Calpine SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calpine Bundle

Calpine, a leading power generator, possesses significant strengths in its diverse, low-carbon generation fleet and extensive market reach. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind Calpine's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Calpine boasts a substantial and varied power generation fleet, primarily consisting of natural gas-fired and geothermal facilities spread across North America. This broad portfolio is a key strength, enabling the company to adapt to fluctuating energy needs and offering a degree of protection against unpredictable fuel costs. The inclusion of geothermal power provides a reliable, baseload renewable energy source.

Calpine stands as the undisputed leader in geothermal energy generation within the United States. They operate The Geysers, a globally significant geothermal complex, solidifying their position as the largest producer of this renewable resource.

This extensive geothermal capacity provides Calpine with a crucial advantage: a stable, baseload power source. This reliability, coupled with its renewable nature, significantly lowers their carbon footprint and sets them apart in the competitive energy market.

Calpine's strategic positioning is a significant strength, with operations spanning 24 states across the U.S., plus Canada and Mexico. This extensive footprint places the company directly within key competitive power markets, allowing it to capitalize on regional demand and supply dynamics.

Serving a diverse customer base, including utilities, retail power providers, and industrial clients, highlights Calpine's adaptability and broad market reach. This wide customer engagement, supported by its retail operations, enables the company to effectively leverage market opportunities and maintain a robust presence.

Commitment to Decarbonization and Advanced Technologies

Calpine's commitment to decarbonization is a significant strength, evidenced by substantial investments in advanced technologies. The company is actively developing carbon capture and storage (CCS) projects, including notable initiatives like Baytown and Sutter. This focus on CCS positions Calpine to address evolving regulatory landscapes and market demands for lower-emission power generation.

Furthermore, Calpine is expanding its footprint in battery energy storage systems (BESS), with a major project underway in California. This strategic move into BESS is crucial for grid reliability and integrating renewable energy sources. By embracing these advanced technologies, Calpine is not only enhancing its environmental profile but also building a more resilient and future-ready energy portfolio.

- Investment in Decarbonization: Calpine is actively pursuing carbon capture and storage (CCS) projects, such as Baytown and Sutter, demonstrating a tangible commitment to reducing its carbon footprint.

- Battery Energy Storage Systems (BESS): The company is undertaking a significant BESS project in California, highlighting its strategic investment in grid modernization and the integration of renewable energy.

- Technological Advancement: These initiatives underscore Calpine's proactive approach to adopting and developing advanced technologies that align with future energy needs and environmental stewardship.

Acquisition by Constellation Energy

Calpine's pending acquisition by Constellation Energy, a prominent nuclear power operator, is a significant strength. This strategic move is poised to forge a leading entity in clean and reliable energy production, offering an expanded portfolio of products and services.

The integration is anticipated to bolster Calpine's operational scale, fortify its financial resilience, and improve its capacity to address the escalating demand for low-carbon energy solutions.

- Enhanced Scale and Financial Stability: The acquisition by Constellation Energy is expected to significantly increase Calpine's market presence and financial robustness.

- Broader Product and Service Offering: The combined entity will offer a more comprehensive suite of clean energy solutions, catering to a wider range of customer needs.

- Meeting Low-Carbon Demand: The merger positions Calpine to more effectively capitalize on and serve the growing market for low-carbon energy.

Calpine's diverse power generation fleet, heavily weighted towards natural gas and geothermal, provides significant operational flexibility and resilience against fuel price volatility. Their leadership in U.S. geothermal, particularly at The Geysers, offers a stable, renewable baseload power source, contributing to a lower carbon footprint and market differentiation. This robust operational base is further strengthened by a strategic geographic footprint across 24 U.S. states and into Canada and Mexico, allowing them to effectively serve diverse markets and capitalize on regional energy demands.

