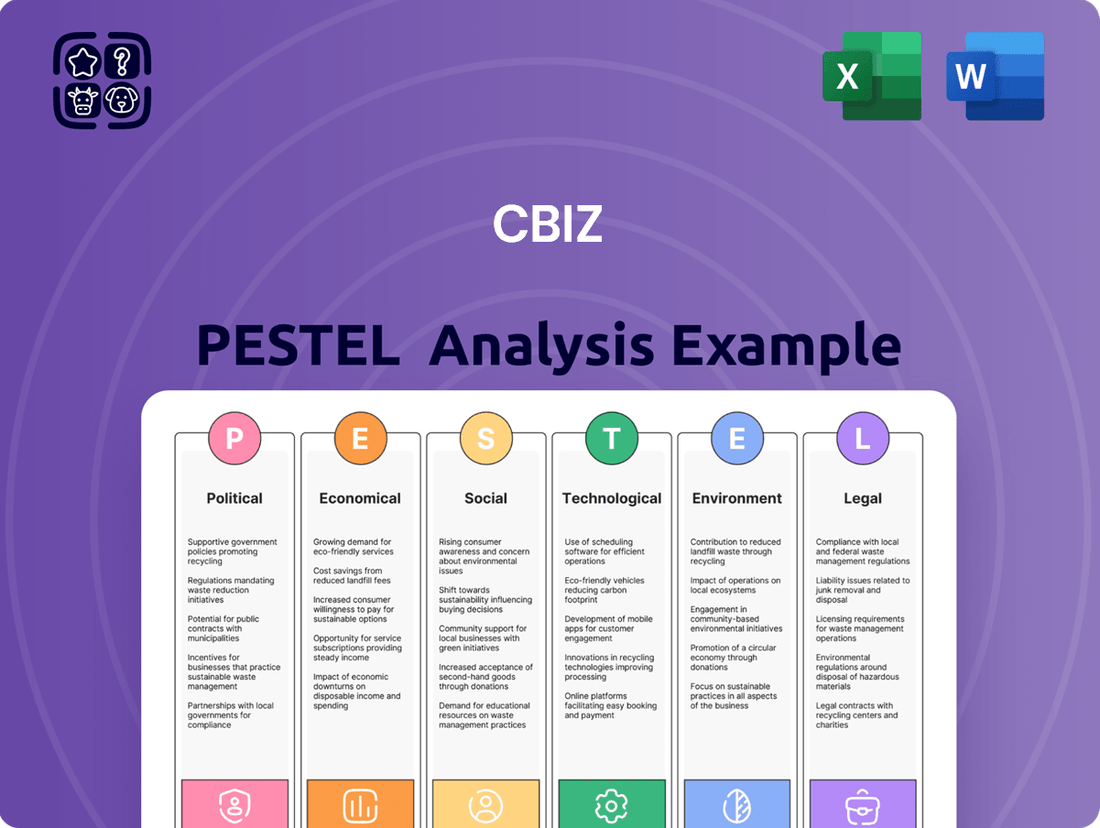

CBIZ PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBIZ Bundle

Unlock the external forces shaping CBIZ's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. This in-depth report provides actionable intelligence for strategic planning and competitive advantage. Download the full version now and gain the insights you need to navigate the evolving business landscape.

Political factors

Government policies significantly shape CBIZ's operating environment, particularly concerning taxation, financial reporting, and labor. Changes in tax legislation, such as the potential expiration of key provisions from the Tax Cuts and Jobs Act at the end of 2025, could drive increased demand for tax planning and compliance services from CBIZ's clients.

Furthermore, evolving regulations in areas like payment processing and mandated increases in minimum wages at state and local levels directly influence the compliance burdens faced by CBIZ's clientele, thereby impacting the scope and demand for the firm's advisory services.

Political stability is a bedrock for business confidence. In 2024, many regions continue to navigate complex geopolitical landscapes, impacting investment decisions. For instance, ongoing trade tensions and regional conflicts can make businesses hesitant to commit to new projects, potentially dampening demand for services that aren't core to immediate operations.

Geopolitical shifts directly influence the demand for professional services. Economic uncertainties stemming from global events in 2024, such as supply chain disruptions and fluctuating energy prices, often lead companies to defer discretionary spending. This caution typically translates to a reduced need for project-based or non-recurring consulting and advisory services.

