Calpine Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calpine Bundle

Curious about Calpine's strategic positioning? This glimpse into their BCG Matrix reveals the potential for growth and stability within their diverse portfolio. Understand which assets are driving current success and which require careful consideration for future investment.

Unlock the full strategic advantage by purchasing the complete Calpine BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions and optimize resource allocation for maximum impact.

Stars

Calpine's Geothermal Power Generation, specifically The Geysers complex, represents a significant 'Star' in its portfolio. This facility is the world's largest geothermal power plant, consistently delivering clean, baseload electricity, a critical component for grid reliability as renewable energy sources grow.

The Geysers' continuous, renewable output is highly prized for its ability to provide stable power, complementing more variable sources like solar and wind. This operational advantage positions it strongly in the market for reliable energy solutions.

Further solidifying its 'Star' status, the North Geysers Incremental Development (NGID) project is slated for full completion by June 2026. This expansion underscores Calpine's commitment to growing its high-market-share geothermal segment, meeting increasing demand for dependable, green energy.

Calpine's natural gas combined cycle (NGCC) plants in high-growth regions like Texas are a strong asset. These modern, efficient facilities are crucial for meeting escalating electricity demand. In 2024, Texas continues to be a prime example of this growth, with Calpine actively expanding its presence.

The company is set to add over 1,000 MW of new generation capacity in Texas in the near future, underscoring its commitment to this market. This expansion is partly fueled by the recent acquisition of the Quail Run Energy Center, a move that highlights Calpine's strategic focus on strengthening its position in high-demand areas.

The surge in electricity consumption, largely attributed to the booming data center and AI industries, makes these NGCC assets vital for ensuring a stable and reliable power supply. This growing demand directly supports the "Star" classification for these assets within the BCG matrix.

Calpine's commitment to carbon capture and sequestration (CCS) places its projects firmly in the "Star" category of the BCG Matrix. The company's significant investments, including the Baytown and Sutter Decarbonization Projects, are supported by substantial funding, such as cost-sharing agreements from the Department of Energy, highlighting their strategic importance and growth potential.

These CCS initiatives are designed to dramatically cut emissions from natural gas power plants, a crucial step in achieving sustainability goals and meeting the increasing market demand for electricity with a lower carbon footprint. This focus on decarbonization is vital for Calpine's long-term market leadership in an evolving energy landscape.

Strategic Expansion in PJM Interconnection

Calpine is aggressively expanding its electricity generation development in the PJM Interconnection, a region experiencing strong market signals and rising energy prices. This strategic push includes exploring new sites in Ohio and Pennsylvania, alongside potential expansions of its existing generation facilities. The company is positioning itself to capture growth in this high-demand market.

This expansion is a clear indicator of Calpine viewing the PJM region as a "Star" in its portfolio, characterized by high growth and a strong competitive position. The company's investment aims to meet the escalating need for reliable and dispatchable power. For instance, in 2024, PJM has seen significant demand growth, requiring new capacity to maintain grid stability.

- PJM Capacity Market: The PJM capacity market prices have shown upward trends, reflecting the increasing value of reliable generation.

- Investment in New Capacity: Calpine's development program is directly responding to these market signals, aiming to add new megawatt capacity.

- Geographic Focus: Ohio and Pennsylvania are key states within PJM, representing areas with substantial development opportunities and demand.

Wholesale Power and Capacity Sales to Utilities and Large Entities

Calpine's primary operation involves selling wholesale electricity, capacity, and ancillary services to utilities and major consumers like industrial, commercial, and government organizations. This segment holds a significant market share within an expanding sector.

The demand for electricity is on the rise, driven by factors such as data centers and artificial intelligence, which fuels continued robust growth in this business area. For instance, the U.S. Energy Information Administration (EIA) projected a 2.1% increase in total U.S. electricity consumption in 2024 compared to 2023.

Calpine's strength lies in its capacity to deliver dependable, dispatchable power, giving it a competitive edge in the power markets.

- High Market Share: Calpine is a dominant player in the wholesale power market.

- Growing Demand: Increased electricity needs from sectors like data centers and AI ensure market expansion.

- Reliability: Calpine's dispatchable power offerings are highly valued by customers.

- 2024 Outlook: The EIA forecasts continued growth in electricity demand for 2024.

