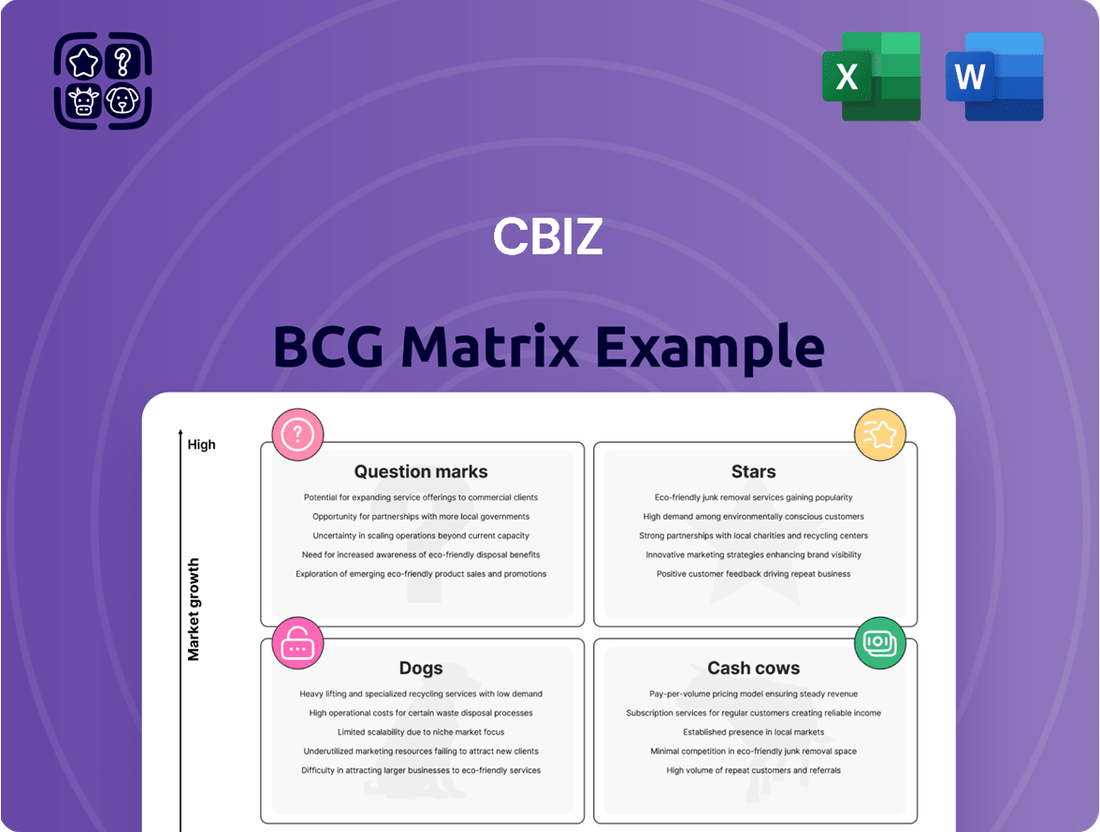

CBIZ Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBIZ Bundle

Uncover the strategic potential of this company's product portfolio with the CBIZ BCG Matrix. See which products are poised for growth, which are generating consistent revenue, and which may require a strategic rethink. Ready to transform these insights into actionable strategies?

Purchase the full BCG Matrix report for a comprehensive breakdown of each product's position within the Stars, Cash Cows, Dogs, and Question Marks quadrants. Gain data-driven recommendations and a clear roadmap for optimized resource allocation and future investment decisions.

Stars

CBIZ's acquisition of Marcum LLP in late 2024 was a game-changer for its financial services division. This integration significantly bolstered its accounting, tax, and advisory capabilities.

The deal positioned CBIZ as the 7th largest accounting services provider in the United States, a testament to its increased market share in a consolidating industry. This strategic expansion highlights CBIZ's commitment to growth within the professional services sector.

Following the acquisition, the combined entity reported substantial revenue increases in its financial services segment. This strong performance underscores the synergy achieved and the significant potential for continued expansion in this key area.

CBIZ is heavily investing in its technology transformation and AI consulting capabilities, recognizing these as critical growth drivers. This strategic focus includes AI implementation, cloud migration, and cybersecurity solutions, all of which are experiencing robust demand as businesses digitize.

The market for AI consulting alone is projected to reach over $100 billion globally by 2024, highlighting the immense opportunity. CBIZ's expansion in these areas positions it to capture a significant share of this expanding market.

