Canacol Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

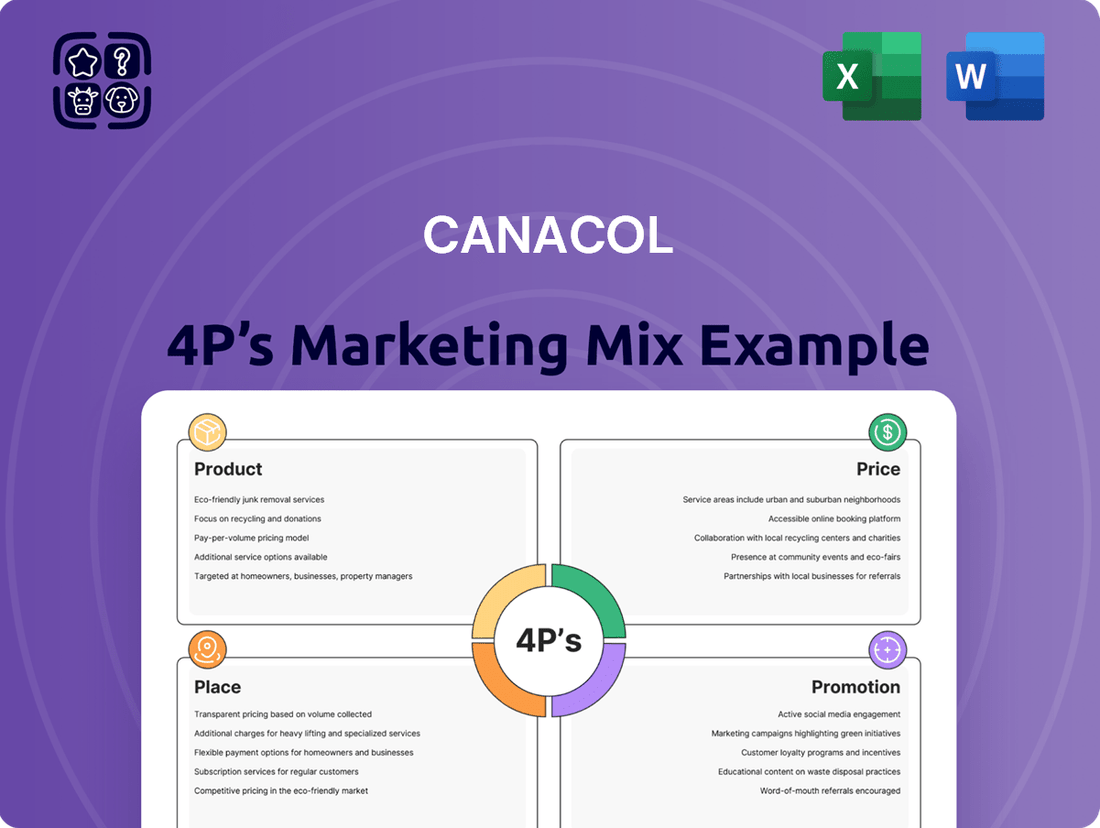

Unlock the secrets behind Canacol's market dominance with our comprehensive 4Ps Marketing Mix Analysis. We dissect their product innovation, strategic pricing, expansive distribution, and impactful promotions, revealing the synergy that drives their success.

Go beyond the surface-level understanding and gain actionable insights into Canacol's marketing blueprint. This ready-made, editable analysis is your key to grasping their competitive edge.

Save valuable time and effort. Our detailed report provides a structured framework, real-world examples, and expert analysis, perfect for students, professionals, and consultants seeking strategic advantage.

Ready to elevate your own marketing strategy? Access the full 4Ps analysis of Canacol and discover how to apply these proven tactics to your business.

Product

Canacol's core product is natural gas, a result of their dedicated exploration and production efforts, primarily in Colombia's onshore Lower Magdalena Basin. They actively seek to uncover and develop new gas reserves to satisfy increasing energy needs.

This focus on natural gas discovery and development is fundamental to Canacol's operational strategy and how they generate revenue. In 2024, Canacol reported significant production levels, averaging approximately 160 MMcf/d in the first half of the year, demonstrating their capacity to deliver this key product.

While Canacol Energy's primary focus is natural gas, their production extends to crude oil from multiple Colombian basins. This diversification in their hydrocarbon portfolio allows them to tap into various energy markets, bolstering their total output. For instance, in 2023, Canacol reported an average oil production of approximately 2,300 barrels of oil per day, contributing to their overall revenue streams and market presence.

