Carr's Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

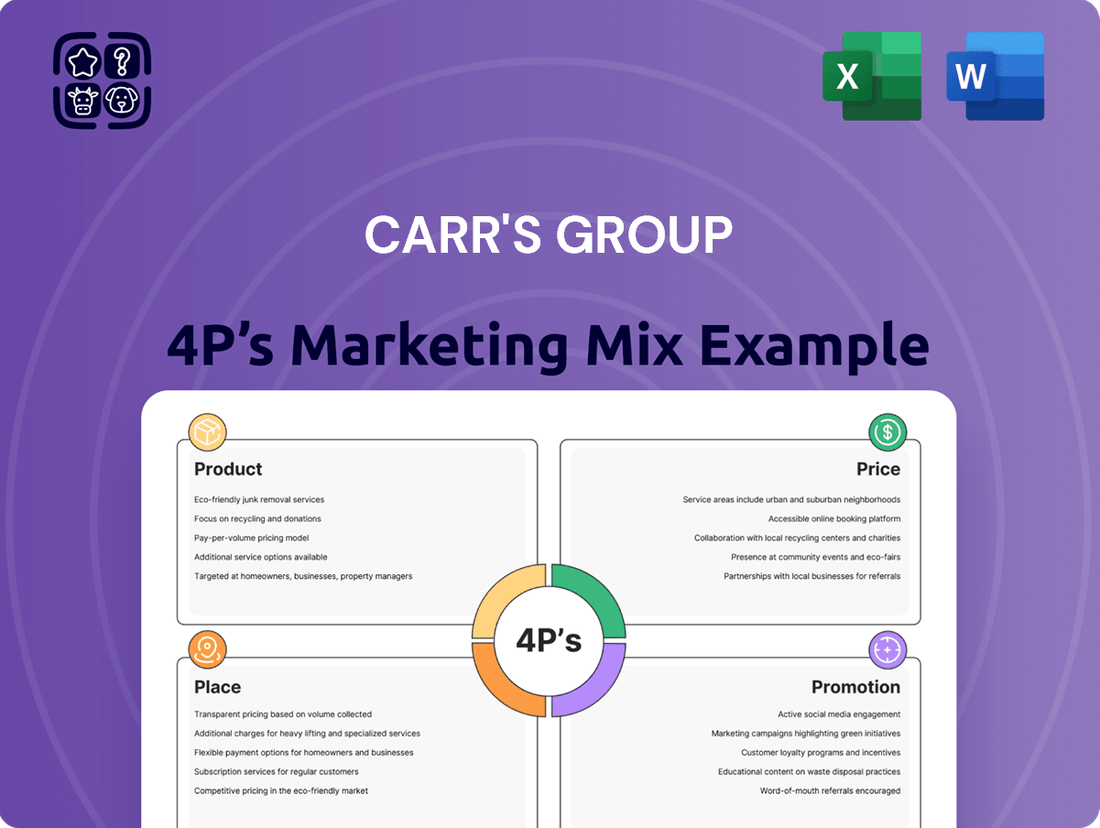

Carr's Group masterfully crafts its product portfolio, balancing heritage with innovation, while its pricing strategy reflects premium quality and market positioning. Their distribution network ensures accessibility, and promotional activities create strong brand resonance.

Unlock a comprehensive breakdown of Carr's Group's Product, Price, Place, and Promotion strategies. This in-depth analysis is perfect for students, marketers, and business strategists seeking actionable insights and a competitive edge.

Product

Carr's Group's agricultural feed supplements are a cornerstone of their Agriculture division, offering specialized livestock nutrition. These products, available as feed blocks, boluses, and bagged minerals, are designed to deliver crucial trace elements and essential minerals. This focus particularly benefits their extensive, grazing-based customer base worldwide, ensuring optimal animal health and productivity.

