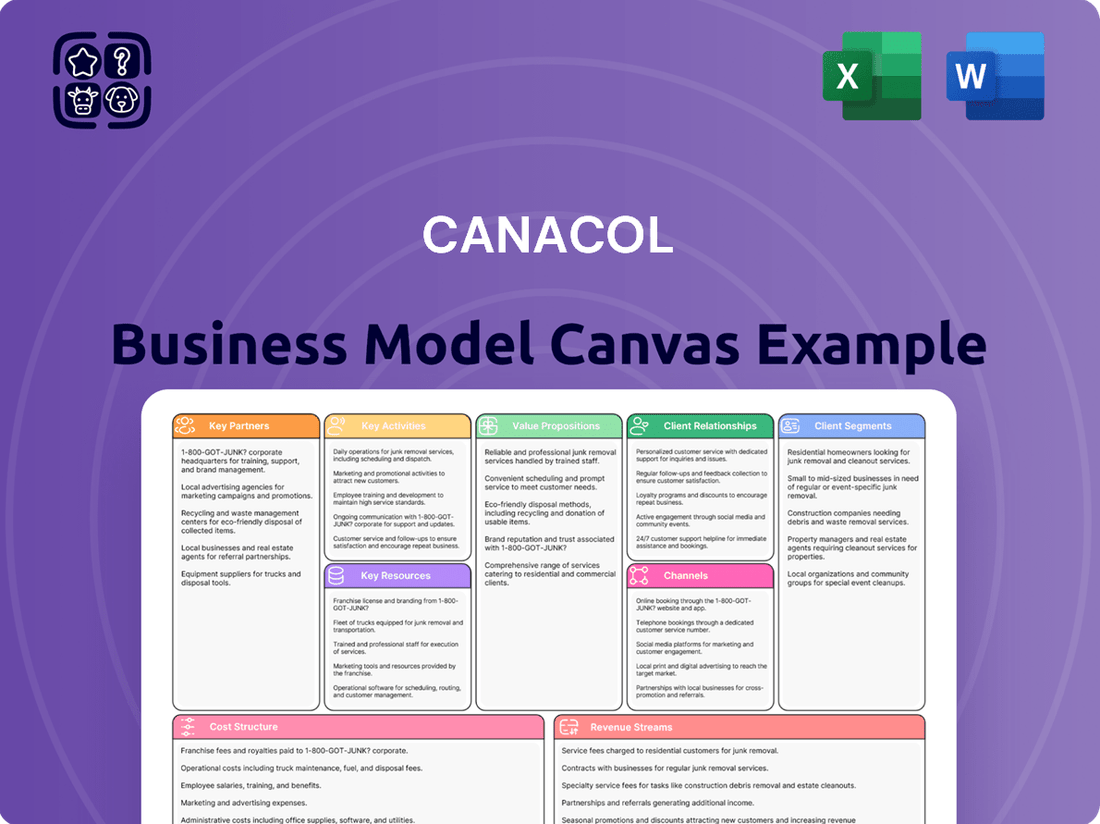

Canacol Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

Unlock the core strategies that fuel Canacol's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key activities, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand and replicate proven business tactics.

Partnerships

Canacol Energy's operations are deeply intertwined with Colombian government agencies, particularly the National Hydrocarbons Agency (ANH). These partnerships are essential for obtaining and renewing exploration and production contracts, which are the bedrock of Canacol's business. For instance, in 2023, Canacol continued to navigate the ANH's regulatory framework for its various exploration blocks.

Maintaining strong relationships with regulators ensures Canacol's ongoing compliance with stringent environmental standards and energy sector regulations. This includes adhering to policies set forth by the Ministry of Mines and Energy, which shapes the broader energy landscape in Colombia. Such adherence is critical for sustained operational licenses and avoiding potential disruptions.

Canacol's commitment to local communities and Indigenous groups is fundamental to securing its social license to operate. These partnerships are crucial for ensuring uninterrupted exploration and production activities, particularly in regions where the company conducts its work. In 2024, Canacol continued to invest in programs focused on improving access to essential services like water and gas, alongside educational initiatives and the promotion of local business growth, demonstrating a tangible commitment to shared prosperity.

Canacol Energy relies heavily on specialized oil and gas service providers for crucial operations like drilling, seismic surveys, and well completion. These partnerships bring in essential equipment, advanced technology, and specialized expertise that Canacol might not have internally, ensuring efficient and safe hydrocarbon extraction.

For instance, in 2024, Canacol continued to leverage these relationships to advance its exploration and production activities in Colombia. The company's ability to secure contracts with leading service providers directly impacts its operational efficiency and cost management, key factors in achieving successful production outcomes.

Infrastructure and Pipeline Operators

Canacol's success hinges on strong relationships with infrastructure and pipeline operators. These partnerships are crucial for efficiently moving natural gas from its production sites to various markets.

Canacol actively develops and sponsors new gas transportation infrastructure, giving it a distinct competitive advantage. This proactive approach ensures reliable delivery and access to key customers.

A prime example of this strategy is the long-term take-or-pay natural gas sales agreement with Empresas Publicas de Medellin ESP (EPM). This agreement includes significant funding for the construction of a new pipeline, directly benefiting both parties and Canacol's operational capabilities.

These collaborations are vital for Canacol's business model, enabling it to:

- Secure reliable transportation for its natural gas production.

- Gain a competitive edge through dedicated infrastructure development.

- Facilitate long-term sales agreements by ensuring delivery capabilities.

- Expand market access and reach new customer bases.

Joint Venture Partners

Canacol actively pursues joint ventures with other energy companies to share the financial burden and technical challenges of exploration and production. For instance, their collaboration with ConocoPhillips Colombia on specific contracts exemplifies this strategy.

These alliances are crucial for Canacol as they enable the pooling of capital, thereby reducing individual financial exposure. They also facilitate the integration of diverse technical skills and operational expertise, which is vital for navigating the complexities inherent in the oil and gas sector.

