Cactus Wellhead Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cactus Wellhead Bundle

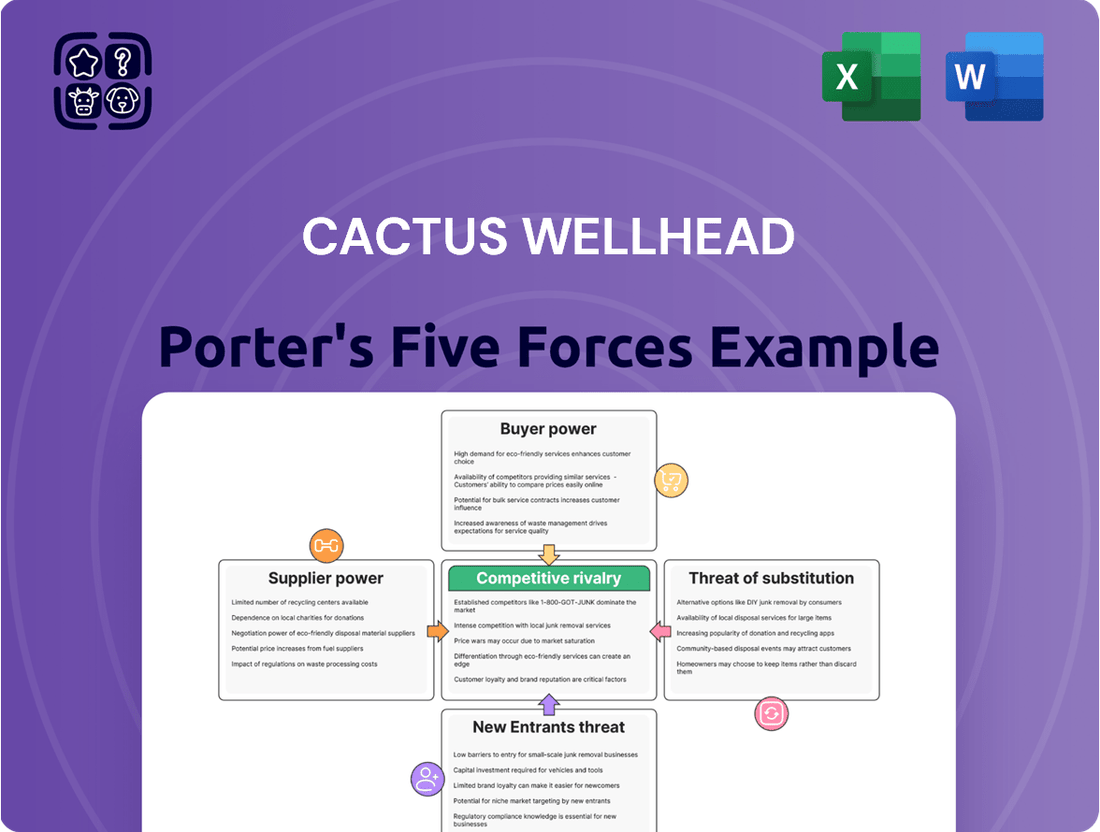

Cactus Wellhead navigates a competitive landscape shaped by intense rivalry and significant buyer power, as revealed by our Porter's Five Forces analysis. Understanding these dynamics is crucial for strategic advantage.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cactus Wellhead’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cactus Wellhead's procurement strategy, which involves sourcing raw materials and components from a broad range of suppliers, generally dilutes the bargaining power of any single supplier. This diversification helps prevent any one supplier from dictating terms or prices.

However, the situation can shift when Cactus requires highly specialized components. If only a few suppliers can provide these critical parts, their leverage naturally increases. This concentration could lead to higher costs or less favorable terms for Cactus.

To counter this, Cactus has been actively pursuing supply chain diversification. A notable example is their January 2025 investment of $6 million in a new manufacturing facility in Vietnam. This strategic move is designed to reduce reliance on any single source and enhance overall supply chain efficiency, thereby mitigating the risks associated with supplier concentration.

For common materials used in wellhead manufacturing, Cactus likely benefits from a broad selection of alternative suppliers. This widespread availability of generic inputs significantly dilutes the bargaining power of any single supplier, allowing Cactus to negotiate more favorable terms and pricing. For instance, in 2024, the global market for basic steel, a key component, saw an oversupply in many regions, further strengthening buyer power.

