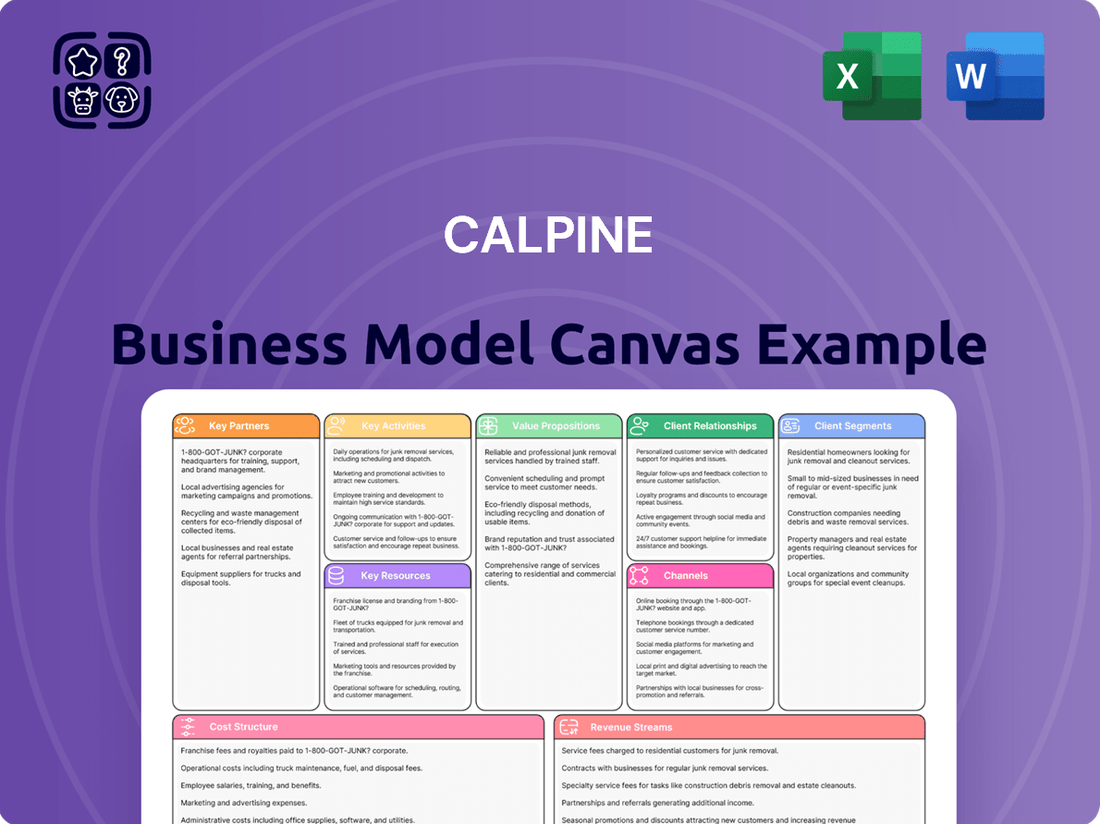

Calpine Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calpine Bundle

Unlock the strategic DNA of Calpine's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals how Calpine effectively manages its key resources, cultivates vital partnerships, and delivers its unique value proposition to diverse customer segments. For anyone seeking to understand the drivers of success in the energy sector, this is an indispensable tool.

Partnerships

Energy Capital Partners (ECP), Access Industries, and CPP Investments, as Calpine's owners since its 2018 privatization, are crucial partners. Their backing provides significant financial flexibility, enabling strategic investments in Calpine's generation fleet and growth initiatives.

These investment firms' influence extends to Calpine's long-term strategy, including potential future exit paths like a sale or initial public offering. Their involvement shapes the company's capital structure and operational priorities, impacting its ability to navigate the evolving energy market.

Constellation Energy's impending acquisition of Calpine, slated for regulatory approval in 2025, is a pivotal development. This strategic move is set to forge a dominant force in clean and dependable energy, significantly reshaping Calpine's operational landscape and competitive standing.

Calpine's partnership with ExxonMobil is a cornerstone of its decarbonization strategy, focusing on carbon capture and storage (CCS). This collaboration is designed to transport and permanently store carbon dioxide (CO2) emissions generated from Calpine's natural gas power plants. This initiative directly supports Calpine's commitment to offering low-carbon electricity solutions.

Department of Energy (DOE)

Calpine's collaboration with the Department of Energy (DOE) is a cornerstone of its strategy to pioneer and deploy advanced clean energy solutions. These partnerships are crucial for de-risking and scaling innovative technologies like carbon capture and sequestration (CCS).

Through cost-sharing agreements, Calpine is advancing commercial-scale CCS demonstrations, notably the Sutter and Baytown Decarbonization Projects. These initiatives are critical for validating and commercializing technologies that significantly reduce the environmental footprint of power generation.

- DOE Cost-Sharing: Calpine has secured significant cost-sharing agreements with the DOE, enabling the progression of large-scale CCS projects.

- Technology Advancement: These partnerships are vital for driving the development and deployment of Calpine's clean energy technologies, particularly in carbon capture.

- Environmental Impact Reduction: The collaboration directly supports Calpine's commitment to reducing its environmental impact and contributing to decarbonization goals.

- Project Milestones: Projects like Sutter and Baytown represent key milestones in demonstrating the viability of CCS at a commercial level, with significant progress reported through 2024.

