Capital Power PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Power Bundle

Capital Power operates in a dynamic energy landscape, heavily influenced by political shifts, economic volatility, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying future opportunities. Our comprehensive PESTLE analysis delves deep into these factors, providing actionable intelligence to navigate the complexities of the energy sector.

Don't get left behind in the evolving energy market. Our PESTLE analysis of Capital Power offers a clear roadmap of the political, economic, social, technological, legal, and environmental trends shaping its future. Gain the competitive edge you need to make informed decisions. Purchase the full report now for immediate access to these vital insights.

Political factors

Government policies in North America are a major force shaping Capital Power's future. The Inflation Reduction Act (IRA) in the United States, for instance, offers significant tax credits and incentives for renewable energy projects, making investments in solar and wind power more attractive. This legislation is a key driver for clean energy development, directly impacting Capital Power's strategic planning and project pipelines.

In Canada, the proposed Clean Electricity Regulations aim for a net-zero electricity grid by 2050. While this sets a clear long-term direction, the timeline and the ongoing discussions between federal and provincial governments introduce a degree of uncertainty. These differing perspectives can create both opportunities for new projects aligned with decarbonization goals and challenges in navigating varied regulatory landscapes across provinces.

Disagreements between provincial and federal governments in Canada regarding climate change and energy production create a complex regulatory environment for Capital Power. For instance, in 2024, Alberta's government continued to express concerns about federal carbon pricing impacts on its energy sector, potentially affecting Capital Power's operational costs and investment decisions.

While some provinces favor less federal oversight and a more business-friendly approach, the federal government is pushing for stricter emissions caps and clean electricity regulations. This tension can lead to policy uncertainty, influencing Capital Power's long-term strategic planning for its generation assets and renewable energy projects across Canada.

Trade policies and international relations significantly influence the energy sector, particularly for companies with cross-border operations like Capital Power. In North America, ongoing discussions and agreements aimed at harmonizing energy efficiency standards and reducing trade barriers directly affect how Capital Power operates and invests in both Canada and the United States.

For instance, the U.S. Department of Energy reported in early 2024 that cross-border electricity trade between Canada and the U.S. reached an estimated 107,000 gigawatt-hours (GWh) in 2023, highlighting the interconnectedness and the potential impact of policy shifts on this vital flow of energy. Changes in import/export regulations or tariffs could alter the cost-effectiveness of Capital Power's generation assets and their ability to serve markets across the border.

Political Stability and Elections

The political climate significantly impacts Capital Power, with upcoming elections in key operating regions like Canada and the United States introducing potential policy shifts. For instance, a change in U.S. federal administration could lead to altered incentives for renewable energy projects or a renewed focus on traditional power generation. In 2024, the U.S. presidential election is a major event to monitor, as energy policy is often a central campaign issue.

Uncertainty surrounding future energy regulations can affect Capital Power's investment decisions and project timelines. For example, a government prioritizing fossil fuel expansion might reduce subsidies for renewables, impacting the economic viability of certain Capital Power assets. Conversely, a pro-renewable stance could accelerate the company's transition strategy.

Capital Power's operations are subject to various government regulations concerning emissions, environmental protection, and energy market structures. Changes in these regulations, often driven by political agendas, can directly influence operating costs and revenue streams. For example, stricter carbon pricing mechanisms, if implemented, would directly affect the profitability of coal-fired power plants.

Key political considerations for Capital Power include:

- U.S. Federal Elections: Potential shifts in energy policy, including renewable energy tax credits and environmental regulations, under a new administration in 2025.

- Canadian Provincial Elections: Provincial governments in Alberta and Ontario, where Capital Power has significant operations, often set energy policy frameworks.

- Climate Change Policies: National and sub-national commitments to reduce greenhouse gas emissions can influence the pace of transitioning away from fossil fuels.

Subsidies and Incentives for Energy Transition

Government subsidies and incentives significantly shape Capital Power's investment decisions in clean energy. For instance, the Inflation Reduction Act (IRA) in the U.S. offers substantial tax credits for renewable energy projects, directly bolstering the economic case for Capital Power's expansion into solar and wind power. These financial supports are vital for making new clean energy ventures economically feasible and accelerating the shift away from carbon-intensive assets.

