Cencosud Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cencosud Bundle

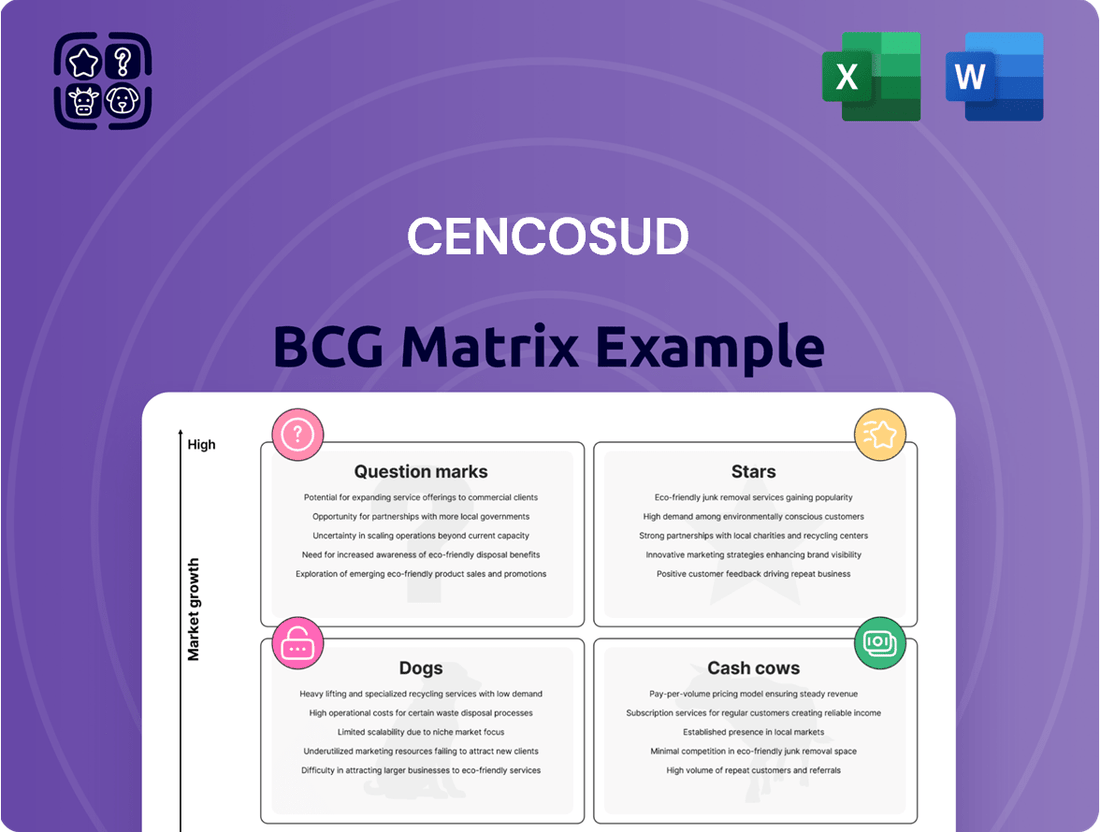

Curious about Cencosud's strategic product portfolio? Our BCG Matrix analysis highlights key areas of growth and potential challenges. See which of their ventures are Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full Cencosud BCG Matrix to gain a comprehensive understanding of their market position and identify actionable strategies for future success. Purchase the complete report for detailed insights and a clear roadmap to optimized resource allocation.

Stars

The Fresh Market, acquired by Cencosud, is a key growth engine, demonstrating robust online sales increases of 23.8% in 2024 and an impressive 27.5% in the first quarter of 2025. This strong digital performance, coupled with strategic physical expansion, positions The Fresh Market as a star within Cencosud's portfolio.

Cencosud's commitment to The Fresh Market is evident in its 2025 expansion plans, which include opening 12 new stores in the U.S. as part of a substantial $610 million investment. This aggressive growth strategy underscores Cencosud's belief in The Fresh Market's high-potential market and its ability to capture increasing market share.

