Carr's Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

Carr's Group navigates a landscape where buyer power can significantly impact pricing, while the threat of substitutes requires constant innovation. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Carr's Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Commodity price volatility significantly impacts Carr's Group's bargaining power of suppliers. Prices for key agricultural inputs like grains and proteins are subject to sharp swings driven by global supply and demand, weather patterns, and international events. For instance, in 2024, global wheat prices experienced considerable fluctuations, with reports indicating a potential 15-20% increase in some regions due to adverse weather impacting harvests. This makes it harder for Carr's Group to predict and control its raw material expenses.

This inherent unpredictability in agricultural commodity markets grants suppliers greater leverage. When prices surge, suppliers are in a stronger position to demand higher prices from buyers like Carr's Group, directly affecting the company's cost of goods sold and overall profitability. The need for effective risk management strategies, such as hedging or securing long-term supply agreements, becomes paramount to mitigate the financial impact of these volatile input costs.

For Carr's Group's nutritional supplements, the availability of specialized ingredients plays a crucial role in supplier bargaining power. If key trace elements, vitamins, or unique feed additives are sourced from a small number of highly specialized suppliers, these suppliers gain significant leverage. This can translate into more favorable pricing and supply terms for them.

Carr's reliance on proprietary ingredients or patented technologies controlled by a limited set of suppliers further amplifies their bargaining power. For instance, if a particular high-performance feed additive used in Carr's animal nutrition products is only available from one or two manufacturers globally, those manufacturers can dictate terms. This dependence limits Carr's ability to switch suppliers easily, strengthening the supplier's position.

Supplier concentration is a key factor in Carr's Group's bargaining power of suppliers. If a few dominant suppliers control essential raw materials or components, they can dictate terms and prices, limiting Carr's Group's ability to negotiate favorable conditions.

For instance, if Carr's Group relies heavily on a limited number of suppliers for specialized agricultural inputs, these suppliers hold significant leverage. In 2024, the global agricultural inputs market saw price volatility, with some key fertilizer components experiencing supply chain disruptions, demonstrating the impact of supplier concentration.

Switching Costs for Inputs

The cost and complexity associated with switching suppliers for essential ingredients significantly bolster the bargaining power of existing suppliers for Carr's Group. If Carr's Agriculture division faces substantial hurdles in changing suppliers, such as the need for extensive product re-formulation, rigorous re-testing, or potential disruptions to manufacturing and supply chains, the company's inclination to switch diminishes. This inertia grants current suppliers greater leverage in price negotiations and contract terms.

Consider the impact of specialized feed ingredients. If Carr's Agriculture relies on unique formulations or specific quality standards from a particular supplier that are not readily replicated, the switching costs become prohibitively high. This is particularly relevant in 2024, where supply chain resilience is paramount, and any disruption could have cascading effects on production schedules and customer commitments. For instance, a shift in a key vitamin premix supplier might necessitate months of trials to ensure animal health and performance remain consistent, a timeline Carr's might not afford.

- High Re-tooling Costs: Implementing new supplier materials can require significant investment in new machinery or modifications to existing equipment, directly increasing switching costs.

- Regulatory Compliance: Obtaining new certifications or ensuring new suppliers meet stringent industry regulations for animal feed can be a lengthy and expensive process.

- Product Performance Risk: The uncertainty of whether a new supplier's inputs will perform identically in finished feed products creates a risk premium, making suppliers with a proven track record more valuable.

Potential for Forward Integration by Suppliers

Suppliers with the capacity and ambition to move into Carr's Group's manufacturing space, like producing animal feed or supplements, gain significant leverage. This threat of forward integration means Carr's Group must carefully manage its relationships with these suppliers to prevent them from becoming direct competitors.

- Supplier Capability: A key supplier of a unique or essential agricultural ingredient might have the financial resources and operational expertise to establish its own feed manufacturing facilities.

- Strategic Intent: If a supplier identifies higher profit margins or market share opportunities in the downstream feed market, it could actively pursue forward integration.

- Competitive Threat: Carr's Group would likely seek to maintain favorable terms and strong partnerships to mitigate the risk of a critical supplier entering its market as a rival.

