Canacol SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

Canacol's strategic position is shaped by its robust operational strengths and significant market opportunities in Latin America's energy sector. However, navigating regulatory landscapes and managing commodity price volatility present key challenges that require careful consideration.

Want the full story behind Canacol's competitive advantages, potential threats, and expansion avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Canacol Energy showcases robust financial health, evidenced by a significant leap in net income to $31.8 million in Q1 2025, a substantial increase from $3.7 million in the same period of the previous year. This impressive growth was partly fueled by a notable deferred income tax recovery, underscoring effective financial planning and asset management.

The company maintained a strong liquidity position with $79 million in cash reserves as of Q1 2025, ensuring operational flexibility and the capacity to meet short-term obligations. Furthermore, Canacol reported an improved leverage ratio of 2.3, comfortably within its stipulated debt covenants, reflecting prudent debt management and a stable financial structure.

Canacol Energy holds a commanding presence in Colombia's natural gas market, supplying around 17% of the nation's total gas consumption. This significant market share underscores its critical role in meeting domestic energy demand.

The company's strategic focus on the onshore Lower Magdalena Basin in Colombia has proven highly effective. This region is not only prospective but also forms the backbone of Canacol's operations, contributing over 50% of the natural gas demand on the Caribbean Coast.

Canacol Energy's exploration and development program is a significant strength, evidenced by its successful drilling activities. In the first quarter of 2025, the company reported the successful drilling of three development and evaluation wells, underscoring its operational proficiency.

Looking ahead to 2025, Canacol plans to further bolster its asset base by drilling up to 11 exploration and 3 development wells. This aggressive drilling schedule is designed to optimize current production and expand its proven reserves, ensuring continued growth and a robust future for the company.

Commitment to ESG Practices

Canacol Energy’s dedication to Environmental, Social, and Governance (ESG) practices is a significant strength, underscored by its top ESG performance rating from ISS. This recognition not only highlights their commitment to sustainability but also positions them favorably with investors increasingly prioritizing socially responsible investments. A strong ESG profile can translate into enhanced investor confidence and potentially better access to capital.

This focus on ESG principles can also foster operational efficiencies and mitigate risks associated with environmental and social factors. For instance, in 2023, Canacol reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 15% compared to 2022, demonstrating tangible progress in their environmental stewardship. This proactive approach to sustainable operations is a key differentiator in the energy sector.

Furthermore, Canacol's commitment to ESG is reflected in several key areas:

- High ESG Rating: Achieved the highest ESG performance rating from Institutional Shareholder Services (ISS), a leading provider of ESG data and analytics.

- Investor Appeal: Attracts socially responsible investors and enhances overall investor confidence due to robust governance and sustainability frameworks.

- Operational Efficiency: Proactive management of environmental and social factors can lead to reduced operational costs and improved risk management.

- Emissions Reduction: Demonstrated a tangible commitment to reducing its environmental footprint, with a 15% decrease in GHG emissions intensity in 2023.

Maximizing Spot Market Exposure

Canacol has strategically reduced its take-or-pay volumes for the latter half of 2025, a move designed to boost its participation in the dynamic spot market. This adjustment aims to capture the benefits of anticipated strong commodity pricing throughout the period.

By prioritizing spot sales, Canacol is positioning itself to take full advantage of favorable gas market conditions, potentially leading to higher average realized prices for its production. This agile approach highlights the company's responsiveness to evolving market opportunities.

- Increased Spot Market Participation: Lowered take-or-pay commitments enable greater flexibility.

- Capitalizing on Favorable Pricing: Strategy aligned with strong commodity price expectations for late 2025.

- Enhanced Realized Prices: Potential for higher average revenue by accessing spot market premiums.

- Market Responsiveness: Demonstrates Canacol's ability to adapt to changing market dynamics.

Canacol's dominant position in Colombia's natural gas market, supplying approximately 17% of the nation's consumption, is a significant strength. Its strategic focus on the Lower Magdalena Basin, which accounts for over 50% of the Caribbean Coast's natural gas demand, further solidifies its market leadership.

The company's robust financial performance, marked by a Q1 2025 net income of $31.8 million and a strong liquidity position with $79 million in cash as of Q1 2025, demonstrates financial stability. Furthermore, a healthy leverage ratio of 2.3 indicates prudent financial management.

