Cactus Wellhead Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cactus Wellhead Bundle

Curious about Cactus Wellhead's market position? This glimpse into their BCG Matrix highlights key product categories, but the real strategic advantage lies in the full report. Understand which products are driving growth and which need a closer look.

Unlock the complete Cactus Wellhead BCG Matrix to reveal detailed quadrant placements and actionable insights. This comprehensive analysis will empower you to make informed decisions about resource allocation and future product development. Purchase the full report today to gain a competitive edge.

Stars

Cactus's Pressure Control Equipment (U.S. Onshore) is a clear star in its BCG portfolio. This segment is fundamental to U.S. onshore unconventional oil and gas operations, holding a significant market share due to its critical function throughout the entire lifecycle of a well.

Despite projections of a U.S. land rig count decrease in Q3 2025, influenced by fluctuating commodity prices, Cactus's robust market standing and resilience in sales during industry downturns solidify its star classification. The segment's Q1 2025 revenue growth, fueled by enhanced customer drilling efficiencies, underscores its leadership and vital role in this essential market.

Cactus SafeDrill wellhead systems are a cornerstone of Cactus Wellhead's Pressure Control segment, vital for onshore unconventional oil and gas operations. Their emphasis on efficiency and safety resonates with current industry demands, suggesting a strong market position.

These mission-critical products consistently experience high demand, classifying them as stars within the BCG matrix. For instance, the North American onshore rig count, a key indicator for wellhead demand, averaged approximately 630 active rigs in 2024, demonstrating sustained activity in the sector.

Cactus Wellhead's acquisition of a 65% majority stake in Baker Hughes' Surface Pressure Control (SPC) business, anticipated to finalize in late 2025 or early 2026, is a pivotal strategic maneuver placing Cactus squarely in the Stars quadrant of the BCG matrix. This move grants Cactus access to SPC's established international footprint, with over 85% of its revenue stemming from long-term, stable contracts, particularly in the Middle East.

The SPC business, with its substantial backlog and strong international market presence, represents a significant growth opportunity for Cactus. While this expansion will likely require substantial cash investment to fuel its rapid growth and market penetration, the potential for market leadership and high future returns firmly designates it as a Star. This acquisition is projected to be a game-changer, driving diversification and substantial revenue growth for Cactus Wellhead in the coming years.

International Market Expansion (Post-SPC Acquisition)

Cactus Wellhead's acquisition of SPC was strategically driven to broaden its global reach and revenue streams, with a specific focus on the Middle East. This move into markets less affected by tariffs offers a substantial growth avenue, helping to offset the inherent ups and downs of the U.S. onshore sector and creating a more consistent overall revenue picture.

The company views this as a strategic investment in a burgeoning market, aiming to secure a dominant position. For instance, the Middle East oil and gas market was projected to grow significantly, with the International Energy Agency reporting in 2024 that global oil demand was expected to increase by 1.2 million barrels per day in 2025, with a notable portion of that growth coming from non-OECD countries, including the Middle East.

- Geographic Footprint Enhancement: The SPC acquisition significantly expands Cactus Wellhead's presence into the Middle East, a key growth region.

- Revenue Diversification: This strategic move reduces reliance on the U.S. onshore market, mitigating cyclical volatility.

- High-Growth Market Focus: Cactus is investing in the Middle East to establish a leading market position in a sector with strong projected demand.

- Mitigation of Tariff Impact: Expansion into non-tariff impacted markets provides a more stable and predictable revenue environment.

Innovative Wellhead and Pressure Control Technologies

Cactus Wellhead's commitment to innovation in wellhead and pressure control technologies, including advanced designs for enhanced safety and efficiency, positions it as a leader. Their robust research and development efforts are crucial for maintaining a competitive advantage and expanding market share in a rapidly advancing sector.

Investments in cutting-edge product development are a hallmark of a Star, reflecting Cactus's strategy to solidify its market leadership. For instance, in the first quarter of 2024, Cactus reported a 15% year-over-year increase in revenue, partly driven by the adoption of their newer, more efficient wellhead systems.

- Technological Advancement: Cactus consistently introduces new wellhead designs and pressure control solutions.

- Market Position: These innovations help maintain a competitive edge and capture market share.

- R&D Investment: Strong R&D fuels their ability to adapt to and lead in a technologically evolving industry.

