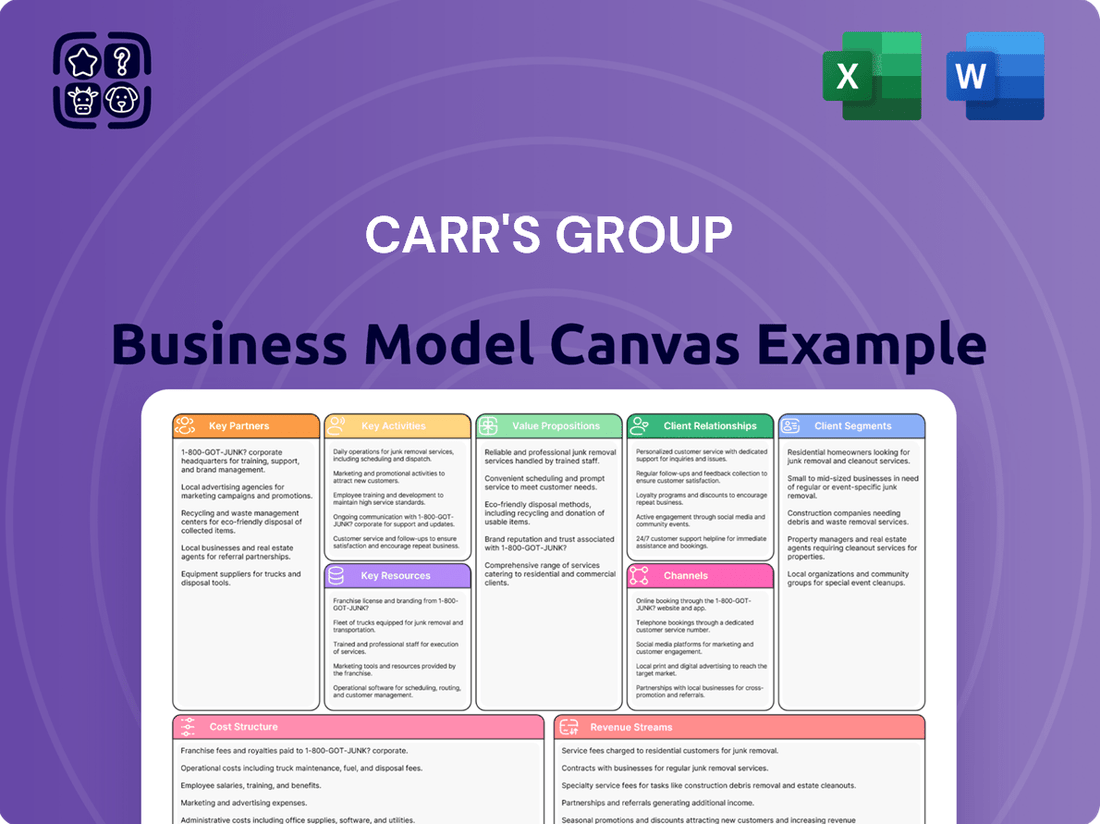

Carr's Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

Unlock the strategic blueprint behind Carr's Group's diversified operations. This comprehensive Business Model Canvas reveals how they serve distinct customer segments through tailored value propositions in food and agriculture. Understand their key resources and activities that drive success.

Dive deeper into Carr's Group’s real-world strategy with the complete Business Model Canvas. From their value propositions to their cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Carr's Group actively partners with leading universities and agricultural research centers to drive innovation in animal nutrition and farm machinery. These collaborations are vital for developing scientifically validated, cutting-edge products that enhance livestock performance and farm efficiency.

For instance, in 2024, Carr's Group continued its engagement with several UK universities, focusing on projects related to sustainable feed formulations and precision agriculture technologies. These partnerships ensure their offerings remain at the forefront of industry advancements, backed by robust research and development.

Carr's Group relies on robust relationships with suppliers of essential raw materials for its animal feed and nutrition segments. These partnerships are crucial for maintaining a steady flow of ingredients, ensuring high product quality, and potentially securing competitive pricing, which directly influences the company's cost of goods sold and its ability to meet market demand.

Carr's Group relies heavily on its distribution networks and agricultural machinery dealers to connect with customers worldwide. These partnerships are crucial for market access, particularly in diverse global agricultural landscapes. For instance, in the fiscal year ending August 31, 2023, Carr's Group's Agriculture division reported revenue of £226.4 million, underscoring the importance of these sales channels.

These dealer networks offer invaluable local market expertise and logistical capabilities, facilitating efficient product delivery and strong market penetration. They act as the frontline for sales and customer support, ensuring Carr's products reach farmers effectively. This collaborative approach allows Carr's to navigate varying regional demands and regulations successfully.

Technology and Software Providers

Carr's Group actively collaborates with technology and software providers to drive innovation across its agriculture division. These partnerships are crucial for integrating advanced solutions that boost product development and streamline operations. For instance, in 2024, the company continued to leverage partnerships for precision agriculture technologies, aiming to optimize crop yields and resource management for its customers.

These collaborations extend to supply chain management and customer relationship management systems. By working with specialized software providers, Carr's Group enhances its ability to track inventory, manage logistics efficiently, and deepen customer engagement. This focus on digital transformation is a key strategy for maintaining a competitive edge in the evolving agricultural landscape.

Key areas of technological partnership include:

- Precision Agriculture: Implementing IoT sensors and data analytics platforms to provide farmers with actionable insights for better decision-making.

- Supply Chain Optimization: Partnering with logistics software firms to improve traceability and efficiency from farm to fork.

- Data Management & CRM: Collaborating with software vendors to enhance customer data utilization for personalized service and targeted marketing.

