Canacol PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

Navigate the complex external landscape impacting Canacol with our PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are shaping the company's strategic direction. Equip yourself with this vital intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now for actionable insights.

Political factors

Colombia's current administration, under President Petro, is championing a 'Just Energy Transition,' a significant policy shift that includes a moratorium on new oil and gas exploration licenses beginning January 2025. This directive is designed to decrease the country's reliance on fossil fuels, pushing towards a greener energy landscape.

Despite the halt on new exploration, the government is committed to optimizing output from existing concessions and even breathing new life into older, less explored contracts. This approach is crucial for ensuring continued energy security during the transition period.

Colombia's political stability is a key consideration for Canacol. Any significant shifts in government could potentially alter the trajectory of energy policies, including the commitment to not award new oil and gas exploration licenses. Without a firmly embedded policy or law, a future administration might reverse this stance, impacting the sector's long-term outlook.

Security risks remain a persistent challenge. The oil and gas sector in Colombia has historically contended with disruptions from strikes and attacks on essential infrastructure like pipelines. These security issues can directly impede Canacol's operations and affect production levels, creating operational uncertainty.

Colombia's commitment to international climate agreements, like the Paris Agreement, is a significant political factor. The nation aims to cut greenhouse gas emissions by 51% by 2030 and achieve net-zero by 2050. This drives domestic policy, prioritizing renewables and a gradual shift away from fossil fuels.

To achieve these ambitious goals, Colombia is actively pursuing international funding and partnerships for its $40 billion 'Portfolio for Socioecological Transition.' This substantial investment aims to bolster clean energy, conservation efforts, and sustainable agriculture, directly impacting the energy sector's development and investment landscape.

Regional Energy Integration and Diplomacy

Canacol Energy Ltd.'s strategic move into Bolivia, with final congressional approval expected in Q4 2025, signifies a critical step in diversifying its political risk. This expansion underscores the growing importance of regional energy integration and the diplomatic efforts required to navigate cross-border energy policies. Successfully securing and operationalizing these international contracts will be paramount for Canacol's sustained growth and market presence.

The company's proactive approach to regional expansion, as seen with its Bolivian venture, directly impacts its political risk profile. A broader operational footprint across different South American nations necessitates robust diplomatic engagement and an understanding of varying regulatory environments. This diversification is key to mitigating the impact of any single country's political instability on its overall business performance.

- Bolivian Expansion: Final approval for new contracts in Bolivia anticipated in Q4 2025.

- Risk Diversification: Regional expansion aims to reduce reliance on a single political jurisdiction.

- Diplomatic Importance: Cross-border energy policies and diplomatic relations are crucial for future growth.

Regulatory Framework for Hydrocarbons

The National Hydrocarbons Agency (ANH) in Colombia is the primary body responsible for managing the country's hydrocarbon resources, including the issuance of exploration and production licenses and ensuring adherence to regulations. Canacol operates within this established framework, even as the current administration has paused the granting of new licenses. This means existing contracts and their associated regulatory requirements remain in effect.

Canacol must diligently comply with existing regulations governing its operations. These include stringent environmental standards and operational protocols, all of which are overseen by government authorities and are subject to potential future modifications. For instance, environmental impact assessments and community engagement protocols are critical components of these regulations.

- ANH Oversight: The ANH manages Colombia's oil and gas sector, controlling exploration and production rights.

- Existing Contracts: Despite a halt on new licenses, Canacol must adhere to regulations governing its active contracts.

- Compliance Focus: Key areas of compliance include environmental standards and operational safety protocols.

- Regulatory Evolution: Canacol must remain adaptable to potential revisions in the regulatory landscape.

Colombia's political landscape is undergoing a significant shift with the "Just Energy Transition" policy, which includes a moratorium on new oil and gas exploration licenses from January 2025. This policy, championed by President Petro, aims to reduce fossil fuel dependency and promote greener energy sources. Despite this, the government is focused on maximizing output from existing concessions, ensuring energy security during this transitional phase.

The political stability in Colombia is a critical factor for Canacol. Any change in administration could potentially alter energy policies, including the stance on new exploration licenses. The country's commitment to international climate agreements, such as the Paris Agreement, drives its domestic agenda towards renewables, with a target of a 51% greenhouse gas emission reduction by 2030.

Canacol's expansion into Bolivia, with final congressional approval anticipated in Q4 2025, is a strategic move to diversify political risk. This regional expansion requires careful navigation of varying regulatory environments and robust diplomatic engagement across South American nations. The company's proactive diversification is essential to mitigate the impact of any single country's political instability on its overall business performance.

