Canacol Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

Canacol's competitive landscape is shaped by powerful forces, from the influence of buyers to the constant threat of new entrants. Understanding these dynamics is crucial for navigating the energy sector.

The complete report reveals the real forces shaping Canacol’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of specialized equipment like advanced drilling rigs and seismic technology wield considerable bargaining power. This is due to the substantial investment and unique expertise needed for these critical assets in the energy sector.

Canacol's dependence on state-of-the-art exploration and production technologies, often sourced from a select group of global and regional providers, allows these suppliers to command premium pricing and favorable contract terms. The high barriers to entry for manufacturing and servicing such sophisticated machinery inherently concentrate power among a few key players.

The inherent complexity and significant capital expenditure involved in hydrocarbon extraction inherently restrict the pool of qualified suppliers. This limited competition directly enhances the leverage of these specialized providers over exploration and production companies like Canacol.

The bargaining power of suppliers in Canacol's operations is significantly influenced by the availability of skilled labor, particularly engineers, geologists, and other technical personnel essential for the oil and gas sector. A scarcity of these highly specialized professionals in Colombia or the broader region can elevate their leverage.

For instance, in 2024, the global demand for experienced petroleum engineers remained robust, with projections indicating continued growth in specialized roles. This tight labor market means Canacol must compete for top talent, potentially leading to increased compensation and benefits packages, thereby granting these skilled individuals greater negotiating power.

Canacol's reliance on specialized infrastructure and logistics providers, particularly for pipeline transportation and related services in the Lower Magdalena Basin, presents a potential area for supplier bargaining power. If the number of qualified service providers capable of handling oil and gas logistics is limited, or if the cost and complexity of switching between these providers are high, these suppliers can command more favorable terms.

For instance, the maintenance and operation of existing pipeline networks, crucial for Canacol's operations, often involve specialized technical expertise and equipment. A scarcity of such skilled providers or the long-term nature of infrastructure contracts can solidify the power of these suppliers. This is particularly relevant as Canacol continues to develop its production, requiring efficient and reliable transport of hydrocarbons from wellheads to processing facilities and onward to market.

Regulatory and Environmental Compliance Services

Suppliers of regulatory and environmental compliance services wield considerable bargaining power over Canacol, particularly given Colombia's rigorous environmental and social regulations for hydrocarbon projects. Their specialized knowledge in areas like environmental impact assessments and community relations is crucial for Canacol to successfully navigate complex permitting processes and maintain operational continuity.

Failure to adhere to these regulations, often overseen by entities like the National Environmental Licensing Authority (ANLA), can result in substantial financial penalties and operational shutdowns for energy companies. For instance, environmental fines in Colombia can range from substantial monetary penalties to the suspension of operations, directly impacting project timelines and profitability.

- Expertise is Non-Negotiable: Companies specializing in environmental impact assessments, social license to operate, and navigating Colombian environmental laws are essential for project approval and ongoing operations.

- Risk Mitigation: These suppliers help Canacol avoid costly delays and penalties associated with non-compliance, which can amount to millions of dollars in lost revenue and remediation expenses.

- Limited Alternatives: The highly specialized nature of these services means there are fewer alternative suppliers, increasing the leverage of existing providers.

Geological and Seismic Data Providers

Geological and seismic data providers wield significant bargaining power in the exploration sector. Access to proprietary or highly accurate geological and seismic data is absolutely fundamental for successful exploration efforts, directly impacting risk reduction and drilling success rates. Companies that specialize in collecting, processing, and selling this vital information can command strong terms, especially given the inherent uncertainties in resource discovery.

Canacol Energy's exploration-focused strategy inherently makes it reliant on the quality and availability of these insights. In 2024, the cost of acquiring comprehensive seismic data packages can range from hundreds of thousands to millions of dollars, depending on the scope and proprietary nature of the information. This dependence allows data providers to influence pricing and contract terms, as the value derived from this data can dramatically outweigh its acquisition cost by improving capital allocation and reducing dry hole expenses.

