Carr's Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

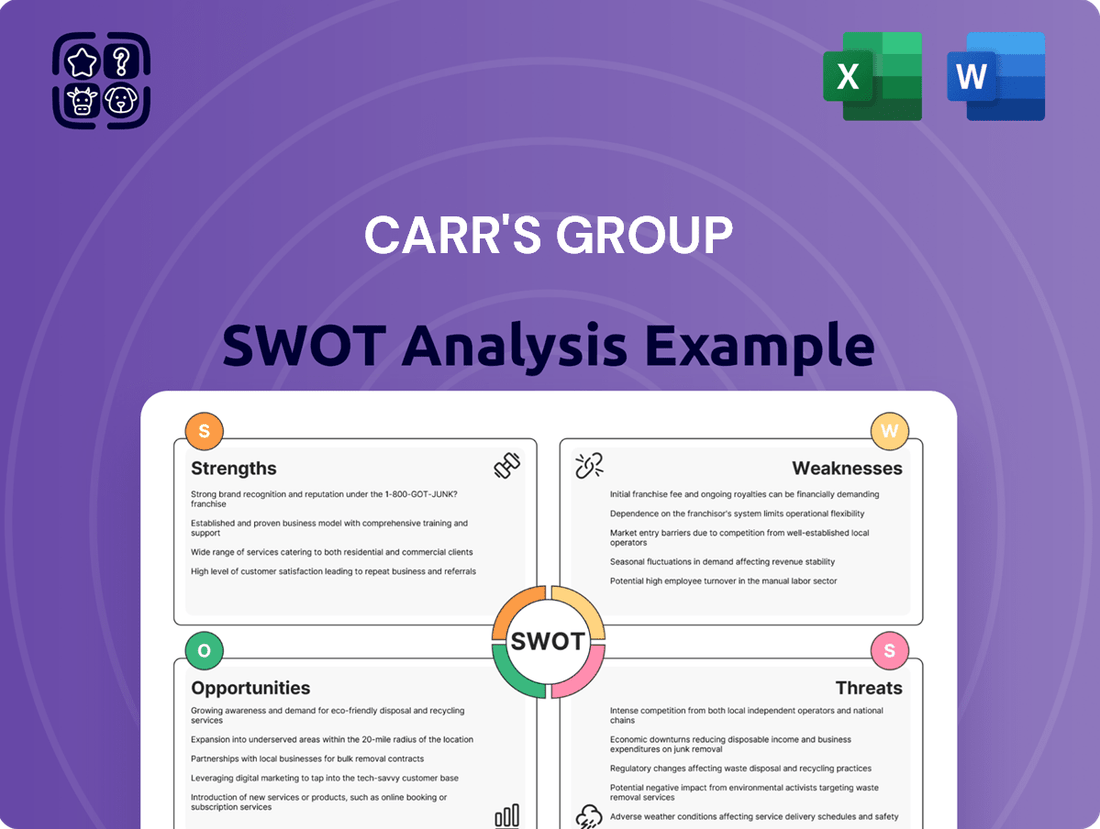

Carr's Group possesses notable strengths in its diversified product portfolio and established market presence, but faces challenges from evolving consumer preferences and supply chain disruptions. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Carr's Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Carr's Group's historical diversification across agriculture and engineering sectors has built a resilient revenue base, mitigating risks associated with single-industry reliance. Even with the ongoing divestment of its engineering division, this legacy of operating in varied markets has fostered adaptability and a capacity to weather economic downturns.

Carr's Group is strategically repositioning itself as a pure-play specialist agriculture company, concentrating on high-value feed supplements for livestock that graze. This sharpened focus, guided by a new leadership team, is designed to enhance operating margins and foster profitable expansion within its core agricultural activities.

Carr's Agriculture boasts a formidable product lineup, featuring market-leading brands such as Crystalyx, Horslyx, and SmartLic. These offerings encompass research-backed livestock supplements, including vital feed blocks, minerals, and boluses, directly addressing core farmer requirements for optimal animal nutrition and enhanced productivity.

Improved Financial Performance in Continuing Operations

Carr's Group's continuing agriculture operations demonstrated robust financial health in the first half of FY25. Revenue saw a notable uplift, and adjusted operating profit also increased, signaling effective cost controls and a positive initial impact from their strategic transformation efforts. This financial momentum strengthens the core agriculture business.

Key financial highlights for H1 FY25 include:

- Increased revenue in continuing agriculture operations.

