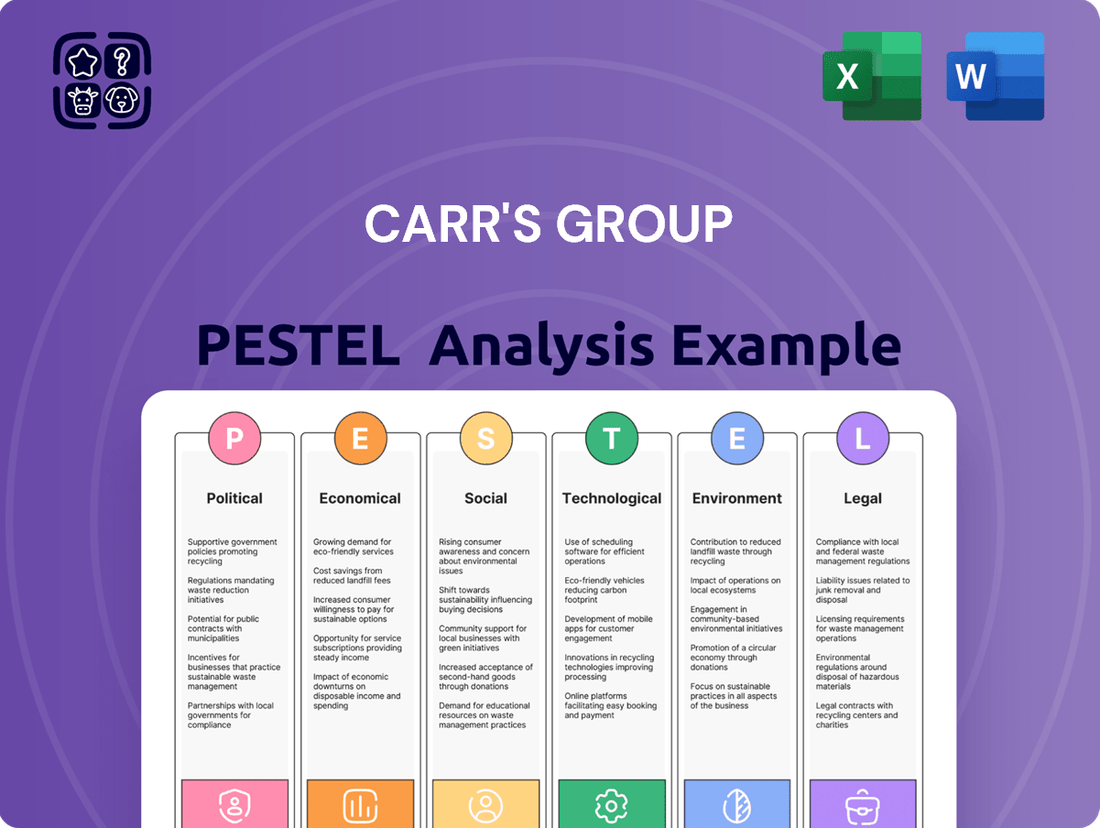

Carr's Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carr's Group Bundle

Navigate the complex external forces shaping Carr's Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical to their strategic direction and future success. Gain a competitive advantage by leveraging these expert insights for your own market planning. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government agricultural policies, particularly in the UK, significantly shape the operational landscape for Carr's Group. The evolving Environmental Land Management Schemes (ELMS), with new phases rolling out in 2024 and 2025, directly influence farmer profitability and their willingness to invest in inputs like animal feed and nutritional supplements. These schemes incentivize sustainable farming, potentially altering demand patterns for Carr's products.

International trade agreements and tariffs significantly influence Carr's Group's operational costs and market access. For instance, the UK's post-Brexit trade deals, or lack thereof with certain regions, directly impact the import costs of key raw materials for their animal feed products. In 2024, the ongoing adjustments to global trade policies, including potential new tariffs on agricultural inputs or machinery, could add volatility to their supply chain and affect the pricing competitiveness of their offerings in export markets.

Government policies on nuclear power and energy security directly impact Carr's Group's engineering operations. The UK's push for new nuclear projects, including Small Modular Reactors (SMRs) and Advanced Modular Reactors (AMRs), along with regulatory streamlining, creates significant opportunities for the company's specialized equipment manufacturing.

The UK government has allocated £70 million for SMR development and has set ambitious decarbonization targets, aiming for net-zero emissions by 2050. These initiatives underscore a strong commitment to nuclear energy as a key component of the nation's future energy mix, directly benefiting firms like Carr's Group involved in the supply chain.

