Calpine Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calpine Bundle

Calpine's marketing success hinges on a carefully orchestrated blend of Product, Price, Place, and Promotion. This analysis delves into how their diverse energy generation portfolio, strategic pricing models, and broad distribution network contribute to their market leadership. Discover the specific promotional strategies that resonate with their target audiences.

Unlock the full potential of Calpine's marketing strategy with our comprehensive 4Ps analysis. Go beyond the surface and gain actionable insights into their product offerings, pricing architecture, distribution channels, and promotional tactics. This ready-to-use report is perfect for professionals and students seeking a competitive edge.

Product

Calpine's wholesale power generation primarily utilizes a diverse fleet of natural gas-fired and geothermal power plants. This robust portfolio includes baseload, intermediate, and peaking facilities, strategically positioned to address fluctuating customer demands and maintain grid stability. In 2024, Calpine operated approximately 25,000 megawatts of generation capacity across the United States, with natural gas accounting for the majority of its output.

Calpine's offering extends beyond simply generating electricity; they are a critical provider of capacity and ancillary services. These services are essential for maintaining the stability and reliability of the power grid, especially as the energy landscape shifts.

These services are vital for integrating renewable energy sources. Calpine's plants can rapidly adjust their output, either ramping up or scaling back, to compensate for the intermittent nature of wind and solar power. This balancing act ensures a consistent power supply, making them indispensable for the ongoing energy transition.

In 2023, Calpine's capacity and ancillary services played a significant role in grid operations. For instance, their flexible generation fleet helped manage grid congestion and voltage support, contributing to the overall efficiency of the power system. This capability is increasingly valuable as renewable penetration grows.

Calpine's retail energy solutions, delivered through subsidiaries like Calpine Energy Solutions and Champion Energy Services, cater to a broad customer base including residential, commercial, industrial, and governmental sectors. These offerings are designed to be flexible, addressing diverse energy needs.

A key aspect of Calpine's retail strategy involves providing specialized products such as custom carbon roadmap solutions and carbon-differentiated energy options. This focus helps customers actively pursue and achieve their environmental and sustainability objectives.

For instance, as of early 2024, the demand for green energy solutions continues to climb, with many businesses setting ambitious net-zero targets. Calpine's tailored carbon solutions directly address this growing market need, positioning them as a partner in sustainability for their clients.

Battery Storage Solutions

Calpine is making substantial investments in battery energy storage systems (BESS) to bolster grid flexibility and facilitate the integration of renewable energy sources. This strategic focus is evident in their development of projects like the Nova Power Bank in California, a significant battery storage facility designed to support the grid during peak demand periods. By 2024, Calpine had already deployed a considerable amount of BESS capacity, with plans for further expansion throughout 2025, aiming to enhance grid reliability and support the transition to cleaner energy. This commitment positions Calpine as a key player in the evolving energy landscape, leveraging advanced storage technologies to meet future energy needs.

The Nova Power Bank, a flagship project for Calpine, exemplifies their dedication to advanced energy storage solutions. This facility boasts a substantial capacity, capable of powering a significant number of homes for several hours during peak demand. As of early 2025, Calpine's BESS portfolio has grown to include multiple projects across key markets, contributing to grid stability and the efficient dispatch of renewable energy. These investments underscore the critical role of battery storage in modernizing the power grid and achieving decarbonization goals.

- Calpine's BESS Investment: Significant capital allocation towards battery energy storage systems (BESS) to improve grid flexibility and renewable integration.

- Nova Power Bank Project: A key initiative in California showcasing Calpine's commitment to advanced energy storage, capable of powering homes during peak demand.

- Capacity Growth: Continued expansion of BESS capacity through 2024 and into 2025, enhancing grid reliability and supporting clean energy.

- Market Position: Establishing Calpine as a leader in leveraging battery storage technology for a modernized and decarbonized energy system.

Carbon Capture and Sequestration (CCS) Initiatives

Calpine's commitment to reducing its environmental footprint is evident in its significant investments in Carbon Capture and Sequestration (CCS) technologies. This strategic focus aligns with the growing demand for cleaner energy solutions and positions Calpine as a leader in sustainable power generation.

