offer a wider range of delivery options and potentially reduce logistics costs. By outsourcing last-mile delivery to specialized providers, the company can focus on its core retail operations. This strategy is vital for competing in the increasingly digital retail landscape, where speed and reliability of delivery are key differentiators.

- Partnerships: Cencosud collaborates with third-party logistics providers for last-mile delivery.

- Geographic Focus: Key markets for these alliances include Brazil and the United States.

- E-commerce Enhancement: These partnerships directly support and improve Cencosud's online sales capabilities.

- Operational Efficiency: The goal is to ensure timely and cost-effective delivery of online purchases.

Cencosud's channels extend beyond physical stores to include extensive shopping centers, known as Cenco Malls, which serve as major traffic drivers across Latin America. These malls are designed as lifestyle destinations, integrating Cencosud's own brands with third-party retailers, thereby creating a comprehensive retail ecosystem and enhancing overall sales for all tenants. In 2023, these shopping centers contributed significantly to Cencosud's revenue, demonstrating their importance as a customer engagement and sales channel.

Customer Segments

Cencosud's mass market consumers represent a vast and diverse group, encompassing individuals and families across a wide spectrum of income levels. These customers primarily rely on Cencosud's supermarkets and hypermarkets for their everyday needs, seeking a comprehensive selection of essential consumer goods. In 2024, Cencosud continued to serve millions of these shoppers daily, with its retail divisions like Jumbo and Santa Isabel being key destinations.

Cencosud's home improvement division, like Easy in Chile and Argentina, directly serves homeowners undertaking renovations and DIY projects. These customers seek a wide array of products for construction, repair, and aesthetic upgrades, from lumber and paint to tools and decorative items. In 2024, the home improvement sector continued to see robust demand, with Cencosud's Easy stores reporting strong sales growth driven by this segment.

Fashion and Lifestyle Seekers are drawn to department stores like Paris, which offer a carefully chosen range of apparel, beauty products, home decor, and electronics. This segment values a shopping experience that feels elevated and aspirational, seeking out popular brands and the latest trends.

Shopping Center Visitors and Families

Cencosud's shopping centers are prime destinations for families and individuals looking for more than just shopping. They offer a complete experience, blending retail therapy with diverse dining options, entertainment venues, and leisure activities designed to appeal to a broad demographic. This creates a vibrant atmosphere that encourages longer visits and repeat business.

In 2024, Cencosud continued to focus on enhancing these experiential aspects. For instance, their centers often host events and promotions specifically targeting families, such as children's play areas, seasonal celebrations, and interactive exhibits. This strategy aims to solidify their position as a go-to location for weekend outings and family gatherings.

- Attraction of Families: Cencosud shopping centers are designed to be family-friendly, offering amenities and events that cater to all age groups, encouraging extended stays and increased spending.

- Diverse Offerings: Beyond retail, the centers provide a mix of dining, entertainment, and leisure, creating a comprehensive destination that meets various consumer needs.

- Experiential Focus: By emphasizing experiences, Cencosud aims to differentiate its malls in a competitive market, fostering customer loyalty and driving foot traffic.

Financial Service Users

Cencosud's customer base includes individuals who leverage their private label credit cards and consumer loans. These users are primarily looking for convenient and readily available financing options to facilitate their shopping experiences and manage personal finances.

In 2023, Cencosud's financial services segment, particularly its credit card operations, played a significant role in driving sales across its retail banners. For instance, the company reported that a substantial portion of transactions within its supermarkets and department stores were completed using Cencosud-issued credit cards, highlighting their importance in customer purchasing power.

- Credit Accessibility: Customers often turn to Cencosud's financial products for easier access to credit, especially for everyday purchases.

- Budget Management: The private label cards and loans provide tools for customers to manage their spending and budget effectively.

- Loyalty Programs: These financial instruments are often integrated with loyalty programs, offering rewards and benefits that encourage repeat business.

- Sales Conversion: Cencosud's financial offerings are a key driver in converting browsing customers into purchasing ones by offering immediate payment solutions.

Cencosud's diverse customer segments include mass-market shoppers relying on supermarkets, homeowners engaging in DIY projects via the home improvement division, and fashion-conscious individuals frequenting department stores. Additionally, families and individuals seeking comprehensive experiences patronize Cencosud's shopping centers, while a segment utilizes financial services like private label credit cards for purchasing power and budget management.