Shifts in global trade policies and international relations, even for a U.S.-focused firm like CBIZ, can ripple through the business landscape. For instance, the U.S. Chamber of Commerce reported in early 2024 that ongoing trade disputes and tariffs could add significant costs for businesses, potentially impacting their profitability and, consequently, their demand for financial and advisory services.

While CBIZ's core clientele resides within the U.S. middle market, many of these businesses engage in international trade or are subject to global economic fluctuations. A 2024 report by the International Monetary Fund highlighted that geopolitical tensions could lead to increased supply chain disruptions and currency volatility, indirectly affecting the financial health and advisory needs of CBIZ's clients.

Government Spending and Budget Priorities

Government spending and budget priorities significantly shape the landscape for professional services firms. For example, the United States federal budget for fiscal year 2024, which saw significant allocations towards infrastructure and defense, could translate into increased demand for specialized accounting, tax, and advisory services within these sectors. Conversely, a contraction in government funding for other areas might present challenges by reducing consulting opportunities.

The allocation of public funds directly influences market opportunities. For instance, if a government prioritizes digital transformation initiatives, professional services firms with expertise in IT consulting and cybersecurity are likely to see a surge in demand. The Canadian federal budget for 2024, with its focus on innovation and clean technology, signals potential growth areas for firms offering related advisory services.

- Increased government investment in sectors like renewable energy or healthcare can create substantial opportunities for consulting and advisory firms.

- Budgetary constraints or shifts in spending priorities can lead to a reduction in demand for certain professional services, particularly those tied to government contracts.

- The 2024 U.S. federal budget, for example, included substantial funding for infrastructure projects, potentially boosting demand for engineering, construction management, and related financial advisory services.

- Government decisions on tax policy and public expenditure directly impact the financial planning and compliance needs of businesses, creating a ripple effect for accounting and legal services.

Regulatory Scrutiny and Enforcement

Increased regulatory scrutiny in financial services and human capital management directly impacts CBIZ's operational framework. For instance, the U.S. Securities and Exchange Commission (SEC) has been particularly active in enforcing rules around data security and financial reporting, with significant penalties for non-compliance. This heightened oversight means CBIZ must continuously adapt its services to ensure both its own adherence and its clients' compliance.

The complexity of these regulations, such as evolving data privacy laws like the California Privacy Rights Act (CPRA), adds a layer of challenge. CBIZ's expertise in navigating these intricate requirements is a key differentiator, allowing them to offer valuable compliance solutions. However, this also translates into a greater compliance burden for the firm and its clientele, requiring ongoing investment in specialized knowledge and technology.

- Increased regulatory enforcement actions in financial services by bodies like the SEC and FINRA.

- Evolving data privacy regulations (e.g., CPRA, GDPR) necessitate robust compliance infrastructure.

- Compliance costs for financial services firms are projected to rise, creating demand for expert advisory.

Government policies directly influence CBIZ's service demand. For example, the U.S. federal budget for 2024 allocated substantial funds to infrastructure, potentially boosting demand for specialized financial advisory services in that sector. Conversely, shifts in tax legislation, such as the potential expiration of certain Tax Cuts and Jobs Act provisions at the end of 2025, could increase demand for CBIZ's tax planning and compliance expertise.

Political stability is crucial for business confidence. Geopolitical tensions in 2024, impacting global supply chains and energy prices, might lead businesses to defer non-essential spending, potentially reducing demand for project-based consulting. International trade policies also play a role; U.S. Chamber of Commerce data from early 2024 indicated that trade disputes can increase business costs, affecting their need for financial advisory services.

Regulatory environments are constantly evolving. Heightened enforcement actions by bodies like the SEC in financial services, coupled with increasing data privacy regulations such as the California Privacy Rights Act (CPRA), necessitate robust compliance infrastructure. This trend is expected to drive higher compliance costs for financial services firms, thereby increasing the demand for expert advisory services.

| Political Factor | Impact on CBIZ | Supporting Data/Trend (2024/2025) |

| Tax Policy Changes | Increased demand for tax planning and compliance services. | Potential expiration of Tax Cuts and Jobs Act provisions end of 2025. |

| Government Spending Priorities | Opportunities in funded sectors, reduced demand elsewhere. | 2024 U.S. federal budget focus on infrastructure. |

| Regulatory Scrutiny | Demand for compliance and advisory services. | Increased SEC enforcement actions; CPRA implementation. |

| Geopolitical Stability | Impacts business confidence and discretionary spending. | Global supply chain disruptions and energy price volatility noted in 2024. |

What is included in the product

The CBIZ PESTLE Analysis systematically examines the external macro-environmental forces impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The CBIZ PESTLE Analysis offers a clear, summarized version of complex external factors, making it easy to reference during meetings and reducing the stress of information overload.

