Canacol Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

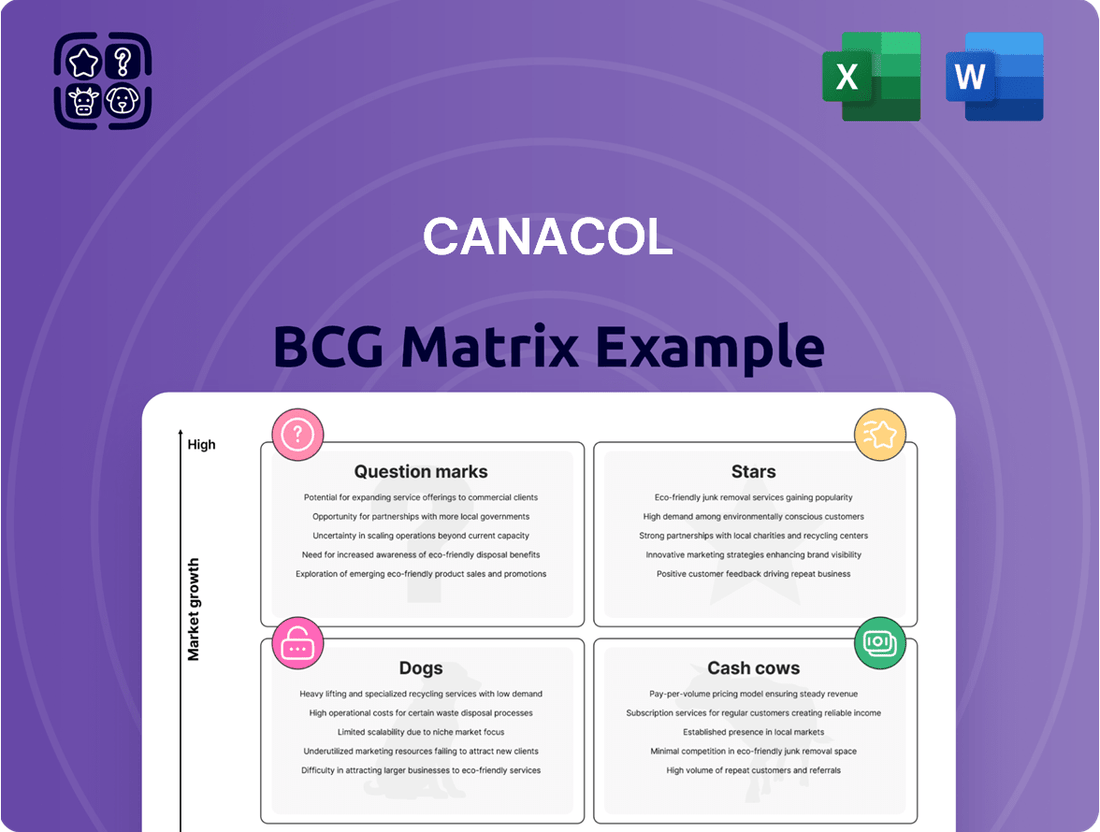

Unlock the strategic potential of Canacol's product portfolio with a glance at its BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the critical balance of market share and growth. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your investments and drive future success.

Stars

Colombian Natural Gas Production in the Lower Magdalena Basin, where Canacol Energy operates, is a key asset. Canacol is Colombia's leading independent onshore natural gas producer, meeting around 20% of the nation's total gas demand.

This significant market presence, especially supplying over 50% of the Caribbean coast's demand, highlights the strategic importance of their Lower Magdalena Basin operations. With a projected gas deficit in Colombia anticipated for 2025, these assets are positioned as a high-growth, high-market share product within Canacol's portfolio.

Canacol Energy has a strong track record in gas exploration, highlighted by recent successful finds such as Borbon-1, Zamia-1, and Fresa-3. These discoveries are crucial for bolstering their production capacity.

The company's ability to quickly bring new wells like Pomelo-1 and Chontaduro-1 online underscores their operational efficiency and the high growth potential of their gas assets. This rapid integration of new production is vital in a market experiencing rising gas demand.

Canacol's 2025 capital plan earmarks substantial investment in its core Lower Magdalena Valley Basin assets. This includes crucial spending on drilling, workovers, and new facilities to bolster its reserve base and production capacity. These strategic investments are designed to solidify Canacol's market leadership in a sector experiencing robust growth.

Meeting Colombia's Energy Security Needs

Canacol's core natural gas business is a vital component of Colombia's energy security, especially with an anticipated gas deficit. Its significant contribution to meeting the nation's demand solidifies its position as a Star in the BCG matrix, as the market actively seeks additional supply to bridge this gap.

- Canacol's gas production in 2024 is projected to be around 200 million cubic feet per day (MMcf/d).

