Capital Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Power Bundle

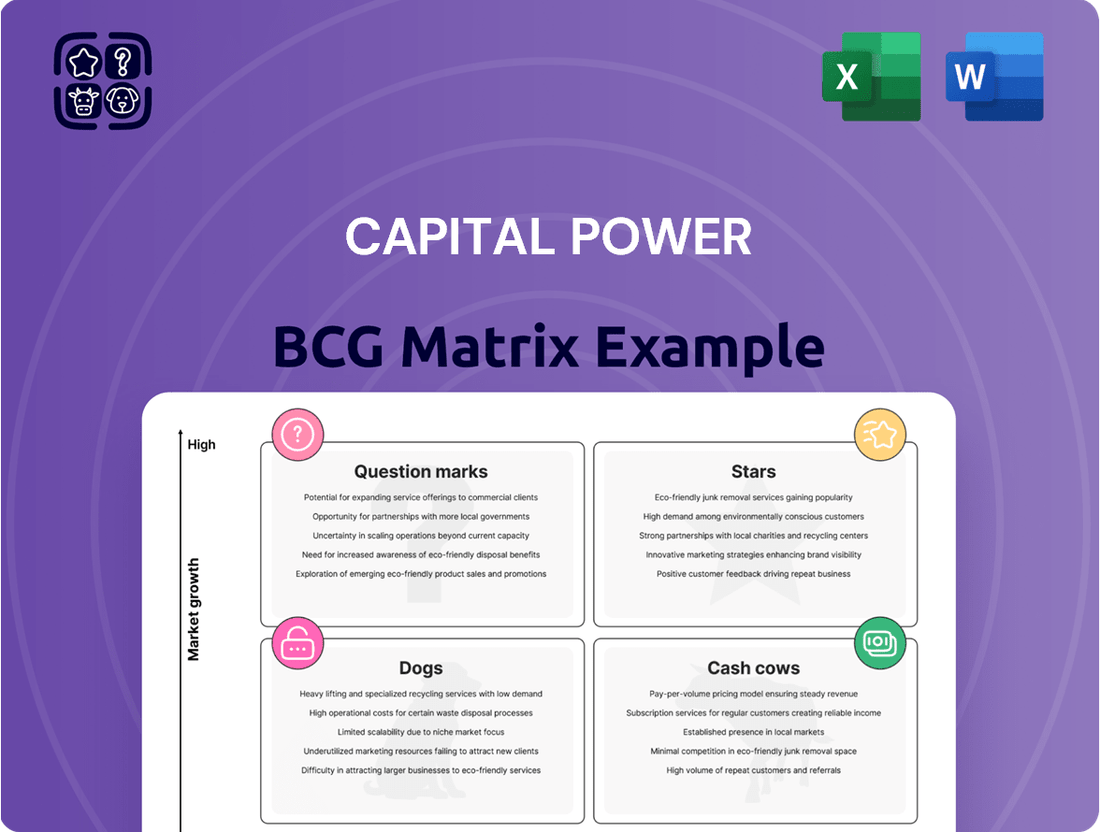

Curious about Capital Power's strategic positioning? Our BCG Matrix preview highlights key product segments, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Understand where capital is flowing and where opportunities lie.

Don't miss out on the complete picture. Purchase the full Capital Power BCG Matrix report for in-depth analysis, actionable insights, and a clear roadmap to optimize your investment and product portfolio.

Stars

Capital Power is strategically expanding its U.S. footprint through acquisitions of flexible generation assets, notably natural gas-fired power plants. This focus is evident in their acquisition of the Hummel Station and Rolling Hills facilities, both located within the PJM market, a key region for North American power trading.

These acquisitions, representing around 2.2 gigawatts of capacity, underscore Capital Power's commitment to a high-growth, high-market-share approach in the flexible generation sector. The company anticipates these moves will bolster its U.S. portfolio and contribute to sustained growth in cash flow per share.

The financial impact of these deals is expected to be positive from the outset, with Capital Power projecting them to be immediately accretive to adjusted funds from operations per share. This indicates a strong belief in the immediate value-generating potential of these flexible generation assets.

Capital Power is aggressively expanding its renewable energy footprint, pouring significant capital into wind and solar projects throughout North America. This strategic focus is evident in developments like the Halkirk 2 Wind project in Alberta, Canada.

The company is also advancing its solar portfolio with projects such as Hornet Solar and Bear Branch Solar in North Carolina, with construction slated to begin in 2024 and 2025 respectively. These investments underscore Capital Power's commitment to a cleaner energy future.

