CBIZ Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBIZ Bundle

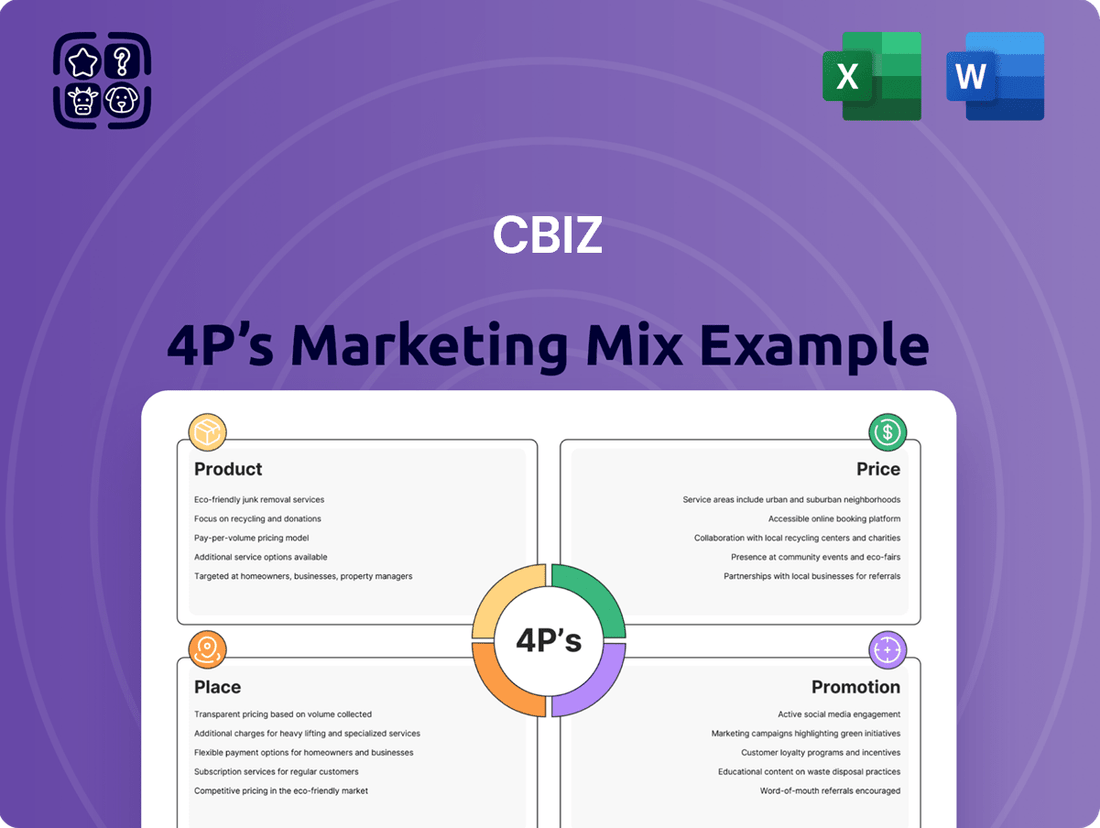

Uncover the strategic brilliance behind CBIZ's marketing efforts by exploring its Product, Price, Place, and Promotion. This analysis reveals how these core elements are meticulously crafted to resonate with their target audience and drive business growth.

Dive deeper into the specifics of CBIZ's market approach with our comprehensive 4Ps Marketing Mix Analysis. Gain actionable insights into their product innovation, pricing strategies, distribution channels, and promotional campaigns.

Ready to elevate your own marketing strategy? Access the full, editable CBIZ 4Ps Marketing Mix Analysis today and learn from a market leader's success.

Product

CBIZ's comprehensive financial services form the bedrock of its product offering, encompassing a wide array of accounting, tax, and advisory solutions designed to support businesses. These services are crucial for clients seeking to navigate complex financial landscapes and maintain strict regulatory adherence.

The strategic integration of Marcum LLP, finalized in late 2024, dramatically amplified CBIZ's service portfolio and market reach. This move positioned CBIZ as a leading professional services firm within the United States, enhancing its ability to deliver integrated financial expertise.