Calpine's geothermal operations, particularly The Geysers, are a clear "Star" due to their consistent, renewable baseload power generation, essential for grid stability. The North Geysers Incremental Development project, set for completion by mid-2026, further reinforces this asset's high market share and growth potential in a market demanding clean energy solutions.

Calpine's modern, efficient natural gas combined cycle (NGCC) plants, especially in high-demand regions like Texas, are also classified as "Stars." The company's strategic expansion, including adding over 1,000 MW in Texas in the near future, directly addresses the escalating electricity needs driven by data centers and AI, solidifying these assets' strong market position.

The company's investment in carbon capture and sequestration (CCS) projects, such as Baytown and Sutter, positions these initiatives as "Stars." Supported by significant funding, including Department of Energy agreements, these projects are crucial for reducing emissions and meeting the growing demand for lower-carbon electricity, ensuring long-term market relevance.

Calpine's aggressive development in the PJM Interconnection, targeting new sites in Ohio and Pennsylvania, highlights this region as a "Star." The upward trend in PJM capacity market prices in 2024, reflecting the increasing value of reliable generation, drives Calpine's investment to meet escalating demand for dispatchable power.

Calpine's core business of selling wholesale electricity, capacity, and ancillary services to utilities and large consumers is a "Star" segment. The projected 2.1% increase in total U.S. electricity consumption for 2024, driven by data centers and AI, ensures continued robust growth for Calpine's reliable, dispatchable power offerings.

| Calpine Portfolio Segment | BCG Matrix Classification | Key Drivers | 2024 Data/Outlook |

|---|---|---|---|

| Geothermal Power (The Geysers) | Star | Baseload renewable power, grid reliability, growing demand for clean energy | North Geysers Incremental Development project completion by June 2026 |

| Natural Gas Combined Cycle (NGCC) - Texas | Star | High demand from data centers/AI, grid stability, efficient generation | Adding over 1,000 MW new capacity in Texas; Quail Run Energy Center acquisition |

| Carbon Capture & Sequestration (CCS) | Star | Emissions reduction, demand for lower-carbon electricity, strategic investments | Baytown and Sutter Decarbonization Projects; DOE cost-sharing agreements |

| PJM Interconnection Development | Star | Strong market signals, rising energy prices, demand for dispatchable power | PJM capacity market prices showing upward trends in 2024; focus on Ohio and Pennsylvania |

| Wholesale Electricity Sales | Star | Growing electricity demand (data centers, AI), reliability, market share | U.S. electricity consumption projected to increase 2.1% in 2024 (EIA) |