Initiatives like the Baytown and Sutter Decarbonization Projects are prime examples of Calpine's dedication. These projects are designed to capture a substantial portion of CO2 emissions, showcasing a tangible effort to mitigate climate impact. For instance, the Baytown project alone aims to capture approximately 90% of the CO2 from its natural gas plant.

The financial implications of these CCS projects are substantial, reflecting the scale of Calpine's commitment. While specific investment figures can vary, large-scale CCS projects often require billions of dollars in upfront capital. Calpine's pursuit of these ventures underscores a long-term strategy to integrate carbon reduction into its core business model.

- Baytown CCS Project: Targets capturing around 2 million metric tons of CO2 annually.

- Sutter Energy Center CCS: Aims to capture a significant percentage of its CO2 emissions, contributing to cleaner operations.

- Technological Advancement: Calpine actively explores and invests in cutting-edge CCS technologies to enhance efficiency and scalability.

- Market Positioning: These initiatives strengthen Calpine's market position by meeting evolving regulatory requirements and investor expectations for environmental responsibility.

Calpine's product is multifaceted, encompassing wholesale electricity generation, capacity, and ancillary services. They leverage a diverse fleet, primarily natural gas and geothermal, to meet fluctuating grid demands. Beyond basic power, Calpine offers crucial grid stabilization services, essential for integrating renewables. Their retail arm provides tailored energy solutions, including carbon management, to a wide customer base.

| Product Aspect | Description | Key Data/Facts (2024/2025) |

|---|---|---|

| Wholesale Power Generation | Electricity supplied to the grid from Calpine's diverse generation fleet. | Operated ~25,000 MW capacity in 2024, predominantly natural gas. |

| Capacity & Ancillary Services | Services ensuring grid stability, reliability, and flexibility. | Vital for balancing intermittent renewables; supported grid congestion and voltage in 2023. |

| Retail Energy Solutions | Customized energy offerings for residential, commercial, industrial, and governmental clients. | Includes carbon roadmap solutions and green energy options, meeting growing net-zero targets. |

| Battery Energy Storage Systems (BESS) | Investments in BESS to enhance grid flexibility and renewable integration. | Significant deployment by early 2025, with ongoing expansion plans for 2025. Nova Power Bank in California is a key project. |

| Carbon Capture and Sequestration (CCS) | Investment in CCS technologies to reduce environmental footprint. | Projects like Baytown aim to capture ~90% of CO2 from natural gas plants. |

What is included in the product

This analysis offers a comprehensive examination of Calpine's marketing strategies, dissecting its Product, Price, Place, and Promotion elements with real-world examples and strategic insights.

It's designed for professionals seeking a detailed understanding of Calpine's market positioning, providing a solid foundation for strategic planning and competitive benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for swift decision-making.

Place

Calpine's direct sales strategy targets major energy purchasers like utilities, cooperatives, and retail electric providers. This approach streamlines the delivery of wholesale power, capacity, and ancillary services directly to these large-scale consumers.

In 2024, Calpine's extensive portfolio, including approximately 23,000 megawatts of clean and natural gas power generation capacity, is positioned to meet the direct demand from these key market players across North America.

Calpine's extensive presence in competitive power markets, spanning 22 U.S. states, Canada, and Mexico, is a cornerstone of its strategy. This broad geographic reach, covering diverse regional demands and market signals, allows for significant operational flexibility and market responsiveness.

Calpine actively participates in wholesale electricity markets, distributing its power and services through these crucial channels. This strategy involves direct sales to entities like the Electric Reliability Council of Texas (ERCOT), a major independent system operator in Texas. In 2024, ERCOT's peak demand reached over 80,000 megawatts, highlighting the significant scale of these wholesale operations.

Furthermore, Calpine is exploring and engaging with other vital regional wholesale market operators, such as PJM Interconnection. PJM, serving 13 states and the District of Columbia, is one of the largest electricity markets in the United States. Calpine's involvement in these markets is essential for ensuring grid reliability and meeting the diverse energy needs of millions of consumers.

Retail Subsidiaries and Online Platforms

Calpine utilizes its retail subsidiaries, such as Calpine Energy Solutions and Champion Energy Services, to directly engage with customers across residential, commercial, and industrial sectors. These subsidiaries operate distinct sales channels, increasingly incorporating online platforms to enhance accessibility and customer interaction.

These platforms are crucial for customer acquisition and service delivery. For instance, Champion Energy Services reported serving over 2.3 million residential customer equivalents in Texas as of early 2024, highlighting the significant reach of their retail operations.