Calpine's proactive investment in decarbonization technologies, including carbon capture and storage (CCS) projects like Baytown and Sutter, and expansion into battery energy storage systems (BESS) in California, positions them favorably for evolving environmental regulations and market preferences. The pending acquisition by Constellation Energy is a major strength, expected to create a leading clean energy entity with enhanced scale, financial stability, and a broader product offering to meet the increasing demand for low-carbon solutions.

| Strength | Description | Key Data/Impact |

| Diverse Generation Fleet | Primarily natural gas-fired and geothermal facilities across North America. | Provides flexibility and hedges against fuel cost fluctuations. Geothermal offers stable, renewable baseload power. |

| Geothermal Leadership | Largest producer of geothermal energy in the U.S. (The Geysers). | Offers a reliable, low-carbon baseload power source, enhancing market position. |

| Extensive Geographic Footprint | Operations in 24 U.S. states, Canada, and Mexico. | Enables access to key competitive power markets and diverse customer bases. |

| Decarbonization Investments | Active development of CCS projects (Baytown, Sutter) and BESS expansion in California. | Addresses future energy needs and environmental stewardship, aligning with market trends. |

| Pending Acquisition by Constellation Energy | Strategic merger creating a leading clean energy provider. | Expected to enhance operational scale, financial resilience, and low-carbon energy offerings. |

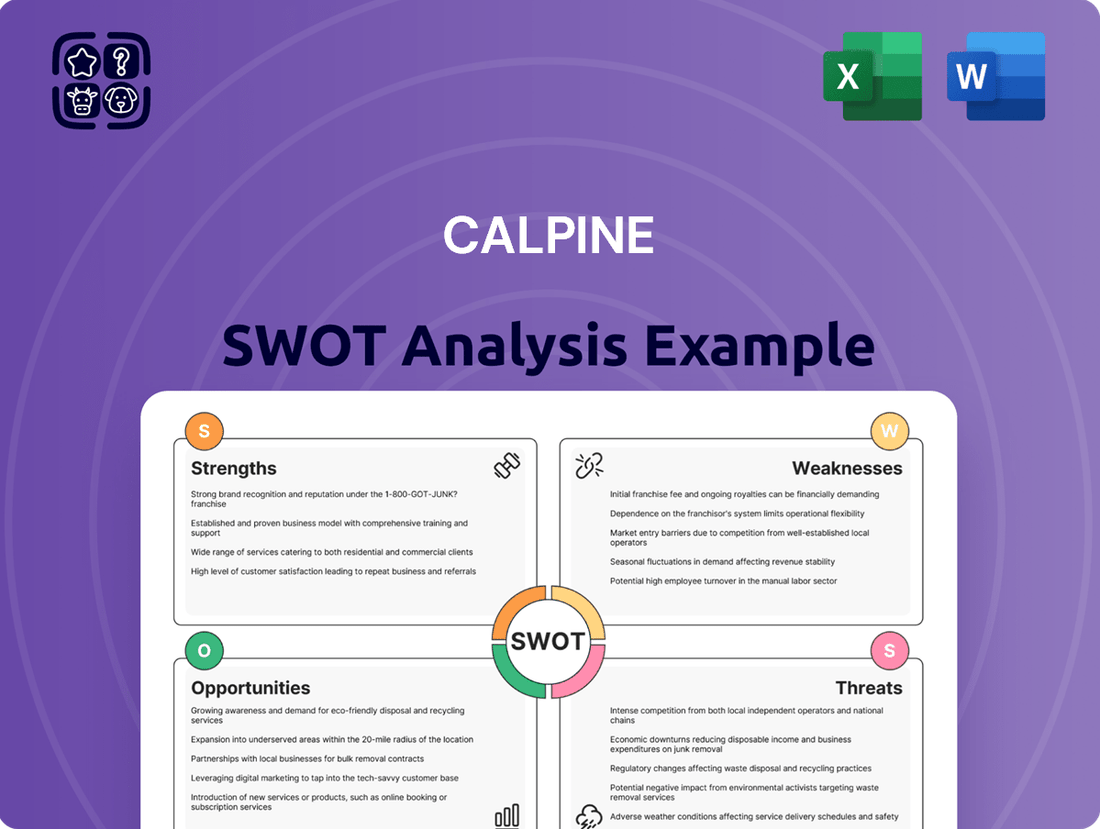

What is included in the product

Analyzes Calpine’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical challenges in the energy sector.

