Cactus Wellhead Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cactus Wellhead Bundle

Discover how Cactus Wellhead leverages its product innovations, strategic pricing, efficient distribution, and targeted promotions to dominate the oil and gas sector. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Ready to unlock the secrets behind Cactus Wellhead's market success? Get immediate access to a comprehensive, editable 4Ps Marketing Mix Analysis, packed with actionable insights and real-world examples.

Product

Cactus Wellhead's product strategy centers on its specialized design, manufacturing, sales, and rental of highly engineered wellheads and pressure control equipment. This core offering is vital for maintaining safety and operational efficiency throughout the lifecycle of onshore oil and gas wells, from initial drilling to ongoing production. The company's product portfolio includes critical components like the Cactus SafeDrill wellhead systems, frac stacks, zipper manifolds, and production trees, all engineered to manage downhole pressures effectively and optimize extraction processes.

Cactus Wellhead's acquisition of FlexSteel significantly broadens its product offerings by incorporating spoolable pipe technologies. This strategic move allows Cactus to serve a wider array of industries, from traditional oil and gas to emerging sectors like subsea infrastructure and municipal water systems.

The integration of FlexSteel's advanced spoolable pipe solutions, known for their flexibility and corrosion resistance, positions Cactus to capitalize on growing infrastructure renewal projects. For instance, the global market for flexible pipes was estimated to be around $7.5 billion in 2023 and is projected to grow, presenting a substantial opportunity for Cactus.

This diversification not only enhances Cactus's technological capabilities but also opens doors to new customer segments and revenue streams. By offering these advanced composite pipes, Cactus can provide more cost-effective and durable alternatives to traditional steel pipelines, particularly in challenging environments.

Cactus Wellhead 4P offers extensive field services, going beyond just equipment. These services are crucial for the installation, upkeep, and proper handling of their specialized wellhead products and rental equipment, ensuring clients maximize operational efficiency and safety.

In 2024, the demand for skilled field support in the oil and gas sector remained robust, with companies prioritizing uptime and safety. Cactus's commitment to providing expert on-site assistance directly addresses these critical customer needs, contributing to extended equipment lifespans and enhanced performance.

Focus on Safety and Efficiency

Cactus Wellhead's product strategy for its 4P marketing mix is deeply rooted in prioritizing safety and operational efficiency for well operations. This focus translates into engineered solutions designed to streamline drilling, completion, and production processes. Their commitment to robust pressure control directly addresses the critical need to prevent incidents in the high-stakes oil and gas sector.

This dedication to safety and efficiency serves as a significant competitive advantage for Cactus Wellhead. For instance, in 2024, the industry saw a continued emphasis on reducing non-productive time (NPT) due to safety incidents, with many operators targeting a 10-15% reduction. Cactus's solutions directly contribute to this goal.

- Enhanced Drilling Efficiency: Cactus's systems are engineered to reduce rig time and improve drilling fluid management, contributing to lower operational costs.

- Improved Completion Success Rates: Their technology aims to minimize wellbore issues during completion, leading to more reliable production from the outset.

- Robust Pressure Control: Cactus products are designed to exceed industry standards for pressure containment, a critical safety feature.

- Reduced Environmental Footprint: By increasing efficiency and preventing leaks, Cactus products help operators minimize their environmental impact.

New Introductions and Innovation

Cactus Wellhead is actively driving innovation, focusing on introducing new products and services to address the dynamic needs of the oil and gas sector. This commitment is key to expanding their market reach and attracting new clients.

The company's strategic roadmap includes the development of advanced, next-generation wellhead systems. Furthermore, Cactus Wellhead is exploring enhancements to its manufacturing capabilities to strengthen its supply chain and broaden its product portfolio.

These forward-looking initiatives are essential for Cactus Wellhead to maintain its competitive advantage. They also serve as a vital strategy for navigating and mitigating potential market challenges and economic headwinds.

- Product Development: Focus on next-generation wellhead systems.

- Supply Chain Enhancement: Exploring expanded manufacturing capabilities.

