Capital Power Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Power Bundle

Capital Power's marketing strategy is a masterclass in balancing sustainable energy solutions with market demand. This analysis delves into how their diverse product portfolio, from renewable energy to natural gas, is strategically positioned to meet evolving energy needs.

Discover the intricate pricing models and distribution channels Capital Power employs to ensure accessibility and competitiveness in the energy sector. Understand their promotional efforts to build brand trust and communicate their commitment to a cleaner future.

Go beyond the surface and gain a comprehensive understanding of Capital Power's entire 4Ps marketing mix. This ready-to-use analysis is perfect for business professionals, students, and consultants seeking actionable insights and strategic frameworks.

Product

Capital Power's core product offering centers on providing dependable baseload power, ensuring a steady electricity supply, and dispatchable power, which allows for rapid adjustments to meet changing grid needs. This combination is crucial for maintaining grid stability and responsiveness.

Their diverse generation portfolio, as of late 2024, includes significant natural gas assets, a strategic transition away from coal, and growing investments in renewables like wind and solar. For instance, as of Q3 2024, their natural gas segment represented approximately 70% of their generation capacity, underscoring its role in baseload and dispatchable services.

Capital Power is significantly expanding its portfolio of renewable energy projects, focusing on wind and solar development and operation. This strategic shift directly addresses the accelerating global energy transition, aiming to build a cleaner energy future. By 2025, the company plans to increase its renewable generation capacity substantially.

Notable projects like the Halkirk 2 Wind project in Alberta, which came online in 2021, and the Hornet Solar project in North Carolina exemplify this commitment. These investments underscore Capital Power's dedication to diversifying its generation mix away from fossil fuels and towards sustainable energy sources.

Capital Power is strategically investing in and researching advanced decarbonization technologies, including carbon capture, energy storage, and hydrogen solutions. These efforts are designed to significantly lower greenhouse gas emissions and establish the company as a leader in the evolving clean energy sector.

The company's commitment is underscored by its Genesee Repowering project, a key initiative demonstrating its dedication to cleaner energy production. This project is anticipated to reduce CO2 emissions by approximately 5 million tonnes annually once completed.

Strategic Acquisitions of Generation Facilities

Capital Power actively pursues strategic acquisitions of existing power generation facilities to bolster its portfolio and expand its geographical footprint. This approach allows for rapid market entry and capacity growth.

A prime example of this strategy in action is Capital Power's acquisition of two natural gas-fired plants, Hummel Station and Rolling Hills, within the PJM Interconnection market. This move significantly enhances their flexible generation capabilities in the United States.

These acquisitions are crucial for meeting evolving energy demands and integrating renewable sources. For instance, in 2024, Capital Power continued to focus on acquiring and developing assets that align with decarbonization goals, aiming to increase its clean energy capacity.

- Acquisition Strategy: Focus on acquiring operational generation facilities to quickly expand capacity and market presence.

- Geographic Expansion: Targeting key energy markets like PJM Interconnection to diversify and strengthen U.S. operations.

- Capacity Enhancement: Acquisitions, such as Hummel Station and Rolling Hills, directly add significant flexible generation capacity.

- Market Position: These strategic moves reinforce Capital Power's position as a key player in North American energy markets.

Energy Solutions for Data Centers and Industrial Demand

Capital Power is strategically targeting the burgeoning energy needs of data centers and industrial clients, sectors characterized by substantial and consistent electricity demand. The rapid expansion of artificial intelligence workloads is a key driver for this focus, creating a significant market opportunity. For instance, by 2027, global AI chip demand is projected to reach $200 billion, directly translating into increased power consumption for the data centers housing these operations.

The company's re-tooled Genesee Generating Station, now operating on natural gas, offers a reliable and scalable power source perfectly suited for these large-scale industrial consumers. This facility’s operational flexibility allows it to meet the fluctuating, yet consistently high, energy demands of data centers. In 2024, Capital Power reported that its Genesee facility provided a stable baseload power contribution, highlighting its capacity to support significant industrial energy needs.

This strategic pivot aligns with broader market trends where industrial and technology sectors are increasingly seeking dedicated and efficient energy supply solutions. Capital Power's approach leverages existing infrastructure while adapting to new market demands.

- Market Focus: Data centers and industrial sectors with high electricity consumption.

- Growth Driver: Increasing demand from artificial intelligence applications.

- Infrastructure Advantage: Repurposed Genesee Generating Station provides scalable, natural gas-fired power.

- 2024 Data Point: Genesee Generating Station's contribution to stable baseload power underscores its capacity.

