Calpine PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calpine Bundle

Navigate the complex external forces impacting Calpine's operations and future growth with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical for strategic decision-making. Download the full version now to gain actionable insights and stay ahead of the curve.

Political factors

Governmental energy policy shifts significantly shape Calpine's strategic direction. The Biden-Harris administration's finalized standards in April 2024 targeting pollution from fossil fuel power plants directly affect Calpine's natural gas operations. Conversely, potential proposals in mid-2025 to repeal certain greenhouse gas emissions standards could provide regulatory flexibility.

The regulatory environment is a major influence on Calpine's operations, particularly rules from the Environmental Protection Agency (EPA) and the Federal Energy Regulatory Commission (FERC). The EPA's May 2024 finalization of Section 111 Clean Air Act regulations, mandating carbon capture and storage for new and existing power plants, directly impacts generation technology choices and costs.

FERC's recent actions to offer more flexibility and speed up natural gas infrastructure development, including temporary waivers on construction authorization timelines, could influence the availability and cost of natural gas, a key fuel for Calpine.

International trade policies and potential tariffs on energy imports or equipment significantly impact Calpine's operational costs. For instance, the potential implementation of a 10% tariff on energy imports from Canada, including natural gas, could lead to increased price volatility and affect Calpine's input expenses.

Geopolitical Stability and Energy Security

Geopolitical events significantly influence energy markets, with nations prioritizing energy security. This focus can lead to shifts in fuel supply chains and impact energy price stability, directly affecting companies like Calpine that rely on diverse fuel sources.

The U.S. federal government actively works to ensure a secure and reliable power supply. Initiatives often encourage domestic energy exploration and production, which can present both opportunities and challenges for independent power producers by influencing fuel costs and availability.

- Global Energy Dependence: In 2023, the U.S. remained a net exporter of energy, yet global geopolitical tensions, particularly in Eastern Europe, continued to affect international oil and natural gas prices, with Brent crude averaging around $82 per barrel for the year.

- Domestic Production Incentives: Government policies aimed at bolstering domestic energy production, including natural gas and renewables, can alter the competitive landscape for power generation.

- Infrastructure Security: The reliability of energy infrastructure is a key concern, with cybersecurity threats and physical vulnerabilities requiring continuous investment and attention from both government and industry.

State-Level Energy Initiatives

Individual state policies significantly shape Calpine's operational landscape. Renewable portfolio standards (RPS) and clean energy commitments enacted by various states present both opportunities and hurdles.

Many states are intensifying their focus on clean energy to satisfy growing power demands. This trend creates openings for Calpine's geothermal and natural gas power plants, particularly those capable of integrating seamlessly with renewable energy sources.

- California's RPS requires utilities to procure 60% of their electricity from renewable sources by 2030, a target that could favor flexible generation assets like Calpine's.

- New York's Climate Leadership and Community Protection Act aims for 100% carbon-free electricity by 2040, driving demand for reliable, dispatchable power.

- Texas, while a leader in wind and solar, also sees opportunities for natural gas to provide grid stability as renewable penetration increases.

Governmental energy policy shifts significantly shape Calpine's strategic direction, with the Biden-Harris administration's finalized standards in April 2024 targeting pollution from fossil fuel power plants directly affecting Calpine's natural gas operations. The EPA's May 2024 finalization of Section 111 Clean Air Act regulations, mandating carbon capture and storage for new and existing power plants, directly impacts generation technology choices and costs.

FERC's recent actions to offer more flexibility and speed up natural gas infrastructure development, including temporary waivers on construction authorization timelines, could influence the availability and cost of natural gas. Geopolitical events and a global focus on energy security can lead to shifts in fuel supply chains and impact energy price stability, directly affecting companies like Calpine that rely on diverse fuel sources.

Individual state policies, such as California's RPS requiring 60% renewable procurement by 2030 and New York's goal for 100% carbon-free electricity by 2040, significantly shape Calpine's operational landscape and create opportunities for flexible generation assets.

The U.S. federal government's initiatives to ensure a secure and reliable power supply, often encouraging domestic energy exploration, can alter the competitive landscape by influencing fuel costs and availability.