Carr's Group's 'Product' pillar, focusing on research-proven nutritional solutions, directly addresses farmer needs for enhanced livestock performance and profitability. Their patented products, like those developed by Carrs Billington, are rooted in scientific validation, aiming to improve key metrics such as calving intervals and weight gain.

This commitment to innovation is crucial in the current agricultural landscape. For instance, in 2024, the UK agricultural sector continued to face pressure to increase efficiency while maintaining sustainability. Carr's Group's solutions, by promoting shorter calving intervals, can directly contribute to a farmer's bottom line by increasing the number of calves produced per breeding animal over time, a critical factor in livestock profitability.

Furthermore, the emphasis on producing safe, healthy, and sustainable food aligns with evolving consumer demands and regulatory frameworks. By offering solutions that enhance weight gain, Carr's Group helps farmers meet market specifications more efficiently, potentially reducing the overall environmental footprint per unit of product. This strategic product development positions them to capitalize on the growing demand for responsibly produced food in 2025.

Carr's Group's livestock solutions, a key part of their product offering, are engineered to boost animal health and productivity. For instance, their specialized feed supplements and nutritional programs are designed to improve feed conversion ratios, meaning livestock gain more weight from less feed. This efficiency gain directly translates to reduced methane emissions per kilogram of meat or milk produced, contributing to a lower carbon footprint for the agricultural sector. In 2024, the agricultural industry is increasingly focused on sustainability metrics, and products like Carr's can help farmers meet these evolving demands.

Specialist Global Portfolio

Carr's Group's Specialist Global Portfolio is central to its strategic pivot towards a pure-play agriculture focus. This portfolio encompasses innovative feed supplements for a variety of livestock, including cattle, horses, sheep, and goats. The company is actively leveraging its intellectual property to establish itself as a global leader in agricultural technology and innovation.

The company's product strategy emphasizes its global reach and the unique value proposition of its specialized feed supplements. This approach aims to solidify Carr's Group's reputation as an international innovator in animal nutrition. For instance, in the fiscal year ending February 2024, Carr's Group reported revenue of £158.4 million, with its Agriculture division demonstrating resilience and growth, contributing significantly to the overall financial performance.

- Global Reach: The portfolio is designed for international markets, catering to diverse agricultural needs worldwide.

- Innovation Focus: Emphasis on R&D for advanced feed supplement solutions.

- Targeted Segments: Specialization in supplements for cattle, horses, sheep, and goats.

- Intellectual Property: Leveraging patents and proprietary formulations to create a competitive advantage.

Adaptable Formats

Carr's Group's product adaptability is a key strength, catering to varied agricultural demands. The product range includes low moisture blocks, ideal for extensive grazing systems common in many global markets. This format supports sustained nutrient release for livestock over longer periods.

Furthermore, the availability of boluses offers a more targeted approach to nutrient delivery. This is particularly beneficial for individual animal health management, addressing specific deficiencies or needs. This dual format strategy allows Carr's Group to serve a broader customer base and adapt to different farming practices and regulatory environments.

For instance, the demand for such adaptable feed solutions has grown. In 2024, the global animal feed additives market was valued at approximately USD 25.3 billion and is projected to grow. This growth underscores the importance of offering diverse product formats to capture market share.

- Low Moisture Blocks: Essential for extensive grazing, providing sustained nutrient release.

- Boluses: Designed for targeted nutrient delivery to individual animals, addressing specific health needs.

- Market Adaptability: Meets diverse farming needs and varying market conditions across geographies.

- Growth Potential: Aligned with the expanding global animal feed additives market, valued at over USD 25.3 billion in 2024.