The National Hydrocarbons Agency (ANH) in Colombia oversees the country's hydrocarbon resources, managing licenses and ensuring regulatory compliance. Canacol must adhere to existing regulations, including environmental standards and operational protocols, which are subject to potential future changes. Diligent compliance with these frameworks is paramount for continued operations.

| Factor | Current Status (2024/2025) | Implication for Canacol |

|---|---|---|

| Energy Transition Policy | Moratorium on new oil/gas exploration licenses from Jan 2025. | Limits new exploration opportunities in Colombia; focus shifts to existing assets. |

| Political Stability | Potential for policy shifts with administration changes. | Risk of policy reversals impacting long-term sector outlook if not enshrined in law. |

| Regional Expansion (Bolivia) | Final approval expected Q4 2025. | Diversifies political risk; requires navigating new regulatory and diplomatic landscapes. |

| Regulatory Oversight (ANH) | ANH manages existing contracts and regulations. | Requires strict adherence to current environmental and operational standards. |

What is included in the product

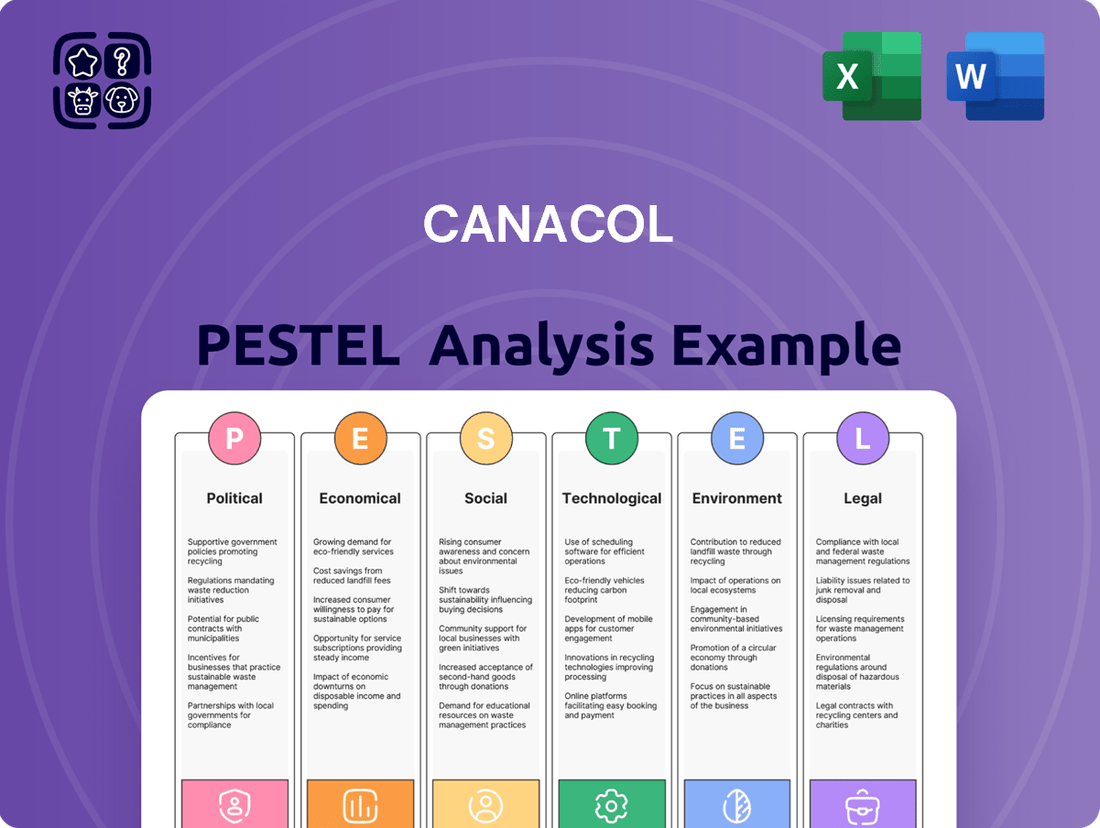

This PESTLE analysis examines the external macro-environmental factors influencing Canacol, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions, to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy development.

Economic factors

Canacol's financial health is closely tied to the fluctuating prices of natural gas and oil, a situation amplified by Colombia's increasingly constrained natural gas supply. These elevated commodity prices directly impact the company's revenue streams and profitability.

The significant increase in natural gas prices within Colombia played a crucial role in Canacol's robust EBITDA performance, reaching an estimated $298 million in 2024. This demonstrates a clear correlation between market prices and the company's operational success.