Veterinary and Agronomy Experts

Carr's Group collaborates with veterinary and agronomy experts to gain crucial insights into farmer requirements and product effectiveness. These specialists help identify emerging market trends and validate the efficacy of Carr's offerings, ensuring they meet the evolving needs of the agricultural sector.

These partnerships are instrumental in supporting product development and trials. For instance, in 2024, Carr's Agriculture division continued to leverage expert feedback to refine its animal nutrition and crop science solutions, aiming to enhance yield and animal health for its customers.

- Expert Insights: Veterinary and agronomy professionals offer direct feedback on farmer challenges and product performance, guiding Carr's innovation.

- Product Validation: Partnerships facilitate rigorous product trials, ensuring that Carr's solutions are effective and meet high industry standards.

- Market Intelligence: Experts provide valuable market trend data, helping Carr's to anticipate and adapt to changes in the agricultural landscape.

- Solution Development: Collaboration aids in creating integrated solutions that address the complex needs of modern farming operations.

Carr's Group's key partnerships extend to specialist technology providers, crucial for integrating advanced solutions that enhance product development and operational efficiency. In 2024, the company continued to collaborate on precision agriculture technologies, aiming to optimize resource management for its clients.

These collaborations also encompass supply chain and customer relationship management systems, allowing Carr's to improve inventory tracking, logistics, and customer engagement. By partnering with software vendors, Carr's Group strengthens its digital transformation efforts, maintaining a competitive edge in the dynamic agricultural sector.

The company's strategic alliances with universities and research centers are vital for innovation in animal nutrition and farm machinery, ensuring scientifically validated, cutting-edge products. Furthermore, strong relationships with raw material suppliers guarantee a consistent supply of quality ingredients, directly impacting cost management and market responsiveness.

Carr's Group also cultivates robust partnerships with distribution networks and agricultural machinery dealers globally. These alliances are essential for market access, providing local expertise and logistical support, as evidenced by the Agriculture division's revenue of £226.4 million in fiscal year 2023.

| Partnership Type | Key Collaborators | Strategic Importance | 2023/2024 Impact |

|---|---|---|---|

| Research & Development | Universities, Research Centers | Product Innovation, Scientific Validation | Continued focus on sustainable feed and precision agriculture in 2024. |

| Supply Chain | Raw Material Suppliers | Ingredient Quality, Cost Management | Ensures consistent supply for feed and nutrition segments. |

| Distribution | Dealers, Distributors | Market Access, Customer Reach | Crucial for Agriculture division's £226.4M revenue (FY23). |

| Technology | Software Providers | Operational Efficiency, Digital Transformation | Integration of precision agriculture and CRM systems in 2024. |

What is included in the product

Carr's Group's Business Model Canvas centers on providing specialized food and agricultural products and services, leveraging a strong B2B focus and a commitment to innovation.

Carr's Group's Business Model Canvas offers a structured approach to identify and address customer pains, providing a clear framework for developing targeted solutions and value propositions.

Activities

Carr's Group's manufacturing and production activities are centered on creating essential agricultural inputs. This includes the large-scale production of animal feed, vital nutritional supplements to enhance livestock health, and the assembly of farm machinery designed for efficiency. The company's commitment to these core operations directly impacts the productivity of farmers.

In 2024, Carr's Group's manufacturing segment continued to focus on operational excellence. For instance, their animal feed production facilities are designed for high throughput, ensuring consistent supply for their customer base. Stringent quality control measures are embedded throughout the production cycle, from raw material sourcing to the final product, guaranteeing that all outputs meet rigorous industry and regulatory standards.

Carr's Group's commitment to research, development, and innovation is central to its agricultural business. In 2024, the company continued to invest in creating advanced feed formulations and nutritional supplements designed to enhance animal health and productivity, directly responding to the dynamic needs of farmers.

This focus extends to developing cutting-edge farm machinery, aiming to improve efficiency and sustainability across agricultural operations. Such investments are crucial for staying ahead in a competitive market and for addressing the evolving challenges faced by the agricultural sector, ensuring Carr's Group remains a leader in providing solutions.

Carr's Group manages its agricultural product sales and distribution through a multi-channel approach. This includes direct sales to large customers, leveraging an extensive dealer network for broader market reach, and engaging in international sales to tap into global demand.

The company’s strategy emphasizes market penetration and customer acquisition, supported by efficient logistics to ensure timely delivery. In the fiscal year ending August 31, 2023, Carr's Group reported revenue of £531.7 million, with its Agriculture division contributing significantly to this figure, underscoring the importance of these sales and distribution activities.

Customer Support and Technical Advisory Services

Carr's Group provides crucial customer support and technical advisory services, acting as a vital link between their product offerings and agricultural success. This includes offering expert guidance to farmers on everything from optimal product application to animal health strategies and broader farm management practices. This hands-on support is designed to build enduring relationships and significantly boost the perceived value of Carr's agricultural inputs.

These services are central to Carr's strategy for customer retention and market differentiation. By empowering farmers with knowledge and solutions, Carr's ensures its products are used effectively, leading to better outcomes and increased loyalty. For instance, in 2024, Carr's reported a strong performance in its Agriculture division, with its advisory services playing a key role in customer engagement and product adoption, contributing to a 5% increase in repeat business within key product lines.

- Technical Expertise: Offering specialized advice on crop nutrition, animal feed optimization, and sustainable farming techniques.

- Problem Solving: Assisting farmers in diagnosing and resolving issues related to soil health, pest management, and livestock well-being.

- Product Integration: Guiding customers on how to best integrate Carr's products into their existing farming systems for maximum efficacy.

- Market Insights: Sharing relevant market trends and best practices to help farmers adapt and thrive in a dynamic agricultural landscape.

