CBIZ SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBIZ Bundle

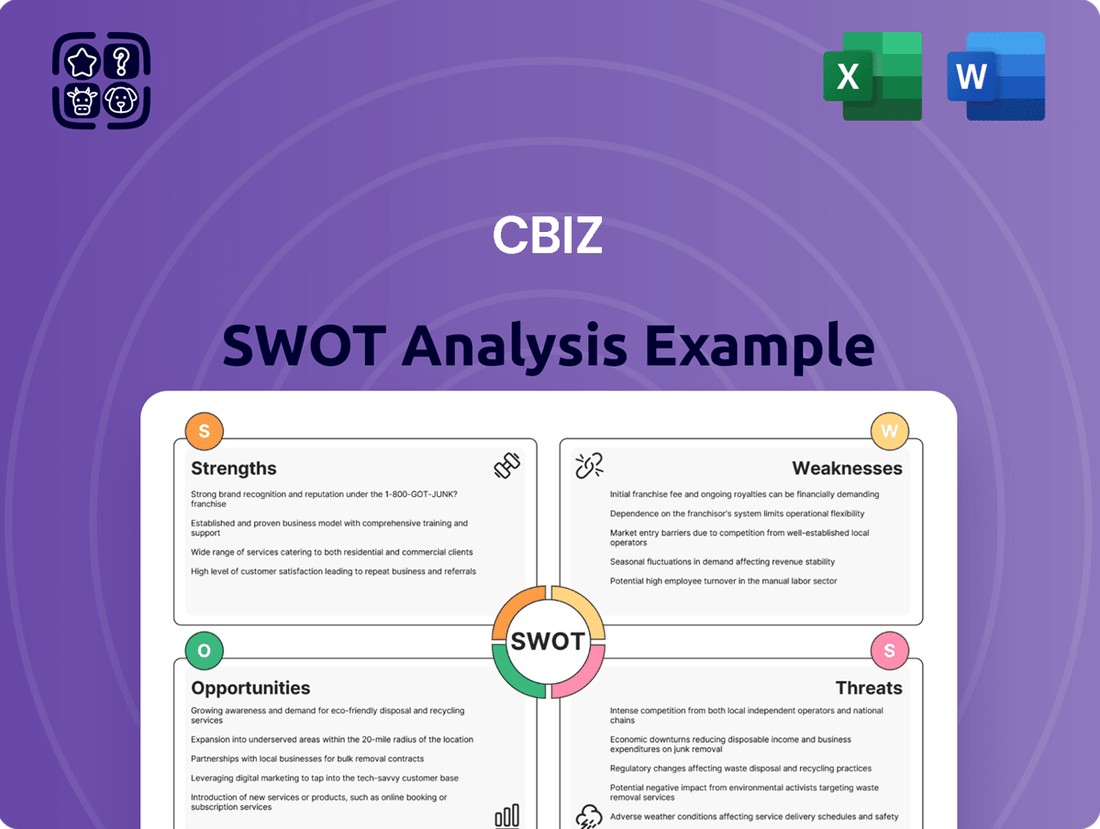

Curious about CBIZ's competitive edge and potential pitfalls? Our comprehensive SWOT analysis dives deep into their market position, revealing actionable insights that can inform your next strategic move. Don't miss out on the full picture; unlock the complete report to gain a strategic advantage.

Strengths

CBIZ's integrated service model is a significant strength, offering clients a one-stop shop for financial advisory, accounting, tax, and human capital management. This comprehensive approach allows them to address a broad spectrum of client needs, from intricate tax planning to essential HR functions, fostering robust, long-term partnerships.

By bundling these diverse professional services, CBIZ cultivates deeper client relationships and positions itself as a strategic partner rather than just a service provider. This holistic offering provides clients with streamlined solutions for complex business challenges, enhancing their operational efficiency and overall business health.

CBIZ's strategic expansion through acquisitions, notably the November 2024 purchase of Marcum LLP, has been a game-changer. This move cemented CBIZ's position as the premier full-service professional services advisor catering to middle-market businesses across the United States.

