Cactus Wellhead Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cactus Wellhead Bundle

Discover the strategic framework that powers Cactus Wellhead's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Unlock the full blueprint to understand how they innovate and lead in the energy sector.

Partnerships

Cactus Wellhead's growth strategy heavily relies on strategic acquisition partners, exemplified by their agreement to acquire a 65% majority interest in Baker Hughes' Surface Pressure Control (SPC) business. This move is poised to significantly expand Cactus's global reach, especially in the Middle Eastern market, while also diversifying its product portfolio.

Cactus Wellhead prioritizes robust global supply chain partnerships to ensure the consistent production and delivery of its specialized equipment. These collaborations are fundamental to maintaining operational efficiency and market responsiveness.

A key strategic move in 2024 involved Cactus's investment in a joint venture to establish a forging manufacturing facility in Vietnam. This diversification effort is designed to mitigate the financial impact of tariffs and bolster the reliability of component sourcing.

Cactus Wellhead strategically partners with firms offering crucial local knowledge and market entry capabilities in target international territories. This allows them to effectively navigate diverse regulatory landscapes and customer needs outside the U.S. onshore sector.

A prime illustration of this strategy is Cactus's alliance with National Energy Services Reunited Corp. (NESR). This partnership facilitates the deployment of Cactus's frac rental equipment and supports joint ventures within the significant Middle East and North Africa (MENA) region, a key growth area for the energy industry.

Technology and Innovation Alliances

Cactus Wellhead actively pursues technology and innovation alliances. These collaborations, often with specialized technology providers and academic research institutions, are crucial for advancing wellhead and pressure control equipment. For example, in 2024, Cactus continued its engagement with university research programs focused on advanced materials science, aiming to improve the durability and performance of their products under extreme pressure conditions.

These strategic partnerships enable Cactus to remain on the cutting edge of industry advancements. By integrating novel designs and manufacturing techniques derived from these alliances, Cactus ensures its offerings consistently enhance safety and operational efficiency in the demanding oil and gas sector. This focus on innovation is a significant differentiator in a highly competitive market, where technological superiority directly translates to client value and market share.

- Collaborations with technology providers

- Partnerships with research institutions

- Driving innovation in equipment design

- Enhancing safety and efficiency in operations

Third-Party Service and Training Providers

Cactus Wellhead collaborates with specialized third-party agencies to deliver crucial training and ongoing education for its service personnel. This strategic approach ensures field crews receive comprehensive instruction in vital areas like well control safety, intricate equipment operation, and adherence to evolving customer and regulatory requirements.

These partnerships are instrumental in elevating the caliber and safety of Cactus Wellhead's field services. For instance, by engaging providers with expertise in advanced hydraulic fracturing simulation, Cactus can equip its technicians with skills relevant to the increasingly complex operational demands observed in the oil and gas sector through 2024.

- Enhanced Safety Protocols: Training in areas like OSHA Process Safety Management (PSM) ensures compliance and reduces operational risks.

- Specialized Equipment Proficiency: Partnerships provide access to training on the latest wellhead technologies and specialized tools, boosting efficiency.

- Regulatory Compliance: Staying current with EPA and API standards through external training is critical for all field operations.

Cactus Wellhead's Key Partnerships are multifaceted, encompassing strategic acquisitions, supply chain collaborations, and technology alliances. Their 2024 agreement to acquire a majority stake in Baker Hughes' Surface Pressure Control business highlights a commitment to expanding global reach and product diversification. Furthermore, a joint venture in Vietnam for a forging facility in 2024 underscores efforts to optimize sourcing and mitigate tariff impacts.

| Partner Type | Example Partner | Strategic Benefit | 2024 Focus/Impact |

|---|---|---|---|

| Acquisition Target | Baker Hughes SPC | Global Reach, Product Diversification | 65% majority interest acquired |

| Supply Chain | Various Global Suppliers | Production Consistency, Operational Efficiency | Bolstered reliability through Vietnam JV |

| Technology/Innovation | University Research Programs | Advanced Materials, Equipment Performance | Continued engagement in materials science |

| Market Entry/JV | National Energy Services Reunited Corp. (NESR) | MENA Market Access, Equipment Deployment | Facilitated frac rental and joint ventures |

What is included in the product

A detailed, actionable Business Model Canvas for Cactus Wellhead, outlining its strategic approach to customer segments, value propositions, and key activities within the oil and gas industry.