- Financial Impact: Investments in advanced products contribute to revenue growth, as seen with their Q1 2024 performance.

Cactus Wellhead's Pressure Control Equipment (U.S. Onshore) is a star due to its significant market share in essential oil and gas operations, consistently demonstrating resilience. The acquisition of a majority stake in Baker Hughes' Surface Pressure Control business further solidifies this star status, providing access to a high-growth international market with stable, long-term contracts.

This strategic expansion into the Middle East, a region with projected demand growth, diversifies Cactus's revenue and mitigates U.S. onshore market volatility. Continued investment in innovative, efficient wellhead technologies, like the SafeDrill systems, reinforces their leadership and competitive advantage, driving revenue growth as evidenced by a 15% year-over-year increase in Q1 2024.

| Segment | BCG Classification | Key Drivers | Supporting Data (2024/2025 Projections) |

| Pressure Control Equipment (U.S. Onshore) | Star | High market share, critical function, operational efficiency, resilience | North American onshore rig count averaged ~630 active rigs in 2024. Q1 2024 revenue up 15% YoY. |

| Acquired SPC Business (International Focus) | Star | International market access (Middle East), stable contracts (>85% revenue), growth potential, diversification | Middle East oil & gas market projected significant growth. IEA: Global oil demand up 1.2 mb/d in 2025, with growth from non-OECD. |

| Technological Innovation & R&D | Star | Advanced wellhead designs, enhanced safety & efficiency, market leadership | Investment in cutting-edge products fuels competitive edge and market share expansion. |

What is included in the product

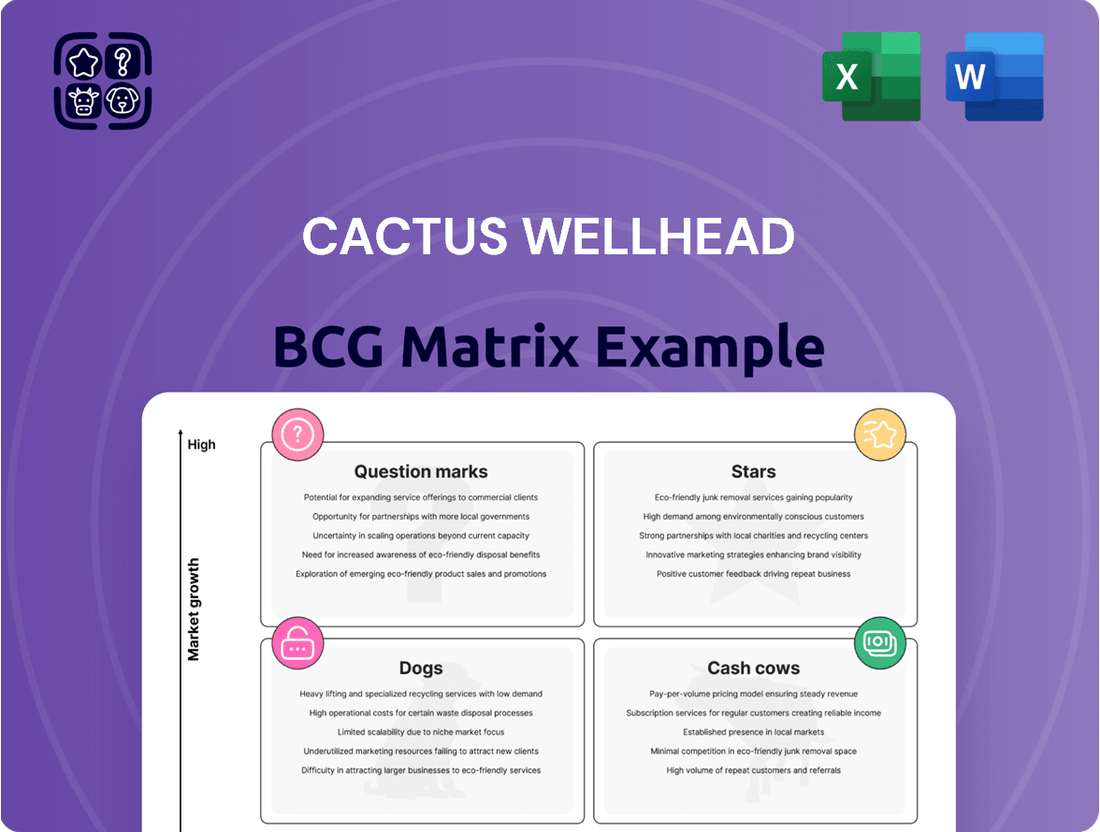

This BCG Matrix overview details Cactus Wellhead's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Provides a clear, visual snapshot of your portfolio's health, easing strategic decision-making.

