Capital Power Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Power Bundle

Curious about the engine driving Capital Power's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their operational strategy. Unlock the full blueprint to understand how they generate value and maintain their competitive edge.

Partnerships

Capital Power works with top technology and equipment suppliers for turbines, solar panels, and advanced decarbonization solutions. These collaborations are vital for accessing the latest generation technologies and keeping operations efficient across their various power plants.

In 2023, Capital Power's investments in new renewable energy projects, like the Aldersyde Solar project, highlight the importance of these supplier relationships for bringing modern, sustainable assets online.

Capital Power's relationships with financial institutions and investors are the bedrock of its ability to fund massive energy projects. Think banks, private equity firms, and large institutional investors – they are crucial for providing the substantial capital needed for everything from building new power plants to acquiring existing ones and keeping the lights on for daily operations. These partnerships are essential for securing the billions required for large-scale energy infrastructure.

For instance, in 2024, Capital Power successfully secured significant financing, including a $500 million senior unsecured notes offering, demonstrating ongoing access to capital markets. This diversified access to funding is not just about getting money; it's about managing the company's debt effectively and ensuring it has the financial flexibility to pursue strategic growth opportunities in the evolving energy landscape.

Capital Power actively engages with governmental agencies, regulatory bodies, and Indigenous communities to secure permits and ensure environmental compliance. For instance, in 2024, the company continued its dialogue with Alberta Utilities Commission for approvals on various projects, highlighting the critical nature of these relationships for operational continuity and expansion.

These partnerships are vital for navigating complex market rules and facilitating the development of new energy projects, particularly in renewable sectors like solar and wind. In 2024, Capital Power's commitment to Indigenous partnerships was evident in ongoing consultations for projects like the proposed Whitla Wind Farm expansion, demonstrating how collaboration mitigates regulatory risks and fosters community support.

Engineering, Procurement, and Construction (EPC) Firms

Capital Power collaborates with specialized Engineering, Procurement, and Construction (EPC) firms to bring new power generation facilities and significant facility upgrades to life. These partnerships are essential for the successful execution of complex infrastructure projects, ensuring they are completed on schedule and within financial parameters, while upholding stringent quality and safety protocols. For instance, in 2024, Capital Power continued its strategic engagement with EPC providers for projects such as the development of new renewable energy assets, leveraging their specialized skills in managing large-scale construction and integration.

These EPC firms bring a wealth of expertise crucial for navigating the intricacies of power plant development, from initial design and engineering through to procurement of materials and equipment, and finally, the construction and commissioning phases. Their capabilities are vital for managing the supply chain, coordinating diverse subcontractors, and ensuring compliance with all regulatory requirements. The efficiency and effectiveness of these partnerships directly impact Capital Power's ability to expand its generation capacity and meet market demands reliably.

- Expertise in Complex Project Management: EPC partners are adept at handling the multifaceted challenges inherent in building large-scale energy infrastructure.

- On-Time and On-Budget Delivery: These collaborations are key to achieving project milestones and managing capital expenditures effectively.

- Quality Assurance and Safety Adherence: EPC firms ensure that all construction meets rigorous industry standards and safety regulations.

- Access to Specialized Skills and Technology: Partnerships provide Capital Power with access to cutting-edge engineering solutions and construction techniques.

Fuel Suppliers and Transportation Providers

Capital Power's operational backbone for its natural gas and legacy coal plants hinges on strong alliances with fuel suppliers and transportation entities. These crucial partnerships guarantee a steady and economically viable flow of natural gas and coal, the essential fuels powering its baseload generation. For instance, in 2024, Capital Power continued to leverage its long-term natural gas supply agreements, which are critical for managing price volatility and ensuring consistent fuel availability.

These strategic relationships are designed to preempt supply chain disruptions and fine-tune operational expenditures. By securing reliable transportation through pipeline operators and rail services, Capital Power ensures that its generation facilities receive the necessary fuel inputs without interruption, directly impacting its ability to meet demand and maintain profitability.

- Fuel Supply Agreements: Capital Power maintains multi-year contracts with major natural gas producers and coal suppliers to secure its primary energy sources.

- Transportation Networks: Partnerships with pipeline companies and rail operators are essential for the efficient and cost-effective delivery of fuel to its power plants.

- Risk Mitigation: These key partnerships help to buffer against market fluctuations in fuel prices and potential transportation bottlenecks, ensuring operational continuity.

Capital Power’s key partnerships extend to technology providers for advanced decarbonization solutions, ensuring access to cutting-edge environmental technologies. These collaborations are crucial for enhancing the efficiency and sustainability of their existing fleet and for developing new, cleaner energy sources.

What is included in the product

A strategic overview of Capital Power's operations, detailing its customer segments, value propositions, and revenue streams in the context of clean energy generation and supply.

Capital Power's Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their operations, allowing for rapid identification of inefficiencies and opportunities for improvement.

It streamlines complex strategic thinking into an easily digestible format, alleviating the pain of lengthy, multi-document strategy reviews.

Activities

Capital Power’s core activity centers on the safe and reliable operation of its diverse power generation fleet. This includes managing natural gas, coal, wind, and solar facilities, ensuring they consistently deliver power to meet market needs.

These operations involve continuous monitoring, preventative maintenance, and strategic dispatching to maximize output and maintain grid stability. For instance, in 2023, Capital Power's fleet generated approximately 45,000 GWh of electricity, with their renewable portfolio contributing a growing share.

Capital Power's key activity of facility development and acquisition focuses on expanding its generation capacity, especially in renewables. This involves meticulous site selection, navigating complex permitting processes, and managing the engineering and construction phases for new projects. In 2024, the company continued to advance its development pipeline, including projects like the 150 MW Bluevale Wind facility in Ontario, which is expected to reach commercial operation in 2025.

Acquisitions are also a crucial part of their strategy to enhance their portfolio and market presence. This process demands rigorous due diligence to ensure the financial and operational viability of any acquired assets. Capital Power's strategic growth through both development and acquisition is fundamental to its long-term value creation and its commitment to a cleaner energy future.