What is included in the product

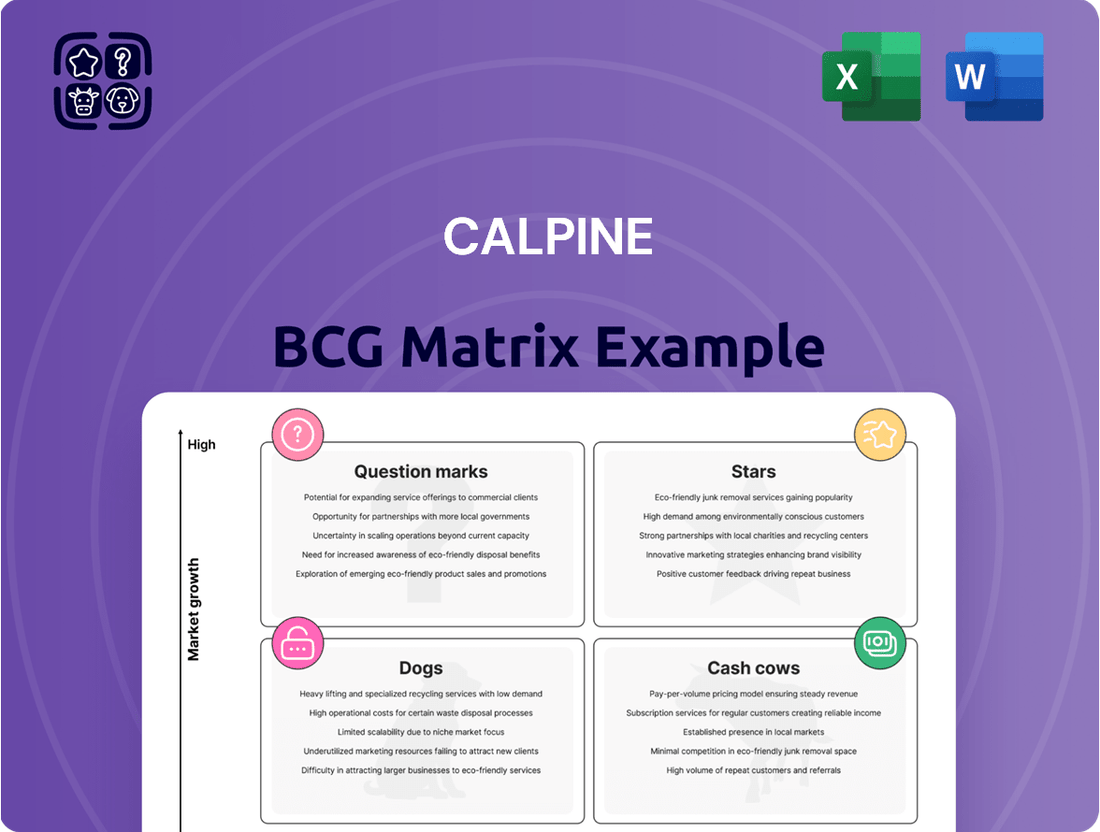

The Calpine BCG Matrix categorizes energy generation assets into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear visual of Calpine's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs, simplifies strategic decision-making.

Cash Cows

Calpine's existing natural gas fleet operations represent a significant cash cow within its portfolio. These numerous natural gas-fired power plants, strategically located across North America, operate in a mature but stable market. Their high market share and operational efficiency allow them to generate substantial and consistent cash flow, crucial for grid reliability by providing dispatchable power.

In 2024, Calpine's natural gas fleet continues to be a bedrock of its financial performance. While the market for new natural gas plant construction may be experiencing slower growth, the operational fleet benefits from consistent demand for reliable energy. This segment consistently contributes significant revenue, underscoring its role as a mature, cash-generating asset.

Calpine's retail energy businesses, including Champion Energy Services and Calpine Energy Solutions, are firmly established as Cash Cows. These entities excel in deregulated markets, catering to a broad customer base encompassing residential, commercial, and industrial sectors. Their robust market presence translates into consistent and predictable cash flow.

The strength of these retail arms lies in their deep-rooted customer relationships and the inherently stable demand for electricity. This stability, coupled with their expertise in offering customized energy solutions within a mature retail landscape, solidifies their position as dependable cash generators for Calpine.

Calpine's cogeneration facilities are strong contenders in the market, acting as Cash Cows. These plants are incredibly efficient, generating both electricity and heat, which translates to substantial energy savings and lower emissions. This dual output gives them a distinct edge, especially in markets where energy efficiency is highly valued.

The inherent efficiency of cogeneration means these facilities likely boast impressive profit margins and generate consistent, reliable cash flow. In 2024, Calpine's portfolio, which includes a significant number of these efficient plants, continued to be a bedrock of its financial performance, contributing significantly to overall earnings stability.

Ancillary Services and Grid Support

Calpine’s ancillary services, including reserves and regulation, are vital for maintaining grid stability and represent a significant cash cow. These services are consistently needed in established power markets, offering predictable and steady revenue. In 2024, the demand for grid reliability services remained robust, supporting Calpine's income generation from these offerings.

The company leverages its extensive and varied fleet of power generation facilities to efficiently deliver these essential grid support functions. This capability allows Calpine to generate substantial cash flow from these mature markets without the need for substantial new capital expenditures for expansion.

- Consistent Demand: Ancillary services like reserves and regulation are perpetually required to balance supply and demand on the grid, ensuring reliability.

- Mature Market Revenue: These services generate stable, predictable revenue streams in established power markets, contributing significantly to cash flow.

- Fleet Utilization: Calpine's large and diverse generation fleet is well-positioned to provide these critical services, maximizing asset utilization and cash generation.

- Low Investment Needs: Unlike growth-oriented segments, these cash cow services require minimal new investment, allowing for strong free cash flow generation.

Geothermal Baseload Operations (Current Capacity)

Calpine's existing 725 MW baseload geothermal capacity at The Geysers represents a significant Cash Cow within its portfolio. This established operation, the world's largest geothermal complex, consistently delivers clean and reliable power, contributing substantial cash flow in a mature renewable energy sector.