Data Center Developers (e.g., CyrusOne)

Calpine is actively forging key partnerships with prominent data center developers, recognizing the symbiotic relationship between reliable power generation and the burgeoning digital infrastructure sector. These collaborations are crucial for meeting the escalating electricity needs of modern data centers, particularly those supporting artificial intelligence workloads.

A prime example of this strategy is Calpine's agreement with CyrusOne, a leading developer of hyperscale data centers. This specific deal, involving a 190-megawatt dedicated power supply in Texas, underscores Calpine's commitment to securing long-term power purchase agreements that align with the predictable, high-demand profiles of these facilities. Such arrangements are vital for ensuring grid stability and providing the consistent power required for uninterrupted data center operations.

- Strategic Alignment: Calpine's partnerships with data center developers like CyrusOne are designed to capitalize on the significant growth in electricity demand driven by AI and cloud computing.

- Dedicated Power Solutions: The company is securing agreements for dedicated power and grid connections, such as the 190-megawatt deal with CyrusOne in Texas, to serve these high-consumption facilities.

- Market Responsiveness: These collaborations demonstrate Calpine's ability to adapt to evolving market needs, directly addressing the power challenges faced by the rapidly expanding data center industry.

Calpine's key partnerships are foundational to its strategic objectives, particularly in clean energy and data center power solutions. The impending acquisition by Constellation Energy in 2025 is a major development, poised to create a leader in clean energy. Collaborations with the Department of Energy are critical for advancing carbon capture and storage (CCS) technologies, with cost-sharing agreements supporting projects like Sutter and Baytown, demonstrating progress through 2024.

Furthermore, Calpine is actively partnering with data center developers, such as CyrusOne, to meet the growing demand for reliable power, exemplified by a 190-megawatt deal in Texas. These alliances are vital for ensuring grid stability and supporting the power-intensive needs of AI and cloud infrastructure.

| Partner Type | Key Partners | Strategic Focus | Key Developments (2024/2025) | Impact |

| Ownership | Energy Capital Partners, Access Industries, CPP Investments | Financial flexibility, long-term strategy | Continued strategic oversight post-privatization | Enables investment in generation fleet and growth |

| Acquisition | Constellation Energy | Clean and dependable energy leadership | Regulatory approval anticipated in 2025 | Reshapes operational landscape and competitive standing |

| Decarbonization | ExxonMobil, Department of Energy (DOE) | Carbon Capture and Storage (CCS) | Advancing Sutter and Baytown CCS projects; DOE cost-sharing agreements | De-risks and scales clean energy technologies |

| Data Centers | CyrusOne | Dedicated power for hyperscale data centers | 190 MW dedicated power supply agreement in Texas | Meets escalating electricity needs for AI workloads, ensures grid stability |

What is included in the product

A detailed breakdown of Calpine's power generation and retail energy services, focusing on their key customer segments, value propositions, and revenue streams.

Calpine's Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of their complex energy generation and retail operations.

It simplifies the understanding of their diverse revenue streams and customer segments, making strategic planning and problem-solving more efficient.

Activities

Calpine's primary function is the efficient management and operation of its extensive network of power generation facilities, predominantly natural gas-fired and geothermal plants located throughout North America. This operational focus is crucial for delivering a steady and dependable flow of electricity to a wide array of regional markets.

In 2024, Calpine continued to leverage its operational expertise, managing a portfolio that generated significant capacity. For instance, as of the first quarter of 2024, the company operated approximately 25,000 megawatts of generating capacity, underscoring its substantial role in the North American energy landscape.

Calpine's core activity is generating electricity and then selling it on the wholesale market. They also offer capacity and ancillary services, which are crucial for grid stability, to various buyers. This means Calpine is a major player in the energy supply chain, ensuring power reaches the grid.

To thrive, Calpine actively participates in competitive power markets. They must constantly monitor and react to market signals, like price fluctuations and demand changes, to make smart decisions about when and how much power to generate and sell. This dynamic approach helps them optimize their revenue and operational efficiency.

In 2024, Calpine's diverse portfolio, which includes natural gas, geothermal, and hydro power, positions them to meet varying market demands. For instance, their natural gas plants are highly flexible, allowing them to ramp up or down quickly to respond to real-time grid needs, a critical capability in today's evolving energy landscape.

Calpine is aggressively growing its power generation capabilities. In 2024, the company continued its expansion efforts, particularly in high-demand areas like Texas and the PJM Interconnection region, which covers a significant portion of the Eastern United States.

Beyond traditional generation, Calpine is investing heavily in future-forward solutions. This includes substantial capital allocation towards large-scale energy storage projects, crucial for grid stability and renewable integration, as well as pioneering carbon capture and storage (CCS) technology to address environmental concerns and meet evolving regulatory landscapes.

Maintaining and Optimizing Geothermal Operations

Calpine's core activity involves the meticulous maintenance and ongoing optimization of its geothermal power generation assets, notably The Geysers in California, the largest geothermal complex globally. This ensures the consistent and reliable delivery of renewable energy to the grid.

Investments in expansion and efficiency are crucial. For instance, projects like the North Geysers Incremental Development aim to enhance output from existing resources, maximizing the value of these unique assets. In 2024, Calpine continued to focus on operational excellence and strategic upgrades across its geothermal portfolio.

- Geothermal Complex Scale: Operates The Geysers, the world's largest geothermal power generation facility.

- Investment in Optimization: Continually invests in projects like North Geysers Incremental Development to boost efficiency and output.

- Renewable Energy Contribution: Provides a stable and consistent source of clean, renewable electricity.