- Example Scenario: Imagine a large-scale grain producer that also supplies Carr's Group. If this producer invests in milling and feed formulation technology, it could directly challenge Carr's Group's existing customer base.

The bargaining power of suppliers for Carr's Group is significantly influenced by the concentration of key ingredient providers. When a few dominant suppliers control essential raw materials, such as specialized vitamins or unique feed additives, they can dictate terms and prices, limiting Carr's Group's ability to negotiate favorable conditions. This was evident in 2024, with reports of supply chain disruptions for certain fertilizer components, highlighting the leverage held by concentrated supplier bases.

High switching costs further empower Carr's Group's suppliers. If the company faces substantial hurdles in changing suppliers, including the need for extensive re-formulation, rigorous testing, or potential manufacturing disruptions, current suppliers gain leverage. For instance, switching a key vitamin premix supplier in 2024 might require months of trials to ensure consistent animal health and performance, a risk Carr's may be hesitant to take.

The threat of forward integration by suppliers also strengthens their bargaining position. If suppliers possess the capability and ambition to enter Carr's manufacturing space, such as producing animal feed or supplements, Carr's Group must manage these relationships carefully to avoid direct competition. A large grain producer supplying Carr's, for example, could invest in milling and feed formulation technology, directly challenging Carr's market position.

| Factor | Impact on Carr's Group | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Limited negotiation leverage for Carr's | Supply chain disruptions for key inputs |

| Switching Costs | Supplier inertia, higher prices | Time and cost of re-testing specialized ingredients |

| Forward Integration Threat | Potential for direct competition | Strategic intent of key ingredient providers |