The integration of Marcum LLP has dramatically amplified CBIZ's market footprint and broadened its service offerings. This significant scaling is projected to contribute substantially to revenue increases throughout 2025, demonstrating the financial impact of such strategic consolidations.

CBIZ has shown impressive financial strength, with adjusted earnings per share (EPS) climbing by 15% and adjusted EBITDA growing by 12% in the first half of 2025 compared to the same period in 2024. This consistent growth highlights the company's solid profitability and effective management.

High Proportion of Recurring Revenue

CBIZ benefits significantly from a high proportion of recurring revenue, with roughly 72% to 77% of its income stemming from essential, ongoing services. This includes critical areas like annual accounting and tax preparation, payroll processing, and employee benefits administration.

This substantial base of stable, predictable income is a key strength, bolstering CBIZ's financial stability and its ability to weather economic downturns. It allows for more reliable forecasting and strategic planning.

- Recurring Revenue Base: Approximately 72-77% of CBIZ's revenue is recurring.

- Service Stability: This revenue comes from essential services like accounting, tax, payroll, and benefits.

- Financial Resilience: The predictable income stream enhances financial stability and reduces vulnerability to economic shocks.

Diversified Client Base and High Retention

CBIZ benefits from a remarkably diversified client base, serving more than 135,000 clients across a wide array of industries. This broad reach means no single client represents a disproportionately large share of revenue, significantly reducing the risk of revenue loss due to downturns affecting a specific sector. For instance, in their 2023 fiscal year, revenue diversification remained a key operational strength.

Furthermore, CBIZ cultivates deep and lasting relationships with its clients, evidenced by consistently high retention rates. This loyalty is a testament to client satisfaction and the value they derive from CBIZ's services, providing a stable revenue foundation. These strong relationships are crucial for sustained growth and market resilience.

- Broad Client Reach: Over 135,000 clients across diverse industries.

- Revenue Stability: No single client dependency, mitigating sector-specific risks.

- Client Loyalty: High retention rates indicate strong client satisfaction and trust.

- Resilient Business Model: Diversification supports consistent performance even in volatile markets.

CBIZ's integrated service model is a significant strength, offering clients a one-stop shop for financial advisory, accounting, tax, and human capital management. This comprehensive approach allows them to address a broad spectrum of client needs, fostering robust, long-term partnerships and streamlining solutions for complex business challenges.

The company's strategic expansion through acquisitions, notably the November 2024 purchase of Marcum LLP, has dramatically amplified its market footprint and service offerings. This scaling is projected to contribute substantially to revenue increases throughout 2025, solidifying CBIZ's position as a premier advisor to middle-market businesses.

CBIZ demonstrates impressive financial strength, with adjusted EPS climbing 15% and adjusted EBITDA growing 12% in H1 2025 compared to H1 2024, highlighting solid profitability and effective management.

A substantial base of recurring revenue, estimated at 72-77% from essential services like accounting, tax, payroll, and benefits, bolsters CBIZ's financial stability and resilience against economic downturns.

CBIZ serves over 135,000 clients across diverse industries, mitigating risk through broad diversification and maintaining strong client loyalty with consistently high retention rates, ensuring a stable revenue foundation.

| Key Strength | Description | Supporting Data/Impact |

| Integrated Service Model | One-stop shop for diverse financial and HR needs. | Fosters deep client partnerships and streamlines solutions. |

| Strategic Acquisitions | Acquisition of Marcum LLP in Nov 2024. | Expanded market footprint; projected revenue increases in 2025. |

| Financial Performance | Strong growth in profitability metrics. | H1 2025: Adjusted EPS +15%, Adjusted EBITDA +12% vs. H1 2024. |

| Recurring Revenue | 72-77% of income from ongoing services. | Enhances financial stability and resilience. |

| Client Diversification | Over 135,000 clients across many industries. | Reduces risk from sector-specific downturns; high retention rates. |

What is included in the product

Analyzes CBIZ’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential problems into opportunities.