Retail Energy Services and Customer Solutions

Calpine's retail energy services, operated through entities like Champion Energy Services and Calpine Energy Solutions, focus on delivering tailored energy solutions directly to a diverse customer base. This includes providing custom carbon roadmap solutions and carbon-differentiated products, catering to the growing demand for sustainable energy options.

These retail arms serve a range of clients, from retail power providers and utilities to other commercial and industrial entities. By offering specialized products and services, Calpine aims to empower its customers to manage their energy consumption more effectively and meet their environmental goals.

- Champion Energy Services: A key retail arm, providing electricity supply and related services to residential, commercial, and industrial customers.

- Calpine Energy Solutions: Focuses on developing and delivering innovative energy solutions, including carbon management strategies and differentiated energy products.

- Customer Focus: Services are designed to meet the specific needs of retail power providers, utilities, and other businesses seeking customized energy management and sustainability programs.

Calpine's key activities revolve around operating and maintaining its vast power generation fleet, primarily natural gas and geothermal plants. They actively participate in wholesale power markets, selling electricity, capacity, and ancillary services. Furthermore, Calpine is expanding its generation capabilities and investing in energy storage and carbon capture technologies, demonstrating a commitment to both current and future energy needs.

What You See Is What You Get

Business Model Canvas

The Calpine Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means the structure, content, and formatting are exactly as presented, ensuring no discrepancies or surprises. You'll gain full access to this comprehensive business model tool, ready for immediate use and customization after completing your transaction.

Resources

Calpine's core strength lies in its extensive portfolio of natural gas-fired power plants, representing a significant portion of its electricity generation capacity. These facilities are crucial for providing reliable and on-demand power to the grid, a key element in meeting fluctuating energy needs.

As of the first quarter of 2024, Calpine operated approximately 25,000 megawatts of generating capacity, with a substantial majority powered by natural gas. This fleet is designed for flexibility, allowing for rapid adjustments in output to balance the intermittency of renewable sources.

The dispatchable nature of these natural gas plants is vital for grid stability, ensuring power is available when and where it's needed most. This capability is increasingly valuable in a market integrating more variable renewable energy sources.

Calpine's key resources include its significant geothermal power generation capabilities. The company operates The Geysers, the world's largest geothermal electrical generation complex, demonstrating a substantial commitment to this renewable energy source.

These geothermal assets are crucial as they provide clean, baseload power, meaning they can operate continuously and reliably, unlike intermittent renewable sources like solar or wind. This consistent energy output is a valuable component of Calpine's diverse energy portfolio.

As of early 2024, Calpine's geothermal segment contributes a stable and predictable revenue stream, underscoring the strategic importance of these assets in meeting ongoing energy demands with minimal environmental impact.

Calpine's operational backbone is its roughly 2,500-strong workforce, a critical asset for its power generation business. This team brings specialized skills in running and maintaining complex power plants, ensuring reliability and safety. Their expertise is fundamental to the company's ability to generate electricity efficiently.

The company's human capital extends beyond just operations and maintenance. Calpine also employs professionals skilled in energy trading, crucial for navigating volatile markets and optimizing revenue. Furthermore, its project development teams possess the expertise needed to identify, plan, and execute new generation facilities, driving future growth.

Access to Fuel and Transmission Infrastructure

Calpine's business model hinges on secure access to fuel and robust transmission networks. Their strategically located power plants across the U.S., Canada, and Mexico ensure they can efficiently source natural gas, their primary fuel. This geographical spread also facilitates the delivery of generated electricity to a wide customer base.

Reliable fuel supply is paramount. In 2024, Calpine continued to leverage its extensive network of natural gas pipelines and storage facilities. The company's operational efficiency is directly tied to the availability and cost-effectiveness of these fuel sources.

- Fuel Sourcing: Calpine's access to natural gas is secured through long-term supply agreements and strategic pipeline interconnections.

- Transmission Networks: The company relies on an extensive network of high-voltage transmission lines to deliver power to wholesale markets.

- Geographic Diversification: Operations spanning multiple U.S. states, Canada, and Mexico mitigate risks associated with localized fuel supply or transmission constraints.

- Infrastructure Investment: Ongoing investments in maintaining and upgrading transmission interconnections are crucial for operational reliability and market access.

Financial Capital and Investment Capacity

Calpine, as a privately held entity, leverages significant investment backing to fuel its operations and expansion. This access to substantial financial capital is crucial for pursuing strategic acquisitions, undertaking new development projects, and maintaining robust ongoing operations. For instance, in 2024, Calpine's financial strength underpins its ability to invest in critical infrastructure upgrades and new energy generation capacity.

This financial capacity directly translates into a strong investment capacity, enabling Calpine to execute its growth strategies effectively. The company's financial health supports its commitment to sustainability initiatives and its role in the evolving energy landscape. Calpine's substantial backing allows for flexibility in capital allocation, ensuring resources are available for both immediate operational needs and long-term development.

- Access to substantial financial capital

- Enables strategic acquisitions and development projects

- Supports ongoing operational needs and growth initiatives

- Underpins commitment to sustainability and infrastructure investment

Calpine's key resources are its diverse power generation fleet, primarily natural gas-fired plants, and its significant geothermal operations, including The Geysers. These assets are complemented by a skilled workforce of approximately 2,500 employees, essential for operations, trading, and development. Furthermore, the company benefits from secure fuel sourcing and robust transmission networks, allowing efficient delivery of power across North America.

Value Propositions

Calpine's natural gas and geothermal power plants offer a reliable, dispatchable energy source, essential for maintaining grid stability. This capability becomes increasingly vital as more intermittent renewable sources, like solar and wind, are integrated into the power mix.