Carr's Group's product strategy centers on specialized, research-driven feed supplements for livestock, aiming to enhance animal health and farm profitability. Their offerings, including feed blocks and boluses, are designed for global markets and leverage intellectual property for competitive advantage. The company's commitment to innovation in animal nutrition is evident in their focus on improving metrics like calving intervals and weight gain, directly addressing farmer needs for increased efficiency and sustainability.

| Product Aspect | Description | Key Benefit | Market Relevance (2024/2025) |

|---|---|---|---|

| Feed Supplements | Specialized nutrition in blocks, boluses, and bagged minerals for cattle, horses, sheep, and goats. | Improves animal health, productivity, and feed conversion ratios. | Addresses growing demand for efficient livestock production and sustainability. |

| Innovation & IP | Patented formulations and R&D focus on scientifically validated nutritional solutions. | Enhances key performance indicators like weight gain and reduced calving intervals. | Positions Carr's as a leader in agricultural technology; supports competitive advantage. |

| Product Formats | Low moisture blocks for grazing systems and boluses for targeted nutrient delivery. | Adaptable to diverse farming practices and specific animal health needs. | Caters to a broad customer base within the expanding global animal feed additives market (est. USD 25.3 billion in 2024). |

What is included in the product

This analysis offers a comprehensive examination of Carr's Group's marketing strategies, detailing their approach to Product, Price, Place, and Promotion with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, easing the burden of detailed analysis for busy teams.

Provides a clear, concise overview of Carr's Group's 4Ps, alleviating the pain of information overload for stakeholders.

Place

Carr's Group's Agriculture division boasts a strategically positioned global manufacturing footprint, with key sites in the UK, USA, and Germany. This international presence, particularly in 2024, allows for efficient local sales support and streamlined global supply chain operations for their diverse agricultural product range.

Carr's Group leverages a robust direct sales and distribution network, primarily through its established rural farm stores across the UK. This direct approach ensures farmers receive essential agricultural products and support efficiently.

In international markets, Carr's Group has strategically adapted its distribution model. For instance, in New Zealand, the company has transitioned to utilizing third-party distributors. This move aims to enhance market penetration and streamline operations, as seen in their 2023 financial reports which highlighted international growth driven by optimized distribution channels.

Carr's Group's distribution strategy for its animal nutrition products is keenly focused on extensive grazing markets. This means ensuring their feed supplements and nutritional solutions are readily available to farmers and ranchers who manage livestock primarily on pastureland, a common practice in many global agricultural regions.

This targeted approach prioritizes convenience for their customer base, placing products where livestock are raised. For instance, in 2024, the global pasture-based livestock sector, particularly in regions like Australia and New Zealand where Carr's has a presence, continues to be a significant market, with demand for specialized nutritional inputs remaining strong.

Optimized Supply Chain Logistics

Carr's Group prioritizes an optimized supply chain to ensure agricultural inputs and finished products reach customers efficiently. This focus on maximizing logistics efficiency directly contributes to enhanced customer satisfaction by guaranteeing product availability when and where it's needed. The company continuously reviews and streamlines its supply chain operations.

Key aspects of Carr's Group's logistics optimization include:

- Strategic Warehousing: Maintaining strategically located distribution centers to minimize transit times for both raw materials and finished goods.

- Inventory Management: Implementing advanced inventory systems to forecast demand accurately, reducing holding costs and preventing stockouts. For instance, in the fiscal year ending August 31, 2023, Carr's Group reported a focus on optimizing inventory levels across its divisions.

- Transportation Efficiency: Utilizing optimized routing and carrier management to reduce transportation costs and delivery times.

- Technology Integration: Employing technology such as real-time tracking and data analytics to monitor and improve supply chain performance.

Strategic Market Presence

Carr's Group cultivates a robust strategic market presence, with the United Kingdom and the United States serving as foundational pillars for its agricultural operations. These established markets are crucial for driving revenue and reinforcing brand loyalty.

The company is actively pursuing expansion into new and developing extensive grazing regions. This strategic move aims to capitalize on emerging opportunities and broaden the reach of its diverse product offerings.

- UK & USA Focus: Core markets for agricultural division, demonstrating significant investment and market penetration.

- Geographic Expansion: Targeting new and growing extensive grazing geographies to unlock further market potential.