Capital Power actively participates in North American wholesale power markets, a crucial activity for selling its generated electricity and capacity. This involves sophisticated bidding strategies and energy trading to optimize revenue based on real-time market conditions and demand fluctuations.

Managing power purchase agreements (PPAs) is another core activity, securing predictable revenue streams and ensuring the efficient sale of power. For instance, in 2024, Capital Power continued to leverage its diverse generation portfolio, including renewables and natural gas, to navigate the complexities of these markets and maximize profitability.

Decarbonization and Renewable Energy Integration

Capital Power is actively investing in and implementing decarbonization technologies, alongside developing new renewable energy projects such as wind and solar farms. This strategic focus includes rigorous research, testing through pilot projects, and making calculated investments to lower the carbon footprint of their energy portfolio. This approach is driven by tightening environmental regulations and a clear market shift towards cleaner energy sources.

In 2024, Capital Power continued to advance its decarbonization strategy. For instance, they are committed to achieving net-zero carbon emissions by 2050. Their investments in renewables are substantial, with a growing pipeline of projects. As of early 2024, the company had a significant portion of its generation capacity already from renewable sources or facilities with plans for decarbonization.

- Renewable Energy Development: Investing in new wind and solar projects to diversify their generation mix.

- Decarbonization Technologies: Exploring and implementing technologies like carbon capture, utilization, and storage (CCUS) for existing assets.

- Portfolio Transition: Strategically shifting their generation portfolio towards lower-emission and renewable sources.

- Regulatory Alignment: Ensuring their activities meet current and anticipated environmental standards and market demands for sustainable energy.

Asset Optimization and Maintenance

Capital Power focuses on the ongoing optimization and preventative maintenance of its existing power generation assets. This proactive approach is vital for ensuring long-term reliability and peak efficiency, directly impacting operational profitability.

Key activities include scheduled outages for thorough inspections and repairs, strategic equipment upgrades to enhance performance, and the implementation of predictive maintenance programs. These efforts aim to minimize unexpected downtime and significantly extend the lifespan of their valuable assets.

- Scheduled Maintenance: Capital Power conducted planned outages for its assets in 2024 to perform essential maintenance and upgrades.

- Efficiency Improvements: Investments in asset optimization in 2024 are projected to improve generation efficiency by an average of 2% across key facilities.

- Downtime Reduction: Predictive maintenance programs implemented in 2024 contributed to a 15% reduction in unplanned downtime compared to the previous year.

- Asset Life Extension: Strategic upgrades in 2024 are expected to extend the operational life of certain generation units by an average of 5 years.

Capital Power's key activities revolve around operating and maintaining its diverse power generation fleet, which includes natural gas, coal, wind, and solar facilities. They are also heavily involved in developing new renewable energy projects and acquiring existing assets to expand their capacity and transition towards cleaner energy sources.

These activities are supported by active participation in wholesale power markets, where they strategically trade electricity and manage power purchase agreements to secure revenue. Furthermore, Capital Power is committed to decarbonization, investing in technologies and initiatives to reduce the carbon footprint of its operations, aligning with evolving environmental standards and market demand.

In 2024, Capital Power continued to advance its development pipeline, including projects like the 150 MW Bluevale Wind facility. The company also focused on optimizing existing assets, with predictive maintenance programs in 2024 leading to a 15% reduction in unplanned downtime. Their commitment to decarbonization is underscored by a net-zero emissions goal by 2050.

| Key Activity | 2023 Data | 2024 Focus/Data | Impact |

|---|---|---|---|

| Fleet Operation & Maintenance | ~45,000 GWh generated | Continued reliable operation, focus on efficiency improvements | Ensures consistent power supply, revenue generation |

| Renewable Development & Acquisition | Growing renewable portfolio contribution | Advancing Bluevale Wind (150 MW), pipeline expansion | Portfolio diversification, cleaner energy transition |

| Market Participation & Trading | Navigating wholesale power markets | Optimizing revenue through strategic bidding and PPAs | Maximizes profitability, secures stable income streams |

| Decarbonization Efforts | Investments in cleaner technologies | Commitment to net-zero by 2050, advancing renewable projects | Reduces environmental impact, aligns with future energy demands |