What is included in the product

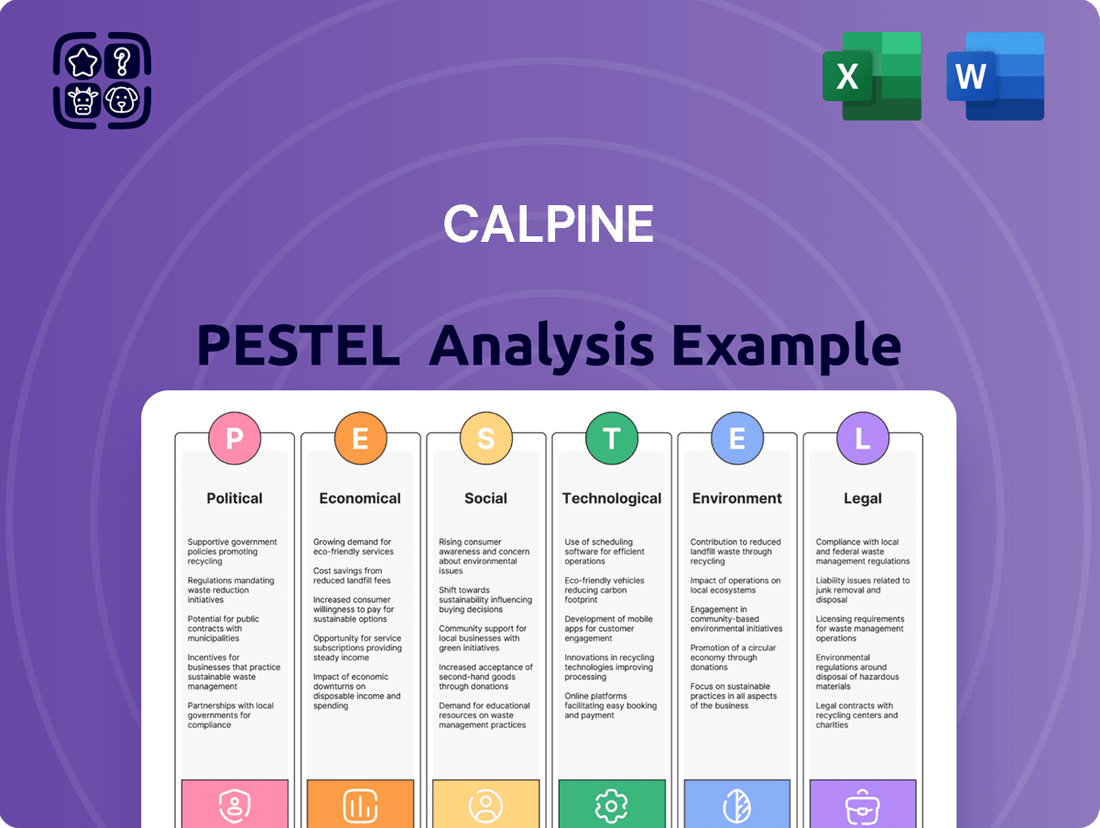

This Calpine PESTLE analysis offers a comprehensive examination of how political, economic, social, technological, environmental, and legal forces impact the company's operations and strategic direction.

It provides actionable insights and forward-looking perspectives to aid in identifying opportunities and mitigating risks within Calpine's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Calpine's strategic discussions.

Easily shareable summary format ideal for quick alignment across teams or departments, alleviating the pain of information silos and ensuring everyone understands Calpine's operating environment.

Economic factors

Natural gas price volatility is a key economic factor for Calpine. Fluctuations in these prices directly affect Calpine's operating expenses and overall profitability, as the company relies heavily on natural gas-fired power plants.

In late 2024 and early 2025, we observed a steady increase in natural gas prices, driven by colder weather and heightened demand. Looking ahead, the U.S. Energy Information Administration (EIA) forecasts the Henry Hub spot price to average approximately $3.40 per million British thermal units (MMBtu) in the third quarter of 2025, and an average of $3.80/MMBtu for the full year 2025.