Weaknesses

CBIZ anticipates ongoing weakness in its non-recurring, project-based service lines, a segment that makes up a significant portion of its revenue in the latter half of 2025. This dependence on less predictable services complicates demand forecasting, as evidenced by recent missed revenue targets. For instance, in Q1 2025, the company reported a 5% year-over-year decline in its advisory segment, largely attributed to this project-based revenue volatility.

CBIZ's recent acquisition of Marcum for roughly $2.3 billion presents a significant challenge in terms of integration costs. These expenses are substantial and are projected to extend into 2026, demanding careful financial oversight.

The substantial debt incurred from the Marcum deal, approximately $2.3 billion, is a key weakness. This increased leverage could strain free cash flow and potentially limit reinvestment opportunities or dividend payouts in the short to medium term.

CBIZ faced headwinds in early 2025, missing revenue projections for both the first and second quarters. This underperformance highlights a struggle to meet top-line growth ambitions. For instance, Q1 2025 revenue of $385 million missed the consensus estimate of $392 million, and Q2 2025 revenue of $405 million also fell short of the $410 million forecast.

These revenue shortfalls are partly attributed to expected downturns in specific legacy Marcum business segments. Additionally, broader economic factors, including a softening in capital markets and advisory service demand during the first half of 2025, contributed to these challenges.

Decline in Specific Business Segments

CBIZ's National Practices segment has seen a notable revenue decline, a key weakness that requires attention. This underperformance in a specific area could potentially dampen overall company growth, even if other segments are performing well. For instance, if National Practices revenue dropped by 5% in 2024 while other segments grew by 10%, it would still impact the consolidated financial picture.

This decline suggests that CBIZ may be facing increased competition, pricing pressures, or a shift in client demand within this particular business line. Addressing this weakness is crucial to ensure that the company's strong divisions are not held back by underperforming ones.

Key considerations for this weakness include:

- Assessing root causes: Identifying why National Practices revenue is declining is the first step, whether it's market saturation, outdated service offerings, or operational inefficiencies.

- Strategic realignment: CBIZ may need to re-evaluate its strategy for this segment, potentially divesting non-core assets or investing in new technologies and talent to revitalize it.

- Performance monitoring: Closely tracking the financial performance of National Practices and comparing it against industry benchmarks will be essential for effective management.

Dependence on Human Capital and Talent Management

CBIZ, as a professional services firm, places immense value on its human capital. The company's ability to deliver high-quality services is directly tied to the expertise and dedication of its employees. This reliance makes talent management a critical, ongoing challenge.

The competitive landscape for skilled professionals, often referred to as the 'talent war,' significantly impacts CBIZ. Attracting and retaining top-tier talent requires substantial and continuous investment in recruitment, training, and development programs. For instance, the accounting and consulting sectors, where CBIZ operates, have seen average annual salary increases of 5-7% in 2024, reflecting this intense competition for talent.

- Talent Dependency: CBIZ's core service delivery hinges on the skills and knowledge of its employees.

- Talent War Impact: The ongoing competition for skilled professionals drives up recruitment and retention costs.

- Investment Needs: Significant financial resources are required for effective human capital management, including training and competitive compensation.

- Industry Trends: The professional services industry, in general, faces challenges in maintaining a consistent supply of highly qualified personnel.

CBIZ's reliance on non-recurring, project-based services introduces revenue unpredictability, as seen in its Q1 2025 advisory segment revenue decline of 5% year-over-year. The substantial $2.3 billion debt from the Marcum acquisition also poses a significant weakness, potentially straining free cash flow and limiting future investments. Furthermore, the company missed revenue projections in both Q1 and Q2 2025, with Q1 revenue at $385 million against a $392 million estimate, and Q2 at $405 million versus a $410 million forecast. This underperformance, partly due to expected downturns in legacy Marcum segments and softening capital markets, highlights challenges in meeting top-line growth ambitions.