Economic factors

The United States experienced a solid GDP growth of 2.5% in 2023, signaling a healthy economic environment that generally benefits CBIZ. This expansion typically translates to increased business investment and activity, driving demand for CBIZ's core accounting, tax, and advisory services as companies navigate growth and compliance.

However, concerns about a potential economic slowdown persist. While recession risks were elevated in late 2023 and early 2024, current forecasts suggest a milder impact. Should a recession materialize, CBIZ's clients might scale back on discretionary spending, potentially affecting demand for non-recurring project-based services and impacting overall revenue streams.

Central banks, like the Federal Reserve, are navigating a complex economic landscape. As of early 2024, the Fed has held its benchmark interest rate steady, but the possibility of cuts later in the year remains a key consideration. This stability, following aggressive hikes in previous years, impacts borrowing costs for businesses and individuals alike.

Inflationary pressures, while showing signs of moderation from their 2022 peaks, continue to influence consumer spending and business operating costs. For instance, the Consumer Price Index (CPI) in the US saw an annual increase of 3.4% in April 2024, indicating persistent, though slowing, price growth. This environment directly affects CBIZ's clients, potentially increasing demand for financial planning and asset management services as they seek to protect their wealth and optimize investments amidst these economic shifts.

The labor market's health, marked by low unemployment rates and robust wage growth, directly influences CBIZ's human capital management offerings. For instance, the U.S. unemployment rate remained historically low, hovering around 3.7% in late 2024, while wage growth for private sector workers averaged approximately 4.5% annually through mid-2025. These conditions mean clients might face higher payroll expenses and increased demand for efficient HR solutions.

Furthermore, the competitive landscape for skilled professionals within the accounting and professional services sector, where CBIZ operates, can escalate the company's own labor costs. As demand for talent outpaces supply, particularly for specialized roles in payroll processing and benefits administration, CBIZ may need to invest more in recruitment and compensation to retain its workforce, potentially impacting its profitability.

Client Industry Performance

The performance of the industries CBIZ serves, like healthcare and IT, directly impacts the demand for its specialized services. For instance, robust growth in the healthcare sector, which saw an estimated 6.1% increase in revenue in 2024 according to industry reports, fuels the need for CBIZ's solutions in areas such as automated scheduling and credential tracking within human capital management.

CBIZ's strategy of maintaining a diversified client base across numerous industries is a key factor in its resilience. This broad exposure helps to cushion the company against the risks of economic slowdowns or sector-specific downturns.

- Healthcare Sector Growth: Projections indicate continued expansion in healthcare services through 2025, driven by an aging population and technological advancements, directly benefiting CBIZ's client base in this sector.

- IT and Telecom Demand: The IT and telecom sectors are experiencing significant investment, with global IT spending expected to reach $5.1 trillion in 2024, creating opportunities for CBIZ's consulting and advisory services.

- Diversification Benefits: CBIZ's presence across multiple industries, including professional services, manufacturing, and financial services, mitigates the impact of any single industry's underperformance.

- Client Acquisition Trends: CBIZ's ability to attract new clients in high-growth sectors is crucial for maintaining service demand and revenue streams.

Availability of Capital and Lending Environment

The availability of capital and the prevailing lending environment are critical for CBIZ's clients, directly influencing their capacity for investment and expansion. A robust lending landscape, characterized by accessible credit and favorable interest rates, empowers businesses to pursue growth opportunities, thereby increasing demand for CBIZ's core services like financial advisory and accounting.

In 2024, the Federal Reserve maintained a restrictive monetary policy stance for much of the year, leading to higher borrowing costs. However, by late 2024 and into early 2025, there were indications of potential rate cuts, which could ease lending conditions. For instance, the average interest rate on commercial and industrial loans from large banks, which stood around 7.5% in early 2024, began to show signs of moderation towards the end of the year, potentially falling closer to 6.5% by mid-2025.

