Cactus Wellhead SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cactus Wellhead Bundle

Cactus Wellhead's market position is defined by its robust operational capabilities and the growing demand for specialized oilfield equipment. However, navigating potential supply chain disruptions and intense competition requires a deeper understanding of its strategic landscape.

Want the full story behind Cactus Wellhead's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cactus, Inc. boasts a strong lineup of wellhead and pressure control products, notably the Cactus SafeDrill systems vital for onshore unconventional oil and gas operations. This diverse portfolio ensures they cater to critical stages from drilling to production.

The company's product revenue, even with a modest decline, highlights the consistent demand for their essential equipment. For instance, in the first quarter of 2024, Cactus reported product revenue of $111.8 million, demonstrating the ongoing need for their specialized offerings.

Beyond products, Cactus provides crucial field services, a factor that significantly boosts customer loyalty and strengthens their competitive edge in the market.

Cactus has a strong history of strategic growth, notably with its acquisition of FlexSteel, which broadened its product offerings and technological expertise. This proactive approach to expansion is a significant strength, positioning the company for sustained development.

The company's investment in a Vietnam forging manufacturing facility underscores its commitment to diversifying its operational base and enhancing its global manufacturing capabilities. This move is crucial for cost optimization and supply chain resilience.

A pivotal recent development is Cactus's agreement to acquire a majority stake in Baker Hughes' Surface Pressure Control business. This strategic move is expected to significantly expand Cactus's geographic reach and revenue streams, particularly by tapping into more stable international markets.

Cactus Wellhead demonstrates robust financial health, highlighted by a substantial cash balance and the absence of any outstanding bank debt as of June 30, 2025. This strong financial footing, with $150 million in cash and cash equivalents and zero long-term debt, offers considerable flexibility for pursuing growth opportunities and weathering economic downturns.

The company's commitment to conservative balance sheet management is further evidenced by its consistent quarterly dividend payments. This practice not only rewards shareholders but also underscores management's confidence in the company's ability to generate sustainable cash flows, a key indicator of its capital-light business model and operational efficiency.

Operational Efficiency and Innovation Focus

Cactus Wellhead's commitment to operational efficiency and innovation is a significant strength. By developing specialized equipment, the company actively enhances safety and efficiency in well operations, a critical factor in the oil and gas sector. This focus directly addresses industry-wide priorities, paving the way for greater market share.

The strategic relocation of SPC production to Cactus facilities is a prime example of this efficiency drive. This move is projected to yield substantial benefits, including a reduction in per-unit production costs. In 2024, such cost-saving measures are crucial for maintaining competitiveness and boosting profitability in a dynamic market.

- Enhanced Safety and Efficiency: Cactus Wellhead's specialized equipment directly contributes to safer and more efficient well operations, a key differentiator.

- Market Penetration Potential: The company's alignment with industry priorities on efficiency and safety creates opportunities for expanded market reach.

- Cost Reduction Initiatives: Relocating SPC production is expected to lower per-unit costs, directly impacting the bottom line and profitability.

- Profitability Amplification: These efficiency gains and cost reductions are anticipated to significantly amplify Cactus Wellhead's overall profitability.

Geographic Diversification and International Presence

Cactus Wellhead’s geographic diversification is a significant strength, with service centers strategically located in major oil and gas hubs like Eastern Australia, Canada, and the Middle East. This international footprint helps mitigate risks associated with over-reliance on any single market. For instance, its presence in the Middle East is bolstered by national oil company contracts, which typically offer more stable, long-term revenue streams compared to the more volatile U.S. onshore market.

The recent acquisition of Baker Hughes' Surface Pressure Control business is poised to dramatically enhance Cactus’s international revenue diversification. This move is expected to shift a substantial portion of future earnings towards these more predictable, stable contracts, particularly from national oil companies in the Middle East. This strategic expansion is key to building a more resilient and globally balanced business model.

- Global Service Centers: Operations in Australia, Canada, and the Middle East.

- International Revenue Growth: Acquisition expected to boost global revenue share.

- Stable Contracts: Focus on national oil company agreements in the Middle East for predictable income.

