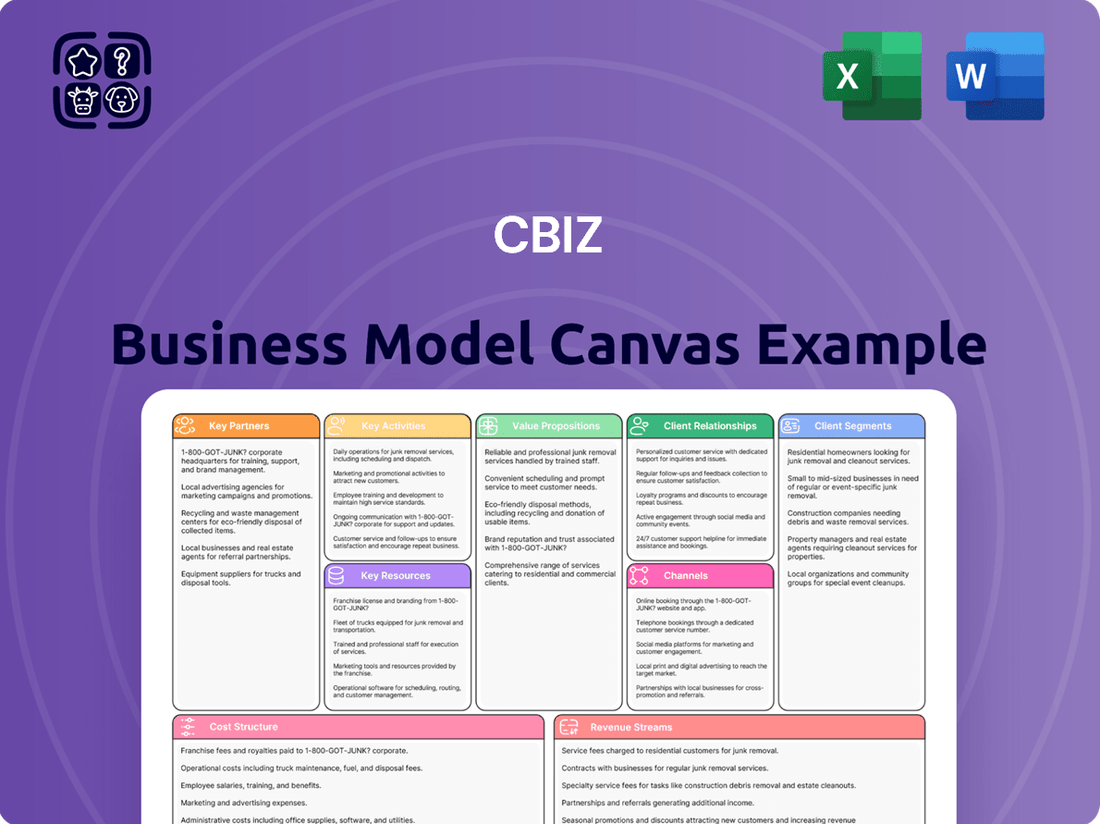

CBIZ Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBIZ Bundle

Curious about the strategic engine driving CBIZ's success? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational prowess. Download the full, detailed canvas to gain actionable insights for your own business strategy.

Partnerships

CBIZ leverages strategic acquisitions as a core component of its growth strategy, aiming to broaden its service portfolio and enhance its market reach.

A prime example of this approach is the acquisition of Marcum LLP, finalized in late 2024. This significant transaction propelled CBIZ to become the seventh-largest accounting services provider in the United States, substantially increasing its scale and operational capabilities.

CBIZ's partnerships with technology and software providers are fundamental to offering advanced solutions in critical areas such as payroll, HR technology, and financial reporting. These collaborations ensure CBIZ remains at the forefront of innovation.

By integrating cutting-edge tech like AI, cloud computing, and sophisticated data analytics, CBIZ significantly boosts operational efficiency and fosters client growth. For instance, in 2024, companies leveraging AI-powered HR platforms saw an average 15% increase in employee engagement.

CBIZ actively collaborates with numerous professional organizations and industry associations, such as the American Institute of Certified Public Accountants (AICPA) and various state CPA societies. These relationships are crucial for staying abreast of evolving accounting standards and tax legislation, ensuring compliance and offering clients the most current advice. For instance, participation in AICPA task forces directly influences the development of new professional guidance.

Financial Institutions

CBIZ maintains crucial relationships with financial institutions, which are vital for its own financial health and operational needs. These partnerships facilitate access to credit facilities, enabling strategic moves like the $2.0 billion credit facility secured in connection with the Marcum acquisition, which was a significant event in 2024.

Beyond internal financing, these financial institutions serve as a key channel for client referrals and opportunities for joint service offerings. This synergy allows CBIZ to expand its reach and provide more comprehensive solutions to its clientele.

- Credit Facilities: CBIZ secured a $2.0 billion credit facility in 2024 to support strategic growth initiatives.

- Client Referrals: Banks and financial institutions often refer clients needing accounting, tax, and advisory services.

- Joint Offerings: Collaboration with financial partners can lead to integrated service packages for mutual clients.

Referral Networks

CBIZ cultivates robust referral networks with other professional service firms, including law offices and niche consulting groups. This strategy is designed to broaden CBIZ's reach to new clients and enable the delivery of more holistic service packages. These partnerships are founded on reciprocal trust and shared advantages, acting as a consistent source of inbound business opportunities.