Looking ahead to 2025, Canacol anticipates its average wellhead natural gas sales prices to fall within the $7.33 to $7.65 per thousand cubic feet (Mcf) range. This projection underscores the company's continued dependence on favorable market dynamics for sustained financial performance.

Despite Colombia's commitment to an energy transition, investments in crude oil and natural gas are set to rise, with projections reaching $4.68 billion in 2025, an increase from $4.33 billion in 2024. This trend highlights a persistent, though evolving, focus on traditional energy sources within the country's investment landscape.

Canacol's strategic capital expenditure for 2025 is planned between $143 million and $160 million. These funds are earmarked for crucial exploration and development activities, aiming to sustain and expand the company's reserve base in this dynamic market.

Colombia's economic reliance on fossil fuels, which historically bolster state revenues and GDP, faces a significant shift with the government's 'Just Energy Transition' initiative. This policy aims to diversify the economy, moving away from hydrocarbon dependence and directly impacting future revenues derived from these exports.

While the long-term vision prioritizes economic stability, the immediate and medium-term outlook presents challenges in offsetting the anticipated decline in income from fossil fuel sales, creating a revenue gap that needs to be addressed through alternative growth drivers.

National Energy Supply and Demand Dynamics

Colombia is experiencing a significant shortfall in its natural gas supply, forcing a greater reliance on imports. These imports saw a substantial increase of 166.4% in the latter half of 2024. This situation naturally drives up natural gas prices within the country, which is advantageous for domestic producers such as Canacol.

The combination of decreasing domestic production and constrained liquefied natural gas (LNG) import capabilities highlights an urgent requirement for ongoing exploration and development of Colombia's own gas reserves. This is crucial for securing the nation's energy independence.

- 166.4% surge in natural gas imports in H2 2024

- Increased dependence on foreign supply due to domestic deficit

- Higher domestic natural gas prices benefiting producers like Canacol

- Critical need for local reserve development to ensure energy self-sufficiency

Currency Fluctuations and Inflation

Canacol Energy Ltd., as an international entity heavily invested in Colombia, faces significant exposure to the volatility between the Colombian Peso (COP) and the US Dollar (USD). This currency mismatch directly influences its reported revenues, operational expenditures, and overall profitability. For instance, a stronger USD relative to the COP can boost reported earnings when converting USD-denominated revenues, but it also increases the cost of local expenses paid in COP.

While specific 2024-2025 inflation data for Colombia impacting Canacol isn't detailed, general economic trends indicate that inflationary pressures can significantly affect the company's cost structure. This includes the price of materials, labor, and services necessary for its exploration and production activities, as well as the cost of capital for new projects.

- Currency Exposure: Canacol's financial results are sensitive to COP/USD exchange rate movements. A depreciation of the COP against the USD generally benefits the company's USD-denominated revenues when translated back to COP, but increases the cost of local operations.

- Inflationary Impact: Rising inflation in Colombia can lead to higher operational costs for materials, equipment, and labor, potentially squeezing profit margins if not passed on through pricing.

- Cost of Capital: Inflationary environments often correlate with higher interest rates, increasing the cost of borrowing for Canacol's capital-intensive projects.

- Revenue Stability: While oil prices are typically denominated in USD, the actual revenue received in COP is subject to exchange rate fluctuations, impacting the company's financial planning and investment decisions.

Colombia's energy policy is navigating a complex transition, aiming to shift away from hydrocarbon dependence while acknowledging the current reliance on oil and gas. This presents a dual economic landscape for Canacol, balancing the benefits of current high commodity prices with the long-term implications of a changing energy focus.

The nation's commitment to a "Just Energy Transition" means a projected decrease in revenue from hydrocarbon exports over time. However, for the immediate future, investments in oil and gas are expected to increase, reaching an estimated $4.68 billion in 2025, up from $4.33 billion in 2024. This indicates continued economic activity in the sector, which Canacol can leverage.

Canacol's financial performance is closely tied to natural gas prices, which have been bolstered by a significant domestic supply deficit. The country's imports of natural gas surged by 166.4% in the latter half of 2024, driving up local prices and benefiting domestic producers like Canacol. This situation underscores the critical need for developing Colombia's own reserves to ensure energy security.