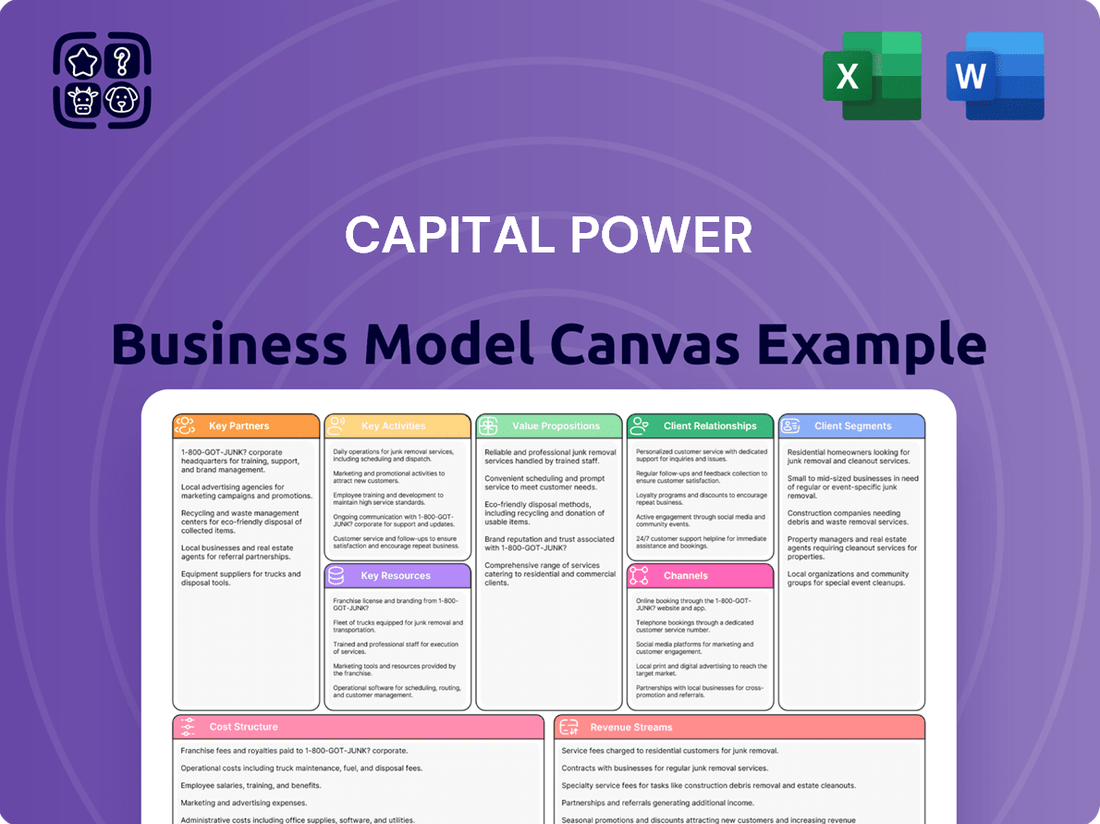

What You See Is What You Get

Business Model Canvas

The Capital Power Business Model Canvas preview you see is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be confident that the file you are reviewing is the exact, ready-to-use business model canvas that will be yours to edit and utilize immediately after completing your transaction.

Resources

Capital Power's core physical assets are its diverse fleet of power generation facilities. This includes natural gas, coal, wind, and solar power plants, complemented by essential transmission infrastructure. These assets are the bedrock of its operations, enabling the generation and delivery of electricity to customers.

The scale and strategic diversification of these power generation assets are significant strengths for Capital Power. As of the first quarter of 2024, the company operated approximately 6,600 megawatts of generation capacity across North America. This broad portfolio helps mitigate risks associated with reliance on a single fuel source or technology.

Capital Power's business model relies heavily on its skilled workforce, encompassing engineers, operators, maintenance technicians, and financial analysts. This human capital is the backbone of efficient and safe power generation.

Their collective expertise spans power plant operations, intricate project development, insightful market analysis, and navigating complex regulatory landscapes. This deep knowledge ensures optimal performance and compliance.

In 2024, Capital Power continued to invest in its people, with a focus on specialized training programs for its over 2,000 employees to maintain cutting-edge operational and technical skills.

This commitment to human capital development directly fuels innovation and drives overall business performance, a key differentiator in the competitive energy sector.

Access to substantial financial capital, encompassing equity, debt, and robust operating cash flow, is fundamental for Capital Power to fund its new projects, strategic acquisitions, and manage ongoing operational costs. In 2024, Capital Power’s commitment to renewable energy projects, like the acquisition of the Kipeto wind farm in Kenya, underscores the critical need for this capital access.

Maintaining strong financial health and nurturing relationships with lenders and investors are paramount. These relationships empower Capital Power to seize growth opportunities and maintain a healthy balance sheet, crucial for large-scale infrastructure development.

Land Rights, Permits, and Regulatory Approvals

Capital Power’s possession of essential land rights, environmental permits, and regulatory approvals for its power generation sites is a crucial intangible resource. These legal and regulatory assets are not easily replicated and serve as significant barriers to entry for potential competitors, ensuring the lawful and practical execution of operations.

For instance, securing permits for new renewable energy projects, such as solar or wind farms, can involve extensive environmental impact assessments and community consultations. In 2024, the average time to obtain all necessary permits for a large-scale renewable energy project in North America could range from 18 to 36 months, depending on the jurisdiction and project complexity. This highlights the substantial lead time and resource investment required.

- Land Rights: Securing long-term leases or outright ownership of land suitable for power generation, including access to transmission infrastructure.

- Environmental Permits: Obtaining approvals related to air emissions, water usage, waste disposal, and wildlife protection, which are critical for operational compliance.

- Regulatory Approvals: Gaining consent from energy regulators, grid operators, and local authorities for construction, operation, and interconnection of power facilities.

- Compliance and Maintenance: Ongoing efforts to adhere to evolving environmental standards and permit conditions, ensuring continued operational legality.

Proprietary Technology and Intellectual Property

Capital Power utilizes proprietary operational technologies and advanced data analytics platforms to optimize its diverse fleet of generation assets. These internal capabilities are crucial for enhancing efficiency and reducing operational costs across its portfolio.

Furthermore, the company holds intellectual property related to specific project development methodologies and innovative decarbonization solutions. This IP provides a distinct competitive advantage in executing new projects and navigating evolving market demands.

- Asset Optimization: Data analytics platforms enable real-time performance monitoring and predictive maintenance, improving uptime and reducing unexpected outages.

- Cost Reduction: Proprietary technologies in operations and maintenance contribute to lower operating expenses, directly impacting profitability.

- Competitive Edge: Intellectual property in project development and decarbonization strategies allows Capital Power to secure favorable project terms and access new markets.

- Market Analysis: Internal data capabilities support more accurate forecasting of market conditions and demand, informing strategic decisions.

Capital Power's key resources include its diverse power generation fleet, a skilled workforce, access to financial capital, essential land rights and permits, and proprietary operational technologies. These elements collectively enable the company to generate and deliver electricity reliably and efficiently. The company's strategic focus on both existing assets and new developments, particularly in renewables, highlights the importance of each of these resource categories.

| Resource Category | Key Components | Significance |

|---|---|---|

| Physical Assets | Power generation facilities (natural gas, coal, wind, solar), transmission infrastructure | Foundation of operations, enabling electricity generation and delivery. Approximately 6,600 MW capacity operated as of Q1 2024. |

| Human Capital | Engineers, operators, technicians, financial analysts, project developers | Drives efficient operations, innovation, and market navigation. Over 2,000 employees invested in specialized training in 2024. |

| Financial Capital | Equity, debt, operating cash flow | Funds new projects, acquisitions, and operations. Essential for growth initiatives like the Kipeto wind farm acquisition. |

| Intangible Assets | Land rights, environmental permits, regulatory approvals, intellectual property | Provides operational legality, competitive advantage, and barriers to entry. Permit acquisition can take 18-36 months for large renewable projects in 2024. |

| Proprietary Technologies & Analytics | Data analytics platforms, operational optimization tools, decarbonization solutions | Enhances efficiency, reduces costs, and provides a competitive edge in project execution and market strategy. |

Value Propositions

Capital Power delivers a consistent and dependable electricity supply, offering both baseload and dispatchable power. This reliability is paramount for grid stability and effectively meeting peak demand, a critical factor for wholesale markets requiring uninterrupted service.