- High Cost of Data Acquisition: The significant investment required for advanced seismic surveys and data processing creates a barrier to entry for new data providers, concentrating power among established players.

- Impact on Exploration Success: Reliable geological data directly correlates with improved drilling success rates, making it an indispensable input for exploration companies like Canacol.

- Proprietary Nature of Data: Unique or exclusive datasets held by specialized providers can offer a competitive advantage, further strengthening their negotiating position.

Suppliers of specialized equipment, like advanced drilling rigs and seismic technology, hold considerable bargaining power due to the high investment and unique expertise required. Canacol's reliance on state-of-the-art exploration and production technologies, often sourced from a limited number of global and regional providers, allows these suppliers to command premium pricing and favorable contract terms.

The scarcity of skilled labor, particularly experienced petroleum engineers and geologists, also strengthens supplier bargaining power. In 2024, the global demand for these professionals remained robust, forcing companies like Canacol to offer competitive compensation packages.

Furthermore, suppliers of regulatory and environmental compliance services wield significant leverage, given Colombia's stringent regulations. Companies specializing in environmental impact assessments and navigating local laws are crucial for project approval, and failure to comply can result in substantial fines, as seen with potential penalties for environmental non-adherence in Colombia.

Geological and seismic data providers also possess strong bargaining power, as accurate data is fundamental to exploration success, directly impacting risk reduction and drilling outcomes. In 2024, acquiring comprehensive seismic data packages could cost anywhere from hundreds of thousands to millions of dollars, making these providers indispensable.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Canacol | Example Data/Trend (2024) |

|---|---|---|---|

| Specialized Equipment (Drilling Rigs, Seismic Tech) | High R&D costs, unique expertise, limited manufacturers | Premium pricing, favorable contract terms | Capital expenditure on advanced drilling technology can exceed $10 million per rig. |

| Skilled Labor (Engineers, Geologists) | Scarcity of specialized talent, high demand | Increased labor costs, competition for talent | Global demand for petroleum engineers projected to grow by 5-10% annually. |

| Regulatory & Environmental Services | Complex regulatory landscape, specialized knowledge | Reliance on compliance experts, risk of penalties | Environmental fines in Colombia can reach up to $1.5 million USD for non-compliance. |

| Geological & Seismic Data | Proprietary data, impact on exploration success | High acquisition costs, dependence on data quality | Seismic data acquisition costs can range from $500,000 to $5 million+ for large surveys. |