The company's strategic capital expenditure for 2025 is set between $143 million and $160 million, primarily for exploration and development. This investment is crucial for maintaining and growing Canacol's reserve base in response to the market dynamics and the nation's energy needs.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Canacol |

| Natural Gas Prices (Colombia) | Elevated due to supply deficit | Projected $7.33 - $7.65/Mcf | Positive revenue impact |

| Oil & Gas Investment (Colombia) | $4.33 billion | $4.68 billion | Continued market activity |

| Energy Transition Policy | Initiated | Ongoing | Long-term revenue shift |

| Natural Gas Imports | 166.4% increase (H2 2024) | Continued reliance | Supports higher domestic prices |

Same Document Delivered

Canacol PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Canacol delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

Canacol prioritizes strong community ties, recognizing that a social license to operate is fundamental, particularly in regions where its energy exploration and production activities take place. This commitment is a cornerstone of their sustainability strategy, underscoring the necessity of fostering positive human rights and community engagement.

In 2023, Canacol reported investing over $10 million in community development programs across its operational areas in Colombia, focusing on education, health, and infrastructure. This investment aims to mitigate potential social risks, such as protests or operational disruptions, which could otherwise derail project timelines and impact production, as seen with similar projects in the region experiencing delays due to localized opposition.

Colombia's commitment to a 'Just Energy Transition' away from fossil fuels poses significant employment challenges for the oil and gas sector. This societal shift, aiming for environmental sustainability, could result in job losses for workers in traditional hydrocarbon industries, impacting communities reliant on these sectors.

Canacol, as a key player in Colombia's energy landscape, must proactively address the social consequences of this transition. Understanding and mitigating the impact on its workforce and operating communities is crucial for maintaining social license and fostering positive stakeholder relations.

The government's strategy to foster an inclusive economy through reindustrialization and export diversification is vital. For instance, in 2023, Colombia's non-traditional exports grew by 7.5%, indicating potential avenues for job creation that Canacol could explore or support through its corporate social responsibility initiatives.

Colombia's evolving environmental policies now grant significant authority to Indigenous groups in environmental decision-making, meaning infrastructure projects must actively respect the rights of these communities. This shift necessitates Canacol's operations to strictly adhere to sustainability, environmental justice, and territorial equity principles. Failure to do so could lead to significant project delays or cancellations, impacting revenue streams.

Canacol must ensure its activities, particularly in regions with Indigenous populations, do not negatively impact traditional lands or communities. This involves robust consultation processes and strict adherence to social and environmental safeguards, a critical factor given the growing emphasis on Indigenous rights in Latin America. For instance, in 2024, several infrastructure projects across the region faced scrutiny and delays due to inadequate consultation with local Indigenous communities, highlighting the financial risks involved.

Public Perception and Environmental Activism

Public perception of energy companies is increasingly shaped by concerns over climate change. Growing awareness of environmental impacts, particularly from fossil fuels, can lead to a more critical view of companies like Canacol. This heightened scrutiny means that environmental performance is no longer just a regulatory concern but a significant factor in public opinion and investor sentiment.

Environmental activism plays a crucial role in amplifying these concerns. Groups actively campaign for stricter regulations and greater corporate accountability, directly pressuring oil and gas firms. For Canacol, this translates into a need for robust sustainability strategies and transparent reporting to maintain its social license to operate and attract environmentally conscious investors. For instance, by mid-2024, several major institutional investors had divested from fossil fuel companies with poor environmental track records, highlighting the financial implications of public perception.

- Increased Scrutiny: Public and activist pressure on Canacol to adopt greener practices and report emissions data.

- Investment Impact: Growing demand from ESG-focused investors can affect Canacol's access to capital if environmental performance is not prioritized.

- Operational Flexibility: Negative public perception could lead to protests or legal challenges, potentially hindering exploration or production activities.

Social Programs and Local Development Contributions

Companies in Colombia's energy sector, including natural gas producers like Canacol, are frequently tasked with contributing to local development and implementing social programs within their operational regions. This expectation is a key component of maintaining a social license to operate, especially in areas where energy projects are situated.

While specific Canacol initiatives aren't detailed here, the broader trend in Colombian energy development shows a strong emphasis on integrated social responsibility. For instance, Atlas Renewable Energy's solar projects in Colombia have often incorporated social initiatives aimed at addressing community needs, demonstrating a common practice within the industry.

These social contributions are vital for fostering positive relationships with local communities and stakeholders. They can range from educational programs and infrastructure improvements to environmental conservation efforts, all designed to enhance the well-being of the areas where companies operate.

- Community Engagement: Energy firms often invest in local infrastructure and social programs to build goodwill and ensure project sustainability.

- Social License to Operate: Proactive social contributions are crucial for gaining and maintaining community acceptance, thereby reducing operational risks.

- Sustainable Development Goals: Many projects align with national and international development goals, contributing to poverty reduction and improved living standards in operational areas.