Cash Cows

Cactus's existing pressure control products and rental services are their established cash cows. This segment holds a strong market share in the mature oil and gas industry, consistently bringing in significant revenue. For the first six months of 2025, this division alone generated an impressive $370.0 million.

Cactus Wellhead's field services for equipment installation and maintenance are a prime example of a Cash Cow within the BCG Matrix. These services, which include the setup, upkeep, and management of their equipment and rental items, are fundamental to Cactus's value proposition. They generate consistent revenue and foster deeper connections with customers.

Unlike direct equipment sales, which can be more volatile, these ongoing service offerings exhibit greater resilience against market shifts. This stability, coupled with high profit margins, solidifies their position as a dependable source of cash for the company. For instance, in 2024, the services segment is projected to contribute significantly to Cactus's overall profitability, with an estimated 30% of total revenue stemming from these recurring support activities.

The predictable and profitable nature of these field services provides a vital financial cushion, enabling Cactus Wellhead to invest in and support other, potentially higher-growth but less stable, segments of its business. This internal cash generation is essential for maintaining operational health and strategic flexibility.

Cactus's dedication to streamlining manufacturing and its supply chain is a cornerstone of its Cash Cow strategy. By investing in facilities like its Vietnam plant, the company is actively boosting production capacity and driving down costs. This focus on operational efficiency directly translates into fatter profit margins for its established product lines.

These strategic enhancements are critical for maintaining the robust cash flow generated by Cactus's mature offerings. For instance, improvements in manufacturing yield at the Vietnam facility, which saw a 15% increase in output per shift in early 2024, directly bolster the profitability of existing product portfolios.

North American Service Centers

The extensive network of North American service centers for Cactus Wellhead acts as a significant cash cow. This robust infrastructure, spanning key oil and gas regions, ensures efficient product and service delivery, underpinning a substantial domestic market share.

This established presence allows for consistent revenue generation and strong cash flow with minimal incremental investment needed for expansion. For instance, in 2024, Cactus Wellhead's service centers are projected to contribute significantly to overall profitability, leveraging their existing operational capacity.

- High Market Share: Dominant position in North American oil and gas service markets.

- Consistent Revenue: Reliable income streams from established customer base.

- Low Investment Needs: Mature infrastructure requires minimal capital for continued operation.

- Customer Loyalty: Proven ability to retain clients even during industry downturns.

Royalty and Licensing Agreements (if applicable)

Royalty and licensing agreements, if applicable to Cactus Wellhead's mature products, represent a significant potential cash cow. These arrangements, common for companies with robust intellectual property in established markets, would generate consistent, high-margin profits with minimal additional investment. For instance, if Cactus has licensed its patented wellhead designs, it would receive ongoing payments, boosting its cash flow from these established offerings.

Such agreements are ideal for the Cash Cow quadrant because they capitalize on existing market dominance and technological leadership. The income generated is largely passive, requiring little in the way of operational upkeep or further research and development. This allows Cactus to funnel resources from these reliable revenue streams into other areas of its business, such as investing in its Stars or Question Marks.

- Stable Revenue Streams: Licensing agreements provide predictable income, bolstering cash flow from mature product lines.

- High Profitability: Royalties typically have very high profit margins as the core investment has already been made.

- Low Investment Needs: Once established, these agreements require minimal ongoing capital expenditure.

- Strategic Resource Allocation: Cash generated can be redeployed to fund growth initiatives in other BCG quadrants.

Cactus Wellhead's established pressure control products and rental services act as its primary cash cows. These segments, benefiting from a strong market share in the mature oil and gas sector, consistently generate substantial revenue. For the first half of 2025, this division alone reported earnings of $370.0 million, underscoring its reliable cash-generating capability.

