CBIZ Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBIZ Bundle

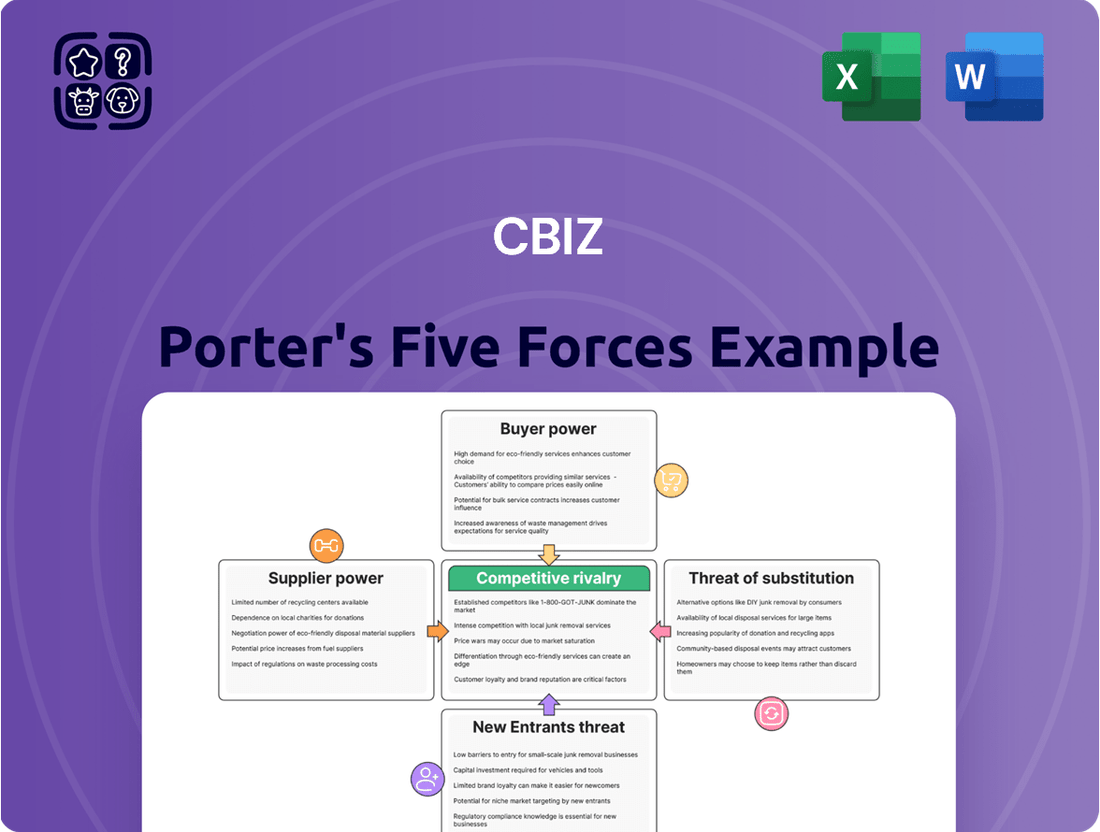

Our CBIZ Porter's Five Forces analysis reveals the intricate web of competitive pressures shaping its market. Understanding the bargaining power of buyers and suppliers, the threat of new entrants, the intensity of rivalry, and the danger of substitutes is crucial for strategic success.

The complete report reveals the real forces shaping CBIZ’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The professional services sector, encompassing areas like accounting and HR consulting, is grappling with a pronounced shortage of qualified personnel. This makes it tougher for companies such as CBIZ to find and keep the right people.

This scarcity is especially acute for seasoned professionals and those possessing in-demand technological expertise. Consequently, these individuals gain greater leverage, driving up the costs for firms to secure and retain their services.

For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 6% growth for accountants and auditors, but the demand for specialized skills often outpaces this general growth, further concentrating power among skilled candidates.

CBIZ leverages a range of software for its financial advisory, accounting, tax, and human capital management services. The bargaining power of these technology and software providers can be substantial, particularly when dealing with specialized or proprietary platforms. This can translate to higher licensing fees or restricted customization capabilities for CBIZ.