Societal expectations in Colombia are increasingly focused on equitable resource distribution and community benefit from energy projects. Canacol's commitment to investing over $10 million in community development in 2023 for education, health, and infrastructure highlights this, aiming to mitigate risks like protests that could impact operations.

The country's push for a 'Just Energy Transition' presents a societal challenge, potentially leading to job displacement in traditional sectors like oil and gas, which Canacol must proactively manage to maintain stakeholder relations.

Furthermore, evolving environmental policies grant Indigenous groups greater authority in decision-making, requiring Canacol to strictly adhere to sustainability and territorial equity principles to avoid project delays, as seen with other regional infrastructure projects in 2024 facing scrutiny for inadequate consultation.

Public perception, heavily influenced by climate change concerns and amplified by environmental activism, is critical, pushing companies like Canacol towards transparent reporting and robust sustainability strategies to attract ESG-focused investors, a trend evident by mid-2024 with investor divestments from companies with poor environmental records.

| Sociological Factor | Impact on Canacol | 2023/2024 Data/Trend |

|---|---|---|

| Community Development Expectations | Need for investment in local infrastructure and social programs to maintain social license. | Canacol invested over $10 million in community programs in 2023. |

| Just Energy Transition Societal Impact | Potential for job displacement in fossil fuel sector, requiring proactive workforce management. | Colombia's transition strategy creates employment challenges for the oil and gas sector. |

| Indigenous Rights and Consultation | Strict adherence to environmental justice and territorial equity principles is crucial to avoid project delays. | Regional infrastructure projects faced delays in 2024 due to inadequate consultation with Indigenous communities. |

| Public Perception and Environmental Activism | Increased scrutiny on environmental performance; need for transparent sustainability reporting to attract ESG investors. | Mid-2024 saw investor divestments from fossil fuel companies with poor environmental track records. |

Technological factors

Canacol's commitment to advanced exploration and production techniques is a key technological driver. The company successfully implemented drilling efficiencies and cost-reduction initiatives, which helped lower its capital expenditure in 2024. This focus on operational excellence is crucial for maintaining a competitive edge in the energy sector.

Looking ahead, Canacol plans to further optimize production and bolster its reserves. This strategy involves drilling new exploration and development wells, complemented by essential workover operations on existing wells. These efforts are designed to maximize the company's asset base and long-term output potential.

The broader industry trend of employing enhanced oil recovery (EOR) techniques, as seen with major players like Ecopetrol, also presents opportunities for Canacol. Implementing such advanced methods could significantly boost output from its mature fields, further contributing to its overall production efficiency and reserve growth.

Canacol is investing in advanced natural gas processing and compression technologies to boost its production capacity. This strategic move is vital for efficiently managing the increasing volumes of natural gas extracted from its operations, particularly in the Lower Magdalena Valley Basin.

These technological upgrades are expected to enhance the reliability and efficiency of transporting natural gas to market. For instance, the company's 2024 plans include significant capital expenditures on compression and processing facilities, aiming to support its projected production growth of 250 MMcf/d in the VIM-5 block.

The implementation of these new technologies directly supports Canacol's strategy to maintain and expand its natural gas output. By improving the infrastructure for handling and transporting gas, Canacol strengthens its competitive position and ability to meet market demand.

The oil and gas sector is heavily investing in digital tools to boost efficiency and cut expenses. This trend is evident as companies leverage advanced analytics and automation to streamline exploration, drilling, and production processes.

Canacol's focus on operational efficiency, as highlighted in their financial reports, indicates a commitment to adopting technologies that refine workflows and improve data-driven decision-making. For instance, the industry saw a significant increase in digital transformation spending, with projections suggesting it would reach over $60 billion globally by 2024, a clear indicator of this technological shift.

Carbon Capture, Utilization, and Storage (CCUS)

As Colombia pushes for decarbonization, Carbon Capture, Utilization, and Storage (CCUS) technologies are gaining traction in the oil and gas industry. While Canacol's specific CCUS initiatives aren't detailed, Ecopetrol's commitment to advancing CCUS studies highlights a significant industry-wide shift towards emission reduction. This trend suggests potential future regulatory demands or market incentives that could prompt Canacol to investigate or implement CCUS solutions to align with Colombia's environmental goals.

The growing emphasis on CCUS reflects a broader global effort to manage greenhouse gas emissions. For instance, by 2023, several countries have announced ambitious CCUS deployment targets, with significant investment flowing into pilot projects and infrastructure development. This evolving landscape means companies like Canacol may face increasing pressure to adopt cleaner operational practices.