- Leveraging Portfolio: Aiming to maximize the impact of their product suite in both established and new territories.

Carr's Group's place strategy centers on a dual approach: strong direct sales in its core UK market via farm stores, complemented by strategic use of third-party distributors in international territories like New Zealand, as evidenced by their 2023 growth initiatives. This ensures product accessibility for extensive grazing markets, a key focus for their animal nutrition division.

| Market | Distribution Strategy | Key Focus Area | 2023/2024 Relevance |

|---|---|---|---|

| United Kingdom | Direct Sales (Farm Stores) | Essential agricultural products & support | Established, high penetration |

| USA | Direct Sales & Distribution Network | Diverse agricultural product range | Foundation for revenue |

| New Zealand | Third-Party Distributors | Enhanced market penetration | Optimized for international growth |

| Global (Extensive Grazing) | Targeted Availability | Animal nutrition solutions | Meeting demand in pasture-based sectors |

Full Version Awaits

Carr's Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Carr's Group's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Carr's Group leverages its strong portfolio of agricultural brands, including Crystalyx, Horslyx, New Generation Supplements, Scotmin Nutrition, and Animax, to drive its promotion strategy. This brand-centric approach focuses on highlighting the inherent quality and established reputation of each product line. By consistently emphasizing these trusted names, Carr's Group aims to foster deep recognition and build enduring trust with its farmer customer base.

Carr's Group’s value proposition strongly emphasizes the tangible benefits delivered to farmers. Their marketing messages consistently highlight how their nutritional solutions lead to improved animal health, ultimately boosting productivity and increasing profitability. For instance, a farmer investing in Carr's specialized feed might see a 5% increase in milk yield, directly impacting their bottom line.

Beyond direct financial gains, Carr's Group effectively communicates the broader impact of their offerings. They showcase how their products contribute to a reduced carbon footprint within livestock farming, aligning with growing demands for environmental sustainability. This focus on eco-friendly practices is increasingly important, with studies in 2024 indicating that 60% of consumers are willing to pay more for sustainably produced food.

Carr's Group actively engages in farm-level marketing, investing in initiatives designed to connect directly with farmers. This strategy focuses on generating demand by communicating specific product benefits and solutions precisely when farmers are making purchasing decisions.

This targeted approach ensures that Carr's Group's offerings resonate with the agricultural community's immediate needs. For instance, in their 2024 financial reporting, the company highlighted increased investment in digital marketing platforms and on-farm demonstrations, aiming to reach over 80% of their key farming customer segments.

Digital and Investor Engagement

Carr's Group actively engages its digital and investor audience through its corporate website, which serves as a central hub for strategic updates and financial performance reporting. This platform, alongside detailed annual reports and investor presentations, clearly articulates the company's ongoing transition to a pure-play agriculture business and outlines its forward-looking growth initiatives.

The company emphasizes transparency in communicating its financial results and sustainability commitments. For instance, in their 2024 interim report, Carr's Group highlighted a revenue of £163.2 million for the six months ended 29 February 2024, demonstrating progress in their strategic repositioning.

Key communication points for investors include:

- Strategic Transformation: Detailed information on the divestment of non-core assets and the sharpened focus on agriculture.

- Financial Performance: Clear reporting of revenue, profitability, and key financial metrics, such as the reported profit before tax of £5.2 million for H1 2024.

- Growth Prospects: Outlining future investment plans and market opportunities within the agricultural sector.

- Sustainability Initiatives: Communicating environmental, social, and governance (ESG) progress and commitments.

Industry Partnerships and Expertise Sharing

Carr's Group actively cultivates industry partnerships to enhance its market presence and demonstrate its commitment to innovation. These collaborations are crucial for leveraging their specialized expertise and patented technologies, particularly within the agricultural sector. For instance, their partnership with Vétalis serves as a powerful promotional avenue, highlighting their dedication to advancing sustainable farming methodologies.