What is included in the product

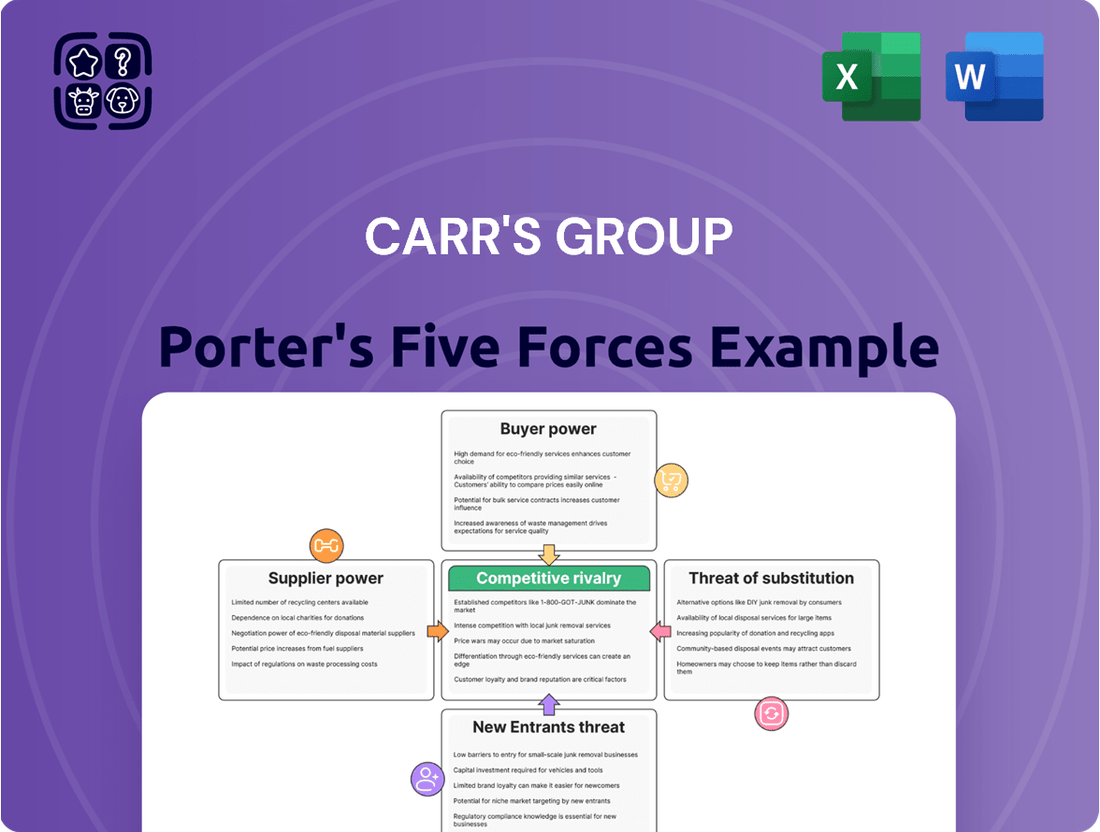

Carr's Group's Porter's Five Forces analysis reveals the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes, all within the context of its specific markets.

Easily identify and address competitive threats with a visual breakdown of industry power dynamics, allowing for targeted strategic adjustments.

Customers Bargaining Power

Carr's Group's Agriculture division primarily serves individual farmers. This typically means their customer base is fragmented, which generally weakens the bargaining power of any single customer. For instance, in 2024, the UK agriculture sector comprises tens of thousands of individual farms, making it difficult for any one farm to exert significant influence on pricing.

However, this dynamic can shift when larger entities like agricultural cooperatives, buying groups, or major distributors aggregate the demand of multiple farmers. These larger entities can then negotiate terms and prices more effectively for bulk purchases of animal feed and nutritional supplements, increasing their collective leverage with Carr's Group.

Farmers are acutely aware of their own profit margins, which are often squeezed by fluctuating commodity prices. This means they are very focused on the cost of inputs like feed and supplements. For Carr's Group, this translates into significant pressure to keep their prices competitive, as farmers will actively seek out cheaper alternatives if available.

The agricultural sector is inherently volatile, with weather patterns and global demand heavily influencing farm gate prices. In 2024, for instance, many farmers faced challenges with lower-than-expected prices for key commodities, intensifying their need to control expenditure. This heightened price sensitivity directly impacts Carr's Group's ability to set premium prices for its products.

Given the fragmented nature of many farming operations, individual farmers may have limited bargaining power, but collectively, their demand for cost-effective solutions is substantial. The ease with which farmers can switch between suppliers for essential agricultural inputs, such as feed, means Carr's Group must remain vigilant about its pricing strategies to retain market share.

Customers can readily access a variety of livestock nutrition options, from conventional feeds to improved grazing practices and supplements from competing suppliers. This abundance of alternatives means that if Carr's Group's pricing or product offerings become less attractive, customers can easily switch, significantly boosting their leverage.

Customer Knowledge and Information

Farmers, as customers of Carr's Group, are increasingly empowered by readily available market information. This includes detailed product performance data and comprehensive competitor analysis, allowing them to make more informed purchasing decisions. For instance, in 2024, agricultural technology platforms provided farmers with real-time data on crop yields and input costs, enabling direct comparison of different feed and fertilizer options.

This enhanced customer knowledge directly translates into increased bargaining power. Farmers can now easily compare Carr's Group's offerings against those of competitors, understanding the value proposition and identifying areas where pricing might be less competitive. This transparency puts downward pressure on prices and necessitates that Carr's Group maintains strong product differentiation to justify its pricing.

- Informed Decision-Making: Access to online agricultural forums and expert reviews in 2024 allowed farmers to share experiences and benchmark product effectiveness, reducing information asymmetry.

- Price Sensitivity: With greater visibility into market prices and input costs, farmers are more inclined to negotiate for better terms, impacting Carr's Group's profit margins.

- Demand for Value: Customers expect not just products but solutions, pushing Carr's Group to innovate and demonstrate superior value beyond basic commodity offerings.

Low Switching Costs for Customers

For many standard animal feed and supplement products, the cost or effort for a farmer to switch from one brand to another is relatively low. This low barrier to switching means customers can easily move to competitors offering better value, service, or prices, thereby enhancing their bargaining power and forcing Carr's Group to continuously demonstrate superior product benefits and service.