CBIZ's Human Capital Management (HCM) solutions extend beyond traditional financial services, offering comprehensive employee benefits, payroll processing, and HR consulting. These offerings are designed to help businesses of all sizes manage their workforce more effectively, from hiring to ensuring employee well-being. For instance, in 2024, businesses are increasingly leveraging technology to streamline these processes, with the global HR tech market projected to reach $39.4 billion by 2026, highlighting the demand for integrated HRIS solutions.

The core of CBIZ's HCM strategy involves optimizing workforce management through technology and strategic guidance. This includes talent acquisition, development, compensation strategies, and employee wellness programs. By providing integrated HRIS platforms, CBIZ empowers clients to automate routine tasks and gain deeper insights into their human capital, a critical factor as companies in 2024 focus on retention and employee engagement amidst evolving work environments.

CBIZ's Integrated Advisory and Consulting services are a core component of their offering, focusing on driving client growth and profitability. They tackle complex business hurdles with specialized consulting in crucial areas like government healthcare compliance, risk advisory, and essential technology services including cloud hosting, ERP systems, and cybersecurity.

The company's strategy hinges on delivering tangible, data-backed solutions by harnessing extensive expertise across diverse industries. This integrated approach ensures clients receive actionable insights tailored to their specific needs, aiming to optimize operations and mitigate risks effectively.

Technology-Driven Solutions

CBIZ's product evolution significantly emphasizes technology-driven solutions, encompassing managed IT services, cloud infrastructure, cybersecurity, and enterprise performance technology. This strategic pivot aims to equip clients with cutting-edge tools that boost operational efficiency and overall performance.

The acquisition of CompuData in March 2024 was a pivotal move, bolstering CBIZ's capabilities in technology-focused advisory services. This integration allows CBIZ to offer more comprehensive and integrated tech solutions, directly addressing the evolving digital needs of businesses.

CBIZ's commitment to technology is reflected in its expanding portfolio, which provides clients with:

- Enhanced IT infrastructure and managed services

- Robust cybersecurity measures

- Scalable cloud solutions

- Tools for optimizing enterprise performance

Specialized Industry Expertise

CBIZ leverages specialized industry expertise, understanding that sectors like capital markets, non-profit and education, construction, and private equity have distinct needs. This focused approach allows them to offer tailored solutions that address specific industry challenges and capitalize on unique opportunities. For instance, in 2024, the construction industry faced rising material costs, and CBIZ provided targeted strategies to help clients navigate these economic pressures.

This deep industry knowledge translates into more effective advisory services. By dedicating resources to understanding the nuances of each sector, CBIZ can deliver highly relevant insights. This specialization is a key differentiator, enabling them to build trust and establish themselves as go-to advisors for businesses operating in these diverse markets.

- Capital Markets: CBIZ offers specialized financial advisory and accounting services to support companies navigating complex regulatory environments and capital raising activities.

- Non-Profit and Education: The firm provides tailored solutions for financial management, compliance, and strategic planning, crucial for organizations in these sectors.

- Construction: CBIZ assists construction firms with project accounting, tax planning, and risk management, addressing the sector's unique operational and financial demands.

- Private Equity: They support private equity firms with due diligence, transaction advisory, and portfolio company management, recognizing the fast-paced nature of this industry.

CBIZ's product strategy centers on delivering integrated financial, human capital management, and technology solutions. This comprehensive approach aims to provide clients with a single, trusted partner for a wide range of business needs. The firm's commitment to technology is evident in its expanding portfolio of managed IT services, cloud solutions, and cybersecurity offerings, further bolstered by strategic acquisitions like CompuData in March 2024.

The company further differentiates itself through deep industry specialization, offering tailored services for sectors such as capital markets, non-profits, construction, and private equity. This focus allows CBIZ to address unique sector challenges, as seen in its 2024 support for construction firms navigating rising material costs.