Capital Power's product is dependable and dispatchable electricity, increasingly supplemented by a growing renewable portfolio. Their strategy involves a mix of natural gas for baseload and flexibility, alongside wind and solar to meet decarbonization goals and evolving market demands.

The company is actively expanding its renewable capacity, aiming for substantial growth by 2025, and investing in advanced technologies like carbon capture to reduce emissions. Strategic acquisitions, such as the Hummel Station and Rolling Hills plants in 2024, bolster their flexible generation and geographic reach, particularly in the PJM market.

Capital Power is also targeting high-demand sectors like data centers, driven by AI growth, leveraging facilities like the Genesee Generating Station for stable, scalable power. This dual approach of strengthening existing assets and investing in renewables positions them to capitalize on diverse energy needs.

| Product Offering | Key Characteristics | Strategic Focus | Key Data Points (2024/2025) |

|---|---|---|---|

| Baseload & Dispatchable Power | Reliable electricity supply, grid stability, rapid response capabilities | Natural Gas assets form the core, ensuring consistent delivery | Natural gas capacity ~70% of generation mix (Q3 2024) |

| Renewable Energy | Wind and Solar power generation, cleaner energy future | Significant expansion of renewable projects by 2025 | Halkirk 2 Wind (online 2021), Hornet Solar (North Carolina) |

| Decarbonization Technologies | Carbon capture, energy storage, hydrogen solutions | Reducing greenhouse gas emissions, leadership in clean energy | Genesee Repowering project to cut ~5 million tonnes CO2 annually |

| Acquired Assets | Operational generation facilities, enhanced flexible generation | Geographic expansion, market presence, capacity growth | Acquisition of Hummel Station & Rolling Hills (2024) in PJM market |

What is included in the product

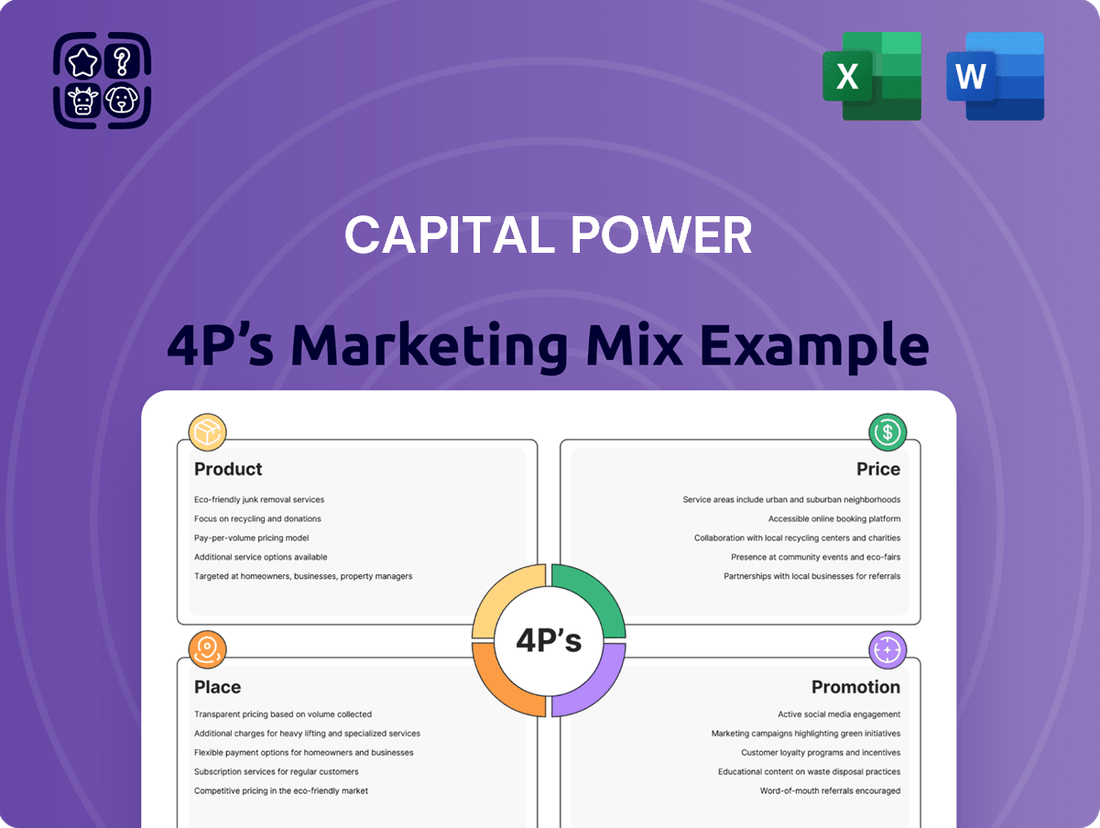

This analysis offers a comprehensive breakdown of Capital Power's marketing strategies, examining their Product, Price, Place, and Promotion efforts with real-world examples and strategic implications.