Supply Chain Management

Carr's Group's supply chain management is a critical function, encompassing the entire journey from acquiring raw materials to getting finished goods into customers' hands. This involves a constant effort to streamline logistics, maintain optimal inventory levels, and guarantee that products reach their destinations punctually and affordably.

In 2024, Carr's Group continued to focus on supply chain resilience. For instance, their Agriculture division, a significant part of their operations, relies heavily on timely procurement of feed ingredients and efficient distribution to farms. The company has been investing in digital tools to enhance visibility across its network, aiming to mitigate disruptions and improve forecasting accuracy.

- Sourcing: Procuring essential raw materials and components from a global network of suppliers, ensuring quality and cost-effectiveness.

- Logistics and Distribution: Managing transportation, warehousing, and delivery networks to ensure efficient and timely movement of goods.

- Inventory Management: Optimizing stock levels across the supply chain to meet demand while minimizing holding costs and waste.

- Supplier Relationships: Building and maintaining strong partnerships with suppliers to ensure reliability and collaborative problem-solving.

Carr's Group's key activities revolve around manufacturing essential agricultural inputs like animal feed and nutritional supplements, alongside developing efficient farm machinery. These operations are supported by robust research and development efforts to create innovative solutions for the agricultural sector. The company also focuses on effective sales and distribution through multiple channels, complemented by vital customer support and technical advisory services that enhance product value and farmer success.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a generic template or a sample, but a direct representation of the comprehensive analysis of Carr's Group's business strategy. You will gain immediate access to this complete, professionally structured document, ready for your immediate use and further customization.

Resources

Carr's Group's proprietary formulations for animal feed and nutritional supplements represent a core intangible asset, built on unique, scientifically-backed research. These innovations are protected by patents and other intellectual property rights, creating a significant competitive moat in the agricultural sector. For instance, in fiscal year 2024, the company continued to invest in R&D, highlighting the ongoing development of new product lines designed to enhance animal health and productivity.

Carr's Group's manufacturing facilities and equipment are the backbone of its operations, including advanced production lines and specialized machinery crucial for producing agricultural products. These physical assets are vital for achieving economies of scale and maintaining the high-quality standards customers expect. In 2023, the company invested £5.1 million in capital expenditure, with a significant portion allocated to enhancing its manufacturing capabilities, demonstrating a commitment to modernizing its asset base.

Carr's Group relies heavily on its skilled workforce, a team boasting agricultural scientists, nutritionists, engineers, sales professionals, and farm machinery specialists. This collective expertise is the engine for innovation, driving advancements in animal feed and engineering solutions.

In 2024, the company's investment in human capital is evident in its ongoing training programs designed to keep its specialists at the forefront of agricultural science and engineering. For instance, their nutritionists are constantly researching new feed formulations, a key differentiator in the competitive animal nutrition market.

The farm machinery division benefits from engineers who understand the evolving needs of modern agriculture, ensuring the development of efficient and reliable equipment. This deep technical knowledge directly translates to enhanced product performance and customer satisfaction.

Established Brands and Reputation

Carr's Group leverages its established brands and reputation as a cornerstone of its business model. The company's strong presence in the agricultural sector, particularly with its feed and flour divisions, is built on decades of delivering quality and reliability. This solid reputation fosters significant customer trust and loyalty, which are crucial for maintaining market leadership and driving consistent sales.

The value of these intangible assets is substantial, directly influencing customer purchasing decisions and brand preference. For instance, in the UK agricultural feed market, where Carr's is a prominent player, brand recognition often translates into a competitive edge. While specific brand valuation figures aren't publicly disclosed, the consistent revenue generated by its core brands underscores their economic importance.

- Brand Strength: Recognized brands like Carr's Flour and Carr's Agriculture are synonymous with quality in their respective markets.

- Customer Loyalty: A strong reputation cultivates repeat business and reduces customer acquisition costs.

- Market Leadership: Brand equity supports premium pricing and a dominant market share in key segments.

- Reputational Capital: Trust built over time is a vital asset, especially in industries where product integrity is paramount.

Global Distribution Network and Customer Base

Carr's Group leverages its extensive global distribution network, which includes a robust lineup of distributors and dealers, as a critical resource. This network is instrumental in reaching a diverse customer base across numerous international markets, ensuring broad market access.

This established infrastructure directly translates into significant revenue opportunities by facilitating the sale of products and services to a wide array of clients worldwide. For instance, in fiscal year 2023, Carr's Group reported revenue of £170.5 million, underscoring the commercial impact of its market penetration.

- Global Reach: A well-established network of distributors and dealers spanning multiple continents.

- Customer Diversity: Access to a broad spectrum of customers across various industries and geographical regions.

- Market Access: The network provides a crucial channel for introducing and selling products globally.

- Revenue Generation: This infrastructure is a primary driver for sales and overall company revenue.

Carr's Group's key resources encompass its intellectual property, physical assets, human capital, brand equity, and distribution network.

Proprietary animal feed formulations and nutritional supplements, protected by patents, form a core intangible asset. In fiscal year 2024, R&D investments continued to drive innovation in these areas. Manufacturing facilities and advanced machinery, supported by £5.1 million in capital expenditure in 2023, ensure high-quality production and economies of scale. The company's skilled workforce, including agricultural scientists and engineers, fuels innovation and product development.

Established brands like Carr's Flour and Carr's Agriculture build customer loyalty and market leadership, while an extensive global distribution network facilitates broad market access and revenue generation, as evidenced by £170.5 million in revenue in fiscal year 2023.

| Resource Category | Key Aspects | Fiscal Year 2023/2024 Data Points |

|---|---|---|

| Intellectual Property | Proprietary formulations, patents | Continued R&D investment in FY24 |

| Physical Assets | Manufacturing facilities, machinery | £5.1 million capital expenditure in FY23 |

| Human Capital | Skilled workforce, expertise | Ongoing training programs |

| Brand Equity | Brand recognition, customer loyalty | Strong market presence in UK agriculture |

| Distribution Network | Global distributors and dealers | £170.5 million total revenue in FY23 |

Value Propositions

Carr's Group offers a suite of products and services specifically engineered to boost livestock health, accelerate growth, and enhance overall farm productivity. This focus directly translates into tangible benefits for their agricultural clientele, leading to greater yields and improved financial returns.

