Carr's Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

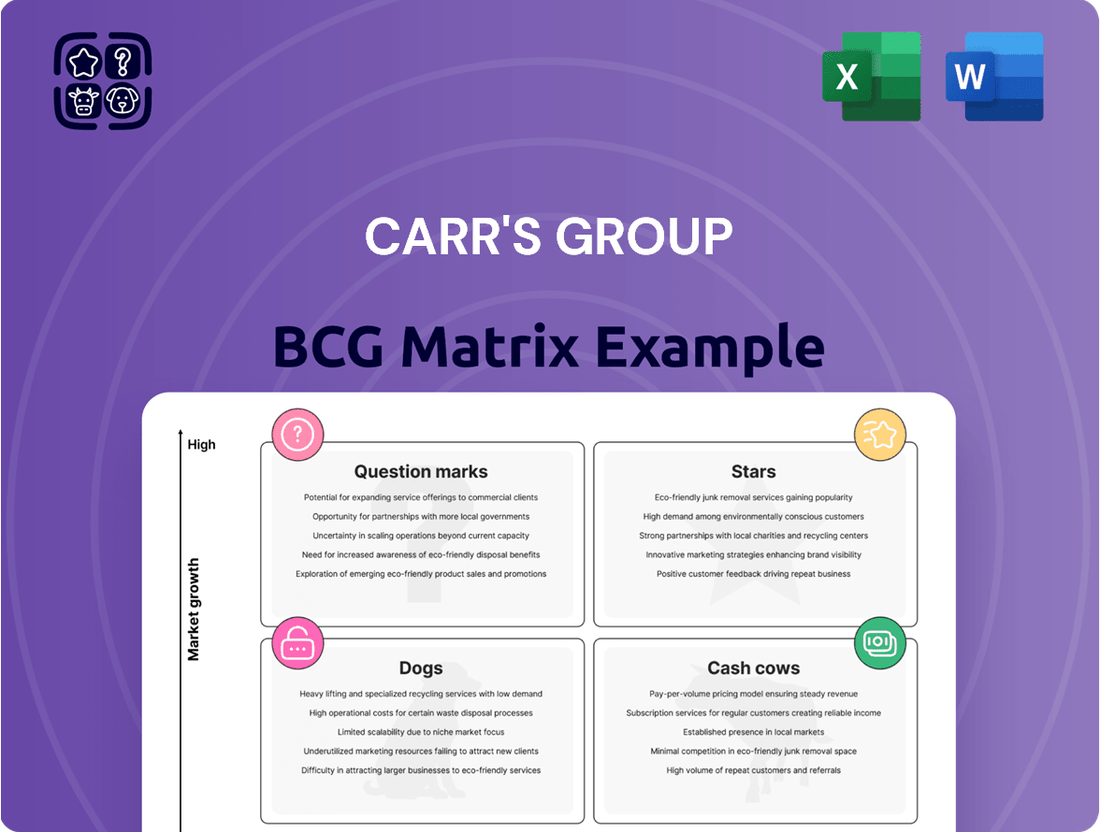

Carr's Group's BCG Matrix offers a strategic snapshot of its diverse product portfolio, highlighting potential growth areas and resource drains. Understand which brands are market leaders and which require careful consideration to optimize your investment strategy.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Carr's Group.

Stars

Carr's Group's Global Agriculture Division, specifically its feed supplements segment, is a cornerstone of their strategic refocus. This area includes research-backed products like feed licks, blocks, bagged minerals, and boluses, demonstrating a commitment to value-added solutions.

Operating in three countries and exporting to over 20, the division boasts market-leading brands such as Animax, Crystalyx, Horslyx, New Generation Supplements, and Scotmin Nutrition. This extensive reach and strong brand portfolio position the feed supplements as a potential star in the BCG matrix, given their established market presence and growth potential.

The UK low moisture block tonnage within Carr's Group's Agriculture Division is a prime example of a Star in their BCG Matrix. This segment experienced a robust 13% year-on-year increase in tonnage during the first half of fiscal year 2025.

Carr's Group's Tracesure® boluses are poised to become a Star in the BCG matrix following a strategic manufacturing partnership with Vétalis, announced in July 2025. This collaboration focuses on developing an advanced range of Tracesure® boluses, aiming to enhance innovation and operational efficiency. The initiative targets the growing market for sustainable livestock supplements, reinforcing Tracesure's strong position in the UK and Ireland.