Cencosud's e-commerce operations are a clear growth engine, demonstrating robust expansion. In 2024, online sales contributed to a significant 15.9% revenue increase overall for the company. This momentum continued into the first quarter of 2025, with online sales climbing by 8.8% year-over-year, surpassing 7 million transactions.

The company's performance in specific markets highlights this digital strength. The United States and Peru, in particular, saw impressive online sales growth of 30% and 44% respectively during Q1 2025. These figures underscore Cencosud's increasing market penetration and the strategic importance of its digital channels.

Cencosud's private label products, exemplified by Cuisine&Co, are a significant growth driver. In Q1 2025, these products captured 17.3% of total sales, demonstrating robust market penetration, especially within the food category.

The expansion of brands like Cuisine&Co into new territories, such as Brazil, underscores a successful regionalization strategy. This geographic diversification is crucial for capturing a larger share in an expanding market segment.

These private label offerings are strategically important due to their higher profit margins and their ability to foster customer loyalty. This positions them as strong contenders to become future cash cows for Cencosud.

Shopping Centers (Chile)

Cencosud's shopping centers in Chile are performing exceptionally well, demonstrating robust growth and profitability. This segment is a clear Star in the BCG matrix, reflecting its high market share and strong growth potential within the Chilean retail landscape.

The division's financial health is underscored by impressive Q1 2025 figures. Revenues saw a significant increase of 10.5%, coupled with an outstanding EBITDA margin of 81.2%. This strong financial performance is further supported by a consistently high occupancy rate of 98.5%, indicating a dominant position in the market.

- Revenue Growth: 10.5% increase in Q1 2025.

- EBITDA Margin: Achieved a remarkable 81.2% in Q1 2025.

- Occupancy Rate: Maintained a high 98.5% occupancy.

- Market Position: Strong market share in a growing segment, driven by tourism and strategic management.

Colombia Supermarket & Retail Operations

Cencosud's Colombian supermarket and retail operations have experienced a significant upswing. In 2024, the company saw its adjusted EBITDA double, a clear indicator of improved financial performance driven by a more attractive commercial proposition and streamlined operations.

The company's strategic expansion plans in Colombia underscore its confidence in the market. Cencosud intends to open more than 150 new Ara stores and incorporate around 70 former Colsubsidio locations. This aggressive expansion strategy highlights Colombia as a key growth market where Cencosud is actively increasing its footprint and market share.

- Adjusted EBITDA doubled in 2024.

- Profitability increased due to enhanced commercial offerings and operational efficiency.

- Over 150 Ara stores planned for opening.

- Approximately 70 former Colsubsidio stores to be integrated.

Cencosud's Chilean shopping centers represent a clear Star in its BCG matrix. These centers boast a dominant market share and are experiencing robust growth, fueled by a strong tourism sector and effective management. The segment achieved a remarkable 10.5% revenue increase in Q1 2025, alongside an impressive 81.2% EBITDA margin, maintaining a high 98.5% occupancy rate.

| Business Unit | Market Share | Growth Rate | Profitability | BCG Category |

|---|---|---|---|---|

| Chilean Shopping Centers | High | High | High | Star |

| The Fresh Market (US) | Growing | High (especially online) | Promising | Star |

| Cencosud E-commerce | Growing | High | Improving | Star |

| Private Label (Cuisine&Co) | Increasing | High | High Margins | Potential Star/Cash Cow |

| Colombia Operations | Expanding | High (store openings) | Improving (EBITDA doubled in 2024) | Potential Star |

What is included in the product

This BCG Matrix overview for Cencosud details strategic recommendations for Stars, Cash Cows, Question Marks, and Dogs.

The Cencosud BCG Matrix provides a clear, one-page overview, instantly clarifying each business unit's strategic position to alleviate decision-making paralysis.