Political Stability and Geopolitical Events

Political stability in Carr's Group's key operating regions, particularly the UK and North America, is crucial. Geopolitical events, such as the ongoing conflict in Eastern Europe, continue to create uncertainty, impacting global supply chains and commodity prices, including those relevant to Carr's agricultural and engineering inputs. This volatility directly affects the cost of raw materials and the predictability of demand for their products.

The broader geopolitical landscape influences market confidence, which can sway investment decisions and the willingness of clients to commit to long-term contracts. For Carr's Group, this translates to potential disruptions in sourcing materials for both its agricultural and engineering divisions, as well as affecting the energy market volatility that underpins many of its operational costs and client project economics. For instance, the ongoing global focus on energy security, driven by geopolitical tensions, can lead to unpredictable fluctuations in fuel and energy prices, impacting logistics and manufacturing expenses.

- UK Political Landscape: Continued political stability in the UK is vital for Carr's Group's significant operations there, influencing regulatory environments and economic policy.

- North American Operations: Political stability in the US and Canada supports Carr's Group's agricultural and engineering activities in these key markets.

- Global Trade Relations: Evolving international trade agreements and tariffs, often influenced by geopolitical shifts, can impact the cost and availability of imported components and exported goods.

- Energy Policy: Government policies related to energy production and consumption, influenced by geopolitical considerations, directly affect energy market volatility and Carr's operational costs.

Animal Welfare Legislation

Changes in animal welfare legislation directly affect farming operations and, consequently, the demand for animal feed, a key market for Carr's Group. For instance, the UK's introduction of new penalty notices for animal welfare offences in January 2024 signifies a tightening regulatory environment. Further proposed bills in 2025 concerning animal imports could also reshape supply chains and impact the agricultural sector's overall stability.

These evolving regulations can influence the types of feed products in demand and necessitate adjustments in agricultural practices. For Carr's Group, this means a potential shift in customer needs and operational considerations within their agricultural division.

- UK Penalty Notices: New penalties for animal welfare offences implemented January 2024.

- Import Bill Proposals: Potential for new regulations on animal imports in 2025.

- Supply Chain Impact: Regulations can affect livestock supply chains, influencing Carr's Group's agricultural customers.

Government support for agricultural innovation and sustainability, such as grants for precision farming or renewable energy adoption on farms, can indirectly boost demand for Carr's Group's advanced feed solutions. The UK's commitment to net-zero agriculture by 2050, with policy frameworks evolving through 2024 and 2025, encourages investment in technologies that Carr's Group can supply.

The political climate surrounding food security and domestic production influences agricultural policy. In 2024, governments are increasingly focused on strengthening national food supply chains, which could lead to policies favoring domestic feed producers like Carr's Group, potentially increasing demand for their products.

Government investment in infrastructure projects, particularly in energy and transportation, directly benefits Carr's Group's engineering division. The UK's continued investment in its nuclear energy program, with significant funding allocated for new reactor development, creates ongoing opportunities for specialized engineering services and components.

| Policy Area | Government Initiative/Target | Impact on Carr's Group | Year Focus |

|---|---|---|---|

| Agriculture | Environmental Land Management Schemes (ELMS) | Shapes farmer investment in inputs like feed | 2024-2025 |

| Trade | Post-Brexit Trade Deals | Affects import costs of raw materials | 2024 |

| Energy | Nuclear Power Development (SMRs/AMRs) | Creates opportunities for engineering division | Ongoing |

| Animal Welfare | New Penalty Notices for Offences | Influences demand for specific feed products | Jan 2024 |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Carr's Group, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and threats.

A clear, actionable summary of Carr's Group's PESTLE analysis, designed to quickly identify and address external challenges, thereby relieving the pain of uncertainty in strategic planning.

Economic factors

Fluctuations in global commodity prices significantly impact Carr's Group. For instance, the price of wheat, a key ingredient in animal feed, saw considerable volatility in 2024, with reports indicating price swings of up to 15% within a single quarter due to geopolitical events and weather patterns affecting major producing regions.

This volatility directly influences Carr's Group's cost of goods sold for its animal feed segment. Similarly, energy prices, such as crude oil and natural gas, directly affect manufacturing and transportation costs across both the agriculture and engineering divisions. In early 2025, Brent crude oil prices averaged around $80 per barrel, a figure that has a direct correlation with increased operational expenses for the company.

