Cencosud PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

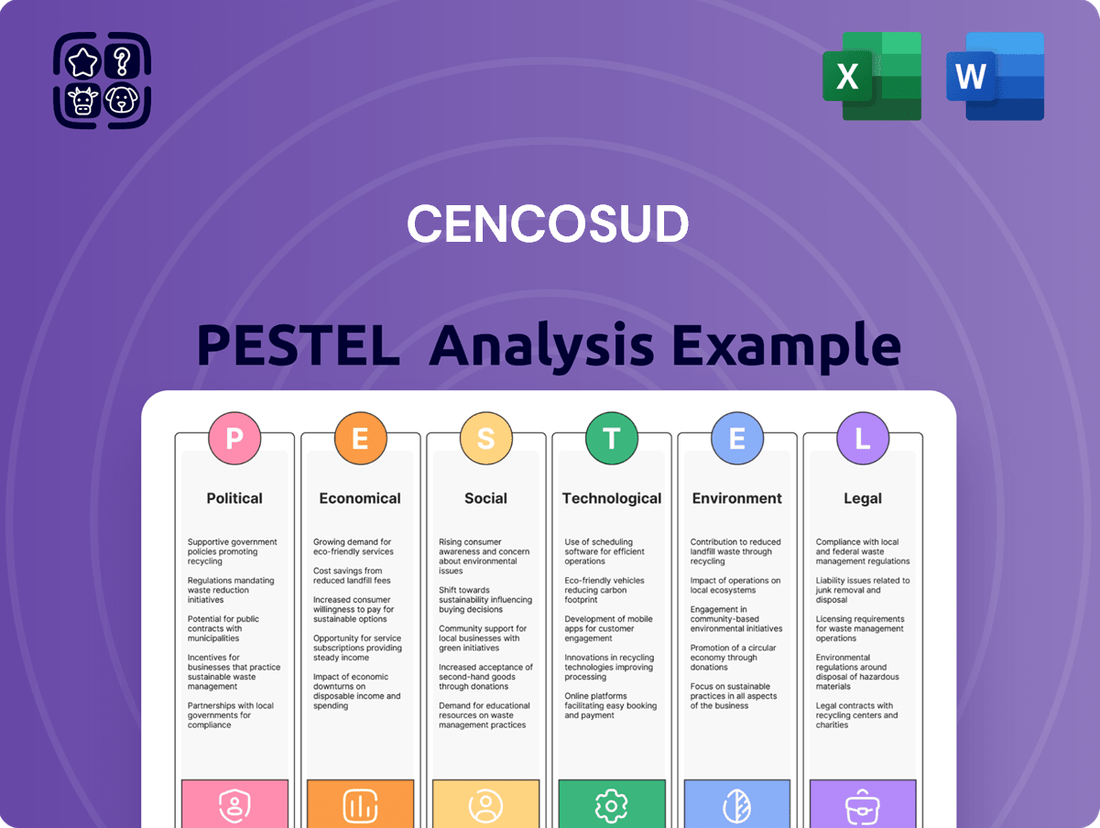

Navigate the complex external forces shaping Cencosud's retail empire with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends create both challenges and opportunities for the company. Gain a strategic advantage by leveraging these critical insights to inform your own market approach.

Unlock the full potential of your strategic planning with our detailed PESTLE analysis of Cencosud. Discover how technological advancements, environmental regulations, and legal frameworks are influencing its operations and future growth. Download the complete report now to arm yourself with actionable intelligence and make more informed business decisions.

Political factors

Cencosud operates across several South American nations, including Chile, Argentina, Brazil, Peru, and Colombia, each with varying degrees of political stability. Changes in government or significant policy shifts in these key markets, such as alterations to foreign investment regulations or labor laws, can directly affect Cencosud's ability to expand and its overall profitability. For instance, in 2024, Argentina's economic policies under its new administration have introduced significant uncertainty, impacting consumer spending and business operations across various sectors, which could spill over into Cencosud's performance in that market.

Cencosud operates within a dynamic regulatory landscape. For instance, in Chile, the Consumer Protection Law (Ley del Consumidor) mandates transparent pricing and prohibits misleading advertising, directly impacting Cencosud's marketing and sales strategies. Similarly, competition authorities in countries like Brazil and Argentina scrutinize mergers and acquisitions, influencing Cencosud's expansion plans and market share dynamics.

Cencosud operates across several Latin American countries, each with varying tax structures. For instance, corporate tax rates in Chile, where Cencosud is headquartered, stood at 27% in 2024, while Brazil's rate was around 34% for consolidated profits. Sales taxes, like Chile's IVA (Value Added Tax) at 19%, and import duties significantly impact the cost of goods for Cencosud's retail operations.