- Customer Reach: Calpine Energy Solutions and Champion Energy Services cater to a broad customer base, from individual homes to large industrial facilities.

- Sales Channels: Both subsidiaries employ direct sales forces and leverage online portals for customer onboarding and management.

- Digital Presence: Online platforms are increasingly vital for marketing, customer service, and account management, reflecting a broader industry trend towards digital engagement.

- Market Penetration: Champion Energy Services' substantial customer base in key markets demonstrates the effectiveness of their retail strategy.

Strategic Power Plant Locations

Calpine's physical assets are a cornerstone of its market presence, with a robust network of 75 natural gas-fired and geothermal power plants. These facilities are not randomly placed; they are strategically positioned to maximize efficiency in both generating electricity and distributing it across various markets. This deliberate placement ensures Calpine can effectively serve a broad customer base with reliable energy.

The company's commitment to expanding its physical footprint is evident in its ongoing development of new sites, including crucial battery storage facilities. As of early 2024, Calpine was actively developing over 600 MW of battery storage capacity across several states, demonstrating a forward-looking approach to energy infrastructure. This expansion enhances grid stability and provides flexible energy solutions, complementing its traditional power generation capabilities.

- Strategic Network: Calpine operates 75 natural gas-fired and geothermal power plants, strategically located for optimal generation and distribution.

- Geographic Reach: This extensive network ensures widespread access to Calpine's energy products across key market regions.

- Future Investments: Development of new battery storage sites, totaling over 600 MW in early 2024, highlights a commitment to modernizing and expanding its physical asset base.

Calpine's physical presence is defined by its strategically located power generation facilities and expanding battery storage network. These assets are situated to efficiently serve diverse wholesale and retail markets across North America, ensuring reliable energy delivery.

The company's 75 natural gas-fired and geothermal plants, as well as over 600 MW of battery storage capacity under development by early 2024, underscore its commitment to a robust and adaptable infrastructure.

This extensive physical network allows Calpine to participate effectively in competitive power markets and directly supply large energy consumers, reinforcing its market position.

| Asset Type | Count/Capacity | Key Regions Served |

|---|---|---|

| Natural Gas-Fired Power Plants | Approximately 75 | 22 U.S. States, Canada, Mexico |

| Geothermal Power Plants | Included within 75 | 22 U.S. States, Canada, Mexico |

| Battery Storage Capacity (Under Development) | Over 600 MW (as of early 2024) | Multiple U.S. States |