These policy drivers are critical for managing the financial risks associated with large-scale decarbonization projects. Capital Power's 2024-2025 strategic planning heavily incorporates the availability and longevity of such incentives. The company is actively evaluating projects that can leverage these programs to enhance returns and de-risk capital deployment in its transition strategy.

Key financial impacts include:

- Enhanced Project Economics: Tax credits and grants reduce the upfront capital costs and improve the overall return on investment for renewable energy projects.

- Accelerated Deployment: Incentives encourage faster development and construction timelines for new clean energy infrastructure.

- Competitive Advantage: Companies that effectively utilize these programs gain a competitive edge in the evolving energy market.

Political factors significantly influence Capital Power's operational landscape and strategic direction, particularly concerning government policies on energy and climate change. The U.S. Inflation Reduction Act (IRA), enacted in 2022, continues to provide substantial tax credits for renewable energy, impacting Capital Power's investment decisions for solar and wind projects throughout 2024 and into 2025. Canada's proposed Clean Electricity Regulations, aiming for a net-zero grid by 2050, create a long-term framework but also introduce federal-provincial policy complexities that Capital Power must navigate. Upcoming elections in both the U.S. and Canada during 2024 and 2025 introduce potential policy shifts that could affect the company's asset performance and future development plans.

What is included in the product

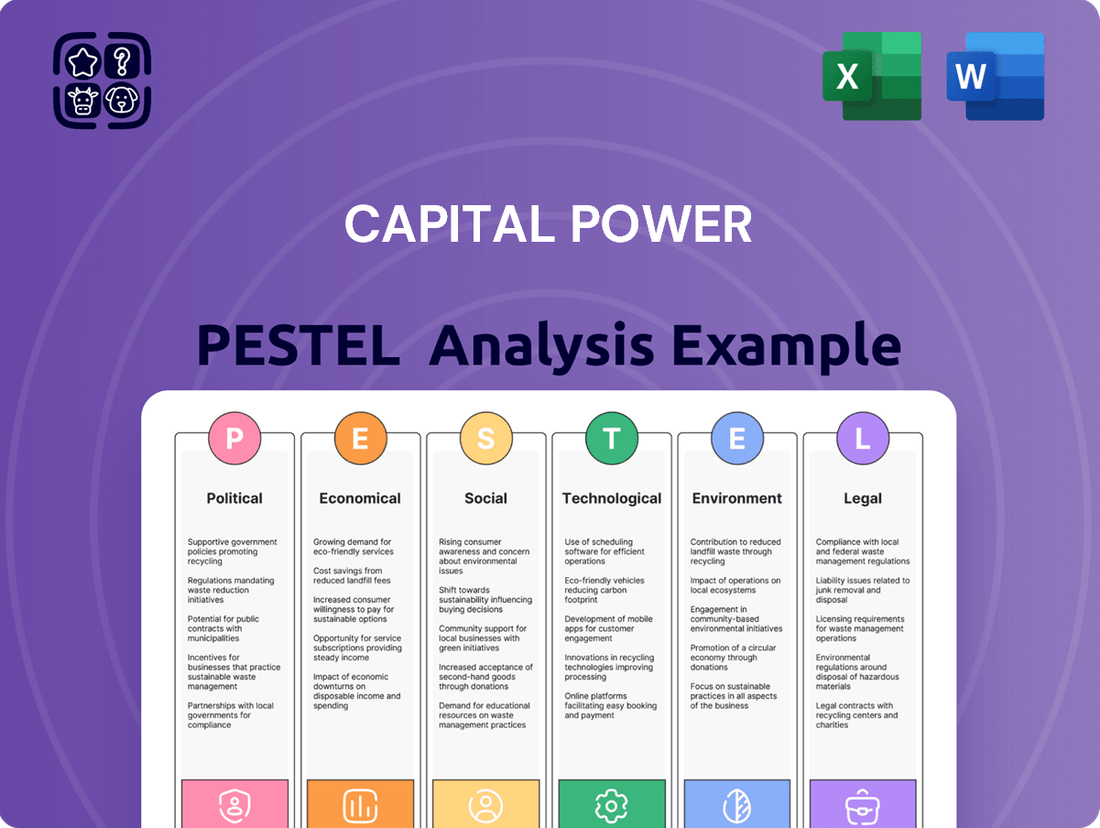

Capital Power's PESTLE analysis examines the external macro-environmental forces impacting its operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This comprehensive evaluation provides actionable insights for strategic decision-making by highlighting key trends and potential challenges within Capital Power's operating landscape.