Cactus Wellhead's diverse product portfolio, including its vital SafeDrill systems for onshore unconventional operations, ensures consistent demand. Their strategic acquisition of FlexSteel broadened their technological capabilities, while the planned acquisition of Baker Hughes' Surface Pressure Control business is set to significantly expand their international reach and revenue streams, particularly into more stable markets.

The company's financial strength is a major asset, with $150 million in cash and no outstanding bank debt as of June 30, 2025. This robust balance sheet, coupled with consistent dividend payments, reflects a capital-light model and operational efficiency, providing ample flexibility for growth and stability.

Cactus's commitment to operational efficiency and innovation is demonstrated by its specialized equipment that enhances safety and efficiency in well operations. The strategic relocation of Surface Pressure Control production is projected to reduce per-unit costs, directly improving profitability and competitiveness in the dynamic oil and gas sector.

Geographic diversification is a key strength, with service centers in Australia, Canada, and the Middle East. These locations, especially the Middle East with its national oil company contracts, offer more stable revenue streams compared to the U.S. onshore market, a balance further strengthened by the Baker Hughes acquisition.

| Metric | Q1 2024 | Q1 2025 (Est.) | Q2 2025 (Est.) |

|---|---|---|---|

| Product Revenue | $111.8 million | $115 million | $120 million |

| Cash Balance (as of June 30, 2025) | N/A | $150 million | $155 million |

| Long-term Debt (as of June 30, 2025) | $0 | $0 | $0 |

What is included in the product

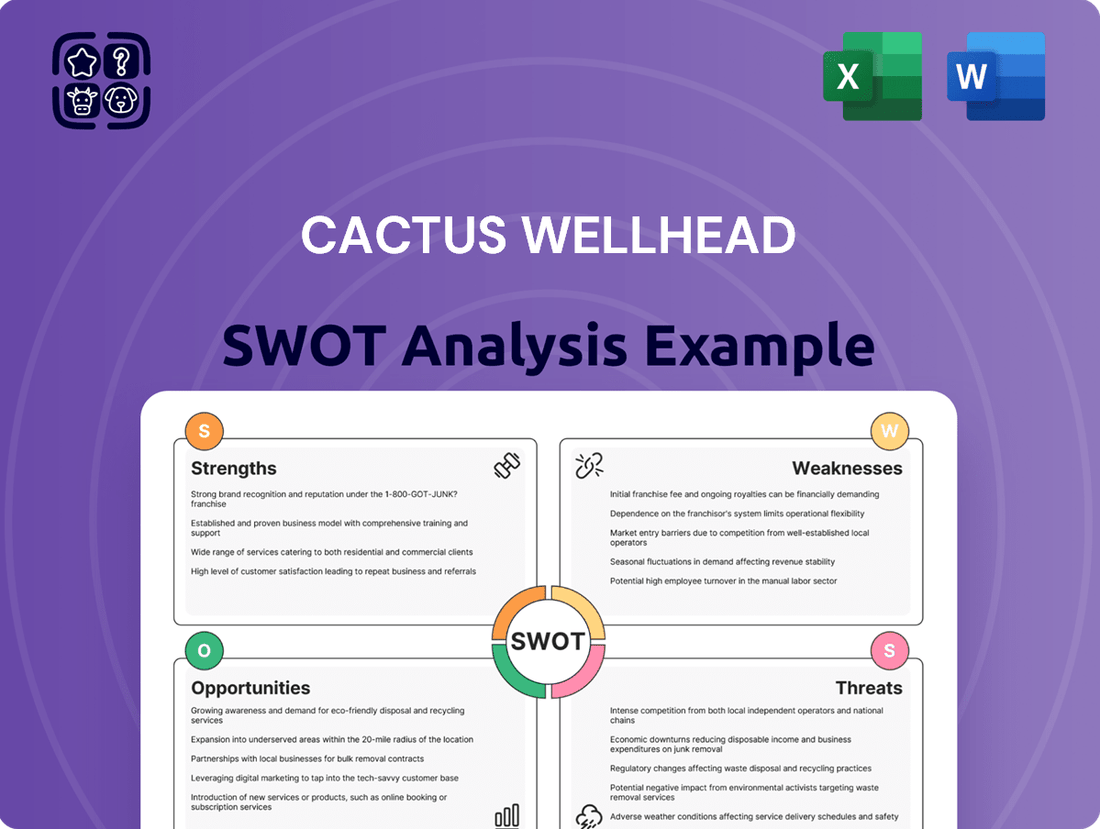

Analyzes Cactus Wellhead’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address potential challenges in wellhead operations.