Full Version Awaits

CBIZ SWOT Analysis

The preview you see is the actual CBIZ SWOT Analysis document you'll receive upon purchase—no surprises, just professional quality and complete insights.

This is a real excerpt from the complete CBIZ SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual CBIZ SWOT analysis file. The complete version, packed with detailed information, becomes available after checkout.

Opportunities

CBIZ has a strong track record of successful acquisitions and maintains an active pipeline, indicating a commitment to growth through strategic purchases. This approach allows them to broaden their geographic reach, diversify their service portfolio, and increase their overall market share.

The recent Marcum acquisition has significantly bolstered CBIZ's market standing, making it a more compelling entity for further consolidation within the accounting and financial services sector. This enhanced position can attract more acquisition targets and facilitate smoother integration processes.

CBIZ can significantly boost its competitive edge by deepening its investment in advanced technologies, especially artificial intelligence. This strategic move allows for the automation of repetitive tasks, freeing up skilled professionals to focus on higher-value client advisory services.

By integrating AI, CBIZ can unlock powerful data analytics capabilities, delivering more precise and actionable insights to clients. This technological enhancement is crucial for innovating service delivery models and creating novel solutions that address evolving client needs in the dynamic professional services landscape.

The integration of Marcum into CBIZ's operations, finalized in early 2024, significantly expands the potential for cross-selling. This merger brings together complementary service lines, creating a more robust and diversified client offering. For instance, clients previously served by Marcum for tax services might now be introduced to CBIZ's wealth management or PEO solutions, and vice versa.

This expanded service portfolio presents a prime opportunity to increase revenue per client. By offering a more comprehensive suite of solutions, CBIZ can deepen existing client relationships and capture a larger share of their business. This strategy is crucial for maximizing the value derived from the Marcum acquisition, aiming to boost client retention and overall profitability.

Growing Demand for Specialized Advisory Services

The professional services sector is anticipated to see ongoing expansion, fueled by the increasing intricacy of business operations and a heightened need for specialized knowledge in financial advice, regulatory adherence, and strategic guidance. CBIZ is strategically positioned to leverage this growing market demand.

This trend presents a significant opportunity for CBIZ, particularly in its core competencies. For instance, the demand for tax advisory services is expected to remain robust, with businesses navigating evolving tax laws and seeking to optimize their financial structures. In 2024, the global financial advisory market was valued at approximately $400 billion and is projected to grow at a CAGR of 6.5% through 2030, according to industry reports.

- Increased complexity in regulatory environments necessitates expert compliance and advisory services.

- The digital transformation of businesses creates a demand for specialized IT and cybersecurity consulting.

- Global economic shifts and geopolitical uncertainties drive the need for strategic financial planning and risk management.

- The growing focus on ESG (Environmental, Social, and Governance) factors is creating new opportunities for specialized advisory services in sustainability and impact reporting.

Focus on ESG and Sustainability Consulting

Clients are increasingly prioritizing Environmental, Social, and Governance (ESG) considerations, creating a significant opportunity for CBIZ. Many businesses are actively seeking expert guidance on implementing sustainable practices to meet stakeholder expectations and regulatory demands. For instance, global sustainable investment assets reached an estimated $37.8 trillion in early 2024, highlighting the market's growth and client demand for ESG integration.

CBIZ can strategically expand its advisory services to capitalize on this burgeoning ESG market. By offering specialized consulting in areas like carbon footprint reduction, supply chain sustainability, and ethical governance, CBIZ can align with evolving client values and address critical emerging business requirements. This expansion positions CBIZ to capture a larger share of the professional services market driven by sustainability mandates.

- Growing Client Demand: Businesses are actively seeking expertise in ESG implementation.

- Market Expansion: The global sustainable investment market is substantial and growing.

- Service Enhancement: CBIZ can offer specialized ESG advisory services to meet client needs.

- Competitive Advantage: Proactive engagement in ESG consulting can differentiate CBIZ.