In 2024, the agricultural sector continued to see price sensitivity among farmers, influenced by fluctuating commodity prices and input costs. For instance, the cost of key ingredients like soya meal saw significant volatility throughout the year, prompting farmers to seek the most cost-effective feed solutions. This environment directly amplifies the bargaining power of customers when dealing with feed suppliers like Carr's Group.

- Low Switching Costs: Farmers can easily change feed suppliers with minimal disruption or expense.

- Price Sensitivity: Volatility in agricultural commodity prices in 2024 made cost a primary driver for purchasing decisions.

- Competitive Landscape: Numerous feed suppliers compete, offering farmers a wide array of choices and increasing their leverage.

- Focus on Value: Carr's Group must consistently highlight superior product benefits and service to retain customers in this price-sensitive market.

The bargaining power of customers for Carr's Group's agricultural division is generally moderate to high. While individual farmers are often fragmented, their collective purchasing power and intense price sensitivity, driven by volatile commodity markets in 2024, grant them significant leverage. The ease with which farmers can switch suppliers for essential inputs like feed, coupled with increased market transparency and access to competitor data, further amplifies their ability to negotiate favorable terms.

| Factor | Impact on Carr's Group | 2024 Context |

|---|---|---|

| Customer Fragmentation | Weakens individual power, but collective demand is strong. | Tens of thousands of UK farms, each with limited individual sway. |

| Price Sensitivity | High pressure on Carr's Group to remain competitive. | Farmers focused on controlling input costs due to fluctuating commodity prices. |

| Switching Costs | Low, allowing customers to easily shift suppliers. | Minimal disruption for farmers changing feed brands. |

| Information Availability | Empowers customers to make informed, value-driven decisions. | Agri-tech platforms provide real-time data for direct product comparison. |

Preview the Actual Deliverable

Carr's Group Porter's Five Forces Analysis

This preview shows the exact Carr's Group Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use, providing valuable strategic intelligence without any surprises.

Rivalry Among Competitors

The animal feed and supplement market is quite crowded, featuring a mix of big global players and many smaller, local companies. This sheer number of competitors, especially those with well-known brands or niche products, really heats up the competition for Carr's Group's agriculture business.

While companies like Case IH, AGCO, and John Deere operate in broader agricultural sectors, their significant presence underscores the intense competitive environment Carr's Group navigates. For instance, the global animal feed market size was valued at approximately USD 260 billion in 2023 and is projected to grow, indicating a dynamic and contested space.

The global demand for beef protein is anticipated to rise, yet Carr's Group has observed difficult trading conditions within the agriculture sector, especially in the United States. These challenges are expected to persist in the near future, thus tempering overall performance.

Slower or more challenging market growth typically intensifies competition among existing companies battling for a greater slice of a market that is either limited or experiencing stagnation. This often translates into aggressive pricing strategies and higher spending on marketing efforts.

Carr's Group actively differentiates itself through its focus on research-proven, value-added livestock supplements, notably with its market-leading brands like Crystalyx, Horslyx, and Animax. This product differentiation, backed by scientific evidence, fosters strong brand loyalty, allowing Carr's to maintain premium pricing power and customer retention.

However, even with strong branding, commoditized segments within the animal nutrition market will still experience intense price-based competition. For instance, while premium supplements command higher margins, basic feed additives might face significant pressure from competitors offering lower-cost alternatives, impacting overall profitability in those specific product lines.

High Fixed Costs and Capacity Utilization

The animal feed and supplements sector, including operations like Carr's Group, is characterized by significant fixed costs. These are tied to large-scale production facilities, specialized machinery, and extensive distribution networks. For instance, setting up a modern feed mill can involve investments in the tens of millions of pounds.

To recoup these substantial investments and achieve profitability, companies must strive for high capacity utilization. This means running their plants as close to full capacity as possible. For Carr's Group, operating its feed mills efficiently is crucial for managing its cost base.

This drive for utilization often intensifies competition. When the market experiences overcapacity, companies may resort to aggressive pricing to ensure their fixed costs are covered. This can put pressure on profit margins across the industry.