Changes in these taxation policies can directly affect Cencosud's profitability. An increase in corporate tax rates would reduce net income, while higher import duties would increase the cost of inventory, potentially squeezing margins or necessitating price adjustments for consumers. Conversely, tax incentives for specific sectors, such as digital transformation or sustainable practices, could offer cost savings and encourage investment.

Trade Relations and Regional Blocs

Cencosud's operations are significantly influenced by trade relations and regional blocs. For instance, Mercosur, a key bloc for Cencosud's South American presence, has seen evolving trade policies that can impact import costs and market access. In 2024, discussions around potential tariff adjustments within Mercosur could alter Cencosud's sourcing strategies for imported goods, potentially affecting product pricing in markets like Argentina and Brazil.

The Pacific Alliance, another influential bloc, also shapes Cencosud's market dynamics in countries such as Chile and Peru. Changes in trade agreements or the implementation of new regulations within these blocs can directly influence Cencosud's supply chain efficiency and its ability to compete across different regions. For example, streamlined customs procedures within the Pacific Alliance could reduce logistics costs, benefiting Cencosud's bottom line.

- Mercosur Trade Dynamics: Potential tariff changes in 2024 within Mercosur could impact Cencosud's sourcing of electronics and textiles, affecting costs in key markets.

- Pacific Alliance Facilitation: Efforts to harmonize regulations within the Pacific Alliance aim to simplify cross-border trade, potentially lowering Cencosud's operational expenses in Chile and Peru.

- Trade Dispute Impact: Ongoing trade tensions between major global economies could indirectly affect Cencosud by increasing the cost of certain imported raw materials or finished goods.

Corruption and Bureaucracy

Corruption and bureaucratic red tape present significant challenges for Cencosud across its operating markets, particularly in some Latin American countries. These issues can translate into operational inefficiencies, inflated costs due to unofficial payments or delays, and substantial legal and reputational risks if not managed diligently. For instance, navigating complex permit processes or customs regulations can be time-consuming and costly, impacting supply chain logistics and project timelines.

Cencosud actively implements strategies to mitigate these risks, focusing on robust internal compliance programs and transparent business practices. The company emphasizes adherence to international anti-corruption standards and invests in training its employees to uphold ethical conduct. This proactive approach aims to ensure compliance with local laws while safeguarding the company's reputation and financial stability.

- Operational Inefficiencies: Bureaucratic delays can slow down store openings, logistics, and product distribution, leading to missed sales opportunities.

- Increased Costs: Navigating complex regulations and potential corruption can result in higher operating expenses through fees, bribes, or extended legal consultations.

- Legal and Reputational Risks: Non-compliance or involvement in corrupt practices can lead to severe penalties, fines, and damage to Cencosud's brand image, impacting consumer trust and investor confidence.

- Compliance Strategies: Cencosud's commitment to strong internal controls, ethical training, and adherence to global compliance standards helps manage these political risks effectively.

Political stability and government policies are critical for Cencosud's operations across South America. For example, changes in government in Argentina in 2024 introduced economic policy uncertainty, potentially impacting consumer spending and Cencosud's performance there. Regulatory frameworks, such as Chile's Consumer Protection Law, directly influence marketing and sales, while competition authorities in Brazil and Argentina scrutinize expansion plans.

Taxation policies significantly affect Cencosud's profitability, with corporate tax rates varying by country; Chile's was 27% in 2024, while Brazil's was around 34%. Sales taxes, like Chile's 19% IVA, and import duties add to operational costs. Trade relations within blocs like Mercosur and the Pacific Alliance also shape market access and sourcing strategies, with potential tariff adjustments in Mercosur in 2024 affecting costs for goods like electronics and textiles.

| Country | 2024 Corporate Tax Rate (approx.) | Key Regulatory Influence | Trade Bloc Involvement |

|---|---|---|---|

| Chile | 27% | Consumer Protection Law | Pacific Alliance, Mercosur observer |

| Argentina | 35% (variable) | Competition Law Scrutiny | Mercosur |

| Brazil | 34% (consolidated) | Competition Law Scrutiny | Mercosur |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Cencosud across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key trends and potential threats and opportunities relevant to Cencosud's operations.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Cencosud's strategic discussions.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the critical PESTLE influences on Cencosud's operations.

Economic factors

Cencosud operates in markets like Chile, Argentina, Brazil, Peru, and Colombia, where economic growth is a key driver. For instance, in 2023, Chile's GDP growth was projected around 0.5%, a slowdown from previous years. This directly affects how much consumers can spend on Cencosud's diverse offerings, from home improvement to financial services, impacting revenue potential.