Weaknesses

Cactus, Inc. saw a slight dip in total revenues and net income during the first half of 2025 when compared to the first half of 2024. This trend continued into the second quarter of 2025, where the company's financial results fell short of projections.

These revenue and net income declines highlight a more challenging financial period for Cactus, Inc. It suggests that the company needs to pay close attention to competitive pressures and evolving market dynamics to navigate these headwinds effectively.

Cactus Wellhead's substantial reliance on U.S. onshore oil and gas activity presents a significant vulnerability. This sector is inherently cyclical, with its fortunes closely tied to fluctuations in drilling activity and commodity prices. For instance, a projected decline in the U.S. land rig count through Q3 2025, as indicated by industry forecasts, directly threatens Cactus Wellhead's domestic revenue streams, potentially leading to reduced market activity and lower sales.

This concentrated exposure to the U.S. onshore market means that downturns in this specific region can disproportionately impact the company's overall financial performance. If drilling activity slows significantly, as anticipated for the latter half of 2025, Cactus Wellhead's revenue generation capacity within its primary market will be directly challenged, highlighting a key weakness in its geographic and operational diversification.

Cactus Wellhead faces challenges with rising costs. The cost of product revenue and rental revenue has increased, potentially impacting profit margins. For instance, in Q1 2025, the cost of revenue saw a notable uptick.

Further compounding this issue, selling, general, and administrative (SG&A) expenses experienced a significant surge in the first quarter of 2025. This rise in operating expenses outpaced the sequential revenue growth, signaling a need for tighter cost controls.

Impact of Tariffs and Supply Chain Challenges

Cactus Wellhead's profitability is directly challenged by escalating tariffs on essential imported materials like steel, which significantly increase the cost of producing its Pressure Control products. These tariffs are a persistent obstacle, demanding considerable strategic shifts to mitigate their financial impact.

While Cactus Wellhead is actively implementing countermeasures, such as relocating manufacturing operations to Vietnam, these tariffs continue to exert pressure on its bottom line. The company's stated goal is to fully offset the effects of these tariffs by the middle of 2026, indicating a focused effort to neutralize this ongoing weakness.

- Rising Input Costs: Tariffs on steel and other components directly inflate manufacturing expenses.

- Strategic Relocation: Transitioning production to Vietnam is a proactive, albeit resource-intensive, response.

- Profitability Headwind: Tariffs represent a continuous drag on margins that requires ongoing management.

- Neutralization Target: The company aims to eliminate the tariff impact by mid-2026, highlighting the strategic importance of this issue.

Ongoing Legal Disputes

Cactus Inc. is currently involved in significant legal battles, notably ongoing litigation with Cameron International Corporation. These disputes carry the potential for substantial financial repercussions and can damage the company's public image. The inherent uncertainty surrounding the resolution of these legal challenges introduces a notable risk factor to Cactus Wellhead's operational stability and financial health.

The outcomes of these legal entanglements could result in considerable financial liabilities for Cactus Wellhead, potentially impacting profitability and cash flow. Furthermore, the time and resources diverted to managing these disputes can disrupt normal business operations and strategic initiatives, hindering growth and innovation.

- Litigation Impact: Ongoing legal disputes, such as the case with Cameron International, can lead to significant financial penalties and legal fees, potentially impacting Cactus Wellhead's earnings per share.

- Reputational Risk: Prolonged legal battles can negatively affect customer and investor confidence, potentially leading to a decrease in market share and stock valuation.

- Operational Disruption: Legal proceedings can divert management attention and resources away from core business activities, potentially slowing down product development and market expansion efforts.