Cash Cows

Cencosud's supermarket operations in Chile, Peru, and the US are prime examples of Cash Cows. These segments consistently generate substantial profits and hold significant market share in their respective regions.

In 2024, these mature markets were instrumental in driving Cencosud's financial performance, contributing significantly to adjusted EBITDA. The company reported double-digit growth in these supermarket divisions, underscoring their reliable and robust cash-generating capabilities.

Jumbo hypermarkets in Chile and Argentina are Cencosud's established cash cows. Despite potentially slower market growth, their substantial market share and strong brand loyalty consistently generate significant revenue. This segment is crucial for funding other business units.

In 2024, Cencosud continued to invest in the Jumbo brand, with a notable new store opening in Argentina during the fourth quarter. This expansion underscores the ongoing commitment to maintaining and growing Jumbo's dominant position in key markets, ensuring its continued role as a reliable cash generator for the group.

Cencosud's financial services, primarily its private label credit cards and consumer loans, act as significant cash cows. These offerings generate consistent revenue by tapping into Cencosud's extensive retail customer base, fostering loyalty through integrated financial solutions.

Operating within a mature financial market, these services exhibit low growth potential but deliver high profitability. This is largely due to their synergistic relationship with the core retail operations, minimizing customer acquisition costs and maximizing cross-selling opportunities.

For instance, in 2023, Cencosud's financial services segment, including its credit card operations, reported a net financial income of approximately CLP 300 billion (around USD 315 million based on average 2023 exchange rates), underscoring their contribution to the company's overall financial health.

Home Improvement Stores (Chile)

The home improvement sector in Chile has demonstrated robust growth, with sales experiencing a notable uptick in the first quarter of 2025, largely attributed to a newly implemented commercial strategy. This segment is a significant contributor to Cencosud's overall performance.

This segment is likely a Cash Cow for Cencosud, characterized by its strong market position within Chile. It generates substantial and stable cash flows, requiring relatively modest reinvestment to maintain its competitive edge and market share.

- Home Improvement Sales Growth (Chile, Q1 2025): Increased sales driven by new commercial strategy.

- Market Position: Strong within the Chilean home improvement market.

- Cash Flow Generation: Consistent and stable, supporting other business units.

- Investment Needs: Lower compared to high-growth segments, indicative of a mature market.

Department Stores (Chile)

Cencosud's department stores, exemplified by Paris in Chile, are performing well, with adjusted EBITDA showing positive trends. This improvement is largely due to Cencosud's focus on strengthening its value proposition and benefiting from a rebound in tourism.

The department store industry can be quite mature, but Cencosud's strong brand recognition and ongoing strategic initiatives are helping it maintain a significant market share. This position allows the business to generate consistent and stable cash flow, characteristic of a cash cow.

- Paris, a key Cencosud department store in Chile, has seen its adjusted EBITDA grow, reflecting successful strategic adjustments.

- The company's efforts to enhance its value proposition and capitalize on increased tourism have directly contributed to this financial improvement.

- Despite the maturity of the department store sector, Cencosud's established brand equity and strategic investments solidify its position as a market leader.

- This strong market presence translates into reliable and substantial cash flow generation, classifying the department store segment as a cash cow for Cencosud.

Cencosud's supermarket divisions in Chile and Peru are strong cash cows, consistently generating substantial profits and holding significant market share. These mature markets are crucial for funding other business units.

In 2024, these segments demonstrated robust financial performance, with Cencosud reporting double-digit growth in their supermarket divisions, highlighting their reliable cash-generating capabilities. For example, in Chile, supermarkets contributed significantly to the company's overall adjusted EBITDA.

Cencosud's financial services, particularly its private label credit cards and consumer loans, are also significant cash cows. These operations leverage the extensive retail customer base to generate consistent revenue, with net financial income in 2023 reaching approximately CLP 300 billion.