What is included in the product

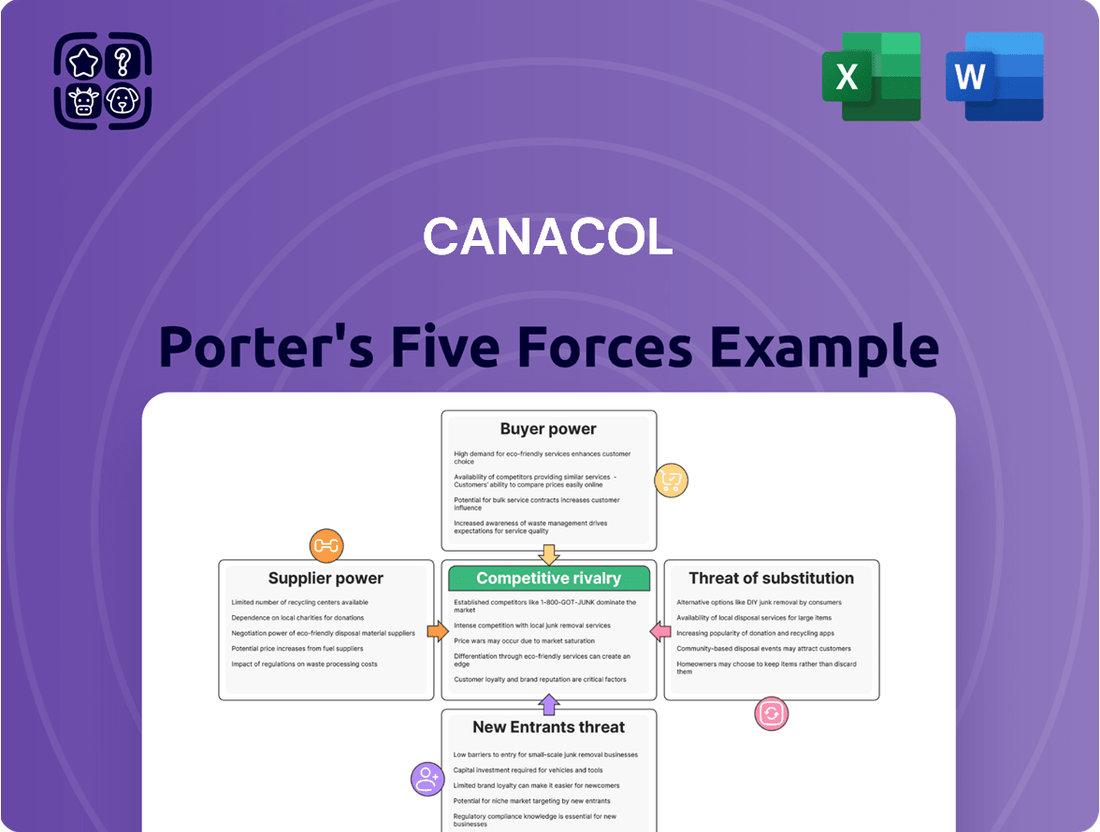

This Porter's Five Forces analysis for Canacol dissects the competitive intensity within the Colombian natural gas market, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly identify and quantify competitive pressures with a dynamic, interactive Porter's Five Forces model, empowering strategic adjustments to mitigate threats.

Customers Bargaining Power

Colombia is confronting a significant natural gas shortage, with forecasts suggesting domestic production will be insufficient to meet demand starting in 2025. This situation positions natural gas producers, such as Canacol, in a strong seller's market as clients actively seek dependable supply sources.

The growing dependence on expensive imported natural gas further bolsters the negotiating leverage of domestic producers like Canacol. For instance, the projected deficit means that by 2027, Colombia could need to import up to 70% of its natural gas supply, driving up prices and making domestic production even more valuable.

Major industrial users and power generators in Colombia currently have very few immediate alternatives to natural gas for their essential operations. This reliance is particularly pronounced as the country works to integrate renewable energy sources, a process that will take time to fully mature. Consequently, these large consumers find their ability to negotiate lower prices significantly constrained by this lack of readily available substitutes.

Residential and commercial customers, while representing a significant demand for natural gas, exhibit considerable price sensitivity. This means that even with high overall demand, sharp price increases can trigger adverse reactions. For instance, in 2024, rising energy costs continued to be a significant concern for households, impacting their budgets and potentially fueling public outcry.

The direct impact of natural gas price hikes on household disposable income and utility bills is a key driver of this sensitivity. When consumers have less discretionary income, they are more likely to scrutinize and resist higher energy prices. This can translate into political pressure on regulatory bodies or even direct public campaigns aimed at capping price increases.

This customer price sensitivity indirectly curtails the pricing power of natural gas producers and distributors. Companies operating in this sector must carefully consider the potential backlash and regulatory scrutiny that could arise from passing on significant cost increases to end-users. For example, in early 2024, several utility providers faced public and governmental pressure to absorb some of the rising fuel costs rather than passing them entirely to consumers.

Regulatory Oversight on Pricing and Supply

The Colombian government and its regulatory bodies exert considerable influence over energy pricing and supply, particularly for natural gas. This oversight acts as a check on how much producers like Canacol can increase prices, even when demand is high. For instance, the Comisión de Regulación de Energía y Gas (CREG) sets the framework for tariffs and service quality, directly impacting Canacol's revenue potential.

These regulations are designed to ensure a stable and affordable energy supply for the nation's consumers. This can limit the bargaining power of customers by providing a baseline of affordability, but it also caps the potential for producers to exploit market shortages. In 2024, the focus on energy security and affordability continued to be a priority for the Colombian administration, influencing CREG's decisions on gas pricing mechanisms.