Cost Structure

The cost of goods sold (COGS) is a significant part of Cencosud's expenses, reflecting the direct costs associated with the products it sells. This encompasses the purchase price of merchandise from a wide range of suppliers, crucial for stocking its supermarkets, department stores, home improvement centers, and shopping malls.

In 2023, Cencosud reported a COGS of approximately CLP 18.4 trillion (around USD 20 billion at prevailing exchange rates), highlighting the sheer volume of goods Cencosud procures. Managing this cost effectively involves optimizing supplier relationships and maintaining efficient inventory levels to minimize waste and storage expenses.

Cencosud's operating expenses, primarily Selling, General, and Administrative (SG&A), are substantial given its vast retail footprint. These costs include the compensation for its workforce, which numbered over 110,000 employees as of early 2024, reflecting significant investment in human capital across its diverse business units.

The company also incurs considerable expenses related to its physical infrastructure, such as rent for its numerous stores and shopping centers, alongside essential utilities. Marketing and advertising efforts to maintain brand visibility and attract customers also contribute significantly to this cost category.

Furthermore, administrative overhead, covering management, IT, and other corporate functions, forms a crucial part of SG&A. These combined expenses are vital for Cencosud's day-to-day operations and its ability to serve millions of customers across Latin America.

Cencosud's extensive multinational footprint necessitates substantial investments in logistics and distribution. These costs encompass the complex movement of goods across various countries, including transportation via sea, air, and land, as well as managing a network of warehouses and distribution centers to ensure products reach over 1,000 stores and e-commerce customers efficiently.

In 2024, Cencosud continued to focus on optimizing its supply chain to mitigate these significant expenses. For instance, the company's efforts to integrate its e-commerce and physical store operations aim to streamline inventory management and reduce last-mile delivery costs, a critical component of its distribution strategy.

Technology and Digital Investment Costs

Cencosud's commitment to its digital transformation is a significant driver of its cost structure, necessitating substantial outlays in technology and digital investments. These expenditures are crucial for bolstering its e-commerce capabilities, developing advanced software solutions, and expanding its digital marketing reach to support an integrated omnichannel experience for customers.

The company's ongoing digital initiatives are designed to enhance customer engagement and operational efficiency across all its business units. This includes investments in cloud infrastructure, data analytics platforms, and cybersecurity measures to ensure a robust and secure digital environment.

- IT Infrastructure: Upgrades to cloud computing, network hardware, and data centers to support increased digital traffic and data processing.

- E-commerce Platforms: Development and maintenance of user-friendly online shopping interfaces, mobile applications, and payment gateways.

- Software Development: Investment in proprietary software for inventory management, customer relationship management (CRM), and business intelligence.

- Digital Marketing: Allocation of resources for online advertising, search engine optimization (SEO), social media campaigns, and content creation to drive online sales and brand visibility.

Capital Expenditures (CAPEX)

Cencosud's capital expenditures are a significant driver of its growth and operational efficiency. The company consistently invests in expanding its retail footprint through new store openings, enhancing customer experience via remodeling existing locations, and growing its retail infrastructure by developing new shopping centers. These investments also extend to crucial logistical capabilities and forward-looking digital projects.

For 2025, Cencosud has outlined a substantial capital expenditure plan of US$610 million. This figure underscores the company's commitment to strengthening its market position and adapting to evolving consumer demands.

- New Store Openings: Expanding physical presence in key markets.

- Remodeling and Upgrades: Enhancing existing store formats and customer experience.

- Shopping Center Development: Investing in the growth and modernization of retail properties.

- Logistics and Digital Investments: Building capabilities for efficient supply chains and digital commerce.

Cencosud's cost structure is dominated by the cost of goods sold, reflecting its extensive retail operations, alongside significant operating expenses for its large workforce and physical store network.

In 2023, the cost of goods sold reached approximately CLP 18.4 trillion. Selling, General, and Administrative (SG&A) expenses are also substantial, driven by over 110,000 employees as of early 2024 and the upkeep of its vast retail and mall infrastructure.