A concise PESTLE analysis for Capital Power offers a readily digestible overview, simplifying complex external factors for efficient strategic decision-making and communication.

Economic factors

North American electricity demand is on the rise, propelled by the electrification of transportation, reshoring of manufacturing, and the immense power needs of burgeoning data centers. For instance, U.S. electricity consumption from data centers is projected to more than double by 2030, reaching an estimated 732 billion kilowatt-hours annually.

These demand surges, combined with the volatility of natural gas prices, directly impact wholesale electricity market prices. In 2024, natural gas prices have seen fluctuations, with benchmarks like Henry Hub averaging around $2.00 per MMBtu, influencing the cost of electricity generation and, consequently, Capital Power's revenue streams.

The push towards decarbonization is fueling massive investment in renewable energy. In 2024 alone, the United States saw record levels of public and private funding flow into clean energy projects. This surge is directly linked to supportive government policies, which are accelerating the build-out of solar, wind, and battery storage infrastructure.

This environment presents a significant growth avenue for companies like Capital Power, enabling them to expand their renewable energy generation capacity. The increasing demand for clean power, driven by both regulatory mandates and market preferences, creates a favorable landscape for developing and acquiring new renewable assets.

Capital Power's capacity to fund its expansion, including renewable energy projects and acquisitions, hinges on its financial flexibility and the cost of its capital. A strong credit rating is crucial for securing favorable financing terms.

The company has demonstrated its commitment to growth by utilizing equity financing and securing term loan facilities. For instance, in 2023, Capital Power issued $500 million in senior unsecured notes, which helped bolster its financial position and support ongoing development activities.

Inflation and Interest Rates

Inflationary pressures in 2024 and 2025 directly affect Capital Power's operational costs, particularly for fuel and maintenance, and can increase the expenses associated with new project development. Rising interest rates, a common response to inflation, will likely increase the cost of capital for Capital Power's significant infrastructure investments, potentially impacting project feasibility and profitability.

For instance, persistent inflation in 2024 has led central banks, including the Bank of Canada and the U.S. Federal Reserve, to maintain higher interest rate environments. This directly translates to higher borrowing costs for companies like Capital Power when financing new generation facilities or undertaking major upgrades.

- Inflationary pressures can increase the cost of raw materials and labor for Capital Power's operations and new projects.

- Higher interest rates, a response to inflation, raise the cost of debt financing for Capital Power's capital-intensive projects.

- These macroeconomic factors influence the overall cost of doing business and the expected investment returns within the energy sector.

Economic Growth and Industrial Activity

Overall economic growth and robust industrial activity are key drivers for Capital Power. Sectors experiencing significant expansion, such as those reliant on advanced computing and artificial intelligence, are increasing their electricity consumption. This trend directly fuels the demand for the reliable and dispatchable power generation that Capital Power specializes in, underpinning its core business strategy.

The growth trajectory of key industrial sectors is a fundamental factor for Capital Power. For instance, the burgeoning demand from artificial intelligence data centers, a significant electricity consumer, is projected to continue its upward trend through 2025. This surge in demand from energy-intensive industries directly translates into a greater need for consistent and available power sources.

Capital Power's focus on providing reliable, dispatchable generation aligns perfectly with the needs of a growing economy. As industrial output expands, particularly in areas like advanced manufacturing and data processing, the requirement for stable and on-demand electricity becomes paramount. This creates a strong, fundamental demand for Capital Power's services.

- Industrial Output Growth: Canada's industrial production saw a 1.2% increase in April 2024 compared to the previous month, indicating a healthy expansion in industrial activity.

- AI Data Center Demand: Projections suggest that data center electricity consumption in North America could double by 2030, highlighting a substantial growth area for power providers.

- Energy Intensity: Sectors like advanced manufacturing and semiconductor fabrication are inherently energy-intensive, meaning their growth directly correlates with increased power demand.

- Economic Outlook: The International Monetary Fund (IMF) forecasts global economic growth of 3.2% for both 2024 and 2025, suggesting a supportive environment for industrial expansion and, consequently, power consumption.

