Capital Power Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Power Bundle

Capital Power faces moderate bargaining power from buyers, as electricity prices are often regulated or influenced by long-term contracts, limiting immediate price concessions.

The threat of new entrants is relatively low due to high capital investment requirements and established infrastructure, creating a barrier to entry for potential competitors in the power generation sector.

The full analysis reveals the strength and intensity of each market force affecting Capital Power, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Capital Power's reliance on natural gas and coal makes fuel suppliers a potent force. The price of natural gas, a key fuel for Capital Power, is notoriously volatile, influenced by global demand, weather patterns, and geopolitical events. In 2024, natural gas prices saw significant fluctuations, with spot prices in North America at times exceeding $3.00 per MMBtu, impacting Capital Power's operational expenses.

The bargaining power of these suppliers is amplified by the concentrated nature of some fuel markets and the essential need for these resources in thermal power generation. Any disruption in supply or substantial price increases directly translates to higher operating costs for Capital Power, potentially squeezing profit margins and affecting the competitiveness of its electricity generation.

Suppliers of critical renewable technology, such as wind turbines and solar panels, often wield significant bargaining power. This stems from the high technological sophistication and proprietary intellectual property involved, coupled with a relatively concentrated market of specialized manufacturers. For instance, the global solar panel market, while growing, is dominated by a few key players who can influence pricing and delivery schedules.

Decarbonization technology providers, like those offering carbon capture, utilization, and storage (CCUS), hold significant bargaining power. This is due to the specialized and often proprietary nature of their solutions in an emerging market. For instance, the global CCUS market was valued at approximately USD 3.5 billion in 2023 and is projected to grow substantially, indicating high demand and limited supplier options.

Construction and Engineering Services

Specialized engineering, procurement, and construction (EPC) firms hold significant bargaining power in the construction and engineering services sector for power generation projects. Their expertise is vital for the successful execution of complex developments, especially those involving new technologies or stringent environmental regulations.

The demand for firms with proven track records in large-scale power projects, particularly in emerging areas like renewable energy (solar, wind) and decarbonization technologies (e.g., carbon capture), can consolidate leverage for these suppliers. This is especially true when seeking firms with specific, hard-to-find skill sets or extensive experience with particular project types.

- Specialized Expertise: EPC firms offering unique technical capabilities for advanced power projects, such as nuclear or large-scale offshore wind, command higher prices.

- Project Complexity: The more intricate and demanding a power project, the fewer EPC firms are qualified, increasing their bargaining power.

- Demand for Renewables: As of 2024, the global push for renewable energy has intensified demand for EPCs experienced in solar, wind, and battery storage installations, boosting their leverage.

- Limited Qualified Suppliers: For niche or cutting-edge power generation technologies, the pool of qualified EPC contractors is often small, giving them considerable negotiating strength.

Operations and Maintenance (O&M) Service Providers

Capital Power depends on a range of Operations and Maintenance (O&M) service providers to keep its diverse power generation facilities running smoothly. These providers offer specialized technical support and supply critical components, directly influencing Capital Power's operational expenses.

The bargaining power of these O&M suppliers is a significant factor. It hinges on how specialized the equipment is and how readily available skilled technicians are to service it. For instance, if a particular turbine requires highly specialized parts or a unique maintenance procedure, the supplier of that technology will likely possess greater leverage.

- Specialized Equipment: Suppliers of proprietary or highly specialized O&M equipment for Capital Power's facilities, such as advanced control systems or unique turbine components, can command higher prices due to limited alternatives.

- Availability of Skilled Labor: The scarcity of qualified personnel experienced in maintaining specific types of power generation technology can empower O&M service providers, allowing them to negotiate more favorable terms for their labor.

- Contractual Agreements: Long-term O&M contracts, often with built-in price escalation clauses or performance guarantees, can lock in costs for Capital Power but also provide revenue stability for suppliers, influencing their bargaining stance.

Capital Power's reliance on fuel suppliers, particularly for natural gas and coal, grants these entities significant bargaining power. The volatility of natural gas prices, a key input, directly impacts Capital Power's operational costs. In 2024, North American spot natural gas prices experienced fluctuations, at times surpassing $3.00 per MMBtu, illustrating this dynamic.