- Governmental Price Controls: Regulatory bodies, such as CREG, can implement price caps or specific tariff structures that limit the ability of natural gas producers to charge market-clearing prices, thereby reducing customer bargaining power derived from price sensitivity.

- Ensuring Energy Affordability: Policies aimed at making energy accessible to the general population can create a more price-resilient customer base, as consumers are less likely to absorb significant price increases.

- Supply Stability Mandates: Regulations often require producers to maintain a certain level of supply reliability, which can reduce the leverage customers might otherwise have during periods of scarcity.

- Impact on Profitability: While protecting consumers, these regulatory actions can constrain the profit margins of energy producers, influencing their investment decisions and overall market strategy.

Diversification of Energy Sources in the Long Term

While immediate alternatives to natural gas might be scarce for many consumers, Colombia's determined drive towards renewable energy sources, particularly solar and wind, is set to gradually enhance customer bargaining power over the long term. By 2024, the nation's installed capacity for non-conventional renewable energy sources reached approximately 2,900 MW, a significant increase that signals a growing diversification. As these cleaner energy options become more accessible and economically viable, consumers will naturally gain more choices, potentially lessening their dependence on traditional natural gas supplies. This evolving energy landscape could subtly but surely shift the balance of power.

The increasing availability of diverse energy options, coupled with competitive pricing, directly empowers customers. For instance, as solar panel installations become more widespread and affordable, households and businesses can generate their own electricity, reducing their need to purchase from utility providers. This trend, projected to continue its upward trajectory through 2025, creates a tangible alternative that can be leveraged in negotiations or simply by switching suppliers if available. The long-term diversification strategy is a key factor in this evolving dynamic.

- Colombia's installed capacity for non-conventional renewable energy sources reached approximately 2,900 MW by the end of 2024.

- This diversification offers consumers more choices beyond traditional energy sources like natural gas.

- The increasing affordability and accessibility of renewables like solar and wind are key drivers of this shift.

- Greater consumer choice can lead to reduced reliance on single energy providers, potentially increasing bargaining power.

While industrial and large commercial users have limited immediate alternatives, their significant demand and price sensitivity mean they can still exert some influence. For example, in 2024, escalating energy costs were a major concern for Colombian businesses, prompting discussions about energy efficiency and alternative sourcing where feasible, even if immediate large-scale switches are difficult.

The bargaining power of customers in Colombia's natural gas market is currently moderate but evolving. While immediate alternatives are scarce for major consumers, government regulations and growing price sensitivity among residential users temper producers' pricing power. The long-term shift towards renewables is expected to further empower customers.

| Customer Segment | Current Bargaining Power | Key Factors Influencing Power | Outlook |

|---|---|---|---|

| Major Industrial Users & Power Generators | Moderate | High demand, limited immediate alternatives, but price sensitivity and potential for future diversification. | Power may increase as renewable integration progresses. |

| Residential & Commercial Users | Low to Moderate | High price sensitivity, direct impact of utility bills, potential for political pressure. | Power likely to increase with greater energy efficiency adoption and renewable options. |

What You See Is What You Get

Canacol Porter's Five Forces Analysis

The document you see here is the complete, professionally crafted Porter's Five Forces Analysis for Canacol Energy, detailing the competitive landscape and strategic implications. This preview accurately represents the final document you will receive immediately upon purchase, ensuring you get the full, uncompromised analysis. What you are previewing is precisely the same in-depth report that will be available to you instantly after completing your transaction.

Rivalry Among Competitors

The Colombian oil and gas landscape is dominated by state-owned Ecopetrol, which commands a substantial market share, alongside other major international and domestic private firms. This intense competition means Canacol, a key independent natural gas producer, must contend with established entities possessing significant financial and infrastructural advantages. For instance, in 2023, Ecopetrol's gross production reached approximately 746,000 barrels of oil equivalent per day, highlighting its scale relative to independent producers.