CBIZ's strategic acquisition approach, highlighted by the successful integration of Marcum in early 2024, significantly expands its cross-selling potential. This allows for deeper client relationships and increased revenue per client by offering a more comprehensive suite of services.

The growing demand for specialized knowledge in financial advice, regulatory compliance, and strategic guidance within an increasingly complex business environment positions CBIZ favorably. For instance, the global financial advisory market was valued around $400 billion in 2024, with projected growth.

CBIZ can capitalize on the rising client focus on ESG factors, a market segment experiencing substantial growth, with global sustainable investment assets reaching approximately $37.8 trillion in early 2024. Offering specialized ESG advisory services can create a competitive advantage and meet evolving client values.

Investing in advanced technologies, particularly AI, offers opportunities to automate tasks, enhance data analytics, and develop innovative service models. This technological advancement is crucial for staying competitive in the dynamic professional services landscape.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Cross-selling & Revenue Growth | Leveraging the Marcum acquisition to offer integrated services and increase revenue per client. | Marcum integration completed early 2024; aims to boost client retention and profitability. |

| Market Expansion & Demand | Capitalizing on the growing need for specialized financial and regulatory advice. | Global financial advisory market valued at ~$400 billion in 2024, projected CAGR of 6.5% through 2030. |

| ESG Advisory Services | Meeting increasing client demand for sustainability and ethical governance guidance. | Global sustainable investment assets estimated at $37.8 trillion in early 2024. |

| Technological Advancement | Implementing AI and advanced analytics to improve service delivery and client insights. | Focus on automation and data-driven solutions to enhance competitive edge. |

Threats

Economic and geopolitical volatility presents a significant threat to CBIZ. Uncertainties in the global landscape can directly impact client spending, especially on services that are considered discretionary or non-recurring. This can lead to a slowdown in demand for CBIZ's diverse range of offerings.

This volatility makes accurate revenue forecasting and margin maintenance a considerable challenge for CBIZ. For instance, the ongoing geopolitical tensions in Eastern Europe and potential trade disputes in 2024-2025 could disrupt supply chains and impact business investment, indirectly affecting the demand for financial and insurance services.

The professional services sector, where CBIZ operates, is intensely competitive and highly fragmented. This means there are many players, from small local outfits to large national corporations, all competing for the same clients. For instance, the accounting and tax services market alone saw over 100,000 firms in the US as of 2024, highlighting the sheer number of potential rivals.

To thrive in this environment, CBIZ must constantly innovate and clearly define what makes its services unique. Staying ahead means offering something distinct from the competition, whether it's specialized expertise, superior technology, or a unique client experience, to hold onto its market share.

The intense competition for skilled professionals, a persistent 'talent war,' presents a considerable threat to CBIZ. This makes it challenging to attract and keep the expertise needed for service delivery. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the unemployment rate for management, professional, and related occupations remained low, hovering around 2.2% for much of the year, indicating a tight labor market.

Difficulty in hiring or high employee turnover directly impacts CBIZ's capacity for growth and the consistent quality of its services. In 2024, many firms reported increased recruitment costs, with some studies indicating that the average cost to hire a new employee exceeded $5,000, a figure likely higher for specialized roles within the financial services sector.

Regulatory Changes and Compliance Risks

CBIZ operates within a heavily regulated landscape, particularly concerning its financial, accounting, and healthcare advisory services. Shifts in tax legislation, financial oversight, or healthcare statutes could demand substantial modifications to its service offerings, escalate compliance expenditures, or adversely affect its earnings. For instance, the Inflation Reduction Act of 2022 introduced significant changes impacting tax credits and healthcare provisions, requiring advisory firms like CBIZ to adapt their guidance and services to clients navigating these new rules.

The complexity of these evolving regulations presents a continuous challenge. Staying abreast of and implementing changes across multiple service lines, from tax law updates to new healthcare compliance standards, demands ongoing investment in expertise and technology. Failure to adapt promptly can lead to penalties or a loss of competitive edge.