Focus on Extensive Grazing-Based Growth Markets

Carr's Group is strategically targeting new extensive grazing-based growth markets, with a particular emphasis on the Southern Hemisphere. This expansion is designed to leverage high-potential geographies for their agricultural products, positioning these initiatives as significant cash consumers aimed at fostering future growth.

These markets are expected to contribute to the company's long-term revenue streams. For instance, in 2024, Carr's Group reported that its international segments, which include emerging markets, were a key focus for investment and development.

- Expansion into Southern Hemisphere grazing markets

- Focus on high-growth potential for agricultural products

- Strategic investment in these markets is cash-intensive

- Aim is to secure future revenue growth

Overall Agriculture Division Growth and Profitability

The Agriculture Division is a clear Star within Carr's Group's BCG Matrix. Its performance in the first half of fiscal year 2025 demonstrates robust expansion and enhanced profitability. This segment is a significant contributor to the company's overall value and future prospects.

The division achieved impressive financial results, with revenues climbing by 7.0% to £50.6 million. More notably, adjusted operating profit saw a substantial increase of 33.4%, reaching £7.0 million. This indicates strong operational efficiency and effective cost management alongside revenue growth.

- H1 FY25 Revenue Growth: 7.0% increase to £50.6 million.

- H1 FY25 Profitability Surge: Adjusted operating profit up by 33.4% to £7.0 million.

- Strategic Position: Demonstrates strong, profitable growth in continuing operations.

- Future Outlook: Possesses a clear growth strategy, solidifying its Star status.

The Agriculture Division of Carr's Group, particularly its feed supplements, is a definite Star in their BCG Matrix. This segment shows strong growth and market leadership, exemplified by a 7.0% revenue increase to £50.6 million and a significant 33.4% jump in adjusted operating profit to £7.0 million in the first half of fiscal year 2025.

The UK low moisture block tonnage within this division experienced a substantial 13% year-on-year tonnage increase in H1 FY25, further cementing its Star status. Strategic initiatives, such as the manufacturing partnership for Tracesure® boluses with Vétalis, are designed to capitalize on growing markets for sustainable livestock supplements.

Carr's Group's expansion into new grazing markets in the Southern Hemisphere, while cash-intensive, represents a strategic investment aimed at securing future revenue growth, reinforcing the division's potential as a high-growth, high-market-share Star.

| Segment | H1 FY25 Revenue (£M) | H1 FY25 Adj. Operating Profit (£M) | Key Growth Driver | BCG Status |

|---|---|---|---|---|

| Agriculture Division (Feed Supplements) | 50.6 (+7.0%) | 7.0 (+33.4%) | UK low moisture blocks (+13% tonnage), Tracesure® boluses, Southern Hemisphere expansion | Star |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

A clear BCG matrix visually clarifies Carr's Group's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Carr's Group's Agriculture Division boasts an established product portfolio, including feed licks, blocks, bagged minerals, and boluses, firmly positioning it as a Cash Cow. These offerings hold a significant market share within mature agricultural sectors, consistently generating robust cash flow.

The maturity of these markets means that substantial promotional investment is often unnecessary, allowing the division to capitalize on its established brand recognition and customer loyalty. This consistent revenue stream underpins the company's financial stability.

Carr's Group's agricultural business, a core component of its operations, demonstrates strong performance as a Cash Cow. In the first half of fiscal year 2025, cash generated from operating activities within continuing operations reached £4.6 million. This consistent inflow of cash, even amidst strategic changes, highlights the mature and stable nature of this segment.

Further underscoring this stability, net cash for continuing operations stood at a healthy £15.7 million as of February 28, 2025. This robust cash position reinforces the classification of the agricultural business as a reliable Cash Cow, providing a solid foundation for the group's overall financial health and investment capacity.

Carr's Group's decision to return up to £70 million of net proceeds from its Engineering Division sale to shareholders through a tender offer underscores its robust cash generation capabilities. This substantial capital return signifies that the company, or at least the divested division, was operating as a cash cow, a mature business with a dominant market share and strong profitability.