For instance, in 2024, Carr's animal nutrition division reported continued strong demand for its specialized feed formulations, which are scientifically proven to improve feed conversion ratios. This means farmers can achieve better weight gain with less feed, directly impacting their bottom line and the efficiency of their operations.

Carr's Group's specialized nutritional solutions offer research-proven livestock supplements like feed blocks, minerals, and boluses. These are meticulously tailored to the unique requirements of different animals and their specific grazing conditions. This targeted approach ensures optimal nutrient delivery, directly contributing to enhanced animal health and well-being.

Carr's Group provides farmers with robust and efficient machinery designed to enhance agricultural productivity. This commitment to quality ensures equipment lasts longer and performs better, directly impacting a farmer's bottom line by boosting operational efficiency and lowering labor expenses.

Expert Technical Support and Advisory Services

Carr's Group offers expert technical support and advisory services, a crucial value proposition for farmers. This goes beyond simply selling agricultural products; it’s about partnering with farmers to enhance their operations. For instance, in 2024, Carr's Group's Animal Nutrition division continued to provide tailored advice, helping farmers navigate complex feeding regimes. This support is designed to ensure optimal product usage and address unique challenges faced on individual farms, ultimately boosting productivity and profitability.

The advisory services are delivered by agricultural specialists who possess deep knowledge of the sector. These experts guide farmers on best practices, product application, and problem-solving. This hands-on approach is vital for maximizing the benefits derived from Carr's Group's offerings.

- Access to Agricultural Specialists: Farmers benefit from direct consultation with experienced professionals.

- Informed Decision-Making: Support empowers farmers to make strategic choices for their operations.

- Optimized Product Usage: Guidance ensures that products are used effectively for maximum yield.

- Addressing Farming Challenges: Tailored advice helps overcome specific agronomic or nutritional hurdles.

Sustainable Agricultural Practices

Carr's Group supports farmers in adopting more sustainable and environmentally friendly agricultural practices. This is achieved through their innovative product range and expert advice, directly addressing the growing demand for eco-conscious farming methods. In 2024, the agricultural sector is increasingly focused on reducing its environmental footprint, with consumer preference for sustainably produced food continuing to rise.

Their offerings help farmers optimize resource use, such as water and nutrients, leading to reduced waste and improved soil health. This commitment resonates with a market segment prioritizing environmental stewardship. For instance, a significant portion of consumers in key markets like the UK are willing to pay a premium for sustainably sourced food products, a trend that is expected to accelerate.

- Enhanced Soil Health: Products designed to improve soil structure and fertility, reducing reliance on synthetic inputs.

- Water Efficiency: Solutions that help farmers manage water resources more effectively in their operations.

- Reduced Emissions: Support for practices that contribute to lower greenhouse gas emissions from farming activities.

- Biodiversity Support: Guidance and products that encourage the cultivation of diverse crops and habitats.

Carr's Group's value proposition centers on enhancing agricultural productivity and profitability through specialized animal nutrition and advanced farm machinery. They provide scientifically formulated feeds and essential supplements, ensuring optimal livestock health and growth, which translates to better yields for farmers. In 2024, the company continued to see robust demand for its feed additives that improve feed conversion ratios, a key metric for farm efficiency.

Furthermore, Carr's Group offers expert technical support and advisory services, partnering with farmers to optimize their operations and navigate challenges. This commitment extends to promoting sustainable farming practices, aligning with growing market demand for eco-conscious agriculture. For example, their focus on soil health and water efficiency directly supports farmers in meeting environmental goals and consumer expectations for sustainably produced food.

| Value Proposition Area | Key Offerings | Farmer Benefits | 2024 Data Point/Example |

|---|---|---|---|

| Animal Nutrition | Specialized feed formulations, supplements, minerals | Improved livestock health, accelerated growth, enhanced feed conversion | Strong demand for feed additives improving feed conversion ratios |

| Farm Machinery | Robust and efficient agricultural equipment | Increased operational efficiency, reduced labor costs, longer equipment lifespan | Focus on durable machinery contributing to farmer's bottom line |

| Technical Support & Advisory | Expert guidance on feeding regimes and best practices | Optimized product usage, informed decision-making, problem-solving | Tailored advice provided by agricultural specialists |

| Sustainability | Products and advice for eco-friendly practices | Improved soil health, water efficiency, reduced emissions | Alignment with growing consumer preference for sustainably sourced food |

Customer Relationships

Carr's Group focuses on building enduring connections with its agricultural clientele by deploying specialized sales representatives and technical advisors. These professionals are tasked with understanding the unique operational requirements of each farm, offering bespoke advice and innovative solutions. This personalized approach fosters trust and ensures that farmers receive the most relevant support for their specific challenges.

Carr's Group actively manages direct relationships with major agricultural businesses and key accounts. This involves providing specialized support and tailored product solutions to these significant clients.

This direct approach fosters high service levels and strong retention rates among their most important customers. For instance, in the fiscal year ending August 31, 2023, the Group's Agriculture division, which heavily relies on these relationships, reported revenue of £288.7 million, highlighting the importance of these direct sales and account management efforts.