The department store segment, notably Paris in Chile, also functions as a cash cow. Despite the maturity of the sector, strong brand recognition and strategic initiatives have led to positive adjusted EBITDA trends, fueled by an improved value proposition and a rebound in tourism, with Paris showing a notable increase in sales in early 2025.

| Business Segment | Market Position | Cash Flow Generation | 2024 Performance Highlight |

|---|---|---|---|

| Supermarkets (Chile, Peru) | High Market Share | Stable and Substantial | Double-digit growth in adjusted EBITDA |

| Financial Services | Integrated with Retail | Consistent Revenue | CLP 300 billion net financial income (2023) |

| Department Stores (Paris, Chile) | Strong Brand Recognition | Reliable and Substantial | Positive adjusted EBITDA trends, sales growth in early 2025 |

What You’re Viewing Is Included

Cencosud BCG Matrix

The Cencosud BCG Matrix preview you see is the complete, final document you will receive upon purchase, offering an in-depth strategic analysis of their business units. This report is meticulously crafted, providing actionable insights without any watermarks or demo content, ensuring immediate professional use. You are viewing the exact same BCG Matrix analysis that will be delivered, ready for immediate integration into your strategic planning or presentations. This preview guarantees that the purchased file is fully formatted and analysis-ready, offering a clear and comprehensive overview of Cencosud's market position.

Dogs

Cencosud's divestiture of Bretas Supermarkets in Minas Gerais in February 2025 signals a strategic move away from underperforming assets. This action suggests Bretas was likely classified as a Dog in the BCG matrix, characterized by low market share and low market growth. Such segments often drain resources without generating substantial returns, prompting companies to shed them to improve overall portfolio performance.

Cencosud's strategic decision to close six underperforming stores in Brazil directly impacted its revenue streams in that market. This action signals that these specific retail outlets were not achieving profitability goals, likely due to a combination of low market share and a difficult economic landscape.

Certain legacy physical retail formats within Cencosud, particularly those that haven't embraced digital transformation or adapted to evolving consumer preferences, are likely experiencing declining foot traffic. For instance, older department store layouts or formats that primarily rely on in-person browsing without integrated online offerings may fall into this category. This trend is further amplified by the significant growth in e-commerce, which has reshaped shopping habits globally.

In 2024, the retail landscape continues to be dominated by online channels, with e-commerce sales projected to reach over $2.7 trillion globally. This shift means that physical stores failing to offer a compelling omnichannel experience or those with outdated operational models are particularly vulnerable. Cencosud's strategic focus on digitalization, as evidenced by investments in its e-commerce platforms and supply chain, signals an understanding of this challenge and a move away from less productive physical footprints.

Certain Non-Food Brands with Low Market Share

Cencosud's portfolio might include non-food brands that are struggling to gain market share. These brands often operate in mature or highly competitive sectors where growth is limited. For instance, if a particular electronics or home goods brand within Cencosud has consistently underperformed, showing minimal sales growth and high customer acquisition costs, it would likely be classified as a Dog. This category represents brands that consume resources without generating significant returns, hindering overall company performance.

In 2024, Cencosud's strategy likely involves evaluating these underperforming non-food segments. Brands that fail to capture even a small percentage of their respective markets, perhaps less than 5%, and are in industries with projected annual growth rates below 3%, would fit the Dog profile. Such brands might require divestment or a significant overhaul to avoid continued drain on company resources.

- Low Market Share: Brands holding less than 5% of their market segment.

- Low Growth Markets: Operating in industries with annual growth rates below 3%.

- Resource Drain: Consuming disproportionate marketing and operational expenses with minimal revenue contribution.

- Strategic Review: Potential candidates for divestment or significant restructuring.

Operations in Highly Challenged Economic Environments (e.g., parts of Argentina)

Cencosud's ventures in Argentina face significant headwinds due to persistent economic instability and a depreciating peso. This challenging landscape has directly affected profitability, even when revenue in local currency shows an uptick. For instance, in the first quarter of 2024, while reported revenue in Argentine pesos increased, the net profit experienced a decline, reflecting the intense pressure from inflation and currency devaluation on margins.