What You See Is What You Get

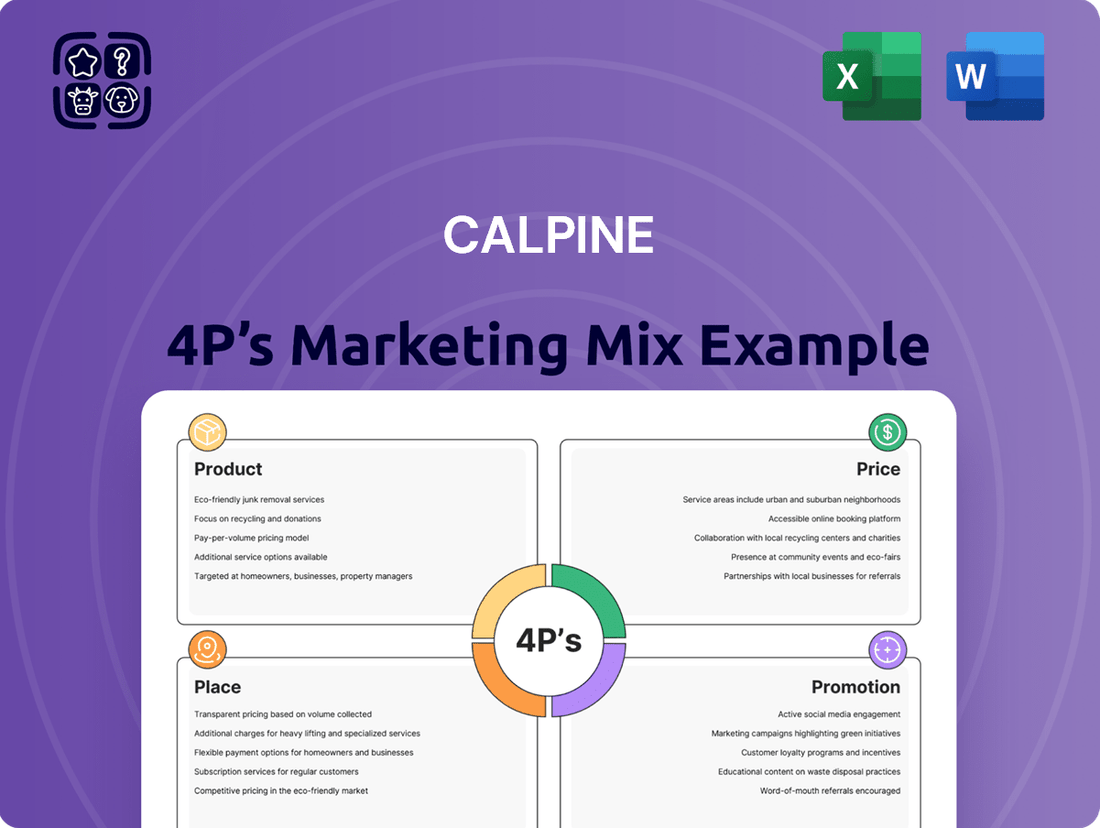

Calpine 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Calpine 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to actionable insights and a thorough breakdown of Calpine's market approach.

Promotion

Calpine's promotional efforts heavily focus on direct engagement with its significant commercial, industrial, and governmental clientele. This approach is often facilitated through its specialized retail divisions, such as Calpine Energy Solutions.

This direct interaction enables Calpine to offer customized energy solutions precisely tailored to the unique needs and sustainability objectives of these large clients. It fosters clear communication channels for discussing intricate energy management strategies.

For instance, in 2024, Calpine Energy Solutions reported a 15% increase in customized energy efficiency projects for industrial clients, highlighting the effectiveness of this direct engagement model in addressing specific client requirements.

Calpine actively engages in industry conferences and trade shows, a crucial element for its B2B marketing. These events allow direct interaction with potential clients like utilities and large industrial users, fostering relationships and demonstrating their capabilities. For instance, participation in events like the Edison Electric Institute (EEI) Annual Convention or the Powering America’s Future summit in 2024 provides a platform to showcase their generation portfolio and energy solutions.

Calpine prominently features its dedication to environmental stewardship, highlighting its role as a significant producer of clean energy from natural gas and geothermal sources. This commitment is a core element of their promotional strategy, aiming to attract environmentally conscious investors and stakeholders.

Their annual sustainability reports serve as a key communication tool, detailing progress in decarbonization and the broader clean energy transition. For instance, Calpine's 2023 sustainability report noted a 20% reduction in greenhouse gas intensity compared to their 2019 baseline, underscoring tangible environmental leadership.

Public Relations and Regulatory Advocacy

Calpine actively engages in public relations and regulatory advocacy to influence energy policy, emphasizing its critical role in grid reliability and the ongoing energy transition. This strategic approach aims to shape the narrative around the company's contributions to a cleaner energy future.

The company champions policies designed to reduce carbon emissions, aligning its advocacy with broader environmental goals. This includes supporting initiatives that foster the development and deployment of low-carbon energy sources, underscoring a commitment to sustainability.

Calpine also actively participates in discussions concerning resource adequacy, ensuring that the energy infrastructure can meet demand reliably. For instance, in 2024, Calpine highlighted its role in providing essential capacity to grids facing increased strain due to extreme weather events, often requiring significant generation output to maintain stability.

- Policy Support: Calpine advocates for policies that facilitate emissions reductions and support grid reliability.

- Energy Transition: The company positions itself as a key player in the shift towards cleaner energy sources.

- Resource Adequacy: Calpine contributes to discussions and actions ensuring sufficient energy supply, particularly during peak demand periods.

- Stakeholder Engagement: Through PR and advocacy, Calpine aims to build trust and understanding with policymakers and the public regarding its operations and strategic direction.

Digital Presence and Investor Communications

Calpine actively manages its digital footprint, primarily through its corporate website and dedicated investor relations portal. This digital hub serves as a critical conduit for disseminating timely information, including recent news, comprehensive financial reports, and updates on operational performance and strategic endeavors. For instance, as of their Q1 2024 earnings report, Calpine highlighted ongoing investments in renewable energy projects, information readily accessible on their investor site.