Weaknesses

Calpine's significant reliance on natural gas for its power generation, despite a diversified portfolio, presents a notable weakness. As of the first quarter of 2024, approximately 70% of Calpine's capacity was natural gas-fired, highlighting this dependence.

This exposure makes the company vulnerable to the volatile pricing of natural gas, directly impacting operating costs and profitability. For instance, a sharp increase in natural gas prices during the winter of 2023-2024 led to higher fuel expenses for Calpine.

Furthermore, the increasing global focus on decarbonization and stricter environmental regulations pose a long-term risk to a business model heavily weighted towards fossil fuels, potentially leading to higher compliance costs or a need for accelerated transition investments.

Calpine's reliance on the wholesale power market exposes it to significant price volatility. As a merchant operator, the company sells electricity at prevailing market rates, which can fluctuate dramatically based on supply, demand, and fuel costs. This inherent unpredictability means revenue streams can be inconsistent, posing a challenge for financial planning and stability.

While wholesale power prices are generally projected to increase across most U.S. regions in 2025, this trend doesn't eliminate the risk of sharp downturns. For instance, unexpected increases in natural gas supply or a decrease in demand could lead to price drops, directly impacting Calpine's profitability. The company's financial performance is therefore closely tied to these external market forces, which are often beyond its direct control.

Calpine's operations, particularly in developing new power generation projects such as battery storage and carbon capture technologies, demand significant capital investment. These ventures require substantial upfront funding, making the business inherently capital intensive.

The company has historically relied on debt financing to fund these large-scale projects. For instance, Calpine's acquisition by Constellation Energy in 2024 was completed with a substantial net debt component, which could potentially limit the company's financial flexibility for future investments or strategic maneuvers.

Regulatory and Environmental Scrutiny

The power generation industry, including Calpine, operates under constant and evolving regulatory oversight. This scrutiny is particularly focused on greenhouse gas emissions and broader environmental standards, which can directly affect operational costs and future development strategies. For instance, as of early 2024, the U.S. Environmental Protection Agency (EPA) continues to refine regulations impacting power plant emissions, potentially requiring significant capital investments for compliance.

Changes in federal and state policies present a significant weakness. Potential rollbacks of existing climate regulations or the introduction of new environmental mandates could alter Calpine's operational expenses and hinder its planned growth initiatives. For example, shifts in state-level renewable portfolio standards or carbon pricing mechanisms, which vary significantly across the U.S., can create an uneven playing field and impact project economics.

- Evolving Emission Standards: Calpine's reliance on natural gas-fired power plants makes it susceptible to stricter regulations on CO2 and other pollutants.

- Policy Uncertainty: Fluctuations in federal and state environmental policies can lead to unpredictable compliance costs and project delays.

- Permitting Challenges: Obtaining environmental permits for new facilities or upgrades can be a lengthy and complex process, influenced by changing regulatory landscapes.

- Reputational Risk: Failure to meet environmental expectations can damage Calpine's reputation and affect its social license to operate.

Integration Challenges Post-Acquisition

The strategic acquisition of Calpine by Constellation Energy in August 2024, valued at approximately $7.3 billion, introduces significant integration challenges. Merging two substantial organizations with distinct operational frameworks and corporate cultures necessitates meticulous planning and execution to achieve operational harmony and unlock the anticipated synergies.

Potential hurdles include aligning disparate IT systems, standardizing operational processes across a larger, more complex asset base, and harmonizing employee benefits and compensation structures. Successfully navigating these complexities is crucial for realizing the full strategic benefits of the combined entity, which aims to create a leading clean energy platform.