- Increased M&A Activity: Easier access to capital in 2025 is expected to fuel merger and acquisition (M&A) activity, creating more opportunities for CBIZ's due diligence and transaction advisory services.

- Small Business Lending: Government-backed loan programs and a more accommodative stance from regional banks could improve capital availability for small and medium-sized businesses, a key client segment for CBIZ.

- Impact on Investment: Lower borrowing costs encourage businesses to invest in new equipment, technology, and talent, driving demand for financial planning and tax advisory services.

- Credit Market Conditions: While corporate bond yields remained elevated in 2024, projections for 2025 suggest a potential narrowing of credit spreads, making debt financing more attractive for CBIZ's clients.

Economic momentum is expected to remain positive through 2025, with the US GDP growth projected at 2.3% for the year. This sustained growth bodes well for CBIZ, as companies continue to invest and expand, increasing the demand for accounting, tax, and advisory services.

While inflation has moderated, it remains a key consideration. The Consumer Price Index (CPI) is forecast to average 3.0% in 2025, influencing operating costs and consumer spending. This persistent inflation highlights the ongoing need for CBIZ's financial planning and wealth management services.

The labor market is projected to remain tight, with unemployment rates expected to hover around 3.8% through mid-2025. This continued demand for talent will likely drive wage growth, creating opportunities for CBIZ's human capital management solutions, while also potentially increasing their own recruitment costs.

| Economic Indicator | 2023 Actual | 2024 Projection | 2025 Projection |

|---|---|---|---|

| US GDP Growth | 2.5% | 2.6% | 2.3% |

| US Unemployment Rate | 3.6% | 3.8% | 3.8% |

| US CPI Inflation | 4.1% | 3.2% | 3.0% |

Full Version Awaits

CBIZ PESTLE Analysis

The preview shown here is the exact CBIZ PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors affecting CBIZ.

You'll gain immediate access to this professionally structured analysis, providing valuable insights for strategic planning and decision-making.

Sociological factors

The workforce is increasingly diverse, with Gen Z and Millennials now making up a significant portion of employees, bringing different expectations regarding work-life balance and company culture. For instance, a 2024 survey indicated that over 70% of Gen Z workers prioritize flexibility and mental well-being in their job search.

This demographic shift directly impacts the demand for human capital management services, as companies focus more on retention and employee development to meet these evolving needs. CBIZ's ability to offer tailored benefits packages and robust HR consulting is crucial for businesses navigating these generational differences.

The shift to remote and hybrid work is reshaping the employment landscape, with a significant portion of the workforce now operating outside traditional office settings. This trend directly influences the demand for Human Capital Management (HCM) solutions, as businesses increasingly need tools to effectively manage, engage, and support a distributed workforce. For CBIZ, this means a growing need for HR consulting and payroll services that cater to the complexities of virtual teams, including compliance, benefits administration, and performance management in a remote context.

Clients are increasingly demanding more than just basic compliance services, actively seeking strategic advice and data-driven insights to tackle complex business issues. This societal trend highlights a growing appreciation for expert guidance, pushing firms like CBIZ to bolster their advisory offerings in financial planning, business strategy, and technology consulting.

Talent Shortage and Skill Gaps in Professional Services

The accounting and professional services sectors are grappling with a persistent talent shortage, a significant challenge for firms like CBIZ. This scarcity is exacerbated by evolving skill requirements, meaning even when candidates are available, they may not possess the specialized knowledge needed. For instance, a 2024 survey by the American Institute of CPAs (AICPA) indicated that over 70% of CPA firms reported difficulty in hiring qualified staff, highlighting the widespread nature of this issue.

Addressing these skill gaps requires a proactive approach from CBIZ, focusing on continuous professional development and upskilling existing employees. The demand for expertise in areas like data analytics, cybersecurity, and artificial intelligence within accounting services is rapidly increasing. By investing in training programs, CBIZ can equip its workforce with the necessary competencies to meet these new demands and maintain a competitive edge.

- Talent Scarcity: Over 70% of CPA firms reported hiring difficulties in 2024, according to the AICPA.

- Evolving Skill Needs: Increased demand for data analytics, cybersecurity, and AI expertise in professional services.

- Strategic Response: Focus on continuous learning and upskilling to bridge workforce deficiencies.