The concentration within certain fuel markets and the essential nature of these resources for thermal power generation further bolster supplier leverage. Any supply disruptions or price hikes directly translate to increased operating expenses for Capital Power, potentially impacting its profitability and market competitiveness.

Suppliers of specialized renewable energy technology and decarbonization solutions also hold considerable bargaining power. This is due to the proprietary nature of their innovations and the often-limited number of qualified providers in these emerging sectors. For instance, the global market for carbon capture technologies, valued around USD 3.5 billion in 2023, reflects high demand and a concentrated supplier base.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Capital Power |

| Fuel Suppliers (Natural Gas, Coal) | Price volatility, market concentration, essential resource | Increased operating costs, potential margin squeeze |

| Renewable Technology Suppliers (Solar, Wind) | Technological sophistication, intellectual property, market concentration | Higher equipment costs, potential delivery schedule impacts |

| Decarbonization Technology Providers (CCUS) | Specialized solutions, proprietary nature, emerging market | High cost of new technology adoption, reliance on few providers |

| EPC Firms | Specialized expertise, project complexity, demand for renewables | Higher project development costs, reliance on qualified contractors |

| O&M Service Providers | Specialized equipment, availability of skilled labor, contractual terms | Increased maintenance expenses, potential for service disruptions |

What is included in the product

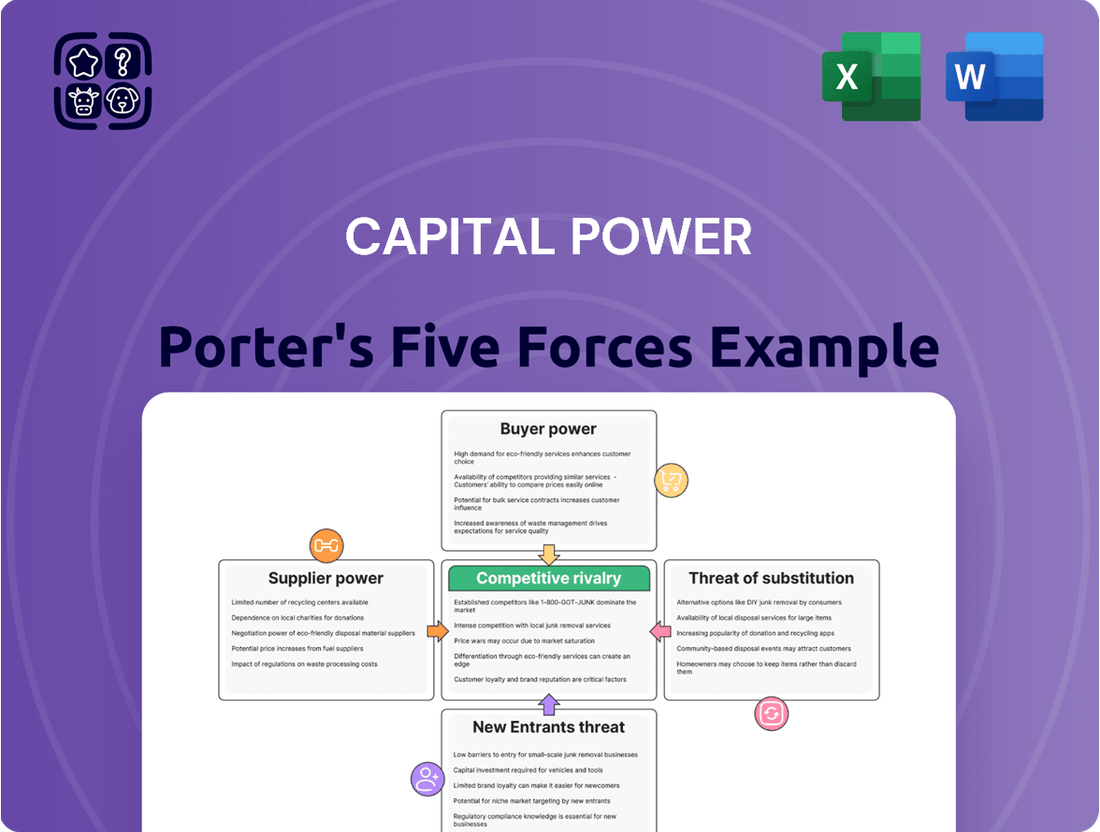

This analysis delves into the competitive forces impacting Capital Power, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the energy sector.