The mature nature of this geothermal capacity means it requires minimal promotional investment. Its high profit margins, a hallmark of Cash Cows, allow it to generate strong earnings that can be strategically deployed to fund other growth initiatives within Calpine, such as its developing geothermal expansion projects.

- The Geysers: World's Largest Geothermal Complex

- 725 MW of Existing Baseload Capacity

- High Profit Margins and Low Promotional Investment Needs

- Consistent Cash Flow Generation in a Mature Market

Calpine's natural gas fleet continues to be a cornerstone of its financial stability, consistently generating substantial cash flow. In 2024, these operations benefited from ongoing demand for reliable energy, underscoring their role as mature, cash-generating assets within the company's portfolio.

The retail energy businesses, including Champion Energy Services and Calpine Energy Solutions, are firmly established as cash cows. Their deep customer relationships and presence in deregulated markets ensure predictable revenue streams, contributing significantly to consistent cash flow generation.

Calpine's cogeneration facilities are highly efficient, producing both electricity and heat, which translates to strong profit margins and reliable cash flow. In 2024, these dual-output plants continued to be a stable contributor to the company's earnings.

Ancillary services, such as reserves and regulation, are vital for grid stability and represent a consistent revenue source. Calpine's extensive fleet effectively provides these essential services, generating substantial cash flow from mature markets with minimal new capital investment needs.

The Geysers, Calpine's 725 MW geothermal complex, remains a significant cash cow. This established operation generates consistent cash flow with high profit margins and low investment requirements, supporting the company's overall financial health.

| Segment | 2024 Contribution (Est.) | Key Characteristics |

|---|---|---|

| Natural Gas Fleet | Significant Cash Flow | Mature market, high utilization, essential for grid reliability |

| Retail Energy Businesses | Consistent Revenue | Strong customer base, stable demand, predictable cash generation |

| Cogeneration Facilities | Strong Profit Margins | Dual output efficiency, reliable cash flow, valued in energy markets |

| Ancillary Services | Steady Income | Grid stability focus, predictable revenue, low investment needs |

| The Geysers (Geothermal) | High Profitability | World's largest complex, established operation, minimal new CapEx |

What You’re Viewing Is Included

Calpine BCG Matrix

The Calpine BCG Matrix preview you're examining is the identical, fully unlocked document you'll receive upon purchase, offering a clear framework for strategic business unit evaluation. This comprehensive analysis, devoid of watermarks or demo content, is ready for immediate application in your strategic planning sessions. You'll gain access to a professionally formatted report that precisely outlines Calpine's business units within the BCG growth-share matrix, enabling informed decision-making. This is the actual, analysis-ready file you'll download, providing actionable insights into Calpine's portfolio for your business needs.

Dogs

Some of Calpine's older natural gas plants could be categorized as Dogs in the BCG Matrix. These facilities may be in markets with limited growth potential or are burdened by rising operational expenses and stricter environmental rules, resulting in a reduced market share and profitability.

These older assets often struggle to compete with newer, more efficient natural gas plants or the growing renewable energy sector. They might consume capital without yielding substantial returns, making them a drain on resources.

Considering the potential acquisition by Constellation, Calpine might evaluate the divestment of these less efficient units. This strategic move could help streamline the portfolio and focus on more profitable and sustainable operations.

As part of its acquisition by Constellation Energy, Calpine is divesting four power plants in the PJM Interconnection, totaling 3,546 MW. These assets, likely considered non-core or underperforming in the context of the combined entity's strategy, are being sold to mitigate market power concerns. This move aligns with the BCG Matrix principle of shedding assets with lower growth potential or those that don't fit the future strategic direction.

Calpine's operations might include segments heavily reliant on older, less efficient technologies, such as simple cycle gas turbines that haven't undergone significant upgrades. These units, while functional, often have higher fuel consumption and emissions compared to more modern combined cycle plants. As the energy sector pushes towards decarbonization and greater efficiency, these older assets could face increasing competitive disadvantages.