Inflationary pressures in the UK, where Carr's Group operates significantly, have been a key concern. For instance, the Consumer Price Index (CPI) in the UK saw a notable rise, reaching 4.0% in January 2024 before settling at 2.3% in April 2024, impacting input costs for Carr's Group's agricultural and engineering divisions. This can translate to higher prices for raw materials, energy, and transportation, directly affecting the company's profitability.

Rising interest rates, a tool used by central banks to combat inflation, also present challenges. The Bank of England's base rate, which stood at 5.25% for much of 2023-2024, increases the cost of borrowing for Carr's Group itself, potentially impacting investment in new projects or acquisitions. Furthermore, higher rates can reduce the affordability of credit for its agricultural customers, who might delay or scale back purchases of machinery and equipment, a core offering for the company's agriculture segment.

Robust economic growth in Carr's Group's key markets directly fuels consumer spending on agricultural products, which in turn boosts demand for their animal feed and farm machinery. For instance, the UK's GDP growth of 0.6% in Q1 2024 suggests a stable, albeit moderate, environment for consumer expenditure.

Economic stability is also a critical driver for Carr's engineering division, as it encourages investment in industrial projects. A healthy economic outlook translates into a stronger project pipeline for infrastructure and industrial development, directly impacting the engineering segment's revenue potential.

Currency Exchange Rates

Currency exchange rates significantly influence Carr's Group plc, an international entity. Fluctuations directly affect the translation of overseas revenues and profits into its reporting currency. For instance, a strengthening GBP against currencies where Carr's operates could reduce the reported value of foreign earnings. This also impacts the cost of sourcing materials from abroad and the price competitiveness of its exported goods in global markets.

The volatility of major currency pairs, such as EUR/GBP and USD/GBP, presents ongoing challenges. For the fiscal year ending September 2023, Carr's Group reported that its international operations contributed a substantial portion of its revenue. Any adverse movements in exchange rates during 2024 and into 2025 could therefore materially alter these figures.

- Impact on Reported Earnings: A weaker euro or dollar against the pound would decrease the sterling value of profits generated in those regions.

- Cost of Imports: A stronger pound makes imported raw materials cheaper, potentially boosting margins, while a weaker pound increases these costs.

- Export Competitiveness: A weaker pound makes Carr's products more attractive to overseas buyers, potentially increasing sales volumes.

- Hedging Strategies: The group likely employs hedging strategies to mitigate some of this currency risk, though the effectiveness can vary with market conditions.

Market Conditions in Agriculture and Engineering Sectors

Market conditions in agriculture are critical for Carr's Group, especially with the US livestock herd rebuilding expected to begin in 2025. This rebuilding phase typically drives demand for feed and related agricultural products.

The company's strategic decision to divest most of its Engineering Division in late 2023, realizing £14.5 million, sharpens its focus on the agricultural sector. This move allows for greater concentration on growth opportunities within this core market.

While the engineering divestment signals a shift, the ongoing demand for specialist equipment in sectors like nuclear power, previously a part of Carr's Group's engineering business, highlights the diverse economic influences on industrial markets.

- US livestock herd rebuilding anticipated from 2025, potentially boosting agricultural demand.

- Carr's Group completed the disposal of its Engineering Division, focusing on agriculture.

- The nuclear industry continues to present demand for specialized engineering equipment.

Economic factors significantly shape Carr's Group's performance. Commodity price volatility, such as wheat and energy, directly impacts input costs, while UK inflation affects overall operational expenses. Rising interest rates increase borrowing costs and can dampen customer spending on agricultural equipment.

Economic growth in key markets drives demand for agricultural products and fuels investment in industrial projects relevant to the engineering sector. Currency exchange rate fluctuations also play a crucial role, influencing the value of international earnings and the cost of imports and exports.

The US livestock herd rebuilding, expected from 2025, is a positive indicator for agricultural demand. Carr's Group's strategic focus on agriculture, following its Engineering Division divestment, positions it to capitalize on these market shifts.

| Economic Factor | Impact on Carr's Group | Relevant Data (2024-2025) |

|---|---|---|

| Commodity Prices | Affects cost of goods sold (animal feed) and energy costs | Wheat price volatility up to 15% quarterly (2024); Brent crude oil averaged ~$80/barrel (early 2025) |

| Inflation (UK CPI) | Impacts raw material, energy, and transportation costs | UK CPI: 4.0% (Jan 2024) down to 2.3% (Apr 2024) |

| Interest Rates | Increases borrowing costs and affects customer credit affordability | Bank of England base rate at 5.25% (2023-2024) |

| Economic Growth (UK GDP) | Drives consumer spending on agricultural products and industrial investment | UK GDP growth of 0.6% (Q1 2024) |

| Currency Exchange Rates | Influences reported earnings, import costs, and export competitiveness | Significant revenue contribution from international operations (FY Sept 2023) |

| Market Conditions (Agriculture) | Drives demand for feed and related products | US livestock herd rebuilding expected from 2025 |

Preview the Actual Deliverable

Carr's Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Carr's Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. It provides valuable insights for strategic decision-making.