Weak economic performance, characterized by lower GDP per capita, can significantly curb discretionary spending. In 2024, many South American economies faced inflationary pressures and slower growth, potentially reducing demand for non-essential goods and services offered by Cencosud. This necessitates careful inventory management and strategic pricing to maintain sales volumes.

Conversely, periods of robust economic expansion, with rising GDP and higher per capita income, fuel consumer confidence and increase purchasing power. Stronger economic tailwinds in Cencosud's key markets would translate to greater demand for its retail goods, financial products, and improvements in its supermarket and department store segments, supporting market expansion initiatives.

Inflationary pressures in key South American markets, such as Argentina and Brazil, remained a significant concern through early 2025. For instance, Argentina's inflation rate hovered around 250% year-on-year by Q1 2025, significantly impacting consumer spending power. This high inflation directly increases Cencosud's operational costs for inventory and supplies.

Central banks across the region, including those in Chile and Colombia, continued to manage interest rates to curb inflation. By mid-2024, interest rates in Chile were around 10.75%, a level maintained to cool demand. Higher borrowing costs for Cencosud translate to increased financing expenses, while elevated rates also dampen consumer credit availability, negatively affecting sales of big-ticket items often purchased on credit.

Cencosud, operating across multiple Latin American countries, is significantly exposed to exchange rate fluctuations. The volatility of local currencies, such as the Chilean peso or the Argentinian peso, against major international currencies like the US dollar directly impacts the cost of imported goods essential for its retail and home improvement segments. For instance, a depreciating peso would increase the cost of electronics or appliances sourced internationally.

Furthermore, these currency movements affect the reported value of Cencosud's international debt obligations. If the company holds debt denominated in US dollars, a weaker local currency means it requires more local currency to service that debt, potentially increasing financial expenses. This was evident in 2023, where several Latin American currencies experienced notable depreciation against the dollar, impacting companies with dollar-denominated liabilities.

The consolidation of financial results from its various subsidiaries also presents challenges due to exchange rate volatility. When translating foreign subsidiary earnings and assets back into Cencosud's reporting currency (typically the Chilean peso), significant gains or losses can arise. This can lead to fluctuations in reported revenue and profitability, making year-over-year comparisons more complex for investors and analysts tracking the company's performance through 2024 and into 2025.

Consumer Spending and Disposable Income

Consumer spending is a major driver for retailers like Cencosud. In 2024, as economies in Latin America stabilize, we're seeing a gradual recovery in consumer confidence, which directly impacts discretionary spending. Disposable income levels are crucial; for instance, in Chile, average real wages saw a modest increase in early 2024, supporting household purchasing power.

Trends indicate a shift towards value-conscious purchasing, especially in supermarkets and home improvement sectors, as consumers navigate persistent inflation. Higher employment rates in countries like Peru during late 2023 and early 2024 have provided a more stable income base for many households, benefiting Cencosud's diverse retail formats.

- Consumer Confidence: Recovering in key Latin American markets in 2024, influencing willingness to spend.

- Disposable Income: Modest growth in real wages observed in markets like Chile in early 2024, supporting spending.

- Employment Rates: Stable or improving employment figures in countries like Peru in late 2023/early 2024 bolster consumer income.

- Spending Habits: A growing preference for value-oriented purchases across Cencosud's supermarket and department store segments.

Unemployment Rates and Labor Costs

Unemployment rates and labor costs significantly influence Cencosud's operational landscape across its key markets in Latin America. In 2024, countries like Argentina have faced persistent high unemployment, impacting consumer purchasing power and potentially dampening demand for Cencosud's retail offerings. Conversely, rising minimum wages and increased demand for skilled labor in markets such as Chile and Colombia can lead to higher operational expenses for Cencosud, affecting its profitability and necessitating adjustments in pricing strategies.

Key trends impacting Cencosud include:

- Argentina's unemployment rate hovered around 6.9% in late 2023 and early 2024, affecting discretionary spending.

- Chile, while experiencing a generally robust labor market, has seen wage growth pressures, impacting labor costs for Cencosud's operations.

- Colombia's unemployment rate has shown fluctuations, with rates around 10% in early 2024, influencing consumer confidence and spending patterns.

- Rising labor costs can directly impact Cencosud's cost of goods sold and overhead, potentially squeezing profit margins if not effectively managed through efficiency gains or price adjustments.

Economic factors significantly shape Cencosud's performance across Latin America. While recovery in consumer confidence was noted in 2024, persistent inflation, particularly in Argentina with rates around 250% year-on-year by Q1 2025, continues to challenge purchasing power and increase operational costs. Fluctuating exchange rates, such as the depreciation of the Argentinian peso against the US dollar, also impact the cost of imported goods and the value of international debt obligations.