Canacol's aggressive and successful exploration and development program, including the drilling of three wells in Q1 2025 and plans for up to 14 more in 2025, ensures future production growth and reserve expansion.

The company's top ESG rating from ISS and a 15% reduction in GHG emissions intensity in 2023 highlight a strong commitment to sustainability, attracting socially responsible investors and potentially improving access to capital.

Canacol's strategic reduction in take-or-pay volumes for late 2025 positions it to capitalize on anticipated strong commodity prices through increased spot market participation, aiming for higher realized prices.

What is included in the product

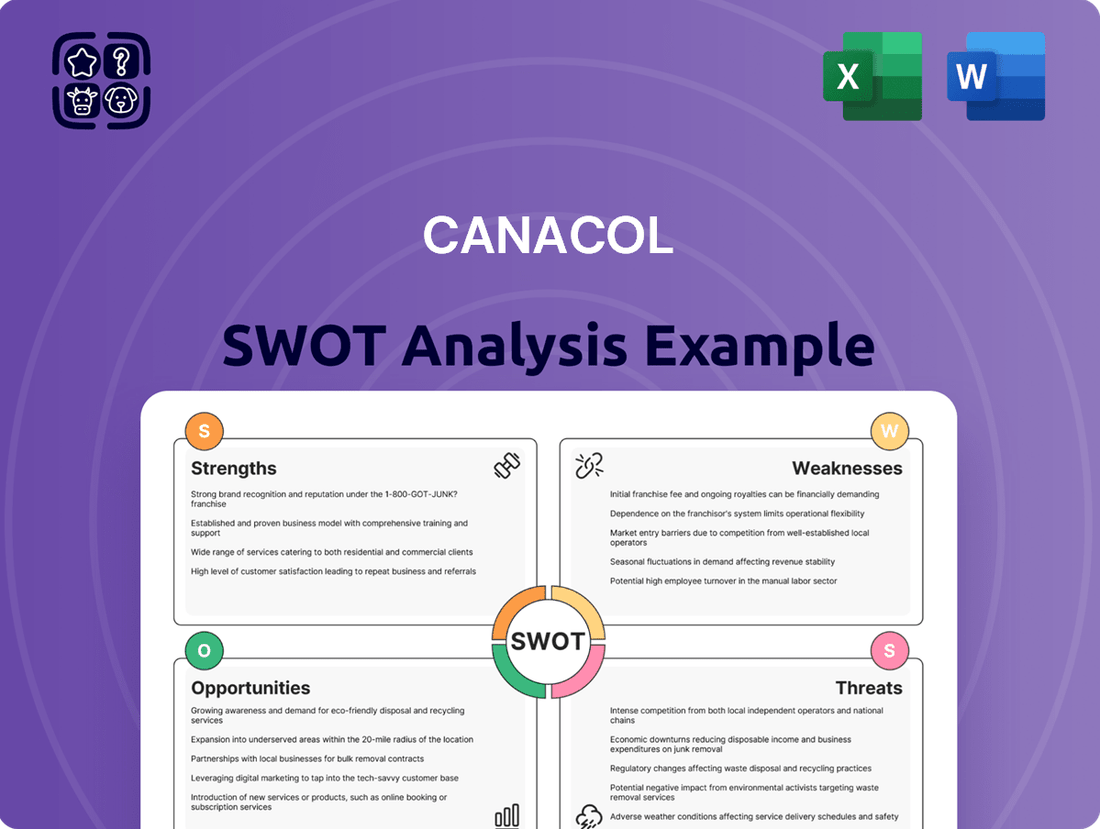

Delivers a strategic overview of Canacol’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable framework to identify and address Canacol's strategic challenges and opportunities.

Weaknesses

Canacol Energy experienced a notable downturn in its recent performance, with total revenues declining by 6% and realized contractual natural gas sales volumes dropping by 14% in the first quarter of 2025 when contrasted with the same period in the prior year. This dip in sales volumes directly affected key financial metrics, including adjusted EBITDAX and adjusted funds from operations, highlighting a short-term hurdle in maintaining consistent sales momentum.

Canacol faced a significant profitability challenge in fiscal year 2024, reporting a net loss of $32.7 million. This marks a stark contrast to the net income achieved in the preceding year, indicating a notable downturn in financial performance. While the first quarter of 2025 has demonstrated a positive recovery, the full-year 2024 results underscore the need for strategies to ensure consistent profitability moving forward, which could be a point of concern for investors evaluating the company's long-term stability.