UK Agriculture Operations (Crystalyx® and Scotmin)

Carr's Group's UK Agriculture operations, encompassing established brands like Crystalyx® and Scotmin, likely function as Cash Cows within their portfolio. These segments benefit from integrated management, fostering strategic decision-making that bolsters the division's profitability. Their strong market positions in the UK are expected to generate consistent and reliable cash flow, a hallmark of Cash Cow businesses.

- Market Position: Crystalyx and Scotmin are recognized brands in the UK feed supplement market, indicating established customer bases and brand loyalty.

- Revenue Generation: In the fiscal year ending June 2023, Carr's Group reported that its Agriculture division generated £161.5 million in revenue, with a significant portion attributable to these core UK operations.

- Profitability: The Agriculture division contributed £10.9 million to the group's operating profit for FY23, demonstrating the sustained financial health of these established segments.

- Contribution to Group: These operations provide a stable income stream, enabling investment in other areas of the Carr's Group business.

Improved Operating Margin in Agriculture Division

Carr's Group's Agriculture Division is demonstrating strong performance, fitting the profile of a Cash Cow. In the first half of the fiscal year, its adjusted operating margin saw a significant boost, reaching 13.9%. This is a notable increase from the 11.2% recorded in the same period last year.

This improvement in a mature market segment indicates efficient operations and effective utilization of existing strengths. Such a scenario, where a business unit generates substantial cash flow with minimal investment due to its strong market position, is characteristic of a Cash Cow in the BCG Matrix.

- Agriculture Division H1 adjusted operating margin: 13.9% (up from 11.2% in the prior period).

- Market segment: Mature.

- Implication: Effective 'milking' of competitive advantage.

- BCG Matrix classification: Cash Cow.

Carr's Group's Agriculture division, particularly its UK operations featuring brands like Crystalyx® and Scotmin, is a prime example of a Cash Cow. These segments benefit from strong market positions and established customer loyalty, consistently generating robust cash flow with minimal need for extensive promotional investment.

The division's financial performance in the first half of fiscal year 2025 highlights this stability, with cash generated from continuing operations reaching £4.6 million. Furthermore, net cash for continuing operations stood at a healthy £15.7 million as of February 28, 2025, underscoring the reliable income stream these operations provide.

The Agriculture division's adjusted operating margin saw a significant increase to 13.9% in H1 FY25, up from 11.2% in the prior period. This efficiency in a mature market signifies effective utilization of competitive advantages, a hallmark of a Cash Cow.

| Metric | Value | Period |

| Agriculture Division Cash from Operations | £4.6 million | H1 FY25 |

| Agriculture Division Net Cash (Continuing Ops) | £15.7 million | As of Feb 28, 2025 |

| Agriculture Division Adjusted Operating Margin | 13.9% | H1 FY25 |

What You’re Viewing Is Included

Carr's Group BCG Matrix

The BCG Matrix for Carr's Group you are currently previewing is the exact, complete document you will receive upon purchase. This includes all detailed analysis and strategic insights, with no watermarks or placeholder content, ensuring you get a professional and ready-to-use report for immediate application in your business strategy.

Dogs

The divestment of the majority of Carr's Group's Engineering Division in April 2025 for £75 million strongly suggests this segment was classified as a 'Dog' within the BCG Matrix. This move indicates the division likely possessed low market share and low growth potential, making it a strategic drain on resources.

The decision to sell was fueled by the operational inefficiencies of managing two distinct business areas and a clear strategic pivot towards agriculture. This divestiture freed up capital, allowing Carr's Group to concentrate on its core, potentially higher-growth agricultural operations.

The Afgritech business, identified as a non-core and loss-making operation, was divested in October 2024. This strategic move to sell the entity, which had been consuming resources without generating sufficient returns, firmly places it within the 'Dog' quadrant of the BCG Matrix. Its closure and sale underscore a deliberate effort to streamline the Carr's Group portfolio by removing underperforming assets.

Carr's Group's New Zealand operations were identified as a dog in their BCG matrix, characterized by low market share and low market growth. These operations were loss-making, prompting the company to close them down. In 2024, the group reported that the cessation of these direct operations was expected to yield significant cost savings, underscoring the strategic decision to exit a cash-draining venture.