Instantly visualize competitive intensity with a dynamic, interactive Porter's Five Forces model, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Capital Power's customers are primarily large entities operating within wholesale power markets, including utilities, industrial users, and power marketers. These buyers are often sophisticated and possess considerable bargaining strength, particularly in markets with limited major purchasers or when generation capacity exceeds demand.

The commodity nature of electricity significantly amplifies customer bargaining power. Because electricity is largely undifferentiated, buyers, especially large industrial consumers and utilities, are highly sensitive to price. This forces Capital Power to compete primarily on cost and reliability, rather than product features. For instance, in 2024, the wholesale price of electricity in many regions fluctuated, directly impacting Capital Power's revenue streams as customers could more easily switch to lower-cost providers if available.

Capital Power's reliance on long-term Power Purchase Agreements (PPAs) significantly mitigates immediate customer bargaining power by fixing prices and volumes. For instance, as of the first quarter of 2024, Capital Power had approximately 92% of its expected 2024 generation hedged through PPAs, with 85% of its expected 2025 generation also secured. This provides substantial revenue predictability.

However, the bargaining power of customers resurfaces during the negotiation and renewal phases of these PPAs. If customers have access to competitive alternative energy sources, such as renewables or other independent power producers, they can leverage this to negotiate more favorable terms, potentially impacting Capital Power's future contract pricing and margins.

Regulatory Influence on Pricing

Regulatory bodies significantly shape electricity prices. For instance, in 2024, the Alberta Utilities Commission (AUC) continued to oversee wholesale market pricing mechanisms, influencing how Capital Power can set its rates. This oversight is designed to protect consumers, thereby increasing their bargaining power by limiting excessive price increases.

This regulatory influence directly impacts Capital Power's ability to command higher prices. By setting price caps or approving specific rate structures, regulators act as a proxy for customer interests. This means that even if market demand is high, regulatory intervention can curb the pricing power that might otherwise be available to a generator, effectively amplifying customer leverage.

- Regulatory Oversight: Agencies like the AUC in Alberta directly influence wholesale electricity prices, limiting generator pricing power.

- Consumer Protection Focus: Regulators prioritize affordable and reliable power for end-users, indirectly bolstering customer influence.

- Price Mechanisms: The specific rules governing market operations, approved by regulators, determine the extent to which companies like Capital Power can adjust prices.

Customer Sophistication and Alternatives

Capital Power's wholesale customers are increasingly sophisticated, armed with comprehensive market data and a growing array of generation alternatives. This includes the option for self-generation or sourcing power from other independent power producers (IPPs).

This heightened customer awareness and the availability of substitute power sources significantly amplify their bargaining power. For instance, in 2024, the increasing adoption of distributed generation technologies, like rooftop solar and battery storage, provided commercial and industrial customers with viable alternatives to traditional utility power purchase agreements, putting pressure on Capital Power's pricing strategies.

- Sophisticated Market Knowledge: Customers possess detailed information on market prices, fuel costs, and regulatory environments, enabling informed negotiation.

- Diverse Generation Alternatives: Options like on-site generation, renewable energy credits, and power purchase agreements with other IPPs provide leverage.

- Price Sensitivity: The availability of alternatives makes customers highly sensitive to price, compelling Capital Power to offer competitive rates and terms.

- Service Expectations: Beyond price, customers demand reliable service and flexible contract structures, further influencing Capital Power's operational and commercial strategies.

Capital Power's customers, primarily large utilities and industrial users, wield significant bargaining power due to the commodity nature of electricity and the availability of alternatives. This power is amplified when generation capacity outstrips demand or when customers can easily switch providers. The increasing sophistication of these buyers, coupled with regulatory oversight aimed at consumer protection, further strengthens their negotiating position, particularly during contract renewals.