These strategic alliances not only validate Carr's Group's technological capabilities but also broaden their reach by associating with established players in the market. Such collaborations can lead to joint marketing efforts and shared promotional activities, amplifying the message of innovation and sustainability to a wider audience. In 2024, the company continued to emphasize these relationships as a key component of its growth strategy.

- Partnership with Vétalis: Showcases commitment to innovation and sustainable farming.

- Expertise Sharing: Leverages patented technology within the agricultural sector.

- Promotional Tool: Collaborations highlight company strengths and market leadership.

- Market Reach: Alliances expand visibility and credibility in the industry.

Carr's Group's promotional efforts are deeply rooted in showcasing the quality and benefits of its agricultural brands like Crystalyx and Horslyx. The company actively communicates the tangible value to farmers, emphasizing improved animal health and profitability. For example, their marketing highlights how their nutritional solutions can boost milk yields, a key metric for dairy farmers.

The company also focuses on sustainability, aligning with consumer demand for eco-friendly food production, a trend noted in 2024. Carr's Group invests in direct farm-level marketing and digital platforms to reach farmers precisely when they are making purchasing decisions, reinforcing their brand message with specific product solutions.

Further enhancing their promotion, Carr's Group cultivates strategic industry partnerships, such as with Vétalis, to demonstrate innovation and commitment to sustainable farming. These collaborations amplify their message and expand their market reach, validating their technological capabilities and reinforcing their market leadership.

| Brand | Key Promotional Focus | Farmer Benefit Highlighted |

|---|---|---|

| Crystalyx | High-quality feed supplements | Improved animal health and productivity |

| Horslyx | Equine nutrition and well-being | Enhanced performance and vitality in horses |

| New Generation Supplements | Advanced nutritional solutions | Increased profitability through better livestock outcomes |

Price

Carr's Group employs a value-based pricing strategy, setting prices for its specialized animal feed and nutritional supplements based on the tangible benefits they offer farmers. This means their products are priced to reflect the enhanced livestock productivity and increased profitability farmers can achieve through their use.

This strategy directly supports Carr's Group's market positioning as a provider of premium, value-added solutions rather than just commodities. For instance, in the 2024 financial year, the Group's focus on innovation in animal nutrition, evidenced by continued R&D investment, underpins the premium pricing of their advanced feed formulations.

Carr's Group's pricing strategy is carefully calibrated against competitor pricing and the prevailing demand within the agricultural industry. This ensures their specialized nutritional solutions remain attractively positioned for customers.

For instance, in the 2023 financial year, Carr's Group reported revenue of £174.5 million, demonstrating their ability to compete effectively. Their pricing aims to reflect their market standing as a leader, balancing competitive allure with the premium associated with specialized, high-quality products.

Carr's Group's pricing strategy for its agricultural products is intrinsically linked to the volatile input cost environment. The company actively adjusts its prices to reflect changes, whether increases or decreases, in the cost of essential agricultural inputs. This adaptive approach is crucial for maintaining healthy profit margins amidst the inherent economic unpredictability of the agricultural sector.

Impact of Operational Efficiencies

Carr's Group's focus on enhancing operational efficiencies, particularly within its agricultural segment, directly impacts its pricing strategies. By streamlining central costs and divesting or improving underperforming business units, the company can gain greater flexibility in setting competitive prices while safeguarding its profit margins. For instance, in the fiscal year ending August 31, 2023, Carr's Group reported a 10% increase in adjusted operating profit to £13.5 million, demonstrating the positive effect of such efficiency drives.

These internal improvements can translate into tangible benefits for customers. As operational costs decrease, Carr's Group has more scope to offer attractive pricing, thereby strengthening its market position. This is crucial in sectors where price sensitivity is high.

The impact of these efficiencies on pricing can be seen in several key areas:

- Improved Margin Management: Streamlining operations allows for better control over cost of goods sold, enabling more stable pricing even amidst market volatility.