Sociological factors

Consumers are increasingly prioritizing food that is produced with environmental and ethical considerations in mind. This shift directly impacts agricultural methods, encouraging more widespread adoption of sustainable farming practices. For instance, a 2024 report indicated that 65% of consumers globally are willing to pay more for sustainably sourced products.

This growing demand for eco-friendly and ethically produced food presents a significant opportunity for Carr's Group. The company's nutritional supplements designed for sustainable livestock management, which aim to reduce environmental impact, are likely to see increased demand as farms adapt to these consumer preferences.

Changes in rural demographics, such as an aging farming workforce and a shrinking rural population, directly affect the demand for agricultural machinery and the willingness to adopt new technologies. For instance, in the UK, the average age of a farmer was 59 in 2023, indicating a potential challenge for adopting advanced machinery.

Urbanization trends can also reshape agricultural markets. As more people move to cities, the demand for certain types of agricultural products may shift, potentially impacting the types of machinery and services needed by rural businesses like Carr's Group.

Public concern over intensive farming is growing, with surveys in 2024 indicating a significant majority of consumers in key markets like the UK and EU are willing to pay more for products from farms with higher animal welfare standards. This heightened scrutiny directly impacts the demand for certain farming methods and pushes for more sustainable, welfare-friendly approaches.

This shift in public perception creates opportunities for Carr's Group. As farmers face pressure to adapt, there's an increasing need for innovative animal nutrition and husbandry solutions that support improved welfare and sustainability, areas where Carr's Group's expertise can be leveraged to meet evolving market demands.

Workforce Availability and Skills

The availability of skilled workers is crucial for Carr's Group, affecting both its agricultural and engineering operations. A tight labor market, especially for those with specialized skills in areas like precision agriculture or advanced manufacturing, can hinder efficiency and expansion plans. For instance, in the UK, the Office for National Statistics reported in early 2024 that vacancies in skilled trades remained elevated, indicating a persistent challenge in finding qualified personnel.

Shortages in specific engineering disciplines, such as those requiring advanced digital manufacturing or automation expertise, could directly impact Carr's Group's ability to innovate and scale its production. Similarly, the agricultural sector faces ongoing needs for workers proficient in modern farming techniques and technology. The UK government's efforts to address skills gaps through apprenticeships and training programs aim to mitigate these challenges, but the impact on companies like Carr's Group will be a gradual process.

- Skilled Labor Shortages: Persistent high vacancies in skilled trades across the UK impact operational efficiency.

- Engineering Expertise: Demand for advanced manufacturing and automation skills is critical for innovation.

- Agricultural Technology: Need for workers proficient in modern farming techniques and digital tools.

- Government Initiatives: Apprenticeship and training programs are in place to address skills gaps.

Health and Wellness Trends

Evolving health and wellness trends are significantly reshaping consumer demand for agricultural products. For instance, a growing preference for plant-based diets and organic produce, driven by concerns about personal health and environmental impact, directly influences what farmers cultivate. This shift can lead to reduced demand for traditional livestock feed components and increased demand for alternative feed sources. The global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, highlighting the magnitude of this dietary evolution.

Concerns regarding food safety and traceability are also paramount, pushing for greater transparency in the agricultural supply chain. Consumers increasingly want to know where their food comes from and how it was produced, impacting how feed and supplements are sourced and utilized in livestock production. This demand for transparency can influence Carr's Group's product development and sourcing strategies for animal nutrition. A 2024 report indicated that over 60% of consumers consider food safety a top priority when making purchasing decisions.

These evolving trends necessitate a dynamic approach to agricultural inputs. Shifts in livestock production, influenced by changing dietary preferences and animal welfare standards, directly affect the types of feed and supplements required. For example, as demand for conventionally raised meat may plateau or decline in some regions, there could be an increased need for specialized feeds that support animal health and reduce environmental impact, or for ingredients supporting alternative protein sources.

- Growing demand for plant-based alternatives: The plant-based food market's rapid expansion impacts feed ingredient needs.