Despite these hurdles, Cencosud has pursued strategic growth initiatives within Argentina. The acquisition of Makro and Basualdo supermarkets in 2023 aimed to bolster its market position and expand its footprint. However, the broader macroeconomic environment means that some existing operations may struggle to achieve robust profitability and market share due to factors beyond the company's immediate control.

- Argentina's inflation rate reached approximately 276% year-on-year as of April 2024, impacting consumer purchasing power and operational costs.

- Cencosud reported a net loss in its Argentine operations for the first quarter of 2024, despite a reported 232% increase in local currency sales.

- The company's strategy includes optimizing operating expenses and integrating newly acquired stores to mitigate the effects of economic volatility.

- The overall market share in Argentina remains a key focus, with ongoing efforts to adapt business models to the dynamic economic conditions.

Dogs within Cencosud's portfolio represent business units or brands with low market share in slow-growing industries. These segments often require significant investment to maintain their position but yield minimal returns, acting as a drain on company resources. Consequently, Cencosud typically evaluates these units for divestment or restructuring to optimize its overall business portfolio.

In 2024, Cencosud's approach to its Dog segments likely involves a rigorous assessment of their viability. Brands or stores that consistently fail to gain traction, perhaps showing less than 3% annual growth in markets with limited expansion potential, are prime candidates for divestment. This strategic pruning allows the company to reallocate capital towards more promising ventures.

Cencosud's operations in Argentina, for instance, illustrate the characteristics of Dog segments due to severe economic headwinds. Despite a reported 232% increase in sales in Argentine pesos for Q1 2024, the company incurred a net loss in the region, highlighting how inflation and currency depreciation erode profitability. Argentina's inflation rate was approximately 276% year-on-year as of April 2024, significantly impacting purchasing power and operational costs.

The divestiture of Bretas Supermarkets in Minas Gerais in February 2025 underscores Cencosud's commitment to shedding underperforming assets. This move suggests Bretas was likely categorized as a Dog, characterized by its inability to capture significant market share or benefit from market growth, leading to a drain on resources.

| Cencosud Business Segment Example | Market Share (Estimated) | Market Growth (Estimated) | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Underperforming Physical Stores (e.g., older formats) | Low (< 5%) | Low (< 3%) | Dog | Divestment or significant modernization |

| Struggling Non-Food Brands | Low (< 5%) | Low (< 3%) | Dog | Divestment or brand overhaul |

| Certain Argentine Operations (post-acquisition integration challenges) | Low to Moderate (variable) | Low (due to economic instability) | Potential Dog/Question Mark | Intensive cost management and adaptation |

Question Marks

Cencosud's recent launch of Hydrum and Cross Check in Q1 2025 positions them as potential question marks within the BCG Matrix. These new non-food brands target expanding markets, but their nascent stage means they likely hold a small market share. Significant capital will be needed for brand building and market penetration to assess if they can transition into Stars.

Cencosud Ventures, the company's dedicated venture capital arm, has strategically placed its bets on high-potential startups like Vopero, a re-commerce platform focused on branded apparel. These ventures are positioned to tap into rapidly expanding markets such as circular fashion, advanced logistics, and innovative fintech solutions.

While these investments signify Cencosud's forward-looking approach, they represent a nascent stage within the conglomerate's broader financial landscape, characterized by a relatively small market share currently. Their ultimate contribution to Cencosud's overall success will be contingent on achieving substantial growth and seamless integration into existing operations.

The Fresh Market's expansion into new states and regions, with a target of 12 new stores in 2025, positions these ventures as Question Marks within the BCG framework. These new markets represent nascent stages of development for the brand, where its market share is currently minimal.

Success hinges on the company's ability to effectively penetrate these local markets and gain consumer acceptance. The Fresh Market's overall strong performance, as a Star, provides a solid foundation, but these new territories require significant investment to grow and potentially become future Stars.