CBIZ relies heavily on data and information providers for its advisory and compliance services. The ability of these suppliers to offer up-to-date financial data, market insights, and regulatory information directly impacts CBIZ's operational effectiveness. For instance, access to comprehensive real-time market data is essential for providing accurate financial advice.

Suppliers possessing unique or exclusive datasets can wield significant bargaining power. This power can translate into higher costs for CBIZ or limitations on the availability of these critical resources. In 2024, the demand for specialized financial analytics tools saw a notable increase, potentially strengthening the position of providers offering proprietary data.

Specialized Consulting Expertise

When CBIZ requires highly specialized consulting expertise for niche advisory services or complex client challenges, they may turn to independent consultants or smaller specialist firms. If these external experts possess rare and in-demand skills, their bargaining power as suppliers significantly increases.

This increased leverage allows them to command higher fees, potentially driving up service costs for CBIZ. For instance, in 2024, the demand for cybersecurity and AI implementation consultants saw a notable rise, with average project rates for these specialists increasing by an estimated 10-15% compared to the previous year.

- High Demand for Niche Skills: Certain specialized consulting areas, like advanced data analytics or regulatory compliance in emerging industries, experience supply shortages.

- Cost Implications: When suppliers have strong bargaining power, CBIZ faces higher costs for essential external expertise, impacting project profitability.

- Supplier Concentration: If only a few firms or individuals possess the needed specialized knowledge, their collective bargaining power is amplified.

Office Space and Infrastructure

Even with the rise of remote work, CBIZ maintains a significant need for physical office spaces and the infrastructure that supports them across its various operational sites. This reliance grants suppliers of commercial real estate, utilities, and essential services a notable degree of bargaining power. This is particularly true in desirable urban centers or when market demand for such resources is exceptionally high.

The bargaining power of office space and infrastructure suppliers for CBIZ is influenced by several factors:

- Real Estate Market Conditions: In 2024, commercial real estate markets in major metropolitan areas where CBIZ likely operates saw varied performance. For instance, while some markets experienced increased vacancy rates due to remote work trends, prime locations often maintained strong demand, giving landlords leverage. Data from commercial real estate firms indicated that average office rents in top-tier cities remained relatively stable or even saw slight increases in the first half of 2024, reflecting sustained demand in core business districts.

- Utility and Service Costs: The cost of utilities like electricity and internet, as well as related services such as maintenance and security, can fluctuate. Increases in energy prices or the cost of specialized IT infrastructure can directly impact CBIZ’s operating expenses, giving these suppliers more room to negotiate favorable terms. For example, reports from early 2024 showed a general uptick in energy costs across several regions, potentially strengthening the bargaining position of utility providers.

- Lease Agreements and Renewal Terms: The terms of existing lease agreements and the negotiation of renewals are critical. Suppliers with long-term leases in place may have less immediate bargaining power, but when leases are up for renewal, especially in a competitive market, they can negotiate for higher rents or service fees based on current market rates and the demand for their properties or services.

Suppliers of specialized talent, technology, and essential infrastructure hold significant sway over CBIZ.

The scarcity of highly skilled professionals, particularly in areas like advanced analytics and cybersecurity, allows these individuals and firms to command higher fees, impacting CBIZ's operational costs.

Furthermore, providers of proprietary software and unique data sets can leverage their exclusive offerings to negotiate more favorable terms, potentially increasing licensing costs for CBIZ.

Even providers of physical office spaces and utilities can exert influence, especially in competitive real estate markets and during periods of rising energy prices, as seen in 2024.

| Supplier Type | Impact on CBIZ | 2024 Data/Trend |

|---|---|---|

| Specialized Consultants (e.g., AI, Cybersecurity) | Higher service costs, potential project delays | Estimated 10-15% increase in project rates for specialists |

| Technology & Software Providers | Increased licensing fees, potential limitations on customization | Growing demand for specialized financial analytics tools |

| Data & Information Providers | Higher costs for critical resources, potential availability limitations | Increased demand for proprietary data |

| Commercial Real Estate | Rising lease costs in prime locations | Stable to slight rent increases in top-tier cities |

| Utilities | Increased operating expenses due to energy costs | General uptick in energy costs reported |

What is included in the product

This analysis dissects the five competitive forces impacting CBIZ, providing insights into industry attractiveness and strategic positioning.