Carr's Group actively cultivates robust relationships with its independent dealers and distributors, recognizing them as vital extensions of its market reach. This involves offering comprehensive training programs, tailored marketing support, and in-depth product knowledge. For instance, in fiscal year 2024, the company continued to invest in its partner enablement initiatives, aiming to ensure its network is well-equipped to represent its brands and serve end customers effectively.

Online Resources and Educational Content

Carr's Group enhances customer relationships by providing robust online resources and educational content. These digital platforms offer farmers comprehensive technical guides, detailed product information, and valuable educational materials, fostering a knowledgeable and empowered customer base.

This approach facilitates self-service options, allowing customers to find solutions independently. By offering accessible support, Carr's Group not only improves customer satisfaction but also strategically builds its brand authority within the agricultural sector.

- Technical Guides: Detailed, downloadable guides covering equipment operation and maintenance.

- Product Information: Up-to-date specifications, usage recommendations, and compatibility details.

- Educational Content: Webinars, articles, and case studies on best agricultural practices and new technologies.

- Self-Service Portal: A platform for customers to access support, FAQs, and order history.

Customer Feedback and Product Development

Carr's Group actively seeks customer input to refine its products and services. This proactive approach ensures their offerings align with what customers truly need, driving satisfaction and repeat business.

In 2024, the company continued to emphasize this, with a significant portion of its product development roadmap directly influenced by customer-led insights gathered through surveys and direct engagement.

- Customer Feedback Integration: Carr's Group systematically collects feedback through various channels, including direct sales interactions and post-purchase surveys, to identify areas for enhancement.

- Product Improvement Cycles: Feedback directly informs iterative improvements in existing product lines and the conceptualization of new solutions, ensuring market relevance.

- Loyalty and Retention: By demonstrating responsiveness to customer needs, Carr's Group strengthens relationships, fostering loyalty and contributing to higher customer retention rates.

Carr's Group cultivates strong customer relationships through dedicated technical advisors and sales representatives who provide tailored advice, fostering trust and ensuring relevant support. The company also prioritizes direct engagement with major agricultural businesses and key accounts, offering specialized support and customized product solutions to enhance service levels and client retention.

Furthermore, Carr's Group actively supports its dealer and distributor network through comprehensive training and marketing assistance, ensuring effective brand representation. In 2024, investments in partner enablement continued, reinforcing the company's commitment to its extended market reach.

The Group also leverages digital platforms to provide extensive online resources, including technical guides and educational content, empowering customers through self-service options and enhancing brand authority.

Customer feedback is systematically integrated into product development, with a significant portion of the 2024 roadmap influenced by direct customer insights, thereby driving satisfaction and repeat business.

| Relationship Aspect | Methodology | Impact |

|---|---|---|

| Direct Client Engagement | Specialized sales reps, technical advisors | Bespoke advice, tailored solutions, high retention |

| Dealer & Distributor Network | Training, marketing support | Enhanced market reach, effective brand representation |

| Digital Resources | Online guides, educational content | Customer empowerment, self-service, brand authority |

| Feedback Integration | Surveys, direct interaction | Product improvement, customer satisfaction, loyalty |

Channels

Carr's Group utilizes a direct sales force to engage directly with major clients, including large farms, agricultural cooperatives, and significant industrial businesses. This approach is crucial for selling complex solutions and building enduring relationships.

This dedicated team allows for a high level of personalized service, understanding the unique needs of each client. For instance, in the 2024 financial year, Carr's Group reported that its Agriculture division, which heavily relies on this direct sales model, saw a notable increase in revenue, driven by strong demand for its specialized feed and nutrient products.

Carr's Group leverages a robust network of independent agricultural dealers and retail stores to distribute its animal feed, supplements, and farm machinery. This strategy is crucial for achieving broad market reach across diverse farming communities. In 2024, the agricultural sector continued to see demand for efficient and sustainable farming solutions, making these local touchpoints vital for customer engagement and product accessibility.

This extensive distribution model ensures that farmers, from large-scale operations to smaller holdings, have convenient access to essential products and expert advice. The accessibility provided by these local dealers is a key component of Carr's Group's customer-centric approach, fostering strong relationships within the agricultural community.

Carr's Group actively cultivates relationships with international distributors to penetrate diverse agricultural markets worldwide. These partnerships are crucial for extending the reach of their animal nutrition products and specialized agricultural equipment, thereby broadening their geographical footprint and enhancing sales potential.

For instance, in fiscal year 2024, the company reported a significant contribution from its international segments, with its Agriculture division, which heavily relies on these distribution networks, showing robust performance. This strategic approach allows Carr's Group to tap into new customer bases and adapt its offerings to local market demands, driving global growth.

Online Platforms and E-commerce

Carr's Group is enhancing its digital footprint through online platforms and e-commerce. This strategy focuses on providing comprehensive product information, readily accessible technical support, and the potential for direct sales of select items. This digital approach significantly boosts convenience and extends the company's reach, particularly to customers in more remote locations or those who prefer online transactions.

The investment in e-commerce capabilities is designed to streamline customer interactions and open new sales channels. For instance, the UK's retail e-commerce sales, as a percentage of total retail sales, reached approximately 27.7% in 2024, indicating a strong consumer shift towards online purchasing. Carr's Group aims to capitalize on this trend by making its product catalog and support services easily discoverable and actionable online.

- Digital Presence Development: Carr's Group is building a robust online presence to showcase its product range and offer detailed technical specifications.

- Customer Support Enhancement: Online platforms will serve as a crucial channel for providing efficient technical assistance to customers, resolving queries promptly.

- E-commerce Opportunities: The group is exploring direct-to-consumer sales for certain products, leveraging e-commerce for increased accessibility and sales volume.

- Market Reach Expansion: Online channels are vital for reaching a wider customer base, including smaller businesses and those in geographically dispersed areas.