Spid Stores (Quick Commerce Format)

Cencosud's SPID stores represent a strategic move into the quick commerce sector, a segment experiencing significant growth. This format is designed for speed and quality, tapping into the increasing consumer preference for rapid delivery of essential goods.

Given its relatively recent launch, SPID likely occupies a nascent position within a high-growth market. This places it in the 'Question Mark' category of the BCG matrix, characterized by low market share in a rapidly expanding industry.

The success of SPID hinges on its ability to capture a substantial market share as the quick commerce landscape evolves. Cencosud's investment in this format signals an expectation of future market leadership, contingent on effective scaling and consumer adoption.

- Market Growth: The global quick commerce market was projected to reach USD 198.07 billion by 2025, indicating a strong growth trajectory that SPID aims to capitalize on.

- Cencosud's Investment: Cencosud has been actively investing in digital transformation and new retail formats, with SPID being a key component of its omnichannel strategy.

- Competitive Landscape: The quick commerce space is highly competitive, with numerous players vying for market share, making SPID's initial low market share a characteristic of a question mark.

Retail Media Initiatives (Cencosud Media)

Cencosud is significantly investing in its retail media arm, Cencosud Media, as a key component of its 2025 digital overhaul. This strategic move taps into the burgeoning retail media market, which capitalizes on rich customer data for targeted advertising.

As a relatively nascent revenue stream for Cencosud, Cencosud Media currently holds a modest market share compared to established advertising giants. This positions it as a Question Mark in the BCG matrix, indicating substantial growth potential but also requiring significant investment to capture market share and achieve profitability.

- Growth Potential: Retail media is a rapidly expanding sector, with global retail media ad spend projected to reach approximately $120 billion by 2025.

- Data Leverage: Cencosud Media can leverage its extensive customer purchase data to offer advertisers highly targeted campaigns, a key differentiator in the digital advertising landscape.

- Investment Needs: As a Question Mark, Cencosud Media will require continued investment in technology, talent, and platform development to compete effectively and realize its growth ambitions.

- Market Position: While still developing, Cencosud Media aims to carve out a significant niche by offering unique advertising opportunities tied directly to the shopping journey.

Cencosud's ventures into new sectors like quick commerce with SPID and the development of its retail media arm, Cencosud Media, exemplify classic Question Marks. These initiatives operate in high-growth markets but are in their early stages, thus possessing low market share.

Significant capital investment is crucial for these ventures to build brand recognition and capture market share. Their success hinges on effectively navigating competitive landscapes and adapting to evolving consumer preferences to potentially ascend to Star status.

The strategic expansion of The Fresh Market into new territories, aiming for 12 new stores in 2025, also places these emerging locations as Question Marks. While the overall brand is strong, these new markets require focused investment to establish a solid foothold and consumer acceptance.

Cencosud's new non-food brands, Hydrum and Cross Check, launched in Q1 2025, are similarly positioned as Question Marks. They target growing markets but are currently small players needing substantial investment to prove their potential and secure a significant market share.

| Cencosud Venture | Market Segment | BCG Category | Growth Potential | Current Market Share | Investment Need |

|---|---|---|---|---|---|

| SPID (Quick Commerce) | Rapidly Expanding | Question Mark | High | Low | Significant |

| Cencosud Media (Retail Media) | Growing Digital Advertising | Question Mark | High | Modest | Substantial |

| The Fresh Market (New Stores) | Grocery Retail Expansion | Question Mark | Moderate to High | Minimal (in new markets) | High |

| Hydrum & Cross Check (New Brands) | Non-Food Retail | Question Mark | High | Low | Significant |

BCG Matrix Data Sources

Our Cencosud BCG Matrix leverages robust data from Cencosud's annual reports, market share data from industry analytics firms, and economic growth forecasts to provide a comprehensive strategic overview.