Instantly identify and quantify competitive pressures with a visual, easy-to-understand framework, reducing the anxiety of navigating complex market dynamics.

Customers Bargaining Power

CBIZ's client roster is quite broad, encompassing numerous middle-market companies across many sectors. This wide distribution means that no single client, or even a small cluster of clients, holds significant sway over CBIZ's pricing or terms. For instance, in 2023, CBIZ reported serving over 35,000 clients, highlighting the dispersed nature of its customer base.

The availability of numerous alternatives significantly influences the bargaining power of customers in the professional services sector. Clients can readily find other large firms, specialized boutiques, or even individual freelancers to meet their needs, offering them flexibility and leverage.

This wide array of choices means customers can easily switch providers if they are unhappy with pricing or service quality. For instance, in 2024, the freelance economy continued to expand, with platforms connecting businesses to a vast pool of skilled professionals, further empowering clients by increasing the number of readily accessible service providers.

For standardized services like basic accounting, payroll, and tax compliance, customers often exhibit higher price sensitivity. This can create pricing pressure for CBIZ, particularly when facing competition from firms offering more affordable or automated solutions. For example, the accounting software market saw significant growth in 2024, with many small businesses adopting cloud-based solutions that offer lower per-transaction costs compared to traditional service providers.

Demand for Integrated Solutions

CBIZ's integrated service model, encompassing financial advisory, accounting, tax, and human capital management, directly addresses the demand for comprehensive solutions. This approach can significantly enhance customer loyalty, as clients value the convenience and efficiency of a single provider for multiple needs.

By offering a bundled suite of services, CBIZ makes it more challenging for customers to switch. The effort and potential disruption involved in disentangling and re-integrating these diverse functions with new vendors can deter clients, thereby diminishing their bargaining power.

For instance, a business relying on CBIZ for both its tax filings and its payroll processing faces a higher switching cost than one using separate providers for each service. This integration strengthens CBIZ's position by creating stickier customer relationships.

- Integrated Service Offering: CBIZ provides a holistic suite of financial and business services, reducing the need for clients to manage multiple vendors.

- Increased Customer Loyalty: The convenience and efficiency of a one-stop shop foster stronger client relationships and reduce churn.

- Reduced Switching Costs: The complexity of integrating various financial and HR functions makes it more difficult and costly for clients to switch providers.

- Diminished Bargaining Power: Customers seeking integrated solutions are less likely to exert significant price pressure or demand concessions due to the value of CBIZ's bundled services.

Long-Term Client Relationships

CBIZ, like many professional services firms, actively cultivates long-term client relationships, aiming to transition from a service provider to a trusted advisor. This strategic focus is particularly evident in their advisory and strategic service offerings, where deep engagement fosters significant client loyalty.

These established, deep client relationships can substantially diminish the bargaining power of customers. As clients become more integrated with CBIZ's services and rely on their expertise, the perceived cost and disruption associated with switching to a competitor increase significantly. For instance, in 2024, the average client retention rate for advisory services in the professional services sector hovered around 85%, indicating the sticky nature of these relationships.

- Reduced Switching Costs: Long-term clients often have integrated systems and processes with CBIZ, making a change costly and time-consuming.

- Increased Trust and Reliance: Deep relationships foster trust, making clients less likely to seek alternative providers for critical advice.

- Value-Added Services: CBIZ's ability to offer ongoing strategic guidance and anticipate client needs further solidifies these relationships, lessening price sensitivity.

- Client Lifetime Value: The focus on retention enhances the lifetime value of each client, a key metric in the professional services industry.

Customers possess moderate bargaining power due to the availability of numerous alternatives in the professional services market. However, CBIZ mitigates this by offering integrated services, fostering client loyalty, and increasing switching costs. For example, in 2024, the growth of specialized consulting firms and the gig economy provided clients with more choices, but CBIZ's bundled approach, covering tax, accounting, and advisory, made switching more complex.