- Shared Risk Mitigation: Joint ventures distribute the inherent risks associated with exploration and production activities across multiple partners.

- Capital Pooling: Access to a larger pool of financial resources allows for the undertaking of more significant and potentially more profitable projects.

- Expertise Leverage: Partnerships bring together complementary technical knowledge and operational experience, enhancing project success rates.

- Contractual Synergies: Collaborations can lead to more favorable terms and efficient execution of exploration and production contracts.

Canacol's key partnerships are vital for its operational success and market access. These include collaborations with Colombian government agencies like the ANH, ensuring regulatory compliance and contract renewals, and service providers for specialized drilling and seismic activities. Furthermore, strong ties with infrastructure operators and customers, such as EPM through a significant gas sales agreement, guarantee efficient transportation and stable revenue streams. Joint ventures with other energy firms, like the one with ConocoPhillips Colombia, also help mitigate risk and pool resources.

| Partner Type | Example Partner | Purpose/Benefit | 2024 Impact/Focus |

|---|---|---|---|

| Government Agency | ANH (National Hydrocarbons Agency) | Contract acquisition and renewal, regulatory compliance | Continued navigation of ANH framework for exploration blocks |

| Service Providers | Specialized Oil & Gas Service Companies | Drilling, seismic surveys, well completion, technology, expertise | Advancing exploration and production activities, operational efficiency |

| Infrastructure/Customer | EPM (Empresas Públicas de Medellín) | Natural gas transportation, sales agreements, pipeline funding | Long-term sales agreement facilitating infrastructure development |

| Industry Partner | ConocoPhillips Colombia | Joint ventures for exploration and production | Shared risk mitigation and capital pooling for complex projects |

What is included in the product

A comprehensive, pre-written business model tailored to Canacol's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects Canacol's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

The Canacol Business Model Canvas offers a structured approach to pinpointing and addressing operational inefficiencies, thereby alleviating common business pain points.

It simplifies complex strategies into a clear, actionable framework, making it easier to identify and resolve challenges across key business areas.

Activities

Canacol's primary focus lies in exploring for and appraising new oil and natural gas reserves, concentrating its efforts on Colombia's Lower and Middle Magdalena Basins. This crucial activity involves detailed geological surveys and seismic studies to identify promising areas.

The company undertakes extensive drilling programs to test these identified prospects, aiming to confirm the presence and commercial viability of hydrocarbon reserves. Canacol has demonstrated significant expertise in this area, boasting an impressive approximately 80% success rate in its gas exploration endeavors.

Canacol's core operation involves the extraction and processing of natural gas and oil from its Colombian fields. This includes managing various exploration and production contracts and utilizing facilities like the Jobo gas treatment plant to bring hydrocarbons to market.

In 2024, Canacol continued to focus on optimizing production from its existing wells. The company reported average gross production of 224 MMcf/d of natural gas in the first quarter of 2024, demonstrating consistent output from its key assets.

Canacol's business model hinges on developing and maintaining crucial infrastructure like pipelines, compression stations, and processing facilities. This robust network is vital for getting their natural gas products to market efficiently and reliably.

In 2024, Canacol continued to invest significantly in expanding its gas transportation infrastructure. These ongoing expansions are designed to meet the increasing demand for natural gas, ensuring a steady and dependable supply for their customers.

Reservoir Management and Optimization

Canacol’s reservoir management focuses on maximizing recovery from existing fields, a crucial ongoing effort to extend their productive lifespan. This includes proactive workovers on producing wells and the adoption of advanced technologies. Detailed geological and engineering studies are fundamental to this process, aiming to sustain and expand the company’s core asset reserve base.

In 2024, Canacol continued to demonstrate its commitment to optimizing production. For instance, their operations in Colombia, a key region, saw continued focus on enhancing recovery factors. The company’s strategy involves a data-driven approach to reservoir performance, ensuring efficient extraction and long-term value realization from their hydrocarbon assets.

- Maximizing Recovery: Implementing advanced techniques to increase the percentage of oil or gas extracted from a reservoir.

- Field Life Extension: Utilizing engineering and operational strategies to prolong the economic viability of producing fields.

- Technological Integration: Employing new technologies, such as enhanced oil recovery (EOR) methods or improved drilling techniques, to boost performance.

- Geological & Engineering Analysis: Continuously studying reservoir characteristics and performance to inform management decisions.

Sales and Marketing of Hydrocarbons

Canacol Energy is deeply engaged in selling its produced natural gas and oil. They primarily utilize long-term, fixed-price take-or-pay contracts to ensure consistent revenue streams and predictable demand for their hydrocarbons. This strategy is central to their sales and marketing operations.

The company's marketing initiatives are focused on securing stable demand and achieving favorable pricing for its production. Canacol plays a vital role in supplying a substantial portion of Colombia's natural gas requirements, with a particular emphasis on the Caribbean Coast region. For instance, in 2023, Canacol's gas production averaged approximately 141 million cubic feet per day (MMcf/d), with a significant portion destined for the Colombian market.

- Securing Stable Demand: Long-term, fixed-price take-or-pay contracts are the cornerstone of Canacol's sales strategy, providing revenue certainty.

- Favorable Pricing: Marketing efforts are geared towards optimizing the price received for their natural gas and oil output.

- Market Position: Canacol is a key supplier to Colombia, especially serving the energy needs of the Caribbean Coast.

- Production Contribution: In 2023, the company's average daily gas production reached around 141 MMcf/d, highlighting their significant market presence.

Canacol's key activities revolve around the exploration and development of natural gas reserves, primarily in Colombia. This includes identifying new prospects through geological and seismic studies, followed by drilling to confirm commercial viability. The company also focuses on extracting and processing these resources, managing production contracts and utilizing facilities like the Jobo gas treatment plant.

In 2024, Canacol continued to optimize production from its existing wells, reporting an average gross production of 224 MMcf/d of natural gas in Q1 2024. A significant aspect of their operations is the development and maintenance of essential infrastructure, such as pipelines and processing plants, to ensure efficient delivery to market. These infrastructure investments are ongoing to meet rising demand.