Economic growth is a primary driver for Capital Power, with rising electricity demand fueled by industrial expansion and the significant power needs of data centers. For example, U.S. data center electricity consumption is expected to more than double by 2030, reaching an estimated 732 billion kilowatt-hours annually.

Fluctuations in natural gas prices, a key fuel source, directly impact wholesale electricity costs and Capital Power's revenue. In 2024, benchmarks like Henry Hub have averaged around $2.00 per MMBtu, showcasing this volatility.

Inflationary pressures and higher interest rates in 2024-2025 increase Capital Power's operational costs and the cost of capital for new projects. For instance, central banks like the U.S. Federal Reserve have maintained higher interest rates to combat inflation, directly impacting borrowing costs.

The strong economic outlook, with the IMF forecasting 3.2% global growth for 2024 and 2025, supports industrial expansion and consequently, increased power demand, benefiting Capital Power's business model.

Preview the Actual Deliverable

Capital Power PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Capital Power PESTLE Analysis offers a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to provide actionable insights for strategic decision-making.

Sociological factors

Public perception significantly shapes Capital Power's ability to operate and expand, especially concerning the shift from fossil fuels to renewable energy sources. Surveys in 2024 indicated that over 70% of Canadians support increased investment in renewable energy, directly impacting how Capital Power's existing and future facilities are viewed by the public.

Maintaining positive community relations is crucial for Capital Power's social license to operate. For instance, in 2024, the company reported investing over $15 million in community initiatives across its operating regions, demonstrating a commitment to local engagement and development.

Engaging respectfully and collaboratively with Indigenous Peoples is a cornerstone of Capital Power's corporate responsibility. The company's 2024 sustainability report highlighted partnerships with several First Nations, focusing on shared value creation and environmental stewardship in project development.

The ongoing energy transition is significantly reshaping the labor market. By 2024, the renewable energy sector in Canada was projected to employ over 247,000 people, a figure expected to grow as clean energy investments accelerate. This shift presents Capital Power with opportunities to recruit skilled workers for its growing renewable portfolio, while also necessitating strategies to manage potential workforce adjustments in its thermal generation assets.

Capital Power's focus on equity, diversity, and inclusion (EDI) is a critical factor in attracting and retaining talent in this competitive landscape. Companies with strong EDI commitments, like Capital Power's stated goal to increase representation of underrepresented groups, often see higher employee engagement and a broader talent pool. For instance, in 2023, Capital Power reported progress in its diversity metrics, aiming to reflect the communities it serves, which is vital for long-term workforce stability and innovation.

Societal preferences are increasingly leaning towards cleaner energy, with consumers and investors alike demanding more sustainable options. This trend is a significant driver for Capital Power as it shapes the company's strategic direction, pushing for expansion in renewable energy sources and a reduction in its overall carbon footprint.

In 2024, for instance, renewable energy sources continued to gain market share. In Canada, renewable electricity generation accounted for approximately 30% of the total electricity supply, a figure expected to grow as policies and consumer demand align. This societal shift directly impacts Capital Power's investment decisions, encouraging a pivot towards wind, solar, and other green technologies.

Health and Safety Standards

The health and safety of employees and the surrounding communities are paramount sociological considerations for a power generation company like Capital Power. Ensuring a secure working environment and minimizing community impact are fundamental to maintaining public trust and operational continuity.

Capital Power demonstrates a strong commitment to these principles by prioritizing the safe and reliable delivery of power. This focus on stringent health and safety standards is embedded in their operational philosophy.

- Zero Harm Culture: Capital Power actively promotes a zero harm culture, aiming to prevent all injuries and incidents.

- Safety Performance: In 2023, Capital Power reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.58, reflecting a strong safety record.

- Community Engagement: The company engages with communities to address concerns and ensure safe operations impacting local residents.

- Regulatory Compliance: Adherence to rigorous occupational health and safety regulations is a core operational requirement.

Indigenous Relations and Land Use

Capital Power's operations are situated within the ancestral homelands of various Indigenous Peoples across North America. This necessitates a deep respect for Indigenous rights and a commitment to meaningful engagement. For instance, in 2023, Capital Power continued its work on the Sundance and Aldersyde renewable energy projects in Alberta, areas with historical significance to the Siksika First Nation and other Treaty 7 Nations, requiring ongoing consultation and collaboration regarding land use and potential impacts.