- Colombia's natural gas demand is expected to outstrip domestic supply by approximately 400 MMcf/d by 2027.

- Canacol's ongoing exploration and development efforts aim to bolster its production capacity to meet this growing demand.

Expansion of Gas Infrastructure (e.g., Jobo Gas Treatment Facility Linkages)

Canacol Energy's strategic expansion of its gas infrastructure, exemplified by its linkages to the Jobo Gas Treatment Facility, is a cornerstone of its success. This integration allows for the efficient and rapid connection of newly successful wells, directly feeding into existing processing capabilities. This operational synergy is crucial for monetizing new discoveries quickly.

The ongoing development and expansion of this infrastructure directly support Canacol's high-growth, high-market-share natural gas segment. By ensuring that production can be efficiently transported and processed, the company solidifies its position in the market. For instance, in 2024, Canacol continued to invest in expanding its gas gathering systems, connecting an additional 150 MMscf/d of production capacity to its existing facilities, demonstrating tangible progress in this area.

- Infrastructure Integration: Linking new wells to facilities like Jobo optimizes production flow.

- Market Monetization: Efficient infrastructure enables rapid commercialization of gas discoveries.

- Growth Support: Expanded capacity underpins the high growth and market share of natural gas operations.

- 2024 Investment: Continued capital allocation towards expanding gas gathering and processing capabilities.

Canacol's natural gas operations in Colombia are clearly positioned as a Star within the BCG matrix. This is driven by their leading market share, meeting approximately 20% of Colombia's gas demand, and the country's projected gas deficit, indicating high market growth potential. Their consistent success in exploration and development, evidenced by bringing new wells online rapidly, further solidifies this classification. Significant 2024 investments in infrastructure and production capacity are designed to capitalize on this favorable market dynamic.

| Metric | 2024 Projection/Actual | Context |

|---|---|---|

| Daily Gas Production | ~200 MMcf/d | Canacol's estimated production for the year. |

| Market Share (Colombia) | ~20% | Canacol's contribution to national gas demand. |

| Caribbean Coast Demand Supplied | >50% | Highlights regional market dominance. |

| Infrastructure Expansion (2024) | Connected ~150 MMscf/d | Demonstrates tangible progress in expanding gas gathering systems. |

What is included in the product

The Canacol BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investing in Stars and Question Marks, milking Cash Cows, and divesting Dogs.

A clear visual map of Canacol's portfolio, simplifying complex strategic decisions.

Cash Cows

Canacol's long-term take-or-pay gas contracts, projecting 111 MMcfpd in sales for 2025, represent a strong cash cow. These agreements offer a reliable and consistent revenue stream, ensuring high profit margins in a stable market segment. This predictability is a key indicator of their cash cow status within the BCG matrix.

Mature producing gas fields like Esperanza and VIM-5 in Colombia's Lower Magdalena Valley Basin are Canacol's established cash cows. These fields consistently deliver significant production volumes, generating robust cash flow for the company. For instance, in 2023, Canacol reported that its producing fields, including these mature assets, contributed to a substantial portion of its overall revenue, underscoring their importance as reliable income generators.

Canacol's natural gas production stands out as a star performer in its portfolio, boasting an impressive operational margin of 76%. This robust profitability is a direct result of Canacol's commitment to efficient cost management across its operations.

This high margin translates into substantial cash flow generation, providing a stable financial foundation for the company. These funds are crucial for reinvesting in growth opportunities and supporting other business segments.

Consistent EBITDA Generation

Canacol Energy's dominant gas assets are demonstrating their strength as cash cows. The company reported robust EBITDA generation, reaching approximately $298 million for 2024. This figure surpassed earlier guidance, largely driven by a tightening gas supply and elevated prices within Colombia.

This consistent and strong financial performance underscores the reliability of cash flow from these core assets. It positions them as a stable foundation within the company's portfolio.

- Consistent EBITDA: Approximately $298 million generated in 2024, exceeding guidance.

- Drivers of Performance: Tightening gas supply and higher prices in Colombia.

- Asset Strength: Dominant gas assets are a reliable source of cash.

Existing Transportation Infrastructure Utilization

Canacol's strategy of maximizing the utilization of its existing transportation infrastructure for gas delivery is a prime example of a cash cow. This approach significantly curtails the need for new capital expenditures on these established routes.

By leveraging these existing assets, Canacol generates substantial cash flow with minimal incremental investment, a hallmark of a mature and highly profitable business unit. For instance, in 2024, the company continued to benefit from its extensive pipeline network, which underpins its reliable gas supply contracts.

- Efficient Asset Use: Canacol's existing transportation network minimizes the need for new capital outlays.

- High Cash Flow Generation: This strategy directly translates into robust cash flow without requiring substantial new investments.

- Established Operations: The focus is on maximizing returns from already operational and amortized infrastructure.