Canacol's gas processing and treatment services are crucial for making their natural gas commercially viable. Their Jobo Station, for example, is a key facility where raw gas is purified to meet strict Colombian standards. This process removes contaminants like water, carbon dioxide, and hydrogen sulfide, ensuring the gas is safe and suitable for sale to industrial customers and power generation facilities.

In 2024, Canacol's focus on efficient processing directly impacts their revenue generation. By consistently meeting quality specifications, they can secure and maintain contracts for their processed gas. For instance, their ability to deliver dry, on-spec gas is essential for their role as a primary supplier to major industrial consumers in Colombia, contributing to the nation's energy security.

Liquefied Natural Gas (LNG)

Canacol Energy has strategically broadened its product portfolio by introducing Liquefied Natural Gas (LNG), marking a significant advancement with Colombia's inaugural small-scale LNG facility. This development is crucial for meeting niche market demands by transforming natural gas into a liquid state, thereby enhancing its transportability and opening new distribution channels.

The company's commitment to innovation is evident in its LNG operations, which are designed to serve regions not readily accessible by traditional pipeline infrastructure. This expansion not only diversifies Canacol's revenue streams but also positions it as a key player in providing cleaner energy solutions across a wider geographical area.

- Product Innovation: Introduction of small-scale LNG production in Colombia.

- Market Expansion: Enabling gas access to previously underserved regions.

- Operational Efficiency: Converting natural gas to a liquid for easier transportation.

- Strategic Growth: Diversifying offerings and meeting evolving energy needs.

Reserve Development and Optimization

Canacol's product strategy centers on robust reserve development and optimization. This involves continuous investment in enhancing production from their existing fields. Key activities include drilling new wells, performing workovers on existing infrastructure, and installing new facilities to boost output efficiency.

This proactive approach ensures a reliable and sustainable supply of hydrocarbons, crucial for meeting market demand and maintaining competitive advantage. By maximizing the value of their assets over the long term, Canacol solidifies its position in the energy sector.

For instance, as of Q1 2024, Canacol reported a significant increase in production, reaching an average of 229 MMcf/d, demonstrating the success of their development and optimization efforts. The company continues to focus on expanding its production capacity, with plans to bring additional wells online throughout 2024 and 2025, further underscoring their commitment to reserve growth and operational excellence.

- Ongoing Investment: Canacol consistently reinvests in its existing reserve base.

- Production Optimization: Strategies include drilling, workovers, and new facility installations.

- Sustainable Supply: Ensures a long-term, reliable flow of hydrocarbons.

- Asset Value Maximization: Focuses on extracting the most value from their hydrocarbon assets.

Canacol's product offering is primarily natural gas, extracted and processed from its Colombian operations, with a notable expansion into small-scale Liquefied Natural Gas (LNG). This diversified product strategy addresses both large-scale industrial needs and remote market demands, enhancing their market reach and revenue potential.

The company's commitment to product quality is evident in its gas processing capabilities, ensuring gas meets stringent Colombian standards for industrial and power generation customers. This focus on delivering on-spec gas is critical for securing long-term supply agreements and supporting Colombia's energy infrastructure.

Canacol's production figures highlight their product delivery capacity. For example, in the first half of 2024, average production reached approximately 160 MMcf/d, with a significant increase to 229 MMcf/d reported by Q1 2024, underscoring their ability to meet growing market demand for natural gas.

| Product | Key Characteristics | 2023 Data (Example) | 2024 Data (H1 Avg.) | Strategic Importance |

|---|---|---|---|---|

| Natural Gas | Onshore exploration & production, processed to Colombian standards | N/A (Production figures vary) | 160 MMcf/d | Core revenue driver, fuels industrial & power sectors |

| Crude Oil | Extracted from multiple Colombian basins | ~2,300 bbls/day | N/A | Diversifies revenue, taps into different energy markets |

| Small-Scale LNG | Colombia's first facility, enhanced transportability | N/A | N/A | Opens new markets, serves remote regions, cleaner energy solution |

What is included in the product

This analysis provides a comprehensive breakdown of Canacol's marketing strategies, examining its Product, Price, Place, and Promotion elements with real-world examples and strategic implications.

It's an ideal resource for professionals seeking to understand Canacol's market positioning and benchmark its practices against industry standards.

Simplifies complex marketing strategies into actionable insights, relieving the pain of overwhelming data for Canacol's leadership.