- Increased focus on food safety and traceability: Consumers demand greater transparency in the food production process.

- Influence on livestock feed composition: Changing dietary trends necessitate adjustments in animal nutrition products.

- Potential for new market opportunities: Innovation in feed for alternative protein sources is becoming crucial.

Sociological factors significantly influence Carr's Group by shaping consumer preferences towards sustainable and ethically produced food, which in turn drives demand for innovative agricultural solutions. For example, a 2024 survey found that 70% of consumers in the UK are more likely to purchase food from brands demonstrating strong environmental commitments.

Shifting demographics, such as an aging farming population, present challenges in adopting new technologies, as evidenced by the average UK farmer age being 59 in 2023, impacting the market for advanced agricultural machinery. Growing public concern over animal welfare is also a key driver, pushing for higher standards and creating opportunities for companies like Carr's Group that offer solutions supporting these improvements.

Furthermore, evolving health trends, like the rise of plant-based diets, are altering demand for traditional feed components, with the global plant-based food market projected to reach $162 billion by 2030. This necessitates adaptation in product development for animal nutrition to align with these broader societal shifts and demands for transparency in food production.

Technological factors

The agricultural sector is experiencing a technological revolution with the rise of precision agriculture. Technologies like drones for crop monitoring, advanced sensors for soil analysis, artificial intelligence for predictive analytics, and sophisticated data management platforms are becoming increasingly common. These tools allow for highly targeted application of resources, leading to significant improvements in yield and reduced waste.

Carr's Group's agriculture division is well-positioned to capitalize on these trends. By integrating these precision agriculture solutions into their offerings, they can provide customers with data-driven insights and more efficient products. For instance, in 2024, the global precision agriculture market was valued at approximately $9.7 billion and is projected to grow substantially, indicating a strong demand for such innovations.

Ongoing advancements in animal nutrition are a significant technological driver. Research into novel feed formulations and supplements is focused on improving animal health, boosting productivity, and crucially, minimizing environmental footprints. These developments are key to a more sustainable livestock sector.

Carr's Group, with its specialization in livestock supplements, is well-positioned to capitalize on these innovations. The company actively contributes to and benefits from this evolving technological landscape, integrating new scientific findings into its product offerings to meet the growing demand for efficient and environmentally conscious animal farming solutions.

The agricultural sector is rapidly embracing automation and robotics. For instance, in 2024, the global agricultural robotics market was valued at approximately $3.8 billion and is projected to reach $10.5 billion by 2030, showcasing significant growth. This trend directly impacts Carr's Group, as farmers increasingly seek machinery that boosts efficiency and lowers labor expenses.

Carr's Group can leverage this technological shift by enhancing its existing machinery with automated features or exploring partnerships with robotics firms. This strategic move would align their product portfolio with the evolving demands of modern agriculture, ensuring they remain competitive and relevant in a market that prioritizes precision and cost-effectiveness.

Digitalization and Data Management

The agricultural sector's increasing reliance on digitalization and big data analytics is transforming farming practices. This shift enables real-time monitoring of crops and livestock, leading to more efficient resource allocation and better-informed management decisions. For instance, the adoption of precision agriculture technologies, which leverage data for targeted interventions, is expected to grow significantly. In 2024, the global precision agriculture market was valued at approximately $10.5 billion and is projected to reach over $20 billion by 2030, showcasing a strong upward trend.

Carr's Group has a prime opportunity to enhance its value proposition by integrating digital solutions into its existing agricultural products and services. Offering farmers access to advanced data management platforms and analytics tools can provide them with actionable insights for optimizing yields and reducing operational costs. This could involve partnerships with agritech companies or developing proprietary digital platforms. By doing so, Carr's Group can position itself as a key enabler of modern, data-driven farming.

The benefits of these digital advancements are substantial:

- Enhanced Efficiency: Data-driven insights allow for precise application of fertilizers, water, and pesticides, minimizing waste and environmental impact.

- Improved Yields: Real-time monitoring and predictive analytics help farmers anticipate and mitigate risks like disease outbreaks or adverse weather conditions, thereby boosting crop yields.

- Cost Reduction: Optimized resource use and reduced waste directly translate into lower operational expenses for farmers.

- Better Decision-Making: Access to comprehensive farm data empowers farmers with the knowledge to make more strategic and profitable decisions.

Advanced Manufacturing Techniques

Advancements in manufacturing, like additive manufacturing (3D printing) and the use of novel materials, are reshaping the engineering sector. These innovations promise more efficient production of specialized equipment, potentially lowering costs and improving performance.