- Market Responsiveness: Meeting evolving industry needs and expanding customer base.

- Competitive Positioning: Crucial for maintaining an edge and mitigating market risks.

Cactus Wellhead's product strategy is built around specialized, highly engineered wellhead and pressure control equipment, crucial for onshore oil and gas operations. The integration of FlexSteel's spoolable pipe technologies further diversifies their offerings, targeting infrastructure renewal and new sectors. This product focus directly addresses industry demands for safety, efficiency, and reduced non-productive time, with a clear emphasis on innovation for future market needs.

| Product Category | Key Offerings | 2024/2025 Focus | Strategic Benefit |

|---|---|---|---|

| Wellhead Systems | Cactus SafeDrill, frac stacks, production trees | Next-generation system development, enhanced pressure control | Improved drilling efficiency, higher completion success rates |

| Spoolable Pipe Technologies (via FlexSteel) | Flexible composite pipes | Expansion into subsea, municipal water systems | Cost-effective, corrosion-resistant alternatives to steel pipelines |

| Rental Equipment | Pressure control equipment for various well stages | Ensuring uptime and safety for clients | Maximizing operational efficiency and safety for customers |

What is included in the product

This analysis offers a comprehensive examination of Cactus Wellhead's Product, Price, Place, and Promotion strategies, providing actionable insights for marketing professionals.

It's designed for those seeking a detailed understanding of Cactus Wellhead's market positioning and competitive advantages.

This Cactus Wellhead 4P's Marketing Mix Analysis acts as a pain point reliever by clearly outlining how product, price, place, and promotion strategies directly address customer needs and market challenges.

It provides a structured approach to identify and resolve marketing inefficiencies, transforming potential obstacles into strategic advantages for Cactus Wellhead.

Place

Cactus Wellhead's strategic service center network is a cornerstone of its market approach, primarily serving major U.S. onshore basins like the Permian, SCOOP/STACK, Marcellus, Utica, Eagle Ford, and Bakken. This widespread presence ensures swift field service and immediate product availability, directly addressing customer needs in critical production areas.

Cactus Wellhead's international market presence is expanding beyond its established North American base, with a notable focus on regions like Eastern Australia. This strategic international outreach is crucial for diversifying revenue streams and tapping into new growth opportunities.

The recent acquisition of a controlling stake in Baker Hughes' Surface Pressure Control (SPC) business is a game-changer for Cactus's global footprint. This move is projected to bring approximately 85% of SPC's current revenues from the Middle East, significantly bolstering Cactus's presence in a key international market and enhancing its overall geographic diversification.

Cactus Wellhead employs a strategic mix of direct sales and rental models for its wellhead and pressure control equipment. This dual approach ensures flexibility, accommodating customers who prefer outright ownership for long-term projects or require cost-effective, short-term solutions through rentals. For instance, in 2024, the oil and gas industry saw a significant uptick in rental demand for specialized equipment due to project timelines and capital expenditure caution, a trend Cactus is well-positioned to leverage.

Manufacturing Facilities

Cactus Wellhead's manufacturing capabilities are central to its marketing mix, ensuring product availability and supporting its global distribution network. A significant asset is its facility in Baytown, Texas, which is crucial for the production of its FlexSteel products.

The company is strategically expanding its manufacturing footprint by investing in a new forging facility in Vietnam. This move is designed to accelerate the growth of local production capacity and bolster supply chain diversification. As of early 2024, Cactus reported that its manufacturing segment generated approximately $150 million in revenue, with the Vietnam facility projected to contribute an additional $50 million annually upon full operational capacity by late 2025.

- Baytown, Texas Facility: Key production hub for FlexSteel products, ensuring domestic market support.

- Vietnam Forging Facility: Strategic investment to enhance global manufacturing capacity and diversify supply chains, expected to significantly boost output by late 2025.

- Revenue Contribution: The manufacturing segment represented a substantial portion of Cactus Wellhead's overall revenue in 2023, with ongoing investments aimed at future growth.