Small, Isolated Assets with Limited Growth Potential

Small, isolated assets with limited growth potential are Calpine's Dogs. These could be individual power plants in very localized or stagnant power markets, where there's not much room to expand or gain more market share. For example, a small, older natural gas peaker plant serving a niche industrial customer might fit this description. While it might cover its operational costs, it doesn't offer much in terms of strategic advantage or future growth for Calpine as a whole.

These assets often struggle to compete in a rapidly evolving energy landscape. In 2024, the push towards renewable energy and grid modernization means that older, less efficient, or geographically constrained assets face increasing challenges. For instance, a plant with limited fuel flexibility or located far from transmission infrastructure might find its revenue streams capped.

- Limited Market Share: These assets typically operate in markets with few expansion opportunities, hindering their ability to grow revenue.

- Low Profitability: While they may break even, their contribution to overall profitability is minimal, often due to high operating costs relative to market prices.

- Minimal Strategic Value: They rarely offer diversification benefits or synergies with other parts of Calpine's portfolio.

- High Risk of Obsolescence: In a sector driven by technological advancement and decarbonization, these assets are more susceptible to becoming outdated.

Legacy Contracts with Low Profit Margins

Legacy contracts with low profit margins, often long-term power purchase agreements (PPAs) or capacity contracts, can act as Dogs in Calpine's portfolio. These were likely secured during periods of lower market prices or less favorable terms, and now yield minimal returns compared to current operational costs or market opportunities. Such agreements can tie up valuable generation capacity without contributing significantly to overall profitability.

These situations present a challenge for companies like Calpine. For instance, if a significant portion of a plant's output is committed under older, low-margin PPAs, it limits the flexibility to capitalize on higher spot market prices. This can directly impact the overall financial performance of the asset.

- Limited Upside Potential: These contracts cap revenue, preventing the company from benefiting from favorable market price fluctuations.

- Reduced Operational Flexibility: Capacity committed under low-margin PPAs cannot be easily redeployed to more profitable opportunities.

- Cost Drag: While generating low revenue, these assets still incur operational and maintenance costs, potentially leading to net losses.

Calpine's "Dogs" are typically older, less efficient power plants or those tied to low-margin, legacy contracts. These assets often operate in markets with limited growth prospects and face increasing competition from newer technologies and renewables.

In 2024, the energy transition continues to pressure older assets. For example, a 200 MW simple cycle gas turbine plant with high fuel consumption and located in a region with stagnant demand would likely be a Dog. Its market share is small, and its profitability is minimal due to operational costs and limited expansion opportunities.

These underperforming assets can hinder overall portfolio performance by consuming capital without generating substantial returns. Calpine, like many energy companies, strategically evaluates divesting such units to focus resources on more profitable and forward-looking operations.

The divestment of four PJM Interconnection power plants totaling 3,546 MW in 2024, as part of the Constellation acquisition, exemplifies the management of "Dog" assets. These were likely deemed non-core or underperforming relative to the combined entity's strategic goals.

| Asset Type | Market Growth Potential | Profitability | Strategic Fit | Example |

|---|---|---|---|---|

| Older Natural Gas Plants | Low | Low to Negative | Poor | Simple cycle plant with high fuel costs |

| Legacy Contracts | N/A (Contractual) | Low Margin | Limited | Long-term PPA with below-market rates |

| Small, Isolated Facilities | Low | Marginal | Minimal | Peaker plant serving a niche industrial customer |

Question Marks

Calpine's new battery storage solutions represent a significant investment in a high-growth sector, fueled by the increasing demand for renewable energy integration. These innovative offerings are positioned to capitalize on the market's expansion, driven by the need to stabilize grids with intermittent sources like solar and wind power.

While these solutions are in a rapidly expanding market, Calpine's current market share for these specific new technologies might be relatively low as they are emerging offerings. This places them in a position that requires substantial capital to scale operations and capture a larger portion of the market.

The success of these battery storage ventures could see them transition into 'Stars' within the BCG matrix. For instance, the global energy storage market was valued at approximately $250 billion in 2023 and is projected to reach over $600 billion by 2030, indicating a substantial growth trajectory that Calpine aims to tap into.

Calpine's potential ventures into hydrogen production and infrastructure would likely fall into the Question Marks category of the BCG matrix. This is due to the burgeoning demand for clean fuels, positioning hydrogen as a high-growth, emerging market. However, Calpine's current, presumably minimal, market share in this nascent sector necessitates significant capital investment to establish viability and achieve market penetration.