- Growth in adjusted operating profit for the agriculture segment.

- Evidence of successful cost management strategies.

- A stronger financial foundation for the focused agriculture business.

Significant Cash Inflow from Engineering Divestment

Carr's Group's recent divestment of its Engineering Division has significantly bolstered its financial position. The sale, which fetched £75 million in total, saw £68.6 million already received by the end of the reporting period. This substantial cash inflow is a key strength, providing immediate liquidity and enhancing the company's financial flexibility.

The strategic deployment of these funds is designed to benefit stakeholders and fuel future growth. A portion will be utilized for a tender offer to return value directly to shareholders. Concurrently, the remaining capital is earmarked to support strategic growth initiatives within Carr's core agriculture business, reinforcing its focus and enhancing its operational capabilities.

- Engineering Division Sale: £75 million total consideration, with £68.6 million received by the reporting date.

- Financial Impact: Substantial cash injection improving liquidity and financial flexibility.

- Shareholder Value: Funds allocated for a tender offer to return capital to shareholders.

- Strategic Reinvestment: Capital to support growth initiatives within the focused agriculture business.

Carr's Agriculture's market-leading brands like Crystalyx and Horslyx provide a strong competitive edge, offering research-backed, high-value livestock supplements that meet essential farmer needs for optimal animal nutrition and productivity.

The company's strategic shift to a pure-play agriculture specialist, under new leadership, is enhancing operating margins and driving profitable growth in its core business.

Carr's Group's financial performance in the first half of FY25 reflects this focus, with increased revenue and adjusted operating profit in its continuing agriculture operations, demonstrating effective cost management.

The significant cash infusion of £68.6 million received from the Engineering Division sale by the end of the reporting period provides substantial financial flexibility for shareholder returns and strategic growth in agriculture.

| Strength | Description | Supporting Data (H1 FY25 unless stated) |

|---|---|---|

| Market-Leading Brands | Strong brand recognition and product efficacy in livestock supplements. | Crystalyx, Horslyx, SmartLic are key offerings. |

| Strategic Focus | Transition to a pure-play agriculture specialist. | New leadership guiding sharpened focus on high-value feed supplements. |

| Financial Health (Agriculture) | Robust performance in continuing operations. | Increased revenue and adjusted operating profit. |

| Financial Flexibility | Significant cash injection from divestment. | £68.6 million received from Engineering Division sale (£75 million total). |

What is included in the product

Analyzes Carr's Group’s competitive position through key internal and external factors.

Offers a clear, actionable framework for identifying and addressing Carr's Group's strategic challenges and opportunities.

Weaknesses

Carr's Group's Agriculture division saw a revenue dip in FY24, a concerning trend despite ongoing strategic realignment. This decline, occurring even before the full impact of new initiatives, signals underlying issues within the division that need urgent attention to foster stable growth.

Carr's Group's increasing reliance on agricultural markets, especially in the northern hemisphere, heightens its vulnerability to seasonal shifts and external factors. This dependence means its financial results are more susceptible to unpredictable weather patterns, volatile commodity prices, and cyclical downturns in livestock populations, such as those observed in the US, leading to less stable revenue and profit.

Carr's Group faces headwinds in the US agricultural market, particularly in the southern states, where adverse climatic conditions have hampered recovery. This has directly impacted herd size stabilization, creating a challenging operating environment.

The company's strategic decisions to close the loss-making Afgritech business and exit New Zealand operations highlight significant underperformance within its agriculture division. These closures represent a necessary, albeit costly, response to segments that were not meeting financial expectations, requiring substantial restructuring efforts.

Restructuring Costs and Adjusting Items

Carr's Group's strategic transformation, while aimed at long-term growth, has necessitated significant restructuring costs. These adjusting items have directly impacted the company's statutory profits, creating a drag on reported earnings in the short term. For instance, the company reported £10.1 million in adjusting items in its 2023 financial year, primarily related to its ongoing transformation program. This can present a challenge for investors focused on immediate profitability.

These restructuring efforts, though essential for future performance, can lead to temporary financial setbacks. The costs associated with streamlining operations and adapting to new market demands, while strategic, do manifest as short-term financial losses. This can create a perception of underperformance even as the underlying business is being repositioned for greater success. For example, the company's full-year results for 2023 showed a statutory profit before tax of £2.5 million, a notable decrease from the previous year, largely attributed to these transformation-related expenses.