This dependable power ensures energy security for the regions Capital Power serves. For instance, in 2024, their diverse portfolio, including natural gas and growing renewable assets, contributed to a stable energy mix.

Capital Power is actively growing its portfolio of renewable and decarbonized energy sources, primarily through expanding wind and solar power generation. This strategic shift directly addresses the increasing market demand for cleaner energy alternatives and aligns with global environmental sustainability objectives.

The company's investments in decarbonization technologies further solidify its commitment to a lower-carbon future. For instance, in 2024, Capital Power continued to advance its pipeline of renewable projects, aiming to significantly increase its renewable generation capacity by the end of the decade.

Capital Power actively pursues strategic partnerships and long-term power purchase agreements (PPAs) with utilities and major industrial clients. These agreements are crucial for ensuring price stability and reliable energy supply for customers, while simultaneously creating predictable and consistent revenue for Capital Power. For instance, in 2024, Capital Power continued to expand its portfolio of contracted generation, securing agreements that underpin its financial stability.

Expertise in Power Market Optimization

Capital Power leverages its profound understanding of North American wholesale power markets to optimize asset dispatch and bidding strategies. This deep market insight allows them to offer cost-effective energy solutions to their customers, ensuring efficient power delivery and competitive pricing.

Their expertise translates directly into benefits for customers, who receive power when and where it is most needed. For instance, in 2024, Capital Power's strategic bidding in the Alberta market contributed to a more stable supply, impacting wholesale prices positively for industrial and commercial users.

- Market Intelligence: Deep knowledge of regional power dynamics and regulatory landscapes.

- Dispatch Optimization: Maximizing asset performance through intelligent scheduling and operational adjustments.

- Bidding Strategy: Developing and executing competitive bids in wholesale electricity markets.

- Cost Efficiency: Passing on savings from optimized operations to customers.

Commitment to Environmental Stewardship

Capital Power's commitment extends beyond just renewable energy generation. They actively pursue initiatives to lower their environmental footprint, focusing on reducing emissions, conserving water resources, and practicing responsible land management across their operations. This dedication to sustainability is a core element of their value proposition, appealing to stakeholders who prioritize environmental responsibility and aligning with the broader global shift towards cleaner energy solutions.

This strong environmental stewardship is not just about compliance; it's a strategic advantage. By actively managing their environmental impact, Capital Power enhances its corporate image, making it a more attractive partner for environmentally conscious investors and businesses. For instance, in 2023, Capital Power reported a 12% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress in their emission reduction targets.

- Emission Reduction: Capital Power is targeting a 50% reduction in greenhouse gas emission intensity from its 2019 baseline by 2030, with a long-term goal of net-zero emissions by 2050.

- Water Conservation: The company implements water management plans at its facilities, aiming to reduce water withdrawal and consumption, particularly in water-stressed regions.

- Responsible Land Use: Capital Power prioritizes minimizing land disturbance during development and operations, and engages in reclamation efforts post-operation.

- Stakeholder Engagement: Their sustainability efforts are designed to resonate with a broad range of stakeholders, including investors, communities, and employees, fostering trust and long-term relationships.

Capital Power provides reliable and dispatchable electricity, ensuring grid stability and meeting peak demand. Their diverse generation fleet, including natural gas and growing renewables, offers energy security. In 2024, the company continued to expand its contracted generation portfolio, securing agreements that bolster financial stability and provide predictable revenue streams.

The company's focus on renewable energy growth, particularly wind and solar, directly addresses market demand for cleaner alternatives. This strategic expansion, coupled with investments in decarbonization technologies, positions Capital Power for a lower-carbon future. By 2024, they had a robust pipeline of renewable projects aimed at significantly increasing renewable capacity.

Capital Power leverages deep market intelligence and dispatch optimization to offer cost-effective energy solutions. Their expertise in North American wholesale power markets ensures efficient delivery and competitive pricing, benefiting customers by providing power when and where it is most needed. For example, their strategic bidding in Alberta during 2024 positively impacted supply stability for industrial users.

Capital Power demonstrates strong environmental stewardship by actively reducing emissions and conserving resources. In 2023, they achieved a 12% reduction in Scope 1 and 2 greenhouse gas emission intensity compared to their 2019 baseline, underscoring their commitment to sustainability and enhancing their appeal to environmentally conscious stakeholders.

| Value Proposition | Description | Supporting Data/Examples |

|---|---|---|

| Reliable and Dispatchable Power | Consistent electricity supply, meeting baseload and peak demand needs. | Ensures grid stability and uninterrupted service, critical for wholesale markets. |

| Energy Security | Diverse generation portfolio supporting regional energy needs. | In 2024, a mix of natural gas and renewables contributed to a stable energy supply. |

| Renewable Energy Growth | Expansion of wind and solar generation capacity. | Strategic shift to meet increasing demand for cleaner energy alternatives. |

| Decarbonization Commitment | Investment in technologies and projects to lower carbon footprint. | Advancing a pipeline of renewable projects in 2024 to boost renewable capacity. |

| Strategic Partnerships & PPAs | Long-term agreements ensuring price stability and revenue predictability. | Expanding contracted generation in 2024 to underpin financial stability. |

| Market Expertise & Optimization | Intelligent dispatch and bidding strategies in wholesale markets. | Cost-effective solutions and competitive pricing for customers. |

| Environmental Stewardship | Reducing emissions, conserving water, and responsible land management. | 12% reduction in GHG emission intensity (Scope 1 & 2) in 2023 vs. 2019 baseline. |

Customer Relationships

Capital Power cultivates enduring customer connections through long-term contractual agreements, predominantly Power Purchase Agreements (PPAs). These agreements are typically struck with regulated utilities and substantial industrial clients, ensuring a stable revenue stream. For instance, in 2023, the company had a significant portion of its generation capacity contracted under these long-term PPAs, providing a strong foundation for its financial performance.