The availability of distributed generation and other independent power producers (IPPs) in 2024 provided commercial and industrial customers with viable alternatives, pressuring Capital Power's pricing. For instance, while Capital Power had hedged a significant portion of its 2024 and 2025 generation through Power Purchase Agreements (PPAs), the negotiation and renewal phases of these contracts remain critical junctures where customer leverage is most evident.

| Customer Type | Bargaining Power Factors | Impact on Capital Power | 2024 Data/Trend Example |

|---|---|---|---|

| Wholesale Utilities | Price sensitivity, access to alternative suppliers, regulatory influence | Negotiate lower prices, shorter contract terms | Fluctuating wholesale electricity prices in 2024 pressured generators to offer competitive rates. |

| Industrial Users | Potential for self-generation, demand for flexible contracts, price sensitivity | Demand for tailored PPAs, leverage for price concessions | Growing adoption of on-site solar and battery storage provided industrial customers with alternatives to traditional PPAs. |

| Power Marketers | Market knowledge, ability to aggregate demand, arbitrage opportunities | Seek best available pricing, may shift demand to lower-cost providers | Sophisticated market participants actively sought out the most cost-effective power sources in 2024. |

Same Document Delivered

Capital Power Porter's Five Forces Analysis

This preview showcases the complete Capital Power Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring you get the full, professionally formatted analysis without any alterations or omissions. This comprehensive report is ready for immediate use, providing actionable insights into Capital Power's strategic positioning.

Rivalry Among Competitors

The North American power generation landscape presents a dynamic competitive environment, featuring a blend of established utilities, agile independent power producers (IPPs), and emerging smaller developers. This creates a complex competitive rivalry, particularly as consolidation trends gain momentum.

While certain segments remain fragmented, a notable trend of consolidation is reshaping the industry. Major players are actively acquiring assets and expanding market share, especially within the rapidly growing renewable energy sector. For instance, in 2024, significant M&A activity was observed, with several large utilities acquiring substantial renewable portfolios from IPPs.

The power generation sector is inherently capital-intensive, meaning companies invest heavily in infrastructure like power plants. This leads to substantial fixed costs, such as debt servicing and maintenance, regardless of how much electricity is produced. To recoup these massive investments, companies are incentivized to run their facilities at high utilization rates, often exceeding 80%.

When the market experiences oversupply, perhaps due to new capacity coming online or slower-than-expected demand growth, this pressure intensifies. Companies with excess capacity are compelled to sell their available power, even at lower prices, to cover their fixed costs. For instance, in 2024, regions with significant renewable energy additions alongside stable demand saw wholesale electricity prices dip, reflecting this competitive dynamic as generators sought to fill their output slots.

Capital Power faces intense competition from rivals who also boast diverse generation portfolios. Many competitors, like TransAlta and FortisAlberta, operate across natural gas, coal, and increasingly, renewable sources such as wind and solar. This broad spectrum of assets means Capital Power is in direct competition on multiple fronts, from baseload power to intermittent renewables.

The rapid transition to renewables further intensifies this rivalry. For instance, in 2024, many utilities are accelerating their retirement of coal-fired plants and significantly increasing investments in wind and solar projects. This strategic shift requires Capital Power to continuously optimize its asset mix and operational efficiency to remain competitive across all energy segments.

Geographic and Regulatory Differences

Competitive rivalry in the North American power sector is heavily influenced by geographic and regulatory differences. Capital Power operates across diverse markets, each with its own set of rules and market structures. For instance, the Alberta market, where Capital Power has a significant presence, differs from the Ontario market or those in the United States.

These variations mean Capital Power must adapt its strategies for each region. In 2024, the company's approach in Alberta, known for its deregulated wholesale market, contrasts with its operations in other jurisdictions that might have different capacity markets or renewable energy credit systems. This necessitates a granular understanding of local competitive dynamics and regulatory landscapes.

Capital Power's competitive intensity is therefore not uniform across its portfolio. For example, in Alberta, it competes with established players and new entrants drawn to the province's resource base and market design. Meanwhile, in other regions, the competitive set might include utilities with different generation mixes or regulatory obligations, impacting pricing and market share opportunities.

- Regional Market Designs: Alberta's energy-only market versus other North American markets with capacity mechanisms.

- Regulatory Frameworks: Varying environmental regulations, renewable portfolio standards, and transmission access rules across provinces and states.

- Resource Availability: Differences in natural gas prices, renewable resource potential (wind, solar), and existing generation asset bases shape competition.

- Local Player Dynamics: Competition from provincial utilities, independent power producers, and developers with specific regional expertise.