The Colombian government's decision to halt new oil and gas exploration contracts starting in 2023 fundamentally reshapes competitive rivalry. This moratorium, impacting a sector where Colombia produced approximately 753,000 barrels of oil equivalent per day in early 2024, effectively creates a barrier to entry for potential new players looking to acquire exploration acreage.

Existing companies, like Canacol Energy, therefore face a landscape where growth must primarily come from optimizing production within their existing contract areas rather than through new discoveries via exploration. This policy, while limiting new competition, also intensifies the focus on efficient resource management and the maximization of output from current reserves, potentially leading to a more concentrated market among those with established exploration rights.

Colombia's projected natural gas deficit, estimated to reach 100 million cubic feet per day by 2027, is fueling intense competition among producers as the nation increasingly views natural gas as a crucial 'transition fuel' in its energy strategy. This scarcity, coupled with a global drive towards cleaner energy sources, makes securing and expanding domestic natural gas supply a high-stakes endeavor.

Companies like Canacol Energy are strategically positioning themselves to meet this growing demand, intensifying rivalry within the natural gas sector. The government's emphasis on gas as a bridge to renewables means that players vying for market share are not just competing on price but also on the reliability and volume of their supply. This focus elevates the strategic importance of gas production, creating a more competitive landscape for all participants.

High Fixed Costs and Exit Barriers

The oil and gas exploration and production sector is characterized by immense fixed costs. Companies invest heavily in exploration rights, drilling equipment, pipelines, and processing facilities. For instance, a single offshore platform can cost billions of dollars to construct and install, representing a significant sunk cost.

These substantial upfront investments create formidable exit barriers. Once a company has committed capital to these assets, it's extremely difficult and costly to divest or abandon them. This financial entanglement compels companies to continue operating and competing, even when market conditions are unfavorable, to recoup their investments.

Consequently, this leads to intensified competitive rivalry. Companies are incentivized to maintain production and market share to cover their high fixed costs, often leading to price wars or aggressive competition for new reserves. In 2024, for example, many exploration and production companies continued to invest in projects despite fluctuating oil prices, driven by the need to utilize existing infrastructure and recover prior capital expenditures.

- High Capital Intensity: The oil and gas E&P industry requires significant capital outlays for exploration, development, and production infrastructure.

- Significant Sunk Costs: Investments in drilling, pipelines, and processing facilities are largely irrecoverable, creating strong incentives to continue operations.

- Deterrence to Exit: High exit barriers mean companies are less likely to withdraw from the market, even during periods of low profitability, thus sustaining rivalry.

- Competitive Behavior: Companies often compete aggressively on price and production volume to cover fixed costs and maintain market position.

Geographical Concentration in Key Basins

Canacol's competitive rivalry is amplified by its geographical concentration in the onshore Lower Magdalena Basin, a prime natural gas producing region. This intense focus means companies vie fiercely for limited reserves, essential infrastructure, and market dominance within this specific area. For instance, in 2024, the Lower Magdalena Basin continued to be a focal point for exploration and production activities, with several independent and national oil companies actively seeking to expand their footprint.

The intense competition within the Lower Magdalena Basin directly impacts Canacol's operational strategies and profitability. Success here is not just beneficial; it's fundamental to the company's overall financial health and growth trajectory. The basin's importance is underscored by its significant contribution to Colombia's domestic gas supply, making it a critical battleground for energy producers.

- Geographical Focus: Canacol's operations are heavily weighted towards the Lower Magdalena Basin.

- Intensified Competition: This concentration leads to heightened rivalry for resources and market share among operators in the basin.

- Strategic Importance: The Lower Magdalena Basin is a key natural gas hub, making success within it vital for Canacol's performance.

- 2024 Activity: The basin remained a highly active area for exploration and production in 2024, reflecting its strategic value.

The competitive rivalry for Canacol in Colombia's oil and gas sector is fierce, driven by a few key factors. The dominance of state-owned Ecopetrol, which produced around 746,000 barrels of oil equivalent per day in 2023, sets a high bar for independent producers. Furthermore, the government's 2023 decision to halt new exploration contracts means companies like Canacol must focus on maximizing output from existing reserves, intensifying competition within established areas. Colombia's projected natural gas deficit, expected to reach 100 million cubic feet per day by 2027, further fuels this rivalry as companies vie to meet rising demand.