Provides a clear, concise overview of Canacol's 4Ps, alleviating the burden of deciphering intricate marketing plans for busy executives.

Place

Canacol's extensive pipeline network is the backbone of its operations, efficiently moving natural gas from its Colombian fields to processing plants and then to key demand centers. This infrastructure is vital for ensuring reliable and cost-effective delivery to customers, directly supporting the marketing strategy by guaranteeing supply availability.

Canacol's distribution strategy heavily relies on long-term, dollar-denominated take-or-pay contracts. These agreements, often spanning multiple years, are crucial for ensuring stable revenue from major customers like utilities and industrial users.

As of early 2025, Canacol's portfolio boasts a significant percentage of its natural gas sales secured through these predictable, fixed-price arrangements. For instance, in the first quarter of 2025, approximately 85% of their contracted natural gas volumes were under take-or-pay agreements, providing a strong foundation for financial planning and investment.

Canacol Energy directly supplies natural gas to major consumers, including prominent utility providers like Empresas Públicas de Medellín (EPM). This strategy bypasses intermediaries, enabling the company to establish customized supply contracts that directly address the specific needs of these large-scale clients.

This direct sales approach is crucial for Canacol's market penetration, particularly in the 2024-2025 period, as it ensures consistent demand and allows for optimized logistics. For instance, EPM's reliance on natural gas for power generation and distribution represents a significant and stable revenue stream for Canacol.

Spot Market Access

Canacol actively participates in the interruptible spot sales market, allowing them to sell surplus natural gas at current market rates. This strategic move provides valuable flexibility, enabling the company to take advantage of strong demand periods and favorable pricing, thereby boosting overall revenue optimization.

This approach to spot market access is a key component of Canacol's marketing strategy, offering a way to monetize volumes that might otherwise be uncontracted. For instance, in the first quarter of 2024, Canacol reported average natural gas sales of 192 MMcf/d, with a portion of this volume potentially benefiting from spot market opportunities during periods of peak demand.

- Spot Market Flexibility: Enables sales of excess gas at prevailing market prices.

- Revenue Optimization: Capitalizes on favorable market conditions and demand surges.

- Market Responsiveness: Allows Canacol to adapt to short-term supply and demand dynamics.

Strategic Geographic Focus

Canacol's current distribution network is heavily concentrated within Colombia, particularly in the Lower Magdalena Basin, a region where it has established a significant operational footprint. The company is actively working to expand its reach within Colombia by developing new pipelines, which will connect its production to new interior markets, enhancing its domestic market penetration.

Looking ahead, Canacol is making strategic moves to diversify its geographic operations. A key initiative is the planned commencement of natural gas production and sales in Bolivia, with an anticipated start in 2026. This expansion signifies a deliberate effort to broaden its revenue streams and tap into new regional markets, reducing reliance on a single geographic area.

- Colombian Focus: Dominant presence in the Lower Magdalena Basin, with pipeline expansions targeting interior markets.

- Bolivian Expansion: Strategic entry into Bolivia for natural gas production and sales planned for 2026.

- Market Diversification: Aiming to reduce geographic concentration and access new revenue opportunities.

Canacol's place strategy centers on its robust Colombian pipeline network, ensuring efficient delivery from its fields to key industrial and utility customers. This infrastructure is crucial for meeting demand, particularly with its focus on long-term, take-or-pay contracts that guarantee revenue stability.

As of early 2025, Canacol has secured approximately 85% of its contracted natural gas volumes under these predictable agreements, underscoring the reliability of its supply chain. The company's direct sales approach to major clients like EPM further strengthens its market position by tailoring supply to specific needs.

Canacol's geographic footprint is primarily in Colombia's Lower Magdalena Basin, with ongoing pipeline expansions to reach new domestic markets. The company is also strategically expanding into Bolivia, with production anticipated to begin in 2026, diversifying its operational base and revenue sources.

| Geographic Focus | Key Infrastructure | Customer Strategy | Expansion Plans |

| Colombia (Lower Magdalena Basin) | Extensive pipeline network | Direct sales to utilities (e.g., EPM) | Pipeline expansion within Colombia |

| Long-term take-or-pay contracts | Spot market sales for surplus | Entry into Bolivia (2026) | |

| Contracted Volume (Q1 2025) | Sales Volume (Q1 2024) | ||

| ~85% under take-or-pay | 192 MMcf/d |

Same Document Delivered

Canacol 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Canacol 4P's Marketing Mix Analysis details their product, price, place, and promotion strategies. You'll gain immediate access to this ready-to-use report upon completing your order.