- Industry Trend: CCUS is becoming a key strategy for oil and gas companies in Colombia to address decarbonization mandates.

- Ecopetrol's Role: Ecopetrol's investment in CCUS studies signals a broader industry commitment to emission mitigation technologies.

- Canacol's Potential: Future regulatory or market drivers could necessitate Canacol's exploration and adoption of CCUS.

Renewable Energy Integration and Diversification

While Canacol's core business is natural gas, Colombia's energy landscape is rapidly evolving with substantial investments in renewables. For instance, Ecopetrol, the national oil company, is projecting significant renewable energy capacity additions and exploring low-carbon hydrogen production, aiming for 4.6 GW of renewables by 2025. This strategic pivot by a major player signals a broader industry trend.

This shift towards cleaner energy sources, including solar and offshore wind, presents both challenges and opportunities for companies like Canacol. Adapting to these national energy goals and anticipating market demand for diversified energy portfolios will be crucial for long-term relevance and growth. Companies may need to consider integrating or diversifying into renewable technologies to remain competitive.

Key aspects of this technological factor include:

- Renewable Energy Growth: Colombia's commitment to decarbonization is driving significant investment in solar and wind power, with targets for increased capacity.

- Diversification Strategies: Traditional energy companies are exploring integration or diversification into renewable energy and low-carbon solutions like hydrogen.

- Market Alignment: Companies must align with national energy transition goals and evolving market preferences to ensure future viability.

- Technological Integration: The need to integrate new renewable technologies into existing energy infrastructure and business models will become increasingly important.

Canacol is actively enhancing its operational efficiency through technological adoption, evident in its 2024 capital expenditure focused on drilling efficiencies and cost reduction. The company's strategy to boost production involves drilling new wells and conducting workovers, aiming to maximize its asset base.

The industry is seeing a significant push towards digital transformation, with global spending projected to exceed $60 billion by 2024. Canacol's focus on advanced analytics and automation streamlines its exploration and production processes, improving data-driven decision-making.

Furthermore, Canacol is investing in advanced natural gas processing and compression technologies to support its projected production growth of 250 MMcf/d in the VIM-5 block, enhancing its capacity and market competitiveness.

The increasing industry focus on Carbon Capture, Utilization, and Storage (CCUS) technologies, as demonstrated by Ecopetrol's studies, suggests a future need for Canacol to consider emission reduction solutions to align with Colombia's decarbonization goals.

Colombia's energy sector is increasingly investing in renewables, with Ecopetrol aiming for 4.6 GW of renewable capacity by 2025. This trend necessitates that companies like Canacol adapt to national energy transition goals and consider diversifying into cleaner energy sources to ensure long-term viability.

Legal factors

Colombia's legal framework for hydrocarbon exploration and production is overseen by the National Hydrocarbons Agency (ANH). Existing exploration and production contracts remain legally binding, providing a degree of stability for companies like Canacol.

A significant policy shift has occurred with the current government suspending the issuance of new oil and gas exploration licenses. This directly impacts Canacol's growth strategy, forcing a reliance on its current asset base and the potential revival of older contractual agreements rather than acquiring new exploration acreage.

For instance, as of early 2025, the ANH has not indicated a timeline for lifting the moratorium on new licenses, reinforcing the need for Canacol to maximize value from its existing concessions. This legal constraint necessitates a focus on operational efficiency and resource optimization within its current operational footprint.

Canacol Energy operates within a robust framework of environmental regulations in Colombia, impacting every facet of its oil and gas activities. These laws, including the National Climate Change Policy and the Climate Change Law, are critical for managing environmental impact and ensuring sustainable operations.

Specific mandates for the oil and gas sector, such as rigorous methane emission monitoring, reporting, and reduction targets, are central to Canacol's compliance strategy. Adherence to these regulations is not merely a legal obligation but a key factor in mitigating operational risks and safeguarding the company's reputation.

Colombia's introduction of a carbon tax on fossil fuels, including natural gas, directly impacts Canacol's operational expenses, with revenues earmarked for environmental initiatives. This levy, alongside stricter methane emission regulations, creates a financial incentive for the company to actively lower its carbon footprint.

For instance, the Colombian government has set targets to reduce greenhouse gas emissions by 51% by 2030 relative to 2018 levels, a framework within which Canacol must operate. These environmental costs and compliance obligations are critical considerations for Canacol's financial forecasting and long-term business strategy, potentially influencing investment in lower-emission technologies.