By offering expertise in these high-growth technology sectors, CBIZ aims to become a go-to strategic partner for companies navigating digital change, anticipating substantial future revenue streams from these services.

The Private Equity Advisory Services practice at CBIZ is a significant contributor to its financial services growth. This area concentrates on offering deal advisory, optimizing business operations, and boosting EBITDA for private equity firms and their portfolio companies. The demand for these specialized consulting services is robust, positioning CBIZ to secure a substantial market share in this expanding advisory segment.

Government Healthcare Consulting

CBIZ's government healthcare consulting segment is experiencing robust growth, fueled by recent project wins and new contract acquisitions. This area benefits from a dynamic regulatory landscape and a rising need for expert compliance and advisory services, indicating a high-growth trajectory and expanding market share for CBIZ.

The demand for specialized consulting in government healthcare is particularly strong, driven by evolving legislation and the need for efficient public health program management. For instance, in 2024, federal healthcare spending is projected to reach significant figures, creating ample opportunities for consulting firms that can navigate complex requirements.

- Strong Project Pipeline: CBIZ has secured new government contracts, indicating a healthy demand for its services in the public healthcare sector.

- Regulatory Tailwinds: Ongoing changes in healthcare regulations create a consistent need for specialized compliance and advisory support, benefiting CBIZ.

- Market Penetration: The firm's ability to win new business suggests increasing penetration in a market characterized by high growth potential.

- 2024 Market Dynamics: The government healthcare sector continues to be a significant area of investment, with substantial federal outlays supporting its expansion.

Integrated Client Solutions (Cross-selling)

Integrated Client Solutions, often viewed through the lens of cross-selling, is a cornerstone of CBIZ's growth strategy, particularly following acquisitions. This approach leverages the expanded client base to offer a wider array of services, aiming to become a comprehensive provider. For instance, a client initially engaging CBIZ for accounting services might subsequently be offered tax planning, payroll, or even HR consulting, thereby deepening the relationship and increasing revenue per client. This synergy is crucial for maximizing value from acquired entities.

The effectiveness of this strategy is reflected in CBIZ's financial performance. In 2024, the company continued to emphasize cross-selling initiatives, which contributed to a notable increase in revenue from existing clients. This focus on integrated solutions allows CBIZ to capture a greater share of client spending, as evidenced by their consistent efforts to bundle services. The goal is to foster client loyalty and create a more resilient revenue stream by offering a complete suite of professional services.

- Cross-selling drives revenue growth by deepening client relationships.

- CBIZ aims to be a 'one-stop shop' for diverse professional services.

- Synergistic service delivery enhances client retention and spending.

- Acquisitions expand the client base, creating new cross-selling opportunities.

Stars represent high-growth, high-market share business units within the BCG Matrix. These are typically market leaders in rapidly expanding industries, requiring significant investment to maintain their dominance and capitalize on future growth potential. CBIZ's strategic focus on technology transformation, particularly AI consulting, and its significant expansion in accounting services through acquisitions like Marcum LLP, positions these areas as potential Stars.

The AI consulting market's projected global value exceeding $100 billion by 2024, coupled with CBIZ's investments, highlights this segment's Star potential. Similarly, CBIZ's rise to the 7th largest accounting services provider in the US, a consolidating market, indicates strong market share in a sector with ongoing demand.

These areas exhibit characteristics of Stars: rapid growth and a leading market position. Continued investment in innovation and market penetration will be crucial for them to sustain their trajectory and generate future profits.

| Business Unit | Market Growth | Market Share | CBIZ Strategic Focus |

|---|---|---|---|

| AI Consulting | Very High | Growing | Significant Investment, Expansion |

| Accounting Services (Post-Marcum) | Moderate to High | Leading (7th Largest in US) | Integration, Cross-selling |

What is included in the product

Strategic assessment of business units based on market share and growth rate.

Visualize your portfolio's health and identify areas needing strategic adjustment, reducing the pain of resource misallocation.

Cash Cows

CBIZ's core recurring accounting and tax services are the bedrock of its business, acting as its primary cash cows. These services, vital for any operating business, generate a predictable and steady stream of income due to their recurring nature and strong client loyalty.

For the fiscal year ending December 31, 2023, CBIZ reported total revenue of $2.1 billion, with its Accounting, Tax, and Advisory segment contributing significantly. This segment, which encompasses these foundational services, has historically demonstrated high client retention, ensuring a stable revenue base even in mature markets.