Advanced geothermal technologies, such as enhanced geothermal systems (EGS) in new geological formations, represent potential Stars for Calpine. While The Geysers is a mature, cash-generating asset, these emerging technologies offer significant future growth prospects. For instance, EGS projects aim to unlock geothermal potential in areas without natural hydrothermal resources, a key differentiator.

These advanced systems are currently in their nascent stages, requiring substantial research and development funding and significant upfront capital to demonstrate commercial viability. The global market for EGS is projected to grow substantially, with some estimates suggesting it could reach tens of billions of dollars by the late 2030s, presenting a high-risk, high-reward opportunity for companies like Calpine to invest in and potentially dominate.

Diversification into Other Renewable Energy Sources (e.g., Solar, Wind)

Diversifying into utility-scale solar and wind farms would position Calpine's new ventures as Stars in the BCG Matrix. These sectors are experiencing robust growth, with the U.S. solar market alone projected to grow by over 100 GW in capacity additions between 2024 and 2028, and wind power continuing its expansion. However, Calpine's established expertise lies in natural gas and geothermal, meaning these new initiatives would begin with a relatively low market share in a rapidly evolving landscape.

This expansion would necessitate significant capital investment to build out operational capacity and establish a competitive presence. For example, the average cost to build a utility-scale solar farm can range from $1 million to $2 million per megawatt, and wind farms can cost $1.5 million to $2.5 million per megawatt. Calpine would need to secure substantial funding to compete effectively against existing, larger players in these renewable energy markets.

- Star Category: Utility-scale solar and wind farms represent potential Stars due to high market growth.

- Market Share Challenge: Calpine would enter these segments with low initial market share, given its primary focus on natural gas and geothermal.

- Investment Requirements: Significant capital expenditure is essential for developing and operating these new renewable energy assets.

- Growth Potential: Despite the challenges, successful entry could lead to substantial future revenue streams as renewable energy adoption accelerates.

Emerging Retail Energy Products Focused on Decarbonization/Custom Carbon Roadmaps

Calpine Energy Solutions is tapping into the burgeoning demand for corporate sustainability with innovative offerings like custom carbon roadmaps and carbon-differentiated energy products. This strategic move positions them to capture a share of a market projected to grow significantly, with many companies actively seeking ways to reduce their environmental footprint. The global corporate sustainability market was valued at approximately $12.7 billion in 2023 and is expected to reach over $25 billion by 2028, indicating substantial growth potential for these types of solutions.

While these products address a clear market need, their current adoption and market share are likely in the early stages, reflecting their status as emerging offerings. Calpine faces the task of educating the market and demonstrating the tangible benefits of these tailored decarbonization strategies. Significant investment in marketing and sales will be crucial to drive widespread customer engagement and transform these nascent products into more established revenue streams within their portfolio.

- Custom Carbon Roadmaps: Tailored plans for businesses to achieve specific decarbonization goals.

- Carbon-Differentiated Products: Energy offerings that highlight reduced carbon intensity.

- Market Growth: The corporate sustainability market is expanding rapidly, with strong demand for decarbonization solutions.

- Adoption Challenge: Early-stage products require substantial marketing and sales efforts to gain traction.

Calpine's ventures into emerging clean energy technologies, such as advanced geothermal and hydrogen production, are likely positioned as Question Marks within the BCG matrix. These areas represent high-growth potential markets driven by the global shift towards decarbonization.

However, Calpine's current market share in these nascent sectors is presumed to be minimal, necessitating substantial capital investment for research, development, and scaling to achieve commercial viability and market penetration.

For instance, the global hydrogen market is projected to grow significantly, with some forecasts indicating it could reach hundreds of billions of dollars by 2030, presenting a high-risk, high-reward scenario for Calpine.

Similarly, advanced geothermal systems, like EGS, are expected to see considerable market expansion, potentially reaching tens of billions of dollars by the late 2030s, requiring significant upfront investment to unlock this potential.

| Business Unit | Market Growth | Calpine Market Share | Capital Needs | BCG Category |

|---|---|---|---|---|

| Advanced Geothermal (EGS) | High | Low | High | Question Mark |

| Hydrogen Production | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including revenue figures, market share reports, and industry growth projections, to accurately position business units.