Capital Power is actively investing in innovative decarbonization technologies like energy storage and hydrogen. These strategic moves are fundamental to their goal of reaching net-zero emissions by 2050, positioning them for future success in the energy sector.

These investments are crucial for Capital Power to stay competitive and foster innovation within the rapidly changing energy market. The company's commitment is further solidified by its green financing framework, established in 2022, which specifically backs the growth of these clean energy initiatives.

Genesee Repowering Project

The Genesee Repowering Project, a significant undertaking by Capital Power, marks a strategic shift towards cleaner energy. Completed in Q4 2024, this project converted the Genesee Generating Station from coal to natural gas, boosting its capacity by 512 MW.

This transformation is projected to cut CO2 emissions by roughly 3.4 million tonnes each year. The repowered Genesee Units 1 and 2 are now recognized as Canada's most efficient natural gas combined cycle units, underscoring Capital Power's commitment to lower-carbon baseload power generation and solidifying the facility's market strength.

- Project Completion: Q4 2024

- Capacity Increase: 512 MW

- Annual CO2 Emission Reduction: Approx. 3.4 million tonnes

- Technology: 100% Natural Gas Combined Cycle

Expansion into Data Center Market

Capital Power is strategically targeting the data center market, a sector experiencing rapid expansion due to the increasing demand for AI infrastructure. This move positions the company to capitalize on a high-growth opportunity, leveraging its existing assets to meet the significant electricity needs of these facilities.

The company's Genesee Generating Station, specifically retooled for greater efficiency, is a key asset in this expansion. This initiative is expected to contribute significantly to Capital Power's future market share, aligning with the broader trend of digitalization and the insatiable power requirements of modern computing.

- Market Growth: North America's data center market is projected to see substantial growth, with electricity demand expected to double by 2030 in some regions.

- Capital Power's Position: The company's Genesee Generating Station offers a reliable and potentially cost-effective power source for these energy-intensive operations.

- Strategic Alignment: This expansion directly addresses the rising need for power to support artificial intelligence and advanced computing, a critical trend in the current economic landscape.

Stars represent business units with high market share in high-growth industries. Capital Power's strategic focus on acquiring flexible generation assets, particularly natural gas-fired plants in the PJM market, aligns with this. Their investment in data centers, a rapidly expanding market driven by AI, also positions them to capture significant growth.

The company’s aggressive expansion into renewables, like the Halkirk 2 Wind project and solar developments in North Carolina, further solidifies its position in a high-growth sector. These initiatives, coupled with investments in decarbonization technologies, demonstrate a forward-looking strategy to capitalize on evolving energy demands.

Capital Power's Genesee Repowering Project, completed in Q4 2024, enhanced capacity by 512 MW and significantly reduced CO2 emissions, positioning it as a strong player in cleaner baseload power. This strategic move strengthens its market presence in a crucial segment.

| Business Unit | Market Growth | Market Share | Capital Power's Position |

|---|---|---|---|

| Flexible Generation (US) | High | Growing | Acquisition of Hummel Station & Rolling Hills (2.2 GW) |

| Renewable Energy | High | Expanding | Halkirk 2 Wind, Hornet Solar, Bear Branch Solar |

| Data Centers | Very High | Emerging | Leveraging Genesee Station for AI infrastructure |

What is included in the product

This Capital Power BCG Matrix overview analyzes each business unit's market share and growth potential.

It provides strategic recommendations for investing in Stars and Question Marks, managing Cash Cows, and divesting Dogs.

Strategic clarity by visually categorizing Capital Power's business units, easing decision-making and resource allocation.

Cash Cows

Capital Power's established natural gas fleet, a significant part of its operations, acts as a cash cow in the BCG matrix. This segment includes a substantial portfolio of natural gas-fired power generation facilities across North America, bolstered by recent acquisitions. These assets are crucial for providing reliable baseload and dispatchable power.

These natural gas facilities are market leaders, consistently generating significant cash flow for Capital Power. The company views natural gas as indispensable for grid reliability and affordability in the coming years, underscoring the enduring strength of this business unit.

Capital Power's long-term contracted capacity acts as a significant cash cow. A substantial amount of its generation power is locked in through long-term agreements, which guarantees consistent and predictable revenue. This contractual security translates into robust profit margins and stable cash flow, shielding the company from the unpredictable swings of market prices.

This contractual backbone is a key driver of Capital Power's financial stability. By securing a large portion of its output through these agreements, the company minimizes its exposure to volatile energy markets. This strategy is particularly beneficial in the current energy landscape, where price fluctuations can significantly impact profitability.