- High Fixed Costs: Significant capital investment is required for feed production facilities and distribution.

- Capacity Utilization Drive: Companies aim for high operating levels to spread fixed costs and improve profitability.

- Pricing Pressure: Overcapacity can lead to price wars as firms try to cover their overheads.

Exit Barriers

Carr's Group likely faces significant competitive rivalry due to high exit barriers within its operating sectors. These barriers, such as specialized machinery and long-term contracts, can trap even underperforming companies in the market. This persistence of struggling competitors often leads to prolonged overcapacity and intense price competition, hindering Carr's Group's ability to achieve better margins or expand its market share.

For instance, in the engineering sector, the need for highly specialized manufacturing assets, which are difficult to redeploy or sell, acts as a substantial exit barrier. In 2024, many industrial companies reported that the cost of decommissioning specialized production lines could run into millions of pounds, making closure a financially prohibitive option. This situation forces companies to continue operating, even at reduced profitability, thereby intensifying the competitive landscape for established players like Carr's Group.

- Specialized Assets: High capital investment in unique machinery creates a significant financial disincentive to exit.

- Contractual Commitments: Long-term agreements with suppliers and distributors can bind companies to operations even when unprofitable.

- Severance Costs: Substantial employee severance packages can add considerable expense to exiting the market.

- Market Persistence: These barriers compel less successful competitors to remain active, perpetuating overcapacity and price wars.

Carr's Group faces intense competition from a broad range of players, from global giants to smaller local firms, particularly in the animal feed sector. The market's substantial size, estimated at around USD 260 billion in 2023, attracts numerous competitors, many of whom employ aggressive pricing strategies to capture market share, especially in commoditized segments.

High fixed costs associated with production facilities necessitate a strong focus on capacity utilization. This drive can lead to price wars when overcapacity arises, as companies strive to cover their overheads, squeezing profit margins across the industry.

Significant exit barriers, such as specialized machinery and contractual obligations, force less profitable companies to remain operational. This persistence exacerbates overcapacity and intensifies price-based competition, making it challenging for Carr's Group to improve profitability or expand its market presence effectively.

SSubstitutes Threaten

Farmers are increasingly adopting sophisticated forage and grazing management techniques. These methods allow them to extract more nutritional value directly from pastures, thereby lessening their dependence on commercially produced feed supplements. For instance, in 2024, advancements in precision grazing, utilizing data analytics to optimize pasture rotation, have shown potential to reduce feed costs by up to 15% for some operations.

These enhanced natural feed sources act as a viable substitute for specific livestock nutrition products offered by companies like Carr's Group. The growing trend towards sustainable agriculture and cost-efficiency in farming practices further bolsters the appeal of these alternative management strategies.

Larger agricultural operations and cooperatives might bypass pre-mixed feed supplements by directly sourcing raw ingredients like grains and protein meals. They can then create custom feeds on-farm, effectively substituting Carr's Group's manufactured products. This direct sourcing and on-farm mixing capability offers a cost-effective alternative for these larger entities.

Beyond Carr's Group's specialized feed blocks and boluses, farmers can utilize a broad spectrum of concentrated livestock feeds like grains, silage, and compound feeds. These alternatives, while not always direct substitutes in application, satisfy fundamental animal nutritional needs. For instance, in 2024, global grain prices saw fluctuations, impacting the cost-effectiveness of these broader feed options compared to specialized supplements.

Technological Advancements in Animal Husbandry

Technological advancements in animal husbandry present a significant threat of substitutes for Carr's Group. Emerging technologies in animal health, such as advanced diagnostics and preventative treatments, can reduce the overall reliance on nutritional supplements. For instance, genetic improvements in livestock, aiming to enhance feed conversion efficiency, directly lessen the quantity of feed and supplements needed per animal. Precision feeding systems, which optimize nutrient delivery based on individual animal needs, also contribute by reducing waste and the overall demand for supplementary products. These innovations act as indirect substitutes, diminishing the need for Carr's Group's existing offerings and shifting industry focus towards more efficient resource utilization.