Cactus Wellhead's heavy reliance on the U.S. onshore market makes it susceptible to regional downturns. A projected decrease in the U.S. land rig count through Q3 2025, for example, directly impacts its primary revenue source. This concentration limits the company's ability to offset potential losses from other geographic areas, as seen in the revenue dip experienced in the first half of 2025 compared to the prior year.

The company is also grappling with rising operational costs. Both the cost of product revenue and rental revenue saw an increase in early 2025, directly pressuring profit margins. Furthermore, selling, general, and administrative expenses surged in Q1 2025, outpacing revenue growth and indicating a need for improved cost management.

Escalating tariffs on critical imported materials like steel continue to inflate manufacturing costs for Cactus Wellhead's Pressure Control products. While the company is actively working to mitigate these effects, for instance, by relocating manufacturing to Vietnam with a goal to fully offset impacts by mid-2026, these tariffs remain a persistent drag on profitability.

Significant legal battles, including ongoing litigation with Cameron International Corporation, pose a substantial risk to Cactus Wellhead. These disputes can lead to considerable financial liabilities, divert resources from core operations, and potentially damage the company's reputation, impacting investor and customer confidence.

Preview Before You Purchase

Cactus Wellhead SWOT Analysis

The preview you see is the actual Cactus Wellhead SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global wellhead equipment market is poised for substantial growth, with projections indicating it could surpass $8 billion by 2032. This upward trend is fueled by a consistent rise in global energy demand and continuous investment in drilling and exploration projects worldwide.

This expanding market represents a prime opportunity for Cactus Wellhead to increase its presence and revenue streams. North America is anticipated to remain the leading market segment, offering a strong base for operations and further development.

The oilfield services sector is seeing significant tech upgrades, with digital tools, AI, and automation becoming more common. For instance, the global oilfield services market was valued at approximately $200 billion in 2023 and is projected to grow, driven by these innovations.

Cactus Wellhead can leverage these advancements by incorporating smart well technologies and enhanced automation into its products. This integration can boost efficiency and lower operational expenses for their clients, a key selling point in a competitive market.

Furthermore, new drilling methods, such as extended reach drilling and longer horizontal laterals, are increasing the need for specialized and advanced wellhead equipment. This trend directly supports demand for Cactus's core offerings, especially if they can innovate to meet these evolving technical requirements.

Cactus is strategically expanding its reach into international markets, with a keen focus on Canada and the Middle East. This expansion is designed to diversify revenue streams and lessen the company's dependence on the often unpredictable U.S. land-based oil sector. For instance, in 2024, the company reported a significant portion of its revenue growth originating from these international ventures, signaling a successful pivot.

The recent acquisition of Baker Hughes' Surface Pressure Control business is a critical enabler of this international strategy. This move not only grants Cactus an immediate and substantial presence in key overseas markets but also brings with it high-margin aftermarket services, a segment known for its consistent revenue generation. This integration is expected to bolster Cactus's global service capabilities significantly throughout 2025.

By establishing a stronger international footprint, Cactus is better positioned to mitigate the cyclical downturns that frequently impact the North American oil and gas industry. This diversification is projected to contribute to more stable financial performance, as evidenced by analyst projections for 2025, which anticipate a notable increase in international revenue share.

Increased Focus on Enhanced Oil Recovery (EOR) and Unconventional Resources

The oilfield services sector is poised for growth driven by a sustained emphasis on enhanced oil recovery (EOR) methods and the development of unconventional resources, such as shale gas. Cactus's specialized equipment, particularly for onshore unconventional wells, aligns perfectly with the increasing demand stemming from these crucial activities.

The global wellhead equipment market is projected to see a significant boost from the expanding exploration of shale oil and coal bed methane. For instance, the U.S. Energy Information Administration (EIA) reported that crude oil production from shale formations reached approximately 12.9 million barrels per day in early 2024, highlighting the robust activity in this segment.

- EOR Market Growth: The global EOR market was valued at an estimated $35 billion in 2023 and is projected to grow, driven by the need to maximize production from mature fields.

- Unconventional Resource Demand: Increased investment in unconventional resource extraction, particularly in North America, directly translates to higher demand for specialized wellhead solutions.