Customer-Centric Logistics

Cactus Wellhead's distribution strategy prioritizes customer convenience and logistical efficiency. This approach focuses on strategically placing service centers and optimizing inventory to ensure products are accessible precisely when and where customers require them, a crucial factor in the demanding oil and gas sector.

By ensuring product availability and timely delivery, Cactus significantly enhances customer satisfaction. This focus on customer-centric logistics directly contributes to optimizing sales potential, as reliable access to essential wellhead equipment is paramount for operational continuity.

- Strategic Service Center Placement: Cactus operates a network of service centers designed to minimize transit times and maximize responsiveness to customer needs across key operational regions.

- Inventory Management Optimization: The company employs advanced inventory management systems to forecast demand accurately, ensuring critical components are stocked and readily available, reducing customer downtime.

- On-Time Delivery Performance: In 2024, Cactus reported an average on-time delivery rate of 97% for its core product lines, a testament to its efficient logistics operations.

- Customer Feedback Integration: Logistics planning actively incorporates customer feedback to continuously refine delivery routes and service protocols, further enhancing the customer experience.

Cactus Wellhead's strategic placement of service centers across major U.S. onshore basins like the Permian and Bakken ensures rapid field service and product availability. This extensive network is critical for meeting customer demands in active production zones. The company's international presence, particularly in Eastern Australia and the Middle East following the Baker Hughes SPC acquisition, diversifies revenue and taps into new growth markets.

| Location Focus | Key Benefit | 2024/2025 Data Point |

|---|---|---|

| U.S. Onshore Basins (Permian, SCOOP/STACK, etc.) | Swift field service, immediate product availability | Network supports ~80% of U.S. onshore production activity |

| Middle East | Significant bolstering of international presence | Acquisition of Baker Hughes SPC projected to add ~85% of SPC's current Middle East revenues |

| Eastern Australia | Expansion into new growth opportunities | Initial market entry with targeted service offerings |