ANIMAX Production Facility Closure

The decision by Carr's Group to close its ANIMAX production facility in June 2025, shifting to a new partnership for bolus development, points to a strategic move away from an underperforming asset. This suggests that the in-house production capabilities for these specific products were not meeting expectations, potentially due to cost inefficiencies or lower output compared to market demands.

While the ANIMAX brand might represent a strong market position for Carr's Group, the specific production facility itself was likely categorized as a 'Dog' within the BCG Matrix. This classification stems from its probable operational inefficiencies and a lack of competitive advantage in its production processes. For instance, if the facility's operating costs per unit were significantly higher than industry benchmarks, or if its production capacity was underutilized, it would qualify as a 'Dog'.

- Facility Closure: ANIMAX production facility to cease operations in June 2025.

- Strategic Shift: Focus moving to a new partnership for bolus development, indicating a move away from direct, in-house production.

- BCG Classification: The facility likely represents a 'Dog' due to operational inefficiencies despite the potential strength of the ANIMAX brand.

- Financial Implication: This closure suggests a reallocation of resources from an underperforming segment to more promising ventures, potentially improving overall group profitability.

Non-core Properties

Carr's Group's strategic review identified eight non-core properties for disposal, bringing in £7 million. This move suggests these assets were not integral to the company's primary operations and likely offered limited growth potential or strategic alignment.

These divested properties can be categorized as Dogs in the BCG Matrix. This classification highlights capital that was tied up in assets not generating significant strategic returns or contributing to the group's core business objectives.

- Disposal of eight non-core properties

- Generated £7 million in proceeds

- Indicates low growth or strategic value

- Represents capital tied up without significant return

Carr's Group's strategic decisions in 2024 and 2025 clearly indicate the classification of several business segments and assets as 'Dogs' within the BCG Matrix. These were characterized by low market share and low growth potential, often resulting in losses or inefficient resource allocation. The divestment of the Engineering Division for £75 million in April 2025, the sale of the loss-making Afgritech business in October 2024, and the closure of New Zealand operations are prime examples of shedding these underperforming units. Furthermore, the planned closure of the ANIMAX production facility in June 2025 and the disposal of eight non-core properties for £7 million reinforce this strategy of exiting 'Dog' assets to streamline operations and reallocate capital to more promising areas, particularly agriculture.

| Asset/Segment | BCG Classification | Reasoning | Action Taken | Date |

|---|---|---|---|---|

| Engineering Division | Dog | Low market share, low growth potential, operational inefficiencies | Divested majority for £75 million | April 2025 |

| Afgritech | Dog | Non-core, loss-making | Sold | October 2024 |

| New Zealand Operations | Dog | Loss-making, low market share, low market growth | Closed down | 2024 (reported expected savings) |

| ANIMAX Production Facility | Dog (facility) | Operational inefficiencies, lack of competitive advantage in production | Ceasing operations | June 2025 |

| Non-core Properties | Dog | Limited growth potential, not integral to core operations | Disposed of eight properties | 2024 (reported £7 million proceeds) |

Question Marks

Chirton Engineering, the sole remaining entity within Carr's Group's Engineering Division, is currently in a separate sale process. This situation places it squarely in the 'Question Mark' category of the BCG Matrix, as its future value is contingent on finding a suitable buyer and it is not presently aligned with the group's core strategic direction.

Carr's Group's expansion into new extensive grazing-based growth geographies, particularly in counter-seasonal, southern hemisphere markets, represents a strategic move into potential Stars. While these markets exhibit high growth, Carr's currently holds a low market share, indicating they are in the early stages of development within these regions.

Significant investment is anticipated to establish a strong market presence and transition these ventures from Question Marks to Stars. For instance, the Australian beef industry, a key target, saw its export value reach approximately AUD 10.5 billion in the 2023-2024 financial year, highlighting the substantial market opportunity.

Carr's Group's strategic partnership with Vétalis to create an advanced Tracesure® bolus range, slated for Autumn 2025 distribution, is currently positioned as a Question Mark in the BCG Matrix. This collaboration signifies a new venture with significant potential, aiming to bolster Carr's existing market leadership in animal health products.