This robust digital presence ensures that all stakeholders, from individual investors to financial professionals, remain well-informed about Calpine's trajectory. The platform provides transparency regarding the company's financial health and strategic vision, fostering trust and engagement. In 2023, Calpine reported significant progress in expanding its clean energy generation capacity, a key strategic initiative detailed on their investor communications channels.

- Corporate Website: Serves as the primary source for company information, news releases, and SEC filings.

- Investor Relations Portal: Offers dedicated sections for financial reports, presentations, and webcasts.

- Transparency: Provides stakeholders with real-time access to performance data and strategic updates.

- Engagement: Facilitates two-way communication and information dissemination to a broad audience.

Calpine's promotional strategy emphasizes direct client engagement and digital transparency. By focusing on customized solutions for large clients through divisions like Calpine Energy Solutions, they foster strong B2B relationships. Their digital platforms, including the corporate website and investor relations portal, ensure stakeholders have access to crucial performance and strategic information.

Calpine actively participates in industry events, showcasing its generation portfolio and energy solutions to potential clients like utilities and industrial users. For instance, their presence at key 2024 energy summits facilitated direct interaction and relationship building. This outreach complements their digital presence, offering a multi-faceted approach to promotion.

The company also highlights its commitment to environmental stewardship, particularly its role as a major producer of clean energy. This narrative is reinforced through sustainability reports, such as their 2023 report noting a 20% greenhouse gas intensity reduction since 2019, appealing to environmentally conscious stakeholders.

Furthermore, Calpine engages in public relations and regulatory advocacy to shape energy policy, emphasizing grid reliability and their contribution to the energy transition. This includes supporting policies for emissions reductions and participating in discussions on resource adequacy, as demonstrated by their 2024 emphasis on providing essential capacity during peak demand periods.

| Promotional Tactic | Focus Area | 2024/2025 Data/Examples |

|---|---|---|

| Direct Client Engagement | Customized Solutions for Large Clients | Calpine Energy Solutions reported a 15% increase in customized energy efficiency projects for industrial clients in 2024. |

| Industry Events | B2B Relationship Building & Capability Showcase | Participation in EEI Annual Convention and Powering America’s Future summit in 2024. |

| Digital Presence | Information Dissemination & Stakeholder Engagement | Q1 2024 earnings report highlighted clean energy investments on investor site; 2023 progress in clean energy capacity expansion detailed online. |

| Sustainability Communication | Environmental Stewardship & Clean Energy Leadership | 2023 sustainability report noted a 20% reduction in greenhouse gas intensity compared to a 2019 baseline. |

| PR & Regulatory Advocacy | Policy Influence & Grid Reliability Emphasis | Highlighted role in providing essential capacity to grids facing strain from extreme weather events in 2024. |

Price

Calpine's wholesale market pricing strategy involves selling power, capacity, and ancillary services at prevailing market rates within competitive power markets. This approach directly ties profitability to the ebb and flow of supply and demand. For instance, during periods of high demand, such as the summer of 2024 with record-breaking heatwaves in several regions, Calpine could command significantly higher prices for its energy output, boosting revenue.

However, this reliance on market dynamics also introduces considerable risk. When demand is low or supply is abundant, prices can fall sharply, impacting Calpine's earnings. The company's ability to navigate these fluctuations, particularly in markets like ERCOT or PJM, where price volatility is a known factor, is crucial for its financial performance.

Calpine's strategy heavily relies on long-term contracts and Power Purchase Agreements (PPAs) with major clients like utilities and retail power providers. These agreements are crucial for securing predictable revenue streams for Calpine and offering rate stability to its customers, often spanning a decade or more.

For instance, as of early 2024, Calpine's portfolio includes a significant portion of its generation capacity under long-term contracts, providing a substantial base of contracted revenue that insulates it from short-term market volatility.

These PPAs are a cornerstone of Calpine's pricing strategy, enabling them to lock in rates and ensure consistent cash flow, which is vital for long-term financial planning and investment in new generation assets.

Calpine Energy Solutions, through its retail arms, provides tailored pricing for its commercial, industrial, and institutional customers. This flexibility allows businesses to select contract structures that best align with their risk tolerance and budget, a key aspect of their product strategy.