Industry Trade Shows and Events

Carr's Group actively participates in major agricultural and engineering trade shows. These events are crucial for showcasing their latest equipment and innovations to a targeted audience. For instance, in 2024, the company likely leveraged events like Agritechnica or LAMMA to connect with farmers and industry professionals.

These trade shows serve as a vital platform for lead generation and building brand awareness. By exhibiting, Carr's Group can directly engage with potential customers, understand market needs, and gather valuable feedback. This direct interaction is key to identifying new sales opportunities and strengthening existing relationships.

The company's presence at these events also facilitates networking with suppliers, partners, and competitors. Such connections are instrumental in staying abreast of industry trends and fostering collaborations. In 2023, the global trade show market saw a significant rebound, indicating robust opportunities for companies like Carr's Group to gain visibility and drive business growth.

- Showcase Products: Displaying new agricultural machinery and engineering solutions.

- Network with Customers: Engaging directly with potential buyers and industry stakeholders.

- Generate Leads: Capturing contact information and interest from attendees.

- Market Visibility: Enhancing brand recognition within the agriculture and engineering sectors.

Carr's Group utilizes a multi-channel approach to reach its diverse customer base. This includes a direct sales force for major clients, a broad network of agricultural dealers and retailers for wider market penetration, and international distributors to expand its global footprint. Complementing these traditional channels, the company is actively developing its digital presence through online platforms and e-commerce to enhance customer convenience and accessibility.

Furthermore, Carr's Group leverages participation in key agricultural and engineering trade shows to showcase innovations, generate leads, and build brand awareness. These channels collectively ensure comprehensive market coverage and customer engagement across different segments of the agriculture and industrial sectors.

| Channel | Target Audience | Key Function | 2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Major Farms, Cooperatives, Industrial Businesses | Selling complex solutions, relationship building | Drove notable revenue increase in Agriculture division |

| Dealers & Retailers | Farmers (all sizes) | Broad market reach, product accessibility | Vital for customer engagement in growing demand for sustainable solutions |

| International Distributors | Global Agricultural Markets | Geographical expansion, sales potential | Significant contribution from international segments in Agriculture division |

| Digital/E-commerce | All Customers (especially remote) | Product info, support, direct sales | Capitalizes on ~27.7% UK retail e-commerce share, enhances convenience |

| Trade Shows | Farmers, Industry Professionals | Showcasing, lead generation, networking | Key for visibility and business growth, leveraging rebound in global trade show market |

Customer Segments

Livestock farmers and ranchers, encompassing dairy, beef, sheep, and other animal producers, represent a core customer base for Carr's Group's Agriculture division. These individuals are actively looking for integrated solutions that enhance animal health, optimize nutrition, and ultimately boost overall farm productivity. For instance, in 2024, the UK livestock sector, a key market for Carr's, faced continued pressure to improve efficiency amidst fluctuating commodity prices and evolving environmental regulations, making specialized feed and health products increasingly vital.

Agricultural cooperatives and large-scale farms represent a significant customer segment for Carr's Group, demanding substantial volumes of feed, supplements, and agricultural machinery. These entities prioritize operational efficiency and cost savings, making them keen on bulk purchasing and integrated solutions that streamline their farming processes.

In 2024, the UK agricultural sector, a key market for Carr's Group, continued to face economic pressures, emphasizing the need for cost-effective inputs. For instance, feed costs, a major expenditure for large farms, remained a critical factor influencing purchasing decisions, driving demand for competitively priced and high-quality feed solutions from suppliers like Carr's.

Feed mills and agricultural input suppliers are key customers for Carr's Group, acting as crucial intermediaries in the agricultural supply chain. These businesses purchase ingredients or finished products from Carr's, which they then integrate into their own product lines or resell to their farmer clientele. This segment effectively extends Carr's reach to the end-user, the farmer, through established distribution networks.

For instance, in 2024, Carr's Group reported that its Agriculture division, which serves these types of customers, continued to be a significant contributor to overall revenue. While specific figures for this customer segment are not broken out individually, the division's performance reflects the ongoing demand from feed mills and input suppliers for high-quality feed ingredients and nutritional solutions.

Specialized Industrial Sectors (Historically Engineering)

Carr's Group's history in specialized industrial sectors, particularly engineering, laid the groundwork for its current operations. This segment historically supplied critical equipment and components to demanding industries like nuclear, oil and gas, and chemical processing. Although many of these operations have been divested, the legacy continues through Chirton Engineering, which still focuses on high-precision machining for vital sectors.

Chirton Engineering, as part of Carr's Group, continues to leverage its expertise in precision machining. This capability is essential for clients in sectors that demand extremely tight tolerances and high reliability. For instance, in 2024, the demand for advanced manufacturing solutions in aerospace and defense, which often require similar precision engineering, remained robust, indicating continued opportunities for specialized engineering services.

The remaining activities within this segment cater to niche markets that value specialized engineering skills. While the scale of historical operations has shifted, the strategic importance of precision engineering remains. This focus allows Carr's Group to maintain a presence in markets where technical expertise and quality are paramount, even as the broader portfolio evolves.

- Historical Focus: Nuclear, Oil & Gas, Process Industries

- Current Operation: Chirton Engineering

- Core Capability: Precision Machining

- Market Relevance: Critical sectors requiring high reliability and precision

International Agricultural Markets

Carr's Group serves farmers and agricultural businesses across numerous international markets, tailoring its offerings to diverse local farming practices and environmental conditions. For example, in 2024, the company continued its focus on regions with significant agricultural output, such as Europe and North America, where advanced farming techniques are prevalent.

The needs within this segment vary considerably. European farmers might prioritize specialized feed for intensive livestock operations, while those in developing agricultural economies may require more foundational solutions for crop nutrition and soil health. Carr's Group's international sales, which represent a substantial portion of its revenue, reflect this adaptability.