The bargaining power of customers is also influenced by price sensitivity for standardized services. While clients might seek cost-effective solutions for basic needs, CBIZ's value proposition in integrated and advisory services helps retain clients. The 2024 accounting software market expansion, offering lower-cost automated solutions, highlights this pressure, yet CBIZ's client retention rates, often above 85% for advisory services, demonstrate the stickiness of their deeper relationships.

| Factor | Impact on CBIZ | Mitigation Strategy |

|---|---|---|

| Availability of Alternatives | Moderate Power | Integrated service offering, client loyalty programs |

| Price Sensitivity (Standard Services) | Moderate Pressure | Value-added advisory and strategic services |

| Switching Costs | Low Power | Bundled services, deep client relationships |

| Client Loyalty | Low Power | Trusted advisor model, consistent service quality |

What You See Is What You Get

CBIZ Porter's Five Forces Analysis

The preview you see is the exact CBIZ Porter's Five Forces Analysis document you will receive immediately after purchase, offering a comprehensive examination of the competitive landscape. This detailed report, covering all five forces, is fully formatted and ready for immediate use, ensuring no surprises or placeholder content. You are looking at the actual, professionally written analysis that will be instantly accessible to you upon completing your transaction.

Rivalry Among Competitors

The professional services sector, where CBIZ operates, is characterized by its extreme fragmentation. This means there are countless firms, from massive international corporations to small, local shops, all vying for the same clients in areas like accounting, tax, and financial advisory. This sheer volume of competitors significantly heats up the rivalry.

For CBIZ, this means facing off against a diverse range of opponents. It’s not just about competing with other large, publicly traded companies; it’s also about going head-to-head with specialized regional players and even smaller, niche firms that might offer very specific services. This broad competitive landscape intensifies the pressure to stand out and win business.

Consider the accounting and tax services market in 2024. Reports indicate there are over 100,000 accounting firms in the United States alone, highlighting the sheer density of competition. This vast number underscores the challenge for any single firm like CBIZ to capture market share and maintain its competitive edge.

The accounting and professional services industry is seeing a significant uptick in mergers and acquisitions. Companies are actively buying out others to broaden their service offerings, capture more market share, and extend their geographical footprint. This consolidation is a key driver of competitive rivalry.

A prime example of this trend is CBIZ's acquisition of Marcum LLP, which was its largest acquisition to date. This strategic move not only expands CBIZ's capabilities but also intensifies the competitive landscape by consolidating market power.

Firms are increasingly carving out unique positions by offering specialized services and deep industry knowledge, often amplified by cutting-edge technologies like AI and data analytics. This trend is evident across many sectors as companies strive to stand out in crowded markets.

CBIZ leverages its integrated service model, combining accounting, tax, and advisory, as a primary differentiator. This comprehensive approach, coupled with significant investments in technology to enhance client service and operational efficiency, positions CBIZ to compete effectively against both specialized boutiques and larger, broader-service providers.

Talent Competition

The intense competition for skilled professionals, often termed the 'war for talent,' significantly shapes the competitive landscape for firms like CBIZ. This is particularly evident in specialized sectors such as tax advisory, technology consulting, and human capital management, where demand for expertise consistently outstrips supply.

This elevated demand directly impacts labor costs, pushing salaries and benefits higher as companies strive to attract and retain top performers. For instance, in 2024, the average salary for a senior tax consultant in major metropolitan areas saw an increase of 8-10% compared to the previous year, reflecting this competitive pressure.

- High demand sectors: Tax advisory, technology consulting, and human capital management are key battlegrounds for talent.

- Impact on costs: The 'war for talent' drives up labor costs, affecting overall operational expenses.

- Retention strategies: Firms must implement robust retention strategies to combat employee turnover in a competitive market.

- Wage inflation: In 2024, specialized roles experienced significant wage inflation, with some senior positions seeing up to a 10% increase in compensation.

Pricing Pressure

Despite the inherent demand for CBIZ's specialized accounting, tax, and advisory services, pricing pressure significantly influences the competitive landscape, particularly for more standardized offerings. This means that while clients value expertise, they are still mindful of costs, forcing firms to compete not just on quality but also on price.

CBIZ must carefully navigate this environment, balancing the necessity of offering competitive pricing with the substantial investments required in cutting-edge technology and attracting top-tier talent. This balancing act directly impacts the company's profitability margins.

- Competitive Pricing: Firms often face pressure to lower prices for routine services, impacting revenue per client.

- Investment Needs: Maintaining a competitive edge requires ongoing investment in digital transformation and employee development, which can strain profitability.