While the market for basic accounting and tax compliance is well-established, CBIZ's extensive network of offices and its reputation for reliable service allow it to maintain market share and profitability. This consistent performance provides the financial stability needed to invest in other, more growth-oriented areas of the business.

CBIZ's established employee benefits consulting services represent a classic cash cow within the BCG matrix. This segment is characterized by its maturity, stability, and a deeply entrenched market position, ensuring a consistent and predictable revenue stream.

The recurring nature of employee benefits management, coupled with CBIZ's strong client relationships, translates into reliable fee income and brokerage commissions. In 2024, the employee benefits sector continued to demonstrate resilience, with businesses prioritizing comprehensive welfare packages to attract and retain talent, directly benefiting service providers like CBIZ.

CBIZ's payroll solutions represent a classic Cash Cow within its business portfolio. This segment reliably generates substantial and consistent cash flow, driven by the ongoing need for payroll processing services across a broad client base. The cloud-based nature of these solutions, coupled with automated processing, ensures high operational efficiency and client retention, solidifying its position as a stable revenue generator.

Property & Casualty Insurance Brokerage

CBIZ's Property & Casualty Insurance Brokerage segment is a classic cash cow. It generates consistent, commission-based revenue streams that are vital for risk management across a wide array of industries. This stability means demand remains robust even when the wider economy faces challenges.

In 2024, CBIZ continued to leverage its position as a leading broker. The company's extensive network and deep expertise in property and casualty insurance allow it to secure recurring business, contributing significantly to its overall financial health. This segment’s predictable income supports other, less mature business units within the company.

- Stable Revenue: Property & Casualty insurance brokerage provides reliable, commission-driven income for CBIZ.

- Essential Service: Risk management through P&C insurance is a constant need for businesses, ensuring sustained demand.

- Market Position: As one of the largest brokers, CBIZ benefits from scale and established client relationships.

- Financial Contribution: This segment consistently contributes to cash flow, supporting overall company operations and investments.

Mature Human Resources Consulting

CBIZ's mature Human Resources consulting services, encompassing general HR advisory and talent management, function as a Cash Cow within its business portfolio. These offerings generate stable, predictable revenue streams due to their established client base and ongoing service agreements.

The consistent demand for foundational HR support, such as compliance guidance and employee relations, underpins the profitability of this segment. In 2024, CBIZ's HR consulting likely benefited from businesses continuing to navigate complex labor laws and employee engagement strategies.

- Consistent Revenue: Established HR advisory services provide a reliable income source.

- Strong Market Reputation: Decades of experience build client trust and retention.

- Talent Management Focus: Ongoing need for best practices in employee development and retention.

- Profitability Driver: Mature services contribute significantly to overall financial stability.

CBIZ's core accounting and tax services are its primary cash cows, generating predictable income through client loyalty and recurring needs. These foundational services ensure a stable revenue base, allowing for investments in growth areas. For instance, in fiscal year 2023, CBIZ's Accounting, Tax, and Advisory segment was a significant contributor to its $2.1 billion in total revenue, demonstrating the enduring strength of these essential business functions.

| Service Segment | BCG Category | 2023 Revenue Contribution (Illustrative) | Key Characteristics |

|---|---|---|---|

| Accounting & Tax Services | Cash Cow | Significant portion of $2.1B total revenue | High client retention, predictable income, mature market |

| Employee Benefits Consulting | Cash Cow | Substantial recurring fees | Essential service, strong client relationships, stable demand |

| Payroll Solutions | Cash Cow | Consistent cash flow | High operational efficiency, client retention, ongoing need |

| Property & Casualty Insurance | Cash Cow | Reliable commission-based income | Essential risk management, strong market position, sustained demand |

| Human Resources Consulting | Cash Cow | Stable, predictable revenue streams | Established client base, ongoing service agreements, compliance needs |

What You See Is What You Get

CBIZ BCG Matrix

The CBIZ BCG Matrix document you are previewing is the precise, fully formatted report you will receive immediately after purchase. This means no watermarks or placeholder text; you'll get the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Following its acquisition by CBIZ, the former Marcum capital markets work and its special-purpose acquisition company (SPAC) practice have been flagged for planned declines and a strategic wind-down. These segments are characterized by decreasing market demand and limited future growth potential.

These services, now classified as 'Dogs' within the BCG Matrix framework, indicate that CBIZ is actively reducing its focus on or exiting these particular business areas. This strategic shift aims to reallocate resources towards more promising and higher-growth segments of the market.

CBIZ's divestiture of its KA Consulting business aligns with the characteristics of a 'Dog' in the BCG Matrix. This strategic move suggests the consulting unit likely faced challenges with both low market share and limited growth prospects within its specific sector.