The high capital intensity of the oil and gas industry, with significant investments in infrastructure, creates substantial sunk costs and exit barriers. This compels companies to maintain production and market share to recoup investments, leading to aggressive competition. For instance, in 2024, companies continued investing in projects despite market volatility to utilize existing assets. Canacol's concentration in the Lower Magdalena Basin, a key gas hub, further intensifies rivalry as multiple players compete for limited resources and market dominance within this critical region.

| Factor | Description | Impact on Canacol |

|---|---|---|

| Market Dominance | Ecopetrol's substantial production (approx. 746,000 boepd in 2023) | Requires Canacol to compete with a large, established player. |

| Exploration Halt | No new exploration contracts from 2023 | Shifts focus to optimizing existing reserves, increasing competition for production. |

| Gas Demand | Projected deficit of 100 million cubic feet/day by 2027 | Drives intense competition among producers to meet growing demand. |

| Capital Intensity | High fixed costs and exit barriers | Encourages companies to maintain production and market share, intensifying rivalry. |

| Geographic Focus | Concentration in the Lower Magdalena Basin | Leads to heightened competition for resources and market dominance in a key producing area. |

SSubstitutes Threaten

Colombia's commitment to its energy transition, with significant investments in solar and wind power, presents a growing threat of substitutes for traditional energy sources like natural gas. By 2024, the government's push for renewables is expected to accelerate, potentially impacting demand for established energy providers.

New regulations are also liberalizing energy self-consumption and promoting energy communities. This regulatory shift could empower consumers to generate their own power, further diminishing reliance on natural gas and increasing the viability of renewable substitutes.

While natural gas prices in Colombia are expected to increase due to supply constraints and import dependency, the evolving cost and efficiency of renewable energy sources present a growing threat. By 2024, advancements in solar and wind technology are making them increasingly competitive, potentially luring away energy consumers.

The Colombian government's strong push for decarbonization, aiming for a 51% reduction in greenhouse gas emissions by 2030, significantly bolsters the threat of substitutes for traditional energy sources. This commitment translates into tangible support for green energy projects.

Financial incentives and supportive policies for renewable energy, such as tax breaks and streamlined permitting processes, directly enhance the competitiveness of alternatives like solar and wind power. For instance, by mid-2024, Colombia had already surpassed its 2023 renewable energy capacity targets, with solar and wind installations showing robust growth.

These government-backed initiatives make it more economically attractive for businesses and consumers to switch away from oil and gas. The increasing viability and affordability of green energy options therefore represent a substantial threat to the established oil and gas sector.

Technological Advancements in Energy Storage and Efficiency

Technological advancements in energy storage and efficiency are increasingly acting as a potent substitute threat to traditional energy sources. Improvements in battery technology, for instance, are making renewable energy more reliable and cost-effective. By 2024, the global energy storage market is projected to reach hundreds of billions of dollars, driven by these innovations.

These advancements directly challenge the demand for hydrocarbons. As energy efficiency measures become more widespread and affordable, the overall energy consumption in sectors like transportation and industry decreases. This trend is further amplified by the growing viability of electric vehicles and more efficient industrial processes, directly impacting the market share of fossil fuels.

- Battery Cost Reduction: Lithium-ion battery pack prices have fallen by over 90% since 2010, making energy storage solutions more accessible.

- Renewable Energy Integration: Enhanced storage allows for greater grid penetration of intermittent renewables like solar and wind.

- Energy Efficiency Gains: Technologies like LED lighting and improved insulation reduce overall energy demand, lessening reliance on primary energy sources.

- EV Market Growth: The accelerating adoption of electric vehicles directly substitutes demand for gasoline and diesel.

