Capital Power SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Power Bundle

Capital Power's transition to cleaner energy sources presents significant growth opportunities, but also exposes them to regulatory shifts and the competitive pressures of the evolving energy market. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Capital Power's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Capital Power boasts a robust and expanding asset portfolio, encompassing approximately 9,800 to 12 gigawatts of capacity spread across 30 to 32 diverse facilities. This strategic diversification across North America, including natural gas, wind, and solar, acts as a significant strength, stabilizing revenues and reducing reliance on any single energy source or market.

The company's proactive approach to growth, highlighted by recent acquisitions primarily in the United States, has further strengthened its operational footprint and broadened its geographic diversification. This expansion not only enhances its overall capacity but also positions Capital Power to capitalize on a wider range of market opportunities and mitigate regional economic downturns.

Capital Power has showcased impressive financial strength, with its first quarter 2025 results highlighting robust adjusted EBITDA and net income figures. This positive trend is expected to continue throughout 2025, as evidenced by the company reaffirming its Adjusted EBITDA guidance in the range of $1,340 million to $1,440 million.

This consistent financial performance is a significant strength, providing a stable base for Capital Power to fund its growth initiatives and deliver value to its shareholders. It underscores the company's operational efficiency and its ability to generate reliable earnings in the current market environment.

Capital Power's strong leadership in decarbonization is a significant strength. The company has a clear net-zero emissions target for 2050 and is actively transitioning its energy portfolio from coal to cleaner sources like natural gas and renewables.

A prime example of this commitment is the Genesee Repowering project. This initiative alone is projected to cut CO2 emissions by roughly 3.4 million tonnes annually, all while boosting the facility's overall capacity. This proactive approach to environmental responsibility aligns well with the growing demand for sustainable energy solutions.

Proven Acquisition and Integration Capability

Capital Power has a well-established history of effectively acquiring and integrating power generation assets, especially within the United States. This proven ability allows them to expand their operational footprint and market reach efficiently.

Their recent acquisition of the Hummel and Rolling Hills natural gas facilities, a deal valued at approximately $3.0 billion, underscores this strength. This strategic move significantly bolsters their presence in the PJM Interconnection market, which is the largest in North America.

This demonstrated capability in acquisition and integration is a key driver for Capital Power's rapid growth and diversification strategies. It solidifies their competitive standing by enabling them to capitalize on strategic opportunities and expand their asset base effectively.

- Proven Track Record: Successfully acquired and integrated numerous power generation assets, primarily in the U.S.

- Significant Expansion: The $3.0 billion acquisition of Hummel and Rolling Hills natural gas facilities expanded their PJM Interconnection market presence.

- Market Dominance: The PJM Interconnection market is North America's largest, indicating strategic market entry.

- Growth Engine: This capability facilitates rapid growth and diversification, enhancing their competitive position.

Stable Cash Flows from Contracted Assets

Capital Power benefits from a robust foundation of stable cash flows, largely stemming from its portfolio of contracted assets. A significant portion of its revenue is secured through long-term power purchase agreements (PPAs), which offer predictable income streams and shield the company from the volatility of energy markets. For instance, as of the first quarter of 2024, approximately 70% of Capital Power's generation capacity was under contract, providing a strong base for financial planning and operational stability.

This contractual backbone is a key strength, ensuring financial predictability and resilience. The long-term nature of these agreements insulates Capital Power from short-term price swings in both power and natural gas markets. This stability is vital for covering operational expenses, maintaining consistent dividend payments to shareholders, and funding strategic investments in new projects and renewable energy transitions.

- Contracted Capacity: Around 70% of Capital Power's generation capacity was contracted in Q1 2024, ensuring stable revenue.

- PPA Stability: Long-term Power Purchase Agreements provide predictable cash flows, mitigating market volatility.

- Financial Resilience: Contracted assets offer a reliable income source, supporting operations and shareholder returns.

- Growth Funding: Stable cash flow facilitates investment in new projects and the company's decarbonization strategy.

Capital Power's diversified asset base, spanning approximately 9,800 to 12 gigawatts across 30 to 32 facilities in North America, is a significant strength. This mix of natural gas, wind, and solar power reduces reliance on any single energy source or market, stabilizing revenues.