Calpine's revenue is directly tied to the ebb and flow of wholesale electricity markets, where it sells power, capacity, and essential grid services. These markets operate on a delicate balance of supply and demand, and any shifts here significantly impact Calpine's financial performance. For instance, in 2024, the demand for electricity saw a notable surge, partly fueled by the rapid expansion of data centers across the United States.

Natural gas continues to play a critical role in ensuring grid reliability, making its availability and price a key factor in wholesale market dynamics. As of early 2025, natural gas prices have shown some volatility, influencing the cost of electricity generation and, consequently, Calpine's operational expenses and revenue potential. This ongoing reliance on natural gas highlights its importance for meeting peak demand and maintaining grid stability, even as renewable energy sources grow.

The global push towards decarbonization is significantly boosting investment in renewable energy. In 2024, renewable energy capacity additions are projected to reach a new record, with solar and wind power leading the charge. This trend directly impacts companies like Calpine, as the increasing competitiveness of renewables can pressure the market share and pricing of traditional energy sources.

Despite the rise of renewables, natural gas power plants, particularly combined-cycle facilities, remain crucial for grid stability. In 2025, it's estimated that natural gas will continue to play a vital role in bridging the intermittency gap of solar and wind power, ensuring reliable 24/7 electricity supply. Calpine's existing fleet of natural gas assets is therefore positioned to benefit from this ongoing demand.

Capital Costs for New Projects

The substantial capital outlay required for new power generation facilities, especially those utilizing geothermal technology, presents a significant consideration for Calpine's growth strategies. These upfront investments are a critical hurdle for project development.

Despite these challenges, the geothermal energy sector saw a notable influx of financial backing in 2024. Governments worldwide committed more than US$2 billion to various geothermal initiatives, aiming to accelerate the adoption of advanced technologies and reduce development costs.

- Government Funding Boost: Over US$2 billion allocated to geothermal projects in 2024.

- Focus on Advanced Technologies: Funding targets innovations to lower capital expenses.

- Impact on Expansion: High initial costs remain a key factor for Calpine's project pipeline.

Economic Growth and Industrial Demand

Overall economic expansion is a key driver for Calpine, as a growing economy naturally leads to increased energy consumption across all sectors. This translates directly into a larger customer base and higher demand for Calpine's power generation and retail energy services. For instance, the U.S. economy experienced a robust GDP growth rate of 2.5% in 2023, signaling a healthy demand environment for energy providers.

Industrial and commercial sectors are particularly important consumers of electricity, and their activity levels significantly impact Calpine's revenue. As businesses expand and manufacturing output rises, so does their need for reliable and cost-effective power. The U.S. industrial production index saw a notable increase throughout 2024, indicating strong demand from this segment.

Emerging trends, such as the rapid expansion of data centers, are creating substantial new demand for electricity. These facilities require immense and continuous power, presenting a significant growth opportunity for Calpine. By mid-2024, the global data center market was projected to consume an unprecedented amount of energy, with North America being a major contributor to this trend.

Calpine's performance is therefore closely tied to these economic indicators:

- Economic Growth: A strong GDP growth rate, like the projected 2.2% for the U.S. in 2024, generally supports increased energy demand.

- Industrial Activity: Rising manufacturing output and industrial production directly correlate with higher electricity consumption.

- Commercial Demand: Expansion in the commercial sector, including retail and services, also contributes to overall energy needs.

- Data Center Expansion: The burgeoning data center industry represents a significant and growing source of demand for power generation capacity.

Natural gas prices are a critical economic factor for Calpine, directly influencing operating costs and profitability. The U.S. Energy Information Administration (EIA) forecasts Henry Hub spot prices to average around $3.40/MMBtu in Q3 2025, rising to $3.80/MMBtu for the full year 2025, indicating potential cost pressures.

Wholesale electricity market dynamics, driven by supply and demand, significantly shape Calpine's revenue. The increasing demand for electricity, exemplified by the rapid expansion of data centers in 2024, creates opportunities but also highlights the need for reliable power generation.