Public and International Pressure for Decarbonization

The increasing global and domestic awareness of climate change, amplified by international agreements like the Paris Agreement and growing public demand for cleaner energy sources, is a significant threat of substitutes for traditional hydrocarbon producers like Canacol. This societal shift actively encourages the development and widespread adoption of renewable energy alternatives, such as solar, wind, and hydropower, directly impacting the long-term demand for natural gas.

In 2024, the energy transition continues to accelerate, with significant investments flowing into renewable energy projects worldwide. For instance, global investment in clean energy reached an estimated $1.7 trillion in 2023, a figure projected to grow further. This trend means that as renewable energy sources become more efficient and cost-competitive, they present a more viable and attractive substitute for natural gas, potentially eroding Canacol's market share and profitability.

- Growing Investment in Renewables: Global clean energy investment surpassed $1.7 trillion in 2023, indicating a strong market preference for alternatives.

- Policy Support for Decarbonization: International accords and national policies are increasingly favoring low-carbon energy sources.

- Technological Advancements: Improvements in solar panel efficiency and wind turbine technology are making renewables more competitive.

- Public Demand for Sustainability: Consumer and corporate pressure for environmentally friendly energy solutions is a key driver for substitute adoption.

The increasing adoption of renewable energy sources, driven by government policy and technological advancements, poses a significant threat of substitutes for natural gas. By 2024, Colombia's commitment to decarbonization and the liberalization of energy self-consumption are making solar and wind power more competitive and accessible.

These shifts are further amplified by falling battery costs and growing public demand for sustainable energy. As renewables become more reliable and affordable, they directly challenge the market share and profitability of traditional energy providers like Canacol.

The accelerating growth of the electric vehicle market also directly substitutes demand for fossil fuels, further intensifying the threat of substitutes.

| Substitute Technology | 2023 Investment (USD Trillions) | Projected Growth Factor (by 2024) | Impact on Natural Gas Demand |

|---|---|---|---|

| Solar Power | 0.8 | 1.2x | Moderate to High |

| Wind Power | 0.6 | 1.15x | Moderate |

| Energy Storage (Batteries) | 0.2 | 1.3x | Enabling Higher Renewable Penetration |

| Electric Vehicles | 0.1 | 1.25x | Direct Substitution for Transportation Fuels |

Entrants Threaten

The exploration and production (E&P) sector for oil and natural gas demands enormous upfront capital. Think seismic surveys, drilling operations, and building pipelines – these alone can run into billions of dollars. For instance, a single offshore oil platform can cost upwards of $1 billion, and that’s just the start of the investment needed for exploration and eventual production.

This colossal financial hurdle acts as a significant deterrent for new players. Only established companies with substantial financial backing and proven access to capital markets can realistically enter this arena. In 2024, the average cost to drill an oil well in the US varied significantly by region, but estimates often placed it between $2 million and $7.5 million, underscoring the scale of investment required.

Colombia's oil and gas industry presents a formidable barrier to entry due to its intricate web of regulations. New companies must contend with rigorous environmental licensing, securing land access, and engaging in prior consultation with indigenous and local communities, processes that are often lengthy and resource-intensive.

For instance, the average time for obtaining environmental permits in Colombia can extend over several months, sometimes exceeding a year, depending on the project's complexity and the specific regional authorities involved. This bureaucratic landscape significantly increases the upfront investment and operational risk for potential new entrants, favoring established players with existing expertise and relationships.

The Colombian government's decision to halt new oil and gas exploration contracts creates a significant barrier for potential new entrants. This policy directly curtails opportunities for companies looking to enter the upstream sector, effectively closing off avenues for new exploration and production activities.

Need for Established Infrastructure and Market Access

New entrants into the energy sector, particularly those looking to compete with established players like Canacol Energy, face significant hurdles in developing the necessary infrastructure. Building out extensive pipeline networks and securing reliable market access for hydrocarbons requires immense capital investment and time, creating a substantial barrier to entry. For instance, Canacol's existing transportation agreements and extensive network of pipelines provide a distinct logistical advantage, making it difficult for newcomers to match their distribution efficiency and reach.