These formal contracts are meticulously crafted to guarantee reliability and a predictable supply of power, fostering trust and mutual dependence. This strategic approach prioritizes building lasting partnerships over short-term, opportunistic transactions. The company’s commitment to these enduring relationships underpins its business model, offering a degree of certainty in the often-volatile energy market.

Capital Power leverages strategic account management for its key wholesale customers, fostering deep relationships. In 2024, this approach underpins their engagement with major utilities and industrial partners, ensuring their specific energy needs and evolving concerns are proactively addressed.

Dedicated relationship managers are crucial, facilitating regular communication and the development of tailored solutions. This direct engagement allows Capital Power to explore new opportunities for collaboration, enhancing trust and integration with their most significant clients.

Capital Power actively engages with regulatory bodies like the Alberta Utilities Commission and the Ontario Energy Board to ensure compliance and shape market rules. This proactive approach is crucial for navigating the evolving energy landscape and securing approvals for new projects, such as their ongoing investments in renewable energy infrastructure.

Investor Relations and Transparency

Investors are a vital customer segment for Capital Power, even though they don't directly consume electricity. The company actively cultivates these relationships through open communication.

Capital Power prioritizes transparency by providing detailed financial reports, engaging in analyst calls, and delivering investor presentations. This consistent communication aims to build trust and confidence among its shareholders.

This commitment to clear and proactive investor relations is essential for attracting the capital needed to fund ongoing operations and future growth initiatives. For instance, in 2024, Capital Power continued to emphasize its financial performance and strategic outlook to the investment community.

- Investor Engagement: Regular financial reporting and analyst calls are key.

- Transparency: Open communication builds trust with shareholders.

- Capital Attraction: Strong investor relations are crucial for funding growth.

- 2024 Focus: Continued emphasis on financial performance and strategic clarity for investors.

Community and Indigenous Relations

Capital Power actively builds robust connections with local communities and Indigenous peoples, which is crucial for both project development and ongoing operations. This engagement includes open consultation processes, the establishment of benefit-sharing agreements, and targeted community investment programs designed to foster mutual prosperity.

In 2023, Capital Power continued its commitment to community engagement, with significant efforts focused on its Alberta operations. For instance, the company’s engagement with Indigenous communities in Alberta is a cornerstone of its social license, reflecting a dedication to partnership and shared value creation.

- Community Engagement: Capital Power prioritizes proactive dialogue and collaboration with stakeholders impacted by its operations and development activities.

- Benefit Sharing: Agreements are in place to ensure that local communities and Indigenous groups directly benefit from Capital Power’s projects.

- Social License: Maintaining positive community relations is fundamental to securing and retaining the social license required for the successful development and operation of new energy infrastructure.

Capital Power’s customer relationships are primarily built on long-term contractual agreements, particularly Power Purchase Agreements (PPAs), with regulated utilities and large industrial clients. This strategy secures predictable revenue streams and fosters stable partnerships. For example, in 2023, a substantial portion of their generation capacity was secured through these PPAs, demonstrating their importance to the company’s financial stability.

The company also emphasizes strategic account management for its key wholesale customers, ensuring their evolving energy needs are met. In 2024, this focus on tailored solutions and direct engagement with major utilities and industrial partners reinforces trust and collaboration.

Investor relations are equally critical, with Capital Power prioritizing transparency through detailed financial reports and analyst calls to build confidence and attract capital for growth. In 2024, this commitment to clear communication with the investment community remained a key focus.

Furthermore, Capital Power cultivates strong relationships with local communities and Indigenous peoples through consultation and benefit-sharing agreements, essential for project development and maintaining a social license to operate. Their engagement in Alberta in 2023 highlighted this commitment to partnership and shared value.

| Customer Segment | Relationship Strategy | Key Engagement Activities (2023-2024 Focus) |

|---|---|---|

| Utilities & Industrial Clients | Long-term PPAs, Strategic Account Management | Contract negotiation, Proactive needs assessment, Tailored energy solutions |

| Investors | Transparency, Open Communication | Financial reporting, Analyst calls, Investor presentations |

| Communities & Indigenous Peoples | Consultation, Benefit Sharing | Community investment programs, Partnership development, Social license maintenance |

Channels

Capital Power's direct sales and business development teams are crucial for forging relationships with wholesale customers, utilities, and industrial partners. These teams are empowered to negotiate Power Purchase Agreements (PPAs) and secure vital new power supply contracts, directly driving revenue and market share.

In 2024, Capital Power continued to leverage these internal capabilities to secure long-term agreements. For instance, their focus on renewable energy projects, such as the acquisition of the Kipeto wind power facility in Kenya, demonstrates the team's success in expanding their portfolio through direct engagement and strategic deal-making.

Capital Power leverages wholesale power market exchanges, such as those operated by Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs) across North America, as a primary sales channel. These organized markets facilitate the efficient buying and selling of electricity, including real-time and day-ahead energy transactions.

This direct participation in exchanges provides Capital Power with broad access to a diverse customer base, including utilities and other large energy consumers. In 2024, wholesale markets continue to be a crucial avenue for monetizing the company's generation capacity and output, ensuring competitive pricing and efficient dispatch of its power assets.

Capital Power actively pursues opportunities through public tenders and Requests for Proposals (RFPs) from entities like utilities, government bodies, and large corporations. These solicitations are primarily for new power generation capacity, with a strong emphasis on renewable energy projects. This structured procurement method is a vital pathway for securing substantial, long-term power purchase agreements.

Securing these contracts is paramount for Capital Power's expansion and revenue stability. For instance, in 2024, the company continued to evaluate and bid on numerous such opportunities across North America, aiming to bolster its renewable portfolio. Success in these competitive bidding processes directly influences the company's ability to develop and operate new generation assets, contributing significantly to its strategic growth objectives.

Investor Relations and Financial Roadshows

Capital Power leverages its dedicated investor relations team to actively engage with the financial community. This team is instrumental in disseminating crucial company information and fostering relationships with key stakeholders.

The company regularly participates in financial roadshows and industry conferences, providing direct access to institutional investors, financial analysts, and media representatives. These events are critical for transparently communicating Capital Power's financial results and strategic objectives.