Corporate Governance and Anti-Corruption Laws

Canacol Energy Ltd. operates under a robust Ethics, Compliance, and Anti-Corruption System, a crucial element for navigating legal landscapes. This system explicitly prohibits restrictive practices that hinder free competition and includes a clear conflict of interest policy, ensuring transparent dealings. The company's dedication to these principles is underscored by an annual audit conducted by an independent third party, validating its adherence to legal and ethical standards. This commitment not only guides Canacol's business operations but also actively contributes to the global effort against corruption and transnational bribery.

The company's proactive stance on corporate governance is further demonstrated through its ongoing efforts to maintain high ethical standards. For instance, in 2023, Canacol reported zero material instances of non-compliance with anti-corruption laws during its annual reporting cycle, reflecting the effectiveness of its internal controls. This focus on compliance is vital in sectors prone to regulatory scrutiny, ensuring Canacol's long-term sustainability and reputation.

- Annual Independent Audits: Canacol's compliance system undergoes annual verification by an independent third party.

- Zero Tolerance for Corruption: Policies are in place to prevent bribery and corrupt practices.

- Competition Law Adherence: The company explicitly prohibits restrictive practices that limit free competition.

- Conflict of Interest Management: A dedicated policy addresses and manages potential conflicts of interest.

Contractual Obligations and Legal Certainty

Canacol's revenue stability hinges on its long-term take-or-pay natural gas contracts. For instance, its agreement with Promigas, a major gas distributor, is a cornerstone of its financial projections. The legal certainty of these agreements, however, is subject to Colombian government policies and potential judicial interpretations that could impact contract enforceability or regulatory frameworks.

The company faces significant administrative hurdles in Colombia, particularly concerning the perfection of legal title for its assets. The process for obtaining governmental approvals for contract assignments can be protracted, often spanning several years. This necessitates rigorous due diligence and careful management of relationships with regulatory bodies to ensure operational continuity and the security of its investments.

- Contractual Stability: Canacol's take-or-pay contracts provide a predictable revenue stream, crucial for financial planning and investor confidence.

- Regulatory Influence: Government policies and judicial decisions in Colombia can significantly affect the legal certainty and economic viability of these long-term contracts.

- Title Perfection Challenges: The lengthy governmental approval process for asset assignments in Colombia requires extensive due diligence and can delay project execution.

The suspension of new oil and gas exploration licenses by the Colombian government, as of early 2025, significantly shapes Canacol's strategic landscape. This legal constraint necessitates a pronounced focus on maximizing value from existing concessions rather than pursuing new acreage. The absence of a clear timeline for lifting this moratorium reinforces the need for operational efficiency and resource optimization within Canacol's current asset base.

Colombia's environmental legal framework, including its National Climate Change Policy, imposes strict methane emission monitoring and reduction targets on the oil and gas sector. The introduction of a carbon tax on natural gas also directly impacts operational expenses, with revenues earmarked for environmental initiatives. These regulations create a financial incentive for Canacol to actively reduce its carbon footprint, aligning with national goals such as the 51% greenhouse gas emission reduction target by 2030.

Canacol's robust Ethics, Compliance, and Anti-Corruption System, validated by annual independent audits, prohibits restrictive practices and manages conflicts of interest. In 2023, the company reported zero material instances of non-compliance with anti-corruption laws, underscoring the effectiveness of its internal controls and commitment to ethical operations.

The legal certainty of Canacol's take-or-pay natural gas contracts, such as the one with Promigas, is crucial for its revenue stability but remains subject to potential shifts in Colombian government policies and judicial interpretations. Furthermore, administrative hurdles, like the protracted process for perfecting legal title for assets, can delay project execution and require diligent management of regulatory relationships.

| Legal Factor | Impact on Canacol | Data/Observation (as of early 2025) |

|---|---|---|

| New Exploration License Moratorium | Limits growth through new acreage acquisition. | Moratorium in effect, no timeline for lifting announced by ANH. |

| Environmental Regulations (Methane Emissions) | Requires investment in monitoring and reduction technologies. | Stricter mandates for methane emission control are active. |

| Carbon Tax on Natural Gas | Increases operational costs, incentivizes emissions reduction. | Carbon tax applied to natural gas sales. |

| Contractual Stability (Take-or-Pay) | Provides predictable revenue but subject to policy changes. | Key contracts with Promigas and others remain in force. |

| Asset Title Perfection Process | Causes administrative delays and requires extensive due diligence. | Governmental approval processes for assignments can take years. |

Environmental factors

Colombia is committed to ambitious climate goals, targeting a 51% reduction in greenhouse gas emissions by 2030 and net-zero by 2050, as formalized by its Climate Action Law. This national drive significantly impacts the oil and gas industry, including companies like Canacol, requiring operational adjustments towards lower-carbon practices and potentially stricter environmental oversight.