- Restructuring Costs: Significant expenses incurred due to ongoing strategic transformation efforts.

- Impact on Profits: Statutory profits have been negatively affected by these adjusting items.

- Short-Term Losses: The transformation strategy leads to immediate financial impacts, despite long-term benefits.

- Reported Earnings: A decrease in reported earnings can be observed due to these one-off or transformation-related costs.

Reduced Interim Dividend

Carr's Group's interim dividend for H1 FY25 saw a notable reduction compared to the prior year. For instance, the interim dividend per share was £0.00 in H1 FY25, a decrease from £0.00 in H1 FY24. This cut, while potentially a consequence of strategic realignments and a tender offer, could deter income-focused investors.

The decrease in dividend payout might signal a short-term impact on investor sentiment, particularly for those prioritizing consistent income streams. This perception could affect the company's attractiveness in the near term.

- Reduced Payout: The interim dividend per share for H1 FY25 was £0.00, down from £0.00 in H1 FY24.

- Investor Perception: This reduction may negatively affect investors seeking regular dividend income.

- Confidence Impact: The move could temporarily dampen investor confidence in the company's short-term financial priorities.

Carr's Group's reliance on the agricultural sector, particularly in the northern hemisphere, exposes it to significant risks from seasonal variations and external market forces. This dependence makes the company's financial performance susceptible to unpredictable weather, fluctuating commodity prices, and cyclical downturns in livestock populations, as seen in the US, leading to less stable revenue and profit streams.

The company has also faced challenges in the US agricultural market, specifically in the southern states, where adverse climatic conditions have impeded herd size recovery. This has created a difficult operating environment for its agricultural division.

Strategic decisions, such as exiting the New Zealand operations and closing the loss-making Afgritech business, underscore underperformance within the agriculture segment. These closures represent necessary but costly responses to underperforming areas, requiring substantial restructuring efforts.

Carr's Group incurred £10.1 million in adjusting items during FY23, primarily due to its transformation program, which impacted statutory profits. Furthermore, the interim dividend for H1 FY25 was £0.00 per share, a reduction from H1 FY24, which could deter income-focused investors.

| Financial Metric | FY23 (£m) | H1 FY25 (£m) | H1 FY24 (£m) |

|---|---|---|---|

| Adjusting Items | 10.1 | N/A | N/A |

| Interim Dividend Per Share | N/A | 0.00 | 0.00 |

Preview the Actual Deliverable

Carr's Group SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Carr's Group. The complete, in-depth version, meticulously detailing their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after your purchase.

Opportunities

Carr's Group is actively exploring expansion into new grazing-based markets, with a particular focus on the southern hemisphere. This strategic move aims to counter seasonal fluctuations in their core markets and unlock growth in regions with significant livestock populations. For instance, countries like Australia and New Zealand, with their extensive grazing industries, present substantial opportunities for Carr's Group's feed and ingredient products.

Carr's Group's strategic shift towards high-margin agriculture products, particularly research-based feed supplements, represents a significant opportunity. This focus allows the company to leverage its expertise and capitalize on growing demand for specialized animal nutrition solutions.

By optimizing its existing product portfolio and concentrating on profitable growth areas, Carr's aims to enhance its adjusted operating margin. For instance, in the fiscal year ending September 2023, the company reported a notable improvement in its adjusted operating profit, demonstrating the early success of its strategic realignment.

This sharpened focus positions Carr's Group to solidify its standing as a global specialist in its chosen segments. The company's commitment to innovation in feed technology is expected to drive further market penetration and revenue growth in the coming years, building on its established reputation.

Carr's Group's recent sale of its Engineering Division, which generated significant cash proceeds, presents a prime opportunity. This infusion of capital allows for strategic reinvestment directly into the agriculture division. For instance, the company could pursue targeted acquisitions to expand its market reach or invest in cutting-edge research and development to enhance its product offerings. This financial flexibility is key to accelerating growth and fostering innovation within its core agricultural business.

Operational Streamlining and Cost Reduction

Carr's Group's strategic move to consolidate into a single agriculture division is a key opportunity. This simplification is projected to unlock substantial annual cost savings, estimated at £4 million by FY25. These savings will directly enhance profitability and strengthen the company's financial standing.

Ongoing cost reduction initiatives, such as the rightsizing of central functions, further bolster this opportunity. By optimizing its operational structure, Carr's Group can improve its efficiency and competitiveness in the market.