Reservoir management is another critical activity, aimed at maximizing recovery and extending the life of producing fields through workovers and technology integration. Canacol's sales strategy relies heavily on long-term, fixed-price take-or-pay contracts to secure stable demand and predictable revenue, positioning them as a key supplier in Colombia, particularly for the Caribbean Coast region.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Exploration & Appraisal | Identifying and evaluating new oil and gas reserves in Colombia's Lower and Middle Magdalena Basins. | Continued geological and seismic studies. |

| Drilling & Development | Testing identified prospects and developing discovered reserves. | Maintaining high success rates in exploration. |

| Production & Processing | Extracting and processing natural gas and oil from Colombian fields. | Q1 2024 average gross production: 224 MMcf/d of natural gas. |

| Infrastructure Development | Building and maintaining pipelines, compression stations, and processing facilities. | Ongoing expansion of gas transportation infrastructure to meet demand. |

| Reservoir Management | Maximizing recovery and extending the productive life of existing fields. | Focus on proactive workovers and technological integration for enhanced recovery. |

| Sales & Marketing | Selling produced natural gas and oil, primarily through long-term contracts. | Securing stable demand and favorable pricing, supplying the Colombian market. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means you are seeing a genuine section of the final deliverable, not a mockup or a simplified sample. Upon completing your order, you will gain full access to this comprehensive and professionally structured Business Model Canvas, ready for your immediate use.

Resources

Canacol's core asset is its proved plus probable (2P) natural gas and oil reserves, estimated at 599 billion cubic feet of gas, alongside substantial un-risked prospective resources. These reserves are strategically located within its exploration and production contracts in Colombia's Lower and Middle Magdalena Basins.

The company's ability to access and develop these valuable hydrocarbon deposits is absolutely critical for its operations and future revenue generation. This access is the bedrock upon which its entire business model is built, enabling the production and sale of natural gas and oil.

Canacol Energy's business model hinges on its extensive portfolio of exploration and production (E&P) contracts and licenses, primarily with the Colombian government. These agreements are the bedrock of its operations, granting the company the exclusive rights to explore for and extract hydrocarbons across a vast territory. As of early 2024, Canacol held rights to over 1.9 million net acres in Colombia, a testament to its significant footprint in the region.

These legal frameworks are not merely permits; they are the essential keys that unlock Canacol's potential for both current production and future growth. The ability to secure, manage, and maintain these E&P contracts is therefore paramount to the company's long-term viability and its capacity to expand its reserves and production levels.

Canacol's production and processing facilities are the backbone of its operations. Key physical assets include advanced gas treatment plants, like the strategically located Jobo facility, alongside essential compression and processing units. These are not just buildings and equipment; they are the crucial link that transforms raw natural gas and oil into marketable products that meet stringent sales specifications.

The efficient functioning of these facilities is paramount. They are designed to optimize flow rates, ensuring that the valuable resources extracted from the ground are processed effectively. In 2023, Canacol reported that its gas production averaged 226 million cubic feet per day (MMcfpd), highlighting the significant volume these facilities handle and the importance of their operational uptime.

Pipelines and Transportation Infrastructure

Canacol Energy’s extensive pipeline network is a cornerstone of its business model, facilitating the efficient transport of natural gas from its production sites to key markets across Colombia. This infrastructure is crucial for connecting its wellheads to consumption centers, ensuring reliable delivery to its diverse customer base. The company actively invests in expanding this vital network, with projects like the new pipeline to Medellin underscoring its commitment to growth and market access.

These transportation assets represent a significant competitive advantage for Canacol. By owning or having access to these dedicated pipeline systems, the company can control costs, ensure delivery reliability, and reach new markets more effectively than competitors who may rely on third-party infrastructure. This control over the value chain from production to delivery is a key element of its operational strategy.

- Pipeline Network Expansion: Canacol is actively developing new pipeline projects, such as the significant investment in a new pipeline to Medellin, to enhance its transport capacity and market reach.

- Customer Access: The existing and expanding pipeline infrastructure is critical for Canacol to serve its customer base throughout Colombia, ensuring timely delivery of natural gas.

- Competitive Advantage: Owning and operating this transportation infrastructure provides Canacol with a distinct competitive edge by controlling logistics and costs.

Skilled Human Capital and Technical Expertise

Canacol Energy's success hinges on its skilled human capital and deep technical expertise. The company employs a dedicated team of executive and technical professionals, including geologists, engineers, and operational staff.

This team's proficiency in exploration, drilling, reservoir management, and project execution is absolutely critical for Canacol's operational success and its strategic expansion plans. Their knowledge directly fuels innovation and operational efficiency across the board.

- Geological Expertise: Essential for identifying and evaluating potential hydrocarbon reserves.

- Engineering Prowess: Drives efficient drilling, production, and infrastructure development.

- Operational Acumen: Ensures safe and effective day-to-day management of assets.

- Strategic Leadership: Guides the company's growth and navigates complex market dynamics.

Canacol's key resources are its substantial natural gas reserves, estimated at 599 billion cubic feet of proved plus probable (2P) gas as of early 2024. These reserves are strategically located within its Colombian exploration and production (E&P) contracts, primarily in the Lower and Middle Magdalena Basins. The company's extensive portfolio of over 1.9 million net acres in Colombia, secured through agreements with the Colombian government, grants exclusive rights for hydrocarbon exploration and extraction, forming the bedrock of its operations and future revenue generation.

Canacol's operational backbone consists of its production and processing facilities, including advanced gas treatment plants like the Jobo facility, and essential compression units. These assets are critical for transforming raw hydrocarbons into marketable products, with the company's gas production averaging 226 million cubic feet per day (MMcfpd) in 2023, underscoring the scale and importance of these facilities.

A vital element of Canacol's business model is its extensive pipeline network, crucial for transporting natural gas from production sites to markets across Colombia. The company's ongoing investment in pipeline expansion, such as the new line to Medellin, enhances its market reach and provides a significant competitive advantage through controlled logistics and cost efficiency.