CBIZ's Human Capital Management (HCM) solutions are designed to streamline workforce management, encompassing payroll, benefits, and HR consulting. This area is experiencing significant growth, with the global HR tech market projected to reach $39.4 billion by 2026, indicating a strong demand for the integrated HRIS platforms CBIZ provides.

| Service Area | Key Offerings | 2024/2025 Focus/Data |

|---|---|---|

| Financial Services | Accounting, Tax, Advisory | Post-Marcum integration (late 2024) enhancing market reach. |

| Human Capital Management (HCM) | Payroll, Benefits, HR Consulting | Global HR tech market projected to reach $39.4B by 2026. |

| Technology Solutions | Managed IT, Cloud, Cybersecurity | Acquisition of CompuData (March 2024) strengthening tech advisory. |

| Industry Specialization | Capital Markets, Construction, etc. | Targeted strategies for sectors like construction facing economic pressures in 2024. |

What is included in the product

This analysis provides a comprehensive, professionally written deep dive into CBIZ's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

Simplifies complex marketing strategies by breaking down the CBIZ 4P's into actionable insights, alleviating the pain of overwhelming data.

Place

CBIZ boasts an extensive national footprint with over 160 offices strategically located in 22 major markets across the United States. This broad physical presence, spanning coast to coast, is crucial for client engagement and accessibility. This widespread network enables CBIZ to effectively serve a diverse range of middle-market businesses throughout the country.

The company's significant geographic reach is further amplified by strategic acquisitions. For instance, the integration of Marcum LLP in 2024 significantly broadened CBIZ's market penetration and client base. This expansion solidifies CBIZ's standing as a national leader in its service offerings.

CBIZ's primary distribution channel is direct client engagement, powered by its vast network of over 10,000 members. This approach fosters deep client relationships, essential for delivering specialized financial, HR, and advisory services. The company actively cultivates client loyalty and encourages cross-selling, demonstrating a strong focus on organic growth through its direct interactions.

CBIZ actively leverages strategic acquisitions as a core component of its market expansion strategy. Over the past three years, the company has completed approximately 34 acquisitions, averaging nearly 2 per year. This consistent inorganic growth demonstrates a commitment to broadening its reach and enhancing its service portfolio.

A significant recent example is the late 2024 acquisition of Marcum LLP, which substantially increased CBIZ's scale and operational capacity. This move, along with others, is designed to integrate new expertise, enter new geographical markets, and attract a wider range of clients, thereby strengthening its competitive position.

Digital Presence and Online Resources

CBIZ cultivates a strong digital footprint through its corporate website and dedicated investor relations portal. These platforms are vital for clients and stakeholders to access crucial information, including news releases, annual reports, and earnings call transcripts. For instance, the site offers specialized resources like their 2025 Tax Planning Guide, demonstrating a commitment to providing timely and relevant insights.

These online resources are designed to enhance client engagement and ensure efficient information dissemination. CBIZ leverages its digital presence to share market updates and strategic analyses, directly supporting informed decision-making. The accessibility of these tools underscores the company's focus on transparency and client support in the digital age.

- Corporate Website: Primary hub for company information and services.

- Investor Relations Portal: Dedicated space for financial reports, news, and shareholder information.

- Online Resources: Access to publications like the 2025 Tax Planning Guide and earnings call transcripts.

- Client Engagement: Digital platforms facilitate communication and information sharing.

Referral Networks and Partnerships

CBIZ, like many professional services firms, leverages referral networks and strategic partnerships as a key, albeit often indirect, distribution channel. These alliances with complementary businesses, law firms, and financial institutions can significantly drive client acquisition. For instance, a partnership with a wealth management firm might lead to referrals for CBIZ's tax planning services.

These collaborative efforts are crucial for expanding reach and accessing new client segments. The firm's emphasis on providing integrated solutions naturally fosters these partnerships, as clients often have multifaceted needs that require coordinated expertise. This approach can be particularly effective in niche markets requiring specialized financial, tax, or HR support.

- Referral Volume: While exact figures for CBIZ's referral-driven revenue are not publicly disclosed, industry benchmarks suggest that for many professional services firms, referrals can account for 30-50% of new business.