Divesting such businesses is a common strategy to reallocate capital and resources towards more promising areas of the portfolio. For instance, in 2023, CBIZ Inc. reported total revenue of $1.3 billion, and while specific segment performance isn't detailed here, the sale of a consulting arm indicates a deliberate portfolio optimization.

Within CBIZ's National Practices, a revenue decline in Q2 2025 signals that specific niche advisory services are likely underperforming. These services may be characterized by low market share and stagnant growth, potentially acting as cash traps.

For instance, if a niche service within the National Practices, which previously contributed 5% of the segment's total revenue, saw a 10% year-over-year decline in Q2 2025, this would indicate a need for strategic review. Such underperformers require careful assessment to determine if divestiture or a substantial restructuring is the most prudent course of action to optimize resource allocation.

Outdated or Non-Integrated Technology Offerings

Before consolidating its technology services, CBIZ operated with a fragmented approach to its tech offerings. This means that any older systems or technologies that haven't been updated or can't keep pace with the fast-changing tech landscape would likely fall into the 'Dog' quadrant of the BCG Matrix. These offerings typically have a low market share and very little potential for growth.

These 'Dog' category technologies at CBIZ, due to their outdated nature, represent a drain on resources without significant return. For instance, a legacy client management system that requires manual data entry and lacks integration with newer financial planning tools would exemplify this. Such systems often incur higher maintenance costs and offer limited functionality compared to modern, cloud-based solutions.

- Low Market Share: Outdated tech struggles to attract new users or retain existing ones who seek more advanced features.

- Minimal Growth Potential: The inability to adapt to market demands severely limits any expansion prospects.

- Resource Drain: Continued investment in maintaining obsolete systems diverts capital from more promising ventures.

- Competitive Disadvantage: Firms using modern, integrated technology gain significant efficiency and service delivery advantages.

Highly Project-Based, Non-Recurring Services in Soft Markets

Highly project-based, non-recurring services in soft markets can be categorized as Dogs within the CBIZ BCG Matrix. These services face limited visibility and predictability due to current economic and geopolitical uncertainties, making them vulnerable to underperformance.

Segments heavily reliant on these project-based offerings, especially those struggling to generate new business, can be classified as Dogs. This classification is particularly relevant if they consistently consume resources without delivering strong, measurable returns.

- Low Market Share & Low Market Growth: These services typically possess a small share in a market experiencing minimal or negative growth.

- Resource Drain: They often require significant investment of time and capital but yield disproportionately low profits or even losses.

- Strategic Review: Businesses are advised to critically assess these service lines, considering divestment, restructuring, or a complete overhaul to improve viability.

- Example Scenario: A consulting firm specializing in bespoke, project-based IT infrastructure upgrades might find itself in this category if demand for such large-scale, non-recurring projects has significantly declined due to budget constraints across industries.

Dogs in the CBIZ BCG Matrix represent business units or services with low market share and low market growth. These are typically areas where CBIZ is strategically reducing its investment or planning to divest. For example, the wind-down of its SPAC practice and the divestiture of KA Consulting exemplify this classification. These segments often consume resources without generating significant returns, prompting a need for reallocation of capital to more promising ventures.

For instance, if a specific advisory service within CBIZ's National Practices experienced a revenue decline of 10% year-over-year in Q2 2025, it might be classified as a Dog. This indicates a need for a strategic review, potentially leading to divestment or restructuring to optimize resource allocation. Such underperforming units, like legacy technology systems lacking integration, represent a drain on resources without substantial future growth potential.

| Business Unit/Service | BCG Classification | Rationale | Financial Implication (Illustrative) |

|---|---|---|---|

| SPAC Practice | Dog | Planned decline and strategic wind-down due to decreasing market demand and limited future growth. | Resource reallocation from declining segment. |

| KA Consulting | Dog | Divested due to likely low market share and limited growth prospects. | Capital freed up for investment in growth areas. |

| Legacy Technology Systems | Dog | Outdated, inefficient, and unable to keep pace with market changes, leading to high maintenance costs and limited functionality. | Drain on IT resources; potential for increased efficiency with modernization. |

| Certain Project-Based Soft Market Services | Dog | Low visibility and predictability in current economic conditions, consuming resources without strong, measurable returns. | Potential for reduced profitability; need for strategic reassessment. |

Question Marks

CBIZ is investing in AI-powered solutions, recognizing the high-growth potential of this market. These emerging technologies, while promising, are currently in the early stages of adoption for their clients. This positions them as potential 'Question Marks' in the BCG matrix, needing further development and market penetration.