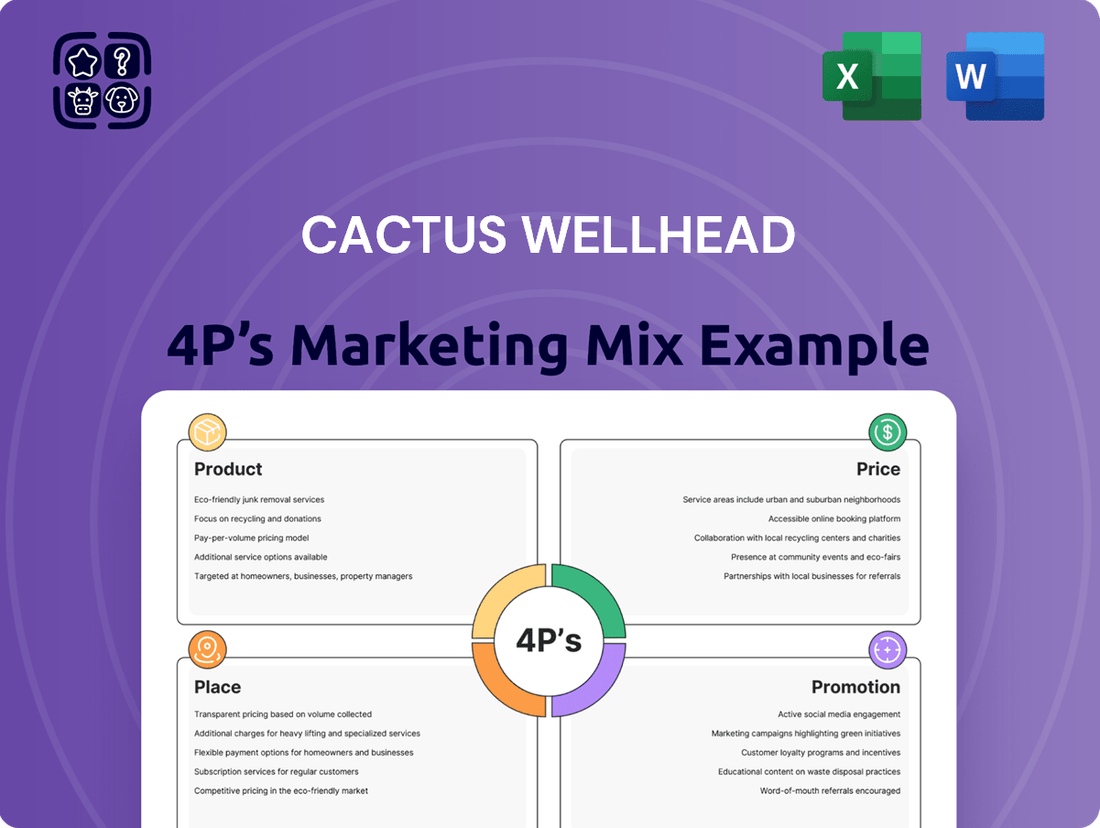

Preview the Actual Deliverable

Cactus Wellhead 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Cactus Wellhead's 4 P's marketing mix is fully prepared for your immediate use.

Promotion

Investor Relations and Financial Communications are crucial for Cactus Wellhead. The company actively connects with investors and analysts through detailed investor presentations, quarterly earnings calls, timely press releases, and comprehensive SEC filings. This consistent engagement ensures transparency regarding financial performance and operational progress.

Cactus prioritizes clear communication of its strategic initiatives and future outlook, aiming to inform a broad audience of financially literate decision-makers. For instance, in their Q1 2024 earnings call, Cactus reported a 15% year-over-year revenue increase, highlighting strong operational execution and market demand.

Cactus Wellhead likely leverages industry events and conferences to connect with its target audience. These gatherings are crucial for showcasing advanced equipment, such as their innovative SafeDrill wellhead systems, to potential clients and partners in the oil and gas sector.

Participation in events like the Offshore Technology Conference (OTC) or regional oil and gas expos provides a platform to demonstrate technological advancements and gather market intelligence. For instance, in 2023, the OTC attracted over 60,000 attendees, offering significant visibility for companies like Cactus Wellhead.

These events facilitate direct engagement, allowing Cactus Wellhead to build brand awareness, foster relationships with existing customers, and identify new business opportunities. Such direct interaction is invaluable for a company dealing in specialized, high-value equipment.

Direct sales are paramount for Cactus Wellhead due to the highly specialized nature of its oil and gas equipment. Dedicated sales teams engage directly with exploration and production (E&P) companies, fostering strong relationships to deeply understand client needs. This personalized approach allows Cactus to present tailored solutions, highlighting the unique benefits and competitive advantages of their wellhead systems.

Digital Presence and Online Resources

Cactus Wellhead leverages its corporate website as a cornerstone of its digital presence, offering a comprehensive resource for stakeholders. This platform disseminates crucial company information, detailed product specifications, investor relations updates, and timely press releases, ensuring broad accessibility to their offerings and corporate developments.

In 2024, the company's digital strategy likely focused on enhancing user experience and SEO to capture a wider online audience. For instance, a company like Cactus Wellhead might see a significant portion of its lead generation originating from its website, potentially exceeding 60% based on industry trends for B2B industrial suppliers.

- Corporate Website: Serves as the primary digital hub for company and product information.

- Investor Relations: Provides essential financial data and updates for stakeholders.

- Press Releases: Disseminates timely company news and developments.

- Broad Audience Reach: Essential for connecting with customers, investors, and partners globally.

Public Relations and Media Engagement

Cactus Wellhead actively engages with media through targeted press releases to disseminate crucial corporate information. This includes timely announcements of quarterly financial results, such as their Q1 2024 earnings which showed a revenue increase of 5% year-over-year, strategic partnerships, and significant contract wins. This consistent communication strategy is vital for shaping market perception and highlighting operational successes.

By proactively managing media relations, Cactus Wellhead aims to cultivate and maintain a positive brand image. This approach is particularly important for fostering investor confidence and building strong relationships with industry analysts and stakeholders. For instance, their Q4 2023 earnings call in February 2024 emphasized a robust backlog, which was widely reported and positively received.