- Simplified Group Structure: Consolidation into one agriculture division.

- Projected Annual Savings: £4 million by FY25 from structural changes.

- Cost Reduction Measures: Rightsizing of central functions contributing to efficiency.

Meeting Growing Demand for Sustainable Food Security

Carr's Group's commitment to enhancing pasture grazing productivity directly addresses the escalating global need for sustainable food security. This mission resonates strongly with a growing consumer and governmental focus on environmentally sound agricultural methods, creating a significant market opportunity.

The company is well-positioned to benefit from this trend. For instance, global demand for sustainable food is projected to grow substantially. Reports indicate the sustainable food market could reach over $1.5 trillion by 2027, demonstrating a clear upward trajectory that Carr's can leverage.

Carr's strategic focus allows it to tap into this expanding market by offering solutions that improve efficiency and sustainability in food production. This alignment with global priorities is a key strength.

- Market Alignment: Carr's mission directly aligns with the increasing global demand for sustainable food production and security.

- Growth Potential: The sustainable food market is experiencing robust growth, with projections indicating continued expansion in the coming years.

- Contribution to Global Needs: By focusing on pasture productivity, Carr's contributes to addressing a critical global challenge, enhancing its brand reputation and market appeal.

Carr's Group is strategically expanding into new grazing-based markets, particularly in the southern hemisphere, to offset seasonal demand dips in its existing markets. This move targets regions like Australia and New Zealand, which boast significant livestock populations and offer substantial growth potential for the company's feed and ingredient offerings.

The company's pivot towards high-margin, research-driven feed supplements is a key opportunity, capitalizing on the increasing demand for specialized animal nutrition solutions and leveraging its existing expertise. This focus is already showing positive results, as evidenced by improvements in adjusted operating profit in the fiscal year ending September 2023.

Carr's Group's recent divestment of its Engineering Division has generated significant capital, which can now be strategically reinvested into the agriculture sector. This financial flexibility allows for potential acquisitions or enhanced investment in research and development, thereby accelerating growth and innovation within its core business.

Consolidating into a single agriculture division is projected to yield substantial annual cost savings, estimated at £4 million by FY25, directly boosting profitability and strengthening the company's financial foundation. Further efficiencies are expected from rightsizing central functions, enhancing overall operational effectiveness.

Carr's commitment to improving pasture grazing productivity aligns perfectly with the growing global imperative for sustainable food security. This focus on environmentally sound agricultural practices positions the company to benefit from the expanding sustainable food market, which is anticipated to exceed $1.5 trillion by 2027.

| Opportunity Area | Description | Financial Impact/Projection |

|---|---|---|

| Geographic Expansion | Entering new grazing markets, especially in the southern hemisphere (e.g., Australia, New Zealand). | Counters seasonal demand, unlocks growth in livestock-rich regions. |

| Product Portfolio Shift | Focusing on high-margin, research-based feed supplements. | Leverages expertise, meets demand for specialized animal nutrition; improved adjusted operating profit noted in FY23. |

| Capital Reinvestment | Utilizing proceeds from Engineering Division sale for agriculture sector growth. | Enables strategic acquisitions and R&D investment to accelerate growth. |

| Operational Efficiency | Consolidation into a single agriculture division. | Projected £4 million annual cost savings by FY25; rightsizing central functions enhances efficiency. |

| Sustainable Food Market | Addressing global demand for sustainable food security through improved pasture productivity. | Aligns with growing market for sustainable food (projected >$1.5 trillion by 2027); enhances brand appeal. |

Threats

Carr's Group's profitability is closely tied to the unpredictable nature of agricultural markets. Fluctuations in commodity prices, such as grain and feed, directly affect input costs and the pricing power of their feed supplements. For instance, a significant drop in global wheat prices in late 2023 and early 2024 could pressure margins for feed producers.

Adverse weather events, like droughts or floods, can disrupt crop yields, leading to shortages and price spikes, which in turn impacts livestock production and the demand for feed. The health of livestock populations also plays a crucial role; disease outbreaks can rapidly reduce the need for feed supplements, impacting sales volumes for Carr's Group.

The animal nutrition and feed sector, a core area for Carr's Group, is characterized by intense competition. Established global players and agile regional businesses are constantly vying for market share, putting pressure on pricing and potentially squeezing profit margins.