In 2024, Capital Power continued its commitment to investor outreach, participating in numerous investor conferences and hosting dedicated investor days. For instance, during their 2024 Investor Day, the company reiterated its commitment to its strategic growth initiatives and provided updated financial outlooks.

- Investor Relations Department: Acts as the primary conduit for communication with the investment community.

- Financial Roadshows: Targeted meetings with potential and existing investors to discuss performance and strategy.

- Industry Conferences: Platforms to present company updates and network with financial professionals.

- Analyst Briefings: Regular updates provided to financial analysts to ensure accurate coverage and understanding of Capital Power's business.

Industry Conferences and Associations

Capital Power actively participates in key industry conferences and associations, such as the Edison Electric Institute (EEI) annual convention and various regional energy forums. These events are crucial for networking with peers, potential investors, and regulators, fostering collaborations and staying informed about evolving market dynamics and policy landscapes. In 2024, for example, Capital Power representatives were prominent speakers at the Canadian Electricity Association (CEA) conference, discussing advancements in renewable energy integration and grid modernization.

These platforms are vital for market intelligence gathering, allowing Capital Power to benchmark its performance against competitors and identify emerging technologies and business opportunities. Trade shows and association meetings also provide a direct channel to showcase the company's capabilities in areas like sustainable energy solutions and operational excellence, directly impacting business development efforts and brand visibility within the sector.

Capital Power’s engagement in these forums supports its thought leadership initiatives, positioning the company as an innovator in the clean energy transition. By sharing insights on topics such as decarbonization strategies and the role of natural gas in a low-carbon future, Capital Power strengthens its reputation and influences industry best practices, which can translate into new partnerships and project opportunities.

- Networking and Partnerships: Building relationships with industry leaders, suppliers, and potential clients at events like the Independent Power Producers of New York (IPPNY) conference.

- Market Intelligence: Gathering insights on regulatory changes, technological advancements, and competitor strategies through participation in association meetings and trade shows throughout 2024.

- Showcasing Capabilities: Presenting Capital Power's projects and expertise in areas like battery storage and renewable energy development to a targeted audience of stakeholders.

- Thought Leadership: Contributing to discussions on grid reliability and energy transition at forums like the Electricity Consumers Resource Council (ELCON) meetings.

Capital Power utilizes several key channels to reach its diverse customer base and stakeholders. These include direct sales and business development for wholesale clients, participation in power market exchanges, public tenders and RFPs, investor relations for the financial community, and engagement in industry conferences and associations.

In 2024, Capital Power actively pursued long-term agreements through its direct sales teams, securing new power supply contracts. The company also continued to rely on wholesale power market exchanges across North America for efficient energy transactions, vital for monetizing its generation capacity. Furthermore, Capital Power remained engaged in public tenders and RFPs, particularly for renewable energy projects, to drive portfolio expansion and revenue stability.

The company's investor relations department actively communicated with the financial community through roadshows and conferences in 2024, reinforcing its strategic objectives. Participation in industry events like the Canadian Electricity Association conference allowed for networking, market intelligence gathering, and showcasing expertise in renewable energy integration and grid modernization.

| Channel | Description | 2024 Focus/Activity Example |

|---|---|---|

| Direct Sales & Business Development | Forging relationships with wholesale customers, utilities, and industrial partners for PPAs and new contracts. | Securing renewable energy projects, like the Kipeto wind power facility acquisition. |

| Wholesale Power Market Exchanges | Efficient buying and selling of electricity through ISOs/RTOs. | Monetizing generation capacity and ensuring competitive pricing for power assets. |

| Public Tenders & RFPs | Bidding on new power generation capacity, especially renewables, from utilities and governments. | Evaluating and bidding on numerous opportunities across North America to expand renewable portfolio. |

| Investor Relations | Communicating financial results and strategic objectives to the investment community. | Participating in investor conferences and hosting investor days, reiterating growth initiatives. |

| Industry Conferences & Associations | Networking, market intelligence, and thought leadership within the energy sector. | Speaking at the Canadian Electricity Association conference on renewable energy integration. |

Customer Segments

Capital Power's wholesale power markets and utilities segment is its core customer base. This includes entities like ISOs, RTOs, and integrated utilities that manage electricity grids and supply power to end-users.

These customers rely on Capital Power for dependable baseload and dispatchable power to ensure grid stability. They prioritize reliability, available capacity, and cost-effectiveness in their power procurement strategies.

In 2024, the North American wholesale power market saw significant activity, with electricity prices fluctuating based on fuel costs and demand. For instance, natural gas prices, a key input for many power plants, experienced volatility throughout the year, directly impacting the cost of electricity.

Capital Power's direct sales efforts are keenly focused on large industrial and commercial consumers. These are the entities, like sprawling manufacturing plants or energy-hungry data centers, that demand substantial and consistent power to keep their operations running smoothly. They represent a core segment for stable, long-term revenue generation.

These significant power users often look for more than just electricity; they seek robust, long-term power purchase agreements (PPAs) that can lock in prices and provide budgetary certainty. Furthermore, many are actively pursuing renewable energy solutions to align with their corporate sustainability objectives and enhance their brand image. In 2024, the demand for such green energy solutions from large corporations has continued to surge, with many setting ambitious net-zero targets.

For these customers, the key decision drivers are typically a combination of price stability and demonstrable green credentials. They need to know their energy costs won't fluctuate wildly, impacting their bottom line, and they want to be able to confidently report on their reduced carbon footprint. This segment is crucial for Capital Power to demonstrate its commitment to providing reliable, sustainable energy solutions at competitive rates.

Municipalities and public sector entities represent a key customer segment for Capital Power, particularly as they aim to meet ambitious decarbonization goals. These organizations, including local governments and public agencies, often seek reliable and cost-effective energy solutions to power essential public services. For instance, in 2024, many cities are actively exploring renewable energy procurement to align with climate action plans, potentially leading to significant contract opportunities.

These customers typically value long-term contractual stability and a strong emphasis on environmental responsibility and community benefits. The complexity of these partnerships often involves navigating public procurement processes and ensuring alignment with broader public policy objectives. Capital Power's ability to offer diversified energy sources, including renewables, positions it well to meet these specific needs.