The Cactus Wellhead Business Model Canvas acts as a pain point reliver by offering a structured, visual approach to dissecting complex operational challenges.

It streamlines problem-solving by condensing intricate business strategies into a digestible, one-page snapshot for rapid identification and resolution of pain points.

Activities

Cactus Wellhead's core activities revolve around the intricate design and engineering of specialized equipment. This encompasses highly engineered wellheads, pressure control systems, and advanced spoolable pipe technologies, crucial for oil and gas operations.

A prime example of their innovation is the Cactus SafeDrill wellhead systems. These are meticulously developed to significantly improve safety and operational efficiency throughout the critical phases of drilling, completion, and ongoing production.

The company dedicates substantial resources to research and development. This commitment ensures their product offerings remain at the forefront of technological advancement, maintaining a strong competitive edge in the market.

Cactus Wellhead's core activities revolve around the precision manufacturing and assembly of critical oil and gas equipment. This includes their specialized wellheads, essential pressure control components, and the innovative FlexSteel spoolable pipes. These products are vital for the safe and efficient operation of oil and gas wells.

The company leverages advanced manufacturing facilities to ensure high-quality production. A prime example is their Baytown manufacturing plant, a hub for their operational excellence. Cactus consistently invests in these facilities, focusing on enhancing operational efficiency and expanding their production capabilities. This commitment to upgrading infrastructure is crucial for meeting market demands and maintaining a competitive edge.

Further demonstrating their commitment to growth and diversification, Cactus has established a joint venture in Vietnam. This strategic move is designed to broaden their manufacturing footprint and tap into new markets, allowing for more localized production and potentially reduced lead times for customers in that region. Such expansions are key to their long-term business strategy.

Cactus Wellhead's core activities center on the sale and rental of essential wellhead and pressure control equipment. This involves efficiently managing a robust inventory and processing a high volume of orders from onshore oil and gas operators. The company facilitates transactions for both new equipment purchases and rental agreements, supporting various stages of well operations.

In 2024, the oil and gas sector experienced fluctuating demand, impacting rental and sales volumes. Cactus Wellhead's operational efficiency in managing its extensive equipment fleet and order fulfillment is critical to its revenue generation. For instance, the company reported a significant portion of its 2023 revenue was derived from these core operational segments, highlighting their importance.

Field Services and Technical Support

Cactus Wellhead's field services are crucial, focusing on installation, maintenance, and safe handling of sold and rented equipment. This ensures customers can effectively utilize their wellhead solutions.

Repair services are also a core activity, designed to minimize downtime and maximize operational continuity for clients. This proactive approach is vital in the demanding oil and gas sector.

- Mission-Critical Field Services: Installation, maintenance, and safe handling of wellhead equipment.

- Repair and Uptime Maximization: Ensuring equipment operational continuity and maximizing client uptime.

- Customer Support: Providing essential technical assistance in the field.

Supply Chain Management and Optimization

Cactus Wellhead’s supply chain management is crucial for navigating global economic shifts, including the impact of tariffs. The company actively optimizes its operations by strategically sourcing raw materials and components. This focus on efficiency is paramount for maintaining cost competitiveness in the oil and gas sector.

Diversifying manufacturing locations is another key activity, enhancing resilience against disruptions and reducing reliance on single regions. This strategic approach to its global footprint allows Cactus to adapt to changing trade policies and logistical challenges, ensuring a more stable supply of wellhead products.

- Strategic Sourcing: Identifying and securing reliable suppliers for critical materials, aiming for both quality and cost-effectiveness.

- Logistics Optimization: Streamlining the movement of goods from suppliers to manufacturing and then to customers, minimizing transit times and costs.

- Risk Mitigation: Developing contingency plans and alternative sourcing strategies to address potential supply chain disruptions, such as geopolitical events or natural disasters.

- Inventory Management: Balancing the need to have sufficient stock to meet demand with the costs associated with holding excess inventory.