The company's financial health, evidenced by strong Q1 2025 adjusted EBITDA and reaffirmed 2025 guidance of $1,340 million to $1,440 million, provides a solid foundation for growth and shareholder value. This financial stability supports ongoing initiatives and operational efficiency.

Capital Power's commitment to decarbonization, with a net-zero target for 2050 and active transition from coal to cleaner sources, is a key advantage. The Genesee Repowering project, set to cut CO2 emissions by an estimated 3.4 million tonnes annually, exemplifies this forward-looking strategy.

The company's proven ability to acquire and integrate assets, demonstrated by the $3.0 billion acquisition of Hummel and Rolling Hills natural gas facilities, strengthens its market position. This strategic expansion into the PJM Interconnection market, North America's largest, fuels growth and diversification.

Stable cash flows, with roughly 70% of capacity under contract as of Q1 2024 through long-term PPAs, provide financial predictability. This contractual backbone insulates Capital Power from market volatility, ensuring consistent income for operations and investments.

What is included in the product

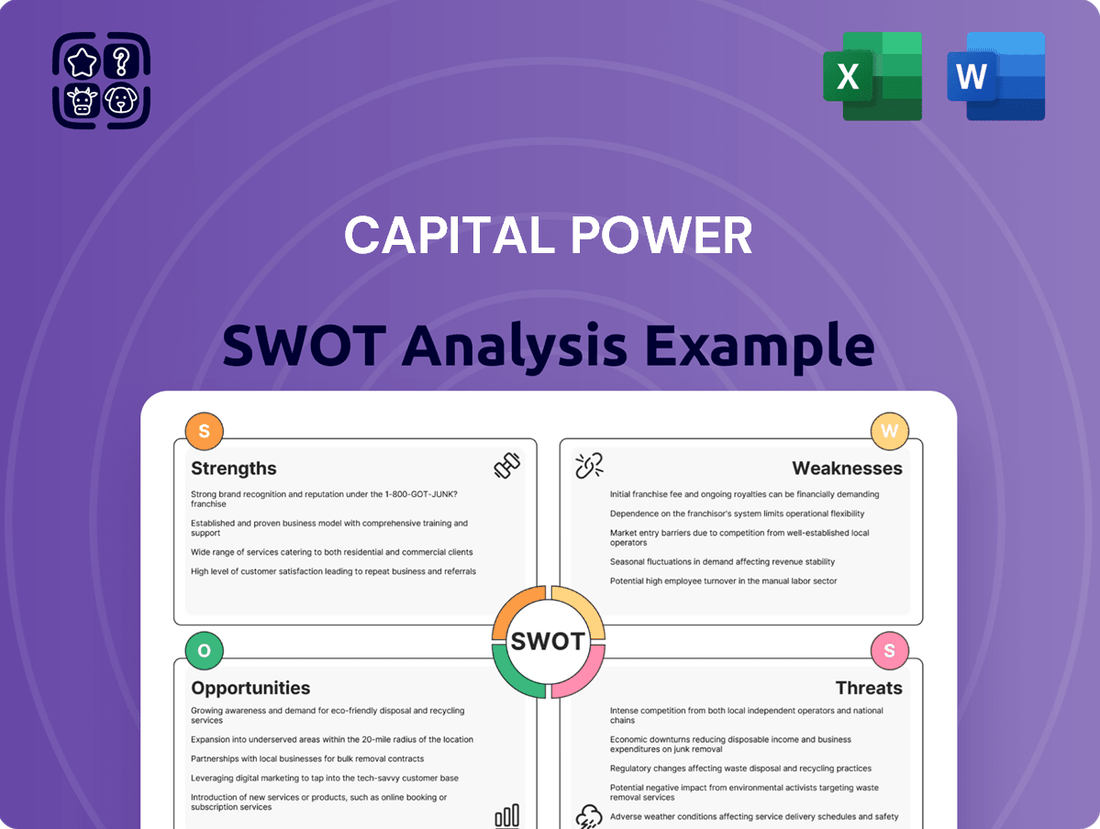

Offers a full breakdown of Capital Power’s strategic business environment, detailing its internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear, actionable framework for identifying and addressing Capital Power's strategic challenges.