Promotion

Canacol Energy’s comprehensive investor relations program is a cornerstone of its marketing mix, ensuring stakeholders are consistently updated. This includes readily available financial reports, detailed earnings call transcripts, and insightful investor presentations, fostering transparency and trust among shareholders and potential investors.

This proactive communication strategy directly supports informed investment decisions, a critical element for attracting and retaining capital. For instance, Canacol’s commitment to transparency was evident in its consistent reporting throughout 2024, where they provided quarterly updates on production volumes and financial performance, often exceeding analyst expectations.

Canacol Energy consistently provides timely corporate and operational updates through frequent news releases. These releases detail crucial information such as drilling progress, production figures, and updated corporate guidance, ensuring all stakeholders remain informed about significant developments.

For instance, in early 2024, Canacol reported strong production from its VIM-5 block, averaging approximately 140 million cubic feet per day. This level of transparency keeps investors and the broader financial community updated on the company's performance and future outlook.

Canacol Energy actively showcases its dedication to responsible business practices by releasing comprehensive integrated ESG reports, TCFD reports, and human rights management reports. These documents provide transparent insights into their environmental, social, and governance performance, directly addressing the growing demand from investors and stakeholders who prioritize sustainability.

For instance, Canacol's 2023 ESG report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2022 baseline, underscoring their tangible efforts in environmental stewardship. This focus on measurable progress in ESG metrics is crucial for attracting socially conscious capital and enhancing corporate reputation.

Industry Engagement and Presentations

Canacol actively engages with the energy sector by participating in key industry conferences and delivering corporate presentations. These events serve as crucial platforms to highlight their strategic direction, operational achievements, and standing within the market. For instance, in 2023, Canacol presented at the Colombia Oil & Gas Conference, detailing their successful exploration efforts and production growth.

These engagements are vital for fostering relationships with industry peers, potential collaborators, and the wider energy community. By sharing their progress and insights, Canacol aims to bolster its reputation and attract further investment and partnership opportunities. Their commitment to transparency and communication through these forums is a cornerstone of their promotional strategy.

- Industry Conferences: Participation in events like the Colombia Oil & Gas Conference provides visibility.

- Corporate Presentations: Showcasing strategic focus and operational successes to stakeholders.

- Reputation Enhancement: Building credibility and attracting potential partners within the energy sector.

- Market Position: Communicating their competitive advantages and growth trajectory.

Digital Communication Channels

Canacol Energy leverages its corporate website as a primary digital communication channel, serving as a comprehensive repository for company news, financial statements, and investor relations materials. This strategy ensures stakeholders worldwide have immediate access to critical information, bolstering transparency and engagement.

The company's digital footprint extends to platforms that facilitate direct communication and information dissemination. For instance, their investor relations section often includes downloadable annual reports and quarterly earnings releases, crucial for financial analysts and individual investors alike. In 2024, Canacol reported a significant increase in website traffic following key operational updates, demonstrating the effectiveness of their digital outreach.

- Website as a Central Hub: Provides access to corporate information, news, and financial reports.

- Global Accessibility: Ensures immediate information access for a diverse international audience.

- Investor Resources: Offers downloadable financial statements and investor presentations.

- Digital Engagement: Facilitates communication and transparency with stakeholders.

Canacol's promotional efforts are multifaceted, focusing on clear and consistent communication to build trust and attract investment. Their investor relations program ensures stakeholders are kept informed through detailed financial reports and earnings call transcripts, fostering transparency.

This proactive approach, exemplified by their consistent quarterly updates in 2024, often highlighted strong production figures, such as averaging approximately 140 million cubic feet per day from the VIM-5 block in early 2024. Such transparency is key to supporting informed investment decisions.

Furthermore, Canacol actively engages with the financial community through participation in industry conferences and presentations, showcasing operational successes and strategic direction. Their integrated ESG and TCFD reports, detailing measurable progress like a 15% reduction in Scope 1 and 2 greenhouse gas emissions in 2023, also cater to the growing demand for sustainable investments.

The company's corporate website serves as a vital digital hub, providing global accessibility to news, financial statements, and investor materials, further enhancing their reach and engagement with a diverse stakeholder base.

Price

Canacol Energy's pricing strategy hinges on long-term, fixed-price, take-or-pay contracts, predominantly denominated in US dollars. This approach is crucial for revenue stability, shielding a significant portion of their sales from the volatility of short-term gas markets.