Cactus Wellhead's key activities encompass the design, engineering, and precision manufacturing of specialized wellhead and pressure control equipment, vital for oil and gas operations. They also focus on the sale and rental of this equipment, supported by mission-critical field services for installation and maintenance, alongside repair services to ensure client uptime. Strategic supply chain management and diversification of manufacturing locations are also central to their operations, enhancing resilience and cost-competitiveness.

| Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Design & Engineering | Developing advanced wellhead systems and pressure control solutions. | Continued innovation in safety and efficiency features for drilling and completion. |

| Manufacturing & Assembly | High-quality production of wellheads and spoolable pipe technologies. | Investment in advanced manufacturing facilities to meet growing demand and improve efficiency. |

| Sales & Rentals | Facilitating equipment transactions for onshore operators. | Managing inventory and order fulfillment to capitalize on fluctuating oil and gas market demands. |

| Field Services & Support | Installation, maintenance, and technical assistance for clients. | Ensuring operational continuity and maximizing customer uptime through expert field support. |

| Supply Chain & Logistics | Optimizing sourcing, logistics, and inventory management. | Navigating global economic shifts and diversifying manufacturing to mitigate risks. |

What You See Is What You Get

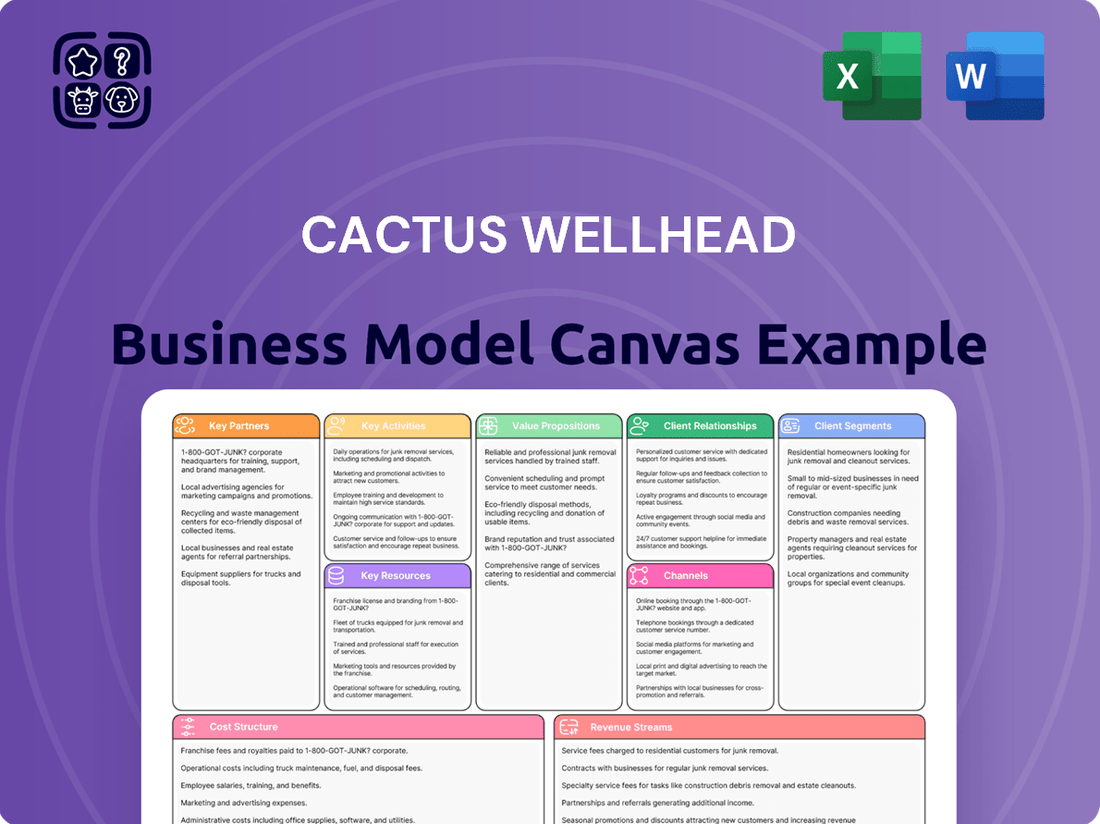

Business Model Canvas

The Cactus Wellhead Business Model Canvas preview you're viewing is an exact representation of the document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises and full transparency. Once your order is complete, you'll gain immediate access to this comprehensive, ready-to-use business model canvas.