- Partnership Impact: Strategic alliances can unlock access to larger client pools. For example, a partnership with a major bank could expose CBIZ to thousands of its business clients seeking accounting or advisory services.

- Integrated Solutions Drive Collaboration: CBIZ's focus on offering a suite of services, such as accounting, tax, and employee benefits, encourages other firms to partner, knowing they can offer a more comprehensive solution to their own clients.

Place, as a component of CBIZ's marketing mix, is defined by its extensive national network of over 160 offices across 22 key markets. This physical presence ensures accessibility for clients seeking financial, HR, and advisory services. The company's strategic acquisitions, such as the integration of Marcum LLP in late 2024, have further expanded this geographic reach, solidifying its position as a national provider.

What You See Is What You Get

CBIZ 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CBIZ 4P's Marketing Mix Analysis provides a detailed breakdown of product, price, place, and promotion strategies. You'll gain valuable insights to refine your marketing efforts.

Promotion

CBIZ prioritizes transparent financial communications via its investor relations website, offering timely updates on earnings, annual reports, and SEC filings. This commitment extends to quarterly earnings calls and presentations, which thoroughly detail financial performance and future strategic direction.

These consistent communications are designed to reach financial professionals and investors, fostering confidence and attracting necessary capital. For instance, CBIZ's fiscal year 2024 first quarter earnings report, released in February 2024, highlighted a 10% increase in revenue, demonstrating solid operational growth to stakeholders.

CBIZ excels in content marketing, publishing strategic analyses and tax planning guides to build its reputation as a thought leader. Their 2025 Tax Planning Guide, released in late 2024, and their ongoing reports on human capital management trends, highlight their commitment to delivering essential information. This strategy effectively positions CBIZ as a trusted advisor and a go-to resource for complex financial and business challenges.

CBIZ leverages public relations to broadcast crucial corporate updates, including significant acquisitions and executive changes, to a wide audience. For instance, their proactive communication around the acquisition of CliftonLarsonAllen's tax and accounting practice in late 2023 likely generated substantial media attention, underscoring their expansion strategy.

News releases are a cornerstone for disseminating key financial performance indicators and strategic achievements, such as reporting a 10.5% increase in revenue for the third quarter of 2024, which bolstered market confidence and informed investors.

This consistent and targeted communication effort is vital for cultivating and preserving a favorable public perception, effectively conveying CBIZ's trajectory of growth and operational resilience to stakeholders and the broader market.

Direct Marketing and Client Relationship Management

CBIZ leverages direct marketing as a core component of its client relationship management, with its vast network of financial and insurance professionals directly engaging clients. This personal touch is crucial for building trust and understanding unique needs. In 2024, CBIZ reported a significant portion of its revenue stemming from existing client relationships, underscoring the success of its retention strategies.

The company places a strong emphasis on client retention and cross-selling opportunities, viewing existing clients as the primary source for future growth. This approach is supported by their investment in client management systems designed to track interactions and identify opportunities for offering additional services. For instance, a client utilizing CBIZ's accounting services might be proactively offered wealth management solutions.

Personalized interactions and the delivery of tailored solutions act as powerful promotional tools for CBIZ. By understanding individual client circumstances, advisors can offer specific advice and services that resonate deeply, fostering loyalty and encouraging referrals. This client-centric model is a key differentiator in the competitive financial services landscape.

- Client Retention Focus: CBIZ's strategy prioritizes nurturing existing client relationships, leading to a high percentage of recurring revenue.

- Direct Engagement: The business model relies on direct interaction between CBIZ professionals and clients for service delivery and relationship building.

- Cross-Selling Success: Personalized outreach effectively identifies and capitalizes on opportunities to offer additional services to the existing client base.

- Tailored Solutions: Customized advice and services are a primary promotional tool, enhancing client satisfaction and loyalty.