- Operational Integration: Challenges in merging diverse generation fleets and grid management systems.

- Cultural Alignment: Bridging differences in corporate culture to foster a unified workforce.

- Synergy Realization: The risk of not fully achieving projected cost savings and revenue enhancements due to integration difficulties.

Calpine's significant reliance on natural gas, making up about 70% of its capacity as of Q1 2024, exposes it to volatile fuel prices. This dependence directly impacts operating costs and profitability, as seen with higher fuel expenses during the winter of 2023-2024. The increasing global push for decarbonization and stricter environmental rules also pose a long-term threat to its fossil fuel-heavy model.

As a merchant operator, Calpine's revenue is tied to fluctuating wholesale power prices, which can be unpredictable due to supply, demand, and fuel costs. While prices are generally expected to rise in 2025, sharp downturns are still possible, impacting financial planning and stability.

The company's capital-intensive projects, like battery storage and carbon capture, require substantial investment, often funded by debt. The $7.3 billion acquisition by Constellation Energy in August 2024, with its significant debt component, could limit future financial flexibility.

Calpine faces integration challenges following its acquisition by Constellation Energy, including aligning IT systems, operational processes, and employee structures. Successfully managing these complexities is crucial for realizing the intended synergies of the combined clean energy platform.

Same Document Delivered

Calpine SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Calpine SWOT analysis you see here is the exact file that will be available to you upon purchase, offering a comprehensive overview of the company's strategic position.

Opportunities

The United States is witnessing a surge in electricity consumption, with data centers and the burgeoning artificial intelligence sector being major catalysts. This trend presents a substantial opportunity for Calpine, a leading independent power producer.

Calpine's robust portfolio of natural gas-fired power plants, known for their reliability, is well-positioned to meet this escalating demand. Furthermore, the company's strategic investments in battery storage solutions directly address the need for flexible and dispatchable power, crucial for supporting the grid's stability amidst increased load from these new energy consumers.

In 2023, data center electricity consumption in the U.S. reached an estimated 200 terawatt-hours (TWh), a figure projected to climb significantly in the coming years, potentially doubling by 2030 according to some analyses. Calpine's ability to provide consistent and efficient power generation directly benefits from this expanding market.

Calpine is actively expanding its Battery Energy Storage Systems (BESS) portfolio, notably with a significant project operational in California and further developments planned. This strategic move aligns with the burgeoning energy storage market, which is projected to grow substantially in the coming years.

The global energy storage market is experiencing rapid expansion, fueled by the increasing integration of renewable energy sources like solar and wind, which are inherently intermittent. BESS solutions are crucial for grid stability, providing essential services such as frequency regulation and peak shaving, thus creating a significant growth avenue for Calpine.

By 2030, the U.S. energy storage market alone is expected to reach over $100 billion, with BESS technologies forming the backbone of this growth. Calpine's investments position it to capitalize on this trend, leveraging its operational expertise to meet the evolving demands of the power grid.

Calpine is actively pursuing cost-sharing agreements for commercial-scale Carbon Capture and Sequestration (CCS) projects, signaling a strategic investment in decarbonization. This proactive approach is crucial as global carbon reduction targets intensify.

Successful implementation of CCS on its natural gas fleet could position Calpine as a frontrunner in providing low-carbon, yet dispatchable, power. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated $12 billion for CCS projects, offering significant opportunities for companies like Calpine to secure funding and advance these critical technologies.

Favorable Policy Support for Clean Energy Transition

The Inflation Reduction Act (IRA) of 2022 is a cornerstone of this opportunity, injecting substantial capital into clean energy. For instance, the IRA is projected to drive over $700 billion in private investment in clean energy and climate resilience through 2030. This robust policy environment, including tax credits and incentives for renewable energy generation and storage, directly benefits companies like Calpine that are positioned within the energy transition. This creates a fertile ground for expanding operations and adopting cleaner technologies.