In 2024, Calpine's diverse fleet played a critical role in ensuring power availability, particularly during peak demand periods and when renewable generation faltered. For instance, their natural gas facilities can ramp up and down quickly, complementing fluctuating renewable output.

Calpine champions clean and environmentally responsible energy by leveraging advanced technologies for low-carbon power generation. This includes a significant focus on its geothermal assets, which provide a consistent and renewable energy source.

The company is actively investing in carbon capture and storage (CCS) technologies, aiming to further reduce the environmental impact of its operations. For instance, in 2024, Calpine continued to explore and implement strategies to minimize its carbon footprint across its diverse portfolio.

Calpine provides adaptable energy solutions designed to meet the dynamic demands of the power market. These offerings are crucial for integrating intermittent renewable sources, ensuring grid stability as the energy sector transforms.

In 2024, Calpine's flexible generation capacity played a vital role in balancing the grid, particularly during periods of high renewable penetration. Their natural gas plants, for instance, can ramp up and down quickly, a critical capability when solar or wind output fluctuates.

The company's commitment to flexibility is demonstrated by its investments in modernizing its fleet. This allows them to respond rapidly to grid needs, a service highly valued by utilities and grid operators seeking reliable power dispatch options.

Wholesale and Retail Market Expertise

Calpine leverages its deep understanding of both wholesale and retail energy markets to provide unparalleled value to its customers. This dual expertise allows them to offer sophisticated market insights and robust risk management strategies.

Their ability to navigate competitive power markets, coupled with their direct engagement in retail energy businesses, enables Calpine to craft customized energy products. These tailored solutions cater to the specific needs of a wide array of clients, ensuring optimal energy management and cost-effectiveness.

- Market Insights: Calpine's extensive experience in competitive power markets provides clients with valuable real-time data and predictive analytics for informed decision-making.

- Risk Management: They offer sophisticated hedging strategies and risk mitigation tools, essential for navigating the volatility inherent in energy markets.

- Customized Products: Calpine develops bespoke energy solutions, including power purchase agreements and other tailored products, designed to meet the unique requirements of commercial and industrial customers.

- Retail Integration: Their presence in retail energy allows for a direct understanding of end-user needs, feeding back into wholesale strategies and product development.

Strategic Support for Growing Energy Demands

Calpine is strategically positioned to meet the escalating electricity demands from burgeoning sectors such as data centers and artificial intelligence. The company provides scalable and dependable power solutions tailored for these mission-critical operations.

This value proposition is underscored by the significant growth in data center power consumption, which is projected to increase substantially in the coming years. For instance, by 2030, AI servers alone could account for a considerable portion of global electricity demand. Calpine's diverse portfolio of generation assets, including natural gas and geothermal, offers the flexibility and reliability needed to support this expansion.

- Scalable Power Solutions: Calpine offers flexible capacity to accommodate the rapid growth of data-intensive industries.

- Reliability for Mission-Critical Users: The company's generation fleet ensures consistent power delivery essential for data centers and AI operations.

- Addressing Growing Demand: Calpine is prepared to supply the increasing electricity needs driven by technological advancements.

- Diverse Generation Mix: A portfolio including natural gas and geothermal provides resilience and adaptability to meet evolving energy requirements.

Calpine's value proposition centers on providing reliable, dispatchable, and increasingly clean energy. Their diverse fleet, including natural gas and geothermal assets, ensures grid stability, a crucial role as intermittent renewables grow. In 2024, this reliability was paramount, especially during peak demand and when renewable output was low.

The company also offers adaptable energy solutions, crucial for integrating renewables and maintaining grid balance. This flexibility, supported by investments in fleet modernization, allows them to respond rapidly to grid needs, a highly valued service. Furthermore, Calpine's market expertise enables them to provide sophisticated risk management and customized energy products, catering to specific client requirements.

Calpine is strategically positioned to meet the growing electricity demands of sectors like data centers and AI. Their scalable and dependable power solutions are designed for these mission-critical operations, addressing the substantial increase in power consumption by these industries.

| Value Proposition | Description | 2024 Relevance/Data Point |

|---|---|---|

| Reliable & Dispatchable Power | Ensures grid stability by providing consistent energy supply, complementing intermittent renewables. | Calpine's natural gas plants can ramp up/down quickly, essential for balancing renewable fluctuations. |

| Clean Energy Focus | Leverages advanced technologies, including geothermal, for low-carbon power generation. | Continued investment in CCS technologies to minimize carbon footprint across its portfolio. |

| Adaptable Energy Solutions | Offers flexible generation capacity to meet dynamic market demands and integrate renewables. | Fleet modernization allows rapid response to grid needs, a key service for utilities. |

| Market Expertise & Customization | Provides market insights, risk management, and tailored energy products through wholesale and retail operations. | Develops bespoke energy solutions like power purchase agreements for commercial and industrial customers. |

| Supporting Emerging Demands | Supplies scalable and dependable power for data centers and AI, addressing increasing electricity needs. | Prepared to meet the significant growth in power consumption driven by AI server demand. |

Customer Relationships

Calpine's direct sales approach is built on robust, long-term contractual agreements. These aren't casual transactions; they are carefully structured partnerships designed for mutual benefit and stability.

These contracts are the bedrock of Calpine's customer relationships, primarily with wholesale power customers. Think of major players like retail power providers, utilities, and substantial industrial, commercial, and government organizations. These are entities that rely on consistent, large-scale energy supply.