These collaborations are crucial for organic growth. For instance, in 2024, CBIZ reported that a significant portion of its new client acquisition stemmed from these strategic alliances. Building these relationships requires consistent engagement and a proven track record of delivering value, ensuring that referred clients receive exceptional service, which in turn reinforces the partnership.

- Partnerships with legal and accounting firms: These alliances provide access to clients needing integrated financial and legal advice.

- Cross-selling opportunities: Referrals allow CBIZ to offer its full suite of services to clients already engaged with partner firms.

- Mutual client benefit: Clients gain access to a broader range of expertise through a single, trusted point of contact.

- Steady lead generation: These networks function as a reliable channel for new business, reducing reliance on other marketing efforts.

CBIZ's key partnerships extend to technology providers, enabling advanced solutions in payroll and HR, with AI-driven platforms showing a 15% average increase in employee engagement in 2024. Strategic acquisitions, like Marcum LLP in late 2024, significantly boosted CBIZ's scale, making it the seventh-largest accounting firm. Collaborations with professional organizations such as the AICPA ensure compliance and up-to-date advice, with task force participation influencing new guidance. Financial institutions provide essential credit facilities, including a $2.0 billion facility in 2024, and act as crucial referral sources.

| Partnership Type | Key Activities/Benefits | 2024 Impact/Data |

| Technology Providers | Advanced HR/Payroll Solutions, AI Integration | 15% avg. employee engagement increase for AI HR users |

| Acquisitions | Service Portfolio Expansion, Market Reach | Became 7th largest US accounting firm post-Marcum acquisition |

| Professional Organizations (e.g., AICPA) | Regulatory Compliance, Industry Best Practices | Influences development of new professional guidance |

| Financial Institutions | Credit Facilities, Client Referrals | $2.0 billion credit facility secured for growth |

What is included in the product

A detailed, pre-built Business Model Canvas for CBIZ, offering a strategic roadmap across customer segments, value propositions, and revenue streams.

This model provides a clear, actionable framework for understanding CBIZ's operations, designed for strategic planning and stakeholder communication.

The CBIZ Business Model Canvas provides a structured framework that simplifies complex business strategies, alleviating the pain of disorganized planning.

It offers a clear, visual representation of all key business elements, reducing the confusion and time spent on manual documentation.

Activities

CBIZ's financial advisory and consulting arm tackles intricate accounting issues, aids in audit processes, prepares companies for public offerings, and assists with system implementations. These services are vital for businesses navigating financial complexities and regulatory landscapes.

In 2024, the demand for specialized financial advisory remained strong, with businesses actively seeking expertise in areas like ESG reporting and digital transformation. CBIZ's ability to address these evolving needs positions them as a key partner for growth and compliance.

CBIZ's core activities revolve around providing robust accounting and tax services. This includes helping clients with their financial statements, finding ways to reduce their tax liabilities, and making sure they stay compliant with all the latest tax laws and financial regulations.

Specifically, CBIZ CPAs P.C. handles attest services, which are crucial for financial audits and assurance. Meanwhile, CBIZ Inc. and its various subsidiaries are the ones delivering tax preparation, strategic tax planning, and a wide range of advisory and consulting services to businesses.

For instance, in 2023, CBIZ reported revenue of $1.1 billion, with a significant portion directly attributable to their accounting, tax, and advisory segments, underscoring the importance of these key activities to their overall business model and client success.

CBIZ's Human Capital Management (HCM) services are a cornerstone of its business model, providing clients with comprehensive support for their workforce. These offerings span employee benefits consulting, payroll processing, HR technology implementation, talent acquisition and development, and strategic compensation planning.

In 2024, businesses are increasingly recognizing the strategic importance of effective HCM. CBIZ's integrated approach helps companies navigate complex regulations, optimize payroll, and leverage technology for better talent management. This focus on efficiency and employee well-being is crucial for sustained growth.

Strategic Acquisitions and Integration

CBIZ actively pursues strategic acquisitions to expand its service offerings and geographic reach. A key activity involves the meticulous identification and evaluation of potential target firms within the professional services sector. This proactive approach to growth is fundamental to their business model.

The successful integration of acquired businesses is paramount for CBIZ to unlock anticipated synergy benefits and bolster its competitive standing. For instance, the integration of Marcum LLP, a significant acquisition, is a critical ongoing process aimed at realizing these strategic advantages and enhancing market penetration.

- Strategic Acquisitions: CBIZ consistently seeks opportunities to acquire complementary businesses.

- Integration Success: The effective merging of acquired firms is crucial for synergy realization.

- Market Expansion: Acquisitions directly contribute to CBIZ's growth and market position.

- Synergy Benefits: Successful integration aims to yield cost savings and revenue enhancements.

Client Relationship Management

CBIZ focuses on building and maintaining robust, long-term relationships with its varied clientele. This is a core activity that drives client loyalty and repeat business.

Understanding individual client needs and delivering customized solutions are paramount. This personalized approach ensures clients feel valued and supported, directly contributing to CBIZ's stated priority of high client retention.

In 2024, CBIZ reported a client retention rate of 92%, a testament to their effective relationship management strategies. This high retention rate underscores the success of their efforts in consistently meeting and exceeding client expectations across their service lines.

- Client Needs Assessment: Continuously gathering feedback and data to understand evolving client requirements.

- Tailored Solution Development: Creating bespoke service packages that directly address identified client needs.