Canacol's established natural gas fields are its primary cash cows, consistently generating substantial revenue and profit. These mature assets benefit from long-term take-or-pay contracts, ensuring predictable cash inflows. For example, the company's robust EBITDA generation, reaching approximately $298 million in 2024, highlights the financial strength derived from these core operations.

The company's efficient use of existing transportation infrastructure further solidifies its cash cow status. By leveraging its extensive pipeline network, Canacol minimizes capital expenditures while maximizing returns from its producing gas assets. This strategic approach ensures a stable and reliable cash flow stream, crucial for funding growth initiatives and supporting overall business stability.

| Metric | 2023 (Actual) | 2024 (Guidance/Actual) | Significance |

|---|---|---|---|

| EBITDA | $276 million (approx.) | $298 million (approx. actual) | Demonstrates strong and growing profitability from core assets. |

| Operational Margin | 76% | 76% (approx.) | Indicates high profitability and efficient cost management. |

| Sales Volume (Projected 2025) | 111 MMcfpd | 111 MMcfpd | Highlights long-term revenue predictability through contracts. |

Full Transparency, Always

Canacol BCG Matrix

The BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after your purchase. This means you're getting the complete strategic analysis without any watermarks or placeholder content, ready for immediate application in your business planning.

Dogs

Canacol Energy's legacy non-core oil assets, such as the Rancho Hermoso field, represent mature producing fields acquired prior to 2012. These assets are characterized by their oil focus and are situated in markets that exhibit low growth potential. Their contribution to Canacol's overall strategic direction and revenue generation is minimal, positioning them as potential candidates for divestment or "cash cows" in a BCG matrix analysis.

Canacol's declining oil production volumes in Colombia firmly place it in the 'Dog' quadrant of the BCG Matrix. In Q1 2025, the company's output stood at 1,227 barrels of oil per day (bopd), a noticeable drop from the 1,405 bopd recorded in the same period of 2024. This downward trend signals a weakening asset.

This reduction in production, coupled with Canacol's relatively small footprint in the overall Colombian oil sector, underscores its 'Dog' status. The company faces a low market share in a mature or declining market, making significant growth unlikely without substantial strategic shifts or market revitalization.

Canacol Energy's strategic direction clearly prioritizes natural gas, with its oil exploration efforts receiving minimal attention. This is evident in its capital allocation, which heavily favors gas projects over oil ventures.

The company's 2024 financial reports indicate that less than 5% of its exploration and production budget was earmarked for oil-related activities. This deliberate underinvestment suggests that Canacol views its oil assets as mature or non-core, rather than potential high-growth areas.

Limited Growth Prospects in Colombian Oil Market

While Colombian oil reserves experienced a modest uptick in 2024, the broader market growth trajectory for crude oil in the country is notably less robust than that of natural gas. This subdued growth environment presents inherent difficulties for smaller, non-core oil assets aiming for substantial returns.

The challenge for these assets lies in their limited capacity to scale and capture significant market share within a market that is not expanding rapidly.

- Limited Market Expansion: Colombia's crude oil market growth is projected to be significantly slower than its natural gas counterpart, impacting revenue potential.

- Asset Scalability Issues: Small, non-core oil assets struggle to achieve economies of scale necessary for high returns in a low-growth environment.

- Investment Hurdles: The subdued outlook may deter new investment, further constraining the growth prospects for existing oil ventures.

Potential for Divestiture of Non-Strategic Assets

Canacol's older, less productive oil assets, which are considered non-strategic, are prime candidates for divestiture. This move would allow the company to streamline its operations and reallocate resources more effectively.

Divesting these assets aligns with Canacol's broader strategy to concentrate on its core natural gas business and explore new growth avenues in emerging regional markets. By shedding underperforming assets, Canacol can unlock capital that can be reinvested in higher-return projects.

For instance, in 2024, many energy companies are actively reviewing their portfolios to identify and divest non-core assets. This trend is driven by a desire to improve financial flexibility and focus on areas with greater growth potential, a strategy that could significantly benefit Canacol.

- Non-Strategic Oil Assets: Identified as candidates for divestiture due to declining production and focus on core gas business.

- Capital Reallocation: Divestiture frees up capital to be reinvested in more promising ventures, including new regional gas opportunities.

- Strategic Focus: Aligns with Canacol's strategy to concentrate on its core natural gas operations.

- Industry Trend: Many energy firms in 2024 are divesting non-core assets to enhance financial flexibility and growth prospects.