The global shift towards decarbonization is boosting renewable energy investments, with record capacity additions expected in 2024, primarily from solar and wind. While this trend pressures traditional energy sources, natural gas power plants remain vital for grid stability, especially in bridging the intermittency of renewables through 2025.

Calpine's growth is also influenced by broader economic expansion, as increased GDP growth, such as the projected 2.2% for the U.S. in 2024, typically drives higher energy consumption across industrial, commercial, and emerging sectors like data centers.

| Economic Factor | 2024/2025 Projection/Observation | Impact on Calpine |

| Natural Gas Prices (Henry Hub) | Forecasted average of $3.40/MMBtu (Q3 2025) and $3.80/MMBtu (Full Year 2025) | Directly impacts operating expenses and profitability. |

| Electricity Demand | Surge in 2024 due to data center expansion; continued growth expected. | Increases revenue potential and demand for generation capacity. |

| Renewable Energy Growth | Record capacity additions projected for 2024 (solar & wind). | Pressures traditional energy markets but highlights need for reliable gas generation. |

| Overall Economic Growth (U.S. GDP) | Projected 2.2% growth for 2024. | Drives increased energy consumption across all sectors. |

Same Document Delivered

Calpine PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Calpine PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview essential for understanding Calpine's operational landscape and future challenges.

Sociological factors

Public sentiment plays a crucial role in shaping the future of energy. Geothermal energy, often viewed as a clean and consistent power source, generally enjoys strong public backing, which can translate into more favorable regulatory environments and increased community acceptance.

Conversely, the natural gas sector navigates a more complex public perception landscape. While it's recognized for its role in providing reliable energy, concerns about methane leakage and its overall environmental footprint, particularly in the context of climate change, continue to draw significant public and regulatory attention. For instance, a 2024 Pew Research Center survey indicated that while a majority of Americans support increasing the use of renewable energy, opinions on natural gas remain more divided, with a significant portion expressing concern over its environmental impact.

Growing awareness of environmental justice is a significant sociological factor impacting Calpine. Communities historically burdened by pollution are increasingly vocal, influencing decisions about where and how power generation facilities are built. This heightened scrutiny can lead to project delays or require more extensive community outreach and mitigation efforts.

Regulations designed to address pollution often incorporate environmental justice considerations, meaning Calpine must pay close attention to the demographic makeup and existing environmental burdens of areas where it proposes new projects or operates existing ones. For instance, in 2024, the U.S. Environmental Protection Agency continued to emphasize equitable environmental enforcement, which could mean stricter oversight for facilities in fenceline communities.

Calpine's operational success hinges on a readily available pool of skilled labor for its power plants, particularly in areas like natural gas and geothermal energy. The demand for specialized engineering and technical talent is consistently high.

As of early 2024, the U.S. Bureau of Labor Statistics projected a 7% growth for power plant operators and a 4% growth for industrial engineers through 2032, indicating a competitive landscape for talent acquisition and retention.

The increasing complexity of energy technologies, including advanced grid management and renewable integration, necessitates ongoing training and development to ensure the workforce possesses the necessary skills for Calpine's evolving operational needs.

Consumer Demand for Sustainable Energy

There's a growing push from both individuals and businesses for energy that's cleaner and more sustainable. This trend directly impacts what Calpine offers and influences the choices of its customers who provide retail power. For instance, by mid-2024, surveys indicated that over 60% of consumers were willing to pay a premium for products from companies committed to sustainability.

Calpine's retail operations are responding by providing tailored carbon roadmap solutions. They also offer products that are specifically differentiated by their carbon footprint, aiming to help clients meet their environmental objectives. This proactive approach is crucial as regulatory bodies and investor pressure continue to mount, pushing for greater transparency and action on climate change.

Key aspects of this shift include:

- Rising Consumer Preference: A significant portion of the population now actively seeks out and supports businesses demonstrating strong environmental, social, and governance (ESG) practices.

- Corporate Sustainability Goals: Many corporations have set ambitious net-zero targets, driving demand for renewable energy sources and carbon-reduction services.

- Calpine's Solutions: The company's ability to offer custom carbon roadmaps and differentiated products positions it to capitalize on this evolving market need.