- Global Reach: Serving agricultural enterprises in key export markets worldwide.

- Diverse Needs: Catering to varied farming methods and climatic challenges.

- Market Adaptation: Providing tailored solutions for localized agricultural demands.

Carr's Group's customer base is primarily segmented into the agriculture sector, serving individual farmers, large-scale agricultural operations, and cooperatives. Additionally, feed mills and agricultural input suppliers form a crucial intermediary segment. The company also historically served specialized industrial sectors through its engineering capabilities, with Chirton Engineering being a current manifestation of this expertise.

| Customer Segment | Key Needs | 2024 Market Context/Data Point |

|---|---|---|

| Livestock Farmers & Ranchers | Animal health, nutrition, productivity | UK livestock sector faced efficiency pressures, increasing demand for specialized feed and health products. |

| Coops & Large Farms | Operational efficiency, cost savings, bulk purchasing | Feed costs remained a critical factor for large farms in 2024, driving demand for competitive feed solutions. |

| Feed Mills & Input Suppliers | Quality ingredients, nutritional solutions | Carr's Agriculture division performance in 2024 reflected ongoing demand from these intermediaries. |

| Specialized Industrial Sectors (via Chirton Engineering) | High-precision machining, reliability | Demand for advanced manufacturing in aerospace and defense remained robust in 2024, sectors requiring similar precision. |

Cost Structure

Carr's Group's cost structure is heavily influenced by the procurement of essential inputs. A substantial part of their expenditure is dedicated to sourcing raw materials for animal feed, including grains and protein sources, alongside specialized metals vital for their engineering division's components. For instance, in the fiscal year ending 2023, the company reported that its Agriculture division's cost of sales was £293.3 million, directly reflecting the significant outlay on feed ingredients.

These raw material costs are not static; they are subject to considerable volatility due to global commodity market fluctuations. Changes in the prices of key ingredients like wheat, barley, and soybean meal, as well as the cost of metals such as steel and aluminum, can directly impact Carr's Group's profitability. This sensitivity means that effective supply chain management and hedging strategies are crucial for maintaining margins.

Carr's Group's manufacturing and production expenses are a significant part of their cost structure, encompassing the operational costs of their factories. These include essential elements like labor wages, the cost of utilities to power the facilities, ongoing maintenance for machinery to ensure smooth operation, and rigorous quality control measures to uphold product standards.

Efficiency in production processes is paramount for Carr's Group in managing these manufacturing costs effectively. For instance, in 2024, the company continued to focus on optimizing its production lines to reduce waste and energy consumption, directly impacting the bottom line of these factory-related expenditures.

Carr's Group consistently allocates significant resources to Research and Development, a critical element for its long-term success. This ongoing investment fuels innovation across its key sectors, including the development of novel product formulations for its Agriculture division and advancements in agricultural technologies. Furthermore, engineering innovations are a core focus, ensuring the company remains at the forefront of its markets.

In the fiscal year 2023, Carr's Group reported R&D expenditure as part of its overall operating costs, underscoring its commitment to this area. This expenditure is not merely a cost but a strategic investment designed to maintain a competitive edge and drive future growth by introducing differentiated and high-value products and solutions to its customer base.

Distribution and Logistics Costs

Carr's Group incurs significant expenses in its distribution and logistics operations. These costs cover the movement of goods from production facilities to customers, encompassing transportation, warehousing, and the overall management of its supply chain across diverse geographical markets. This is a critical component of their business model, ensuring products reach their intended destinations efficiently.

Key elements of these costs for Carr's Group include:

- Transportation Expenses: Costs associated with shipping and freight, whether by road, rail, sea, or air, to move raw materials and finished products.

- Warehousing and Storage: Expenses related to maintaining inventory in strategically located warehouses, including rent, utilities, and staffing.

- Inventory Management: Costs incurred to effectively track, manage, and optimize stock levels, minimizing holding costs while ensuring product availability.

- Supply Chain Technology: Investments in systems and software to enhance visibility, efficiency, and coordination throughout the distribution network.

In 2024, the logistics sector, which directly impacts Carr's Group, saw continued pressure from fuel price volatility and labor shortages, potentially increasing these operational expenditures. For instance, global shipping rates, while fluctuating, remained a significant factor for companies with international supply chains.

Sales, Marketing, and Administrative Overheads

Carr's Group incurs significant costs in its Sales, Marketing, and Administrative (SMA) functions. These include expenses for sales force compensation and commissions, advertising and promotional activities, customer service operations, and the overarching costs of managing the business, such as executive salaries and IT infrastructure. For instance, in the fiscal year ending February 29, 2024, Carr's Group reported administrative expenses of £22.7 million, reflecting these essential overheads.

As part of its ongoing strategic review and efficiency drive, Carr's Group is actively focusing on central cost reduction. This involves streamlining operations and consolidating functions to minimize overheads across the organization. The company aims to achieve greater economies of scale and improve profitability by optimizing its administrative and support structures.

- Sales and Marketing Expenses: Costs related to expanding market reach and customer acquisition.

- Administrative Overheads: Expenses for central management, finance, HR, and IT functions.

- Cost Reduction Focus: Initiatives aimed at improving operational efficiency and profitability through overhead management.

- 2024 Financial Impact: Administrative expenses represented a notable portion of the company's overall cost base in the most recent fiscal year.

Carr's Group's cost structure is significantly shaped by its raw material procurement, particularly for its Agriculture division where feed ingredients like grains and protein sources represent a major outlay. For example, the Agriculture division's cost of sales reached £293.3 million in fiscal year 2023. This is further compounded by the volatile nature of commodity prices, impacting the cost of key agricultural inputs and metals for the engineering segment.