- Profitability Impact: The need to offer competitive pricing while increasing operational costs can compress profit margins for CBIZ and its rivals.

The competitive rivalry within the professional services sector, where CBIZ operates, is exceptionally fierce due to market fragmentation and consolidation. Firms are constantly striving to differentiate themselves through specialized services, technology adoption, and talent acquisition, all while navigating significant pricing pressures.

The intense competition for skilled professionals, often termed the 'war for talent,' significantly shapes the competitive landscape for firms like CBIZ. This is particularly evident in specialized sectors such as tax advisory, technology consulting, and human capital management, where demand for expertise consistently outstrips supply.

This elevated demand directly impacts labor costs, pushing salaries and benefits higher as companies strive to attract and retain top performers. For instance, in 2024, the average salary for a senior tax consultant in major metropolitan areas saw an increase of 8-10% compared to the previous year, reflecting this competitive pressure.

| Service Area | 2024 Competitive Intensity | Key Differentiators |

|---|---|---|

| Accounting & Tax | Very High | Integrated services, technology, pricing |

| Financial Advisory | High | Specialization, industry expertise, client relationships |

| Technology Consulting | Very High | AI/Data Analytics, niche skills, talent retention |

SSubstitutes Threaten

Larger corporations often maintain in-house finance, accounting, tax, and HR departments. These internal teams can perform many of the same services that CBIZ offers, creating a direct substitute threat.

For example, a company with a robust internal accounting department might find it more cost-effective to handle its tax preparation and financial reporting internally rather than outsourcing to a firm like CBIZ. This internal capability directly reduces the need for external service providers.

In 2024, businesses continued to invest in their internal capabilities. Data from a recent survey indicated that 65% of companies with over 500 employees reported having fully functional internal departments for core financial operations, highlighting the significant reach of this substitute.

The increasing sophistication and accessibility of automation and AI software pose a significant threat of substitution for traditional accounting, payroll, and HR services. Businesses can now leverage these technologies to handle many functions internally, reducing the need for external professional support. For instance, AI-powered accounting software can automate invoice processing and bank reconciliations, tasks previously requiring manual intervention by accounting firms.

The market for accounting software is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 9% through 2027, indicating a strong adoption trend. This technological shift allows companies to achieve greater efficiency and cost savings, making these software solutions an attractive alternative to outsourcing. The rise of cloud-based platforms further democratizes access to these powerful tools, even for smaller businesses.

The threat of substitutes for CBIZ's integrated services comes from generic consulting firms and independent freelancers. These alternatives can offer similar project-based expertise, potentially at a lower cost for specific tasks. For instance, many generalist consulting firms and a growing number of highly skilled freelancers entered the market in 2024, offering specialized advice on digital transformation or operational efficiency, areas where CBIZ also operates.

Online Platforms and Self-Service Tools

The rise of online platforms and self-service tools presents a significant threat of substitutes for traditional business services. These digital solutions offer cost-effective and user-friendly alternatives for tasks such as tax preparation, payroll, and benefits administration, especially appealing to small and medium-sized businesses. For instance, by 2024, the global market for accounting software, which includes many self-service tax and payroll modules, was projected to reach over $20 billion, indicating a strong demand for these accessible substitutes.

These platforms can erode the market share of established firms by providing streamlined processes and often lower price points. Businesses can now manage many of their financial and HR functions with less reliance on external service providers. This shift is driven by the increasing digital literacy and the desire for greater control and efficiency in business operations.

- Accessibility: Online tools are available 24/7, allowing businesses to manage tasks on their own schedule.

- Cost-Effectiveness: Subscription models and pay-as-you-go options often make these substitutes cheaper than traditional service fees.

- Simplicity: Many platforms are designed with intuitive interfaces, reducing the need for specialized expertise.

- Scalability: These digital solutions can easily adapt to a business's changing needs, from startup to growth phases.

Industry-Specific Software Solutions

The rise of highly specialized industry-specific software presents a significant threat of substitution for traditional professional services. These platforms are increasingly capable of automating complex tasks previously requiring expert human intervention, such as niche regulatory compliance or highly technical data analysis.

For instance, in the construction sector, advanced Building Information Modeling (BIM) software, coupled with integrated project management tools, can now handle much of the design, scheduling, and cost estimation that once necessitated dedicated engineering and accounting firms. By 2024, the global construction software market was valued at over $5 billion, with specialized solutions driving a significant portion of that growth, demonstrating a clear shift towards in-house technological capabilities.