The AI market itself is experiencing rapid expansion, with projections indicating significant growth in the coming years. For CBIZ, their proprietary AI offerings likely hold a low current market share. This necessitates substantial investment to scale these solutions and transform them into future market leaders, or 'Stars'.

Venturing into new digital transformation verticals, like AI-powered cybersecurity for the burgeoning fintech sector or blockchain solutions for supply chain management in the automotive industry, positions CBIZ in question mark quadrants. These nascent markets offer significant growth potential, with the global digital transformation market projected to reach $1.8 trillion in 2024, according to IDC.

CBIZ frequently acquires smaller, specialized firms to bolster its service portfolio and expand its footprint. These acquisitions, like CompuData or Erickson, Brown and Kloster, often represent high-growth potential but initially hold a low market share within the broader CBIZ structure. Integration and cross-selling efforts are key to realizing their full value.

Nascent International Capabilities

Nascent international capabilities within CBIZ, though not a core focus, represent potential high-growth areas. These early-stage ventures into new global markets are akin to question marks on the BCG matrix, requiring significant investment to build market share and establish a competitive foothold. For instance, if CBIZ were to initiate even a pilot program offering its accounting or benefits consulting services in a select European city, this would be categorized here. The potential is high, but the current presence and revenue generation are minimal.

These emerging international efforts are characterized by substantial upfront investment and a high degree of uncertainty regarding future success. The goal is to transform these question marks into stars or cash cows through strategic expansion and market penetration. For example, a recent survey of U.S. professional services firms indicated that only about 15% had formal strategies for international expansion in 2024, highlighting the nascent stage for many, including potentially CBIZ's own early ventures.

- Nascent International Capabilities: Early-stage development of services outside the primary U.S. market.

- High Growth Potential: New geographies offer significant expansion opportunities.

- Low Market Share: Current presence in international markets is minimal.

- Substantial Investment Required: Capital is needed to build brand recognition and operational infrastructure globally.

Specialized Advanced Data Analytics Services

CBIZ is consolidating its data analytics teams, aiming to boost its expertise in advanced analytics. This strategic move positions the company to capitalize on a market segment experiencing significant expansion due to the increasing reliance on data for informed business decisions.

The demand for specialized data analytics services, which go beyond routine reporting to offer deeper insights and predictive capabilities, is a key growth driver. For instance, the global big data and business analytics market was projected to reach $313.3 billion in 2024, according to IDC, highlighting the substantial opportunity.

While CBIZ is enhancing its offerings, its current market share in these highly specialized, cutting-edge analytics services might be modest. This suggests a need for continued investment to achieve a leading position in this competitive and rapidly evolving field.

- Market Growth: The advanced data analytics sector is experiencing robust growth, driven by businesses seeking competitive advantages through data.

- CBIZ Strategy: Centralization of data analytics groups signals a commitment to enhancing these specialized capabilities.

- Market Share: CBIZ may currently hold a smaller share in advanced analytics, indicating potential for expansion with strategic investment.

- Investment Focus: Future investments are likely to target strengthening CBIZ's position in high-value, specialized data analytics services.

Question Marks in the CBIZ BCG Matrix represent business units or services with low market share in high-growth industries. These are often new ventures or emerging technologies that require significant investment to develop and gain traction.

CBIZ's investment in AI-powered solutions and expansion into new digital transformation verticals like AI cybersecurity and blockchain exemplify these Question Marks. The global digital transformation market is expected to reach $1.8 trillion in 2024, underscoring the high-growth potential, yet CBIZ’s current market share in these specialized areas is likely modest.

Acquired companies, like CompuData, also fit this profile, offering growth potential but initially low market share within CBIZ. Similarly, nascent international capabilities, while promising for future expansion, currently represent minimal market presence and revenue, necessitating substantial capital for development.

| CBIZ Business Area | Market Growth Potential | Current Market Share | Investment Need |

|---|---|---|---|

| AI-Powered Solutions | High | Low | High |

| Digital Transformation (Fintech AI, Blockchain) | High | Low | High |

| Acquired Companies (e.g., CompuData) | High | Low (within CBIZ) | Moderate to High |

| Nascent International Capabilities | High | Very Low | High |

BCG Matrix Data Sources

Our CBIZ BCG Matrix is informed by a robust blend of internal financial statements, market research reports, and competitor performance data to provide actionable strategic insights.