Central banks' efforts to control inflation through interest rate hikes, like Chile's rate maintained around 10.75% by mid-2024, increase financing expenses for Cencosud and reduce consumer credit availability. Despite these headwinds, stable employment rates, such as in Peru in late 2023/early 2024, and modest real wage growth in Chile in early 2024, offer some support to consumer spending, leading to a preference for value-oriented purchases.

| Country | Key Economic Indicator | Period | Value/Trend |

|---|---|---|---|

| Argentina | Inflation Rate | Q1 2025 | ~250% (YoY) |

| Chile | Central Bank Interest Rate | Mid-2024 | ~10.75% |

| Chile | Real Wage Growth | Early 2024 | Modest Increase |

| Peru | Employment Rate | Late 2023/Early 2024 | Stable |

| Latin America (General) | Consumer Confidence | 2024 | Gradual Recovery |

Full Version Awaits

Cencosud PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Cencosud PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a comprehensive understanding of the external forces shaping Cencosud's strategic landscape.

Sociological factors

Cencosud operates in markets experiencing diverse demographic trends. For instance, in Chile, the population is aging, with the median age projected to reach 43 by 2050, impacting demand for healthcare-related products and services. Conversely, countries like Peru are still relatively young, presenting opportunities for entry-level consumer goods and family-oriented retail formats.

Urbanization continues to be a significant driver across Latin America, with a substantial portion of Cencosud's customer base residing in major cities. This trend necessitates the development of smaller, more convenient store formats, such as express supermarkets and neighborhood stores, to cater to urban lifestyles and shorter shopping trips. For example, in 2024, over 80% of the population in countries like Argentina and Chile lived in urban areas.

Changes in household composition, such as a rise in single-person households and smaller family units, also influence purchasing patterns. This shift favors smaller package sizes and ready-to-eat meal options, areas where Cencosud can adapt its product offerings and store layouts to meet evolving consumer needs.

Cencosud is navigating a significant shift in consumer lifestyles, with a growing emphasis on convenience, health, and sustainability. For instance, in 2024, reports indicate a substantial rise in demand for ready-to-eat meals and online grocery delivery services across Latin America, a key market for Cencosud. This trend directly impacts how Cencosud's supermarket and home improvement divisions must adapt their product assortments and operational strategies to cater to time-pressed consumers seeking easy solutions.

Furthermore, consumer values are increasingly aligning with ethical and environmentally conscious purchasing. Cencosud's commitment to offering more organic and locally sourced products, a trend gaining momentum throughout 2024 and projected to continue into 2025, reflects this evolving preference. The company's ability to provide personalized shopping experiences, through loyalty programs and targeted promotions, will be crucial in retaining and attracting customers who prioritize both quality and responsible consumption.

Cultural norms significantly shape consumer behavior across Cencosud's operating regions in Latin America. Family-centric shopping remains a strong tradition, influencing store design and promotional efforts to accommodate group outings. For instance, in 2024, a significant portion of grocery shopping in countries like Chile and Argentina still involves multiple family members, prompting Cencosud to focus on creating welcoming, spacious store environments.

Preference for physical retail experiences also persists, despite the rise of e-commerce. Many consumers value the tactile experience of browsing products and the immediate gratification of taking purchases home. Cencosud's strategy in 2024 continues to emphasize well-maintained physical stores, offering personalized customer service to cater to this preference, which is particularly evident in its supermarket and department store formats.

Specific holiday spending patterns also dictate marketing calendars and inventory management. Major events like Christmas, Easter, and local national holidays drive substantial sales spikes. Cencosud's 2024 promotions are heavily aligned with these cultural observances, with targeted campaigns and product assortments designed to capitalize on increased consumer spending during these key periods.

Education and Income Distribution

Cencosud operates in markets with varying educational attainment and income levels, directly impacting consumer spending habits. In 2024, for instance, countries like Chile, where Cencosud has a strong presence, reported a significant portion of the population with secondary education, but a smaller percentage with tertiary degrees. This educational stratification often correlates with income disparities, influencing purchasing power and brand perception across Cencosud's diverse customer base.

The distribution of income is a critical determinant of demand for both value-for-money and premium products offered by Cencosud. In regions with a more pronounced income gap, Cencosud must carefully segment its markets. For example, a higher proportion of middle-income consumers in Argentina might prioritize affordability and promotions, while a smaller, affluent segment in Peru might be more receptive to premium private label brands or specialized product lines.