Focus on Decarbonization and Renewables

The energy sector's intense focus on decarbonization fuels fierce competition. Companies are aggressively pursuing renewable energy projects, leading to a scramble for prime development locations and access to grid interconnection. This rivalry is particularly sharp for securing long-term power purchase agreements (PPAs) for clean energy, as seen in the growing demand for offshore wind leases and solar farm sites.

This push for renewables means competitors are locked in a battle for talent and technology in areas like battery storage and green hydrogen. For instance, in 2024, many utilities and independent power producers announced substantial capital expenditures dedicated to expanding their renewable portfolios, often exceeding billions of dollars. This investment spree intensifies the competitive landscape as firms vie for market share in the rapidly evolving clean energy market.

- Renewable Development Site Competition: Increased demand for land suitable for solar and wind farms drives up acquisition costs and competition for prime locations.

- Interconnection Queue Backlogs: The sheer volume of renewable projects seeking grid connection creates lengthy and competitive queues, delaying project timelines and increasing costs.

- PPA Market Intensity: Securing long-term contracts for renewable energy is crucial for project financing, leading to bidding wars and higher prices for off-takers.

- Technological Innovation Race: Competitors are investing heavily in R&D for more efficient solar panels, advanced wind turbines, and grid-scale battery storage solutions.

Capital Power faces intense rivalry from a diverse set of North American power generators, including large utilities and agile independent power producers. This competition is amplified by the capital-intensive nature of the industry, where high fixed costs pressure all players to maximize asset utilization, often leading to price competition during periods of oversupply.

The ongoing energy transition, particularly the rapid expansion of renewables, intensifies this rivalry as companies like Capital Power must continually adapt their generation portfolios. In 2024, this has translated into significant M&A activity and substantial investments in wind and solar, creating a competitive race for prime development sites and securing long-term power purchase agreements.

Geographic and regulatory variations across different markets further segment the competitive landscape, requiring Capital Power to tailor its strategies. For instance, the company's competitive positioning in Alberta's energy-only market differs from its approach in other jurisdictions with distinct market designs and renewable energy support mechanisms.

The battle for talent and technological advancements in areas like battery storage and green hydrogen is also a key differentiator. Many utilities and IPPs announced multi-billion dollar capital expenditures in 2024 to bolster their clean energy capabilities, underscoring the aggressive competition for market share in this evolving sector.

SSubstitutes Threaten

The rise of distributed generation, such as rooftop solar, presents a significant threat by enabling end-users to produce their own electricity. This directly diminishes the need for power from traditional, centralized sources like Capital Power. For instance, in 2023, solar installations in Canada saw substantial growth, with residential rooftop solar contributing to this trend, thereby reducing reliance on grid-supplied energy.

Advancements in battery storage and other energy storage technologies present a significant threat by offering alternatives to traditional dispatchable power. These solutions allow for storing energy from intermittent sources like solar and wind, or during off-peak times. For instance, by the end of 2023, global battery storage capacity had surpassed 100 GW, a substantial increase from previous years, indicating growing adoption.

As energy storage technologies become more affordable, they directly challenge the need for baseload and dispatchable thermal generation, a core offering of companies like Capital Power. The decreasing cost of lithium-ion batteries, for example, has made grid-scale storage increasingly competitive, potentially reducing demand for conventional power plants.

Improvements in energy efficiency are a significant threat to Capital Power. For instance, in 2024, many industrial sectors are adopting advanced automation and smart manufacturing processes that slash energy usage per unit of output. This directly reduces the need for the electricity Capital Power generates.

Demand-side management (DSM) programs, often incentivized by regulators, also pose a threat. These programs encourage consumers to shift electricity usage away from peak hours, thereby flattening demand curves and lessening the need for Capital Power's peak generation capacity. Some utilities reported a 5-10% reduction in peak demand through successful DSM initiatives in 2023-2024.

Microgrids and Off-Grid Solutions

The rise of microgrids and off-grid power solutions presents a significant threat of substitution for traditional utility providers like Capital Power. These systems allow for localized electricity generation and distribution, effectively bypassing the main power grid.