The company's commitment to expanding its contracted capacity is evident. As of late 2024, Capital Power reported a notable 10% increase in its contracted generation capacity. This strategic move further strengthens its ability to generate consistent cash flow, reinforcing its position as a reliable energy provider with a stable financial foundation.

Capital Power's dedication to operational excellence fuels its cash cow status. In 2024, the company continued to emphasize reliability and efficiency across its fleet, leading to strong profit margins. For instance, their focus on optimizing fuel consumption and reducing downtime at their mature facilities directly translates into consistent and substantial cash flow generation.

By embracing digital transformation and advanced technologies, Capital Power is actively enhancing the productivity of its existing assets. This strategic investment in modernization ensures that these mature power plants remain cost-effective cash generators, reinforcing their position as reliable contributors to the company's financial strength. This ongoing commitment solidifies their cash cow designation.

Strategic Asset Rotation

Capital Power strategically rotates its assets, particularly its Cash Cows, by selling down minority stakes in mature, contracted renewable facilities. This allows the company to realize gains and boost its financial maneuverability.

A prime example of this strategy in action is the late 2024 sale of 49% interests in the Quality Wind and Port Dover and Nanticoke Wind facilities. These transactions are designed to effectively 'milk' profits from established, income-generating assets.

- Asset Rotation: Selling minority interests in mature, contracted renewable assets.

- Objective: Crystallize returns and enhance financial flexibility.

- 2024 Example: Sale of 49% interests in Quality Wind and Port Dover and Nanticoke Wind facilities.

- Benefit: Frees up capital for new growth initiatives.

Consistent Financial Performance

Capital Power's cash cow status is well-supported by its consistent financial performance. For 2024, the company reported strong Adjusted EBITDA and Adjusted Funds from Operations (AFFO), figures that are projected to remain healthy into 2025. This sustained generation of cash from operations is a key indicator of its stability and ability to fund ongoing business needs and shareholder returns.

The company's financial health is further evidenced by its ability to leverage these cash flows. These funds are strategically allocated to support growth initiatives, manage operational expenses, and importantly, distribute dividends to shareholders. This reliable cash generation underpins Capital Power's position as a mature and dependable asset within its portfolio.

- Consistent Cash Generation: Capital Power's 2024 results show robust Adjusted EBITDA and AFFO, with projections indicating continued strength through 2025.

- Strategic Fund Allocation: Cash generated is effectively used for growth investments, operational costs, and shareholder dividends.

- Financial Stability: The company's financial performance underscores the success of its strategic planning and operational efficiency.

Capital Power's established natural gas fleet and long-term contracted capacity are its primary cash cows. These segments consistently generate significant, predictable cash flow, underpinning the company's financial stability and ability to fund growth and shareholder returns.

The company's strategic asset rotation, including the sale of minority stakes in mature renewable facilities, further maximizes returns from these cash-generating assets. For example, the late 2024 sale of 49% interests in Quality Wind and Port Dover and Nanticoke Wind facilities exemplifies this approach.

In 2024, Capital Power reported strong financial performance with robust Adjusted EBITDA and Adjusted Funds from Operations (AFFO), projecting continued health into 2025. This sustained cash generation from operations is a testament to the reliability and efficiency of its cash cow assets.

The company's commitment to operational excellence and digital transformation enhances the productivity of its existing fleet, ensuring these mature power plants remain cost-effective cash generators. This focus directly translates into consistent and substantial cash flow, solidifying their cash cow designation.

| Segment | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Natural Gas Fleet | Cash Cow | Reliable baseload and dispatchable power, market leadership | Significant cash flow generation |

| Contracted Capacity | Cash Cow | Long-term agreements, predictable revenue, market price insulation | Guaranteed consistent revenue |

| Mature Renewable Assets (Minority Stakes) | Cash Cow (via rotation) | Income-generating, contracted | Realized gains from asset sales (e.g., Quality Wind, Port Dover and Nanticoke Wind in late 2024) |

Delivered as Shown

Capital Power BCG Matrix

The Capital Power BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered to you without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

Capital Power's strategic shift away from coal, exemplified by the Genesee facility's conversion to natural gas in 2024, effectively phases out its coal-fired generation assets. These assets, prior to their transformation, represented a declining segment within the company's portfolio.

The coal-fired generation segment, before its conversion or retirement, exhibited characteristics of a 'dog' in the BCG matrix. This was due to its low growth prospects and increasing regulatory pressures, making it a non-viable long-term asset class for Capital Power.

This divestment strategy highlights Capital Power's commitment to decarbonization and a move towards more sustainable energy sources, aligning with evolving market demands and environmental regulations. The company's proactive approach ahead of mandates demonstrates forward-thinking capital allocation.