However, the situation shifts for highly engineered and specialized components crucial for wellhead and pressure control systems. The pool of qualified suppliers for these unique parts is considerably smaller, often limited to a few niche manufacturers. This scarcity can empower these specialized vendors, potentially leading to higher costs and longer lead times for Cactus, as seen in the increased lead times for specialized alloy components in late 2023 due to supply chain constraints.

Switching suppliers for Cactus Wellhead's standard raw materials may not incur high costs. However, for specialized or custom-engineered components, the expense and effort to switch suppliers can be substantial. This includes the time and resources needed for qualification, potential re-tooling of manufacturing processes, and necessary design adjustments, all of which can significantly increase switching costs.

These elevated switching costs grant specialized suppliers greater bargaining power over Cactus. For instance, if a critical custom component requires extensive testing and certification with a new supplier, the disruption and expense can be prohibitive, making it more advantageous to retain the existing supplier despite potentially higher prices.

Cactus Wellhead's strategic move to acquire FlexSteel in March 2023 highlights an effort to bolster production and potentially integrate its supply chain. This acquisition could lead to reduced reliance on external suppliers for certain parts, thereby mitigating the bargaining power of those suppliers by bringing more production in-house or through a controlled entity.

Supplier's Product Differentiation

Suppliers providing highly differentiated or proprietary technologies crucial for Cactus Wellhead's specialized equipment can exert significant pricing power. When these unique components are indispensable for maintaining product quality and performance, the suppliers' leverage naturally grows. For instance, a supplier developing advanced sealing materials or unique valve mechanisms that offer superior durability or operational efficiency could command premium prices, directly impacting Cactus's cost structure.

Innovation in materials science and manufacturing processes by suppliers can create exclusive offerings, further solidifying their position. Companies that invest heavily in R&D for specialized alloys or precision manufacturing techniques for critical wellhead components can create a competitive moat for themselves. This differentiation means Cactus might have fewer viable alternatives, increasing the supplier's ability to dictate terms. For example, a supplier holding patents on a specific high-pressure, corrosion-resistant alloy used in critical valve seats would have substantial bargaining power.

- Supplier Differentiation: Suppliers with unique, patented technologies for wellhead components increase their bargaining power.

- Criticality of Components: If a supplier's differentiated product is essential for Cactus's performance and quality, their leverage is amplified.

- Innovation Impact: Suppliers innovating in materials or manufacturing processes can create exclusive offerings, limiting Cactus's alternatives.

- Pricing Power: This differentiation allows suppliers to potentially charge higher prices, impacting Cactus's profitability.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into wellhead manufacturing, while theoretically possible for large, integrated players in the oil and gas equipment sector, remains a low concern for Cactus Wellhead. This is primarily due to the significant capital investment and highly specialized technical knowledge demanded by the wellhead production niche, an area where Cactus excels.

Most suppliers in this industry find it more strategic to concentrate on their established core competencies rather than venturing into the complex and capital-intensive wellhead market. For instance, a major pipe manufacturer would likely find the specialized machining and testing protocols for wellheads to be outside their primary operational expertise.

The oil and gas equipment sector saw significant investment in 2023, with global capital expenditures by major oil companies projected to reach approximately $560 billion, indicating a strong focus on core upstream and midstream operations rather than diversification into adjacent, highly specialized manufacturing segments.

- Low Capital Allocation: Suppliers typically direct capital towards their existing, profitable product lines rather than the substantial investment needed for wellhead production.

- Specialized Expertise Gap: The intricate engineering, material science, and regulatory compliance for wellheads require a depth of knowledge not commonly held by general oil and gas equipment manufacturers.

- Focus on Core Competencies: The industry trend favors specialization, with companies like Cactus Wellhead concentrating on their niche to maintain a competitive edge.

The bargaining power of suppliers for Cactus Wellhead is influenced by the availability and specialization of the components they provide. For common materials like basic steel, Cactus benefits from a wide supplier base, as evidenced by the oversupply in the global steel market during 2024, which strengthens buyer power.