- Increased Compliance Costs: Adapting to new regulations often requires significant investment in training, software, and personnel, directly impacting operating expenses.

- Service Adjustments: Changes in tax codes or healthcare policies may necessitate modifying or developing new service lines to meet client needs and regulatory requirements.

- Reputational Risk: Non-compliance or slow adaptation to regulatory shifts can damage CBIZ's reputation and client trust.

Cybersecurity and Data Breaches

CBIZ, as a custodian of sensitive financial and human capital information, confronts significant cybersecurity threats. A successful cyber-attack or data breach could result in substantial financial penalties, severe reputational harm, and a critical loss of client confidence. For instance, the average cost of a data breach in the financial services sector reached $5.90 million in 2023, a figure that underscores the potential financial fallout.

The increasing sophistication of cyber threats means that even robust security measures can be challenged. Disruptions to CBIZ's information processing systems, whether through ransomware or other malicious activities, could paralyze operations and impact service delivery. In 2024, ransomware attacks are projected to cost businesses globally over $10 trillion annually, highlighting the pervasive nature of this threat.

- Heightened risk of financial losses due to data breaches.

- Potential for significant reputational damage impacting client trust.

- Operational disruptions from cyber-attacks leading to service interruptions.

- Increasingly sophisticated threat landscape requiring continuous security investment.

The intensifying competition within the professional services sector poses a substantial threat to CBIZ. With a fragmented market boasting numerous competitors, from small local firms to large national entities, CBIZ must continually differentiate its offerings to retain and attract clients. For example, the U.S. market for accounting and tax services alone comprised over 100,000 firms in 2024, underscoring the crowded landscape.

The ongoing "talent war" is another significant challenge, making it difficult for CBIZ to recruit and retain skilled professionals. In 2024, the low unemployment rate for management, professional, and related occupations, around 2.2%, signals a tight labor market. This scarcity of talent can impede CBIZ's growth and compromise service quality, with recruitment costs for specialized roles potentially exceeding $5,000 per hire.

Navigating a complex and evolving regulatory environment presents a continuous threat, particularly for CBIZ's financial, accounting, and healthcare advisory services. Changes in tax laws, financial regulations, or healthcare statutes, such as those introduced by the Inflation Reduction Act of 2022, necessitate constant adaptation, increased compliance spending, and potential service adjustments. Failure to keep pace can lead to penalties and a loss of competitive advantage.

Cybersecurity threats represent a critical danger, with the financial services sector experiencing an average data breach cost of $5.90 million in 2023. The increasing sophistication of attacks, including ransomware projected to cost businesses globally over $10 trillion annually in 2024, could lead to severe financial losses, reputational damage, and operational disruptions for CBIZ.

| Threat Category | Specific Threat | Impact on CBIZ | 2024-2025 Data/Context |

|---|---|---|---|

| Market Competition | Fragmented and Intense Competition | Difficulty in client acquisition and retention, pressure on pricing. | Over 100,000 accounting/tax firms in US (2024); high number of advisory firms. |

| Talent Acquisition & Retention | Talent War/Scarcity of Skilled Professionals | Challenges in service delivery capacity, increased recruitment costs, potential impact on service quality. | U.S. unemployment for professional roles ~2.2% (2024); recruitment costs >$5,000 (2024). |

| Regulatory Environment | Evolving Regulations (Tax, Healthcare, Financial) | Increased compliance costs, need for service line adjustments, potential penalties for non-compliance. | Inflation Reduction Act (2022) impacts tax credits and healthcare; ongoing updates require continuous adaptation. |

| Cybersecurity | Data Breaches and Cyber-Attacks | Financial losses, reputational damage, loss of client trust, operational disruptions. | Average data breach cost in financial services: $5.90M (2023); global ransomware costs projected >$10T annually (2024). |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of internal financial statements, comprehensive market research reports, and expert industry forecasts. These diverse data streams are synthesized to provide a well-rounded and actionable understanding of CBIZ's strategic position.