For large industrial users or entire communities, these independent power sources can act as a direct alternative to buying electricity from wholesale markets, thereby cutting out established generators. For instance, in 2024, the global microgrid market was valued at approximately $30 billion, with projections indicating substantial growth driven by resilience and cost-saving benefits for end-users.

- Growing Adoption: Industrial and commercial sectors are increasingly exploring microgrids to ensure energy security and reduce reliance on the main grid.

- Cost Competitiveness: Advancements in renewable energy technologies, particularly solar and battery storage, are making off-grid solutions more economically viable.

- Policy Support: Government incentives and favorable regulations in various regions are further accelerating the adoption of microgrids and distributed generation.

- Resilience Demand: Extreme weather events and grid instability are driving demand for resilient power solutions, which microgrids readily provide.

Fuel Switching and Alternative Fuels

The threat of substitutes for Capital Power's services arises from industrial consumers' ability to switch to alternative fuels for on-site power generation or direct process heat. This bypasses the need for grid electricity, particularly impacting industries with substantial energy requirements that can justify investing in their own energy infrastructure.

For instance, in 2024, many large industrial facilities, such as chemical plants and manufacturing operations, continued to explore or implement co-generation systems utilizing natural gas, biomass, or even waste heat recovery. These investments allow them to control energy costs and ensure a more stable supply, directly substituting the need for electricity purchased from grid-dependent providers like Capital Power.

- Fuel Switching Capability: Industries with significant energy consumption can invest in on-site generation, reducing reliance on grid electricity.

- Cost Control: On-site generation offers potential cost savings and greater predictability for energy expenses.

- Energy Independence: Alternative fuel adoption enhances energy security and reduces vulnerability to grid price fluctuations.

The increasing efficiency of industrial processes directly reduces electricity demand, presenting a significant substitute for Capital Power's services. For example, by 2024, sectors like advanced manufacturing were seeing energy consumption per unit of output fall by as much as 15% due to smart technologies.

Demand-side management programs also act as substitutes by shifting usage away from peak times, thereby lowering the need for Capital Power's peak generation capacity. Utilities reported reductions in peak demand ranging from 5% to 10% in 2023-2024 through these initiatives.

The threat of substitutes is further amplified by the growing adoption of microgrids and off-grid solutions, which allow end-users to generate their own power, bypassing traditional utilities. The global microgrid market was valued at approximately $30 billion in 2024, highlighting this trend.

Alternative fuels for on-site generation, such as natural gas or biomass, also substitute for grid-supplied electricity, especially for large industrial consumers seeking cost control and energy independence. Many industrial facilities in 2024 continued to invest in co-generation systems for these reasons.

| Substitute | Impact on Capital Power | 2023-2024 Trend/Data |

|---|---|---|

| Distributed Generation (Rooftop Solar) | Reduces reliance on centralized power | Significant growth in residential solar installations |

| Energy Storage Technologies | Offers alternatives to dispatchable power | Global battery storage capacity exceeded 100 GW by end of 2023 |

| Energy Efficiency Improvements | Lowers overall electricity demand | Industrial sectors saw up to 15% reduction in energy use per output unit |

| Demand-Side Management (DSM) | Flattens demand curves, reduces peak load needs | Utilities reported 5-10% peak demand reduction |

| Microgrids/Off-Grid Solutions | Bypass traditional grid supply | Global microgrid market valued at ~$30 billion in 2024 |

| On-Site Generation (Alternative Fuels) | Directly substitutes grid electricity for industrial users | Continued investment in co-generation by industrial facilities |

Entrants Threaten

The power generation sector, including companies like Capital Power, demands massive upfront investment. Building a new power plant, whether it's a natural gas facility or a renewable energy project, can cost billions of dollars. For instance, the construction of a new natural gas plant can range from $1 billion to $2 billion, while large-scale solar or wind farms also require hundreds of millions in capital.

This substantial capital requirement serves as a formidable barrier for potential new competitors. Entrants must not only secure this enormous financing but also prove their long-term financial stability and operational capacity to lenders and investors. This makes it exceptionally difficult for smaller or less capitalized entities to enter the market and challenge established players who already possess the necessary infrastructure and financial backing.

New power generation projects, like those Capital Power might consider, face a gauntlet of intricate regulations. These include rigorous environmental impact assessments, obtaining various operating licenses, and securing grid interconnection approvals. For instance, in 2024, the average time to secure all necessary permits for a new renewable energy project in North America could extend well over two years, involving multiple federal, state, and local agencies.