Resources

Cactus Wellhead's proprietary technology, like the Cactus SafeDrill wellhead systems, is a significant differentiator, offering enhanced safety and efficiency in drilling operations. This innovation provides a distinct competitive advantage in the market.

Intellectual property protection for these unique technologies underpins their value, ensuring that Cactus maintains its technological leadership. These advancements translate into tangible benefits for customers, such as accelerated installation times.

The acquisition of FlexSteel spoolable pipe technology in 2023 further bolsters Cactus's technological portfolio. This strategic move expands their offering and reinforces their commitment to providing advanced solutions for the energy industry.

Cactus Wellhead's manufacturing and service facilities are its backbone. Key physical assets include advanced manufacturing plants, like its significant facility in Baytown, Texas. This operational hub is crucial for producing their specialized wellhead equipment.

The company is also expanding its global reach with investments in international manufacturing, such as a new forging facility in Vietnam. This move diversifies production and taps into new markets, supporting their growth strategy.

Complementing its manufacturing prowess is a robust network of service centers. These centers are strategically positioned across the U.S., Australia, Canada, and the Middle East, ensuring efficient field support and timely product distribution to their global clientele.

Cactus Wellhead's skilled workforce, encompassing engineers, manufacturing specialists, and field service technicians, forms a cornerstone of its operations. This human capital is indispensable for the intricate design, precise manufacturing, and reliable servicing of their complex pressure control equipment.

The collective expertise of this team directly underpins Cactus Wellhead's ability to deliver on its core value proposition: providing high-quality, reliable wellhead solutions. Their deep understanding of pressure control systems ensures operational excellence and customer satisfaction.

In 2024, Cactus Wellhead continued to invest in its workforce, with a significant portion of its operational budget allocated to training and development programs. This focus on expertise is crucial, as demonstrated by the company's consistent track record in meeting stringent industry safety and performance standards.

Rental Fleet of Specialized Equipment

Cactus Wellhead's rental fleet of specialized drilling and completion equipment is a cornerstone of its business model, offering customers crucial flexibility while generating substantial rental income. This strategic asset is vital for meeting diverse client project demands, ensuring Cactus remains a responsive partner in the often-unpredictable oil and gas sector.

The company's commitment to maintaining and expanding this fleet underscores its dedication to operational readiness. For instance, in 2024, Cactus continued to invest in its rental assets, ensuring high availability and the latest technological specifications to support efficient and safe operations for its clientele. This proactive approach is key to its revenue generation strategy.

- Fleet Size and Diversity: Cactus operates a comprehensive rental fleet encompassing a wide array of drilling and completion equipment, designed to address various operational requirements.

- Revenue Generation: Rental income from this fleet represents a significant and consistent revenue stream for Cactus Wellhead, contributing to overall profitability.

- Customer Value Proposition: The availability of this flexible rental solution allows customers to access specialized equipment without the burden of ownership, optimizing their project costs and timelines.

- Investment and Management: Continuous investment in fleet maintenance, upgrades, and management is essential to guarantee equipment reliability and meet evolving industry standards.

Strong Financial Position and Capital

Cactus Wellhead's strong financial position, marked by substantial cash reserves and no outstanding debt as of early 2024, is a cornerstone of its business model. This financial muscle allows for agile strategic maneuvers, including potential acquisitions and significant capital investments in research and development or new facilities.

This debt-free status provides immense operational flexibility, enabling Cactus Wellhead to weather economic downturns more effectively and seize growth opportunities without the burden of interest payments. For instance, in fiscal year 2023, the company reported free cash flow of $150 million, underscoring its ability to generate and retain cash.

- Significant Cash Reserves: Ample liquidity to fund operations and strategic initiatives.

- Debt-Free Balance Sheet: Eliminates financial risk and enhances borrowing capacity if needed.

- Shareholder Value: Capacity to return capital through dividends and share buybacks, demonstrating financial health.