Calpine can leverage these policy tailwinds to accelerate its investments in decarbonization and renewable energy projects. The IRA’s long-term certainty for clean energy tax credits, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), provides a stable financial framework for project development. Furthermore, state-level initiatives and renewable portfolio standards continue to create demand for clean power, bolstering Calpine's market position.

Key opportunities include:

- Enhanced profitability through tax credits: Direct access to and utilization of IRA tax credits for renewable generation and storage projects.

- Increased project development funding: Availability of federal grants and loan programs supporting clean energy infrastructure.

- Accelerated adoption of cleaner technologies: Policy incentives encouraging the deployment of carbon capture and advanced grid technologies.

Leveraging Geothermal as a Baseload Renewable

Calpine's significant geothermal portfolio positions it to meet the growing need for consistent, round-the-clock renewable power. This capability is particularly valuable as the grid integrates more intermittent sources.

Geothermal provides a dependable, non-weather-dependent energy supply, acting as a vital complement to variable renewables like wind and solar. This stability is essential for maintaining grid reliability and ensuring a steady power flow.

- Geothermal's Baseload Advantage Geothermal plants can operate 24/7, unlike solar and wind, providing a constant power source.

- Grid Stability Contribution This reliability is critical for grid operators managing the fluctuating output of other renewable sources.

- Calpine's Asset Strength Calpine operates a substantial amount of geothermal capacity, directly benefiting from this demand. For instance, as of early 2024, Calpine's geothermal segment is a significant contributor to its overall generation mix, with capacity figures consistently demonstrating its importance.

- Market Demand for Baseload Renewables The increasing focus on grid resilience and the need to firm up renewable energy supplies directly enhances the value proposition of geothermal assets.

The surging demand for electricity, particularly from data centers and AI, presents a significant growth opportunity for Calpine, which operates a reliable fleet of natural gas power plants. Its strategic investments in battery storage further bolster its ability to meet this escalating need, offering grid stability services. The U.S. data center electricity consumption was estimated at 200 TWh in 2023, a figure poised for substantial growth.

Calpine's expansion of its battery storage portfolio, with operational projects and planned developments, positions it to capitalize on the rapidly growing energy storage market, projected to exceed $100 billion in the U.S. by 2030. This growth is driven by the need to integrate intermittent renewables and enhance grid stability.

The company's pursuit of Carbon Capture and Sequestration (CCS) projects, supported by initiatives like the Bipartisan Infrastructure Law's $12 billion allocation for CCS, offers a pathway to low-carbon dispatchable power. Furthermore, the Inflation Reduction Act (IRA) of 2022 is expected to drive over $700 billion in private clean energy investment through 2030, providing substantial benefits through tax credits and incentives for Calpine's clean energy and storage projects.

Calpine's robust geothermal portfolio provides a consistent, round-the-clock renewable power source, which is increasingly valuable as the grid integrates more variable renewables. This baseload advantage is critical for grid stability, and Calpine's significant geothermal capacity allows it to directly benefit from the growing market demand for reliable renewable energy.

Threats

Calpine faces significant threats from the escalating competition within the power generation sector. The rapid, cost-effective expansion of solar and wind energy capacity is a primary concern, directly challenging the market share of traditional thermal power sources.

While natural gas, Calpine's core business, offers reliability, the increasing penetration of renewables is projected to influence overall demand. For instance, in 2024, renewable energy sources are expected to account for a substantial portion of new capacity additions globally, potentially dampening the long-term outlook for thermal generation.

Calpine's profitability is directly tied to the volatile natural gas market. For instance, during the first quarter of 2024, natural gas spot prices saw significant swings, impacting the cost of fuel for Calpine's power generation facilities. Increased global demand for liquefied natural gas (LNG) exports, a trend expected to continue through 2025, puts upward pressure on domestic prices, directly affecting Calpine's operating expenses and potentially squeezing margins.