However, for highly specialized components, such as advanced sealing materials or unique valve mechanisms, Cactus faces suppliers with greater leverage. These niche manufacturers often hold patents or possess proprietary technologies, limiting Cactus's alternatives and potentially leading to higher prices. For example, a supplier with patents on critical high-pressure alloys can command premium pricing.

The switching costs for these specialized parts are substantial, involving qualification, re-tooling, and design adjustments, which further empowers these suppliers. Cactus’s acquisition of FlexSteel in March 2023 aims to mitigate this by potentially bringing more production in-house, reducing reliance on external specialized suppliers.

| Factor | Impact on Cactus Wellhead | Example/Data Point |

| Supplier Specialization | Increases supplier bargaining power | Limited suppliers for advanced sealing materials |

| Component Criticality | Amplifies supplier leverage | Proprietary technologies essential for performance |

| Switching Costs | Elevates supplier power | High costs for qualifying new specialized component suppliers |

| Supplier Innovation | Creates exclusive offerings | Patented alloys for critical valve seats |

What is included in the product

This analysis meticulously examines the competitive forces impacting Cactus Wellhead, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the oil and gas equipment sector.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, empowering strategic adjustments for Cactus Wellhead.

Customers Bargaining Power

Cactus's customer base is concentrated among large multinational oil and gas firms, independent E&Ps, and national oil companies. This concentration, especially in the U.S. onshore sector where Cactus has a strong presence, grants these major clients considerable leverage in price and term negotiations.

However, Cactus is actively working to mitigate this by diversifying its customer pool. Their recent move to acquire a majority stake in Baker Hughes' Surface Pressure Control business, which draws 85% of its revenue from Middle Eastern NOCs, is a strategic step to reduce dependence on any single customer or region.

For customers, switching wellhead and pressure control equipment providers can involve moderate to high costs. These can include re-qualification processes, operational adjustments, and potential downtime, creating some stickiness for Cactus Wellhead's products and services once integrated. For instance, in 2024, the average cost for a major oil and gas operator to change primary wellhead suppliers was estimated to be between $50,000 and $150,000, factoring in engineering and testing.

While wellhead and pressure control equipment often share standardized core functions, Cactus Wellhead actively works to differentiate its offerings. This differentiation is achieved through superior design, meticulous manufacturing quality, enhanced safety features, and specialized field services, setting them apart in the market.

By offering highly differentiated products and consistently delivering superior service, Cactus effectively reduces the bargaining power of its customers. This strategy works because customers begin to perceive unique, tangible value in Cactus's solutions, making them less likely to switch based on price alone.

Cactus's ongoing commitment to improving safety and operational efficiency serves as a significant differentiator. For instance, their focus on advanced sealing technologies and remote monitoring capabilities directly addresses critical customer pain points, further solidifying their value proposition and diminishing customer price sensitivity.

Customer's Price Sensitivity

Customer price sensitivity for Cactus Wellhead, primarily oil and gas operators, is directly tied to volatile crude oil and natural gas prices. When commodity prices dip, these customers become more inclined to seek cost savings, putting pressure on Cactus for lower prices. This sensitivity was evident in Cactus's financial performance, with sequential revenue declines reported in periods of reduced customer spending.

This price sensitivity directly impacts Cactus's revenue and profitability. For instance, a significant drop in oil prices can lead to reduced drilling activity, directly decreasing demand for wellhead equipment. This was observed in recent financial reports where lower customer activity translated into revenue contraction.

- Customer Price Sensitivity: Oil and gas operators' willingness to pay for wellhead equipment fluctuates with crude oil and natural gas prices.

- Impact of Low Commodity Prices: During downturns, customers demand cost reductions, affecting Cactus's margins and revenue.

- Revenue Correlation: Cactus experienced sequential revenue declines in 2024, partly due to reduced customer activity driven by price sensitivity.

- Profitability Squeeze: Increased price pressure from customers can compress Cactus's profit margins, especially in a challenging market.

Threat of Backward Integration by Customers

The threat of backward integration by customers for wellhead manufacturers like Cactus is generally low. Major oil and gas exploration and production (E&P) companies, the primary customers, typically lack the specialized manufacturing capabilities and the significant capital outlay required to produce complex wellhead and pressure control equipment in-house. Their focus remains on their core competencies: finding and extracting hydrocarbons.