Capital Power's decision in May 2024 to abandon its $2.4 billion carbon capture project at the Genesee plant signifies a classic 'dog' in the BCG matrix. The project, while technically sound, was deemed economically unviable, reflecting a low market share and low growth potential for the project as currently structured.

Older, less efficient fossil fuel power plants within Capital Power's portfolio, particularly those not slated for modernization or conversion, would be categorized as dogs in a BCG matrix. These assets are characterized by high operational costs and declining market competitiveness, especially as the energy sector rapidly decarbonizes.

In 2024, the pressure on such assets intensified. For instance, while specific Capital Power plant data isn't publicly broken down for this exact BCG classification, the broader trend shows that older coal and natural gas facilities are increasingly facing regulatory scrutiny and market disadvantages. Capital Power's strategy, as outlined in their 2024 investor updates, emphasizes growth in renewables and modern, efficient natural gas, suggesting a deliberate move away from legacy, less efficient assets.

Underperforming Merchant Assets

Assets operating in highly competitive, uncontracted merchant markets with consistently low spark spreads or capacity factors can be categorized as 'dogs' in the Capital Power BCG Matrix. These assets, if they struggle to secure profitable contracts or face prolonged periods of low market prices, generate minimal returns and may consume cash without significant growth prospects.

Capital Power's strategic emphasis on contracted generation is designed to proactively mitigate the risks associated with these underperforming merchant assets. For instance, in 2024, the company's strategy prioritizes assets with long-term power purchase agreements (PPAs) to ensure stable revenue streams and reduce exposure to volatile market conditions.

- Underperforming Merchant Assets: Typically characterized by uncontracted positions in competitive markets.

- Low Profitability: Suffer from consistently low spark spreads or capacity factors, leading to minimal returns.

- Cash Consumption: May require ongoing investment without offering significant growth potential.

- Capital Power's Strategy: Focuses on contracted generation to avoid the risks associated with these 'dog' assets.

Divested or Non-Strategic Assets

Divested or non-strategic assets within Capital Power's portfolio, when analyzed through a BCG matrix lens, would typically fall into the 'dogs' category. These are assets that offer little growth and a low market share, often representing older, less efficient generation facilities or smaller, non-core operations that no longer align with the company's strategic direction.

Capital Power's strategic focus is on flexible generation, renewables, and expanding its presence in the United States. Assets that do not contribute to these core areas, or are slated for divestiture, are prime candidates for the 'dog' classification. For instance, if Capital Power were to sell off a coal-fired power plant in a region with declining demand and stringent environmental regulations, this asset would likely be considered a dog.

- Divestiture of Non-Core Assets: Capital Power has actively managed its portfolio, divesting assets that do not fit its long-term strategy.

- Low Growth Prospects: These assets typically operate in mature or declining markets, offering limited potential for future growth or profitability.

- Capital Reallocation: The sale of such 'dog' assets allows Capital Power to free up capital for investment in higher-growth areas like renewables and U.S. market expansion.

- Strategic Misalignment: Assets that do not align with the company's focus on flexible generation and decarbonization are candidates for divestment.

Assets that are old, inefficient, and face significant regulatory headwinds, like Capital Power's former coal-fired generation assets, are classic 'dogs' in the BCG matrix. These assets typically have low market share and no growth potential, often requiring more investment than they generate in returns.

Capital Power's strategic pivot, including the 2024 conversion of its Genesee plant from coal to natural gas, effectively removes these 'dog' assets from its core operations. This move aligns with the company's broader decarbonization goals and its focus on more profitable, sustainable energy sources.

The company's decision to abandon its $2.4 billion carbon capture project at Genesee in May 2024 also exemplifies a 'dog,' deemed uneconomical despite its technical feasibility, highlighting a lack of market viability.

Capital Power's strategy actively seeks to avoid or divest 'dog' assets, prioritizing contracted generation and investments in renewables and U.S. market expansion to ensure capital is allocated to high-growth areas.

| Asset Type | BCG Category | Capital Power's Strategy |

|---|---|---|

| Coal-fired generation (pre-conversion) | Dog | Phased out/Converted (e.g., Genesee 2024) |

| Inefficient legacy fossil fuel plants | Dog | Divestment or modernization focus |

| Uncontracted merchant assets with low spreads | Dog | Mitigated through focus on contracted generation |

| Non-strategic or divested assets | Dog | Sold to reallocate capital to growth areas |

Question Marks

Capital Power's collaboration with Ontario Power Generation (OPG) to explore Small Modular Reactors (SMRs) for Alberta positions SMRs as a significant 'question mark' in their BCG matrix. This venture highlights the potential for high growth and future energy diversification, aligning with decarbonization goals.