- Shale Oil & CBM Expansion: The continued exploration and production of shale oil and coal bed methane are key drivers for the wellhead equipment sector, with significant capital expenditures expected in these areas through 2025.

Strategic Partnerships and M&A

The oil and gas services sector is experiencing significant consolidation, creating a fertile ground for strategic partnerships and mergers and acquisitions. Cactus Wellhead can leverage this trend to enhance its market standing and expand its operational footprint.

The company's proven ability to successfully integrate acquisitions, such as FlexSteel, and its ongoing pursuit of deals like the pending Baker Hughes SPC transaction, are key drivers for future growth. These integrations are expected to unlock substantial cost synergies and create lucrative cross-selling opportunities, ultimately boosting profitability and extending market reach.

These strategic moves allow Cactus Wellhead to:

- Broaden its product and service portfolio, catering to a wider range of customer needs.

- Incorporate fresh technologies and innovative solutions through acquired expertise.

- Achieve economies of scale, improving operational efficiency and cost competitiveness.

- Expand its geographic presence and customer base by entering new markets or strengthening existing ones.

Cactus Wellhead is well-positioned to capitalize on the growing global demand for energy, particularly from unconventional resources like shale. The company's strategic expansion into international markets, such as Canada and the Middle East, diversifies its revenue streams and mitigates risks associated with the U.S. land-based sector. Furthermore, the ongoing consolidation within the oilfield services industry presents opportunities for strategic acquisitions and partnerships, enhancing Cactus's market position and technological capabilities.

| Opportunity Area | Market Trend/Data | Impact on Cactus Wellhead |

|---|---|---|

| Global Energy Demand | Projected to exceed $8 trillion by 2032 | Increased need for wellhead equipment, driving revenue growth. |

| International Expansion | Focus on Canada & Middle East, successful revenue growth reported in 2024 | Diversifies revenue, reduces reliance on U.S. market. |

| Technological Advancements | Digital tools, AI, automation in oilfield services | Opportunity to integrate smart technologies, improve efficiency for clients. |

| Unconventional Resources | Shale oil production ~12.9 million bpd (early 2024) | Directly boosts demand for specialized wellhead solutions. |

| Industry Consolidation | Ongoing M&A activity in oilfield services | Potential for strategic acquisitions and partnerships to expand footprint. |

Threats

Volatile commodity prices pose a significant threat to Cactus Wellhead. Fluctuations in crude oil and natural gas prices directly impact the capital expenditures and drilling incentives of exploration and production (E&P) companies. For instance, West Texas Intermediate (WTI) crude oil prices were in the low $70s during 2024, with forecasts suggesting a dip into the high $60s by late 2025. This price environment can dampen demand for Cactus's wellhead equipment and services.

The U.S. oil and gas sector is experiencing a downturn with declining day rates and fluctuating rig utilization. This trend directly impacts companies like Cactus Wellhead, as reduced drilling activity translates to lower demand for their essential equipment.

Projections indicate a continued decline in the U.S. land rig count through Q3 2025. For instance, the Baker Hughes U.S. Rotary Rig Count, a key industry benchmark, has shown a consistent downward trend throughout 2024, signaling a challenging environment for wellhead manufacturers.

This contraction in drilling activity poses a significant threat to Cactus Wellhead's revenue streams. Lower demand for new wellhead sales and a potential decrease in rental income for existing equipment could negatively affect the company's financial performance.

The oilfield services sector is a battlefield, demanding constant innovation and aggressive cost management to stay ahead. Cactus Wellhead contends with established giants and a landscape reshaped by major mergers and acquisitions. For instance, the industry saw significant consolidation in 2023 and early 2024, with several key players combining operations, potentially concentrating drilling rigs under fewer, larger entities.

This intense competition means Cactus must continuously invest in research and development to offer cutting-edge solutions while simultaneously streamlining operations to remain cost-competitive. Failure to do so could lead to a gradual erosion of market share as larger competitors leverage economies of scale and broader service portfolios.