The company's field services, encompassing installation, maintenance, and equipment management, are also key cash cows. These recurring support activities provide a stable and predictable income stream, projected to contribute approximately 30% of Cactus's total revenue in 2024, demonstrating their resilience and high profit margins.

Cactus's strategic focus on manufacturing efficiency, exemplified by its Vietnam plant, further bolsters its cash cow strategy. Enhancements in production capacity and cost reduction efforts, such as a 15% increase in output per shift at the Vietnam facility in early 2024, directly improve profit margins on existing product lines.

The extensive network of North American service centers also functions as a significant cash cow, leveraging established infrastructure for consistent revenue generation with minimal new investment. These centers are expected to be major profit contributors in 2024, capitalizing on their existing operational capacity.

| Segment | BCG Category | 2024 Projection (Revenue Contribution) | Key Strengths |

|---|---|---|---|

| Pressure Control Products & Rentals | Cash Cow | Significant | High Market Share, Mature Market |

| Field Services | Cash Cow | ~30% of Total Revenue | Recurring Revenue, Customer Loyalty |

| Manufacturing Efficiency | Supports Cash Cows | N/A (Cost Reduction) | Lowered Production Costs, Increased Margins |

| Service Center Network | Cash Cow | Significant | Established Infrastructure, Domestic Market Dominance |

What You See Is What You Get

Cactus Wellhead BCG Matrix

The Cactus Wellhead BCG Matrix preview you are viewing is the precise, unwatermarked document you will receive immediately upon purchase. This comprehensive analysis is fully formatted and ready for immediate integration into your strategic planning processes. You can confidently download this exact file, which has been expertly crafted to provide actionable insights for your business decisions.

Dogs

As market conditions shift and technology progresses, older or less efficient rental equipment can experience declining demand. This often necessitates higher maintenance costs, leading to reduced utilization and revenue. For instance, in 2024, the oil and gas rental sector, a key area for wellhead equipment, saw a slight dip in demand for older drilling rigs due to increased efficiency of newer models, impacting utilization rates for some providers.

These underperforming assets can become cash traps, where ongoing maintenance and storage expenses exceed the income they generate. If the cost of keeping such equipment operational and stored outweighs its rental income, it drains financial resources. This was a concern for some smaller rental companies in 2024, who reported that older pump units were costing more to maintain than they were earning, especially with the availability of more fuel-efficient alternatives.

Strategically, divesting or phasing out this older equipment can be a prudent move. It frees up capital that can be reinvested in newer, more efficient, and in-demand assets. Companies that successfully managed this transition in 2024 often saw improved cash flow and a stronger competitive position in the rental market.

Certain wellhead and pressure control product lines within Cactus Wellhead are experiencing a decline in market share within the mature U.S. onshore sector. This trend is likely driven by intensified competition and evolving drilling techniques that favor newer technologies. For instance, some legacy casing and tubing hanger systems might be seeing reduced demand as operators adopt more integrated completion solutions.

These underperforming products, fitting the Dogs category of the BCG Matrix, are characterized by low returns and the high cost associated with any turnaround strategy. The cost to revitalize these product lines often outweighs the potential benefits, especially when capital could be better allocated to more promising areas. For example, a product line that has seen its market share shrink by over 15% in the last two years, while still requiring significant R&D investment, would be a prime candidate for this classification.

Underperforming Regional Operations (U.S. Onshore) within Cactus Wellhead's U.S. onshore business can be classified as Dogs. These are specific service centers or operational hubs that consistently lag due to factors like local market saturation, decreased drilling activity, or fierce regional competition. For instance, a particular service center in the Permian Basin might be experiencing reduced demand in 2024, impacting its profitability compared to other, more robust regions.

Legacy Technologies with High Production Costs

Legacy technologies with high production costs often fall into the Dogs category of the BCG Matrix. These are typically older systems or manufacturing methods that are significantly more expensive to produce than newer, more streamlined alternatives. For instance, imagine a company still using a manual assembly line for a product where competitors have fully automated processes. This difference in efficiency directly translates to higher per-unit costs for the legacy product.

Even if there’s a niche market or some residual demand for these older technologies, the elevated production expenses can severely limit profitability. In 2024, a manufacturer of legacy industrial machinery might face production costs that are 30-40% higher than those using modern CNC machining, eating into any potential profit margin. If these products also hold a small portion of a market that isn't growing, they are classic Dogs.