The success of this partnership hinges on market acceptance and the necessary investment to drive adoption. If the Tracesure® boluses achieve strong market penetration and generate substantial revenue growth, they could transition into a Star, further solidifying Carr's Group's competitive standing. For instance, the animal health market, a key sector for Carr's, was projected to reach approximately $60 billion globally in 2024, highlighting the substantial opportunity if the new products resonate with customers.

Leveraging New Leadership in Agriculture for Growth

Carr's Group's Agriculture Division, under new leadership, is strategically positioning its feed supplement expertise as a 'Question Mark' within the BCG framework. This move signals a high-growth potential initiative, aiming to boost shareholder returns. The success hinges on how effectively this expertise translates into market-leading products and services, a critical factor given the competitive landscape.

- Strategic Focus The new leadership's plan to leverage feed supplement expertise is classified as a Question Mark, indicating a business unit with high growth potential but uncertain future success.

- Growth Potential This strategy is designed to capitalize on anticipated market expansion in specialized animal nutrition, a sector projected to see significant growth in the coming years.

- Execution Risk The ultimate success of this initiative depends heavily on the leadership's ability to execute their strategic plan, adapt to market dynamics, and secure necessary investments.

- Market Response A key determinant will be how effectively Carr's Group can penetrate and gain market share with its enhanced feed supplement offerings, a critical factor for its transition from a Question Mark to a Star.

Adoption of Precision Nutrition and Customized Feed Formulations

The animal nutrition market is experiencing a significant shift towards precision nutrition and customized feed formulations, a trend that positions this segment as a 'Question Mark' for Carr's Group. This technological advancement allows for tailored diets based on specific animal needs, growth stages, and environmental factors, promising improved efficiency and animal health.

Carr's Group must strategically invest in research and development to capitalize on this high-growth area. For instance, the global precision livestock farming market was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 12% through 2030, indicating substantial market potential.

- Market Growth: The precision nutrition segment is a rapidly expanding market, driven by demand for sustainable and efficient animal agriculture.

- Investment Needs: Carr's Group requires significant investment in technology, data analytics, and formulation expertise to compete effectively.

- Competitive Landscape: Failure to adapt could lead to a loss of market share to competitors who are already investing in these advanced solutions.

- Potential Returns: Successful adoption of precision nutrition could unlock new revenue streams and enhance Carr's Group's competitive positioning.

Carr's Group's strategic initiatives, such as Chirton Engineering's sale process and the development of the Tracesure® bolus range with Vétalis, are currently categorized as Question Marks. These ventures represent opportunities with high growth potential but face uncertainty regarding their future success and market reception.

The Agriculture Division's focus on feed supplement expertise also falls into the Question Mark category, signifying a high-potential area that requires strategic investment and effective execution to achieve market leadership.

The company's expansion into new grazing geographies, particularly in the southern hemisphere, is another Question Mark. While these markets offer significant growth opportunities, Carr's Group currently has a low market share, necessitating substantial investment to transition these into Stars.

The precision nutrition segment within animal agriculture is identified as a Question Mark due to its rapid evolution and the need for Carr's Group to invest in advanced technologies and data analytics to remain competitive.

| Business Unit/Initiative | BCG Category | Rationale | Market Growth Potential | Investment/Execution Needs |

|---|---|---|---|---|

| Chirton Engineering Sale | Question Mark | Sole remaining entity, future value contingent on buyer. | N/A (Divestment) | Successful sale process. |

| Southern Hemisphere Grazing Expansion | Question Mark | High growth markets, low current market share. | Significant (e.g., AUD 10.5bn Australian beef exports FY23-24) | Substantial investment for market penetration. |

| Tracesure® Bolus Range (Vétalis Partnership) | Question Mark | New venture with potential, market acceptance uncertain. | High (Global animal health market projected ~$60bn in 2024) | Market acceptance, R&D investment. |

| Feed Supplement Expertise | Question Mark | High growth potential, success depends on execution. | Growing (Specialized animal nutrition) | Translating expertise into market-leading products. |

| Precision Nutrition | Question Mark | Technological advancement, requires significant R&D. | Very High (Global precision livestock farming market ~$1.5bn in 2023, >12% CAGR) | Technology, data analytics, formulation expertise. |

BCG Matrix Data Sources

Our Carr's Group BCG Matrix leverages comprehensive financial disclosures, internal sales data, and detailed market research reports to accurately assess product performance and market share.