For instance, in 2024, the capital expenditure for a single, advanced wellhead system can run into hundreds of thousands of dollars, with the associated manufacturing requiring highly specialized machinery and a skilled workforce. The average E&P company's operational scope does not extend to managing such intricate manufacturing processes, making in-house production an economically unviable and strategically misaligned endeavor.

- Low Likelihood of Backward Integration: Oil and gas operators prioritize upstream activities, not manufacturing specialized equipment.

- High Capital Investment: Establishing wellhead manufacturing facilities demands substantial financial resources.

- Technical Expertise Gap: Designing and producing complex wellhead systems requires specialized engineering and production knowledge.

- Operational Complexity: Managing a manufacturing operation adds significant complexity to an E&P company's business model.

Cactus Wellhead faces moderate bargaining power from its customers, primarily large oil and gas firms. This power stems from customer concentration and price sensitivity, especially when commodity prices fall, as seen with revenue declines in 2024. While switching costs offer some customer stickiness, Cactus mitigates this by differentiating its products through superior design and service, making customers less likely to switch solely on price. The threat of customers integrating backward into wellhead manufacturing is low due to high capital and technical expertise requirements.

| Factor | Assessment | Impact on Cactus |

| Customer Concentration | Moderate to High (Large E&Ps, NOCs) | Increases customer leverage in negotiations. |

| Switching Costs | Moderate to High (Re-qualification, downtime) | Creates some customer stickiness. |

| Price Sensitivity | High (Tied to oil/gas prices) | Pressures margins during commodity downturns. |

| Product Differentiation | High (Design, quality, service) | Reduces customer reliance on price alone. |

| Backward Integration Threat | Low (High capital, technical needs) | Minimal direct threat to Cactus's market. |

Preview the Actual Deliverable

Cactus Wellhead Porter's Five Forces Analysis

This preview showcases the complete Cactus Wellhead Porter's Five Forces Analysis, detailing the competitive landscape of the oil and gas equipment sector. You'll receive this exact, professionally formatted document immediately after purchase, providing insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

The wellhead and pressure control equipment market is quite competitive, featuring several significant established companies that compete directly with Cactus. These major players include industry giants like Schlumberger, Baker Hughes, National Oilwell Varco (NOV), and Weatherford, alongside a number of smaller, more specialized firms.

Cactus is considered a substantial competitor, especially within its primary domestic market. For context, in 2023, the global oil and gas drilling equipment market, which includes wellheads, was valued at approximately $25.6 billion, indicating a large and active competitive landscape.

The global wellhead equipment market is expected to see a compound annual growth rate (CAGR) between 2.23% and 5.4% from 2024 to 2034. This growth is fueled by rising energy needs and increased exploration efforts worldwide. While this indicates a growing market, it's not experiencing hyper-growth, which can naturally lead to more intense rivalry as companies vie for a larger slice of the market.

This moderate growth environment means established players, including Cactus Wellhead, face pressure to differentiate and capture market share. Cactus's reported sequential revenue increase in Q1 2025 suggests some success in navigating this competitive landscape and maintaining market presence amidst the ongoing demand for wellhead solutions.

Cactus Wellhead distinguishes its offerings through specialized designs, enhanced safety features, and a robust suite of field services, exemplified by its SafeDrill wellhead systems. This focus on unique value propositions, rather than solely on price, helps to soften the impact of direct competition.

While the industry adheres to certain standards, Cactus's product differentiation, coupled with moderate customer switching costs, effectively dampens the intensity of rivalry. For instance, the investment in specialized training for technicians to operate and maintain Cactus's proprietary systems can represent a significant hurdle for customers considering a change. This strategic emphasis on value and service delivery plays a crucial role in reducing the pressure from direct price-based competition.

Exit Barriers

High exit barriers in the wellhead sector, driven by specialized manufacturing assets and significant capital investment, can keep companies operating even when market conditions are unfavorable. This persistence intensifies competition, as firms are less likely to withdraw, potentially leading to aggressive pricing to preserve market share.

The capital-intensive nature of wellhead manufacturing, with substantial investments in specialized machinery and facilities, creates a significant hurdle for companies looking to exit. For instance, a typical advanced CNC machining center for wellhead components can cost upwards of $500,000, making it difficult to recoup such investments quickly. This financial commitment often ties companies to the industry, even during periods of reduced demand or profitability, thereby maintaining a higher level of competitive pressure.