- Competitive Pricing Power: Reduced operational overheads can facilitate more aggressive pricing strategies against competitors.

- Investment in Innovation: Cost savings can be reinvested into product development, further enhancing value and justifying pricing.

- Enhanced Profitability: Ultimately, operational efficiencies contribute to a healthier bottom line, supporting sustained business growth and shareholder value.

Market Conditions and Regional Factors

Carr's Group's pricing strategies are significantly influenced by external market conditions, especially in the US. For instance, regional drought conditions can severely impact feed availability and costs, forcing price adjustments. Cyclical herd sizes also play a crucial role; a larger herd typically means increased demand but can also lead to oversupply and price pressure.

Navigating these fluctuations requires adaptable pricing. For example, during periods of high feed costs due to drought, Carr's might implement tiered pricing or offer bundled solutions to maintain customer loyalty and manage margins. Conversely, in a market with abundant supply and lower feed costs, competitive pricing becomes more critical to capture market share.

The company's ability to monitor and respond to these regional factors is key.

- US Drought Impact: Recent data from the US Department of Agriculture (USDA) in early 2024 indicated widespread moderate to severe drought conditions across several key agricultural regions, directly affecting grain prices and, consequently, feed costs for livestock.

- Herd Size Fluctuations: USDA reports from late 2023 showed a continued decline in the US cattle herd, the smallest since 1951, which can lead to tighter supplies and potentially higher prices for beef, influencing demand for feed products.

- Pricing Adaptability: Carr's Group's strategy likely involves dynamic pricing models that can be adjusted based on real-time commodity prices and regional supply-demand imbalances to mitigate risks and capitalize on opportunities.

Carr's Group's pricing strategy is deeply intertwined with the cost of raw materials, particularly grains, which are subject to considerable market volatility. The company actively adjusts its prices to reflect these fluctuations, aiming to protect its profit margins in a sector where input costs can change rapidly.

This adaptive pricing approach is crucial for maintaining competitiveness and profitability. For example, the Group's financial performance is sensitive to commodity prices, and their pricing models are designed to absorb or pass on these changes efficiently.

The company's operational efficiencies, such as cost-saving initiatives and improvements in underperforming units, provide pricing flexibility. In the fiscal year ending August 31, 2023, Carr's Group achieved an adjusted operating profit of £13.5 million, up 10%, highlighting the success of these efficiency drives which can translate into more attractive customer pricing.

External market conditions, especially in the US, significantly influence pricing. Drought conditions in early 2024 across key agricultural regions, as reported by the USDA, directly impacted grain prices and thus feed costs. Furthermore, the US cattle herd size, at its smallest since 1951 by late 2023, affects demand and pricing dynamics for feed products.

| Factor | Impact on Pricing | Example Data/Observation (2023-2024) |

|---|---|---|

| Input Costs (Grains) | Directly influences cost of goods sold, necessitating price adjustments. | Grain prices saw significant volatility in 2023-2024 due to weather patterns and geopolitical events. |

| Operational Efficiencies | Provides pricing flexibility and supports competitive positioning. | 10% increase in adjusted operating profit to £13.5 million (FY23) suggests cost control benefits. |

| US Market Conditions (Drought) | Increases feed costs, impacting regional pricing strategies. | Widespread moderate to severe drought in US agricultural regions (early 2024) raised feed ingredient prices. |

| US Herd Size | Affects demand and supply balance, influencing feed product pricing. | US cattle herd at its smallest since 1951 (late 2023) can lead to tighter feed demand or shifts in product focus. |

4P's Marketing Mix Analysis Data Sources

Our Carr's Group 4P's analysis is grounded in a comprehensive review of publicly available company information, including annual reports, investor relations materials, and official product announcements. We also incorporate insights from industry publications and competitor analysis to provide a well-rounded view of their marketing strategies.