To manage these critical relationships, Calpine employs dedicated commercial operations teams. These teams are the front line, ensuring smooth operations and ongoing satisfaction for their key clients. For instance, in 2024, Calpine continued to emphasize these direct, contractual sales, which are crucial for securing predictable revenue streams in the dynamic energy market.

Calpine, via subsidiaries like Champion Energy Services and Calpine Energy Solutions, focuses on robust customer relationships in the retail energy sector. They offer personalized account management and tailored energy solutions designed to meet diverse customer needs.

This commitment translates into responsive customer service and the development of specialized energy products. For instance, in 2024, Calpine continued to refine its digital platforms to enhance customer interaction and streamline account management processes, aiming for greater customer satisfaction and retention.

Calpine cultivates strategic partnerships, notably with data center operators and technology providers focused on carbon capture initiatives. These collaborations involve joint development efforts and extend over long-term commitments, underscoring a shared vision for sustainable energy solutions.

These crucial relationships are founded on principles of mutual benefit and aligned objectives, ensuring that both Calpine and its partners contribute to and gain from advancements in areas like carbon capture technology. For instance, Calpine's ongoing projects in 2024 demonstrate a commitment to integrating innovative carbon capture solutions, often requiring deep collaboration with specialized technology firms.

Market-Driven Interactions

As a merchant power plant operator, Calpine’s customer relationships are fundamentally market-driven. This means their interactions are largely dictated by the real-time dynamics of competitive power markets, where they respond to price signals and participate in capacity auctions to sell their electricity. This transactional approach is strategic, focusing on optimizing sales based on market conditions.

Calpine’s engagement in these markets is characterized by a direct, often automated, interaction to buy and sell energy. For instance, in 2023, Calpine’s total megawatt-hours sold through wholesale markets directly reflected these market-driven interactions, with pricing heavily influenced by supply and demand fluctuations.

- Market Responsiveness: Calpine’s sales are directly tied to wholesale power market prices and demand, necessitating constant monitoring and quick adjustments.

- Capacity Auctions: Participation in capacity auctions, a key market mechanism, is crucial for securing revenue streams and ensuring grid reliability.

- Transactional Sales: The primary mode of interaction is transactional, focusing on the efficient sale of generated power at the best available market price.

- Strategic Optimization: While transactional, these interactions are underpinned by sophisticated strategies to maximize profitability in volatile markets.

Community Engagement and Sustainability Initiatives

Calpine actively fosters strong customer relationships through dedicated community engagement. In 2024, the company continued its tradition of charitable giving, supporting numerous local non-profits and community development projects across its operating regions. This commitment underscores Calpine's role as a responsible corporate citizen.

These initiatives not only build goodwill but also create shared value, aligning business objectives with community well-being. Calpine’s sustainability efforts, including investments in cleaner energy technologies, further resonate with customers and stakeholders who increasingly prioritize environmental responsibility.

- Community Investment: Calpine’s 2024 charitable contributions focused on education, environmental conservation, and local economic development.

- Stakeholder Alignment: Engaging with communities on sustainability projects enhances trust and strengthens Calpine's social license to operate.

- Brand Reputation: Proactive community support and transparent communication about sustainability efforts bolster Calpine's brand image among its diverse customer base.

Calpine's customer relationships are multifaceted, encompassing long-term contractual agreements with wholesale power purchasers like utilities and large industrial clients, alongside more personalized retail energy services through subsidiaries. The company also cultivates strategic partnerships for developing new energy technologies, particularly in areas like carbon capture, and engages in market-driven transactional sales of electricity. Community engagement and a focus on sustainability are also key components, building goodwill and aligning with stakeholder values.

| Relationship Type | Key Counterparties | Primary Interaction Mode | 2024 Focus/Data Point |

|---|---|---|---|

| Wholesale Power Sales | Utilities, Retail Power Providers, Industrial & Commercial Clients | Long-term Contracts | Securing predictable revenue streams through robust agreements. |

| Retail Energy Services | Residential & Small Commercial Customers (via subsidiaries) | Personalized Account Management, Digital Platforms | Enhancing customer interaction and streamlining account management. |

| Strategic Partnerships | Technology Providers, Data Center Operators | Joint Development, Long-term Commitments | Collaborating on sustainable energy solutions like carbon capture. |

| Market-Driven Sales | Wholesale Power Markets | Transactional, Price Signal Driven | Optimizing sales based on real-time market conditions and capacity auctions. |

| Community Engagement | Local Communities | Charitable Giving, Sustainability Initiatives | Supporting local non-profits and community development projects. |

Channels

Calpine primarily sells its generated electricity through organized wholesale power markets and exchanges across various regions in North America, including ERCOT, PJM, and California. These markets are crucial for its revenue generation, allowing it to transact power from its extensive fleet of natural gas and renewable generation facilities. For instance, in 2024, Calpine's participation in these markets directly contributed to its significant revenue streams, reflecting the dynamic pricing and demand within these interconnected grids.

Calpine leverages its direct sales teams and commercial operations to forge robust relationships with major clients, securing vital long-term power purchase agreements and capacity contracts. This direct engagement allows for the tailoring of energy solutions to meet specific customer needs, fostering strong partnerships.

In 2024, Calpine's commercial operations were instrumental in managing a diverse portfolio, with their direct sales force actively engaging in negotiations that underpin the company's revenue stability. These teams are crucial for navigating the complexities of the energy market and securing predictable cash flows through these bilateral agreements.