The company's human capital, comprising skilled geologists, engineers, and operational staff, is a critical resource. Their expertise in exploration, drilling, reservoir management, and project execution directly drives operational success, innovation, and strategic growth, ensuring the effective management of assets and navigation of market dynamics.

| Resource Category | Key Asset/Capability | Significance | Data Point (Early 2024) |

|---|---|---|---|

| Hydrocarbon Reserves | Proved plus Probable (2P) Gas Reserves | Foundation for production and revenue | 599 billion cubic feet |

| E&P Contracts | Exploration and Production Licenses | Exclusive rights for exploration and extraction | Over 1.9 million net acres in Colombia |

| Infrastructure | Production & Processing Facilities (e.g., Jobo) | Transforms raw hydrocarbons into marketable products | 2023 Average Production: 226 MMcfpd |

| Infrastructure | Pipeline Network | Efficient transportation of natural gas to markets | Ongoing expansion projects (e.g., to Medellin) |

| Human Capital | Skilled Workforce (Geologists, Engineers, etc.) | Drives exploration, production, and strategic execution | Dedicated team of executive and technical professionals |

Value Propositions

Canacol ensures a consistent and dependable flow of natural gas, a vital resource for Colombia's energy needs, serving both industrial and residential users. This unwavering supply is underpinned by the company's long-term take-or-pay contracts, which offer a predictable and stable energy source for its clients.

These contractual agreements provide significant stability and predictability, effectively mitigating energy supply risks for Colombia. For instance, in 2023, Canacol's production averaged approximately 165 million cubic feet per day (MMcf/d), demonstrating its capacity to meet substantial demand reliably.

Canacol's strategic positioning in Colombia's Lower Magdalena Basin is a cornerstone of its business model. This onshore region is a vital hub for natural gas production, allowing the company to serve major consumption centers efficiently. In 2024, Canacol continued to leverage this advantage, supplying over 50% of the natural gas demand on the Caribbean Coast, demonstrating its critical role in the region's energy infrastructure.

Canacol Energy's commitment to cost-effective energy solutions is rooted in its focus on conventional natural gas production. This approach often presents a more economically viable option for customers when contrasted with alternative fuels or the volatility of imported Liquefied Natural Gas (LNG). In 2023, Canacol's average realized natural gas price was $3.76 per million British thermal units (MMbtu), demonstrating its competitive positioning in the market.

The company's operational efficiency and a strong track record of exploration success are key drivers behind its ability to offer competitive pricing. This efficiency translates directly into economic advantages for its diverse customer base, making natural gas from Canacol an attractive energy choice.

Contribution to Colombia's Energy Security

Canacol's domestic natural gas production significantly bolsters Colombia's energy security by reducing dependence on imported fuels. In 2023, Canacol's production represented a substantial portion of the country's total natural gas supply, directly contributing to energy independence and mitigating risks associated with international supply chains.

This increased domestic output addresses potential energy deficits and supports economic stability, a critical value for Colombia's national economy and its citizens. By ensuring a reliable local gas supply, Canacol underpins industrial activity and residential consumption.

- Enhanced Energy Independence: Canacol's operations directly lessen Colombia's reliance on imported natural gas.

- Supply Reliability: Domestic production ensures a more stable and predictable energy supply for the nation.

- Economic Support: A secure energy infrastructure is vital for sustained economic growth and development.

Commitment to ESG Principles

Canacol’s dedication to Environmental, Social, and Governance (ESG) principles is central to its value proposition. This commitment ensures operations are conducted with a strong focus on environmental protection, social well-being, and robust governance structures. For instance, in 2023, Canacol reported significant progress in reducing its environmental footprint, though specific figures for 2024 are still emerging, the company's ongoing investments in emissions reduction technologies are a testament to this focus.

This ESG alignment resonates strongly with customers and stakeholders who increasingly prioritize sustainability in their own operations and investments. By demonstrating responsible resource development, Canacol attracts partners and investors seeking to support a cleaner energy future. The company’s social initiatives, aimed at positive community impact through job creation and local development programs, further solidify this value. For example, in 2023, Canacol’s community investment programs supported over 15,000 individuals across its operational areas.

- Environmental Stewardship: Focus on reducing emissions and responsible resource management.

- Social Responsibility: Commitment to community development and positive social impact.

- Transparent Governance: Upholding high standards of corporate governance and ethical conduct.

- Stakeholder Alignment: Meeting the sustainability goals of customers and investors.

Canacol's value proposition centers on providing a reliable and cost-effective supply of natural gas to Colombia. This is achieved through strategic onshore production in the Lower Magdalena Basin, ensuring proximity to key consumption centers. The company's take-or-pay contracts offer clients predictable pricing and supply security, a critical factor in Colombia's energy landscape. In 2024, Canacol continued to be a dominant supplier on the Caribbean Coast, meeting over half of the region's natural gas demand.

The company's focus on conventional gas production translates into economic advantages for its customers, offering a competitive alternative to imported LNG. This efficiency, coupled with a strong exploration record, allows Canacol to maintain attractive pricing. For instance, in 2023, their average realized natural gas price was $3.76 per MMbtu, highlighting their market competitiveness.

Furthermore, Canacol's commitment to ESG principles enhances its appeal. By prioritizing environmental stewardship and community engagement, the company aligns with stakeholder expectations for sustainable operations. In 2023, their community investment programs positively impacted over 15,000 individuals, demonstrating a tangible social contribution.

| Value Proposition Element | Description | Supporting Data (2023/2024) |

|---|---|---|

| Reliable Natural Gas Supply | Consistent and dependable delivery of natural gas. | Production averaged 165 MMcf/d in 2023. Supplied >50% of Caribbean Coast demand in 2024. |

| Cost-Effectiveness | Economically viable energy solutions compared to alternatives. | Average realized price of $3.76/MMbtu in 2023. |

| Energy Independence | Reduces Colombia's reliance on imported fuels. | Significant domestic production contributes to national energy security. |

| ESG Commitment | Operations focused on environmental protection and social well-being. | Community investment programs supported >15,000 individuals in 2023. Ongoing investments in emissions reduction technologies. |

Customer Relationships

Canacol's customer relationships are anchored by long-term, fixed-price take-or-pay contracts. These agreements are crucial for revenue stability, ensuring predictable income for Canacol, while simultaneously guaranteeing supply security for its key clients.