It's designed for professionals seeking to understand Capital Power's market positioning, providing a solid foundation for competitive benchmarking and strategic planning.

Simplifies complex marketing strategies by presenting Capital Power's 4Ps in a clear, actionable framework, easing the burden of strategic planning.

Provides a concise, visual representation of Capital Power's marketing approach, alleviating the pain of information overload for busy executives.

Place

Capital Power's marketing efforts are deeply rooted in the North American wholesale power markets, spanning both Canada and the United States. This expansive operational footprint enables them to cater to a broad spectrum of utility and industrial clients. Their strategic growth initiatives are particularly focused on key U.S. markets, such as the PJM Interconnection, a significant player in the Eastern U.S. power grid.

Capital Power strategically positions its assets to ensure optimal market access and operational efficiency. This careful placement is key to their business model, allowing them to serve a wide customer base effectively.

The company’s portfolio is notably diversified across North America. As of early 2024, Capital Power has been actively working to balance its Canadian and U.S. asset bases, aiming for a more even distribution. This diversification is crucial for financial stability, as it spreads risk across different regulatory environments and market demands, ultimately strengthening their overall risk management approach.

Capital Power's direct sales strategy targets credit-worthy utilities and government entities, securing revenue through long-term Power Purchase Agreements (PPAs). For instance, in 2023, the company highlighted its ongoing PPA discussions for its Fox Creek facility, demonstrating a commitment to stable, direct customer relationships. This approach provides predictable cash flows, insulating the company from short-term market volatility.

Interconnection with Major Power Grids

Capital Power's generation assets are strategically linked to major North American power grids. This interconnection is fundamental to their operations, enabling the efficient movement of electricity from their facilities to areas with high demand.

This robust grid connectivity is a key enabler for Capital Power, ensuring reliable power delivery and maximizing their ability to participate and profit in competitive wholesale electricity markets. For instance, in 2023, Capital Power reported that its fleet's capacity factor, a measure of how much electricity is produced compared to the maximum possible, was influenced by its ability to dispatch power effectively through these grid connections.

- Grid Interconnection: Facilitates transmission across North America.

- Reliability: Essential for consistent power supply to customers.

- Market Access: Maximizes sales opportunities in wholesale electricity markets.

- Efficiency: Enables cost-effective distribution to demand centers.

Development of New Project Sites

Capital Power is strategically acquiring new locations for future energy projects, focusing on renewable sources and flexible generation capacity. This proactive site selection is crucial for sustained growth and adapting to changing energy needs.

By securing prime locations, Capital Power ensures it can deploy new assets efficiently, supporting its long-term vision for a cleaner energy future. For instance, in 2024, the company continued to advance its portfolio of renewable projects, including solar and wind developments across North America.

Key aspects of this development include:

- Site Identification: Rigorous assessment of land availability, grid connection feasibility, and environmental considerations for new renewable energy installations.

- Permitting and Approvals: Navigating regulatory processes to secure necessary permits for project construction and operation, a critical step in bringing new sites online.

- Strategic Land Acquisition: Proactive purchasing or leasing of land parcels that align with the company's growth strategy and renewable energy targets, ensuring a pipeline of future development opportunities.

Capital Power's "Place" in the marketing mix is defined by its extensive North American operational footprint and strategic asset positioning. This includes a significant presence in key U.S. markets like the PJM Interconnection, alongside a balanced portfolio across Canada and the United States, aiming for greater distribution by early 2024.

Their generation assets are strategically linked to major power grids, facilitating efficient electricity transmission and maximizing market access. This robust grid connectivity, crucial for reliable delivery and participation in wholesale markets, was a factor in their fleet's capacity factor performance in 2023.

The company actively acquires new locations for renewable and flexible generation projects, emphasizing site identification, permitting, and strategic land acquisition to support future growth and a cleaner energy future, as seen in their 2024 renewable project advancements.

| Market Presence | Key U.S. Markets | Asset Distribution Focus (as of early 2024) | Grid Connectivity | Future Site Strategy |

|---|---|---|---|---|

| North America (Canada & U.S.) | PJM Interconnection | Balancing Canadian and U.S. assets | Major North American power grids | Renewable and flexible generation |

Full Version Awaits

Capital Power 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Capital Power 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain valuable insights into how Capital Power positions itself in the market.