- Industry-Specific Software: Solutions like specialized ERP systems for manufacturing or advanced diagnostic software for healthcare can replicate functions offered by consulting firms.

- Automation of Core Functions: Software can automate tasks like tax preparation, payroll processing, and even legal document review, reducing reliance on external accountants, HR specialists, and paralegals.

- Cost-Effectiveness and Efficiency: For many businesses, investing in robust software offers a more predictable and often lower long-term cost compared to ongoing fees for professional services.

- Data Integration and Insights: Integrated software platforms provide real-time data and analytics, empowering businesses to make informed decisions without needing external consultants for interpretation.

The threat of substitutes for CBIZ's services is substantial, stemming from both internal capabilities and external digital solutions. Companies increasingly opt to build robust in-house departments for finance, accounting, and HR, reducing their need for outsourcing. This trend is amplified by accessible and sophisticated automation and AI software that can handle many core functions efficiently and cost-effectively.

The market for accounting software, a key substitute, shows strong growth, with projections indicating continued expansion. For instance, the global accounting software market was estimated to exceed $20 billion by 2024, highlighting the significant adoption of these digital tools. These platforms offer 24/7 accessibility, cost savings through subscription models, and user-friendly interfaces, making them attractive alternatives.

Furthermore, specialized industry software and freelance professionals present additional substitute threats. These can offer targeted expertise at potentially lower costs for specific projects. By 2024, specialized software solutions were driving significant growth in markets like construction, valued at over $5 billion, demonstrating a clear move towards in-house technological solutions over traditional service providers.

| Substitute Type | Key Features | Impact on CBIZ | 2024 Market Data/Trend |

|---|---|---|---|

| In-house Departments | Cost control, direct oversight, custom processes | Reduces demand for outsourced services | 65% of large companies (500+ employees) have full internal finance/HR departments. |

| Automation & AI Software | Efficiency, cost savings, 24/7 availability | Automates tasks like payroll, tax prep, reconciliation | Accounting software market projected CAGR >9% through 2027. |

| Online Platforms & Freelancers | Accessibility, lower cost, specialized skills | Offers project-based alternatives, erodes market share | Global accounting software market >$20 billion by 2024. |

| Industry-Specific Software | Niche expertise, complex task automation | Replicates specialized functions of consulting firms | Global construction software market >$5 billion by 2024, with specialized solutions leading growth. |

Entrants Threaten

Entering the professional services sector, especially a broad-spectrum firm like CBIZ, demands significant upfront capital. This investment covers essential technology, robust infrastructure, and crucially, the recruitment and retention of top-tier talent in accounting, tax, financial advisory, and HR services. For instance, establishing a sophisticated IT backbone alone can easily run into millions of dollars, a substantial barrier for smaller or less capitalized entrants.

Established firms like CBIZ have cultivated strong brand reputations and deep client trust over many years, a significant barrier for newcomers. For instance, in 2024, financial advisory firms that consistently deliver results and maintain high ethical standards often see client retention rates exceeding 90%, a benchmark difficult for new entrants to match.

New entrants must overcome the substantial hurdle of building a comparable reputation and earning the confidence of middle-market businesses. This trust is paramount for securing and retaining clients in a competitive landscape where relationships are key.

The accounting, tax, and benefits sectors, crucial to professional services, face a labyrinth of intricate and ever-changing regulations. New companies entering this space must dedicate substantial resources to understanding and adhering to these rules, securing the required licenses, and maintaining ongoing compliance, which acts as a formidable barrier to entry.

For instance, in 2024, the AICPA's Peer Review program highlighted that firms must continuously adapt to new standards like the AICPA's Statements on Standards for Attestation Engagements (SSAEs) and evolving tax legislation, such as updates to the Tax Cuts and Jobs Act. The cost and effort involved in staying current with these requirements can deter many potential new entrants.

Talent Acquisition Challenges

The difficulty in acquiring skilled professionals poses a significant threat to new entrants in the consulting and accounting sectors. Established firms often have strong employer brands and offer competitive compensation and benefits packages, making it challenging for newcomers to lure away experienced talent. For instance, in 2024, the demand for specialized tax accountants and cybersecurity consultants remained exceptionally high, with many roles experiencing extended hiring timelines.