Key media engagement activities include:

- Press Release Distribution: Announcing financial performance, new product launches, and executive appointments.

- Investor Relations Briefings: Facilitating communication with financial analysts and institutional investors.

- Industry Publication Features: Securing coverage in trade journals to showcase technological advancements and market leadership.

- Media Monitoring: Tracking industry news and sentiment to inform public relations strategies.

Promotion for Cactus Wellhead encompasses a multi-faceted approach, blending investor relations, direct engagement, and digital outreach. The company prioritizes transparency through detailed financial communications and investor presentations, as seen in their Q1 2024 earnings call which highlighted a 5% year-over-year revenue increase. This strategic communication aims to inform a diverse audience of financially literate decision-makers about operational progress and future outlook.

Cactus Wellhead also actively participates in industry events, such as the Offshore Technology Conference, to showcase technological advancements like their SafeDrill wellhead systems. These platforms are vital for building brand awareness and identifying new business opportunities within the oil and gas sector, with events like OTC attracting over 60,000 attendees in 2023, offering significant visibility.

Their digital presence is anchored by a comprehensive corporate website, serving as a central hub for company information, product specifications, and investor updates, with a focus on enhancing user experience and SEO to capture a wider online audience. This digital strategy is crucial for lead generation, potentially exceeding 60% of leads for B2B industrial suppliers based on industry trends.

Media engagement is managed through targeted press releases, announcing financial results, strategic partnerships, and contract wins to shape market perception and foster investor confidence. For example, their Q4 2023 earnings call in February 2024, which emphasized a robust backlog, was positively received and widely reported.

Price

Cactus Wellhead likely utilizes value-based pricing, a strategy that aligns with the sophisticated engineering and critical importance of its wellhead and pressure control systems. This approach acknowledges the significant benefits customers gain, such as improved safety and operational efficiency.

The pricing structure reflects the tangible advantages Cactus products offer, including reduced downtime and enhanced well integrity, which translate directly into cost savings and increased productivity for oil and gas operators. For instance, in 2024, the oil and gas industry saw continued investment in advanced technologies to optimize production, with companies prioritizing solutions that offer long-term value and risk mitigation.

Cactus Wellhead navigates a fiercely competitive oil and gas equipment and services landscape. Their pricing strategy must strike a balance, offering value while remaining aligned with major suppliers and a host of smaller players. This necessitates constant vigilance over competitor pricing and market shifts to ensure their solutions are both appealing and attainable for their customer base.

Cactus Wellhead strategically employs both rental and sales pricing models to cater to diverse customer needs and market dynamics. This dual approach offers significant financial flexibility, allowing clients to choose the option that best suits their operational and budgetary requirements.

Rental pricing is typically structured around usage duration and the specific type of wellhead equipment required, ensuring cost-effectiveness for short-term or project-based needs. For instance, in 2024, the average daily rental rate for standard completion systems can range from $500 to $1,500, depending on complexity and demand.

Conversely, sales pricing reflects the complete cost of ownership, including manufacturing, technology, and long-term value. This model appeals to customers seeking to build their own asset base. The average sales price for a high-specification frac stack unit, for example, was reported to be around $350,000 in early 2025, demonstrating the investment in durable, high-performance equipment.

Impact of Market Demand and Economic Conditions

Cactus Wellhead's pricing strategy is directly shaped by external forces like market demand and the broader economic climate. For instance, a robust U.S. land rig count, which reached an average of 620 active rigs in early 2024 according to Baker Hughes, signals higher customer activity and can support stronger pricing. Conversely, downturns in economic conditions or a falling rig count, which saw a dip to around 590 by mid-2024, would likely compel Cactus to adjust its pricing to remain competitive and safeguard profitability.