Weaknesses

Capital Power's significant reliance on natural gas assets, accounting for roughly 85% of its total capacity as of early 2024, presents a notable weakness. This concentration exposes the company to considerable volatility in natural gas prices, which can directly impact operating costs and profitability.

Furthermore, this heavy dependence on natural gas places Capital Power at a disadvantage as regulatory environments increasingly favor cleaner energy sources. The ongoing global and regional push towards decarbonization means that assets heavily weighted towards fossil fuels may face greater scrutiny and potential policy headwinds, impacting long-term investment and operational strategies.

Capital Power's pursuit of growth through acquisitions has resulted in a substantial increase in its debt burden. This financial leverage makes the company particularly vulnerable to fluctuations in interest rates, which could escalate borrowing expenses for upcoming projects and further acquisitions.

For instance, as of the first quarter of 2024, Capital Power reported total debt of approximately $5.1 billion. A hypothetical 1% increase in interest rates on this debt could translate to an additional $51 million in annual interest expenses, impacting profitability and cash flow available for reinvestment or shareholder returns.

Managing this debt while continuing to fund significant capital expenditures, such as the development of new renewable energy projects, presents a continuous challenge. Maintaining its investment-grade credit rating is crucial for accessing favorable financing terms, making prudent financial management a top priority.

While strategic asset divestitures, like the sale of partial interests in wind facilities, can boost financial flexibility and realize equity returns, they inherently reduce direct revenue streams. For example, Capital Power's first quarter of 2025 saw a decrease in Canadian renewables revenue directly linked to these partial interest sales.

This necessitates a deliberate strategy to balance the long-term advantages of asset rotation with the immediate, albeit temporary, impact on reported revenue figures.

Regulatory and Market Rule Changes

Capital Power operates in heavily regulated wholesale power markets, making it vulnerable to shifts in market rules and environmental policies. For instance, the ongoing Market Renewal Program in Ontario, aimed at modernizing the market, could introduce new compliance costs and potentially affect existing power purchase agreements. Similarly, escalating carbon pricing mechanisms, such as those expected to continue evolving through 2025, directly impact operational expenses and future revenue projections.

These regulatory shifts necessitate constant vigilance and proactive strategic planning to mitigate financial risks and ensure continued profitability. For example, changes in emissions standards could require significant capital investment in retrofitting existing facilities or accelerating the transition to cleaner energy sources. Capital Power’s ability to adapt swiftly to these evolving frameworks is crucial for maintaining its competitive edge and long-term financial health.

- Regulatory Exposure: Capital Power's business model is inherently tied to the stability and predictability of wholesale power market regulations.

- Compliance Costs: Evolving environmental standards, including carbon pricing, can lead to increased operational expenditures.

- Contractual Impact: Changes in market rules may affect the terms and profitability of existing power purchase agreements.

- Strategic Adaptation: Continuous monitoring and flexible strategic adjustments are essential to navigate regulatory uncertainties.

Operational Risks of Diverse Fleet

Capital Power's diverse fleet, encompassing natural gas, wind, and solar assets across North America, presents significant operational challenges. Coordinating maintenance for varied technologies and optimizing fuel logistics for thermal plants require sophisticated management systems. For instance, in 2024, the company continued to invest in upgrading its natural gas facilities to improve efficiency and reduce emissions, a complex undertaking across multiple sites.

Ensuring consistent performance across these different technological platforms is another hurdle. Each energy source has unique operational parameters and potential failure points. This diversity necessitates specialized expertise and robust monitoring to maintain reliability and output, especially as the energy transition demands greater flexibility from existing assets.

- Maintenance Coordination: Managing distinct maintenance cycles for gas turbines, wind turbines, and solar arrays across various regulatory environments.

- Fuel Supply Optimization: Ensuring reliable and cost-effective natural gas procurement and transportation for thermal generation assets.

- Technological Performance: Addressing potential performance disparities and maintenance needs unique to each power generation technology.