Canacol Energy's decision in March 2024 to discontinue its quarterly dividend, while intended to bolster its balance sheet, presents a significant weakness by potentially alienating income-oriented investors.

This cessation of dividend payments, a move aimed at retaining capital for financial strengthening, could diminish the company's attractiveness to a segment of its shareholder base.

Outstanding Receivables and Disputes

Canacol Energy's financial health is impacted by outstanding receivables, particularly a $21 million sum tied to a customer dispute as noted in their 2024 financial report. This situation directly affects their liquidity and operational flexibility.

Such disputes can drain resources through legal fees and administrative overhead, hindering efficient cash flow management.

- Overdue Receivables: $21 million in receivables were overdue as of the 2024 report due to a customer dispute.

- Impact on Liquidity: This situation ties up essential capital, potentially restricting the company's ability to meet short-term obligations.

- Additional Costs: Resolving disputes often incurs significant legal and administrative expenses, further straining financial resources.

- Cash Flow Optimization: Addressing these outstanding issues is critical for improving Canacol's overall cash flow and financial efficiency.

Reduced Gas and Oil Sales Forecast for 2025

Canacol is projecting a dip in its natural gas sales for 2025, with volumes anticipated to fall between 140 and 153 million cubic feet per day (MMcfpd). This follows a stronger 2024 where sales were around 157 MMcfpd. The company also foresees a decrease in its forecasted oil volumes, which could put a damper on revenue expansion even if prices remain strong.

- Projected 2025 Natural Gas Sales: 140-153 MMcfpd (down from 157 MMcfpd in 2024).

- Oil Volume Forecast: Expected reduction in oil sales volumes.

- Revenue Impact: Potential limitation on revenue growth due to lower sales volumes.

Canacol's profitability faced a significant setback in 2024, resulting in a net loss of $32.7 million. This downturn, coupled with a 6% revenue decline and a 14% drop in natural gas sales volumes in Q1 2025 compared to the previous year, highlights a vulnerability in maintaining consistent financial performance and sales momentum.

The suspension of its quarterly dividend in March 2024, while aimed at strengthening its balance sheet, could alienate income-focused investors, potentially impacting shareholder sentiment and the company's attractiveness to a specific investor segment.

Canacol's financial flexibility is constrained by $21 million in overdue receivables stemming from a customer dispute as of its 2024 report, which ties up capital and could incur additional costs for resolution.

Projected lower natural gas sales volumes for 2025, estimated between 140-153 MMcfpd (down from 157 MMcfpd in 2024), alongside an anticipated decrease in oil sales, poses a risk to revenue growth even if commodity prices are favorable.

| Metric | 2024 (Actual/Reported) | Q1 2025 (vs. Q1 2024) | 2025 (Projected) |

|---|---|---|---|

| Net Income/Loss | -$32.7 million | N/A (Focus on volume impact) | N/A |

| Total Revenues | N/A | -6% | N/A |

| Contractual Natural Gas Sales Volumes | ~157 MMcfpd (2024) | -14% | 140-153 MMcfpd |

| Oil Sales Volumes | N/A | N/A | Projected Decrease |

| Overdue Receivables (Customer Dispute) | $21 million | N/A | N/A |

| Dividend Status | Discontinued (March 2024) | N/A | N/A |

Full Version Awaits

Canacol SWOT Analysis

This is the actual Canacol SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct preview of the comprehensive report that will be yours to download and utilize immediately after completing your transaction.

Opportunities

Colombia is facing a natural gas shortage, with limited import capacity expected to keep prices high for an extended period. This scarcity creates a prime opportunity for Canacol Energy to leverage strong domestic demand and attractive pricing, as the company is strategically focused on serving the local market.

Canacol is strategically positioning itself for entry into Bolivia, with operations slated to begin by 2026, contingent on congressional approval of exploration and redevelopment agreements. This move into a new operational theater, specifically targeting the Tita field which holds considerable gas potential, presents a significant chance to broaden its asset portfolio and boost both production and reserve figures.

This expansion offers a pathway to cultivate fresh revenue streams, thereby lessening the company's dependence on any single geographical market. For instance, Bolivia's estimated natural gas reserves, which stood at approximately 8.9 trillion cubic feet (Tcf) as of early 2024, represent a substantial resource base for Canacol to tap into.