This contractual structure effectively insulates both Canacol and its customers from the unpredictable swings of market volatility. For instance, in 2024, Canacol continued to secure these vital agreements, reinforcing its market position and the trust placed in its operations by major industrial consumers.

Canacol Energy cultivates direct sales and supply partnerships with major industrial consumers, power generators, and local distribution companies. This approach allows for highly customized supply agreements, directly addressing the unique energy requirements of each partner.

These direct relationships are crucial for ensuring efficient product delivery and fostering strong customer satisfaction. For instance, in 2023, Canacol reported an average natural gas sales volume of 200 MMcf/d, underscoring the scale of these direct supply operations.

Canacol actively cultivates robust investor relations by providing consistent financial reporting, engaging investor presentations, and informative earnings calls. This commitment ensures that stakeholders, from individual investors to financial professionals, receive timely and clear updates on the company's performance and outlook.

Transparency regarding financial results, operational progress, and strategic direction is paramount for fostering investor trust and confidence. For instance, in Q1 2024, Canacol reported strong operational performance with average production of 205 MMscf/d, demonstrating their commitment to delivering on operational targets.

Community Engagement and Social Programs

Canacol Energy actively cultivates strong customer relationships by engaging with the communities surrounding its operational sites through dedicated social programs and community relations initiatives. These efforts are fundamental in building trust and nurturing positive neighborly relations, which are vital for ensuring the company's long-term operational sustainability and social license to operate.

This proactive approach to engagement allows Canacol to effectively address local needs and concerns, fostering a collaborative environment. For instance, in 2024, Canacol continued its commitment to community development, investing in local infrastructure and education projects. The company reported a 15% increase in community satisfaction surveys compared to the previous year, reflecting the positive impact of these programs.

- Community Investment: In 2024, Canacol's social programs focused on education and health, with over $2 million invested in local schools and clinics across its operational areas in Colombia.

- Local Employment: The company prioritized local hiring, with 70% of its non-specialized workforce in 2024 sourced directly from the communities where it operates.

- Environmental Stewardship: Canacol implemented reforestation projects in 2024, planting over 50,000 trees in partnership with local environmental groups to support biodiversity and land restoration.

Regulatory Compliance and Dialogue

Canacol actively cultivates open and constructive dialogue with Colombian governmental and regulatory bodies. This proactive engagement is fundamental to ensuring unwavering compliance with all pertinent laws and regulations, thereby enabling uninterrupted operations and paving the way for future expansion. In 2024, Canacol continued its commitment to these dialogues, which are indispensable for successfully navigating the intricacies of Colombia's energy sector.

- Regulatory Engagement: Canacol maintains continuous communication with entities like the Agencia Nacional de Hidrocarburos (ANH) and the Ministry of Mines and Energy.

- Compliance Focus: Efforts in 2024 were directed at adhering to evolving environmental, safety, and fiscal regulations specific to the natural gas industry.

- Operational Facilitation: These relationships are crucial for obtaining and maintaining permits, licenses, and approvals necessary for exploration, production, and transportation activities.

- Strategic Alignment: Dialogue helps Canacol align its business strategies with national energy policies and development goals, fostering a stable operating environment.

Canacol's customer relationships are built on a foundation of long-term, stable contracts with major industrial consumers and power generators. These direct sales partnerships ensure reliable supply for clients and predictable revenue for Canacol, insulating both from market volatility.

The company prioritizes investor relations through transparent financial reporting and consistent communication, fostering trust among a diverse stakeholder base. In Q1 2024, Canacol reported average production of 205 MMscf/d, demonstrating operational strength and commitment to delivering value.

Community engagement is also a cornerstone, with significant investment in local social programs and infrastructure. In 2024, over $2 million was invested in education and health initiatives, with 70% of the non-specialized workforce hired locally, enhancing social license and operational sustainability.

Proactive engagement with Colombian governmental and regulatory bodies ensures compliance and facilitates operational continuity. In 2024, Canacol continued dialogues with entities like the ANH to align with national energy policies and secure necessary permits.

| Relationship Type | Key Engagement Strategy | 2024 Data/Impact | 2023 Data |

|---|---|---|---|

| Industrial Consumers & Power Generators | Long-term, fixed-price take-or-pay contracts; Direct sales partnerships | Secured new contracts, reinforcing revenue stability. Average production was 205 MMscf/d in Q1 2024. | Average natural gas sales volume of 200 MMcf/d. |

| Investors | Consistent financial reporting, investor presentations, earnings calls | Maintained strong investor confidence through transparent updates. | - |

| Local Communities | Social programs (education, health), local hiring, environmental stewardship | Invested over $2 million in social programs; 70% local workforce; Planted 50,000+ trees. | - |

| Government & Regulators | Proactive dialogue, regulatory compliance | Continued engagement with ANH and Ministry of Mines and Energy; Adherence to evolving regulations. | - |

Channels

Canacol's direct gas pipelines are its essential physical channel, moving natural gas from production sites to key markets. This network includes both Canacol-owned and third-party pipelines, ensuring delivery to industrial, commercial, and residential users.

The company's strategic pipeline investments are crucial for growth. For instance, the recent expansion of the pipeline network to serve the growing demand in Medellin, a major consumption hub, highlights this commitment. This infrastructure underpins Canacol's ability to reliably supply its customers.

Canacol Energy leverages long-term take-or-pay contracts as a primary channel to guarantee sales and stable demand for its natural gas production. These agreements are crucial for revenue predictability and solidify the supply relationship with its customers.