Corporate Branding and Industry Positioning

CBIZ positions itself as a premier national advisor for middle-market businesses, emphasizing its extensive service offerings and deep industry knowledge. This branding strategy highlights their role as a comprehensive, full-service provider designed to foster client growth and manage intricate business hurdles. For instance, in 2024, CBIZ continued to expand its service lines, acquiring several specialized accounting and advisory firms to bolster its national presence and expertise in key growth sectors.

Their messaging consistently portrays CBIZ as an unparalleled partner, focused on accelerating client success and simplifying complex operational and financial landscapes. This strategic differentiation is crucial in a crowded professional services market. By the end of 2024, CBIZ reported a significant increase in client retention rates, attributing this to their integrated service model and commitment to client outcomes.

CBIZ's industry positioning as a leading national professional services advisor is reinforced by its commitment to innovation and client-centric solutions. This approach aims to set them apart by offering a holistic suite of services that address the multifaceted needs of growing businesses. In early 2025, CBIZ launched new digital tools to enhance client collaboration and data analytics, further solidifying their image as a forward-thinking industry leader.

Key aspects of CBIZ's branding and positioning include:

- National Reach: A broad network of offices and professionals across the United States.

- Middle-Market Focus: Tailored services specifically designed for businesses in the middle market.

- Comprehensive Services: Offering accounting, tax, payroll, benefits, and advisory services under one umbrella.

- Expertise Depth: Showcasing specialized knowledge in various industries and service areas.

CBIZ utilizes a multi-faceted promotional strategy, integrating investor relations, content marketing, public relations, and direct client engagement. Their investor relations website serves as a central hub for financial data, with timely updates on earnings and SEC filings, fostering transparency. For instance, their Q1 2024 earnings report in February 2024 showed a 10% revenue increase.

Content marketing, through strategic analyses and tax planning guides like their 2025 guide released in late 2024, positions CBIZ as a thought leader. Public relations efforts, such as communicating their late 2023 acquisition of CliftonLarsonAllen's tax practice, amplify corporate achievements and strategic moves to a wider audience.

Direct marketing, through personal client interactions by financial and insurance professionals, is key to building trust and understanding client needs, a strategy reflected in 2024's revenue largely coming from existing clients. This client-centric approach, offering tailored solutions and cross-selling opportunities, drives loyalty and growth.

CBIZ's branding emphasizes its role as a premier national advisor for middle-market businesses, highlighting extensive services and deep industry knowledge. Their messaging consistently portrays them as a partner focused on client success, a strategy reinforced by their early 2025 launch of new digital tools for client collaboration.

Price

CBIZ likely employs a value-based pricing strategy for its professional services, aligning costs with the significant benefits clients gain. This approach reflects the specialized knowledge and comprehensive solutions offered, which are crucial for financial management, regulatory compliance, and business expansion. For instance, in 2024, businesses increasingly sought expert guidance to navigate complex tax laws and economic shifts, making the value derived from CBIZ's services directly proportional to their pricing.

The pricing structure is designed to mirror the return on investment clients achieve through improved financial performance and risk mitigation. This means that the fees charged are not just for the service itself, but for the tangible outcomes and strategic advantages CBIZ delivers. The company's strong recurring revenue, a testament to client retention, underscores the consistent value proposition that justifies this pricing model.

CBIZ operates within a highly competitive professional services landscape. Following its acquisition of Marcum in 2024, the company is strategically positioning its pricing to reflect enhanced capabilities while remaining competitive. This balancing act is crucial for attracting new business and retaining existing clients in a market where value perception is key.

While precise pricing structures for CBIZ are proprietary, publicly available financial reports from 2024 and early 2025 indicate a focus on maintaining profitability. For instance, reports suggest a revenue growth of approximately 8-10% year-over-year, implying successful client acquisition or expansion of services, which would necessitate competitive pricing strategies.

However, the market is not without its challenges. Anecdotal evidence and industry analysis point to client sensitivity regarding rate increases. This pushback suggests that while CBIZ offers advanced services, its pricing must demonstrate clear value and ROI to overcome potential objections and maintain market share.