- Specialized Assets: Wellhead manufacturers often possess highly specialized, custom-built machinery and tooling, which have limited resale value outside the industry.

- Long-Term Contracts: Many companies are bound by long-term supply agreements with oil and gas producers, making immediate cessation of operations financially unviable.

- Workforce Dedication: A skilled and dedicated workforce, trained in specific manufacturing processes for wellhead equipment, represents another sticky element, as retraining or redeployment can be challenging and costly.

- Capital Intensity: The significant upfront investment in plant, property, and equipment, often running into millions of dollars for a single facility, discourages quick exits.

Strategic Acquisitions and Partnerships

The competitive landscape in the wellhead sector is highly dynamic, marked by frequent strategic acquisitions and partnerships. Companies are actively consolidating to gain market share and access new technologies. For instance, in 2024, Cactus Wellhead announced its agreement to acquire a majority interest in Baker Hughes' Surface Pressure Control business. This move is designed to significantly diversify Cactus's geographic footprint and bolster its competitive standing, especially in international markets.

This ongoing consolidation trend highlights strategic maneuvering within the industry as firms seek to enhance their market position and operational capabilities. Such transactions underscore the intense rivalry and the need for companies to adapt through strategic alliances and mergers to remain competitive.

- Strategic Acquisitions: Cactus Wellhead's 2024 agreement to acquire a majority interest in Baker Hughes' Surface Pressure Control business exemplifies this trend.

- Market Share Expansion: Such deals aim to consolidate market share and create larger, more influential players.

- Technological Advancement: Partnerships and acquisitions often facilitate access to new technologies and capabilities.

- Geographic Diversification: The Baker Hughes deal specifically targets expanding Cactus's presence in international markets.

The wellhead market is populated by major players like Schlumberger and Baker Hughes, alongside specialized firms, creating a crowded competitive space for Cactus Wellhead. Despite moderate market growth, estimated between 2.23% and 5.4% CAGR from 2024 to 2034, companies like Cactus focus on product differentiation, such as their SafeDrill systems, to stand out from rivals.

High capital requirements and specialized assets create significant exit barriers, meaning companies tend to persist even in less favorable conditions, thus intensifying rivalry. For example, the cost of advanced CNC machining centers for wellhead components can exceed $500,000, making quick exits difficult.

Strategic consolidation, like Cactus Wellhead's 2024 agreement to acquire a majority interest in Baker Hughes' Surface Pressure Control business, is a key tactic to expand market share and geographic reach amidst this competitive pressure.

Cactus's sequential revenue increase in Q1 2025 suggests it is effectively navigating this environment by focusing on value-added services and specialized designs, which can mitigate direct price competition and customer switching costs.

SSubstitutes Threaten

While direct substitutes for wellhead systems are scarce, evolving completion technologies present an indirect threat. Innovations like advanced horizontal drilling and hydraulic fracturing techniques aim to boost reservoir recovery and operational efficiency. These advancements can influence the specific types of wellhead equipment required, potentially reducing demand for certain legacy systems.

The increasing global shift towards renewable energy sources, such as solar and wind power, represents a significant long-term, indirect threat to the oil and gas sector, and by extension, to the demand for wellhead equipment. For instance, in 2024, global investment in clean energy is projected to reach a record $2 trillion, signaling a substantial move away from fossil fuels.

Government policies actively promoting renewables and stricter environmental regulations are increasingly discouraging new investments in oil and gas exploration and production. This trend is evident as many nations, including those in the EU, are setting ambitious targets for renewable energy integration, aiming to phase out fossil fuel reliance by mid-century.

Despite this, the immediate demand for oil and gas remains robust, especially in developing economies that are still reliant on these resources for industrial growth and energy security. In 2023, global oil demand still saw an increase of 2 million barrels per day, highlighting the ongoing need for traditional energy infrastructure, including wellheads.

Enhanced Oil Recovery (EOR) techniques, while not direct substitutes for wellheads themselves, can significantly impact the demand for new wellhead equipment. By extending the productive life of existing oil wells, EOR methods can reduce the immediate need for drilling new wells, thus potentially shifting demand towards maintenance and optimization services for current wellheads.