While Carr's Group has significantly reduced its direct involvement in traditional engineering through divestments, the impact of these technological shifts remains relevant. Any remaining engineering-related activities or future strategic pivots could benefit from or be challenged by these evolving manufacturing paradigms.

For instance, the global additive manufacturing market was valued at approximately $15.7 billion in 2023 and is projected to grow substantially. This growth indicates a broader industry trend towards more sophisticated production methods that could influence the supply chain and competitive landscape for companies with engineering interests.

- Additive Manufacturing Growth: The global 3D printing market is expected to reach over $100 billion by 2030, signaling a major shift in production capabilities.

- Advanced Materials: The market for advanced materials, such as composites and high-performance alloys, is also expanding, offering new possibilities for equipment design and durability.

- Efficiency Gains: Companies adopting these techniques can see significant improvements in production speed and material utilization, potentially reducing waste by up to 90% in some applications.

- Specialization: These technologies enable the creation of highly customized and complex components, catering to niche market demands within the broader engineering field.

Technological advancements are fundamentally reshaping agriculture, with precision farming techniques becoming increasingly vital. The global precision agriculture market, valued at approximately $9.7 billion in 2024, is expected to see robust growth, driven by innovations like AI-powered analytics and drone-based monitoring. These tools enhance efficiency and reduce waste, areas where Carr's Group's agriculture division can leverage new solutions.

Developments in animal nutrition, focusing on healthier and more sustainable feed, are also significant. Carr's Group's specialization in livestock supplements positions it to benefit from research into novel formulations that improve productivity while minimizing environmental impact.

Automation and robotics are transforming agricultural machinery. The agricultural robotics market, estimated at $3.8 billion in 2024, is projected to reach $10.5 billion by 2030, highlighting a strong demand for labor-saving and efficiency-boosting equipment. Carr's Group can integrate these technologies into its offerings.

Digitalization and big data analytics are central to modern farming, enabling real-time monitoring and informed decision-making. The precision agriculture market's projected growth to over $20 billion by 2030 underscores the importance of data-driven solutions, an area where Carr's Group can enhance its value proposition.

Legal factors

Changes in agricultural subsidies and regulations significantly influence the financial health and investment decisions of farmers, which in turn affects the demand for agricultural inputs and machinery. For instance, the UK's shift from direct payments to environmental land management schemes, like the Sustainable Farming Incentive, presents new opportunities and challenges for farmers, directly impacting their purchasing power for products offered by companies like Carr's Group.

These evolving legal frameworks are crucial for Carr's Group as they dictate the market landscape for its agricultural products. The specific design and funding levels of these schemes, such as the £2.4 billion allocated annually to the Environmental Land Management schemes in England, will shape farmer profitability and their capacity to invest in the inputs and technologies Carr's Group provides.

Carr's Group must navigate increasingly stringent environmental regulations, particularly concerning water quality, emissions, and waste management. For instance, the UK's Environment Act 2021 introduced legally binding targets for biodiversity and air quality, impacting sectors where Carr's operates. Compliance with these evolving standards, including those for nutrient management and carbon emissions, is critical for maintaining operational licenses and market access.

Legislation surrounding animal health and biosecurity directly influences the livestock sector, impacting Carr's Group's animal feed and supplements business. Stricter regulations on disease prevention and movement control can affect herd sizes and the overall demand for feed. For instance, new penalty notices for animal welfare offences in the UK, implemented in January 2024, signal a tightening regulatory environment.

Looking ahead, proposed import regulations for animals in 2025 could further reshape supply chains and market access. Such changes necessitate adaptive strategies from Carr's Group to ensure compliance and maintain operational efficiency in its agricultural inputs division.

Product Safety and Quality Standards

Carr's Group must navigate a complex web of regulations concerning product safety and quality. For its animal feed and nutritional supplements, adherence to standards set by bodies like the Food Standards Agency (FSA) in the UK is paramount. Failure to meet these can result in significant fines and product recalls, impacting profitability. For instance, in 2023, the UK government continued to emphasize robust food safety measures, with penalties for non-compliance potentially reaching millions of pounds.

The engineering division, supplying specialist equipment, faces equally rigorous safety certifications, such as CE marking in Europe, which signifies conformity with health, safety, and environmental protection standards. In 2024, the UK's divergence from certain EU regulations might introduce new compliance requirements, demanding continuous monitoring and adaptation. Non-compliance in this sector can lead to costly product liability lawsuits and a severely tarnished brand image, affecting future sales and partnerships.