- Education Levels: In 2023, the average years of schooling across Cencosud's key Latin American markets varied, with Chile around 11.5 years and Colombia closer to 9 years, influencing general consumer sophistication.

- Income Inequality: The Gini coefficient in countries like Brazil, a market Cencosud serves, highlights significant income inequality, impacting the purchasing power available for discretionary spending on Cencosud's diverse product categories.

- Purchasing Power Impact: Fluctuations in disposable income, driven by economic conditions and employment rates in 2024, directly affect the demand for non-essential goods sold in Cencosud's department stores and home improvement segments.

- Brand Loyalty Drivers: For lower-income segments, price and promotions are key drivers of loyalty, whereas higher-income consumers may exhibit loyalty based on product quality, brand reputation, and in-store experience at Cencosud outlets.

Health and Wellness Trends

Consumers are increasingly prioritizing health, wellness, and sustainable living, directly impacting purchasing decisions. This shift fuels demand for organic foods, eco-friendly products, and healthier alternatives across retail sectors, including supermarkets and hypermarkets. Cencosud is actively responding to these evolving consumer preferences.

In 2024, Cencosud's efforts to align with these trends are evident in their product assortment and store formats. For instance, their Jumbo and Santa Isabel banners in Chile have expanded their organic and gluten-free sections. This strategic move caters to a growing segment of the population actively seeking healthier food options.

- Growing Demand for Healthy Options: In Latin America, the market for organic food products saw a significant increase, with projections indicating continued growth through 2025.

- Cencosud's Product Expansion: The company has increased its private label offerings of healthy and sustainable products, aiming to capture a larger share of this expanding market.

- Focus on Sustainable Sourcing: Cencosud is also emphasizing sustainable sourcing for its produce and packaged goods, appealing to the environmentally conscious consumer.

Sociological factors significantly influence Cencosud's market approach. Demographic shifts, such as aging populations in Chile and youthful demographics in Peru, necessitate tailored product offerings and retail strategies. Urbanization, with over 80% of populations in key markets like Argentina and Chile residing in cities in 2024, drives demand for convenient, smaller store formats. Evolving lifestyles, marked by a preference for convenience and health, are evident in the 2024 surge in demand for ready-to-eat meals and online grocery services, prompting Cencosud to expand its offerings in these areas.

Technological factors

The accelerated adoption of e-commerce in Latin America, a trend significantly amplified in recent years, presents both a challenge and a substantial opportunity for retailers like Cencosud. This digital shift means consumers increasingly expect seamless online shopping experiences.

Cencosud is actively investing in its digital infrastructure to address this, focusing on enhancing its online platforms and mobile applications. These investments are crucial for meeting the growing demand for convenient, accessible online purchasing options across the region.

Key to this strategy is strengthening last-mile delivery capabilities. For instance, by Q1 2024, Cencosud reported continued growth in its digital sales channels, contributing a notable percentage to its overall revenue, underscoring the importance of efficient logistics in this evolving market.

Cencosud is increasingly using big data analytics and artificial intelligence to understand its customers better. By analyzing purchasing patterns and online behavior, the company can tailor marketing efforts and product offerings. For instance, in 2024, Cencosud's digital platforms processed millions of customer interactions, providing rich data for personalization initiatives. This allows for more effective promotions and a smoother shopping journey, boosting customer loyalty.

Cencosud is increasingly leveraging technology to streamline its supply chain and logistics operations. This includes the implementation of automated warehouse systems and advanced inventory management software, designed to boost efficiency and reduce errors. For instance, by optimizing delivery routes using real-time data, Cencosud aims to cut fuel costs and delivery times, a crucial factor in the competitive retail landscape.

These technological advancements are projected to significantly lower operational costs and minimize product waste. In 2024, the global supply chain management market was valued at over $25 billion, with automation and AI playing a key role in its growth. Cencosud's investment in these areas is expected to enhance its ability to ensure products are available when and where customers need them, directly impacting customer satisfaction and sales.

In-store Technology and Customer Experience

Cencosud is integrating advanced in-store technologies to elevate the customer experience and streamline operations. Self-checkout kiosks, for instance, have become more prevalent, reducing wait times and empowering shoppers with greater control over their purchases. In 2024, many retailers, including those in Cencosud's portfolio, reported increased adoption rates for these systems, with some seeing a 15-20% reduction in checkout queues during peak hours.

Furthermore, smart displays and interactive digital signage are being deployed to offer personalized promotions and product information, creating a more engaging environment. Mobile payment options, such as contactless payments and integrated store apps, are also crucial, with a significant portion of transactions in 2024 occurring through these convenient channels, often exceeding 30% of total sales in tech-forward regions.

These technological advancements not only enhance customer satisfaction but also drive operational efficiencies for Cencosud.