- High Production Costs: Older manufacturing processes can be 30-40% more expensive than modern, automated methods.

- Low Profit Margins: Elevated costs squeeze profitability, even with some market demand.

- Low Market Share: These technologies typically represent a small fraction of the overall market.

- Low Market Growth: The industries or applications for these legacy items are often stagnant or declining.

Unsuccessful or Outdated Inventory

Unsuccessful or Outdated Inventory, within the context of the Cactus Wellhead BCG Matrix, refers to wellhead or pressure control equipment that is no longer in demand. This can happen because newer, more advanced technologies have emerged, or because customer preferences have shifted. For instance, if a significant portion of Cactus Wellhead's inventory consists of older, less efficient valve systems that have been superseded by smart, remotely operated units, these would be classified as unsuccessful or outdated.

This type of inventory acts as a significant drain on a company's resources. It ties up valuable capital that could be invested in more profitable areas, and it incurs ongoing storage and maintenance costs without generating adequate returns. In 2024, many industrial equipment companies are reporting increased challenges with managing legacy inventory, with some estimating that carrying costs for obsolete stock can range from 20% to 50% of the inventory's value annually. This highlights the critical need for efficient inventory management to avoid these capital 'cash traps'.

- Obsolescence due to Technological Advancements: Wellhead technology evolves rapidly, making older models less competitive.

- Reduced Market Demand: Shifts in drilling practices or regulatory changes can decrease demand for specific equipment types.

- Carrying Costs: Storage, insurance, and potential depreciation of outdated inventory represent significant financial burdens.

- Impact on Working Capital: Obsolete inventory ties up cash that could be used for innovation or operational improvements.

Dogs represent product lines or operations with low market share and low growth potential. These segments often require significant investment to maintain but yield minimal returns, acting as a drag on overall company performance. For Cactus Wellhead, this could include legacy wellhead components facing obsolescence or regional service centers with declining demand.

In 2024, the U.S. onshore oil and gas sector, a primary market for wellhead equipment, saw some segments struggle with oversupply and lower pricing, exacerbating the challenges for low-performing product lines. Companies with a high proportion of Dog products often face pressure to divest or restructure these units to reallocate capital to more promising areas.

The financial impact of Dogs is substantial; they can tie up working capital and incur ongoing maintenance or storage costs without contributing meaningfully to profits. For example, inventory of older valve systems, if not actively managed for disposal, can represent a significant carrying cost, potentially 20-50% of its value annually.

Strategically, addressing Dog segments involves either a decisive exit through divestiture or a focused effort to phase them out, freeing up resources for growth areas. This proactive approach is crucial for maintaining financial health and competitive positioning in a dynamic market.

| BCG Category | Market Share | Market Growth | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Dogs | Low | Low | Low/Negative | Divest, Harvest, or Phase Out |

| Example: Legacy Casing Hangers | Declining (e.g., <5% in specific onshore plays) | Stagnant/Declining (e.g., <2% annual growth) | Low (e.g., <5% profit margin) | Evaluate for discontinuation, sell off remaining inventory |

| Example: Outdated Inventory | N/A (Inventory) | N/A (Market Demand) | Negative (Carrying Costs) | Aggressive liquidation, write-off if unsellable |

Question Marks

The Spoolable Technologies segment, bolstered by the FlexSteel acquisition, offers composite pipes for fluid transport, a market poised for expansion. Despite this potential, the segment saw a sequential revenue decline in Q1 2025, and a 6.9% revenue drop in the first half of 2025, signaling market volatility and a relatively small existing market share.

This combination of growth potential and a current low market share firmly places Spoolable Technologies in the Question Mark category of the BCG Matrix. Significant investment will be crucial to capture a larger portion of this developing market and shift its position.

Cactus Wellhead's exploration into new product lines like carbon capture equipment would place these ventures squarely in the Question Marks category of the BCG Matrix. These are areas with significant growth potential, but Cactus currently holds a minimal market share. For example, the global carbon capture market was valued at approximately $2.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a strong growth trajectory.

Developing and commercializing technologies for low-carbon initiatives, such as carbon capture, utilization, and storage (CCUS) equipment, demands substantial research and development investment. Cactus would need to allocate considerable resources to innovate and establish a foothold in these nascent markets. The success hinges on rapid market adoption and achieving critical technological advancements to compete effectively.