The market for wellhead equipment is influenced by both new drilling activity and the drive to maximize output from mature fields. In 2024, the global EOR market was valued at approximately $35 billion, demonstrating its substantial role in the oil and gas industry. This continued investment in EOR could temper the growth of new wellhead installations as operators focus on extracting more from their existing infrastructure.

Evolution of Well Control Technologies

Technological advancements, particularly the emergence of electric well control systems, present a potential threat of substitution for traditional hydraulic technologies. These electric systems, designed to enhance efficiency and safety, could replace certain components or even entire systems within the pressure control equipment sector. Cactus, as a key player in this market, must actively track and integrate these evolving technologies to maintain its competitive edge.

For instance, the increasing adoption of electric actuation in subsea equipment, a segment where Cactus operates, signifies a shift away from purely hydraulic solutions. While specific market share data for electric versus hydraulic well control is still developing, the trend towards electrification in the broader oil and gas industry, driven by a focus on reduced environmental impact and operational costs, suggests a growing substitutionary pressure.

- Electric Actuation: Replacing hydraulic power units and associated piping with electric motors and control systems.

- Reduced Complexity: Electric systems often involve fewer components, potentially lowering maintenance requirements and failure points.

- Cost and Safety Benefits: Innovations aim to decrease operational expenditures and improve safety by eliminating hydraulic fluid leaks.

- Market Adaptation: Cactus's ability to incorporate these electric technologies into its wellhead and pressure control offerings will be crucial.

Recycling and Refurbishment of Equipment

The recycling and refurbishment of wellhead equipment present a significant threat of substitutes for new equipment sales. Companies that can effectively restore used wellhead components for subsequent drilling and well operations directly compete with manufacturers of new products. This practice can potentially reduce the demand for new wellhead units, impacting sales volumes for established players like Cactus Wellhead.

While refurbishment offers a cost-effective alternative, the oil and gas industry's unwavering commitment to safety and operational reliability often dictates the preference for new or certified refurbished equipment. This stringent requirement means that not all recycled equipment can readily substitute for new units, as performance and safety certifications are paramount. For instance, in 2024, the global market for oil and gas equipment, including wellheads, continued to emphasize compliance with rigorous industry standards, such as API specifications, which can limit the direct substitution of uncertified refurbished parts.

- Threat of Substitutes: Refurbished wellhead equipment can replace the need for new purchases.

- Market Impact: This practice may decrease new sales volume for companies like Cactus Wellhead.

- Mitigating Factors: Stringent safety standards and the critical need for dependable equipment often favor new or certified refurbished products over uncertified used parts.

- Industry Standards: Compliance with API specifications remains a key factor in the oil and gas sector, influencing the acceptance of refurbished equipment.

The growing adoption of electric actuation in well control systems presents a substitution threat to traditional hydraulic technologies. These electric systems, aiming for enhanced efficiency and safety, could displace certain components or entire systems within pressure control equipment. For example, the oil and gas industry's increasing focus on electrification, driven by cost reduction and environmental considerations, suggests a rising substitutionary pressure.

Refurbished wellhead equipment also poses a threat by offering a cost-effective alternative to new purchases. Companies specializing in restoring used components can directly compete with manufacturers of new products, potentially reducing sales volumes. However, the industry's stringent safety and reliability standards, such as API specifications, often favor new or certified refurbished equipment, limiting the direct substitution of uncertified used parts.

Furthermore, advancements in completion technologies, like sophisticated horizontal drilling and hydraulic fracturing, indirectly impact wellhead demand. These innovations aim to improve reservoir recovery and efficiency, potentially altering the specific types of wellhead equipment required and reducing demand for older systems.

The broader energy transition, with a significant global investment in renewables, represents a long-term indirect threat. As nations prioritize clean energy and implement stricter environmental regulations, the demand for fossil fuels, and consequently wellhead equipment, could decline over time.

Entrants Threaten

Entering the wellhead and pressure control equipment manufacturing sector demands a significant financial commitment. New players must invest heavily in specialized machinery, state-of-the-art manufacturing facilities, and ongoing research and development. This substantial upfront capital requirement serves as a formidable barrier, deterring potential new entrants from challenging established companies like Cactus.