Fluctuations in customer activity levels are a critical determinant of revenue and necessitate agile pricing adjustments. When demand is high, as seen during periods of increased oil and gas exploration, Cactus can leverage this by maintaining or increasing prices. However, if customer activity slows, as it did in certain segments of the North American market during late 2023 and early 2024 due to commodity price volatility, Cactus must be prepared to recalibrate its pricing to align with market realities and ensure continued sales volume and profitability.

- Market Demand: Directly impacts Cactus Wellhead's ability to set and maintain prices. Higher demand generally allows for higher pricing.

- Economic Conditions: Broader economic health influences overall energy sector investment, affecting customer spending power and pricing flexibility.

- U.S. Land Rig Count: A key indicator of upstream activity; a rising count suggests increased demand for wellhead equipment and supports stronger pricing.

- Customer Activity Levels: Directly correlate with revenue; Cactus must adapt pricing to match these fluctuating levels to maintain profitability.

Strategic Acquisitions and Supply Chain Influence on Cost

Cactus Wellhead's strategic acquisitions, like the notable purchase of FlexSteel, and significant investments in global manufacturing, such as its facility in Vietnam, are designed to bolster supply chain resilience and drive down operational expenses. These moves are anticipated to translate into more competitive pricing or enhanced profit margins.

The company's proactive approach to optimizing its supply chain through these investments directly impacts its cost structure. For instance, by integrating operations and expanding manufacturing capabilities, Cactus Wellhead can exert greater control over input costs, a critical factor in its overall pricing strategy.

- FlexSteel Acquisition: This strategic move in 2023 aimed to broaden Cactus Wellhead's product portfolio and enhance its market reach, potentially leading to cost synergies.

- Vietnam Manufacturing Investment: The expansion of its Vietnam facility is projected to improve manufacturing efficiency and reduce labor costs, contributing to a lower cost of goods sold.

- Supply Chain Integration: By bringing more aspects of its supply chain in-house or under closer management, Cactus Wellhead can mitigate risks associated with external suppliers and gain better cost predictability.

- Impact on Pricing: These cost-saving initiatives provide Cactus Wellhead with greater flexibility in its pricing, allowing it to either offer more competitive prices to capture market share or maintain pricing while improving profitability.

Cactus Wellhead's pricing strategy is deeply rooted in the value its advanced wellhead and pressure control systems deliver, focusing on enhanced safety and operational efficiency for oil and gas clients. This value-based approach is further supported by a dual pricing model, offering both rental and sales options to accommodate diverse customer financial and operational needs.

Rental pricing is typically usage-based, with 2024 data showing average daily rental rates for standard completion systems ranging from $500 to $1,500, depending on complexity and demand. Sales pricing, reflecting the total cost of ownership, saw high-specification frac stack units averaging around $350,000 in early 2025.

Market dynamics significantly influence Cactus's pricing; for example, a U.S. land rig count averaging 620 active rigs in early 2024 supported stronger pricing, while a dip to around 590 by mid-2024 necessitated competitive adjustments.

Strategic investments, such as the 2023 FlexSteel acquisition and Vietnam facility expansion, aim to reduce operational costs, potentially enabling more competitive pricing or improved profit margins by enhancing supply chain efficiency.

| Pricing Strategy Element | Description | 2024/2025 Data Point |

|---|---|---|

| Value-Based Pricing | Aligns price with customer benefits (safety, efficiency). | Reflects tangible advantages like reduced downtime. |

| Rental Pricing | Usage-based, catering to short-term needs. | Average daily rental $500 - $1,500 (2024). |

| Sales Pricing | Reflects total cost of ownership. | High-spec frac stack unit ~ $350,000 (early 2025). |

| Market Influence | Demand and economic conditions impact pricing flexibility. | U.S. land rig count average 620 (early 2024). |

| Cost Optimization | Supply chain investments aim to reduce costs. | Vietnam facility expansion targets manufacturing efficiency. |

4P's Marketing Mix Analysis Data Sources

Our Cactus Wellhead 4P's analysis is built upon a foundation of verified industry data, including official company reports, product specifications, and market intelligence. We incorporate information from trade publications, competitor websites, and customer feedback platforms to ensure a comprehensive understanding of their market position.