These complex and time-consuming regulatory processes act as a significant deterrent for potential new entrants. The sheer administrative burden, coupled with the substantial costs associated with compliance and legal counsel, creates a formidable barrier to entry. Companies without established expertise in navigating these systems would find it exceptionally difficult to enter the market, thereby protecting existing players like Capital Power.

New power generation projects face significant hurdles in accessing existing transmission infrastructure and securing necessary interconnection agreements. These processes are often lengthy and complex, creating substantial delays for new entrants aiming to connect to the grid and deliver power to customers.

Transmission bottlenecks and the sheer volume of projects in interconnection queues, which can stretch for years, act as a powerful deterrent. For instance, in the US, the Federal Energy Regulatory Commission (FERC) has been working to reform its interconnection queue processes, acknowledging that by the end of 2023, the queue had grown to over 17,000 projects totaling more than 1.7 terawatts of generation capacity, a stark increase from previous years.

Incumbent power producers, already connected to the grid and possessing established relationships with transmission operators, hold a distinct advantage. This established access allows them to bring new capacity online more efficiently, effectively raising the barrier to entry for new competitors who must navigate these complex and often congested systems.

Economies of Scale and Experience

Established power producers like Capital Power leverage significant economies of scale, particularly in fuel procurement and maintenance, which translates to lower operational costs per megawatt-hour. For instance, in 2024, large-scale generation facilities often benefit from bulk purchasing agreements that new entrants cannot easily replicate.

New entrants face a steep climb in achieving cost competitiveness due to their initial lack of operational experience and smaller asset base. This disadvantage is compounded when considering the learning curve associated with managing complex power generation assets, which can take years to optimize for efficiency.

- Economies of Scale: Capital Power's existing infrastructure allows for more efficient resource utilization and lower per-unit costs in 2024.

- Experience Curve: Decades of operational experience enable established players to optimize performance and reduce downtime, a benefit new entrants must build over time.

- Procurement Power: Bulk purchasing of fuel and equipment provides a significant cost advantage for incumbent firms.

- Financing Costs: Larger, established companies often secure more favorable financing terms, further reducing their overall cost of capital compared to new ventures.

Market Volatility and Price Risk

Wholesale power markets are inherently volatile, with prices swinging significantly due to shifts in supply and demand, the cost of fuels like natural gas, and even weather patterns. For instance, the average price of electricity in the U.S. experienced notable fluctuations throughout 2023 and into early 2024, influenced by these factors.

New companies entering the capital power sector, particularly those without a broad mix of generation assets or sophisticated hedging and risk management tools, face a heightened exposure to this price volatility. This makes the capital investment inherently riskier compared to businesses operating in more predictable, regulated utility environments.

- Price Volatility: Wholesale electricity prices can change rapidly, impacting revenue streams for new entrants.

- Fuel Cost Exposure: Fluctuations in natural gas prices, a key input for many power plants, directly affect profitability.

- Weather Dependence: Extreme weather events can disrupt supply and demand, leading to unpredictable price spikes or drops.

- Risk Management Challenges: New entrants may lack the established infrastructure and expertise to effectively manage these market risks.

The threat of new entrants in the power generation sector, which includes companies like Capital Power, is significantly mitigated by the immense capital required to build new facilities. These costs, often running into billions for a single plant, create a substantial financial hurdle. For example, constructing a new natural gas power plant in 2024 could cost between $1 billion and $2 billion, making it difficult for new players to compete without significant backing.

Furthermore, the complex web of regulations and the lengthy process of obtaining permits and grid interconnection approvals act as a strong deterrent. Navigating these requirements, which can take over two years for renewable projects as of 2024, demands specialized expertise and resources that new entrants may lack.

Established players also benefit from economies of scale in procurement and operations, as well as years of experience optimizing plant performance. This cost advantage, coupled with the inherent price volatility in wholesale power markets, makes it challenging for new, less experienced companies to enter and thrive.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Capital Power is built upon a foundation of publicly available financial statements, regulatory filings from bodies like the SEC and provincial utilities commissions, and industry-specific reports from reputable energy sector analysts.