Promotion

Capital Power prioritizes clear communication with its investors, offering detailed financial results and integrated annual reports. In 2024, the company reported adjusted EBITDA of $1.5 billion for the trailing twelve months ending September 30, 2024, demonstrating a focus on consistent performance.

They actively engage with both individual and institutional investors through regular conference calls and webcasts. This approach ensures stakeholders are well-informed about financial performance and ongoing strategic developments, such as their continued investment in renewable energy projects which represented 40% of their capital expenditure in the first nine months of 2024.

Capital Power actively showcases its dedication to Environmental, Social, and Governance (ESG) principles through detailed sustainability reports. These reports underscore their progress in areas like decarbonization, community involvement, and ethical operations, aiming to resonate with investors and stakeholders prioritizing social responsibility.

In 2023, Capital Power reported a 38% reduction in greenhouse gas (GHG) emissions intensity compared to a 2005 baseline, demonstrating a concrete commitment to environmental stewardship. This focus on sustainability is crucial for attracting socially conscious capital and enhancing long-term enterprise value.

Capital Power strategically leverages industry conferences and investor presentations to communicate its vision and performance. For instance, their participation in events like the Jefferies Power, Utilities and Clean Energy Conference and the Scotiabank Utilities & Renewables Conference in 2024 provides direct access to key financial stakeholders. These engagements are crucial for showcasing their growth strategy, current projects, and financial stability to investors and analysts, reinforcing their market presence.

Corporate Website and Digital Presence

Capital Power's corporate website acts as a crucial information nexus, offering stakeholders in-depth details about their diverse operations, ongoing projects, recent news, and vital investor relations materials. This digital platform is designed for easy navigation, ensuring that anyone looking for comprehensive company data and timely updates can access it efficiently.

Their commitment to a robust digital presence means that information is readily available, supporting transparency and engagement with a broad audience. For instance, by the end of Q1 2024, Capital Power reported approximately $5.7 billion in assets, with their website detailing the strategic allocation of these resources across their generation fleet and development pipeline.

- Website as Information Hub: Centralizes operational details, project updates, and investor resources.

- Digital Accessibility: Ensures stakeholders can easily access comprehensive company data and news.

- Stakeholder Engagement: Facilitates communication and information dissemination to investors, customers, and the public.

- Transparency: Provides clear insights into Capital Power's business, strategy, and financial performance.

Media Releases and News Coverage

Capital Power strategically uses media releases to communicate key achievements and operational updates. For instance, their Q1 2024 results, released in May 2024, highlighted adjusted EBITDA of $306 million, demonstrating continued financial strength. These releases are crucial for informing investors and the public about their growth trajectory and strategic direction.

The company's proactive approach to news coverage aims to build trust and transparency with stakeholders. By consistently sharing information on project advancements, such as the ongoing development of their portfolio of renewable energy projects, Capital Power reinforces its commitment to a cleaner energy future. This communication strategy is vital for managing market expectations and attracting investment.

- Q1 2024 Adjusted EBITDA: $306 million, showcasing robust operational performance.

- Focus on Renewables: Continuous updates on renewable energy project development, including wind and solar.

- Stakeholder Communication: Proactive engagement to build trust and transparency with investors and the public.

- Market Perception: Shaping a positive image as a reliable and forward-thinking energy provider.

Capital Power's promotional efforts center on transparent communication and showcasing their commitment to sustainability and growth. They leverage their corporate website and regular media releases to keep stakeholders informed about financial performance, such as their reported $1.5 billion in adjusted EBITDA for the twelve months ending September 30, 2024, and their ongoing investments in renewable energy, which accounted for 40% of their capital expenditure in the first nine months of 2024.

Active participation in industry conferences and investor presentations in 2024, including events like the Jefferies Power, Utilities and Clean Energy Conference, allows Capital Power to directly engage with financial stakeholders. This strategy highlights their growth plans and financial stability, reinforcing their market position and attracting investment. Their focus on ESG principles, demonstrated by a 38% reduction in GHG emissions intensity by 2023 compared to a 2005 baseline, further appeals to socially conscious investors.

| Communication Channel | Key Data/Focus | Purpose |

|---|---|---|

| Corporate Website | $5.7 billion in assets (Q1 2024), operational details, project pipeline | Centralized information hub, transparency |

| Media Releases | $306 million adjusted EBITDA (Q1 2024), renewable project updates | Timely updates, building trust |

| Investor Conferences | Growth strategy, financial stability, ESG commitment | Direct stakeholder engagement, market positioning |

| Sustainability Reports | 38% GHG emissions reduction (vs. 2005 baseline) | Attracting socially conscious capital |

Price

Capital Power's revenue heavily relies on the wholesale power market, where prices can swing significantly. In 2024, for instance, average wholesale electricity prices in many North American markets saw considerable volatility due to factors like natural gas prices and renewable energy intermittency, directly impacting Capital Power's top-line performance.