Calpine’s retail energy subsidiaries, such as Champion Energy Services and Calpine Energy Solutions, are key channels reaching millions of residential, commercial, and industrial customers directly. These entities are crucial for customer acquisition and ongoing service delivery in competitive deregulated energy markets.

Champion Energy Services, for instance, has consistently been recognized as a leading retail electricity provider, serving hundreds of thousands of customers across various states. In 2024, the retail segment continued to be a significant contributor to Calpine’s overall revenue, demonstrating the effectiveness of this direct-to-consumer approach.

Interconnection with Grid Operators

Calpine's power generation assets are directly linked to the electricity grid, primarily through regional transmission organizations (RTOs) and independent system operators (ISOs).

These entities manage the flow of electricity, ensuring reliable delivery from Calpine's plants to consumers. This grid interconnection is the essential pathway for Calpine's product – electricity – to reach its market.

In 2023, Calpine operated approximately 25,000 megawatts of generating capacity across the United States, all of which is integrated into these grid networks.

- Grid Interconnection: Calpine's plants connect to the transmission infrastructure managed by RTOs/ISOs.

- Delivery Mechanism: This interconnection serves as the primary channel for electricity distribution.

- Operational Scale: In 2023, Calpine's 25,000 MW capacity relied on these grid connections.

Digital Platforms and Investor Relations Portal

Calpine’s digital platforms and investor relations portal are crucial for transparent communication with financial stakeholders. These channels offer direct access to vital information, including financial reports, earnings call transcripts, and press releases, ensuring investors have up-to-date data. For instance, in 2024, Calpine continued to update its investor relations website with quarterly earnings data, SEC filings, and presentations, facilitating informed decision-making.

This digital infrastructure empowers both current and prospective investors by providing a centralized hub for all essential Calpine disclosures. It streamlines the process of accessing key financial metrics and strategic updates, fostering trust and engagement within the investment community. The company's commitment to digital accessibility ensures that financial stakeholders can easily find the information needed to evaluate Calpine's performance and outlook.

- Investor Relations Website: Provides access to financial reports, SEC filings, and investor presentations.

- Digital Communication: Facilitates transparent communication through news releases and webcasts.

- Data Accessibility: Ensures timely availability of financial data for stakeholders.

- Stakeholder Engagement: Supports informed decision-making for investors.

Calpine utilizes wholesale power markets and direct sales to reach its customers. Wholesale markets are essential for selling electricity generated from its diverse fleet, including natural gas and renewables. Direct sales teams secure power purchase agreements with key clients, ensuring stable revenue streams.

Retail energy subsidiaries like Champion Energy Services provide a direct channel to millions of residential and commercial customers. These operations are vital for customer acquisition and service in deregulated markets.

Calpine's grid interconnection with RTOs/ISOs is the fundamental channel for delivering its electricity product to end-users. This network ensures reliable power flow from its generation facilities.

The company also leverages digital platforms, particularly its investor relations website, for transparent communication with financial stakeholders, providing timely access to financial reports and strategic updates.

| Channel | Description | Key Activities | 2024 Relevance |

|---|---|---|---|

| Wholesale Power Markets | Organized markets and exchanges (ERCOT, PJM, CAISO) | Selling generated electricity, dynamic pricing | Significant revenue generation from fleet participation |

| Direct Sales Teams | Commercial operations, client relationships | Securing long-term PPAs and capacity contracts | Stable revenue through tailored energy solutions |

| Retail Subsidiaries (Champion Energy) | Direct-to-consumer engagement | Customer acquisition and service for millions | Key contributor to overall revenue via direct-to-consumer approach |

| Grid Interconnection (RTOs/ISOs) | Transmission infrastructure | Delivery of electricity from plants to consumers | Essential pathway for 25,000 MW capacity (as of 2023) |

| Digital Platforms (Investor Relations) | Online communication hub | Providing financial reports, SEC filings, presentations | Facilitating informed decision-making for investors |

Customer Segments

Retail power providers are a key customer segment for Calpine, acting as intermediaries who buy wholesale electricity to supply residential and commercial end-users. These providers rely on Calpine's substantial generation capacity and its diverse energy portfolio, which includes natural gas, hydro, and geothermal sources, to ensure a consistent and dependable power supply for their customer base. In 2024, Calpine's strategically located and efficient generation fleet, totaling approximately 25,000 megawatts, positions it as a critical supplier for these retail entities navigating fluctuating market demands and regulatory landscapes.

Calpine's core customer base includes utilities that need reliable wholesale power, capacity, and crucial ancillary services to keep their service areas energized. These utilities depend on Calpine to balance their energy portfolios, ensuring consistent supply for their end-users.

In 2024, utilities continued to be a significant segment for Calpine, particularly as they navigated evolving grid demands and the transition towards cleaner energy sources. Calpine's diverse generation fleet, including natural gas and geothermal, allows it to provide the flexibility utilities require for both baseload and peaking power needs.

Large industrial and commercial entities, including manufacturing plants and extensive commercial operations, represent a core customer segment for Calpine. These businesses typically possess substantial and consistent electricity demands, often with specific requirements for power quality and reliability to ensure uninterrupted operations. In 2024, Calpine's focus on serving these high-volume users is critical for its revenue generation.

Governmental Entities

Calpine also serves governmental entities, including federal, state, and local agencies, as well as public institutions like universities and military bases. These organizations require reliable and often substantial amounts of electricity to power their operations, from administrative buildings to critical infrastructure.