Colombia's status as a megadiverse nation means its energy transition, with substantial investments in conservation and restoration, directly impacts companies like Canacol. Canacol's operations, especially in the Lower Magdalena Basin, must actively manage and reduce any potential harm to biodiversity and natural habitats. This necessitates strict adherence to environmental licensing requirements.

Canacol's operations, as an exploration and production company, naturally involve significant water usage and waste generation, making effective management crucial. The company's sustainability strategy highlights focused efforts on both water management and waste reduction, demonstrating a commitment to minimizing its environmental impact.

In 2023, Canacol reported that its water management practices aimed to reduce freshwater consumption, a key consideration given the operational intensity. The company also emphasized its waste reduction initiatives, striving to divert materials from landfills through recycling and responsible disposal methods, aligning with evolving environmental regulations and best practices.

Methane Emissions and Air Quality Regulations

Colombia's environmental regulations, particularly Resolution 2099 of 2016, impose strict requirements on oil and gas companies like Canacol to manage methane emissions from their infrastructure. This includes mandatory monitoring, reporting, and implementation of reduction strategies to improve air quality and meet national climate goals. The country also levies a carbon tax on fossil fuels, directly impacting operational costs.

Compliance with these methane emission rules is crucial for Canacol. Failing to adhere can result in significant fines and damage to its environmental reputation. For instance, in 2023, the Colombian government continued to emphasize stricter enforcement of environmental laws, with a focus on emissions reduction targets for the energy sector.

- Resolution 2099 of 2016: Mandates methane emission controls for oil and gas operations.

- Carbon Tax: Applied to fossil fuels, affecting operational expenses.

- Monitoring and Reporting: Essential for demonstrating compliance and avoiding penalties.

- Emission Reduction Targets: Aligned with Colombia's national climate commitments.

Transition to Cleaner Energy Sources

Colombia, like many nations, is actively pursuing a transition to cleaner energy sources, a trend that impacts Canacol's operational landscape. While natural gas is a comparatively cleaner fossil fuel than oil or coal, the broader environmental push in Colombia is towards reducing reliance on all fossil fuels. This positions natural gas as a transitional energy source in the country's long-term energy strategy.

Canacol's future environmental strategy will likely need to address its role in this evolving energy mix. The company's adaptation to or contribution towards a future where renewables dominate will be a key consideration. For instance, by 2024, Colombia aimed to have 10% of its electricity generation come from non-conventional renewable sources, a figure expected to grow. This indicates a clear policy direction away from traditional fossil fuels.

- Fossil Fuel Transition: Colombia's environmental policy increasingly favors renewable energy over fossil fuels, even cleaner options like natural gas.

- Natural Gas as Transitional: Canacol's primary product, natural gas, is viewed as a bridge fuel in the country's move towards a low-carbon economy.

- Renewable Energy Growth: By 2024, Colombia targeted 10% of its electricity from non-conventional renewables, signaling a significant shift.

- Strategic Adaptation: Canacol's long-term success may depend on how it aligns its business model with this growing renewable energy landscape.

Colombia's commitment to reducing greenhouse gas emissions by 51% by 2030 and achieving net-zero by 2050, as outlined in its Climate Action Law, directly influences Canacol's operational strategies. The company must navigate stricter environmental oversight and adapt to lower-carbon practices. As a megadiverse nation, Colombia's investments in conservation and restoration mean Canacol needs to actively manage and minimize its impact on biodiversity, adhering to stringent environmental licensing. Furthermore, the nation's push towards cleaner energy sources, with a target of 10% electricity from non-conventional renewables by 2024, positions natural gas as a transitional fuel and necessitates Canacol's strategic adaptation to this evolving energy landscape.

| Environmental Factor | Colombia's Policy/Target | Impact on Canacol |

|---|---|---|

| Climate Goals | 51% GHG reduction by 2030, Net-zero by 2050 | Requires operational adjustments towards lower-carbon practices and stricter oversight. |

| Biodiversity Conservation | Investments in conservation and restoration | Necessitates active management to minimize harm to biodiversity and adhere to licensing. |

| Renewable Energy Integration | 10% electricity from non-conventional renewables by 2024 | Positions natural gas as transitional; requires strategic adaptation to a growing renewables sector. |

| Emissions Regulation | Resolution 2099 of 2016 (methane), Carbon Tax | Mandates methane controls, monitoring, reporting; increases operational costs. |

PESTLE Analysis Data Sources

Our Canacol PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.