Proposed regasification projects in Colombia are poised to significantly improve domestic gas sales pricing, directly benefiting companies like Canacol. These developments are expected to unlock greater market access and provide leverage for negotiating more advantageous sales contracts.

This enhanced pricing power translates to a tangible uplift in profitability for Canacol's current natural gas production. For instance, the potential increase in domestic gas prices, driven by improved supply flexibility, could see Canacol's revenue per unit of gas sold rise, bolstering its financial performance in the 2024-2025 period.

High-Impact Exploration in Magdalena Valley

Canacol is strategically targeting high-impact gas exploration in Colombia's Lower and Middle Magdalena Valley Basins. This focus is designed to unlock substantial new reserves, significantly bolstering the company's production capacity and long-term financial health. The success of these exploration ventures is paramount for sustained growth.

These exploration efforts are projected to significantly enhance Canacol's reserve base. For instance, in 2024, the company continued its aggressive drilling campaign. By the end of Q3 2024, Canacol reported a 15% increase in proved plus probable reserves compared to the previous year, largely driven by successful exploration in these key regions.

- Targeting High-Impact Gas: Focus on Lower and Middle Magdalena Valley Basins for significant discoveries.

- Reserve Enhancement: Aim to substantially increase the company's proven and probable gas reserves.

- Production Growth: New discoveries are expected to directly translate into higher production volumes.

- Long-Term Value Creation: Successful exploration is critical for enhancing shareholder value and future financial performance.

Optimizing Production and Infrastructure Utilization

Canacol is actively working to boost its production and expand its reserves by making the most of its existing transportation network. This includes adding new compression and processing facilities to its operations.

This strategic approach is designed to improve efficiency and get the maximum output from the company's current assets. By doing so, Canacol ensures that its investments in infrastructure directly contribute to higher deliverability and increased sales volumes.

- Increased Production Efficiency: The company's focus on optimizing existing infrastructure and adding new facilities aims to enhance the overall output from its natural gas assets.

- Reserve Maximization: By fully utilizing transportation and processing capabilities, Canacol seeks to maximize the economic recovery of its proven reserves.

- Enhanced Deliverability: Investments in compression and processing directly improve the ability to deliver more natural gas to market, meeting demand effectively.

- Improved Sales Volumes: The optimization strategy is geared towards translating increased production and deliverability into higher sales figures, driving revenue growth.

Colombia's natural gas shortage presents a significant opportunity for Canacol to capitalize on strong domestic demand and elevated prices, as the company is focused on serving this market. The potential for improved domestic gas sales pricing through proposed regasification projects in Colombia could directly benefit Canacol, unlocking greater market access and leverage for more favorable sales contracts, potentially increasing its revenue per unit of gas sold in the 2024-2025 period.

Canacol's strategic targeting of high-impact gas exploration in Colombia's Lower and Middle Magdalena Valley Basins is designed to unlock substantial new reserves, boosting production capacity and long-term financial health. By the end of Q3 2024, Canacol reported a 15% increase in proved plus probable reserves compared to the previous year, largely due to successful exploration in these key regions.

The company is also working to boost production and expand reserves by optimizing its existing transportation network and adding new compression and processing facilities. This strategy aims to enhance output efficiency and directly contribute to higher deliverability and increased sales volumes from its current assets.

Canacol's planned entry into Bolivia by 2026, contingent on congressional approval, offers a chance to broaden its asset portfolio and increase production and reserves, tapping into Bolivia's estimated 8.9 trillion cubic feet of natural gas reserves as of early 2024.

Threats

Canacol's operations in Colombia and its expansion into Bolivia present significant threats from regulatory and political instability. Delays in securing crucial licenses and government approvals are a constant concern, potentially hindering project timelines and increasing costs. For instance, the energy sector in Latin America often faces shifts in policy that can impact existing agreements.

Changes in governmental policies, renegotiation of contractual terms, or adverse shifts in political sentiment can directly affect Canacol's operational efficiency and the profitability of its investments. Such instability introduces a layer of uncertainty, making long-term financial planning more challenging and potentially creating unforeseen operational hurdles that require swift adaptation.

Canacol, like all players in the oil and gas sector, faces the persistent threat of fluctuating commodity prices. While current market conditions may be favorable, the inherent volatility of global energy markets means significant downturns in natural gas and oil prices are a constant risk. Such price drops could directly impact Canacol's revenue streams and overall profitability.