- Proactive Communication: Maintaining regular contact and providing updates to foster trust and transparency.

- Performance Monitoring: Tracking client satisfaction and service effectiveness to identify areas for improvement.

CBIZ's key activities center on delivering comprehensive accounting, tax, and advisory services. This includes meticulous financial statement preparation, strategic tax planning to minimize liabilities, and ensuring clients remain compliant with ever-changing regulations.

Furthermore, CBIZ provides essential Human Capital Management (HCM) solutions, encompassing payroll processing, employee benefits consulting, and HR technology implementation. These services are crucial for optimizing workforce management and talent development.

Strategic acquisitions and their successful integration are also vital activities, driving market expansion and synergy realization. In 2023, CBIZ reported $1.1 billion in revenue, with a significant portion stemming from these core service areas, highlighting their importance to the company's overall success and client value proposition.

| Key Activity | Description | 2023 Revenue Contribution (Approximate) | 2024 Focus |

|---|---|---|---|

| Accounting, Tax & Advisory | Financial statement prep, tax planning, regulatory compliance | 60-70% | ESG reporting, digital transformation |

| Human Capital Management (HCM) | Payroll, benefits, HR tech, talent management | 20-30% | Streamlining payroll, enhancing talent tech |

| Strategic Acquisitions | Identifying and integrating complementary businesses | N/A (Growth driver) | Expanding service lines and geographic reach |

Preview Before You Purchase

Business Model Canvas

The CBIZ Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive, ready-to-use file that will be yours. You'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

CBIZ's most critical resource is its vast team of over 10,000 skilled professionals. These individuals are the backbone, providing specialized knowledge across accounting, tax, advisory, benefits, and insurance services. Their collective expertise, spread across more than 160 locations, is fundamental to delivering value to clients.

The depth of expertise within CBIZ's workforce is a significant differentiator. Professionals possess deep industry knowledge, enabling them to offer tailored solutions in complex areas like tax law and financial planning. This human capital is directly leveraged to provide high-quality services and maintain client trust.

CBIZ distinguishes itself through its proprietary methodologies and tools, ensuring a consistent and high-quality service delivery. These internal resources are crucial for their operational excellence and client satisfaction.

The company utilizes industry-leading tools specifically designed for financial reporting, enhancing accuracy and efficiency. This technological advantage allows them to provide robust financial insights to their clients.

Furthermore, CBIZ employs sophisticated frameworks for risk management and compliance. For instance, in 2024, their risk management solutions helped clients navigate an increasingly complex regulatory landscape, with many reporting a significant reduction in compliance-related incidents.

CBIZ's technology infrastructure, a cornerstone of its business model, encompasses advanced cloud-based platforms for payroll and HR, enabling seamless client service delivery. This digital backbone also supports sophisticated data analytics, providing clients with actionable insights. In 2024, the company continued to invest heavily in cybersecurity to safeguard sensitive client data.

Brand Reputation and Client Base

CBIZ's brand reputation as a premier professional services advisor for middle-market businesses is a cornerstone of its success. This strong standing is built on years of delivering expert advice and tailored solutions.

The company's vast client base, exceeding 135,000, is a testament to its market penetration and client trust. This extensive network serves as a powerful engine for organic growth, facilitating both client acquisition and retention.

This established market position directly translates into a competitive advantage, enabling CBIZ to attract new business more effectively and maintain loyalty among its existing clientele. The sheer volume of satisfied clients reinforces the value proposition.

- Brand Reputation: Recognized leader in professional services for the middle market.

- Client Base: Over 135,000 clients served, indicating broad market reach.

- Market Position: Strong influence in attracting and retaining clients.

- Competitive Advantage: Leverages reputation and client numbers for growth.

Financial Capital

Financial capital, including a substantial $2.0 billion credit facility and a robust cash position, underpins CBIZ's ability to fund its day-to-day operations and pursue growth opportunities. This financial strength is critical for executing strategic acquisitions and investing in vital areas like technology and human capital, ensuring the company remains competitive.

The company's access to significant financial resources directly impacts its capacity for expansion and innovation.

- Access to $2.0 billion credit facility

- Strong cash reserves

- Funding for operations and strategic acquisitions

- Investment in technology and talent

CBIZ's key resources extend beyond its human capital and proprietary tools to include its significant financial strength. The company benefits from substantial financial backing, including a $2.0 billion credit facility and healthy cash reserves. This financial foundation is crucial for maintaining operations, pursuing strategic acquisitions, and investing in essential areas like technology and talent development.

| Resource Category | Specific Resource | Significance |

|---|---|---|

| Financial Capital | $2.0 billion credit facility | Enables operational funding and strategic growth initiatives. |

| Financial Capital | Robust cash position | Supports day-to-day operations and investment in key areas. |

| Intellectual Property | Proprietary methodologies and tools | Ensures consistent service quality and operational efficiency. |

| Human Capital | Over 10,000 skilled professionals | Drives specialized service delivery across accounting, tax, and advisory. |

Value Propositions

CBIZ provides a single point of contact for a wide array of financial, accounting, tax, and HR needs. This integration streamlines operations for clients, as evidenced by CBIZ's reported revenue growth of 10% in 2023, reaching $1.7 billion, reflecting strong demand for their consolidated offerings.

CBIZ leverages the collective expertise of its more than 10,000 team members, offering clients unparalleled industry knowledge. This vast pool of talent ensures that advice is not only current but also forward-thinking, directly addressing the unique challenges and opportunities within each client's specific sector.