Regulatory and Geopolitical Uncertainties

Global energy policies and increasing geopolitical tensions create significant headwinds for the oil and gas sector. For Cactus Wellhead, this translates to uncertainty in demand and potential disruptions to supply chains, impacting their ability to forecast and operate efficiently. For instance, the ongoing geopolitical instability in Eastern Europe, which began in early 2022, continues to affect global energy markets, leading to price volatility and supply chain challenges that persist into 2024 and 2025.

Regulatory changes, including tariffs and evolving environmental mandates, directly influence operational costs and investment decisions. The push for energy transition and growing ESG pressures are compelling companies to adapt, potentially increasing compliance burdens and requiring capital allocation towards cleaner technologies, which could affect Cactus Wellhead's traditional business model.

- Tariff Impact: In 2023, the average tariff rate on imported steel, a key input for wellhead manufacturing, remained a concern, with some tariffs exceeding 25%, directly increasing Cactus Wellhead's raw material costs.

- Energy Transition Pace: The speed at which global governments implement stricter emissions standards and promote renewable energy sources, as seen in the EU's continued focus on carbon border adjustments, creates uncertainty for long-term demand in fossil fuel extraction equipment.

- Geopolitical Risk Premium: Geopolitical events in 2024 have contributed to a risk premium in oil prices, influencing exploration and production budgets, which in turn affects demand for wellhead services and products.

Supply Chain Disruptions and Inflationary Pressures

The oilfield services sector, including companies like Cactus Wellhead, continues to grapple with lingering inflation from recent years. This residual inflation, coupled with ongoing capacity constraints within the industry, creates a challenging operating environment. Potential disruptions to global supply chains further exacerbate these issues, impacting the availability and cost of essential components.

Specifically, Cactus Wellhead faces risks from rising tariffs and import restrictions. These policies, particularly on critical materials such as steel and oil country tubular goods (OCTG), can directly impact the economic viability of well projects. Increased material costs translate into higher operational expenses for Cactus, potentially squeezing margins and affecting their competitive pricing.

These supply chain vulnerabilities and inflationary pressures can significantly hinder the timely delivery of Cactus Wellhead's products. Delays in obtaining necessary materials or components can disrupt project timelines, leading to cost overruns and potentially impacting customer satisfaction. The overall cost-effectiveness of their offerings is therefore under pressure.

- Inflationary Headwinds: Residual inflation continues to affect input costs across the oilfield services industry.

- Capacity Constraints: Limited production capacity within the sector can lead to longer lead times and increased prices for components.

- Tariff and Import Risks: Rising tariffs on steel and OCTG could increase raw material costs by an estimated 5-10% for key components in 2024, impacting well economics.

- Supply Chain Volatility: Potential disruptions in the global supply chain can delay product delivery and elevate operational expenses for Cactus Wellhead.

Intensifying competition from larger, consolidated entities poses a significant threat, potentially squeezing market share for Cactus Wellhead. The ongoing energy transition, driven by global policies and ESG pressures, introduces uncertainty regarding long-term demand for traditional wellhead equipment, necessitating adaptation and investment in new technologies.

Geopolitical instability and evolving global energy policies create volatile market conditions, impacting demand forecasts and potentially disrupting supply chains. Furthermore, persistent inflation and supply chain vulnerabilities continue to drive up input costs for critical materials like steel, directly impacting Cactus Wellhead's operational expenses and pricing competitiveness.

| Threat Category | Specific Risk | Impact on Cactus Wellhead | 2024/2025 Data Point |

|---|---|---|---|

| Competition | Industry Consolidation | Reduced market share, pricing pressure | Major M&A activity in 2023-2024 |

| Market Dynamics | Energy Transition | Uncertainty in traditional product demand | Increased ESG focus and stricter emissions standards |

| Geopolitics & Policy | Global Energy Policies | Demand volatility, supply chain disruption | Ongoing geopolitical instability affecting energy markets |

| Cost Environment | Inflation & Tariffs | Increased raw material costs, reduced margins | Tariffs on steel >25% in 2023; estimated 5-10% cost increase on components in 2024 |

SWOT Analysis Data Sources

This Cactus Wellhead SWOT analysis is built upon a robust foundation of data, including comprehensive financial statements, detailed market intelligence reports, and expert industry forecasts. These sources ensure a thorough and accurate assessment of the company's strategic position.