Considering land use implications for new projects is a critical sociological factor. This involves understanding traditional land use, sacred sites, and the potential environmental and cultural impacts of energy infrastructure development. Capital Power's approach involves early and ongoing dialogue to ensure projects align with the values and concerns of Indigenous communities, aiming for mutually beneficial outcomes.

- Indigenous Consultation: Capital Power actively engages with Indigenous communities for new projects, respecting their rights and traditional territories.

- Land Use Agreements: Negotiations and agreements with Indigenous groups are vital for project development, ensuring consideration of cultural and environmental heritage.

- Partnership Opportunities: Exploring opportunities for Indigenous participation and benefit-sharing in energy projects fosters stronger relationships and shared prosperity.

- Cultural Sensitivity: Understanding and respecting Indigenous cultural practices and historical connections to the land is paramount in all operational and development phases.

Societal expectations are increasingly prioritizing environmental sustainability and corporate responsibility, influencing public perception of energy companies. In 2024, Canadian public opinion strongly favored renewable energy, with over 70% supporting increased investment, directly impacting Capital Power's social license to operate and its strategic shift towards cleaner sources.

Community engagement and Indigenous relations are vital for Capital Power's long-term viability. The company's 2024 sustainability report highlighted over $15 million invested in community initiatives and ongoing partnerships with First Nations, emphasizing shared value creation and environmental stewardship in project development.

The evolving energy landscape presents both opportunities and challenges for Capital Power's workforce. By 2024, Canada's renewable energy sector employed over 247,000 individuals, a number projected to rise, creating a demand for skilled workers in clean energy while requiring strategies for managing transitions in traditional generation roles.

Capital Power's commitment to equity, diversity, and inclusion (EDI) is crucial for talent acquisition and retention. In 2023, the company reported progress in its diversity metrics, aiming to better reflect the communities it serves, which is essential for fostering employee engagement and a stable, innovative workforce.

Technological factors

Ongoing advancements in solar and wind power technologies are making these renewable sources more efficient and cost-effective. For instance, the global average levelized cost of electricity for utility-scale solar PV dropped by 89% between 2010 and 2022, while onshore wind saw a 69% decrease in the same period. These improvements directly enhance the economic viability of renewable energy projects.

Capital Power's strategic investments in wind and solar facilities, such as its portfolio of wind farms in Alberta and its growing solar development pipeline, are well-positioned to capitalize on these technological leaps. The company's commitment to renewables allows it to benefit from increased energy output and reduced operational expenses as technology matures.

Breakthroughs in battery storage, like advancements in lithium-ion and emerging solid-state technologies, are critical for managing the intermittency of renewable energy sources. These innovations are making grid-scale storage more economically viable, with global energy storage capacity projected to reach over 1,000 gigawatts by 2030, a significant jump from around 200 gigawatts in 2023.

Capital Power's strategic emphasis on flexible generation directly benefits from these energy storage developments. The company can integrate these solutions to provide grid services, improve the dispatchability of its renewable assets, and enhance overall grid reliability, potentially reducing reliance on traditional peaker plants.

Carbon capture technologies are rapidly advancing, with innovations like mineralization creating stable forms of CO2, crucial for tackling emissions from industries and power plants. This evolution directly supports decarbonization efforts.

Capital Power's Genesee Repowering project, transitioning from coal to natural gas and significantly lowering emissions, demonstrates a commitment to cleaner energy. This aligns with the growing adoption of CCUS solutions for hard-to-abate sectors.

Smart Grid and Digital Transformation

Capital Power is navigating a landscape increasingly shaped by smart grid technologies and broad digital transformation. The integration of Artificial Intelligence (AI) and machine learning is becoming crucial for optimizing power generation operations and proactively predicting equipment failures, thereby boosting overall efficiency and reliability. For instance, by 2024, AI in the energy sector is projected to save billions through improved grid management and predictive maintenance.

The growing demand for electricity is directly linked to digital advancements, particularly the expansion of AI-driven data centers. These facilities require substantial and consistent power, presenting both a challenge and an opportunity for power generation companies like Capital Power. Global data center electricity consumption is estimated to reach nearly 1.7% of total global electricity demand by 2027, underscoring the significant impact of this trend.

- Smart Grid Integration: Enhanced grid efficiency and reliability through AI and machine learning for operational optimization and predictive maintenance.