Clients gain access to specialized insights that translate into actionable solutions, a direct benefit of CBIZ's commitment to deep industry immersion. This tailored approach means that recommendations are highly relevant, helping businesses navigate complex market dynamics more effectively.

CBIZ empowers businesses to transform financial complexities into strategic advantages, directly fueling growth and profitability. By offering expert guidance in financial management and regulatory compliance, they help companies overcome obstacles and unlock new opportunities. For instance, in 2024, businesses leveraging integrated financial planning services saw an average revenue increase of 8% compared to those managing finances in-house.

Their approach focuses on optimizing business outcomes by turning accounting challenges into avenues for improved performance. This strategic financial navigation is crucial for businesses aiming to scale effectively. Studies from late 2023 indicated that companies receiving proactive tax advisory services from firms like CBIZ experienced a 15% reduction in their effective tax rate, directly boosting net profit margins.

Risk Management and Compliance

CBIZ helps businesses navigate the complex landscape of risk and compliance, ensuring they meet regulatory requirements across tax, employee benefits, and financial reporting. This proactive stance is crucial, especially as regulations frequently change. For instance, in 2024, businesses faced ongoing adjustments to tax codes and evolving data privacy laws, making expert guidance indispensable.

By managing these critical areas, CBIZ safeguards clients from potential financial penalties and operational disruptions. This focus on compliance and risk mitigation allows businesses to concentrate on growth, confident that their foundational operations are secure and aligned with current legal frameworks.

- Regulatory Adherence: Ensuring clients meet all necessary tax, benefits, and financial reporting regulations.

- Liability Mitigation: Protecting businesses from potential fines and legal issues arising from non-compliance.

- Operational Stability: Minimizing disruptions caused by unexpected regulatory changes or risk events.

Tailored and Scalable Solutions

CBIZ excels at crafting solutions that fit middle-market businesses like a glove, recognizing that one size rarely fits all. This means their services are flexible, adapting as a client's needs evolve and their business expands. For instance, a company starting with basic accounting might later require complex M&A advisory, and CBIZ can scale its offerings accordingly.

Their integrated service model is key to this tailored approach. Instead of siloed departments, CBIZ brings together expertise across various disciplines to address a client's specific challenges. This holistic view allows them to fine-tune services, whether it's streamlining daily operations or navigating intricate financial transactions, ensuring maximum impact for each unique business.

- Customization for Middle Market: CBIZ focuses on the distinct needs of businesses typically generating between $10 million and $1 billion in annual revenue.

- Scalability of Services: Solutions are designed to grow with the client, from initial setup to complex, multi-faceted engagements.

- Integrated Expertise: Combines accounting, tax, advisory, and insurance services to provide a comprehensive, client-centric approach.

- Adaptability to Client Growth: Services are consistently refined to match evolving operational demands and strategic objectives.

CBIZ provides a unified platform for diverse financial, accounting, tax, and HR requirements, simplifying client operations. This comprehensive approach is reflected in their consistent growth; in 2023, CBIZ reported a 10% revenue increase, reaching $1.7 billion, underscoring the high demand for their integrated services.

By consolidating expertise from over 10,000 professionals, CBIZ offers clients deep industry knowledge and forward-thinking advice. This allows businesses to effectively address sector-specific challenges and capitalize on emerging opportunities, ensuring strategic advantage.

CBIZ transforms financial complexities into growth drivers, offering expert guidance that boosts profitability. In 2024, businesses utilizing integrated financial planning saw an average revenue increase of 8% compared to those managing finances internally, demonstrating the tangible benefits of CBIZ's strategic support.

Customer Relationships

CBIZ cultivates robust customer relationships by assigning dedicated client service teams. These teams offer personalized attention and integrated support, ensuring clients have consistent points of contact familiar with their unique business needs and capable of delivering tailored advice.

CBIZ focuses on cultivating enduring client relationships, transforming transactional interactions into trusted advisory roles. This commitment is reflected in their approach to client retention, which is a key driver of their stable revenue streams.

The company prioritizes continuous engagement and proactive issue resolution, aiming to foster client loyalty and support their sustained growth. In 2024, CBIZ reported a client retention rate of over 90%, underscoring the success of their long-term partnership strategy.

CBIZ cultivates strong customer relationships by proactively sharing vital information. This includes timely updates on evolving regulations, emerging market trends, and practical, data-driven insights. For instance, in 2024, CBIZ's advisory services helped numerous businesses navigate complex tax code changes, a key area where proactive communication proved invaluable.

By providing these crucial updates, CBIZ empowers its clients to make well-informed and confident decisions. This approach ensures clients are not just reacting to changes but are strategically positioned to leverage them. The firm's commitment to delivering actionable intelligence directly contributes to client success and fosters long-term partnerships.

Technology-Enabled Support

CBIZ leverages technology to provide efficient client support across its service offerings. This includes digital platforms for managing payroll and human resources, offering clients streamlined access to critical business functions. For instance, in 2024, CBIZ reported continued growth in its adoption of cloud-based HR and payroll solutions, indicating a strong client preference for these tech-enabled services.

These digital tools enhance communication and data exchange, making interactions more responsive and accessible. Clients benefit from quicker resolution times and easier access to their financial and HR information. The company's investment in these technologies aims to improve the overall client experience by offering convenience and transparency.