For instance, a sustained 10% decrease in natural gas prices, a key commodity for Canacol, could lead to a proportional reduction in earnings before interest, taxes, depreciation, and amortization (EBITDA). This external market risk, largely outside the company's direct control, could also affect the viability of future investment returns and project development, as seen in historical industry cycles where lower prices curtailed capital expenditure across the sector.

The exploration and production of oil and gas inherently carry significant operational risks. These include the uncertainty of interpreting drilling data, complex geological formations, and the potential for unexpected cost increases or project delays. For instance, in 2024, the industry continued to grapple with price volatility, impacting investment decisions in new exploration projects.

Unsuccessful exploration wells can result in substantial financial write-offs, directly affecting a company's reserve replacement ratio. Similarly, production issues, such as equipment failures or reservoir performance below expectations, can lead to significant financial losses. These are fundamental challenges embedded within the exploration and production business model, requiring robust risk management strategies.

Potential Market Saturation and Demand Shifts

While Colombia currently experiences gas scarcity, the long-term outlook for its gas market could involve saturation. This saturation, coupled with potential shifts in demand driven by the adoption of alternative energy sources or economic downturns, poses a threat to Canacol. Such scenarios could intensify competition and diminish the company's pricing power.

For instance, a significant increase in renewable energy capacity, such as solar or wind, could directly impact natural gas demand. By the end of 2024, Colombia's renewable energy capacity is projected to reach over 3.5 GW, a substantial increase from previous years, indicating a growing trend towards diversification. This evolution necessitates continuous market analysis and strategic adaptation from Canacol to effectively mitigate these potential threats.

- Market Saturation Risk: Long-term oversupply could depress natural gas prices.

- Demand Shift Vulnerability: Increased adoption of renewables or energy efficiency measures could reduce gas consumption.

- Competitive Pressure: Saturation may lead to price wars and reduced profit margins for Canacol.

- Economic Sensitivity: A slowdown in Colombia's economy could curb industrial and residential energy demand.

Liquidity and Debt Management Challenges

While Canacol has shown progress in its leverage ratio and maintains a solid cash reserve, a key threat lies in managing its liquidity and debt. The decision to suspend dividends in late 2023, aiming to bolster its balance sheet, highlights potential underlying pressures. Furthermore, the company has experienced periods of overdue receivables, which can strain cash flow.

Any unexpected large expenses or a prolonged downturn in revenue could put significant pressure on Canacol's ability to meet its debt obligations. For instance, a substantial capital expenditure not anticipated in current forecasts, or a sharp decline in commodity prices impacting sales, could quickly tighten liquidity. Maintaining strict financial discipline and proactive debt management are therefore paramount to navigate these potential future strains.

- Leverage Ratio Improvement: Canacol's net debt to EBITDA ratio improved to 2.3x as of Q1 2024, down from 2.6x at the end of 2023, indicating a move towards deleveraging.

- Dividend Suspension: The company halted dividend payments starting in Q4 2023 to preserve cash and strengthen its financial position.

- Overdue Receivables: While specific figures fluctuate, periods of extended payment terms from customers can temporarily impact cash inflows.

- Liquidity Risk: A sudden increase in operating costs or a significant drop in revenue, potentially due to market volatility or operational disruptions, could challenge the company's short-term financial flexibility.

Canacol faces significant threats from regulatory and political instability in its operating regions, particularly Colombia. Changes in government policies or adverse political shifts can directly impact operational efficiency and investment profitability, introducing uncertainty into long-term financial planning. For example, the energy sector in Latin America is prone to policy shifts that can affect existing agreements.

Fluctuating commodity prices remain a persistent threat for Canacol, as the global energy market is inherently volatile. A significant downturn in natural gas prices, a key commodity for the company, could directly reduce revenue streams and overall profitability. For instance, a sustained 10% drop in natural gas prices could lead to a proportional reduction in EBITDA, impacting future investment returns.

The company is also vulnerable to market saturation and shifts in demand for natural gas. Increased adoption of alternative energy sources or economic slowdowns could reduce gas consumption, intensifying competition and diminishing pricing power. By the end of 2024, Colombia's renewable energy capacity is projected to exceed 3.5 GW, indicating a growing trend towards energy diversification.

SWOT Analysis Data Sources

This Canacol SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert analyses of the energy sector. These sources provide a clear understanding of Canacol's operational performance, market position, and the external factors influencing its business.