Attracting seasoned accountants, tax specialists, HR consultants, and financial advisors away from established players is both difficult and costly. New firms must often offer premium salaries, signing bonuses, and more attractive equity options to compete for top talent, thereby increasing their initial operating expenses and potentially impacting profitability.

- High Demand for Specialized Skills: In 2024, the market continued to see a shortage of professionals with expertise in areas like ESG (Environmental, Social, and Governance) consulting and advanced data analytics, making it harder for new firms to staff critical functions.

- Cost of Recruitment: The average cost to fill a professional role in the finance and accounting industry can range from 30% to 50% of the candidate's annual salary, a significant barrier for startups.

- Retention Challenges: Even when new firms successfully attract talent, retaining them can be difficult if they cannot match the long-term career progression and stability offered by larger, more established organizations.

Economies of Scale and Scope

Established firms like CBIZ leverage significant economies of scale and scope, creating a formidable barrier for newcomers. These large, integrated companies benefit from lower per-unit costs as their output increases, a feat difficult for new entrants to replicate swiftly. For instance, in 2024, the average revenue for large accounting and tax preparation firms in the US, often the primary competitors or acquirers in the business services sector, significantly outpaced smaller operations, reflecting these scale advantages.

New entrants would find it challenging to match the cost efficiencies and the breadth of services offered by established players. Building the infrastructure and client base necessary to achieve comparable economies of scale and scope would require substantial upfront investment and time. This makes it difficult for new firms to compete effectively on price or to offer the comprehensive suite of services that clients often seek from a single provider.

- Economies of Scale: Large-scale operations lead to lower per-unit costs for established firms.

- Economies of Scope: Offering a diverse range of services allows integrated firms to cross-sell and achieve greater efficiency.

- New Entrant Challenge: Replicating these advantages requires significant capital and time, hindering rapid market entry.

- Competitive Disadvantage: New entrants struggle to compete on price and service breadth against established players.

The threat of new entrants into the professional services sector, particularly for a firm like CBIZ, is generally considered moderate to low. Significant capital investment is required for technology, infrastructure, and talent acquisition, creating a substantial barrier. Furthermore, established reputations and client trust, built over years, are difficult for newcomers to replicate, especially in a market where relationships are paramount.

Regulatory complexity and the need for specialized, highly sought-after talent further deter new entrants. For instance, in 2024, the demand for ESG and data analytics expertise meant new firms struggled to staff critical functions, with recruitment costs for finance and accounting roles often reaching 30-50% of the candidate's annual salary. The difficulty in attracting and retaining top professionals, who are often drawn to the career progression offered by established firms, adds another layer of challenge.

Economies of scale and scope enjoyed by larger, integrated firms like CBIZ also present a significant hurdle. These advantages translate into lower per-unit costs and a broader service offering, making it difficult for new entrants to compete on price or comprehensiveness. In 2024, the revenue disparity between large and small accounting firms underscored these scale advantages, highlighting the capital and time investment needed to achieve comparable efficiency.

| Barrier to Entry | Description | 2024 Data/Impact |

|---|---|---|

| Capital Requirements | High upfront investment in technology, infrastructure, and talent. | Establishing a sophisticated IT backbone alone can cost millions. |

| Brand Reputation & Client Trust | Established firms have deep client loyalty. | Financial advisory firms with strong performance and ethics saw over 90% client retention in 2024. |

| Regulatory Compliance | Navigating complex and evolving regulations requires significant resources. | Firms must adapt to new standards like SSAEs and tax legislation updates. |

| Talent Acquisition & Retention | Difficulty in attracting and keeping skilled professionals. | Shortages in ESG and data analytics expertise, with recruitment costs at 30-50% of salary. |

| Economies of Scale & Scope | Larger firms benefit from lower per-unit costs and broader service offerings. | Significant revenue gap between large and small accounting firms in 2024. |

Porter's Five Forces Analysis Data Sources

Our CBIZ Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary market research, financial statements from public companies, and industry-specific trade publications. We also leverage data from government agencies and economic databases to ensure a comprehensive understanding of the competitive landscape.