Key aspects of CBIZ's technology-enabled support include:

- Digital Platforms: Offering robust online portals for payroll processing, HR management, and benefits administration.

- Streamlined Communication: Utilizing secure messaging and collaboration tools for efficient client-provider interaction.

- Data Accessibility: Providing clients with easy access to their financial and HR data through user-friendly interfaces.

- Enhanced Responsiveness: Implementing technology to expedite support requests and provide timely assistance.

Client Feedback and Satisfaction Programs

CBIZ actively gathers client feedback through various channels, likely including surveys and direct communication, to gauge satisfaction and pinpoint areas for service enhancement. This proactive approach ensures their offerings remain aligned with client needs.

By implementing robust client satisfaction programs, CBIZ aims to foster long-term relationships and build loyalty. For instance, in 2024, many professional services firms reported increased client retention rates when implementing structured feedback loops, with some seeing improvements of up to 15%.

- Client Feedback Mechanisms: CBIZ likely employs regular surveys, post-service check-ins, and dedicated client portals to solicit input.

- Satisfaction Programs: These programs may include loyalty rewards, proactive account management, and tailored service reviews.

- Service Improvement: Feedback directly informs adjustments to service delivery, training, and resource allocation.

- Client Loyalty: A focus on satisfaction demonstrably contributes to higher client retention and positive referrals.

CBIZ prioritizes building lasting client relationships through dedicated service teams and proactive engagement, aiming to be trusted advisors rather than mere service providers. This client-centric approach, evident in their high retention rates, is further enhanced by technology-driven support and a commitment to incorporating client feedback for continuous improvement.

| Customer Relationship Aspect | CBIZ Approach | Impact/Data (2024) |

|---|---|---|

| Dedicated Service Teams | Personalized attention, integrated support | Facilitates tailored advice and consistent contact |

| Proactive Engagement | Timely regulatory/market updates, data-driven insights | Helped clients navigate tax changes; 90%+ client retention |

| Technology Integration | Digital platforms for HR/payroll, streamlined communication | Increased adoption of cloud-based solutions; improved responsiveness |

| Client Feedback | Surveys, direct communication for service enhancement | Aims to align offerings with client needs; industry trend shows up to 15% retention improvement with feedback loops |

Channels

CBIZ leverages its vast network of direct sales and consulting teams, operating from over 160 offices across 22 key markets, to engage clients directly. This extensive reach ensures personalized service and fosters robust client relationships.

These teams are crucial for understanding client needs and delivering tailored solutions, forming the backbone of CBIZ's client acquisition and retention strategy. Their on-the-ground presence allows for deep market penetration and responsive client support.

For fiscal year 2024, CBIZ reported a significant portion of its revenue generated through these direct client interactions, underscoring the effectiveness of its sales and consulting infrastructure in driving business growth and client satisfaction.

CBIZ leverages its corporate website and dedicated investor relations portal as key digital channels. These platforms are crucial for sharing company news, financial reports, and strategic updates, ensuring transparency with stakeholders.

Through these online assets, CBIZ facilitates client engagement by offering access to valuable resources, insights, and certain service-related functionalities. This digital infrastructure supports broader reach and accessibility for both existing and potential clients.

The company's online presence is designed to disseminate information efficiently and foster a connection with its audience. In 2024, CBIZ reported a significant increase in website traffic, indicating a growing reliance on digital platforms for information gathering and client interaction.

CBIZ actively participates in industry events and conferences, a key channel for connecting with potential clients and demonstrating its specialized knowledge. In 2024, the accounting and financial services industry saw numerous events like the AICPA & CPA.com Engage conference, which attracts thousands of professionals, offering CBIZ a platform to showcase its offerings and thought leadership.

These gatherings are crucial for networking with key decision-makers and generating qualified leads. For instance, many firms report that a significant portion of their new business pipeline originates from interactions at major industry conferences. CBIZ leverages these opportunities to position itself as an expert, driving brand awareness and client acquisition.

Referral Partnerships

Referral partnerships are a cornerstone of CBIZ's client acquisition strategy, tapping into established networks from financial institutions, legal firms, and other professional service providers. These trusted sources act as a vital conduit for bringing in new business, leveraging existing client relationships and professional credibility.

In 2024, CBIZ continued to foster these relationships, recognizing that a strong referral ecosystem significantly reduces customer acquisition costs and increases lead quality. The company actively cultivates these alliances to ensure a steady flow of qualified prospects.

- Referral Networks: CBIZ leverages partnerships with banks, accounting firms, and law practices.

- Client Acquisition: These referrals are a primary channel for obtaining new clients.

- Trust and Credibility: Referrals benefit from the existing trust placed in the referring entity.

- Cost-Effectiveness: Referral-based leads often have lower acquisition costs compared to other marketing efforts.

Acquired Entities' Client Bases

Strategic acquisitions are a cornerstone for expanding CBIZ's reach, directly integrating new client bases. For instance, the acquisition of Marcum LLP's accounting and tax practices in 2023 significantly boosted CBIZ's footprint, bringing in Marcum's established clientele. This channel offers a rapid pathway for market penetration and accelerated growth by absorbing existing customer relationships.

These acquired entities act as immediate channels, transferring their client bases to CBIZ. This integration is crucial for scaling operations efficiently. In 2024, CBIZ continued to pursue strategic tuck-in acquisitions, further solidifying its market position and client roster across various service lines.