- Technology Leverage: Exploring technology solutions to augment workforce capabilities and address skill gaps.

Focus on Diversity, Equity, and Inclusion (DEI)

The increasing societal focus on diversity, equity, and inclusion (DEI) significantly shapes how companies like CBIZ manage their workforce and brand image. This emphasis translates into expectations for active promotion of diversity and equal opportunities, which in turn can attract and retain younger talent pools.

For professional services firms, demonstrating a commitment to DEI is becoming a critical factor in attracting clients and top talent. For instance, a 2024 survey indicated that 67% of job seekers consider DEI a crucial factor when evaluating potential employers, and 55% believe that diverse companies are more innovative.

- Workforce Management: DEI initiatives influence hiring practices, employee development programs, and overall workplace culture at CBIZ.

- Corporate Reputation: A strong DEI record enhances CBIZ's public image, attracting socially conscious clients and investors.

- Talent Acquisition: Younger generations, in particular, prioritize workplaces that champion DEI, making it a key differentiator for CBIZ in the competition for talent.

- Market Trends: By 2025, it's projected that companies with robust DEI strategies will see a 10-15% increase in employee retention and a 5-8% boost in profitability.

Societal values are shifting, with a growing emphasis on work-life balance and mental well-being, particularly among younger demographics like Gen Z and Millennials. A 2024 survey revealed that over 70% of Gen Z workers prioritize flexibility and mental health support in their employment choices.

This societal trend directly influences the demand for comprehensive human capital management services, pushing companies to adapt their offerings. CBIZ's role in providing tailored benefits and HR consulting becomes vital for businesses aiming to attract and retain this evolving workforce.

The increasing demand for personalized and flexible work arrangements, including remote and hybrid models, is reshaping the employment landscape. This necessitates advanced Human Capital Management (HCM) solutions to effectively manage distributed teams, impacting CBIZ's need for adaptable payroll and benefits administration services.

Clients increasingly seek strategic guidance beyond basic compliance, valuing data-driven insights for complex business challenges. This indicates a growing reliance on expert advice, prompting firms like CBIZ to expand their advisory services in areas such as financial planning and technology consulting.

| Societal Factor | Impact on Business | CBIZ Relevance |

|---|---|---|

| Generational Workforce Shifts | Changing employee expectations (flexibility, culture) | Demand for tailored HR and benefits solutions |

| Remote/Hybrid Work Trends | Need for distributed workforce management tools | Growth in demand for HCM and virtual team support services |

| Demand for Strategic Advice | Clients seeking expert guidance on complex issues | Opportunity to expand advisory and consulting services |

Technological factors

Artificial intelligence and automation are rapidly reshaping accounting and financial services. CBIZ can harness these technologies to streamline operations, such as automating data entry and payroll, allowing staff to focus on higher-value client advisory services. By 2024, the global AI market in financial services was projected to reach over $20 billion, highlighting the significant potential for efficiency gains and enhanced service offerings.

The increasing adoption of cloud-based accounting and human capital management software is a significant technological factor. These solutions provide CBIZ and its clients with greater accessibility, real-time data, and improved collaboration capabilities. For instance, by mid-2024, over 90% of businesses surveyed were utilizing cloud-based solutions for at least some of their core operations, highlighting a strong market trend.

Leveraging advanced data analytics tools is crucial for extracting actionable insights and identifying market trends. CBIZ can employ these technologies to offer clients data-driven strategies, enhancing decision-making processes. In 2024, companies that invested in data analytics reported an average revenue increase of 5-10% compared to their peers, underscoring the tangible benefits of this technological shift.

Cybersecurity threats are a major concern for CBIZ, a company entrusted with sensitive client data. The increasing sophistication of cyberattacks means continuous investment in advanced security protocols is essential. For instance, the global average cost of a data breach reached $4.45 million in 2024, a significant figure for any professional services firm.

Maintaining robust data security is not just about preventing financial loss; it's about safeguarding client trust and CBIZ's reputation. A single breach could erode years of goodwill. In 2024, organizations spent an average of $1.8 million on cybersecurity measures, highlighting the industry's commitment to this critical area.

Blockchain Technology and Digital Assets

Blockchain technology is fundamentally reshaping how financial transactions are conducted, offering unprecedented levels of transparency and security. As this technology matures, CBIZ will need to consider its implications for auditing practices and financial reporting standards, ensuring compliance and accuracy in a decentralized environment.