In 2024, the demand for power from public sector entities remains a significant, albeit less publicly detailed, component of the energy market. While specific figures for Calpine's governmental contracts are proprietary, the broader trend shows continued investment in grid stability and energy security by these bodies. For instance, the U.S. federal government alone operates a vast network of facilities, all with consistent energy needs. Many of these entities also prioritize sustainability, aligning with Calpine's focus on cleaner energy sources.

- Public Sector Demand: Governmental bodies are consistent, large-scale consumers of electricity.

- Infrastructure Needs: Essential services and facilities rely on uninterrupted power supply.

- Sustainability Alignment: Many public institutions are increasingly seeking to procure power from renewable or lower-emission sources.

- Long-Term Contracts: These segments often engage in long-term power purchase agreements, providing revenue stability.

Hyperscale Data Centers and AI Companies

Hyperscale data centers and AI companies represent a significant and rapidly expanding customer base for Calpine. These entities have an insatiable appetite for consistent and high-capacity power, essential for their energy-intensive operations.

Calpine is actively adapting its strategy to cater to this burgeoning demand. The company recognizes the critical need for reliable power infrastructure to support the growth of artificial intelligence and large-scale computing.

- Growing Demand: The global AI market is projected to reach $1.5 trillion by 2030, driving substantial electricity needs for data centers.

- Strategic Positioning: Calpine is investing in and optimizing its generation fleet to provide the stable, baseload power required by these advanced technology users.

- Reliability Focus: Ensuring uninterrupted power supply is paramount, as downtime can result in significant financial losses for hyperscale and AI operations.

Calpine's customer segments are diverse, encompassing entities that require reliable and substantial electricity. Retail power providers act as crucial intermediaries, sourcing wholesale electricity from Calpine to serve residential and commercial end-users, relying on Calpine's vast generation capacity. Utilities form another cornerstone, needing dependable wholesale power, capacity, and ancillary services to maintain their service areas and balance their energy portfolios.

Large industrial and commercial businesses, with their significant and consistent energy demands, are key clients, often requiring high power quality for uninterrupted operations. Additionally, governmental entities and public institutions, such as universities and military bases, represent a stable demand for electricity to power their extensive facilities and critical infrastructure.

The burgeoning hyperscale data center and AI company sector presents a rapidly expanding customer base, characterized by an immense and continuous need for high-capacity, reliable power, making them a strategic focus for Calpine's future growth and operational adjustments.

Cost Structure

Fuel costs, primarily natural gas, represent a substantial component of Calpine's operational expenses. The company's profitability is directly tied to the volatile pricing of this essential commodity, which powers its extensive fleet of gas-fired generation facilities.

Calpine's plant operations and maintenance (O&M) costs are fundamental to its business model, encompassing the daily running, upkeep, and repair of its diverse power generation facilities. These expenses are critical for ensuring reliability and efficiency across its fleet, which includes natural gas, geothermal, and hydro power plants. In 2023, Calpine reported O&M expenses of approximately $1.6 billion, reflecting the significant investment required to maintain such a large and varied asset base.

Calpine's commitment to growth and efficiency is reflected in its significant capital expenditures. In 2024, the company continued to invest heavily in building new power generation capacity, enhancing existing facilities, and integrating cutting-edge technologies such as carbon capture and energy storage solutions. These investments are crucial for maintaining a competitive edge and meeting evolving energy demands.

Debt Service and Financing Costs

Calpine's cost structure is significantly impacted by its debt service and financing costs. As a company that frequently invests in large-scale power generation facilities, it carries substantial debt. These obligations include regular interest payments, which are a consistent outflow.

For instance, in the first quarter of 2024, Calpine reported interest expense of $326 million. This figure highlights the ongoing financial commitment required to manage its capital-intensive operations and growth initiatives.

- Debt Service: Calpine incurs significant costs related to repaying the principal and interest on its outstanding debt.

- Financing Costs: This includes fees and charges associated with securing and maintaining various forms of financing for its assets.

- Interest Expense (Q1 2024): $326 million, demonstrating a substantial portion of operational expenses dedicated to debt obligations.

Regulatory Compliance and Environmental Costs

Calpine's cost structure is significantly influenced by regulatory compliance and environmental expenditures. Adhering to stringent environmental regulations, particularly those concerning carbon emissions, necessitates substantial ongoing investment. This includes the deployment of advanced emissions control technologies and the development of carbon capture projects to mitigate environmental impact.

These regulatory requirements translate into direct financial outlays. For instance, in 2024, companies in the power generation sector, including Calpine, face increasing pressure to invest in cleaner technologies. The U.S. Environmental Protection Agency's (EPA) proposed regulations for greenhouse gas emissions from power plants, expected to be finalized in 2024, could drive further capital expenditures for compliance.

- Environmental Compliance Investments: Ongoing capital and operational expenses for meeting air quality and greenhouse gas emission standards.

- Carbon Pricing Mechanisms: Potential costs associated with carbon taxes or cap-and-trade systems, impacting operational expenses.

- Technology Upgrades: Investments in scrubbers, selective catalytic reduction (SCR) systems, and carbon capture, utilization, and storage (CCUS) technologies.

- Permitting and Reporting: Costs related to obtaining and maintaining environmental permits and fulfilling extensive reporting obligations.