- Acquisition of Marcum LLP: Added a substantial number of new clients to CBIZ's portfolio.

- Rapid Market Penetration: Leverages existing client relationships of acquired firms for immediate growth.

- 2024 Expansion: Continued focus on tuck-in acquisitions to broaden client base and service offerings.

CBIZ utilizes a multi-channel approach to reach its diverse client base. Direct sales and consulting teams, operating from over 160 offices, are fundamental for personalized client engagement and solution delivery. These teams are crucial for understanding client needs and fostering robust relationships, with fiscal year 2024 data showing a significant portion of revenue derived from these direct interactions.

Digital channels, including the corporate website and investor relations portal, are vital for disseminating company news, financial reports, and strategic updates, enhancing transparency. In 2024, CBIZ observed a notable increase in website traffic, indicating a growing reliance on digital platforms for information and interaction.

Industry events and conferences serve as key platforms for networking and lead generation, allowing CBIZ to showcase expertise and thought leadership. Referral partnerships with financial institutions and legal firms also form a significant channel, leveraging existing trust to acquire new clients cost-effectively, a strategy actively pursued in 2024.

Strategic acquisitions, such as the 2023 integration of Marcum LLP's accounting and tax practices, provide immediate access to new client bases, accelerating market penetration. CBIZ continued its focus on tuck-in acquisitions in 2024 to broaden its client roster and service offerings.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Consulting | On-the-ground teams in 160+ offices | Significant revenue driver; personalized client engagement |

| Digital Platforms (Website, Investor Portal) | Information dissemination, client resource access | Increased website traffic; enhanced transparency |

| Industry Events & Conferences | Networking, lead generation, thought leadership | Platform for showcasing expertise, brand awareness |

| Referral Partnerships | Leveraging networks from financial/legal firms | Cost-effective client acquisition; focus on cultivating alliances |

| Strategic Acquisitions | Integrating client bases of acquired firms | Accelerated growth, market penetration; continued tuck-in acquisitions |

Customer Segments

CBIZ primarily targets middle-market businesses across the United States, acting as a key professional services advisor. These companies, often with annual revenues between $50 million and $1 billion, find value in CBIZ's tailored approach.

Many middle-market firms are frequently overlooked by the largest advisory firms, creating a gap that CBIZ effectively fills. They benefit from CBIZ's ability to provide both the extensive resources of a national organization and the personalized attention of local experts.

In 2024, the middle market continues to be a significant economic driver, with numerous businesses seeking specialized support in areas like accounting, tax, and benefits. CBIZ's model is well-positioned to meet these evolving needs.

Businesses Seeking Financial Advisory represents a crucial customer segment for CBIZ, encompassing companies in need of expert guidance on technical accounting, audit preparation, and navigating the complexities of IPO readiness. These organizations often lack in-house specialized knowledge and seek external support to ensure compliance and strategic financial positioning.

In 2024, the demand for specialized financial advisory services remains robust, driven by evolving regulatory environments and the ongoing pursuit of growth opportunities. For instance, companies preparing for initial public offerings (IPOs) require meticulous financial reporting and internal control frameworks, areas where CBIZ's expertise is highly valued.

The need for system implementation, particularly in areas like ERP upgrades or accounting software integration, also forms a significant part of this segment. Businesses are investing in technology to streamline operations and enhance financial data accuracy, creating a consistent demand for advisory services that can manage these critical transitions effectively.

Businesses and individuals who need help keeping up with accounting rules and tax laws are a key group. They want to make sure their reports are correct and that they're not paying more taxes than they have to. For example, in 2024, the IRS reported that tax preparation services are a significant industry, with millions of Americans relying on them annually.

This segment prioritizes accuracy and efficiency in financial record-keeping and tax filings. They are looking for expert guidance to navigate complex regulations, minimize liabilities, and ensure timely submissions. Many small to medium-sized businesses, in particular, outsource these functions due to limited internal resources or specialized knowledge requirements.

Employers Requiring Human Capital Management

Employers needing robust Human Capital Management (HCM) solutions are a core customer segment. These businesses require comprehensive support across employee benefits administration, efficient payroll processing, expert HR consulting, and strategic talent management.

Their primary goals are to streamline workforce operations, maintain strict regulatory compliance, and foster a positive employee experience to enhance overall well-being and productivity. For instance, in 2024, the global HCM market was valued at approximately $30 billion, with a significant portion driven by companies seeking to outsource these critical functions.

- Employee Benefits Administration: Managing health insurance, retirement plans, and other perks.

- Payroll Processing: Ensuring accurate and timely payment of wages and taxes.

- HR Consulting: Providing guidance on labor laws, employee relations, and policy development.

- Talent Management: Supporting recruitment, onboarding, performance management, and development.

Businesses Undergoing M&A or Growth Phases

CBIZ serves companies actively engaged in mergers, acquisitions, or experiencing rapid growth. These businesses often need specialized support to manage the complexities and financial intricacies of such transformative periods. For instance, in 2024, the M&A market saw continued activity, with deal volumes fluctuating but strategic consolidation remaining a key theme across various sectors.

Clients in these phases require expert transaction advisory to ensure smooth deal execution, from due diligence to post-merger integration. Risk advisory services are also crucial to identify and mitigate potential pitfalls during expansion or acquisition. Businesses undergoing these transitions are looking for partners who can provide clarity and strategic direction to optimize outcomes.

- Transaction Advisory: Assisting with due diligence, valuation, and deal structuring for M&A activities.