- Enhanced Customer Journey: Technologies like self-checkout and mobile payments reduce friction points, leading to quicker and more satisfying shopping trips.

- Operational Efficiency Gains: Automation through self-service options frees up staff for more value-added customer interactions and reduces labor costs.

- Competitive Differentiation: Early adoption and effective implementation of these technologies can set Cencosud apart from competitors who lag in digital integration.

- Data-Driven Insights: In-store tech can provide valuable data on customer behavior, enabling more targeted marketing and inventory management.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are paramount for Cencosud in its digital operations, especially with the increasing volume of online transactions and sensitive customer information handled. Protecting this data from breaches and ensuring compliance with stringent regulations like LGPD (Brazil's General Data Protection Law) and similar frameworks across Latin America is a core operational focus. Cencosud invests in robust security measures to safeguard customer data and maintain trust.

The company actively implements advanced technologies and protocols to secure its online platforms and payment systems. This includes measures to prevent unauthorized access, data theft, and fraud, thereby mitigating significant financial and reputational risks. For instance, in 2023, the global average cost of a data breach reached an estimated $4.45 million, underscoring the critical need for Cencosud's proactive approach.

- Data Protection Investments: Cencosud allocates resources to advanced encryption, secure network infrastructure, and regular security audits to protect customer data.

- Regulatory Compliance: Adherence to evolving data privacy laws across its operating markets is a continuous effort, ensuring legal and ethical data handling.

- Consumer Trust: Demonstrating strong cybersecurity practices is crucial for maintaining customer confidence in Cencosud's digital services and loyalty programs.

- Risk Mitigation: Proactive cybersecurity measures help prevent costly data breaches, which can lead to financial penalties, operational disruptions, and damage to brand reputation.

Cencosud's technological focus is on enhancing digital capabilities and customer experience. The company is heavily investing in e-commerce infrastructure and last-mile delivery to meet growing online demand, with digital sales channels showing continued growth contributing significantly to revenue by early 2024.

Leveraging big data and AI, Cencosud aims to personalize customer interactions and marketing efforts, processing millions of customer interactions on its digital platforms in 2024 to refine offerings and boost loyalty.

The integration of in-store technologies, such as self-checkout kiosks and mobile payments, is improving operational efficiency and customer satisfaction, with these contactless payment methods exceeding 30% of total sales in some regions during 2024.

Cybersecurity is a critical priority, with Cencosud investing in robust measures to protect sensitive customer data and ensure compliance with privacy regulations, a vital step given the global average cost of a data breach was an estimated $4.45 million in 2023.

Legal factors

Cencosud must navigate a complex web of consumer protection laws across its operating markets, including Chile, Argentina, Brazil, Peru, and Colombia. These regulations govern everything from the safety of products sold in its supermarkets and department stores to the clarity of labeling and the truthfulness of advertising. For instance, Chile's Law No. 19,496 on Consumer Rights mandates clear pricing, accurate product information, and specific return policies, while Brazil's Consumer Defense Code (CDC) offers robust protections against misleading advertising and defective products.

Adherence to these consumer protection statutes is not merely a legal obligation but a strategic imperative. Non-compliance can lead to substantial financial penalties, costly litigation, and severe damage to Cencosud's brand reputation. In 2023, for example, regulatory bodies in various Latin American countries issued significant fines to retailers for issues ranging from price gouging to misleading promotions, highlighting the financial risks involved. Maintaining consumer trust through transparent practices and responsive complaint resolution is therefore paramount to Cencosud's long-term success and market standing.

Cencosud must navigate a complex web of labor laws across its operating regions, impacting everything from minimum wage requirements to mandated employee benefits. For instance, in Chile, the minimum wage for 2024 is CLP 440,000, directly influencing Cencosud's payroll expenses. Regulations concerning working hours and overtime pay also add to operational costs and require careful HR management to ensure compliance.

Employee benefits, such as healthcare contributions and paid leave, vary significantly by country, adding another layer of complexity to Cencosud's human resource strategy. In Argentina, for example, specific provincial labor laws dictate additional benefits beyond national mandates. These varying requirements necessitate localized HR policies and can lead to substantial differences in labor costs between Cencosud's Chilean operations and its ventures in other South American nations.

Unionization rights and collective bargaining agreements are also critical legal factors. In Brazil, strong labor unions can negotiate favorable terms for employees, potentially increasing Cencosud's labor costs and influencing operational flexibility. Managing these labor relations effectively is crucial for maintaining stable operations and avoiding costly disputes, especially as Cencosud expands its footprint.