- Market Growth: The global renewable energy market is projected to reach trillions of dollars by 2030, underscoring the scale of this demand.

Impact of Energy Costs on Households and Businesses

Fluctuations in energy costs significantly shape public opinion and intensify political scrutiny on energy providers. When electricity prices climb, consumers and businesses in America feel the pinch, leading to widespread demands for more affordable and dependable power sources.

For instance, in early 2024, the U.S. Energy Information Administration (EIA) reported that the average residential electricity price was approximately 16.8 cents per kilowatt-hour, a figure that can strain household budgets, particularly for lower-income families. Businesses also face increased operational expenses, impacting their competitiveness and potentially leading to price hikes for goods and services.

- Consumer Impact: High electricity bills can reduce disposable income, forcing households to cut back on other essential spending.

- Business Impact: Increased energy expenses can erode profit margins, potentially leading to job cuts or reduced investment.

- Political Pressure: Rising energy costs often translate into public outcry and increased lobbying efforts for regulatory intervention or subsidies.

- Reliability Concerns: When costs are high, there's often a concurrent concern about the reliability of the energy supply, further fueling public dissatisfaction.

Sociological factors significantly influence Calpine's operations, particularly public perception of energy sources and the growing emphasis on environmental justice. Geothermal energy generally enjoys broad public support due to its clean profile, which aids in regulatory acceptance. In contrast, natural gas faces more divided public opinion, with ongoing concerns about methane emissions and climate impact, as evidenced by 2024 surveys showing public concern about its environmental footprint.

Technological factors

Ongoing innovations in natural gas turbine technology, such as advancements in combined-cycle systems and the integration of hydrogen blending, are significantly boosting efficiency and cutting emissions. For instance, GE's HA gas turbine, a leading combined-cycle technology, has achieved over 64% efficiency in recent tests, a substantial leap forward.

These technological strides are vital for making Calpine's natural gas fleet more adaptable and environmentally responsible. The ability to blend hydrogen, with pilot projects aiming for up to 20% hydrogen by volume in natural gas pipelines, allows for a cleaner energy profile, crucial for meeting evolving environmental regulations.

Such advancements are critical for the seamless integration of natural gas power generation with a growing portfolio of renewable energy sources. This synergy ensures grid stability and reliability, even as intermittent renewables like solar and wind become more prevalent in the energy mix.

Advancements in Enhanced Geothermal Systems (EGS) are significantly broadening geothermal energy's reach, moving beyond historically favorable locations. These next-generation technologies, often employing techniques borrowed from the oil and gas sector, are attracting substantial investment. For instance, in 2023, the U.S. Department of Energy announced $77 million in funding for EGS projects, signaling strong industry confidence and a push towards wider adoption.

The increasing maturity and deployment of Carbon Capture and Storage (CCS) technologies are paramount for mitigating the environmental impact of natural gas power generation. Calpine, recognizing this, is investing in significant CCS projects, with several initiatives being supported by cost-sharing agreements from the U.S. Department of Energy, such as the proposed CCS project at its Baytown, Texas facility.

Battery Energy Storage Systems

The integration of large-scale battery energy storage systems (BESS) is a pivotal technological factor for power generators like Calpine. These systems, often paired with natural gas and renewable energy sources, significantly bolster grid stability and reliability by smoothing out intermittent power generation and providing rapid response capabilities. Calpine has been actively investing in and developing these critical BESS projects to meet evolving grid demands and regulatory requirements.

Calpine's strategic focus on battery storage is evident in its project pipeline and operational assets. For instance, as of early 2024, the company was advancing several BESS projects, including a notable 300 MW / 1,200 MWh facility in Texas. This investment underscores the growing importance of storage in the energy transition, enabling greater penetration of renewables while maintaining grid integrity.

- Grid Stability Enhancement: BESS provides ancillary services like frequency regulation and voltage support, crucial for modern grids.

- Renewable Integration: Storage allows for better management of variable renewable energy sources, improving their dispatchability.

- Calpine's Investment: The company is actively developing and operating large-scale battery storage facilities, demonstrating commitment to this technology.