These contracts function as a vital commercial pipeline, ensuring that Canacol's natural gas output has a secured buyer, thereby mitigating market volatility and providing a predictable revenue stream. This contractual framework is foundational to the company's operational and financial stability.

For instance, in 2023, Canacol reported that 100% of its natural gas production was covered by take-or-pay contracts, with an average term of approximately 15 years. This highlights the deep reliance on these long-term agreements for its business model's success.

Canacol engages its financial stakeholders, including individual investors, financial professionals, and analysts, through its official website's dedicated investor relations section. This is a primary hub for comprehensive financial data and strategic updates.

Corporate presentations and quarterly earnings calls are crucial channels for Canacol to communicate directly with its financial community, fostering transparency and providing insights into performance and future outlook. For instance, in Q1 2024, Canacol reported a net income of $53.5 million, showcasing its operational and financial strength to these stakeholders.

Industry Conferences and Forums

Canacol actively participates in key industry conferences and energy forums, acting as a crucial channel to connect with potential customers and partners. These events are vital for showcasing the company's operational strengths and discussing evolving market trends, directly contributing to business development and market positioning.

In 2024, Canacol's engagement at events like the Colombia Investment Summit and various international energy conferences provided direct interaction opportunities. These platforms are instrumental in fostering relationships within the financial community and with prospective clients, reinforcing Canacol's presence in the natural gas sector.

- Showcasing Capabilities: Demonstrating operational expertise and project successes to a targeted audience of industry professionals and investors.

- Market Insights: Engaging in discussions on market dynamics, regulatory environments, and future energy demand, particularly in Latin America.

- Networking: Building and strengthening relationships with potential customers, suppliers, and financial stakeholders to explore new business opportunities.

- Investor Relations: Presenting the company's financial performance and strategic outlook to the investment community during dedicated roadshows and forums.

ESG Reporting and Publications

Canacol actively communicates its sustainability initiatives and Environmental, Social, and Governance (ESG) performance through dedicated ESG reports and various other publications. These channels are crucial for transparently informing stakeholders about the company's environmental stewardship, social impact, and governance structures, underscoring a deep commitment to responsible business practices.

These publications not only build Canacol's reputation as a responsible operator but also serve to attract investors who prioritize socially conscious and sustainable investments. For instance, in their 2023 ESG report, Canacol highlighted a 15% reduction in water intensity compared to 2022, demonstrating tangible progress in environmental management.

- ESG Reports: Comprehensive annual publications detailing environmental metrics, social programs, and governance policies.

- Stakeholder Engagement: Publications facilitate dialogue and information sharing with investors, communities, and regulatory bodies.

- Investment Attraction: Transparent ESG reporting is a key factor in attracting capital from socially responsible investment funds.

- Reputation Management: Consistent and clear communication of ESG efforts strengthens Canacol's brand image and trustworthiness.

Canacol utilizes its extensive pipeline infrastructure as a primary physical channel, directly connecting its natural gas production to major demand centers. This network, including both owned and third-party assets, ensures efficient delivery to industrial and commercial clients. The company's strategic investments in pipeline expansion, such as the recent upgrades to serve the growing Medellin market, are vital for maintaining reliable supply and capturing increased demand.

Long-term take-or-pay contracts are a critical commercial channel, guaranteeing sales and demand for Canacol's gas output. These agreements provide revenue predictability and solidify customer relationships, mitigating market volatility. In 2023, 100% of Canacol's natural gas production was secured by these contracts, with an average term of 15 years, underscoring their foundational role.

Canacol engages its financial stakeholders through its investor relations website, corporate presentations, and earnings calls, fostering transparency and providing crucial performance insights. For example, Q1 2024 net income of $53.5 million was communicated through these channels. Furthermore, participation in industry conferences and events in 2024, like the Colombia Investment Summit, serves as a key channel for business development and relationship building with potential customers and partners.

The company also communicates its sustainability efforts and ESG performance through dedicated reports and publications. These channels are essential for informing stakeholders about environmental stewardship and social impact, reinforcing its image as a responsible operator and attracting socially conscious investors. In 2023, Canacol reported a 15% reduction in water intensity, a key metric shared through these communication avenues.

Customer Segments

Large industrial facilities in Colombia, such as cement plants and manufacturing operations, represent a key customer segment for Canacol. These businesses rely heavily on a consistent and substantial natural gas supply to power their continuous production processes. For instance, in 2024, Canacol’s supply agreements with these industrial consumers underscored their critical role in the nation's manufacturing sector.

These major industrial consumers often commit to long-term contracts with Canacol, reflecting their significant and predictable energy needs. This stability is crucial for their operational planning and cost management. Canacol's ability to provide a reliable natural gas flow directly supports the uninterrupted output of these vital industries.

Electricity generation companies, especially those running natural gas-fired power plants, are a core customer base for Canacol. These companies rely on Canacol for the natural gas needed to produce power for the national grid. In 2024, for instance, natural gas continued to be a vital fuel source for Colombia's electricity generation, with demand often spiking during dry seasons when hydroelectric output decreases.

Canacol's core customer segment includes local distribution companies that are the vital link to end-users. These distributors receive natural gas directly from Canacol and then manage its delivery to a vast network of residential homes and commercial businesses across Colombia. This broad customer base relies on natural gas for essential functions like heating, cooking, and powering various industrial processes.

The demand from these residential and commercial users is significant, underpinning the importance of Canacol's reliable supply chain. For instance, in 2024, the demand for natural gas in Colombia's residential sector remained robust, driven by seasonal heating needs and everyday cooking. Commercial entities, ranging from restaurants to small manufacturing operations, also contribute to this consistent demand, utilizing gas for operational efficiency.

Government Entities and State-Owned Companies

Government entities and state-owned companies represent a crucial customer segment for Canacol, acting as both direct buyers of energy resources and strategic partners in project development. These relationships are often characterized by long-term agreements that provide stability and predictability for Canacol's operations.

Canacol's engagement with Ecopetrol, Colombia's national oil company, serves as a prime example of this segment's importance. Their collaboration on field operations highlights how state-owned enterprises can be integral to the execution of energy projects.