Calpine's cost structure is dominated by fuel, primarily natural gas, which is subject to market volatility. Operations and maintenance (O&M) expenses are also significant, covering the upkeep of its diverse power generation fleet. The company's substantial debt load results in considerable interest expenses, as evidenced by the $326 million reported in Q1 2024.

| Cost Category | Description | 2023/2024 Data Point |

|---|---|---|

| Fuel Costs | Natural gas purchases for power generation | Substantial component, highly volatile |

| Operations & Maintenance (O&M) | Running, upkeep, and repair of power plants | Approx. $1.6 billion (2023) |

| Interest Expense | Cost of servicing outstanding debt | $326 million (Q1 2024) |

| Capital Expenditures | Investment in new capacity and technology | Continued heavy investment in 2024 |

| Environmental Compliance | Meeting emissions regulations, carbon capture | Increasing investment driven by regulations |

Revenue Streams

Calpine's core revenue generation hinges on its wholesale power sales, a critical component of its business model. This involves supplying electricity to a variety of customers, including utilities and other large power consumers.

These sales encompass different types of power, such as baseload power, which is electricity generated continuously, and peaking power, used during periods of high demand. Calpine also generates revenue from ancillary services, which are essential for maintaining the stability and reliability of the power grid.

In 2023, Calpine reported total revenues of approximately $10.7 billion, with a significant portion derived from these wholesale power sales, underscoring its central role in the company's financial performance.

Calpine generates revenue through capacity payments, essentially being compensated for keeping its power generation facilities ready to serve the grid. This ensures a baseline income stream, even if their power isn't always needed. For instance, in 2023, capacity payments played a significant role in their financial stability, contributing to their ability to cover fixed costs and maintain operations.

Calpine's retail electricity sales, conducted through its subsidiaries, represent a direct channel for generating income by supplying power and associated services to a broad customer base. This includes households, businesses, and industrial facilities, effectively broadening its revenue streams beyond traditional wholesale electricity markets.

This diversification is crucial, as it allows Calpine to tap into the end-consumer market, potentially capturing higher margins and offering more stable revenue compared to the volatility often seen in wholesale power trading. For instance, in 2024, the retail segment continued to be a significant contributor to the company's overall financial performance, reflecting the ongoing demand for reliable energy solutions at the consumer level.

Ancillary Services Revenue

Calpine generates revenue by offering critical ancillary services to grid operators, ensuring the stability and reliability of the power system. These services, like frequency regulation and spinning reserves, are vital for balancing supply and demand in real-time.

In 2024, Calpine continued to be a significant provider of these essential grid support functions. The company's participation in capacity markets and ancillary services markets across various regions contributed meaningfully to its overall financial performance.

- Frequency Regulation: Calpine's fast-response generating units can quickly adjust output to maintain the grid's frequency within a narrow band, a crucial service for grid stability.

- Spinning Reserves: The company provides reserve capacity that is already synchronized to the grid and ready to be dispatched immediately if a sudden loss of generation occurs.

- Other Ancillary Services: This category includes services like voltage support and reactive power, which are also fundamental to maintaining a healthy and reliable electrical grid.

Carbon Capture and Storage (CCS) Related Revenue/Incentives

Calpine's involvement in carbon capture and storage (CCS) projects opens avenues for new revenue. One key area is the potential sale of captured carbon dioxide (CO2) itself, which can be utilized in various industrial processes, such as enhanced oil recovery (EOR) or the production of chemicals and building materials.

Government incentives and tax credits are also critical revenue drivers for CCS initiatives. For instance, the U.S. Inflation Reduction Act of 2022 significantly enhanced the 45Q tax credit for carbon sequestration, offering up to $85 per metric ton of CO2 stored geologically. This makes CCS projects more economically viable for companies like Calpine.

- Sale of Captured CO2: Direct revenue from selling captured CO2 for industrial use.

- 45Q Tax Credit: Leveraging U.S. federal tax credits for carbon sequestration, potentially up to $85/metric ton.

- State-Level Incentives: Exploring additional financial support or credits offered by individual states for CCS development.

- Ancillary Services: Potential revenue from providing CCS technology or expertise to other entities.

Calpine's revenue model is multifaceted, primarily driven by wholesale electricity sales, where it supplies power to utilities and other large buyers. This includes revenue from both baseload and peaking power generation.

Capacity payments provide a stable income stream, compensating Calpine for maintaining generation readiness, while ancillary services, such as frequency regulation and spinning reserves, ensure grid stability and generate additional revenue. In 2023, Calpine reported total revenues of approximately $10.7 billion, with wholesale sales forming the largest component.

The company also generates revenue through its retail electricity sales, serving end-consumers directly. Furthermore, Calpine is exploring revenue opportunities in carbon capture and storage (CCS) projects, including the sale of captured CO2 and leveraging government incentives like the 45Q tax credit, which can provide up to $85 per metric ton of CO2 stored.

| Revenue Stream | Description | 2023 Data (Approximate) |

|---|---|---|

| Wholesale Power Sales | Selling electricity to utilities and large consumers. | Largest contributor to total revenue. |

| Capacity Payments | Compensation for maintaining generation readiness. | Provided baseline income and supported operations. |

| Ancillary Services | Providing grid stability services like frequency regulation. | Contributed to overall financial performance. |

| Retail Electricity Sales | Direct sales to households, businesses, and industrial facilities. | Significant contributor to overall financial performance in 2024. |

| Carbon Capture & Storage (CCS) | Sale of captured CO2 and utilization of tax credits (e.g., 45Q). | Emerging revenue stream with potential up to $85/metric ton via 45Q. |

Business Model Canvas Data Sources

The Calpine Business Model Canvas is informed by a robust blend of internal financial statements, operational performance metrics, and extensive market intelligence reports. These sources provide a comprehensive view of Calpine's current operations and future opportunities.