- Market Opportunity: The increasing demand for grid services driven by decarbonization efforts presents significant revenue potential for BESS.

Digitalization and Smart Grid Technologies

The increasing adoption of digitalization and smart grid technologies is a significant technological factor for Calpine. These advancements allow for the optimization of power plant operations through sophisticated control systems and data analytics, leading to improved efficiency across Calpine's diverse energy portfolio. For instance, in 2024, utilities are investing heavily in grid modernization, with smart grid spending projected to reach over $60 billion globally. This trend is crucial for Calpine as it helps in better integrating variable renewable energy sources, a key aspect of their strategy.

These smart technologies are fundamental in adapting to the fluctuating nature of renewable energy outputs, such as solar and wind power. By leveraging data analytics, Calpine can better predict and manage the intermittency of these sources, ensuring grid stability and reliability. The company's focus on flexible generation assets positions it well to capitalize on these technological shifts. By 2025, it's anticipated that over 70% of new grid infrastructure will incorporate advanced metering and communication capabilities.

- Optimized Operations: Advanced control systems and data analytics enhance the efficiency and output of Calpine's power generation facilities.

- Grid Integration: Smart grid technologies facilitate the seamless integration of diverse energy sources, including renewables, into the existing power grid.

- Adaptability to Renewables: These technologies are vital for managing the variability inherent in renewable energy generation, ensuring grid stability.

- Investment Trends: Significant global investment in smart grid infrastructure, projected to exceed $60 billion in 2024, underscores the growing importance of these technologies.

Technological advancements in natural gas turbines, including higher efficiency ratings and hydrogen blending capabilities, are enhancing Calpine's operational performance and environmental profile. GE's HA turbines, for example, have demonstrated efficiencies exceeding 64%, showcasing significant progress in the sector.

The integration of battery energy storage systems (BESS) is crucial for grid stability and renewable energy integration, with Calpine actively developing projects like a 300 MW / 1,200 MWh facility in Texas, highlighting the growing importance of storage solutions.

Digitalization and smart grid technologies are optimizing Calpine's operations through advanced analytics and control systems, supporting the integration of variable renewables. Global smart grid investment is projected to surpass $60 billion in 2024, emphasizing the trend towards more intelligent grid infrastructure.

Carbon Capture and Storage (CCS) technologies are becoming increasingly vital for mitigating emissions from natural gas power generation, with Calpine pursuing projects supported by government funding, such as at its Baytown facility.

| Technology | Impact on Calpine | Key Data/Trend |

|---|---|---|

| Advanced Gas Turbines | Increased efficiency, reduced emissions, hydrogen blending capability | GE HA turbines >64% efficiency |

| Battery Energy Storage Systems (BESS) | Enhanced grid stability, renewable integration, dispatchability | Calpine's 300 MW / 1,200 MWh Texas project |

| Digitalization & Smart Grid | Optimized operations, improved asset management, better renewable integration | Global smart grid investment >$60 billion (2024) |

| Carbon Capture & Storage (CCS) | Emissions reduction for natural gas fleet | US Dept. of Energy supported projects |

Legal factors

Calpine's operations are heavily influenced by environmental regulations, particularly those concerning greenhouse gas emissions and air pollutants. The U.S. Environmental Protection Agency (EPA) finalized new rules in April and May 2024, impacting emissions standards for power plants. These regulations, however, are subject to ongoing reconsideration and legal challenges, creating a dynamic compliance landscape for Calpine.

The permitting and licensing processes for new power plant construction and modifications are intricate and time-consuming, directly impacting project schedules and overall expenses for companies like Calpine. These hurdles can significantly influence the feasibility and profitability of new energy infrastructure development.

In 2024, the U.S. Department of Energy reported that grid interconnection backlogs for new renewable energy projects reached an average of 5 years in some regions, highlighting the substantial delays developers face, which also affects traditional power generation projects requiring grid integration.

Federal Energy Regulatory Commission (FERC) rules are a significant factor for Calpine, impacting its operations in wholesale electricity markets, transmission, and natural gas pipelines. FERC's oversight directly shapes the competitive landscape and infrastructure development within these critical energy sectors.