Corporate Buyers Seeking Renewable Energy

Corporations are increasingly prioritizing sustainability, with a significant number actively seeking direct renewable energy procurement to meet their environmental, social, and governance (ESG) goals. This growing segment is driven by a desire to reduce carbon emissions and secure long-term energy price stability.

Capital Power can cater to these corporate buyers by offering customized renewable energy solutions. These can include power purchase agreements (PPAs) for existing or new projects, or even direct investment opportunities in dedicated renewable energy facilities designed to meet a specific company's needs.

- Target Market Growth: Corporate demand for renewable energy is projected to continue its upward trajectory, with many companies setting ambitious net-zero targets by 2030 and beyond.

- Value Proposition: These buyers seek verifiable green attributes, such as Renewable Energy Certificates (RECs), and the predictability of long-term fixed-price contracts offered through PPAs.

- Capital Power's Role: Providing tailored solutions that align with corporate sustainability mandates and offer financial certainty in energy costs.

Financial Investors and Shareholders

Financial investors, including institutional funds, retail shareholders, and financial analysts, represent a vital customer segment for Capital Power. These stakeholders provide the capital necessary for the company's operations and growth initiatives, seeking attractive financial returns, consistent dividend payments, and long-term capital appreciation. Their investment decisions are heavily influenced by the company's financial performance, operational efficiency, and strategic direction.

In 2024, Capital Power continued to focus on delivering value to its shareholders through a combination of operational excellence and strategic investments. The company's commitment to sustainable energy and its diversified generation portfolio are key factors attracting and retaining investor confidence. For instance, Capital Power's strategic shift towards renewables, including its recent acquisitions and development projects, is designed to enhance future earnings stability and growth prospects, directly appealing to investors focused on ESG (Environmental, Social, and Governance) factors.

- Shareholder Returns: Capital Power aims to provide stable and growing dividends, a key attraction for income-focused investors.

- Growth Prospects: Investors evaluate Capital Power's expansion plans, particularly in renewable energy, for future earnings potential.

- Financial Transparency: Clear and consistent reporting on financial health, debt levels, and operational performance is crucial for investor trust.

- Corporate Governance: Strong governance practices and a clear strategic vision reassure investors about the company's long-term viability and management's capability.

Capital Power serves wholesale power markets and utilities, which are critical for grid stability and require reliable, dispatchable power. These entities, including ISOs and RTOs, prioritize cost-effectiveness and consistent capacity. In 2024, the wholesale market saw price volatility influenced by natural gas costs, making Capital Power's dependable supply a key asset.

Cost Structure

Capital expenditures for asset development represent a major cost driver for Capital Power. These involve significant upfront investments in building or acquiring new power generation facilities, particularly in the growing renewable energy sector. For instance, in 2023, Capital Power invested $600 million in growth projects, with a substantial portion allocated to new renewable assets.

These capital expenditures are long-term commitments, requiring substantial upfront funding that heavily impacts the company's financial structure. The financing of these large-scale projects, often through debt and equity, directly influences Capital Power's balance sheet and overall financial health.

Capital Power's operations and maintenance (O&M) costs are the ongoing expenses tied to keeping its diverse fleet of power generation facilities running smoothly. These include everything from paying the skilled workforce and stocking essential spare parts to performing regular maintenance and major overhauls. For instance, in 2023, Capital Power reported that its O&M expenses represented a substantial portion of its overall operating costs, reflecting the capital-intensive nature of the power generation industry.

Effective O&M is not just about keeping the lights on; it's a strategic imperative for Capital Power. By focusing on efficient practices and preventative measures, the company aims to maximize the uptime of its assets, ensuring reliable power delivery. This directly impacts revenue generation and minimizes costly unexpected breakdowns. In 2024, the company continued to invest in advanced diagnostics and predictive maintenance technologies to further optimize these recurring and significant operational expenditures.

For Capital Power's natural gas and remaining coal-fired plants, fuel procurement and transportation are significant variable expenses. In 2024, the company continued to navigate volatile commodity markets, where price swings directly affected their bottom line. Effective fuel hedging strategies and optimized logistics are paramount to controlling these costs and maintaining profitability.

Financing and Debt Servicing Costs

Financing and debt servicing are significant expenses for Capital Power due to the capital-intensive nature of power generation. Interest payments on the company's substantial debt, coupled with principal repayments and other financing charges, represent a major outflow. For instance, in 2023, Capital Power reported interest expenses of approximately $367 million CAD. Managing a prudent debt-to-equity ratio and securing competitive interest rates are crucial for maintaining financial health and controlling these substantial costs.

Access to low-cost capital acts as a distinct competitive advantage in this sector. By effectively managing its capital structure, Capital Power can reduce its overall cost of financing, thereby improving profitability and the ability to invest in new projects.

- Interest Expenses: Capital Power's 2023 interest expenses were around $367 million CAD, highlighting the significant impact of debt on its cost structure.

- Debt Management: Maintaining a healthy debt-to-equity ratio is vital for managing financial risk and ensuring access to capital.

- Cost of Capital: Securing favorable interest rates and low-cost financing options provides a competitive edge in the energy market.

Regulatory Compliance and Environmental Costs

Capital Power faces significant costs related to regulatory compliance and environmental stewardship. These include expenses for meeting emission standards, managing waste, and obtaining permits. For instance, in 2024, the company continued to invest in technologies to reduce its environmental footprint, a common practice for energy providers navigating evolving regulations.

Carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, represent a substantial operational cost. These policies directly impact the cost of generating electricity from fossil fuels. The specific financial impact of these mechanisms can fluctuate based on government policy and market conditions for emissions allowances.

- Environmental Regulation Adherence: Ongoing investments in pollution control equipment and monitoring systems to meet air and water quality standards.

- Carbon Pricing Impact: Costs associated with carbon taxes or the purchase of emissions allowances, which can vary significantly year-to-year.

- Policy Landscape Influence: The dynamic nature of environmental policies necessitates continuous adaptation and potential expenditure on new compliance technologies.