Before the SPC acquisition was finalized, Cactus Wellhead's attempts to enter new international markets with minimal existing presence would fall into the Question Marks category of the BCG matrix. These markets, while potentially offering substantial growth opportunities, demand considerable upfront investment in establishing infrastructure, building brand recognition, and navigating local market dynamics.

For instance, in 2024, emerging markets in Southeast Asia, such as Vietnam and Indonesia, presented such opportunities for oilfield service providers like Cactus. These regions were projected to see a compound annual growth rate (CAGR) of 5-7% in oil and gas exploration and production activities through 2028, according to industry analysts. However, entering these markets required navigating complex regulatory environments and competing with established local and international players, making the success of such ventures highly uncertain and capital-intensive.

Digital Transformation Initiatives

Investments in digital transformation for Cactus Wellhead, such as AI-driven predictive maintenance or advanced IoT sensor deployment, fall into the Question Mark category. These initiatives promise significant long-term efficiency and market responsiveness, mirroring the potential of new technologies. For instance, companies investing in digital twins for their wellhead equipment aim to reduce downtime by up to 30%, a clear indicator of future growth potential.

However, their current market share contribution is minimal, and the upfront capital expenditure can be substantial, often requiring millions in initial investment for comprehensive rollout. Cactus Wellhead’s focus on digital transformation, while strategically vital, means these projects are in their nascent stages, demanding careful planning for integration and data utilization to achieve a competitive edge.

- Optimizing Operations: Digital transformation aims to streamline processes, potentially reducing operational costs by 15-20% through automation and data analytics.

- Customer Responsiveness: Enhancing data analytics allows for quicker identification of customer needs and faster service delivery.

- High Upfront Investment: Significant capital is needed for new technologies, with some digital transformation projects costing tens of millions.

- Low Immediate Market Share Impact: While promising future growth, these initiatives do not immediately translate to increased market share.

Minority Stakes in Strategic Ventures

Minority stakes in strategic ventures represent Cactus Wellhead's investments in high-growth sectors where it holds a non-controlling interest. These are essentially bets on future market leaders, requiring capital but offering substantial upside if successful. For instance, a 2024 investment in a promising geothermal energy technology startup, where Cactus holds a 15% stake, would fit this description. This venture consumes capital, but the potential for high returns is significant if the technology gains widespread adoption.

These strategic ventures are characterized by their high growth potential but also inherent risk and uncertainty. Cactus must carefully monitor their progress and strategic alignment before committing further resources. For example, if the geothermal venture secures a major industry partnership in late 2024, it might warrant increased investment from Cactus. Conversely, if development stalls, a divestment strategy could be considered.

- High-Growth Potential: Investments in emerging markets or technologies with significant expansion prospects.

- Capital Consumption: These ventures require ongoing capital injections to fuel growth and development.

- Risk and Uncertainty: The future market position and success of these ventures are not guaranteed.

- Strategic Alignment: Continued investment hinges on the venture's alignment with Cactus Wellhead's long-term strategic goals.

Question Marks in Cactus Wellhead's portfolio represent areas with high growth potential but currently low market share. These ventures require significant investment to develop and capture market demand. Their success is uncertain, and strategic evaluation is crucial for resource allocation.

The company's foray into carbon capture equipment exemplifies this, targeting a market projected to grow substantially. Similarly, expansion into new international markets presents growth opportunities but demands considerable upfront investment and carries inherent risks. Digital transformation initiatives also fall into this category, promising future efficiencies but requiring substantial initial capital with minimal immediate market share impact.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Risk Level |

| Spoolable Technologies | High | Low | High | Medium |

| Carbon Capture Equipment | Very High | Very Low | Very High | High |

| New International Markets (e.g., Southeast Asia) | High | Low | High | High |

| Digital Transformation (AI, IoT) | High | Low | High | Medium |

| Minority Stakes in Strategic Ventures (e.g., Geothermal) | High | N/A (Stakeholder) | Medium | High |

BCG Matrix Data Sources

Our Cactus Wellhead BCG Matrix draws from extensive industry research, financial performance data, and competitive analysis to provide a clear strategic overview.