The rise of digital assets, including cryptocurrencies and tokenized securities, presents both challenges and opportunities for firms like CBIZ. The firm could leverage its expertise to provide specialized advisory services in areas such as cryptocurrency taxation, regulatory compliance, and the accounting treatment of digital assets, catering to a growing client demand.

- Blockchain's potential to streamline reconciliation processes could reduce audit times and costs.

- The global digital asset market capitalization reached approximately $2.5 trillion in early 2024, indicating significant client interest.

- CBIZ can develop new service lines focused on blockchain-based accounting and the taxation of non-fungible tokens (NFTs).

- Regulatory frameworks for digital assets are still evolving, creating a need for expert guidance.

Technology Integration and Interoperability

The capacity to smoothly combine different technological tools and ensure they work together across various systems is vital for CBIZ to offer complete services. This includes integrating CRM, accounting software, and client portals to create a unified client experience.

CBIZ faces the challenge of managing technological advancements and ensuring these systems communicate effectively. For instance, in 2024, many businesses are investing in cloud-based solutions for better data accessibility and collaboration, a trend CBIZ needs to leverage. This integration directly impacts operational efficiency and the quality of service delivered to clients.

Key areas for CBIZ's technology integration efforts include:

- Data Synchronization: Ensuring client data is consistent across all platforms used by CBIZ.

- Platform Compatibility: Verifying that new software solutions can connect with existing systems.

- Automation: Implementing automated workflows to reduce manual tasks and improve response times.

- Cybersecurity: Integrating robust security measures to protect sensitive client information across all interconnected systems.

The rapid advancement of artificial intelligence and automation is transforming accounting and financial services, offering CBIZ opportunities to streamline operations like payroll and data entry. By 2024, the global AI market in financial services was projected to exceed $20 billion, indicating substantial potential for efficiency gains and enhanced client advisory services.

Cloud-based solutions are becoming standard, providing CBIZ and its clients with improved accessibility and real-time data. By mid-2024, over 90% of businesses reported using cloud solutions for core operations, highlighting a strong market trend towards these platforms.

Leveraging advanced data analytics is crucial for CBIZ to offer clients data-driven strategies, leading to better decision-making. In 2024, companies investing in data analytics saw revenue increases of 5-10%, demonstrating the tangible benefits of this technology.

Cybersecurity remains a critical concern, with the global average cost of a data breach reaching $4.45 million in 2024. CBIZ must continuously invest in advanced security protocols to protect sensitive client data and maintain trust.

| Technology Area | Impact on CBIZ | Market Trend/Data (2024) |

|---|---|---|

| AI & Automation | Streamlined operations, enhanced advisory services | Global AI in FinServ market > $20 billion |

| Cloud Computing | Improved accessibility, real-time data, collaboration | >90% businesses using cloud for core ops |

| Data Analytics | Data-driven strategies, improved client decision-making | Analytics adopters saw 5-10% revenue increase |

| Cybersecurity | Protecting client data, maintaining trust | Avg. data breach cost: $4.45 million |

Legal factors

Ongoing shifts in federal, state, and local tax legislation directly influence CBIZ's tax advisory and compliance services, necessitating continuous adaptation. For instance, the expiration of key provisions from the 2017 Tax Cuts and Jobs Act at the close of 2025 presents a significant compliance challenge and opportunity for CBIZ to guide clients through evolving tax landscapes.

CBIZ's core services rely heavily on adherence to evolving financial reporting standards and regulations, including Generally Accepted Accounting Principles (GAAP) and Securities and Exchange Commission (SEC) requirements. This necessitates ensuring clients maintain accurate financial reporting, a critical component given the growing emphasis on strategic financial planning.

For instance, the SEC's ongoing focus on enhancing disclosures around environmental, social, and governance (ESG) factors, as seen in proposed rules and guidance throughout 2024, directly impacts how CBIZ advises its clients on reporting practices. Failure to comply can lead to significant penalties and reputational damage, underscoring the importance of robust regulatory understanding.

Changes in labor laws, such as minimum wage hikes and evolving overtime rules, directly impact CBIZ's human capital management services. For instance, in 2024, several states, including California, saw significant minimum wage increases, impacting payroll processing and compliance for businesses.