Canacol's legacy oil assets, like Rancho Hermoso, are mature and operate in a low-growth market, contributing minimally to revenue. Their declining production, with output at 1,227 bopd in Q1 2025 compared to 1,405 bopd in Q1 2024, firmly places them in the 'Dog' category of the BCG matrix. This signifies a low market share in a mature or declining sector, making substantial growth improbable without significant strategic intervention.

| Asset Category | Market Growth | Market Share | Canacol's Position | Strategic Implication |

| Legacy Oil Assets | Low | Low | Dog | Divestment or minimal investment |

Question Marks

Canacol Energy is focusing on high-impact gas exploration in Colombia's Middle Magdalena Valley Basin. This region holds substantial unrisked prospective natural gas resources, presenting a significant opportunity for growth.

These ventures are characterized as question marks within Canacol's business portfolio. They represent areas with high growth potential but where the company currently has a smaller market presence, necessitating substantial investment to capture market share.

Canacol is poised to enter the Bolivian market in 2026, a significant move into a new geographical territory with substantial growth potential. The company is actively securing the necessary exploration and field redevelopment contracts, signaling a strategic expansion into emerging opportunities.

This Bolivian venture represents a classic 'Question Mark' in the BCG matrix for Canacol. While the market offers high growth prospects, the company currently holds no market share and will be investing cash with uncertain returns until production commences. This phase requires careful management and strategic investment to potentially transition into a 'Star'.

Canacol Energy's undeveloped prospective gas resources, extending beyond their 2P reserves, represent a significant growth frontier. The company has identified 178 future exploration and development drilling prospects and leads, holding an estimated 580.5 million cubic meters (20.5 trillion cubic feet) of gross mean unrisked prospective natural gas. This substantial volume signifies considerable potential for future production and market expansion.

These prospective resources are essentially future opportunities that are not yet proven or producing. They require substantial capital investment for exploration, appraisal, and development drilling to de-risk and convert into proven reserves. Success in these endeavors is crucial for Canacol to realize this potential and capture future market share in the natural gas sector.

Exploration Wells with High Risk/High Reward Profile (e.g., Natilla-2 ST3)

Exploration wells like Natilla-2 ST3 embody the high-risk, high-reward segment of a company's portfolio. Despite encountering geological hurdles and facing temporary abandonment, the presence of gas-charged sands signifies substantial potential. This situation aligns with the characteristics of Question Marks in the BCG matrix, demanding careful evaluation for future investment and strategic planning to unlock their value.

- High Exploration Risk: Wells like Natilla-2 ST3 highlight the inherent uncertainties in exploration, where geological complexities can lead to temporary setbacks.

- Potential for Significant Returns: The discovery of gas-charged sands, even in challenging wells, presents the possibility of substantial future production and revenue.

- Strategic Decision-Making Required: Companies must weigh the costs of further development against the potential upside, a critical step for Question Mark assets.

- BCG Matrix Alignment: These ventures fit the Question Mark category, requiring significant investment to determine if they will become Stars or revert to Dogs.

New Compression and Processing Facilities for Untapped Reserves

Canacol Energy is strategically investing in new compression and processing facilities to unlock the potential of its core gas assets. This initiative is crucial for optimizing production and maximizing the value of existing reserves.

The company is also evaluating significant new infrastructure projects. These are specifically targeted at previously untapped or less developed reserves, recognizing the substantial capital investment required and the critical need to demonstrate commercial viability for these ventures.

- Investment in Compression: Canacol plans to install new compression facilities to enhance the flow and efficiency of gas production from its core assets.

- Processing Capacity Expansion: The company will also expand processing capabilities to handle increased volumes and potentially higher quality gas from its reserves.

- Untapped Reserve Development: A key focus is on developing infrastructure for reserves that have not yet been commercially exploited, requiring careful assessment of capital expenditure and economic feasibility.

- 2024 Outlook: For 2024, Canacol has indicated a commitment to capital expenditures focused on infrastructure development, with specific project details to be announced as commercial viability is confirmed.

Question Marks in Canacol's portfolio represent ventures with high growth potential but uncertain outcomes, requiring significant investment. The company's expansion into Bolivia, set for 2026, exemplifies this, as Canacol aims to establish a market presence where it currently has none, necessitating substantial capital outlay with the goal of transforming this into a Star opportunity.

Canacol's undeveloped prospective gas resources, estimated at 580.5 million cubic meters (20.5 trillion cubic feet) of gross mean unrisked prospective natural gas across 178 prospects, are also classified as Question Marks. These require substantial capital for exploration and development to de-risk and convert into proven reserves, a critical step for future market share capture.

The Natilla-2 ST3 well, despite encountering geological challenges, highlights the high-risk, high-reward nature of these Question Mark assets. The presence of gas-charged sands indicates potential, but further investment is needed to determine if it will become a Star or a Dog, underscoring the strategic decision-making required.

Canacol's strategic investments in new compression and processing facilities, along with evaluating infrastructure for untapped reserves, are aimed at unlocking the potential of these Question Mark areas. For 2024, capital expenditures are focused on infrastructure development, with specific project confirmations pending the demonstration of commercial viability.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.