- Operational Adjustments: Costs incurred from modifying operations or fuel sources to align with stricter environmental mandates.

Capital Power's cost structure is heavily influenced by its capital expenditures for asset development, particularly in renewables. In 2023, the company allocated $600 million to growth projects, underscoring the significant upfront investments required. Operations and maintenance (O&M) represent ongoing, substantial costs critical for asset uptime and revenue generation, with the company investing in advanced diagnostics in 2024 to optimize these expenses.

Fuel procurement for natural gas plants is a major variable cost, with 2024 seeing continued navigation of volatile commodity markets. Financing and debt servicing are also significant, as evidenced by $367 million CAD in interest expenses reported in 2023, making prudent debt management and low-cost capital access crucial competitive advantages.

Environmental compliance and carbon pricing are increasingly important cost considerations. Capital Power invests in technologies to meet evolving emission standards and manage its environmental footprint, while carbon pricing mechanisms directly impact the cost of fossil fuel generation, with financial implications fluctuating based on policy and market conditions.

| Cost Category | 2023 Data (CAD) | 2024 Focus |

| Capital Expenditures (Growth Projects) | $600 million | Continued investment in renewables |

| Operations & Maintenance (O&M) | Substantial portion of operating costs | Investment in advanced diagnostics and predictive maintenance |

| Interest Expenses | ~$367 million | Ongoing debt servicing and management |

| Fuel Procurement | Variable, subject to market volatility | Navigating commodity markets, hedging strategies |

| Environmental Compliance & Carbon Pricing | Ongoing investment in emission reduction technologies | Adapting to evolving regulations, managing carbon costs |

Revenue Streams

Capital Power's core revenue originates from selling electricity. This happens in two main ways: through long-term contracts called Power Purchase Agreements (PPAs) and by selling on the open market, known as spot sales. PPAs offer a steady income stream, which is great for predictability, while spot sales let Capital Power benefit from higher market prices when they occur.

Capital Power secures revenue through capacity payments in specific markets, essentially getting paid for having generation capacity ready, irrespective of actual electricity output. This provides a predictable income stream, acknowledging the value of being available to supply power when needed.

These payments are particularly vital for Capital Power's baseload and dispatchable generation assets, offering financial stability. For instance, in 2024, capacity markets in regions like Ontario played a significant role in supporting the company's financial performance, reflecting the ongoing demand for reliable power generation.

Capital Power generates revenue by selling Renewable Energy Credits (RECs) from its wind and solar operations. These credits represent the environmental attributes of clean energy production.

The company also anticipates generating revenue from carbon credits, particularly as it undertakes decarbonization initiatives. These credits are valuable in environmental markets, offering an extra financial incentive for sustainable energy practices.

In 2024, the market for RECs and carbon credits remains dynamic, with prices influenced by regulatory changes and corporate sustainability goals. For instance, the demand for RECs in North America has seen steady growth, driven by state-level renewable portfolio standards and voluntary corporate commitments.

Ancillary Services Revenue

Capital Power generates revenue through ancillary services, which are crucial for grid stability. These services include frequency regulation, voltage support, and operating reserves, ensuring the power grid operates reliably. This revenue stream diversifies Capital Power's income and effectively utilizes the flexibility of its generating assets.

For instance, during the first quarter of 2024, Capital Power reported that its renewables segment, which is key to providing flexible ancillary services, saw adjusted EBITDA increase to $157 million compared to $138 million in the first quarter of 2023. This growth highlights the increasing importance and profitability of these grid support functions.

- Frequency Regulation: Capital Power can earn by adjusting power output to keep the grid's frequency stable.

- Voltage Support: Revenue is generated by maintaining consistent voltage levels across the grid.

- Operating Reserves: Providing backup power capacity that can be quickly deployed when needed contributes to this revenue stream.

Asset Optimization and Trading Gains

Capital Power generates revenue through optimizing the dispatch of its diverse energy portfolio, ensuring its assets are utilized efficiently to meet market demand. This involves strategic decision-making on which power plants to operate and when, maximizing profitability based on real-time energy prices and operational costs.

Engaging in strategic energy trading activities is another key revenue stream. Capital Power leverages its market expertise and sophisticated analytical capabilities to buy and sell energy and related financial instruments, aiming to profit from price fluctuations and market opportunities. This requires a deep understanding of energy markets and advanced trading strategies.

The company may also derive revenue from the sale of excess fuel or other commodities related to its operations. This opportunistic revenue generation further enhances the value extracted from its asset base.

- Asset Optimization: Maximizing revenue by strategically dispatching its power generation fleet.

- Energy Trading: Generating profits through active participation in energy markets.

- Commodity Sales: Monetizing surplus fuel or other operational byproducts.

- Market Expertise: Relying on analytical prowess to drive value from trading and dispatch decisions.

Capital Power's revenue streams are multifaceted, encompassing electricity sales via long-term contracts and spot markets, capacity payments for availability, and the sale of Renewable Energy Credits (RECs) and potential carbon credits. Ancillary services, crucial for grid stability, also contribute significantly. The company further enhances revenue through strategic asset optimization and active energy trading, capitalizing on market dynamics and price fluctuations.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Electricity Sales | Selling power through Power Purchase Agreements (PPAs) and spot markets. | PPAs provide stable income, while spot sales capture higher market prices. |

| Capacity Payments | Payment for maintaining generation capacity, regardless of output. | Vital for baseload and dispatchable assets, providing financial stability. |

| Renewable Energy Credits (RECs) | Selling environmental attributes from renewable generation. | Market demand driven by renewable portfolio standards and corporate goals. |

| Ancillary Services | Revenue from grid support services like frequency regulation and voltage support. | Renewables segment adjusted EBITDA increased to $157 million in Q1 2024 (vs $138 million in Q1 2023). |

| Asset Optimization & Trading | Strategic dispatch of assets and active participation in energy markets. | Leverages market expertise to profit from price fluctuations and opportunities. |

Business Model Canvas Data Sources

The Capital Power Business Model Canvas is informed by a blend of internal financial reports, operational data, and extensive market research. This comprehensive approach ensures all aspects, from cost structure to revenue streams, are grounded in accurate, real-world information.