CBIZ's payroll and HR consulting must constantly adapt to help clients navigate these complex and shifting regulations. The increasing demand for paid leave policies at state and local levels further necessitates robust compliance solutions from service providers like CBIZ.

Data Privacy and Security Laws

CBIZ must navigate a complex web of data privacy and security laws, with regulations like the GDPR and various US state-level privacy acts, such as the California Privacy Rights Act (CPRA), imposing significant compliance burdens. These laws mandate stringent controls over how sensitive client data is collected, stored, and utilized, requiring substantial investment in robust data security infrastructure and protocols to prevent breaches and ensure client trust. For instance, the CPRA, which became fully effective in 2023, expanded consumer rights regarding personal information, impacting how businesses like CBIZ manage data.

Failure to adhere to these evolving legal frameworks can result in substantial penalties, reputational damage, and loss of client confidence. CBIZ's commitment to data protection is therefore not just a legal necessity but a core component of its operational strategy and client service delivery.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher.

- US State Laws: As of late 2024, over a dozen US states have enacted comprehensive data privacy laws, creating a patchwork of compliance requirements for businesses operating nationwide.

- Data Breach Costs: The average cost of a data breach globally reached $4.45 million in 2024, highlighting the financial imperative for strong security measures.

- Consumer Trust: Surveys consistently show that consumers prioritize data privacy, with a significant percentage willing to switch providers due to privacy concerns.

Corporate Governance and Beneficial Ownership Reporting

New legal frameworks are significantly impacting businesses, especially concerning transparency. Starting in 2025, the second year of the federal Corporate Transparency Act will enforce new beneficial ownership information reporting. Failure to comply can result in substantial penalties, underscoring the need for expert guidance.

CBIZ's advisory services are crucial in navigating these evolving compliance landscapes. They help clients understand and meet these new obligations, ensuring adherence to regulations and fostering greater business transparency. This proactive approach is vital for avoiding legal repercussions and building trust.

- Corporate Transparency Act (CTA) Enforcement: The CTA, fully operational in 2025, mandates reporting of beneficial ownership information for millions of U.S. businesses.

- Penalty Avoidance: Non-compliance can lead to civil penalties of $500 per day and criminal penalties, including fines and imprisonment.

- Advisory Role: CBIZ assists businesses in identifying beneficial owners, collecting necessary data, and submitting reports accurately to FinCEN.

- Focus on Transparency: The regulations aim to enhance transparency and combat illicit financial activities, requiring businesses to provide detailed ownership information.

CBIZ's tax and accounting services are directly shaped by federal and state tax legislation, with the close of 2025 marking the expiration of key Tax Cuts and Jobs Act provisions, creating compliance complexities and advisory opportunities. Furthermore, the Corporate Transparency Act, fully enforced in 2025, mandates beneficial ownership reporting, with penalties for non-compliance reaching $500 daily, underscoring CBIZ's role in guiding clients through these evolving transparency requirements.

Navigating a growing number of US state data privacy laws, in addition to federal regulations, presents a significant challenge. As of late 2024, over a dozen states have enacted comprehensive privacy legislation, creating a complex compliance landscape that requires robust data security protocols and careful data handling, especially given the average global data breach cost of $4.45 million in 2024.

CBIZ's human capital management services are impacted by evolving labor laws, including minimum wage increases seen in states like California during 2024, and the expanding requirements for paid leave policies at state and local levels. These changes necessitate continuous adaptation to ensure clients remain compliant with payroll and HR regulations.

Environmental factors

There's a significant uptick in how much companies are paying attention to environmental, social, and governance (ESG) factors, and sustainability is becoming a major talking point in financial reports. This trend is directly impacting businesses like CBIZ, as their clients, especially the bigger ones, are weaving ESG principles into their core strategies.

This strategic shift by CBIZ's clients is fueling a growing demand for expert advice on sustainability reporting and how to accurately assess environmental impacts. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, showcasing the financial significance of ESG integration.

Climate change presents significant operational risks for businesses, including potential resource scarcity and extreme weather events that disrupt supply chains. For instance, the World Meteorological Organization reported that 2023 saw record-breaking global temperatures, with extreme weather events causing billions in damages worldwide.

While CBIZ, as a professional services firm, might not be directly impacted by physical resource scarcity, its clients across various sectors will increasingly require guidance on managing these environmental risks. This includes developing robust business continuity plans and strategies for navigating climate-related disruptions.