- Regulatory Compliance: Navigating diverse environmental and operational regulations in multiple North American jurisdictions.

Capital Power's significant reliance on natural gas, representing about 85% of its capacity in early 2024, makes it susceptible to volatile natural gas prices, impacting costs and profits. This also positions the company unfavorably as regulations increasingly favor cleaner energy, potentially leading to policy challenges for its fossil fuel assets.

The company's substantial debt, around $5.1 billion as of Q1 2024, heightens its vulnerability to interest rate hikes, which could increase borrowing costs by an estimated $51 million annually for every 1% rise. Balancing debt management with capital expenditures for new renewable projects is a key challenge.

Divesting partial interests in assets, while improving financial flexibility, directly reduces revenue streams, as seen in Canadian renewables revenue in Q1 2025. This requires a careful balance between asset rotation benefits and immediate revenue impacts.

Operating in regulated markets exposes Capital Power to shifts in market rules and environmental policies. For example, the Ontario Market Renewal Program and evolving carbon pricing mechanisms through 2025 can introduce compliance costs and affect existing agreements.

Preview Before You Purchase

Capital Power SWOT Analysis

This is the actual Capital Power SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing you to leverage detailed insights into Capital Power's strategic positioning.

Opportunities

North America's power demand is surging, fueled by electrification, reshoring initiatives, and a massive boom in AI data centers. These data-hungry facilities are becoming significant electricity consumers, creating a substantial market for power providers like Capital Power.

Capital Power is strategically positioned to capitalize on this trend, actively pursuing opportunities to supply clean and reliable power to these growing sectors. The company is exploring partnerships and developing solutions tailored to the unique needs of large industrial users and data center operators.

The global shift towards decarbonization presents a prime opportunity for Capital Power to bolster its renewable energy assets. This includes expanding its footprint in solar and wind power generation, alongside strategic investments in energy storage technologies to enhance grid reliability and capture market share.

By capitalizing on these trends, Capital Power can tap into growing demand for clean energy, driven by increasing environmental regulations and corporate sustainability goals. For instance, the company's ongoing development of the 77 MWac High Plains Solar project, expected to be operational in late 2024, exemplifies this strategic expansion.

The U.S. power market, still quite fragmented, presents significant opportunities for Capital Power to acquire existing assets. These strategic acquisitions can be a more cost-effective route to growth than building new facilities from scratch, potentially allowing for quicker capacity expansion and broader market reach.

For instance, in 2024, the U.S. electricity generation capacity market saw continued activity, with some regions exhibiting lower asset valuations due to specific market conditions or aging infrastructure, making them attractive targets for consolidation by financially sound players like Capital Power.

Development of Advanced Decarbonization Technologies

Capital Power is strategically investing in advanced decarbonization technologies, such as carbon capture, utilization, and storage (CCUS) and green hydrogen production. These investments align with the company's commitment to achieving net-zero emissions by 2050 and position it to capitalize on the growing demand for low-carbon energy solutions. For instance, Capital Power is involved in the Genesee CCUS project, aiming to capture a significant portion of CO2 emissions from its power generation facilities.

The development and deployment of these innovative technologies present substantial growth opportunities. By pioneering CCUS and hydrogen, Capital Power can establish new revenue streams and enhance its competitive edge in a rapidly transforming energy landscape. This forward-thinking approach is crucial for long-term value creation and meeting future energy needs sustainably.

- CCUS Investment: Capital Power is actively pursuing CCUS projects, such as the Genesee CCUS initiative, to reduce its carbon footprint.

- Hydrogen Exploration: The company is exploring the potential of hydrogen as a clean fuel source, including production and integration into its operations.

- Net-Zero Alignment: These technological advancements are key to achieving Capital Power's ambitious net-zero emissions targets.

- Future Growth Potential: Investing in these emerging decarbonization solutions opens avenues for new markets and revenue generation.

Leveraging Existing Assets for New Uses

Capital Power has a significant opportunity to repurpose its existing assets for emerging energy technologies. This includes utilizing its extensive land holdings and operational know-how to support new ventures. For instance, the company is exploring the potential of Small Modular Reactors (SMRs) in Alberta, a move that could significantly diversify its energy portfolio and leverage existing sites.