- Data Center Demand: Increasing electricity consumption driven by AI and data center growth presents new market opportunities.

- Operational Efficiency: Digital tools are key to reducing operational costs and improving the performance of power generation assets.

- Cybersecurity Focus: The digital transformation necessitates robust cybersecurity measures to protect critical infrastructure.

Efficiency Improvements in Power Generation

Technological advancements are significantly boosting power generation efficiency. Capital Power's Genesee 1 and 2 facilities, for instance, have been upgraded to highly efficient natural gas combined cycle (NGCC) units. This transition lowers their heat rates, meaning less fuel is needed to produce the same amount of electricity. In 2024, Capital Power reported that its NGCC fleet, including these units, achieved an average heat rate improvement, contributing to a reduction in their overall carbon footprint.

These efficiency gains translate directly into operational and environmental benefits. Lower heat rates mean reduced fuel consumption, which in turn lowers operating costs and greenhouse gas emissions. For example, a 1% improvement in heat rate for a large natural gas plant can save millions in fuel costs annually. Capital Power's ongoing investments in these technologies underscore a commitment to both economic performance and environmental stewardship in the evolving energy landscape.

- Improved Heat Rates: NGCC technology allows for more energy extraction from fuel, reducing the amount of fuel needed per megawatt-hour.

- Reduced Emissions: Higher efficiency directly correlates with lower carbon emissions per unit of energy produced.

- Cost Savings: Efficient operations lead to decreased fuel expenditures, enhancing profitability.

- Operational Flexibility: Modernized plants can often ramp up and down more quickly, adapting to grid demands.

Technological advancements continue to drive down the cost and improve the efficiency of renewable energy sources like solar and wind. For example, by 2024, the levelized cost of electricity for utility-scale solar PV had seen significant reductions, making it increasingly competitive with traditional power generation. Capital Power's strategic focus on these technologies positions it to benefit from these ongoing improvements in performance and economics.

Legal factors

Environmental regulations, particularly emissions standards, are a significant factor for Capital Power. For instance, Canada's strengthened clean electricity regulations, aiming for a net-zero grid by 2035, directly influence Capital Power's operational choices and future investments.

These stringent rules, including emissions caps, compel companies like Capital Power to accelerate their transition towards lower-carbon energy sources. This shift is crucial for maintaining compliance and adapting to evolving environmental expectations in both Canadian and U.S. markets.

Navigating the complex web of permitting and licensing is a significant legal challenge for power generation projects. In the United States, while overall political risk is considered low, the journey through these regulatory processes can be lengthy, often involving extensive reviews and mandatory public consultations. For instance, obtaining a permit for a new natural gas plant can take anywhere from 2 to 5 years, depending on the state and the project's scale.

The specific requirements vary considerably by jurisdiction, impacting project timelines and development costs. For example, the Environmental Protection Agency (EPA) plays a crucial role in setting emissions standards, and compliance with the Clean Air Act can necessitate substantial investments in pollution control technology. Capital Power, like other energy companies, must meticulously adhere to these regulations to secure and maintain operational licenses, with penalties for non-compliance potentially reaching millions of dollars.

Capital Power's commitment to corporate governance is central to its operations, ensuring accountability and transparency. In 2023, the company reported that its Board of Directors oversees timely and accurate financial reporting and approves significant strategic decisions, reinforcing its adherence to legal frameworks.

Compliance with evolving regulations is paramount. Capital Power actively manages its adherence to environmental, social, and governance (ESG) standards, which are increasingly scrutinized by investors and regulators alike.

Contractual Obligations and Power Purchase Agreements

Capital Power's operations are fundamentally underpinned by long-term contractual obligations, primarily through Power Purchase Agreements (PPAs). These agreements are crucial as they legally bind counterparties to purchase electricity, thereby securing predictable revenue streams and stabilizing cash flows for the company. For instance, their portfolio often features PPAs with terms extending for 10 to 20 years, providing a solid foundation for financial planning and investment.

The company actively pursues strategic growth initiatives that are contingent upon securing new PPAs. These contracts not only de-risk new project developments, such as renewable energy installations or facility upgrades, but also ensure that the generated power has a guaranteed market. As of early 2024, Capital Power continued to focus on expanding its contracted renewable capacity, a strategy directly tied to its ability to negotiate favorable PPAs.