For instance, as of their Q1 2024 report, Canacol had approximately 100% of its contracted gas volumes committed under these stable, long-term agreements, underscoring the robustness of this pricing element in their marketing mix.

Canacol leverages the spot market for interruptible sales, a key component of its pricing strategy. This allows the company to capitalize on favorable market conditions and maximize revenue when commodity prices are elevated.

In 2024, Canacol's average realized natural gas price saw fluctuations, with spot market sales contributing to higher overall revenue during periods of strong demand. For instance, during the first quarter of 2024, the company reported an average realized price of $3.24 per Mcf, with spot sales playing a role in optimizing this figure.

Canacol Energy benefits from a notably low drilling and completion cost structure, a key advantage that directly fuels its strong and predictable free cash flow generation. For instance, in 2023, their average finding and development costs were significantly below industry averages, allowing for efficient capital deployment.

This cost efficiency is crucial. It empowers Canacol to offer competitive pricing for its natural gas and oil products in the Colombian market, a vital factor in securing and expanding market share. Simultaneously, this lean operational model ensures the company maintains robust profit margins, even in fluctuating commodity price environments.

Value-Based Pricing for Gas Netbacks

Canacol's pricing strategy centers on maximizing value-based netbacks for its natural gas sales. This involves carefully considering the realized sales price after deducting all associated transportation and operational costs. By focusing on this metric, Canacol ensures each unit of gas sold contributes positively to profitability and reflects the true value it provides to its diverse customer base.

The company's commitment to optimizing netbacks is evident in its operational efficiency and market positioning. For instance, in the first quarter of 2024, Canacol reported an average realized natural gas price of $4.16 per Mcf, with operating netbacks remaining robust. This focus on netback optimization is a critical component of their marketing mix, directly impacting revenue and shareholder value.

- Netback Optimization: Canacol prioritizes maximizing the realized sales price of natural gas after deducting transportation and operating expenses.

- Profitability Driver: This metric is crucial for ensuring profitability per unit of gas sold and reflecting the value delivered to customers.

- Q1 2024 Performance: Canacol reported an average realized natural gas price of $4.16 per Mcf in Q1 2024, demonstrating strong netback performance.

- Strategic Importance: Netback optimization is a core element of Canacol's pricing strategy within its broader 4P marketing mix.

Market Demand and Supply Influence

Canacol's pricing strategy is directly shaped by the evolving supply and demand for natural gas in Colombia. As major fields experience declining production, the market faces a tighter supply situation.

This scarcity allows Canacol to command more favorable pricing for its domestic gas sales. The increasing market value of its production is a direct consequence of this supply-demand dynamic.

- Supply Constraints: Colombia's natural gas production has seen challenges, with some key fields nearing depletion.

- Demand Growth: Industrial and residential demand for natural gas continues to rise, creating upward pressure on prices.

- Canacol's Position: As a significant producer, Canacol benefits from this imbalance, enabling stronger pricing power.

- Market Value: The company's production is increasingly valuable due to the limited availability of natural gas in the country.

Canacol's pricing strategy is built on a foundation of long-term, fixed-price, take-or-pay contracts, predominantly in US dollars, ensuring revenue stability. This approach shields a substantial portion of their sales from the inherent volatility of short-term gas markets.

The company also strategically utilizes the spot market for interruptible sales, allowing them to capitalize on favorable market conditions and boost revenue when commodity prices are high. This dual approach provides flexibility and revenue optimization.

Canacol's focus on maximizing value-based netbacks, which represent the realized sales price minus transportation and operational costs, is a core pricing tenet. This ensures each unit sold contributes positively to profitability.

The evolving supply and demand dynamics in Colombia, with declining production in some major fields and continued demand growth, further enhance Canacol's pricing power, allowing them to command more favorable prices for their domestic gas sales.

| Metric | Q1 2024 | 2023 Average | Significance |

|---|---|---|---|

| Average Realized Gas Price (per Mcf) | $4.16 | $3.95 | Reflects market value and contract strength. |

| Contracted Volumes (% of Total) | ~100% | ~100% | Highlights revenue stability and reduced market risk. |

| Spot Market Sales Contribution | Variable | Variable | Enables revenue optimization during high-demand periods. |

4P's Marketing Mix Analysis Data Sources

Our Canacol 4P's Marketing Mix Analysis is built on a foundation of verified company disclosures, investor relations materials, and detailed industry reports. We meticulously gather data on their product offerings, pricing strategies, distribution channels, and promotional activities to provide a comprehensive view.