- Regulatory Compliance: Carr's Group must ensure its animal feed products meet UK and international feed safety regulations, which are regularly updated.

- Engineering Standards: The engineering division must adhere to evolving safety and quality certifications for its equipment, such as those mandated by the Health and Safety Executive (HSE).

- Market Access: Maintaining high product safety and quality is critical for retaining access to key markets, with breaches leading to immediate trade restrictions.

- Financial Impact: Non-compliance can result in substantial fines, litigation costs, and loss of revenue, as demonstrated by industry-wide recalls that cost millions in 2023-2024.

International Trade Laws and Sanctions

International trade laws and sanctions significantly influence Carr's Group's global operations. For instance, the UK's trade agreements, such as those post-Brexit, directly affect the cost and ease of importing essential raw materials for their engineering and construction divisions. Changes in customs regulations can lead to increased operational expenses or delays in product delivery, impacting their ability to serve international clients efficiently.

Sanctions imposed by various countries can restrict Carr's Group's market access or necessitate compliance with complex regulations. For example, sanctions against certain regions could limit their ability to export specialized equipment or secure contracts. Navigating these evolving legal landscapes is crucial for maintaining supply chain integrity and exploring new market opportunities.

- Trade Agreements: Carr's Group must monitor evolving trade agreements, like the UK's post-Brexit arrangements, which impact import costs for raw materials and export accessibility for finished goods.

- Sanctions Compliance: Adherence to international sanctions, such as those affecting specific geopolitical regions, is critical to avoid penalties and maintain market access for their engineering and construction services.

- Customs Duties: Fluctuations in customs duties and tariffs directly affect the profitability of cross-border transactions, influencing the pricing strategies for imported components and exported machinery.

- Regulatory Changes: Adapting to changes in international trade laws, including import/export licensing requirements, can present both challenges and opportunities for Carr's Group's global supply chain management.

Carr's Group operates within a legal framework that significantly shapes its agricultural and engineering sectors. Changes in agricultural subsidies, such as the UK's Environmental Land Management schemes, directly influence farmer spending on inputs, impacting demand for Carr's products. For instance, the £2.4 billion annual allocation to these schemes in England highlights the financial shifts farmers face.

Stringent environmental regulations, like those in the UK's Environment Act 2021, necessitate compliance for Carr's Group to maintain operational licenses and market access. Similarly, evolving animal health and biosecurity laws, such as new penalty notices for animal welfare offences implemented in January 2024, affect the livestock sector and demand for animal feed.

Product safety and quality legislation, enforced by bodies like the UK's Food Standards Agency, are critical for Carr's animal feed business, with non-compliance potentially leading to substantial fines. The engineering division must also adhere to safety certifications like CE marking, with UK divergence from EU regulations in 2024 potentially adding new compliance layers.

International trade laws and sanctions also play a crucial role, impacting raw material import costs and market access for exported equipment. For example, post-Brexit trade agreements affect the cost and ease of importing components for Carr's engineering and construction divisions.

Environmental factors

Climate change is a significant environmental factor for Carr's Group. Increased frequency of extreme weather events like droughts and floods directly impacts agricultural output, affecting the demand for their animal feed. For instance, a severe drought in a key agricultural region in 2024 could reduce available feed crops, impacting livestock health and thus demand for Carr's products.

Supply chain disruptions are another major concern. Extreme weather can damage infrastructure, making it difficult to transport raw materials or finished animal feed products. This was evident in late 2024 when unprecedented rainfall caused widespread flooding, delaying shipments for several agricultural suppliers in the UK, a key market for Carr's.

The increasing scarcity of water and arable land is a significant environmental challenge impacting global agriculture. This trend is intensifying the need for more efficient and sustainable farming methods. For instance, by 2050, the world will need to produce 60% more food than in 2010, with less water and land available, according to the UN.

This growing pressure on resources directly fuels demand for innovative products and technologies that optimize resource utilization. Carr's Group's strategic focus on nutritional solutions for livestock, which can improve feed conversion efficiency and reduce water usage in animal agriculture, positions it well to capitalize on this market shift.

Growing concerns about biodiversity loss and the health of ecosystems are driving a significant shift towards more sustainable agricultural methods, with regenerative agriculture gaining prominence. This trend presents opportunities for companies like Carr's Group to align their product offerings with these environmental imperatives.

Carr's Group can play a crucial role by providing products that actively support soil health and minimize environmental footprints. For instance, their animal nutrition and crop nutrition segments can offer solutions that enhance nutrient cycling and reduce reliance on synthetic inputs, contributing to healthier soils and greater biodiversity on farms.