Supply chain disruptions, particularly for critical components needed for new power plant construction or upgrades, represent another significant threat. Delays in equipment delivery or increased costs for materials, exacerbated by global trade dynamics and geopolitical events anticipated through 2025, can hinder project timelines and inflate capital expenditures, impacting Calpine's expansion plans and overall growth trajectory.

The U.S. energy sector is subject to a dynamic regulatory environment, with potential shifts in federal policy creating uncertainty for long-term investments. For instance, the 2024 election cycle could bring about significant changes in energy policy, impacting everything from carbon emissions regulations to renewable energy incentives, directly influencing Calpine's operational and capital expenditure planning.

Environmental Activism and Public Pressure

Environmental activism is increasingly influencing energy policy. For Calpine, this translates to potential hurdles in developing new natural gas plants, as public and regulatory scrutiny intensifies. This pressure could lead to higher compliance costs and delays in project approvals.

The push for reduced greenhouse gas emissions, amplified by environmental groups, directly impacts Calpine's operational landscape. For instance, in 2024, several proposed natural gas projects faced significant public opposition, leading to extended environmental reviews. This trend is projected to continue, potentially affecting Calpine's ability to expand its generation capacity in certain regions.

- Increased Regulatory Scrutiny: Growing environmental activism can prompt stricter emissions standards for natural gas facilities, potentially increasing operational expenses for Calpine.

- Permitting Challenges: Public opposition can complicate and prolong the permitting process for new natural gas power plants, impacting development timelines and costs.

- Social License to Operate: Negative public perception and organized campaigns can erode Calpine's social license, making it more difficult to secure community support for new projects.

Grid Reliability Challenges and Transmission Constraints

While Calpine's diverse fleet of power plants plays a crucial role in maintaining grid reliability, the broader U.S. power grid is grappling with significant challenges. These include managing escalating electricity demand and the complex integration of various energy sources, from traditional fossil fuels to renewables.

Transmission infrastructure is a key bottleneck. The existing grid often struggles to accommodate the flow of power, especially from new generation sites. This necessitates substantial investment in upgrades and expansion to prevent congestion and ensure efficient delivery of electricity. For instance, the U.S. Department of Energy has highlighted the need for trillions of dollars in transmission investment by 2050 to meet clean energy goals and enhance grid resilience.

- Grid Modernization Needs: The U.S. electric grid requires significant upgrades to handle increased load and the intermittency of renewable sources.

- Transmission Bottlenecks: Insufficient transmission capacity can limit the ability to deliver power from generation facilities to demand centers, impacting revenue.

- Infrastructure Investment: The cost and timeline for necessary transmission build-out present a substantial hurdle for the entire energy sector, including Calpine.

- Regulatory Hurdles: Permitting and siting new transmission lines can be a lengthy and complex process, delaying critical infrastructure improvements.

Calpine faces intense competition from the expanding renewable energy sector, which is rapidly adding capacity at lower costs. This trend, evident in 2024's global new capacity additions, puts pressure on traditional thermal power sources like those Calpine operates.

The company's reliance on natural gas exposes it to price volatility. In Q1 2024, natural gas prices fluctuated significantly, impacting Calpine's fuel costs. Continued global demand for LNG exports through 2025 is expected to keep domestic prices elevated, squeezing profit margins.

Supply chain disruptions and potential policy shifts following the 2024 election cycle present further threats. Delays in equipment delivery or changes in environmental regulations could hinder expansion plans and increase capital expenditures.

The U.S. power grid's need for modernization, including transmission infrastructure upgrades, poses a significant challenge. Insufficient transmission capacity can restrict power delivery, and the substantial investment required for grid improvements, estimated in the trillions by 2050, presents a hurdle for all energy providers.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of reliable data, including Calpine's official financial statements, comprehensive market research reports, and expert industry analysis to provide a robust strategic overview.