Logistics and digital transformation initiatives represent further key cost areas, with planned capital expenditures of US$610 million in 2025 to support new store openings, upgrades, and digital capabilities.

| Cost Category | Approximate 2023 Value (CLP Trillions) | Key Components |

|---|---|---|

| Cost of Goods Sold (COGS) | 18.4 | Merchandise procurement, supplier relationships |

| Selling, General, and Administrative (SG&A) | N/A (Significant) | Employee compensation, rent, utilities, marketing, administration |

| Logistics & Distribution | N/A (Significant) | Transportation, warehousing, supply chain optimization |

| Digital Transformation | N/A (Ongoing Investment) | E-commerce platforms, software development, digital marketing |

| Capital Expenditures (Planned 2025) | N/A (US$610 million) | New stores, remodeling, shopping center development, digital projects |

Revenue Streams

Cencosud's primary revenue engine is its retail sales, predominantly from supermarkets and hypermarkets. This segment is the backbone of the company, consistently contributing the largest share of its income.

In fact, by the end of 2023, this segment accounted for over 70% of Cencosud's consolidated revenue. This highlights the significant consumer reliance on their extensive network for everyday necessities like groceries and fresh produce.

Cencosud generates significant revenue from its home improvement segment, primarily through its Easy stores. These outlets offer a wide array of products essential for construction, renovation, and home decoration projects.

In 2024, Cencosud's Home Improvement division, which includes Easy, continued to be a cornerstone of its operations. While specific revenue figures for just the home improvement stores are part of broader segment reporting, the overall performance of this sector reflects strong consumer demand for DIY and renovation activities across its operating regions.

Cencosud generates significant revenue from its department stores, such as Paris, which offer a wide array of products. These include fashion apparel, consumer electronics, and a variety of home furnishings and decor. This diverse product mix caters to a broad customer base, driving consistent sales.

In 2024, Cencosud's department store segment continued to be a cornerstone of its financial performance. For instance, the company reported strong sales figures across its Chilean operations, with department stores playing a pivotal role in achieving these results. The ongoing strategy to enhance the in-store experience and expand online offerings further supports this revenue stream.

Rental Income from Shopping Centers

Cencosud's shopping centers are a major source of rental income, with spaces leased to both Cencosud's own retail brands and a diverse range of external businesses. This dual occupancy strategy maximizes the utilization of its prime retail real estate.

In 2024, Cencosud continued to leverage its extensive portfolio of shopping malls across Latin America. The company's ability to attract and retain a strong tenant mix, encompassing fashion, electronics, and food services, directly translates into consistent rental revenue streams.

- Diversified Tenant Base: Rental income is bolstered by a mix of Cencosud's own brands like Paris and Ripley, alongside numerous third-party retailers.

- Strategic Location: The company's shopping centers are strategically located in high-traffic urban areas, ensuring consistent footfall and desirability for tenants.

- Occupancy Rates: Maintaining high occupancy rates across its properties is a key driver for predictable and substantial rental income.

- Lease Agreements: Rental income is secured through long-term lease agreements, providing a stable revenue foundation for the company.

Financial Services Income

Cencosud's financial services segment is a significant contributor to its overall revenue. This income primarily stems from interest charged on private label credit cards and consumer loans extended to its extensive retail customer base.

These financial products not only foster customer loyalty by offering convenient payment options but also generate a steady stream of interest income. Additionally, various fees associated with these services, such as account maintenance or late payment fees, further bolster this revenue stream.

- Interest Income: Earned on outstanding balances from private label credit cards and consumer loans.

- Fee Income: Generated from various service charges related to financial products.

- Customer Loyalty: Financial services enhance customer retention and purchasing frequency.

Cencosud's revenue streams are robust and diversified, reflecting its strong presence across multiple retail and service sectors in Latin America.

The company's financial services, primarily through its credit card operations and consumer loans, provide a consistent and valuable income source. This segment is crucial for customer retention and drives incremental sales across its retail banners.

In 2024, Cencosud's financial services division continued to demonstrate resilience, contributing significantly to the company's profitability. The focus on digital integration and personalized offers for its customer base further strengthened this revenue stream.

| Revenue Stream | Primary Source | 2023 Contribution (Approx.) | 2024 Outlook |

|---|---|---|---|

| Retail Sales | Supermarkets, Hypermarkets, Home Improvement, Department Stores | Over 70% of consolidated revenue | Continued growth driven by consumer demand and strategic expansion. |

| Shopping Centers | Rental income from own brands and third-party tenants | Significant contributor, driven by high occupancy | Stable income generation from prime real estate locations. |

| Financial Services | Interest and fees from credit cards and consumer loans | Key driver of profitability and customer loyalty | Expected to remain strong, supported by digital initiatives and customer engagement. |

Business Model Canvas Data Sources

The Cencosud Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer behavior and retail trends across Latin America, and operational data from its diverse business units.