While SMRs offer promising future energy solutions, their commercial deployment is still in its nascent stages, characterized by low current market share and substantial upfront investment. This makes them a high-risk, high-reward proposition for Capital Power.

The regulatory landscape and the need for significant capital expenditure represent key challenges. For instance, a typical SMR project could require billions in upfront investment, with commercial viability heavily dependent on future market adoption and regulatory approvals, underscoring the 'question mark' classification.

Capital Power's early-stage renewable development sites, such as approximately 300 MW of new renewables projects in Alberta and North Carolina, represent potential growth areas. These ventures are in nascent stages, demanding significant capital infusion before reaching commercial operation and securing market standing. Their future success remains uncertain, placing them in a high-risk, high-reward category.

Capital Power's entry into the PJM market, a significant undertaking, involves integrating recent acquisitions like Hummel and Rolling Hills. This process is crucial for establishing a robust competitive presence in a major North American energy market.

The PJM market offers substantial growth opportunities, but requires ongoing strategic investment and operational fine-tuning. Capital Power's focus remains on adapting to local market conditions to secure and expand its market share.

In 2024, PJM continued to be a dynamic market, with evolving regulatory landscapes and increasing demand for diverse energy sources. Capital Power's strategic integration efforts are aimed at capitalizing on these trends, leveraging its new assets to enhance its portfolio's performance and market penetration.

Energy Storage Market Ventures

Capital Power's investment in energy storage aligns with the BCG matrix's recognition of high-growth, potentially high-return sectors. While the market for energy storage is booming, with global investment projected to reach hundreds of billions by the late 2020s, Capital Power's current footprint in this specific area is likely nascent.

These ventures represent potential Stars or Question Marks, demanding substantial capital to build market share and technological expertise. For instance, by the end of 2023, the U.S. alone had over 13 GW of energy storage capacity installed, a figure rapidly increasing.

- High Growth Potential: The energy storage market is experiencing exponential growth, driven by renewable energy integration and grid modernization needs.

- Capital Intensive: Developing and scaling energy storage projects requires significant upfront investment in technology, infrastructure, and grid interconnection.

- Nascent Market Share: Capital Power's current market share in energy storage is likely small relative to its established generation assets, classifying these ventures as potential Question Marks.

- Strategic Importance: Energy storage is critical for grid stability and enabling higher renewable penetration, making it a strategic focus for companies like Capital Power.

Hydrogen Technology Exploration

Hydrogen technology represents a significant 'question mark' for Capital Power as it aligns with their long-term decarbonization goals. While the potential for growth in hydrogen for power generation is substantial, its current market share for the company is minimal. This necessitates considerable investment in research, development, and infrastructure to achieve commercial viability.

Capital Power's exploration into hydrogen is a forward-looking strategy, acknowledging the nascent stage of this technology. The company is likely evaluating the significant upfront capital required for hydrogen production facilities and integration into existing power generation assets.

- Market Potential: The global hydrogen market is projected to grow significantly, with some forecasts indicating a market size of over $1.8 trillion by 2030, driven by decarbonization efforts.

- Investment Needs: Developing green hydrogen production (using renewable energy) can require substantial capital, with estimates for electrolysis plants varying widely based on scale and technology.

- Technological Hurdles: Challenges remain in efficient hydrogen storage, transportation, and integration into existing grid infrastructure, impacting immediate commercialization.

- Regulatory Landscape: Government incentives and supportive policies are crucial for accelerating hydrogen adoption, with many regions actively developing hydrogen strategies and funding programs.

Capital Power's investments in emerging technologies like Small Modular Reactors (SMRs), energy storage, and hydrogen clearly fall into the 'question mark' category of the BCG matrix. These areas represent high growth potential but currently have low market share and require significant capital investment, making their future success uncertain. For example, SMRs are still in the early stages of development and regulatory approval, with projected costs for initial deployments potentially running into billions of dollars per unit. Similarly, while energy storage is rapidly expanding, with the U.S. alone exceeding 13 GW of installed capacity by the end of 2023, Capital Power's specific market penetration in this sector is likely still developing.

| Category | Current Market Share | Market Growth Rate | Capital Requirement | Risk/Reward Profile |

|---|---|---|---|---|

| SMRs | Very Low (Nascent) | High (Potential) | Very High | High Risk, High Reward |

| Energy Storage | Low to Moderate (Developing) | High (Rapidly Growing) | High | Moderate Risk, Moderate to High Reward |

| Hydrogen | Very Low (Nascent) | High (Projected) | Very High | High Risk, High Reward |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.