Key aspects of these contractual obligations include:

- Revenue Stability: PPAs provide a predictable revenue stream, insulating Capital Power from short-term market price volatility.

- Project Financing: The existence of long-term PPAs is often a prerequisite for securing project financing, making new developments feasible.

- Counterparty Risk: The creditworthiness of the PPA off-takers is a critical legal consideration, impacting the overall risk profile of the contract.

- Regulatory Compliance: PPAs must adhere to various energy market regulations and environmental standards, influencing contract terms and operational requirements.

Land Use and Property Rights

Capital Power's operations are heavily influenced by land use and property rights regulations. Acquiring suitable land for new power plants, like the proposed Albright 2 natural gas facility in Alberta, involves navigating complex provincial and municipal zoning laws and obtaining necessary permits. Securing rights-of-way for transmission lines, often through easements, is also critical for connecting facilities to the grid. Failure to comply with these legal frameworks can lead to significant delays and increased project costs.

In 2024, ongoing legal challenges and evolving land use policies in regions where Capital Power operates can impact project timelines and expansion plans. For instance, provincial governments may introduce new land access regulations or environmental impact assessment requirements that affect property acquisition and development strategies. These legal factors are essential for ensuring the long-term viability and operational continuity of Capital Power's diverse asset portfolio, which includes wind, solar, and natural gas facilities.

- Zoning Compliance: Ensuring all facilities meet local land use and zoning ordinances is paramount.

- Easement Management: Legal agreements for transmission line corridors and access roads require careful management.

- Property Rights: Respecting and adhering to existing property rights is fundamental for site acquisition and expansion.

- Regulatory Approvals: Obtaining and maintaining land-use permits from various governmental bodies is a continuous process.

Legal frameworks governing energy production and environmental protection are critical for Capital Power's operations. Stringent emissions standards, like Canada's 2035 net-zero grid target, necessitate significant investment in cleaner technologies, impacting operational strategies and future capital allocation. Navigating complex permitting processes in the U.S., which can take 2-5 years for a new natural gas plant, also adds considerable time and cost to development.

Long-term Power Purchase Agreements (PPAs) are a cornerstone of Capital Power's revenue stability, often spanning 10-20 years and providing predictable cash flows. These contracts are vital for securing project financing and ensuring market access for new developments, with the company actively seeking to expand its contracted renewable capacity in 2024.

Land use and property rights regulations significantly influence project development, from site acquisition to transmission line easements. Compliance with zoning laws and obtaining permits, as seen with the Albright 2 project, are essential to avoid delays and cost overruns. Evolving land access policies in 2024 continue to be a key consideration for expansion plans.

Environmental factors

The global drive to combat climate change, aiming for net-zero emissions by 2050, significantly shapes Capital Power's strategic direction. This imperative necessitates a fundamental shift in energy generation, pushing companies like Capital Power to adapt their portfolios.

Capital Power is proactively responding by investing in and developing lower-carbon power generation facilities. For instance, in 2023, the company advanced its Dauphin Solar project in Manitoba, a 137 MW solar farm, and continued development on its Windrise project, a 200 MW wind farm in Illinois, both contributing to a cleaner energy mix.

These investments are crucial for aligning with national and international decarbonization targets. Capital Power's commitment to reducing its carbon footprint is evident in its ongoing transition away from coal-fired generation, with plans to retire its last coal unit by the end of 2028, a key step in meeting its own emission reduction goals.

Capital Power is actively working to lower its carbon emissions, a key environmental factor. Their Genesee Repowering project, transitioning from coal to natural gas, is a prime example, significantly cutting CO2 output. This initiative alone is projected to reduce annual greenhouse gas emissions by approximately 4.5 million tonnes.

The company's commitment extends to exploring advanced technologies like carbon capture. These efforts are crucial as regulatory pressures and public demand for cleaner energy sources continue to grow, influencing operational strategies and investment decisions.

The availability of renewable resources, such as wind and solar, and the capacity to integrate them into existing power grids are critical environmental considerations. Capital Power is actively increasing its investment in renewables, demonstrating a strategic pivot towards these cleaner energy sources.

In 2024, Canada saw significant growth in renewable energy capacity, with solar and wind power leading the expansion. For instance, Alberta, a key market for Capital Power, continues to develop its wind energy potential, with over 3,000 MW of installed wind capacity by early 2025, showcasing the increasing resource availability.