Cactus's reliance on highly engineered products and proprietary technology, like its SafeDrill wellhead systems, presents a significant barrier to new entrants. The substantial investment in research and development, coupled with the need for specialized engineering talent and the protection of intellectual property, makes it incredibly challenging for newcomers to replicate Cactus's advanced solutions. This technological moat is a key factor in deterring potential competitors.

Established players like Cactus Wellhead have cultivated significant brand recognition and deep-rooted relationships with major oil and gas operators. This loyalty is built on a foundation of proven reliability and consistent performance in a high-stakes industry. For instance, Cactus Wellhead's commitment to quality is reflected in its robust product lines, designed to withstand extreme conditions, a critical factor for operators where equipment failure can lead to substantial financial losses and safety hazards.

Newcomers face a formidable barrier in replicating this trust. The oil and gas sector, by its very nature, demands absolute certainty in equipment performance. A new entrant would find it exceptionally challenging to displace established suppliers who have demonstrated decades of dependable service, making market penetration a slow and arduous process.

Regulatory Hurdles and Safety Standards

The oil and gas sector, especially for essential components like wellheads, faces demanding safety and environmental regulations. New companies entering this market must overcome intricate certification procedures and adhere to these strict standards, significantly increasing both the expense and duration of market entry. These compliance expenses are inherently built into the final pricing of products within the industry.

For instance, in 2024, the cost of obtaining necessary certifications for specialized oilfield equipment can range from tens of thousands to hundreds of thousands of dollars, depending on the specific product and the jurisdictions involved. Furthermore, ongoing compliance with evolving environmental mandates, such as those related to emissions control and waste management, adds a continuous operational cost that potential new entrants must factor into their business models.

- Regulatory Compliance Costs: Significant upfront investment required for certifications and approvals.

- Safety and Environmental Standards: Rigorous requirements necessitate specialized engineering and manufacturing processes.

- Market Entry Barriers: High compliance costs and lengthy approval times deter new players.

- Impact on Pricing: Compliance expenses are passed on to customers, influencing overall market price levels.

Access to Distribution Channels and Supply Chains

Newcomers face substantial challenges in establishing efficient distribution channels and securing reliable supply chains for specialized components. Established players like Cactus Wellhead have cultivated extensive networks and strong supplier relationships over time, creating a significant barrier to entry.

Cactus Wellhead's strategic investment in supply chain diversification, announced in early 2024, underscores the critical nature of these established relationships. This move aims to further solidify their advantage by ensuring consistent access to essential materials, a feat difficult for new entrants to replicate quickly.

- Established Networks: Cactus Wellhead benefits from long-standing distribution agreements and logistics infrastructure built over years of operation.

- Supplier Leverage: Existing relationships grant Cactus favorable terms and priority access to raw materials and specialized components.

- Supply Chain Resilience: Investments in diversification, like those seen in 2024, enhance Cactus's ability to manage disruptions, a capability new entrants lack.

- Cost Disadvantage: New entrants often face higher initial costs for setting up similar distribution and supply chain capabilities.

The threat of new entrants for Cactus Wellhead is moderate due to high capital requirements and technological complexity. Significant investments in specialized manufacturing and R&D, along with proprietary technology, act as substantial barriers. For instance, the global wellhead market was valued at approximately $7.5 billion in 2023, with growth projected, indicating substantial capital needed to compete.

| Barrier Type | Description | Impact on New Entrants | Example for Cactus |

|---|---|---|---|

| Capital Requirements | High investment in machinery, facilities, and R&D. | Deters new entrants due to substantial upfront costs. | Estimated $50M+ for a new, fully equipped wellhead manufacturing facility. |

| Technology & IP | Proprietary designs and specialized engineering expertise. | Difficult for newcomers to replicate advanced solutions. | Cactus's SafeDrill technology requires significant engineering know-how. |

| Brand & Relationships | Established trust and long-term customer loyalty. | Challenging for new players to displace incumbents. | Cactus's proven reliability with major oil operators. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cactus Wellhead is built upon a foundation of industry-specific market research reports, financial filings from publicly traded competitors, and expert interviews with industry veterans. This multi-faceted approach ensures a comprehensive understanding of the competitive landscape.