Antitrust laws and competition regulations are crucial for Cencosud, as they govern market share strategies, mergers, and pricing. These regulations aim to prevent monopolies and unfair practices, ensuring a level playing field in the retail sector. For instance, in 2023, Chile's Fiscalía Nacional Económica (FNE) continued to scrutinize major retail players for potential anticompetitive behavior, impacting how companies like Cencosud approach market expansion and pricing.

Cencosud must navigate these legal frameworks to maintain compliance and avoid penalties, which can significantly affect its financial performance and strategic decisions. The company's approach to mergers and acquisitions is particularly scrutinized to ensure it does not unduly stifle competition, as demonstrated by past regulatory reviews of significant retail consolidation in Latin America.

Financial Services Regulations

Cencosud's financial services operations, primarily through its Cencosud Shopping and Cencosud Ventures divisions, navigate a stringent regulatory landscape. Banking regulations, credit provision rules, and robust data security protocols for financial transactions are paramount. Compliance with anti-money laundering (AML) directives is also a critical operational requirement, adding layers of complexity to their business model.

The financial sector's highly regulated nature demands constant vigilance and adaptation. For instance, in Chile, the Comisión para el Mercado Financiero (CMF) oversees banking and financial entities, setting capital adequacy ratios and consumer protection standards. Similarly, in Peru, the Superintendencia de Banca, Seguros y AFP (SBS) enforces similar regulations. These frameworks impact everything from how credit cards are issued to how customer data is protected, with significant penalties for non-compliance.

Key regulatory considerations for Cencosud's financial services include:

- Banking and Credit Regulations: Adherence to capital requirements, lending practices, and consumer credit protection laws in each operating country.

- Data Privacy and Security: Compliance with data protection laws like Chile's Law No. 19,628 on the Protection of Private Life and Peru's Law No. 29733 on Personal Data Protection, especially for sensitive financial information.

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF): Implementing robust Know Your Customer (KYC) procedures and transaction monitoring systems to prevent illicit financial activities.

- Consumer Protection: Ensuring fair treatment of customers, transparency in financial product offerings, and accessible complaint resolution mechanisms.

Data Protection and Privacy Regulations

Cencosud must navigate a growing landscape of data protection and privacy regulations across Latin America, mirroring global trends like the GDPR. These laws significantly influence how the company handles customer information, from initial collection to storage and processing. For instance, Brazil's LGPD (Lei Geral de Proteção de Dados) and similar legislation in countries like Chile and Colombia mandate strict consent mechanisms and robust data governance frameworks. Failure to comply can result in substantial fines, impacting Cencosud's operational costs and reputation.

These regulations dictate that Cencosud must be transparent about its data practices and obtain explicit consent for data usage. This requires implementing sophisticated data management systems and clear privacy policies. The company's ability to collect, store, process, and utilize customer data for marketing, personalized offers, and operational improvements is directly governed by these legal frameworks. Ensuring compliance is crucial for maintaining customer trust and avoiding legal repercussions.

- GDPR-like regulations are increasingly prevalent in Latin America, impacting Cencosud's data handling.

- Compliance requires robust data governance and explicit customer consent mechanisms.

- LGPD in Brazil is a prime example of legislation Cencosud must adhere to.

- Non-compliance can lead to significant financial penalties and reputational damage.

Cencosud's operations are significantly shaped by evolving environmental regulations across Latin America, particularly concerning waste management, emissions, and sustainable sourcing. For instance, Chile's Extended Producer Responsibility (EPR) laws require companies to manage the end-of-life of their products, impacting packaging and logistics. Brazil's National Solid Waste Policy also imposes obligations on waste management and recycling.

Compliance with these environmental mandates is crucial to avoid fines and maintain social license to operate. In 2023, several Latin American countries intensified enforcement of environmental standards, leading to increased scrutiny of retail and logistics operations. Cencosud's commitment to sustainability, including reducing its carbon footprint and promoting circular economy principles, is therefore directly influenced by these legal requirements and broader societal expectations.

The company must also contend with regulations related to product safety and labeling, ensuring that all goods sold meet national standards. This includes adherence to specific requirements for food products, electronics, and textiles. For example, Peru's consumer safety regulations and labeling requirements for imported goods add complexity to supply chain management and product compliance.

Environmental factors

Climate change poses significant risks to Cencosud's operations. The increasing frequency of extreme weather events, such as droughts and floods in regions like Chile and Argentina, directly impacts agricultural supply chains, potentially leading to product shortages and price volatility for Cencosud's supermarkets and retail divisions. For instance, severe droughts in Chile during 2023-2024 have already strained water resources, affecting crop yields for key produce sold by the company.