Clients can choose from various pricing models, including fixed-price contracts for predictable budgeting, blend-and-extend options to manage price volatility, and market participation strategies for those seeking to capitalize on fluctuating energy markets. This customization is crucial for managing energy costs effectively.

For instance, in 2024, businesses leveraging these customized options could have seen significant savings compared to standard variable rates, especially during periods of high market volatility. Calpine's approach aims to empower clients by giving them control over their energy expenditures and associated risks.

Value-Based Pricing for Ancillary Services

Calpine’s pricing for ancillary services is strategically set to reflect the significant value these services bring to grid stability, particularly as intermittent renewables like solar and wind become more prevalent. This approach ensures that the market recognizes the critical role Calpine’s flexible generation assets play in maintaining a reliable power supply.

The value-based pricing model directly correlates with the rapid response and operational flexibility Calpine offers, essential for balancing supply and demand in real-time. This is crucial for grid operators managing the inherent variability of renewable energy sources.

For instance, in 2024, the increasing penetration of renewables necessitated greater reliance on fast-ramping generation. Calpine's capacity to provide services like frequency regulation, which adjusts output within seconds, commands a premium under this value-based framework. The company's strategic asset portfolio, including fast-starting natural gas plants, positions it to capture this value.

- Grid Stability Contribution: Ancillary services are priced based on their direct impact on maintaining grid voltage and frequency, a function becoming more critical with higher renewable integration.

- Flexibility Premium: Calpine’s ability to quickly adjust generation output to compensate for renewable intermittency is a key driver of its value-based pricing for these services.

- Market Demand: The growing demand for grid balancing services, driven by renewable energy growth, underpins the pricing power of providers like Calpine.

- Operational Efficiency: The cost-effectiveness of Calpine’s flexible assets in providing these essential services further supports its value-based pricing strategy.

Competitive and Cost-Effective Generation

Calpine emphasizes its competitive pricing, driven by the high efficiency of its combined-cycle natural gas plants. This operational advantage, coupled with strategic access to cost-effective natural gas supplies, allows them to be a low-cost producer in the wholesale electricity market.

This cost leadership translates directly into competitive wholesale electricity prices for customers. For instance, in early 2024, natural gas prices remained relatively stable, supporting Calpine's ability to maintain its cost advantage. Their fleet's efficiency, often exceeding 60% thermal efficiency for modern combined-cycle units, significantly reduces fuel costs per megawatt-hour generated compared to older, less efficient technologies.

- Fleet Efficiency: Calpine's combined-cycle plants boast thermal efficiencies often above 60%, reducing fuel consumption.

- Natural Gas Access: Strategic sourcing and transportation agreements ensure access to affordable natural gas, a key cost driver.

- Wholesale Market Competitiveness: Lower generation costs enable Calpine to offer attractive prices in wholesale electricity markets.

- Cost Advantage: In 2023, Calpine reported that its natural gas fleet was among the lowest-cost providers in many of the regions it operates.

Calpine’s pricing strategy is multifaceted, balancing wholesale market dynamics with tailored customer solutions and value-based ancillary services. Their competitive edge stems from efficient, low-cost generation assets, particularly their combined-cycle natural gas fleet, which as of early 2024, maintained a cost advantage due to stable natural gas prices and high thermal efficiencies often exceeding 60%.

This efficiency allows Calpine to offer competitive prices in wholesale markets, while long-term contracts and Power Purchase Agreements (PPAs) provide revenue stability, with a significant portion of their capacity contracted through 2024. Furthermore, their retail energy solutions offer flexible pricing models—fixed, blend-and-extend, and market participation—empowering commercial and industrial clients to manage energy costs and risks effectively.

For ancillary services, Calpine employs value-based pricing, reflecting the critical role of their flexible generation in grid stability, especially with increasing renewable penetration. The demand for services like frequency regulation, which Calpine's fast-ramping assets excel at, commands a premium, a trend amplified in 2024 as grid operators managed greater renewable intermittency.

4P's Marketing Mix Analysis Data Sources

Our Calpine 4P's Marketing Mix Analysis is constructed using a comprehensive review of publicly available information, including company reports, investor communications, and industry publications. We meticulously gather data on Calpine's product offerings, pricing strategies, distribution channels, and promotional activities to provide an accurate market perspective.