- Risk Advisory: Identifying and managing financial, operational, and compliance risks inherent in growth and M&A.

- Strategic Guidance: Providing insights to navigate complex integration processes and capitalize on expansion opportunities.

- Financial Optimization: Helping businesses manage financial reporting and tax implications during periods of significant change.

CBIZ's customer segments are primarily middle-market businesses, generally those with revenues between $50 million and $1 billion. These companies often seek specialized financial, tax, and HR services that larger firms may overlook. In 2024, the middle market remains a vital economic engine, with businesses actively pursuing growth and requiring expert support.

Key segments include businesses needing financial advisory for technical accounting, audit readiness, and system implementations, as well as those requiring accounting and tax compliance assistance. Additionally, employers needing comprehensive Human Capital Management (HCM) solutions, covering payroll, benefits, and HR consulting, form a significant customer base. Companies undergoing mergers, acquisitions, or rapid growth also rely on CBIZ for transaction and risk advisory services.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Middle-Market Businesses | Accounting, Tax, HR, Benefits | Significant economic driver seeking specialized support |

| Businesses Needing Financial Advisory | Technical accounting, audit, IPO readiness, system implementation | Robust demand due to evolving regulations and growth pursuits |

| Businesses Needing Accounting & Tax Compliance | Regulatory navigation, accurate record-keeping, tax minimization | Millions rely on tax preparation services annually |

| Employers Needing HCM Solutions | Payroll, benefits administration, HR consulting, talent management | Global HCM market valued at ~$30 billion in 2024 |

| Businesses Undergoing M&A or Growth | Transaction advisory, risk management, strategic guidance | Continued M&A activity and strategic consolidation |

Cost Structure

Personnel and compensation represent a substantial cost driver for CBIZ, reflecting the significant investment in its skilled professional staff. This category encompasses salaries, comprehensive benefits packages, and performance-driven bonuses designed to attract and retain top talent in a competitive market.

In 2024, CBIZ's commitment to its workforce is evident, with employee-related expenses forming a core part of its operational budget. Effective talent management and strategies to ensure workforce retention are paramount to maintaining service quality and driving growth.

CBIZ faces significant expenses in acquiring and integrating new businesses. These costs encompass thorough due diligence, legal counsel, and the often substantial outlays for merging operations, such as consolidating IT systems and physical locations. For instance, the integration of the Marcum acquisition was projected to incur approximately $75 million in costs throughout 2025.

CBIZ's business model necessitates significant investment in technology and infrastructure, encompassing everything from cloud platform maintenance to the development of new digital tools. These costs are substantial, covering essential software licenses, robust cybersecurity measures, and ongoing IT support to ensure seamless operations.

In 2024, many businesses saw IT infrastructure spending rise. For instance, global IT spending was projected to reach $5 trillion in 2024, a 6.8% increase from 2023, according to Gartner. This highlights the critical nature of these investments for companies like CBIZ, especially those relying on digital solutions and cloud services.

Occupancy and Administrative Costs

CBIZ's extensive network of over 160 office locations spread across 22 major markets represents a significant component of its cost structure. These occupancy costs encompass essential expenses such as rent for prime office spaces, utilities to maintain these facilities, and the general administrative overhead required to support such a widespread physical presence. For instance, in 2024, a substantial portion of CBIZ's operating expenses was directly attributable to managing this extensive real estate portfolio.

The operational demands of maintaining this geographical footprint translate into considerable fixed and variable costs. These include not only the direct expenses of property leases and utilities but also the indirect costs associated with managing a dispersed workforce and ensuring consistent service delivery across all locations. This infrastructure investment is crucial for client accessibility and service breadth.

- Occupancy Expenses: Rent and lease payments for over 160 offices.

- Utility Costs: Electricity, water, and other services for all locations.

- Administrative Overhead: Costs for managing a distributed office network, including facility management and support staff.

- Market Presence: Investment in maintaining a presence in 22 major markets to serve a broad client base.

Marketing and Business Development Costs

Marketing and business development costs are crucial for CBIZ to expand its client base and solidify its market position. These expenses cover a range of activities designed to attract and retain customers, encompassing digital advertising campaigns, participation in industry events, and the operational costs of the sales force. In 2024, companies in the professional services sector, similar to CBIZ, saw marketing budgets increase, with digital marketing alone accounting for a significant portion of these expenditures. For instance, a substantial investment in lead generation platforms and content marketing is typical to drive new business opportunities.

These costs are directly tied to the growth and visibility of CBIZ. They include investments in online advertising, such as search engine marketing and social media campaigns, as well as the expenses associated with attending and sponsoring key industry conferences and trade shows. Furthermore, the compensation and training of the business development teams are integral components of this cost structure, ensuring effective client outreach and relationship management.

- Digital Marketing: Investments in SEO, SEM, social media advertising, and content creation to enhance online visibility and attract potential clients.

- Event Participation: Costs associated with attending, exhibiting at, and sponsoring industry conferences, seminars, and networking events to engage with prospects and clients.

- Sales Team Expenses: Salaries, commissions, travel, and training for the business development and sales personnel responsible for client acquisition.

- Brand Building: Expenditures on public relations, thought leadership content, and brand awareness campaigns to elevate CBIZ's market reputation.

The cost structure for CBIZ is heavily influenced by its personnel, technology investments, and extensive office network. Significant expenses are also incurred for business acquisitions and marketing efforts to fuel growth.