Recently, FERC has implemented temporary waivers to streamline the approval process for new natural gas infrastructure, a move that could accelerate projects relevant to Calpine's fuel supply. Simultaneously, the commission is actively reviewing its interconnection rules, which could influence how Calpine connects its power generation facilities to the grid.

Land Use and Siting Laws

Land use and siting laws present significant hurdles for geothermal development, particularly concerning the extensive drilling operations required. These regulations dictate where power plants can be built and how land can be utilized, directly impacting project feasibility and timelines. Navigating these complex legal frameworks is crucial for successful project execution.

Geothermal projects must meticulously adhere to permitting and licensing processes, which can be lengthy and multifaceted. For instance, in California, the California Energy Commission (CEC) plays a key role in siting thermal power plants, ensuring compliance with environmental and land-use requirements. The Bureau of Land Management (BLM) also oversees leasing and development on federal lands, often a critical component for geothermal resources.

- Permitting Complexity: Geothermal projects require a range of permits, including environmental impact assessments, drilling permits, and operational licenses, often involving multiple state and federal agencies.

- Siting Restrictions: Laws often designate specific zones for industrial development, potentially limiting access to prime geothermal resources due to proximity to residential areas, protected habitats, or agricultural land.

- Legal Challenges: Disputes over land use, environmental impacts, or procedural compliance can lead to litigation, delaying projects and increasing costs. For example, challenges to environmental reviews have historically impacted energy infrastructure projects.

- Regulatory Evolution: Land use and siting regulations are subject to change, requiring developers to stay abreast of evolving legal landscapes to maintain compliance and project viability.

Corporate Governance and Reporting Requirements

Calpine operates under a framework of corporate governance, necessitating adherence to evolving reporting standards. These include growing demands for transparency in environmental, social, and governance (ESG) metrics, a trend that intensified through 2024 and is projected to continue into 2025.

The company's commitment to ESG is demonstrated by its continued focus and reporting, with its 2021 sustainability report serving as a baseline. This ongoing emphasis on ESG performance is critical for investor relations and regulatory compliance in the current financial landscape.

- Corporate Governance: Calpine must maintain robust internal controls and ethical business practices to meet stakeholder expectations and regulatory mandates.

- Reporting Requirements: Adherence to Securities and Exchange Commission (SEC) filings and other disclosures remains paramount, with increasing scrutiny on ESG data.

- ESG Focus: Continued publication and refinement of sustainability reports, reflecting performance on environmental impact, social responsibility, and governance structures, are key.

- Investor Expectations: Meeting the data-driven demands of investors for quantifiable ESG performance metrics is essential for capital access and valuation.

Calpine's legal landscape is shaped by evolving environmental regulations, particularly concerning emissions, which saw new EPA rules finalized in spring 2024. These regulations, however, face ongoing legal challenges, creating uncertainty for compliance. Furthermore, FERC's oversight of wholesale electricity markets and transmission significantly impacts Calpine's operational framework and competitive positioning.

Environmental factors

The intensifying global and national commitment to tackling climate change and achieving decarbonization is a significant driver impacting the energy sector. This translates into increased demand for cleaner energy alternatives and heightened regulatory scrutiny for traditional fossil fuel power generation facilities.

Calpine is strategically positioned to navigate this evolving landscape. As a leading independent power producer, the company is instrumental in facilitating the energy transition. This involves not only supplying sustainable and dependable power but also effectively integrating variable renewable energy sources into the grid.

For instance, as of early 2024, the U.S. aims to achieve a 50-52% reduction in greenhouse gas emissions below 2005 levels by 2030, a target reinforced by initiatives like the Inflation Reduction Act, which offers substantial incentives for clean energy development. Calpine's investments in natural gas and its growing portfolio of renewable assets, including solar and storage, directly align with these policy objectives, demonstrating its commitment to a lower-carbon future.

Water availability and evolving regulations significantly impact Calpine's operations, particularly its natural gas facilities which require substantial water for cooling. The U.S. Environmental Protection Agency (EPA) introduced new, more stringent wastewater management regulations in 2024, directly affecting power plant discharge standards and potentially increasing compliance costs.