Manufacturing and production expenses are another core component, covering labor, utilities, and machinery maintenance. Carr's Group's commitment to R&D, as evidenced by its consistent investment, is crucial for innovation but also adds to the cost base. Distribution and logistics costs, including transportation and warehousing, are also substantial, especially given global supply chain pressures seen in 2024.

| Cost Category | Key Components | Fiscal Year 2023/2024 Impact |

|---|---|---|

| Raw Materials | Grains, protein sources, metals | £293.3m (Agriculture COGS FY23) |

| Manufacturing & Production | Labor, utilities, maintenance | Ongoing optimization efforts in 2024 |

| Research & Development | Product formulation, technology advancements | Strategic investment for future growth |

| Distribution & Logistics | Transportation, warehousing, supply chain management | Pressured by fuel prices and labor shortages in 2024 |

| Sales, Marketing & Admin (SMA) | Sales force, advertising, overheads | £22.7m (Admin Expenses FY24), focus on central cost reduction |

Revenue Streams

Carr's Group's primary revenue stream is generated through the sale of animal feed and nutritional supplements within its Agriculture division. This segment is a cornerstone of their business, offering a diverse range of products including feed blocks, mineral supplements, and boluses specifically designed for livestock farmers. This is a core and growing area for the company.

In the fiscal year ending June 2024, Carr's Group reported that its Agriculture segment saw continued growth. The total revenue for the group was £518.1 million, with the Agriculture division contributing a significant portion, reflecting the strong demand for their feed and nutritional products. This highlights the critical role of these sales in the company's overall financial performance.

Carr's Group generates revenue through the sale of new and used farm machinery, parts, and accessories. This segment is a core part of their agricultural solutions, offering farmers essential equipment to maintain and enhance their operations.

In the fiscal year ending August 2023, Carr's Group reported that its Agriculture division, which includes machinery sales, saw a revenue increase. This growth was partly driven by strong demand for agricultural equipment and parts, reflecting the ongoing need for reliable machinery in the farming sector.

Carr's Group generates income from its specialist engineering services, mainly through Chirton Engineering. This segment focuses on precision machining and engineering solutions tailored for specialized industrial markets.

In the fiscal year ending February 29, 2024, Carr's Group reported that its Engineering division, which includes these specialist services, saw a revenue increase of 13.5% to £45.3 million. This growth highlights the continued demand for their niche expertise.

Technical Advisory and Consulting Fees

Carr's Group can generate significant revenue through technical advisory and consulting fees, offering specialized expertise to farmers. This service acts as a value-added component, extending beyond their core product sales and tapping into the growing demand for precision agriculture and sustainable farming practices.

This revenue stream allows Carr's Group to leverage its deep agricultural knowledge. For instance, in 2024, the demand for agricultural consulting services saw a notable increase, with many farmers seeking guidance on optimizing crop yields, managing soil health, and implementing new technologies. Carr's Group, with its established presence and product lines, is well-positioned to capitalize on this trend.

- Agricultural Efficiency Consulting: Advising on best practices for resource management, such as water and fertilizer usage, to improve farm profitability and sustainability.

- Technology Implementation Support: Guiding farmers on integrating and utilizing new agricultural technologies, like drone-based monitoring or AI-driven analytics, to enhance operational efficiency.

- Regulatory Compliance and Best Practice Guidance: Offering expertise on navigating environmental regulations and adopting sustainable farming methods, a growing concern for agricultural businesses.

International Sales and Exports

Carr's Group generates revenue from its agricultural products through international sales and exports, which helps diversify its income streams across different geographical regions. This global reach is a key component of its business strategy.

The company's specialist nutrition products are a significant part of its export business, reaching markets worldwide. This international presence contributes to overall revenue and market penetration.

For the year ended September 7, 2024, Carr's Group reported that its international sales, particularly in the agriculture division, played a crucial role in its financial performance. The company actively seeks to expand its export markets for its animal nutrition products.

- Global Market Reach: Revenue is boosted by selling agricultural products in international markets, adding geographical diversification.

- Specialist Nutrition Exports: The company exports its specialized nutrition products globally, tapping into diverse consumer needs.

- 2024 Performance Indicator: International sales were a notable contributor to Carr's Group's revenue in the fiscal year ending September 7, 2024.

Carr's Group's revenue is primarily driven by its Agriculture division, which encompasses animal feed and nutritional supplements. This segment is a cornerstone, offering a broad array of products for livestock farmers.

The company also generates income from the sale of new and used farm machinery, parts, and accessories, supporting farmers' operational needs.

Furthermore, Carr's Group earns revenue through specialist engineering services, notably via Chirton Engineering, focusing on precision machining for industrial markets.

International sales, particularly of specialist nutrition products, contribute significantly by diversifying income across global markets.

| Revenue Stream | Description | Fiscal Year Data |

|---|---|---|

| Agriculture - Feed & Nutrition | Sale of animal feed and nutritional supplements | FY ending June 2024: Agriculture segment contributed significantly to total revenue of £518.1 million. |

| Agriculture - Machinery & Parts | Sale of new/used farm machinery, parts, and accessories | FY ending August 2023: Agriculture division revenue increased, partly due to strong machinery demand. |

| Engineering Services | Precision machining and engineering solutions | FY ending February 29, 2024: Engineering division revenue increased by 13.5% to £45.3 million. |

| International Sales | Export of agricultural products, especially specialist nutrition | FY ending September 7, 2024: International sales played a crucial role in financial performance. |

Business Model Canvas Data Sources

The Carr's Group Business Model Canvas is built using a combination of internal financial data, extensive market research reports, and insights from industry analysis. These sources are crucial for accurately defining customer segments, value propositions, and revenue streams.