To navigate these fluctuations, Capital Power employs pricing strategies that carefully weigh market demand, supply availability, and the actions of competitors. This approach aims to maximize profitability in these inherently unpredictable wholesale environments, ensuring they can capitalize on favorable market conditions.

Capital Power's revenue stream is significantly bolstered by long-term Power Purchase Agreements (PPAs). These agreements, often spanning decades, lock in revenue from their generation assets, providing a bedrock of financial stability.

As of early 2024, Capital Power reported that approximately 90% of its generation capacity was contracted under these long-term PPAs. This high percentage shields the company from the unpredictable swings of the wholesale electricity market, ensuring a more consistent financial performance.

The predictable cash flows generated by these PPAs are crucial for Capital Power's strategic planning and investment in new, cleaner energy projects. For instance, their 2023 financial reports highlighted the ongoing contribution of these contracts to their operational earnings, underscoring their importance in the marketing mix.

Capital Power prioritizes shareholder returns through a robust dividend policy, aiming for consistent annual increases. This commitment is a cornerstone of their strategy to deliver attractive total returns to investors, reflecting their stable cash flow generation from diverse energy assets.

Capital Allocation and Investment Funding

Capital Power's pricing and financial strategies are deeply intertwined with its approach to capital allocation. The company focuses on disciplined investment in growth projects, such as expanding its renewable energy portfolio and pursuing strategic acquisitions. This commitment to growth is balanced with a focus on financial health.

To fuel these initiatives, Capital Power employs a diversified funding strategy. This includes accessing capital through equity financing and securing term loan facilities. The objective is to support investments while diligently maintaining an investment-grade credit rating, a key indicator of financial stability.

- Capital Allocation Focus: Prioritizes investments in renewable energy projects and strategic acquisitions for growth.

- Funding Sources: Utilizes a mix of equity financing and term loan facilities to secure necessary capital.

- Financial Prudence: Aims to maintain an investment-grade credit rating while funding expansion.

- 2024/2025 Outlook: Continued investment in renewables is expected, supported by robust financial planning and access to capital markets.

Competitive Pricing in Project Development and Acquisitions

Capital Power positions itself as a low-cost developer and an efficient operator when undertaking new projects or acquiring existing assets. This strategy allows them to offer competitive pricing in the market, which is crucial for securing new contracts and expanding their generation portfolio profitably.

For instance, in their 2024 outlook, Capital Power highlighted a disciplined approach to capital allocation, aiming for projects with attractive risk-adjusted returns. Their focus on operational efficiency directly translates to lower per-unit costs, enhancing their ability to bid competitively on power purchase agreements.

- Cost Leadership: Capital Power strives for cost efficiency in development and operations.

- Competitive Bidding: This allows them to secure new contracts and projects.

- Portfolio Expansion: Their pricing strategy supports profitable growth.

- Operational Excellence: Efficiency is key to maintaining a low-cost structure.

Capital Power's pricing strategy is a delicate balance between the volatile wholesale market and the stability offered by long-term Power Purchase Agreements (PPAs). Their ability to secure a significant portion of their generation capacity under PPAs, approximately 90% as of early 2024, provides a predictable revenue stream.

This PPA dominance allows them to absorb wholesale price fluctuations, ensuring consistent cash flow which is vital for their investment in new projects. Their low-cost developer and operator approach further enables competitive pricing, crucial for securing new contracts and expanding their profitable generation portfolio.

The company's focus on shareholder returns via a consistent dividend policy, coupled with disciplined capital allocation towards renewables and acquisitions, underscores their pricing strategy's role in achieving overall financial objectives.

| Metric | 2023 (Actual) | 2024 (Projected/Early Data) | 2025 (Projected) |

|---|---|---|---|

| PPA Contracted Capacity | ~90% | ~90% | ~90% |

| Wholesale Market Exposure Impact | Moderate Volatility | Moderate Volatility | Moderate Volatility |

| Dividend Growth Target | Annual Increase | Annual Increase | Annual Increase |

4P's Marketing Mix Analysis Data Sources

Our Capital Power 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor communications, and industry-specific market intelligence. We meticulously review public filings, press releases, and energy sector analyses to ensure our insights are accurate and relevant.