The impact of these substitutes is underscored by the rapid pace of innovation in the agricultural technology sector. For example, the global precision farming market was valued at approximately USD 5.6 billion in 2023 and is projected to grow significantly, indicating a strong trend towards technologically driven efficiency in animal agriculture. This growth suggests that technologies capable of reducing supplement requirements will become increasingly prevalent.

- Genetic Improvements: Livestock breeds with inherently better feed conversion ratios reduce the need for supplemental feed additives.

- Precision Feeding: Technologies that deliver exact nutrient amounts minimize over-supplementation and waste.

- Animal Health Innovations: Improved disease prevention and management can lead to healthier animals requiring fewer supportive supplements.

- Data Analytics: Advanced data analysis in farming allows for more targeted and efficient use of all inputs, including supplements.

Shifts in Consumer Dietary Preferences

Shifts in consumer dietary preferences, such as the growing adoption of veganism and flexitarianism, represent a significant threat of substitutes for traditional animal agriculture. This trend, observed globally, can indirectly impact the demand for livestock feed and supplements, a core market for Carr's Group. For instance, in 2024, the plant-based food market continued its robust growth, with projections indicating further expansion in the coming years. A substantial decline in the livestock sector due to these dietary changes could shrink the addressable market for Carr's agricultural offerings.

The increasing consumer focus on health, sustainability, and ethical considerations is driving this dietary evolution. This translates to a reduced reliance on animal products, which in turn affects the entire supply chain. While not a direct product substitute for animal feed, a widespread reduction in livestock numbers would diminish the overall need for the inputs Carr's Group provides.

- Growing Vegan and Flexitarian Markets: The global plant-based food market was valued at over $30 billion in 2023 and is projected to reach over $70 billion by 2030, indicating a significant shift away from animal products.

- Impact on Livestock Numbers: A sustained decrease in demand for meat and dairy could lead to a contraction in the global livestock population, directly affecting the volume of feed and supplements required.

- Indirect Market Reduction: While Carr's Group does not directly sell meat, a smaller livestock industry means a smaller overall market for agricultural inputs, including their feed and supplement products.

The threat of substitutes for Carr's Group's products is multifaceted, stemming from advancements in farming techniques, alternative feed sources, and evolving consumer diets. Farmers are increasingly adopting precision grazing and on-farm feed mixing, reducing reliance on commercial supplements. For instance, precision grazing techniques in 2024 showed potential to cut feed costs by up to 15% for some farms.

Technological innovations in animal husbandry, such as genetic improvements for feed efficiency and precision feeding systems, also act as substitutes by minimizing the need for supplementary products. The global precision farming market, valued at approximately USD 5.6 billion in 2023, highlights this trend towards technologically driven efficiency.

Furthermore, shifts in consumer preferences towards plant-based diets indirectly impact Carr's Group by potentially reducing livestock populations. The plant-based food market, exceeding $30 billion in 2023, signals a growing move away from animal products, which could contract the overall market for agricultural inputs.

| Substitute Category | Example | Impact on Carr's Group | 2024/2023 Data Point |

|---|---|---|---|

| Farming Techniques | Precision Grazing | Reduces need for commercial feed supplements | Potential 15% feed cost reduction |

| Alternative Feed Sources | On-farm mixing of raw ingredients | Bypasses manufactured feeds | Cost-effective for large operations |

| Technological Advancements | Precision Feeding Systems | Minimizes waste and demand for supplements | Precision farming market valued at USD 5.6 billion (2023) |

| Consumer Dietary Shifts | Veganism/Flexitarianism | Indirectly reduces livestock population and feed demand | Plant-based food market over $30 billion (2023) |

Entrants Threaten

The animal feed and nutritional supplements market demands significant upfront investment. Building state-of-the-art production facilities, funding crucial research and development for innovative formulations, and establishing widespread distribution channels all require substantial capital. For instance, a new entrant might need to invest hundreds of millions of dollars to achieve a comparable scale to established players.

Existing companies, including Carr's Group, already enjoy considerable economies of scale. This means they can produce goods more cheaply per unit due to their large-scale operations, bulk purchasing power, and optimized logistics. These cost advantages create a formidable barrier, making it challenging for newcomers to compete on price and achieve profitability without matching this scale, which is a capital-intensive undertaking.