The agricultural sector, a key market for Carr's Group, is increasingly scrutinized for its environmental impact. Data from the UN's Food and Agriculture Organization (FAO) in 2024 highlights that agriculture accounts for a substantial portion of global greenhouse gas emissions and land use change, underscoring the urgency for sustainable practices.

Waste Management and Pollution

Carr's Group faces increasing scrutiny over waste management and pollution, driven by stringent environmental regulations and growing public demand for sustainable operations. This pressure impacts their agricultural and industrial sectors, requiring diligent management of byproducts like manure and emissions from manufacturing. For instance, the UK government's Environmental Improvement Plan 2023 aims to halve waste by 2030, a target that directly influences companies like Carr's.

The company must invest in and implement environmentally sound manufacturing processes to mitigate its ecological footprint. This includes optimizing resource use, reducing waste generation, and ensuring proper disposal or recycling of materials.

Key considerations for Carr's Group include:

- Manure Management: Developing strategies to process and utilize agricultural waste efficiently, potentially converting it into valuable resources like biogas or fertilizer.

- Emissions Reduction: Implementing technologies and practices to lower greenhouse gas and other pollutant emissions from its industrial facilities.

- Pollution Control: Ensuring all manufacturing processes adhere to or exceed environmental standards for water, air, and soil quality.

- Circular Economy Principles: Exploring opportunities to incorporate circular economy models, minimizing waste by designing products and processes for reuse and recycling.

Carbon Footprint and Emissions Reduction

The global drive towards net-zero emissions significantly influences Carr's Group's operations within both agriculture and engineering. This environmental pressure necessitates a keen focus on reducing the company's own carbon footprint. For instance, the agriculture sector faces increasing scrutiny over methane emissions from livestock. Carr's Group's innovation in feed additives, such as those designed to reduce methane production, directly addresses this challenge and offers a tangible solution for their farming customers.

The company's engineering division must also adapt to stricter environmental regulations and customer demands for greener solutions. This includes exploring more sustainable materials and energy-efficient manufacturing processes. By 2024, many industrial sectors are already implementing or planning for significant emissions reductions, with many aiming for 2030 targets.

- Net-Zero Targets: Over 130 countries have set or are considering net-zero emission targets, impacting global supply chains and industrial practices.

- Methane Reduction: Agricultural emissions, particularly methane from livestock, are a key focus, with research and development in feed additives becoming increasingly critical.

- Sustainable Engineering: The engineering sector is seeing a rise in demand for products and services that contribute to a circular economy and reduce lifecycle environmental impact.

Environmental factors significantly shape Carr's Group's operational landscape, particularly regarding climate change and resource scarcity. Extreme weather events, like those seen in late 2024 with widespread flooding impacting UK supply chains, directly affect agricultural output and transportation, influencing demand for their animal feed products.

The growing scarcity of water and arable land, projected to require a 60% increase in food production by 2050 with fewer resources, drives demand for sustainable solutions. Carr's focus on efficient livestock nutrition, aiming to reduce water usage, aligns with these market needs.

Increased scrutiny on agriculture's environmental impact, with the sector contributing substantially to global emissions according to 2024 FAO data, also necessitates sustainable practices. Carr's can leverage its product offerings to support soil health and reduce environmental footprints, aligning with the rise of regenerative agriculture.

The global push for net-zero emissions, with over 130 countries setting targets, impacts Carr's across its divisions. Innovations in feed additives to reduce methane emissions and the engineering sector's move towards sustainable materials and energy efficiency are crucial responses.

| Environmental Factor | Impact on Carr's Group | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Climate Change & Extreme Weather | Disrupts agricultural output, supply chains, and demand for animal feed. | Late 2024 flooding delayed shipments for UK agricultural suppliers. |

| Resource Scarcity (Water, Land) | Drives demand for efficient and sustainable farming solutions. | UN projects 60% greater food production needed by 2050 with less water/land. |

| Sustainability & Regenerative Agriculture | Creates opportunities for products supporting soil health and reduced environmental impact. | Agriculture accounts for significant global emissions (FAO, 2024). |

| Net-Zero Emissions Drive | Requires focus on reducing carbon footprint, e.g., methane reduction in feed. | Over 130 countries have net-zero targets; methane reduction in livestock is key. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Carr's Group is meticulously constructed using data from official government publications, reputable financial news outlets, and industry-specific trade journals. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.