In 2024, CBIZ's operational costs reflect a strategic focus on talent, technology, and market expansion. The company's commitment to a broad physical presence and digital engagement necessitates substantial ongoing expenditure.

| Cost Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Personnel & Compensation | Salaries, benefits, and bonuses for skilled professionals. | Core operational budget; crucial for service quality and growth. |

| Business Acquisitions | Due diligence, legal fees, and integration costs for new businesses. | Example: Marcum acquisition integration projected at $75 million in 2025. |

| Technology & Infrastructure | Cloud maintenance, software licenses, cybersecurity, IT support. | Global IT spending projected to reach $5 trillion in 2024 (Gartner). |

| Occupancy Expenses | Rent, utilities, and administrative overhead for over 160 offices. | Substantial portion of operating expenses in 2024. |

| Marketing & Business Development | Digital advertising, events, sales team costs for client acquisition. | Increased marketing budgets in professional services sector in 2024. |

Revenue Streams

CBIZ generates significant revenue from its financial advisory and consulting services. These offerings span a broad spectrum, including specialized accounting, audit support, IPO readiness, and strategic business consulting.

These services are typically billed on a project-based fee structure, allowing clients to engage CBIZ for specific needs. For instance, in 2024, many companies sought expert guidance on navigating complex regulatory changes and optimizing their financial strategies, driving demand for these project-based engagements.

CBIZ generates substantial revenue from its accounting and tax services. A significant portion of this income is recurring, derived from services like annual tax preparation, financial statement compilation, and continuous compliance assistance. These ongoing client relationships form a high percentage of CBIZ's predictable revenue.

CBIZ generates revenue through its Human Capital Management (HCM) services, which encompass a range of offerings like payroll processing, employee benefits consulting, HR advisory, and talent management. These services often involve recurring fees, providing a stable income stream for the company.

For instance, in 2024, the HCM segment of the professional services industry saw robust growth, with many firms reporting increased demand for outsourced payroll and benefits administration. CBIZ's recurring revenue model in HCM positions it well to capitalize on this trend, as clients typically engage these services on an ongoing basis.

Insurance Brokerage Commissions and Fees

CBIZ generates income primarily through commissions and fees earned by acting as an intermediary for various insurance products and financial services. This includes placing employee benefits, property and casualty insurance, and providing consulting for retirement plans. For instance, in the first quarter of 2024, CBIZ reported that its insurance segment, which heavily relies on these commission and fee structures, saw a notable increase in revenue.

The revenue streams are diverse and reflect the breadth of CBIZ's offerings:

- Employee Benefits: Commissions are earned on the sale and servicing of group health, life, disability, and other employee-related insurance policies.

- Property and Casualty (P&C) Insurance: Fees and commissions are generated from placing commercial and personal lines of insurance, covering risks like property damage, liability, and business interruption.

- Retirement Plan Consulting: Revenue is derived from fees associated with advising businesses on and administering their 401(k), pension, and other retirement savings plans.

- Other Financial Services: This can include fees for specialized risk management services, payroll processing, and other ancillary financial advisory services that complement their core insurance offerings.

Acquisition-Driven Revenue Growth

A significant portion of CBIZ's revenue growth is fueled by acquiring other companies. This strategy immediately integrates their existing clients and services, expanding CBIZ's market reach and capabilities. For instance, the acquisition of Marcum in 2024 was a major contributor, substantially increasing CBIZ's revenue for both 2024 and projected for 2025.

This acquisition-driven approach allows CBIZ to rapidly scale its operations and client base. By bringing in established firms, CBIZ benefits from immediate revenue streams and a broader service offering. The integration of acquired entities is a core component of their revenue generation strategy.

- Acquisition Strategy: CBIZ actively pursues strategic acquisitions to drive revenue.

- Immediate Revenue Impact: Acquired firms bring existing client bases and service revenues.

- Marcum Acquisition: This key acquisition significantly boosted 2024 revenue and is expected to continue impacting 2025.

CBIZ's revenue is built on a foundation of recurring fees from its accounting, tax, and human capital management services. These ongoing client relationships provide a stable and predictable income stream, essential for consistent financial performance.

The company also generates significant revenue from project-based financial advisory and consulting engagements. These services cater to specific client needs, such as regulatory compliance and strategic financial planning, which saw increased demand in 2024.

Commissions and fees from insurance and financial services, particularly in employee benefits and property & casualty, form another crucial revenue pillar. CBIZ's acquisition strategy, notably the Marcum acquisition in 2024, has also been a substantial driver of immediate revenue growth and expanded market presence.

| Revenue Segment | Primary Revenue Source | 2024 Impact/Trend |

|---|---|---|

| Financial Advisory & Consulting | Project-based fees | High demand for regulatory and strategic guidance |

| Accounting & Tax Services | Recurring fees (annual prep, compliance) | Stable, predictable income from ongoing relationships |

| Human Capital Management (HCM) | Recurring fees (payroll, benefits) | Robust growth in outsourced HR services |

| Insurance Services | Commissions & fees (employee benefits, P&C) | Notable revenue increase in Q1 2024 |

| Acquisitions | Integrated revenue from acquired firms | Significant boost from Marcum acquisition in 2024 |

Business Model Canvas Data Sources

The CBIZ Business Model Canvas is built using a combination of internal financial data, customer feedback, and market research reports. These sources provide a comprehensive view of our operations and market position.