Cencosud faces significant challenges from resource scarcity, especially water, in key operating regions like Chile and Peru. Droughts in these areas directly impact the availability and cost of agricultural products sold in its supermarkets, potentially increasing supply chain expenses. For instance, Chile experienced its most severe drought in 2023, impacting agricultural output across the country.

Furthermore, water shortages can escalate operational costs for Cencosud's extensive network of stores and distribution centers, requiring investments in water-efficient technologies and potentially higher utility bills. The company must implement robust sustainable water management practices, such as rainwater harvesting and water recycling systems, across all its facilities to mitigate these risks and ensure business continuity.

Cencosud is actively pursuing waste reduction and circular economy principles, evidenced by its 2024 initiatives to decrease packaging waste by 15% across its supermarket operations in Chile and Argentina. This includes phasing out single-use plastics for certain product categories and increasing the use of recycled materials in private label packaging.

The company is also implementing robust food waste management programs, aiming to reduce spoilage by 10% by the end of 2025 through improved inventory tracking and donation partnerships with local charities. Cencosud's commitment extends to responsible electronic waste disposal, with dedicated collection points in major stores and partnerships with certified recycling firms, a move responding to increasing consumer demand for sustainable practices.

Energy Consumption and Carbon Footprint

Cencosud's extensive operations, encompassing numerous retail stores, distribution hubs, and administrative offices, naturally lead to significant energy consumption. This consumption directly contributes to the company's carbon footprint, a key environmental consideration.

To address this, Cencosud has been actively implementing energy efficiency measures across its facilities. These efforts include upgrading lighting to LED, optimizing HVAC systems, and improving building insulation. The company has also set ambitious emission reduction targets, aiming to align its environmental impact with global sustainability goals.

Furthermore, Cencosud is increasingly exploring and adopting renewable energy sources to power its operations. This strategic shift aims to decrease reliance on fossil fuels and further reduce its carbon footprint. For instance, as of 2024, the company has been investing in solar panel installations at various store locations, contributing to a cleaner energy mix.

- Energy Efficiency Initiatives: Cencosud is implementing LED lighting upgrades and optimizing HVAC systems across its retail network.

- Renewable Energy Adoption: Investments in solar panel installations at store locations are underway to increase the use of clean energy.

- Emission Reduction Targets: The company has established specific goals for reducing its greenhouse gas emissions, reflecting its commitment to sustainability.

- Operational Footprint: Energy consumption is a critical factor across Cencosud's extensive network of stores and distribution centers.

Sustainable Sourcing and Ethical Supply Chains

Cencosud recognizes the growing consumer demand for products sourced sustainably and ethically. The company actively works with its suppliers to ensure environmental regulations are met and fair labor practices are upheld throughout the production process. This commitment extends to promoting responsible resource management and minimizing the ecological footprint of the goods it offers.

In 2024, Cencosud continued to strengthen its supplier codes of conduct, emphasizing transparency and accountability in areas such as waste reduction and energy efficiency. For instance, efforts were made to increase the proportion of private label products adhering to specific sustainability certifications. By fostering these relationships, Cencosud aims to build a more resilient and responsible supply chain, aligning with global environmental and social governance (ESG) expectations.

- Supplier Audits: Cencosud conducts regular audits to verify compliance with its sustainability and ethical sourcing standards.

- Product Certifications: The company encourages suppliers to obtain certifications for sustainable forestry, fair trade, and organic production.

- Consumer Transparency: Cencosud is increasing the visibility of its sourcing practices, allowing consumers to make more informed choices.

- Waste Reduction Initiatives: Partnerships with suppliers focus on reducing packaging waste and promoting circular economy principles.

Environmental regulations are becoming increasingly stringent across Cencosud's operating markets, impacting everything from packaging to emissions. Compliance with these evolving rules, such as stricter waste management directives in Chile and new carbon reporting requirements in Peru, necessitates ongoing investment in operational adjustments and technology. Failure to adapt could lead to fines and reputational damage.

Cencosud's commitment to sustainability is evident in its 2024 initiatives, including a 15% reduction target for packaging waste in its Chilean and Argentinian supermarkets and a 10% reduction goal for food waste by the end of 2025. These efforts are driven by both regulatory pressures and growing consumer demand for eco-friendly practices.

The company's energy consumption is a significant environmental factor, with ongoing efforts to improve efficiency through LED lighting and HVAC upgrades. Furthermore, Cencosud is expanding its use of renewable energy, with solar panel installations at various store locations contributing to a cleaner energy mix as of 2024.

PESTLE Analysis Data Sources

Our PESTLE analysis for Cencosud is built on a robust foundation of data from official government statistics agencies across Latin America, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Cencosud's operations.