Water Usage and Management

Capital Power's operations, particularly its thermal generation facilities, are significant water consumers. For instance, in 2023, the company reported water withdrawal volumes across its portfolio. Effective water management is crucial for environmental stewardship and operational continuity, especially in regions facing water scarcity.

Ensuring sustainable water usage involves strategies like optimizing cooling tower efficiency and exploring water recycling opportunities. Capital Power's commitment to environmental performance includes monitoring and reporting on water withdrawal and consumption, aligning with regulatory requirements and stakeholder expectations.

- Water Intensity: Monitoring water withdrawal per megawatt-hour generated is a key metric for efficiency.

- Cooling Technologies: The type of cooling technology employed, such as once-through versus closed-loop systems, significantly impacts water usage.

- Regulatory Compliance: Adherence to provincial and federal water quality and quantity regulations is paramount.

- Water Risk Assessment: Evaluating water-related risks in different operating regions helps inform management strategies.

Biodiversity and Ecosystem Impact

Capital Power's operations, particularly those involving land use for power generation facilities, can affect local biodiversity and ecosystems. For instance, their natural gas facilities and renewable energy projects, like solar farms, require land that might otherwise support diverse flora and fauna.

In 2023, Capital Power reported on its environmental performance, highlighting efforts to manage and mitigate impacts on biodiversity. Their sustainability reporting likely details specific initiatives, such as habitat restoration or conservation programs, aimed at minimizing their ecological footprint.

The company's approach to environmental stewardship is crucial for maintaining positive community relations and regulatory compliance.

- Land Use Footprint: Capital Power's generation facilities, including its 2,420 MW of natural gas capacity and 396 MW of renewable capacity as of Q1 2024, occupy land that can impact local habitats.

- Mitigation Strategies: The company likely employs strategies such as environmental impact assessments and land management plans to reduce negative effects on biodiversity.

- Sustainability Reporting: Capital Power's commitment to sustainability means their annual reports often detail their environmental performance and conservation efforts.

- Regulatory Compliance: Adherence to environmental regulations is key to managing ecosystem impacts and ensuring operational continuity.

The global push for decarbonization, targeting net-zero emissions by 2050, fundamentally shapes Capital Power's strategy, driving investments in lower-carbon generation. For example, their Dauphin Solar project (137 MW) and Windrise project (200 MW) are key steps in this transition.

Capital Power is actively transitioning away from coal, with its last unit slated for retirement by the end of 2028, a move that significantly reduces its carbon footprint. The Genesee Repowering project, shifting from coal to natural gas, alone is projected to cut annual greenhouse gas emissions by approximately 4.5 million tonnes.

The increasing availability of renewable resources, like wind and solar, is a critical environmental factor. Alberta, a key market, boasted over 3,000 MW of installed wind capacity by early 2025, highlighting this trend.

Water management is also crucial, with Capital Power's thermal facilities being significant water consumers. The company's 2023 environmental performance reporting likely details water usage metrics and mitigation strategies to ensure sustainable operations.

| Environmental Factor | Capital Power's Response/Data | Impact/Significance |

|---|---|---|

| Climate Change & Emissions | Targeting net-zero, investing in renewables (Dauphin Solar 137 MW, Windrise 200 MW). Coal retirement by end of 2028. Genesee Repowering to cut 4.5M tonnes CO2 annually. | Aligns with global decarbonization goals, reduces regulatory risk, enhances brand reputation. |

| Renewable Resource Availability | Increasing investment in renewables. Alberta has over 3,000 MW wind capacity (early 2025). | Supports portfolio diversification, meets growing demand for clean energy. |

| Water Management | Monitoring water withdrawal, optimizing cooling efficiency, exploring recycling. | Ensures operational continuity, compliance with regulations, and environmental stewardship, especially in water-scarce regions. |

| Biodiversity & Land Use | Managing land footprint for generation facilities (2,420 MW natural gas, 396 MW renewables as of Q1 2024). Implementing mitigation strategies. | Minimizes ecological impact, maintains community relations, and ensures regulatory compliance. |

PESTLE Analysis Data Sources

Our Capital Power PESTLE Analysis is built on a robust foundation of data from official government energy agencies, international economic institutions, and leading industry research firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors influencing the energy sector are grounded in verified information.