While the risk of seismic activity from geothermal operations is generally low, advanced geothermal systems, particularly enhanced geothermal systems (EGS), do present a potential environmental concern. This necessitates rigorous monitoring protocols and transparent communication with the public regarding any induced seismicity. For instance, in the past, projects in regions like the Geysers in California have experienced minor seismic events, prompting increased scrutiny and research into mitigation strategies.

However, the geothermal industry is actively innovating. Next-generation geothermal technologies are in development, aiming to significantly reduce the risk of induced seismicity. These advancements include improved reservoir stimulation techniques and real-time seismic monitoring systems, which are crucial for maintaining public trust and ensuring the long-term viability of geothermal energy projects, especially as the sector aims to expand its contribution to the clean energy mix, targeting substantial growth by 2030.

Natural Resource Availability (Natural Gas)

Calpine's core business relies heavily on the availability of natural gas. The accessibility and cost of this crucial fuel directly impact its profitability and operational capacity. Recent projections indicate a positive trend for the U.S. natural gas market.

U.S. marketed natural gas production is anticipated to see an increase in 2025 when compared to 2024 figures, suggesting a stable or improving supply outlook for companies like Calpine. This growing production is a key environmental factor influencing the energy sector.

- Natural Gas as a Primary Fuel: Calpine's power generation facilities are largely fueled by natural gas, making its availability paramount.

- Projected Production Growth: U.S. marketed natural gas production is expected to rise in 2025 versus 2024, supporting operational needs.

- Impact on Operational Costs: Fluctuations in natural gas prices, driven by availability, directly affect Calpine's cost of electricity generation.

Land Use and Biodiversity Impact

The physical presence of power generation facilities and their supporting networks, like pipelines and transmission lines, undeniably impacts land use patterns and can affect local ecosystems. This is a crucial consideration for any energy company, including Calpine.

However, the evolving landscape of energy production, particularly with the advancements in next-generation geothermal technology, suggests a potentially more favorable environmental footprint. Estimates indicate that these advanced geothermal systems could require substantially less land area per megawatt of capacity when compared to other renewable energy sources such as large-scale solar farms or extensive wind turbine installations.

For instance, while a typical utility-scale solar project might occupy 5-10 acres per megawatt, and a wind farm can require even more distributed acreage, emerging geothermal designs aim for a significantly reduced surface footprint. This efficiency in land utilization is a key environmental advantage that Calpine can leverage as it explores and expands its geothermal portfolio.

- Reduced Land Footprint: Next-generation geothermal technology is projected to demand considerably less land per megawatt than solar or wind power.

- Infrastructure Impact: The construction of power plants and associated infrastructure, such as transmission lines, necessitates careful land management to minimize biodiversity disruption.

- Ecosystem Considerations: Careful site selection and operational practices are vital to mitigate the impact on local flora and fauna, a growing concern for energy providers.

The push for decarbonization and climate change mitigation significantly influences the energy sector, driving demand for cleaner alternatives and increasing regulatory scrutiny on fossil fuels. Calpine's strategy, including investments in natural gas and renewables like solar and storage, aligns with U.S. emission reduction targets, such as the goal for a 50-52% reduction below 2005 levels by 2030, supported by the Inflation Reduction Act.

Water availability and stricter EPA wastewater regulations introduced in 2024 directly impact Calpine's operations, potentially increasing compliance costs for its natural gas facilities. While advanced geothermal systems have a low risk of seismic activity, ongoing monitoring and public transparency are crucial, especially considering past minor seismic events in areas like The Geysers, California.

Calpine's reliance on natural gas is supported by projections of increased U.S. marketed production in 2025 compared to 2024, ensuring a stable fuel supply. Furthermore, next-generation geothermal technology promises a reduced land footprint compared to solar or wind, minimizing environmental impact and supporting efficient land use for energy generation.

PESTLE Analysis Data Sources

Calpine's PESTLE Analysis draws from a comprehensive blend of official government reports, leading economic databases, and respected industry publications. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the energy sector.