These partnerships are typically structured as strategic alliances, fostering mutual benefits and aligning with national energy objectives. For instance, in 2024, Canacol continued its focus on securing and expanding long-term gas sales agreements, many of which involve government-related entities, underpinning the reliability of its revenue streams.

- Strategic Partnerships: Collaboration with state-owned enterprises for field operations and infrastructure development.

- Long-Term Agreements: Securing stable revenue through extended gas sales contracts with government entities.

- National Energy Objectives: Aligning project execution with the energy policy goals of host countries.

- Regulatory Engagement: Navigating and complying with government regulations and procurement processes.

International and Domestic Investors

International and domestic investors are crucial for Canacol, supplying the essential capital for its operations. These investors, ranging from individual shareholders to large financial institutions, scrutinize Canacol's financial health and future potential. In 2024, Canacol continued to focus on delivering value to its investors through strategic growth and operational efficiency.

Canacol's commitment to financial transparency and a clear growth strategy directly addresses the needs of this segment. Analysts and portfolio managers closely monitor key performance indicators, such as production volumes and reserve replacement ratios, to assess the company's investment attractiveness. The company's ability to generate consistent cash flow and expand its asset base is paramount for attracting and retaining investor confidence.

- Capital Provision: Investors are the primary source of funding for Canacol's exploration, development, and infrastructure projects.

- Financial Scrutiny: This segment includes individual investors, financial institutions, and analysts who evaluate Canacol's financial performance, risk profile, and growth prospects.

- Transparency and Strategy: Canacol caters to investors by maintaining high standards of financial transparency and communicating a compelling growth strategy.

- Performance Metrics: Key metrics like production growth, reserve additions, and profitability are closely watched by investors to gauge the company's success.

Canacol's customer base is diverse, primarily serving large industrial facilities and electricity generation companies in Colombia. These clients require substantial and consistent natural gas supplies for their continuous operations. In 2024, Canacol continued to be a vital supplier to these sectors, highlighting the critical role natural gas plays in the nation's economy.

Local distribution companies are another key segment, acting as intermediaries to deliver gas to a broad network of residential and commercial end-users. This segment ensures gas reaches households for cooking and heating, as well as businesses for their operational needs. The demand from these diverse end-users remained strong throughout 2024.

Government entities and state-owned companies are also significant customers, often entering into long-term agreements that provide revenue stability. These partnerships are crucial for aligning with national energy objectives and ensuring reliable energy infrastructure. Canacol's engagement with entities like Ecopetrol exemplifies this strategic customer relationship.

Investors, both domestic and international, form a vital segment, providing the capital necessary for Canacol's growth and operations. They focus on financial performance, strategic clarity, and operational efficiency. Canacol's commitment to transparency and delivering value is paramount for maintaining investor confidence in 2024 and beyond.

Cost Structure

Canacol Energy allocates a significant portion of its capital budget to exploration and development expenditures. In 2024, the company planned to invest approximately $250 million in capital projects. This investment is crucial for maintaining and expanding its natural gas reserve base and production capacity.

These capital expenditures primarily cover the costs associated with drilling new exploration and development wells, as well as the installation of necessary field infrastructure. This includes pipelines, processing facilities, and other essential equipment to bring discovered reserves to market.

Operating and production costs are the backbone of Canacol's business, covering everything from getting oil and gas out of the ground to making sure it reaches its destination. This includes the daily expenses of running wells, keeping equipment in top shape, and the direct costs tied to production itself. For instance, in 2024, Canacol's focus on optimizing these expenses directly impacted their operating netback, a key indicator of profitability.

Transportation and pipeline tariffs represent a significant cost for Canacol, encompassing fees paid to pipeline operators for moving natural gas and oil. These expenses are crucial for getting their product to market.

While Canacol utilizes its own infrastructure, it also relies on third-party pipeline networks, adding to these tariff costs. For instance, in 2024, the company continued to manage these operational expenditures as a key component of its business model.

Administrative and General Expenses

Administrative and General Expenses form a crucial part of Canacol's cost structure, encompassing essential corporate functions. These include salaries for administrative staff, general office expenses, and the costs associated with legal and compliance oversight. These expenses are vital for maintaining the company's operational integrity and corporate governance.

Canacol dedicates a significant portion of its resources to these non-operational yet critical activities. For instance, in 2024, the company's general and administrative expenses were approximately $30.5 million, reflecting investments in its corporate infrastructure and ongoing compliance efforts.

- Salaries and Benefits: Costs associated with executive management, finance, legal, human resources, and other administrative personnel.

- Office Expenses: Includes rent for corporate offices, utilities, supplies, and IT infrastructure supporting administrative functions.

- Legal and Compliance: Expenses related to legal counsel, regulatory filings, and ensuring adherence to industry standards and governmental regulations.

- Professional Fees: Costs for external auditors, consultants, and other professional services essential for corporate operations.

Debt Service and Financing Costs

Debt service and financing costs are a major component of Canacol's expenses due to the capital-intensive nature of oil and gas exploration and production. These costs primarily include interest payments on the company's outstanding debt, such as its senior secured notes. For instance, in 2023, Canacol reported interest expense of $106.3 million, reflecting its leverage.

Canacol has made debt reduction a strategic priority to improve its financial flexibility and reduce these ongoing financing costs. This focus is essential for enhancing profitability and delivering better returns to shareholders. By managing its debt effectively, the company aims to lower its overall cost of capital.

- Interest Expense: In 2023, Canacol's interest expense on its debt was $106.3 million.

- Debt Reduction Strategy: The company prioritizes paying down its debt to reduce future financing costs.

- Impact on Profitability: Lowering debt service costs directly contributes to improved net income and earnings per share.

Canacol's cost structure is heavily influenced by its capital expenditures in exploration and development, operating and production costs, transportation, and administrative expenses. The company also incurs significant financing costs due to its debt obligations.