Governments worldwide are intensifying environmental regulations, compelling businesses like CBIZ's clients to adopt more sustainable practices. For instance, by 2025, the EU's Corporate Sustainability Reporting Directive (CSRD) will mandate detailed environmental disclosures for many companies, requiring expert guidance.

CBIZ can play a crucial role in helping businesses navigate these complex, evolving rules and integrate eco-friendly strategies into their core operations. This includes advising on areas like carbon emissions reduction targets, waste management, and renewable energy adoption, which are becoming increasingly critical for market access and investor confidence.

Client Demand for Eco-Friendly Practices

Clients and the broader public are increasingly favoring companies that prioritize environmental responsibility. This growing awareness translates into a demand for businesses to showcase genuine eco-friendly practices, influencing purchasing decisions and brand loyalty.

CBIZ can capitalize on this trend by integrating sustainable operations, such as reducing energy consumption and waste generation. For instance, a 2024 report indicated that 62% of consumers consider a company's sustainability efforts when making a purchase. Aligning with these values not only meets client expectations but also strengthens CBIZ's market position and brand image.

- Client Preference: A significant portion of consumers actively seek out environmentally conscious businesses.

- Reputational Enhancement: Demonstrating eco-efficiency can boost CBIZ's public image and attract environmentally aware clients.

- Operational Alignment: Adopting practices like carbon footprint reduction and resource conservation directly addresses client demand.

- Market Differentiation: Sustainability can serve as a key differentiator in a competitive landscape.

Waste Reduction and Energy Efficiency

CBIZ can significantly boost its brand image by adopting robust internal environmental sustainability practices. Initiatives like enhanced recycling programs and waste reduction strategies in its numerous offices not only align with growing corporate social responsibility expectations but also present tangible cost-saving opportunities.

Focusing on energy efficiency, such as upgrading lighting to LED or optimizing HVAC systems, can directly impact operational expenses. For instance, a 2024 study indicated that businesses implementing comprehensive energy efficiency measures saw an average reduction of 15% in their utility bills. This translates to improved profitability and a more sustainable operational model for CBIZ.

- Waste Reduction: Implementing paperless workflows and digital document management can cut paper consumption by an estimated 20-30% in office environments.

- Recycling Programs: Expanding recycling streams to include electronics and specialized materials can divert a significant portion of office waste from landfills.

- Energy Efficiency: Transitioning to smart thermostats and motion-sensor lighting in common areas can reduce energy usage by up to 10% annually.

- Brand Image: Publicizing these sustainability efforts can attract environmentally conscious clients and talent, differentiating CBIZ in a competitive market.

Environmental factors are increasingly shaping business strategies, with a strong emphasis on sustainability and ESG principles. This trend is driving demand for specialized advisory services, as seen in the substantial growth of the sustainable investment market, which reached an estimated $37.4 trillion in 2024.

Climate change poses tangible risks, from resource scarcity to supply chain disruptions, as evidenced by record-breaking global temperatures in 2023 causing billions in damages. Businesses need guidance to build resilience and navigate these challenges.

Stricter environmental regulations, like the EU's CSRD by 2025, necessitate detailed disclosures and sustainable practices, creating opportunities for firms like CBIZ to offer expert advice on compliance and eco-friendly integration.

Consumer preference for environmentally responsible companies is a significant market driver, with a 2024 report indicating 62% of consumers consider sustainability in their purchasing decisions, impacting brand loyalty and market position.

| Environmental Factor | Impact on Businesses | Opportunity for CBIZ |

|---|---|---|

| Sustainability Demand | Clients integrating ESG into core strategies | Provide advisory on sustainability reporting and impact assessment |

| Climate Change Risks | Operational disruptions, resource scarcity | Guide clients on risk management and business continuity |

| Regulatory Intensification | Mandatory environmental disclosures (e.g., CSRD) | Assist with compliance and eco-friendly strategy implementation |

| Consumer Preferences | Preference for eco-conscious brands | Help clients showcase genuine eco-friendly practices |

PESTLE Analysis Data Sources

Our CBIZ PESTLE Analysis is powered by a robust blend of official government data, reputable financial institutions, and leading market research firms. This ensures every factor, from political stability to technological advancements, is grounded in current and authoritative information.