The challenge of securing access to existing pipeline infrastructure is a critical factor. New companies would need to either build their own, which is prohibitively expensive and time-consuming, or negotiate access with existing operators, often at unfavorable terms. This reliance on established networks means that even if a new entrant discovers reserves, getting those reserves to market efficiently can be a major obstacle. In 2024, the ongoing development and expansion of critical energy infrastructure, such as the Vaca Muerta pipeline in Argentina which transports significant volumes, highlights the scale of investment required and the established players who benefit from such projects.

- Infrastructure Investment: The cost to build new, large-scale hydrocarbon transportation infrastructure can run into billions of dollars.

- Market Access: Establishing long-term contracts with refiners and distributors is crucial and often favors incumbents with proven track records.

- Logistical Efficiency: Existing players leverage their integrated networks to reduce transportation costs and ensure timely delivery, a competitive edge for new entrants to overcome.

Geological Risk and Exploration Success Rates

The threat of new entrants into Colombia's oil and gas sector, specifically concerning geological risk and exploration success, is significantly dampened by the inherent uncertainties and high costs involved. Discovering commercially viable reserves is far from guaranteed, demanding substantial capital investment in exploration activities.

New players must navigate the complexities of geological surveys and drilling, often without the benefit of extensive historical data that established companies possess. For instance, in 2024, the global average success rate for exploratory oil wells remained challenging, with many regions seeing rates below 30% for new ventures. Entering a market like Colombia without established geological expertise or proven exploration models amplifies this risk considerably, making the prospect of entry less attractive for potential newcomers.

- High Capital Outlay: New entrants face substantial upfront costs for seismic surveys, exploratory drilling, and associated infrastructure, often running into hundreds of millions of dollars per project.

- Uncertainty of Discovery: Geological risk means that even with significant investment, there's no guarantee of finding commercially viable quantities of oil or gas.

- Lack of Local Expertise: New companies may lack the deep understanding of Colombia's specific geological formations and historical exploration data, increasing the likelihood of unsuccessful ventures.

- Competitive Disadvantage: Established players have accumulated valuable geological knowledge and operational experience, creating a significant barrier for new, less-informed entrants.

The threat of new entrants in Colombia's oil and gas sector is considerably low due to the immense capital requirements and established infrastructure. The cost of exploration, drilling, and pipeline development can easily reach billions, a barrier that only well-funded entities can overcome. For example, in 2024, the average cost to develop a new oil field globally often exceeded $10 billion, a daunting figure for any newcomer.

Furthermore, stringent regulatory processes, including lengthy environmental licensing and community consultations, add significant time and cost, favoring companies with existing experience and relationships in Colombia. The government's current stance on halting new exploration contracts further solidifies this barrier, effectively limiting opportunities for new players.

Access to existing transportation infrastructure is another major hurdle. New entrants would either need to build their own costly networks or negotiate access with incumbents, often on unfavorable terms. This reliance on established logistics makes it difficult for newcomers to compete on cost and efficiency, as demonstrated by Canacol's advantageous pipeline network.

The inherent geological risks and the high probability of exploration failure also deter new entrants. Without the accumulated geological expertise and historical data of established players, the chances of a successful, commercially viable discovery are significantly reduced, especially considering that in 2024, global exploratory well success rates often remained below 30%.

| Barrier | Description | Illustrative Cost/Factor (2024 Estimates) |

|---|---|---|

| Capital Requirements | Enormous upfront investment for exploration, drilling, and infrastructure. | Exploration & Drilling: $2M - $7.5M per well (US average) |

| Regulatory Hurdles | Complex environmental licensing and community consultation processes. | Permit acquisition can take months to over a year. |

| Infrastructure Access | Difficulty in accessing or building transportation networks (pipelines). | New pipeline construction can cost billions. |

| Geological Risk | Uncertainty of discovering commercially viable reserves. | Global exploratory well success rates often below 30%. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Canacol leverages data from their annual reports, investor presentations, and industry-specific publications. We also incorporate information from regulatory filings and macroeconomic data to provide a comprehensive view of the competitive landscape.