CBIZ's revenue stream is a blend of recurring and project-based services, a mix that directly shapes its pricing strategies. The stability of recurring services, which accounted for about 72% of their total revenue in recent periods, often allows for predictable, often subscription-based pricing models. This provides a solid revenue foundation.

The remaining 28% of CBIZ's revenue stems from project-based work, such as specialized advisory and consulting engagements. These services typically command more variable and negotiated fees, reflecting the bespoke nature and often higher perceived value of these engagements. This segmentation allows CBIZ to cater to diverse client needs and market demands.

Strategic Acquisition Impact on Pricing

The acquisition of Marcum LLP by CBIZ in late 2023, a move that significantly expanded CBIZ's accounting and tax services, is poised to reshape its pricing strategies. This consolidation, which added considerable scale and broadened its service portfolio, allows for potential cost efficiencies that could translate into more competitive pricing for core services.

Conversely, the enhanced expertise and broader capabilities resulting from the Marcum integration may enable CBIZ to command premium pricing for specialized advisory and niche service offerings. This dual impact of scale-driven efficiency and expertise-driven value will likely be a key consideration in their 2024 and 2025 pricing models.

Integration costs, while a short-term consideration, also play a role in the overall financial performance and thus influence pricing decisions. For instance, the reported deal value of approximately $1.05 billion for Marcum means that managing these integration expenses effectively will be crucial for maintaining healthy margins and competitive pricing post-acquisition.

- Scale Efficiencies: The combined entity's larger footprint could lead to operational efficiencies, potentially lowering per-unit service costs.

- Premium for Expertise: Expanded specialized services, such as international tax or forensic accounting, may justify higher price points.

- Integration Costs: The financial impact of integrating Marcum will be factored into pricing to ensure profitability.

- Market Competitiveness: CBIZ will need to balance its new capabilities with the pricing of competitors in the accounting and advisory space.

Financial Performance and Revenue Guidance

CBIZ's pricing strategy is directly influenced by its financial performance and revenue outlook. For 2025, the company projects total revenue in the range of $2.8 billion to $2.95 billion. This revenue guidance, coupled with an adjusted diluted EPS forecast of $3.60 to $3.65, underpins their pricing decisions to ensure profitability.

These financial targets are crucial in shaping CBIZ's pricing policies. The company aims to balance achieving its profitability goals with the need to remain competitive and manage ongoing integration costs from recent acquisitions.

- 2025 Revenue Projection: $2.8 billion - $2.95 billion

- 2025 Adjusted Diluted EPS Projection: $3.60 - $3.65

- Pricing Influence: Financial performance and revenue targets directly shape pricing decisions.

- Strategic Goal: Achieve profitability while navigating market conditions and integration expenses.

CBIZ's pricing strategy for 2024 and 2025 is a dynamic blend of value-based principles and market responsiveness, particularly post-acquisition. The company aims to reflect the enhanced capabilities and broader service offerings following the Marcum integration, while remaining competitive. This approach is designed to capture the ROI clients receive from their specialized services, ensuring that fees align with tangible benefits like improved financial performance and risk mitigation.

The company's financial outlook for 2025, with projected revenues between $2.8 billion and $2.95 billion and adjusted diluted EPS between $3.60 and $3.65, directly informs these pricing decisions. These targets underscore a commitment to profitability, balanced against the need to absorb integration costs and maintain market share.

| Metric | 2025 Projection | Impact on Pricing |

|---|---|---|

| Projected Revenue | $2.8 billion - $2.95 billion | Supports pricing to achieve revenue targets. |

| Projected Adjusted Diluted EPS | $3.60 - $3.65 | Drives pricing to ensure profitability and margin goals. |

| Recurring Revenue Share | ~72% | Enables stable, predictable pricing for core services. |

| Project-Based Revenue Share | ~28% | Allows for variable, negotiated fees reflecting specialized value. |

4P's Marketing Mix Analysis Data Sources

Our CBIZ 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including SEC filings and annual reports, alongside in-depth industry research and competitive intelligence. We also leverage direct insights from brand websites, product pages, and publicly available promotional materials to ensure accuracy.