The animal feed and supplement industry is heavily regulated globally, with strict rules on product safety, ingredient sourcing, and manufacturing. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to enforce its Food Safety Modernization Act (FSMA) for animal food, requiring preventive controls and hazard analysis for manufacturers.

New companies entering this sector must invest significantly in understanding and complying with these varied international regulations, securing certifications, and maintaining ongoing adherence. This compliance burden, including detailed record-keeping and quality assurance protocols, represents a substantial barrier, deterring many potential new entrants due to the associated costs and complexities.

Carr's Group benefits from well-established brands like Crystalyx, Horslyx, and Animax, which have built significant customer loyalty among farmers. This strong brand equity makes it difficult for new entrants to capture market share, as replicating this level of trust and recognition requires substantial, long-term investment in marketing and consistent product quality.

Access to Distribution Channels

New entrants face a significant hurdle in accessing established distribution channels within the agricultural sector. These networks, whether direct to farmers or through intermediaries like merchants, cooperatives, and veterinarians, are often built on years of trust and reciprocal agreements.

For instance, Carr's Group benefits from its long-standing relationships, which can make it difficult for newcomers to secure shelf space or preferred supplier status. In 2024, the agricultural distribution landscape continues to be dominated by established players, with many channels operating on exclusivity or volume-based rebates that new entrants find hard to match.

- Limited Access: Newcomers struggle to penetrate existing distribution networks due to established relationships and preferred supplier agreements.

- Channel Control: Dominant players often control key distribution points, making it challenging for new entrants to reach customers effectively.

- Cost Barriers: Building new distribution channels or gaining access to existing ones can incur substantial costs, deterring new market participants.

Proprietary Technology and Research & Development

Carr's Group's focus on proprietary technology and extensive research and development significantly raises the barrier for new entrants. Their commitment to research-proven livestock supplements and unique formulations means newcomers must invest heavily in R&D to achieve similar product efficacy and differentiation. For instance, in 2024, companies with strong IP portfolios often command premium valuations, reflecting the cost and time required to build such competitive advantages.

Developing advanced manufacturing processes or acquiring specialized knowledge also acts as a deterrent. New companies would face substantial capital expenditure and a steep learning curve to match Carr's Group's operational expertise. This technological moat makes it difficult for less-resourced entrants to offer comparable value propositions, thereby limiting the threat of new competition.

- Proprietary Formulations: Carr's Group's unique product recipes are a key differentiator.

- R&D Investment: Significant capital is required to develop comparable intellectual property.

- Manufacturing Expertise: Advanced production processes are difficult for new entrants to replicate.

- Licensing Costs: Newcomers may face high fees if they choose to license existing technologies.

The threat of new entrants for Carr's Group is moderate, primarily due to high capital requirements for establishing manufacturing facilities and securing necessary regulatory approvals. Companies like Carr's Group benefit from established economies of scale, making it difficult for newcomers to compete on price without significant investment in matching operational capacity and distribution networks.

Regulatory compliance, particularly concerning animal feed safety and ingredient sourcing, presents a substantial barrier, demanding considerable investment in quality assurance and adherence to evolving global standards as seen with the continued enforcement of FSMA in 2024. Furthermore, strong brand loyalty built over years, such as with Carr's Group's Crystalyx and Horslyx brands, requires extensive marketing and consistent product quality to overcome, posing a significant challenge for new market participants seeking to gain customer trust and market share.

Accessing established agricultural distribution channels, often secured through long-term relationships and volume-based agreements, remains a key hurdle for potential new entrants in 2024. Carr's Group's proprietary formulations and ongoing R&D investment create a technological moat, necessitating significant upfront investment in research and development for any new company aiming to offer comparable product efficacy and differentiation.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Carr's Group leverages a comprehensive suite of data, including their annual reports, investor presentations, and market research from firms like Mintel and Euromonitor. This ensures a robust understanding of industry dynamics and competitive positioning.