The joint assessment with Ontario Power Generation for SMR development highlights this strategic direction. SMRs are seen as a key technology for providing clean, reliable baseload power, a critical component for future energy grids. This initiative aligns with Capital Power's strategy to adapt and innovate within the evolving energy landscape, potentially unlocking new revenue streams and enhancing its market position.

- Asset Repurposing: Capital Power can leverage its existing infrastructure, including land and operational expertise, for new energy solutions like SMRs.

- SMR Potential: The company is jointly assessing SMR development in Alberta with Ontario Power Generation, aiming for clean, reliable baseload power.

- Diversification: This strategic move diversifies Capital Power's future energy supply and optimizes the use of its current operational sites.

The increasing demand for electricity, driven by AI and reshoring, presents a significant growth avenue for Capital Power. The company is also well-positioned to benefit from the global push towards decarbonization by expanding its renewable energy portfolio, including solar and wind projects like the High Plains Solar development expected in late 2024. Furthermore, the fragmented U.S. power market offers opportunities for strategic asset acquisitions, potentially accelerating capacity expansion.

Capital Power's investment in advanced decarbonization technologies such as Carbon Capture, Utilization, and Storage (CCUS) and green hydrogen production aligns with its net-zero by 2050 commitment and taps into the growing market for low-carbon solutions. For example, the Genesee CCUS project aims to significantly reduce emissions. The company is also exploring the repurposing of existing assets for emerging technologies like Small Modular Reactors (SMRs), as seen in their joint assessment for SMR development in Alberta.

| Opportunity Area | Description | Key Initiatives/Examples | 2024/2025 Relevance |

|---|---|---|---|

| Surging Power Demand | Increased electricity consumption from AI data centers and reshoring initiatives. | Supplying clean and reliable power to large industrial users and data centers. | Directly addresses growing North American energy needs. |

| Decarbonization & Renewables | Global shift towards cleaner energy sources and corporate sustainability goals. | Expanding solar and wind capacity (e.g., High Plains Solar project operational late 2024), energy storage. | Aligns with regulatory trends and market demand for green energy. |

| Asset Acquisition | Fragmented U.S. power market with potential for cost-effective growth. | Acquiring existing power generation assets. | Offers faster market entry and capacity expansion compared to new builds. |

| Decarbonization Technologies | Developing and deploying CCUS and green hydrogen solutions. | Genesee CCUS project, exploring hydrogen production. | Positions Capital Power for future low-carbon energy markets and meets net-zero targets. |

| Asset Repurposing | Leveraging existing infrastructure for new energy technologies. | Exploring Small Modular Reactors (SMRs) in Alberta (joint assessment with OPG). | Diversifies energy portfolio and optimizes existing operational sites. |

Threats

Stricter environmental policies and rising carbon prices represent a significant financial threat to Capital Power. For instance, Ontario's carbon pricing is slated to increase to $170 per tonne of CO2 equivalent by 2030, directly impacting the cost of operating fossil fuel assets.

These evolving regulations, coupled with more stringent performance standards for existing fossil fuel generation, could substantially increase operational expenses for Capital Power's natural gas facilities. While some of its current contracts might offer a degree of protection, the overarching regulatory environment suggests a clear trend toward higher compliance costs.

The power sector is seeing more players, especially with the big push into renewables. This means Capital Power might face tougher competition when looking for new projects or trying to grow its market share. For example, in 2024, global investment in renewable energy capacity is projected to reach new highs, creating more opportunities but also more rivals.

This increased competition can lead to lower profit margins on projects. It also makes it harder to lock in good long-term deals for selling power, which is crucial for stable revenue. Companies like Capital Power will need to stay sharp and find ways to be more efficient and innovative to stand out.

Capital Power faces risks from market volatility, particularly in wholesale power prices. While a significant portion of its revenue comes from contracts, its exposure to uncontracted assets means it's vulnerable to price swings. For instance, if wholesale electricity prices drop significantly, or if natural gas costs spike for its unhedged facilities, the company's financial performance could be negatively impacted. This was evident in early 2024, where fluctuating energy markets presented challenges for many power producers.