In 2024, capital expenditures were planned at approximately $250 million, focusing on drilling and infrastructure. Operating costs are crucial for profitability, as seen in the 2024 focus on optimizing operating netback. Administrative costs, including salaries and legal fees, amounted to around $30.5 million in 2024.

Transportation tariffs and debt service, with $106.3 million in interest expense reported in 2023, are also key cost components. Canacol actively manages these expenses, particularly debt reduction, to enhance its financial flexibility and profitability.

| Cost Category | 2023 (Millions USD) | 2024 (Planned Millions USD) | Notes |

|---|---|---|---|

| Capital Expenditures | N/A | ~250 | Exploration and development, infrastructure |

| Operating & Production Costs | N/A | Key focus for optimization | Impacts operating netback |

| Administrative & General Expenses | N/A | ~30.5 | Salaries, office, legal, compliance |

| Interest Expense (Debt Service) | 106.3 | N/A | Reflects leverage and financing costs |

Revenue Streams

Canacol's main income comes from selling natural gas. They primarily use take-or-pay contracts, which are long-term agreements. These contracts are usually in US dollars and have fixed prices.

Under these agreements, customers commit to buying a minimum amount of natural gas. This creates a steady and reliable revenue stream for Canacol, shielding them from the ups and downs of natural gas prices. For instance, in 2024, Canacol reported significant production volumes, underscoring the strength of these contracts.

Canacol Energy also generates revenue from interruptible natural gas sales. These are volumes that are sold when they are available, often at prices that react to market conditions. This flexibility allows Canacol to benefit from peak demand periods or take advantage of spot market opportunities, adding to their income beyond their firm contracts.

While Canacol Energy is predominantly known for its natural gas operations, it also generates revenue through the sale of crude oil. This income stream stems from its oil exploration and production activities across different Colombian regions.

Although oil sales represent a smaller portion of Canacol's total revenue compared to natural gas, they are still a valuable contributor to the company's financial performance. The Rancho Hermoso block serves as a key example of an asset that produces crude oil for sale.

Future Revenue from Bolivian Operations

Canacol is preparing to launch operations in Bolivia in 2026, a move anticipated to generate new revenue streams from natural gas and possibly oil extraction. This strategic expansion is a significant growth opportunity for the company.

The successful ratification of exploration contracts in Bolivia is crucial for Canacol to realize these future revenue potentials. This development is a key factor in their long-term financial planning.

- Bolivian Expansion: Operations slated to begin in 2026, targeting gas and oil production.

- Strategic Growth: Represents a significant new avenue for revenue generation.

- Contract Ratification: Essential for unlocking the full revenue potential from Bolivian assets.

Hydrocarbon Liquids (NGLs) Sales

Canacol Energy also generates revenue from the sale of Natural Gas Liquids (NGLs), which are valuable byproducts extracted during the natural gas processing. While not always highlighted as a primary revenue stream, NGLs like propane, butane, and natural gasoline contribute significantly to the overall hydrocarbon sales. The company's processing infrastructure is key to efficiently separating these liquids, enhancing the economic value derived from its gas production.

These NGLs can be sold into various markets, often commanding premium prices compared to raw natural gas. For instance, in 2023, the global NGL market saw robust demand, with prices for ethane and propane showing resilience. Canacol's ability to capture and market these liquids diversifies its revenue base and improves the profitability of its natural gas operations.

- NGL Extraction: Processing facilities at Canacol's gas fields separate NGLs from the raw natural gas stream.

- Market Sales: These extracted NGLs are then sold to third-party purchasers in the petrochemical and energy sectors.

- Revenue Diversification: NGL sales provide an additional revenue stream beyond natural gas, contributing to overall financial performance.

- Value Addition: The separation process adds significant value to the extracted hydrocarbon liquids.

Canacol's revenue is primarily generated through the sale of natural gas under long-term, US dollar-denominated take-or-pay contracts. These agreements ensure a stable income floor, as customers are obligated to purchase a minimum volume, insulating Canacol from price volatility. Additionally, the company benefits from interruptible gas sales, which capitalize on market demand fluctuations and offer opportunities for higher pricing during peak periods.

Beyond its core gas business, Canacol also derives income from the sale of crude oil, a byproduct of its exploration and production activities. While a smaller contributor than natural gas, oil sales, such as those from the Rancho Hermoso block, still add to the company's overall financial performance. The company is also poised to expand its revenue base with planned operations in Bolivia starting in 2026, targeting both gas and oil production, contingent on the ratification of exploration contracts.

Furthermore, Canacol generates revenue from the sale of Natural Gas Liquids (NGLs), valuable byproducts like propane and butane extracted during gas processing. These NGLs are sold to petrochemical and energy sector buyers, diversifying revenue and enhancing the profitability of its gas operations. For example, in 2023, the global NGL market demonstrated strong demand, supporting the value of these extracted liquids.

| Revenue Source | Primary Mechanism | Key Characteristics | 2024 Relevance |

| Natural Gas Sales (Firm) | Take-or-Pay Contracts | Long-term, USD-denominated, fixed prices, minimum volume commitments | Foundation of stable revenue, significant production volumes reported |

| Natural Gas Sales (Interruptible) | Market-driven pricing | Flexible sales based on availability and market conditions, captures peak demand | Adds opportunistic revenue beyond firm contracts |

| Crude Oil Sales | Exploration & Production | Revenue from oil extraction activities, smaller portion of total revenue | Example: Rancho Hermoso block contributes to hydrocarbon sales |

| Natural Gas Liquids (NGLs) Sales | Byproduct extraction and sale | Sale of propane, butane, etc., to petrochemical and energy sectors | Diversifies revenue, enhances gas operation profitability, strong global NGL market in 2023 |

| Bolivian Operations (Future) | Gas & Oil Production | Planned 2026 launch, contingent on contract ratification | Significant new revenue stream potential |

Business Model Canvas Data Sources

The Canacol Business Model Canvas is informed by a blend of internal financial data, extensive market research on the renewable energy sector, and strategic insights from industry experts. This triangulation ensures a robust and data-driven representation of our business.