In 2024, the global animal feed market was valued at approximately $270 billion, with significant growth expected. This vast market attracts numerous competitors, from multinational corporations to smaller, specialized producers, all seeking to capture a piece of the demand for animal nutrition solutions.

Carr's Group must navigate this crowded landscape, where innovation in product development and efficient supply chain management are crucial to maintaining a competitive edge and protecting its market position against both existing rivals and emerging entrants.

Broader macroeconomic challenges, including a potential global economic slowdown and persistent inflationary pressures, pose a significant threat to Carr's Group. These factors directly impact input costs for raw materials and energy, while also increasing operational expenses.

Rising interest rates, a consequence of inflationary pressures, could dampen farmer purchasing power, directly affecting demand for Carr's products and services. This economic climate creates uncertainty and could negatively impact the company's financial performance in the near to medium term.

Regulatory Changes and Environmental Concerns

Carr's Group faces potential headwinds from evolving agricultural regulations and environmental policies. For instance, shifts in European Union directives concerning sustainable farming practices or stricter rules on animal welfare and waste management could directly impact operational costs and supply chain requirements. In 2024, the UK government continued to refine its post-Brexit agricultural support schemes, with a growing emphasis on environmental stewardship, which may necessitate adjustments in how Carr's Group's feed and ingredients businesses operate or source materials.

Increased scrutiny over feed additives, particularly those with perceived environmental impacts or health concerns, presents another challenge. Regulatory bodies globally are re-evaluating the use of certain compounds, which could lead to bans or restrictions, forcing Carr's Group to reformulate products or invest in research and development for alternatives. This could affect their competitive edge in specific markets if compliance costs rise significantly.

- Regulatory shifts: Potential for increased compliance costs due to evolving environmental and agricultural regulations in key markets like the UK and EU.

- Feed additive scrutiny: Risk of restrictions or bans on certain feed additives, requiring product reformulation and R&D investment.

- Environmental policies: Growing pressure for sustainable livestock farming practices could impact sourcing and operational efficiency.

- Cost implications: Non-compliance or the need for significant investment in new technologies could negatively affect profit margins.

Integration Risks of Strategic Transformation

Carr's Group's strategic pivot to a pure-play agriculture business, while promising, introduces significant integration risks. Successfully merging new management structures and optimizing diverse agricultural operations are paramount. Failure here could derail the anticipated cost synergies and growth projections, impacting the company's financial trajectory.

The company must navigate the complexities of aligning disparate agricultural practices and supply chains. For instance, if the integration of acquired entities, such as the proposed acquisition of a significant feed producer in late 2024, doesn't achieve its projected 7% EBITDA margin enhancement by fiscal year 2025, it could create a drag on overall profitability.

- Integration Challenges: Difficulty in assimilating new management and operational frameworks from acquired agricultural businesses.

- Operational Optimization: Risks associated with streamlining diverse agricultural processes to achieve expected efficiencies.

- Financial Targets: Potential shortfalls in realizing anticipated cost savings and revenue growth post-transformation, impacting the 2025 financial outlook.

Carr's Group operates within a highly competitive animal nutrition and feed sector, where established global players and agile regional businesses constantly vie for market share. The global animal feed market was valued at approximately $270 billion in 2024, a vast arena attracting numerous competitors, from multinational corporations to smaller, specialized producers, all seeking to capture demand.

Broader macroeconomic challenges, including potential global economic slowdowns and persistent inflation, pose significant threats by increasing input costs for raw materials and energy, as well as operational expenses. Rising interest rates could also dampen farmer purchasing power, directly impacting demand for Carr's products and services.

Evolving agricultural regulations and environmental policies present further headwinds. For instance, shifts in EU directives concerning sustainable farming or stricter rules on animal welfare could impact operational costs and supply chain requirements. The UK's post-Brexit agricultural support schemes, with their increased focus on environmental stewardship, may also necessitate adjustments for Carr's Group.

Increased scrutiny over feed additives, particularly those with perceived environmental impacts or health concerns, presents another challenge. Regulatory bodies globally are re-evaluating certain compounds, which could lead to bans or restrictions, forcing Carr's Group to reformulate products or invest in R&D for alternatives, potentially affecting competitive edge if compliance costs rise significantly.

SWOT Analysis Data Sources

This Carr's Group SWOT analysis is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and expert industry commentary. These sources provide a well-rounded perspective on the company's internal capabilities and external environment, ensuring an accurate and actionable strategic assessment.