Technological Obsolescence and Disruption

Capital Power faces a significant threat from technological obsolescence. Rapid advancements in renewable energy, particularly solar and wind power, alongside improvements in battery storage, could render its existing thermal generation assets less competitive sooner than anticipated. For instance, the declining cost of utility-scale solar PV, which fell by approximately 10% globally in 2023 according to the International Renewable Energy Agency (IRENA), directly challenges the economic viability of older fossil fuel plants.

A failure to proactively invest in and integrate these emerging technologies poses a substantial risk to Capital Power's long-term market position. The company's strategy must account for the accelerating pace of innovation; otherwise, its portfolio could become increasingly outdated, impacting its competitive advantage and financial performance.

- Accelerated Depreciation: Older thermal assets may face earlier-than-expected retirement due to technological advancements in renewables and storage.

- Investment Lag: Delays in adopting or investing in new, cleaner energy technologies could result in Capital Power falling behind competitors.

- Market Share Erosion: As renewable energy sources become more efficient and cost-effective, Capital Power's market share in traditional energy generation could decline.

Supply Chain Disruptions and Inflationary Pressures

Global supply chain disruptions and persistent inflation are significant threats for Capital Power. These issues can drive up the costs of essential equipment, materials, and labor needed for both new projects and routine operations. For instance, the cost of critical components for renewable energy projects, like solar panels and wind turbines, has seen notable increases due to these pressures.

These escalating costs directly impact Capital Power's financial outlook. They can lead to delays in project schedules, put a strain on existing investment plans, and ultimately erode the profitability of new and ongoing ventures. The uncertainty surrounding these external economic factors creates a challenging environment for long-term financial planning and capital allocation.

- Increased Capital Expenditures: Rising material and component costs, such as those seen in the steel and semiconductor markets throughout 2024, directly inflate the cost of building new power generation facilities.

- Higher Operational Costs: Persistent inflation in fuel, maintenance supplies, and skilled labor wages can significantly increase the day-to-day operating expenses for existing plants.

- Project Timeline Delays: Supply chain bottlenecks, particularly for specialized equipment, can push back project completion dates, impacting revenue generation timelines.

- Reduced Profitability: The combination of higher upfront costs and increased operational expenses can squeeze profit margins, especially for projects with fixed long-term power purchase agreements.

Capital Power faces significant threats from evolving environmental regulations and increasing carbon pricing, which directly impact the cost of operating its fossil fuel assets. For example, carbon prices in some jurisdictions are projected to rise substantially by 2030, increasing compliance expenses. Furthermore, the competitive landscape in the power sector is intensifying with the growing prominence of renewable energy, potentially leading to lower profit margins and challenges in securing favorable power purchase agreements. Technological obsolescence is another key threat, as rapid advancements in renewables and energy storage could diminish the competitiveness of Capital Power's existing thermal generation fleet.

| Threat Category | Specific Threat | Impact on Capital Power | Relevant Data/Trend (2024/2025) |

|---|---|---|---|

| Regulatory & Policy | Stricter Environmental Policies & Carbon Pricing | Increased operating costs for fossil fuel assets, potential for higher compliance expenses. | Ontario's carbon price to reach $170/tonne CO2e by 2030; global trend towards carbon taxes and cap-and-trade systems. |

| Market Competition | Increased Competition from Renewables | Erosion of market share, pressure on profit margins, difficulty securing long-term contracts. | Global renewable energy investment projected to hit record highs in 2024, increasing the number of market participants. |

| Technological | Technological Obsolescence of Thermal Assets | Reduced competitiveness of existing assets, risk of earlier-than-expected retirement. | Utility-scale solar PV costs declined ~10% globally in 2023 (IRENA); advancements in battery storage improving grid integration. |

| Economic | Supply Chain Disruptions & Inflation | Higher capital expenditures for new projects, increased operational costs, potential project delays. | Persistent inflation in materials (e.g., steel, semiconductors) and labor costs impacting project economics throughout 2024. |

SWOT Analysis Data Sources

This Capital Power SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and insights from industry experts to ensure a thorough and actionable strategic overview.