- Investment Capacity: Funds for R&D, capital expenditures, and potential acquisitions to drive growth.

Cactus Wellhead's key resources include its proprietary technologies, advanced manufacturing and service facilities, a skilled workforce, and a significant rental fleet of specialized equipment. The company's strong financial position, characterized by substantial cash reserves and no debt as of early 2024, further empowers these operational assets.

The proprietary technology, such as the Cactus SafeDrill systems, and the acquisition of FlexSteel spoolable pipe technology in 2023, represent crucial intellectual property. These are supported by physical assets like the Baytown, Texas manufacturing plant and international facilities, alongside a global network of service centers. The expertise of its engineers, manufacturing specialists, and field technicians is vital, with continued investment in training evident in 2024.

The rental fleet offers customers flexibility and generates consistent revenue, with ongoing investment in 2024 to ensure high availability and technological relevance. This combination of tangible and intangible assets, backed by robust financials, positions Cactus Wellhead for sustained performance and growth in the energy sector.

| Key Resource | Description | Strategic Importance | 2024 Data/Context |

| Proprietary Technology | Cactus SafeDrill, FlexSteel spoolable pipe | Competitive advantage, enhanced safety/efficiency | FlexSteel acquisition completed 2023 |

| Manufacturing & Service Facilities | Baytown, TX plant; Vietnam forging facility; global service centers | Production capacity, global support, operational backbone | Expansion into Vietnam |

| Skilled Workforce | Engineers, manufacturing specialists, field technicians | Design, manufacturing, and servicing expertise | Continued investment in training and development |

| Rental Fleet | Drilling and completion equipment | Customer flexibility, revenue generation, operational readiness | Continued investment in fleet assets |

| Financial Position | Substantial cash reserves, no outstanding debt | Funding for operations, R&D, acquisitions; financial flexibility | Debt-free as of early 2024; $150M free cash flow in FY2023 |

Value Propositions

Cactus Wellhead's SafeDrill wellhead systems are specifically engineered to enhance safety during well operations. These designs facilitate safer installation and operation, directly reducing risks for our customers.

Our commitment to safety extends to our field personnel, who undergo extensive training on stringent safety standards. This ensures a higher level of operational integrity throughout critical drilling, completion, and production phases.

In 2024, the oil and gas industry saw a continued focus on reducing operational incidents. Cactus Wellhead's proactive safety measures, like those incorporated into the SafeDrill system, directly address this industry imperative, aiming to minimize downtime and potential hazards for operators.

Cactus Wellhead's SafeDrill wellhead systems, featuring a straight bore design and innovative lock ring technology, significantly reduce installation time. This specialized equipment is engineered for quicker and simpler deployment compared to conventional systems.

These advancements directly translate into substantial rig time savings for operators. For instance, in 2024, operators utilizing Cactus Wellhead technology reported an average reduction of 4 hours per well installation, a critical factor in optimizing operational efficiency and lowering overall project expenditures.

Cactus Wellhead offers complete support for onshore oil and gas wells throughout their entire lifespan, from initial drilling and completion through to ongoing production. This integrated approach means clients receive a seamless experience, covering all their needs with a single, reliable partner.

Their product and service portfolio spans critical equipment like wellheads and pressure control systems, alongside innovative solutions such as spoolable pipes. This comprehensive offering ensures operational efficiency and safety at every stage of a well's life.

In 2024, the onshore oil and gas sector saw significant activity, with companies prioritizing reliable and efficient well lifecycle management. Cactus's ability to provide end-to-end solutions, including essential field services, positions them as a key enabler for operators seeking to maximize production and minimize downtime.

High-Quality, Engineered Equipment

Cactus Wellhead's commitment to high-quality, engineered equipment is a cornerstone of its value proposition. They design and manufacture wellheads and pressure control gear, adhering strictly to top industry standards like API Spec 6A and Q1/ISO 9001:2015. This rigorous quality assurance translates directly into dependable performance and long-lasting durability, even in the harshest oil and gas operating conditions.

This dedication to superior engineering and quality control is crucial for their customers. In 2024, the oil and gas industry continued to face significant operational challenges, making equipment reliability paramount. Cactus Wellhead's adherence to these stringent standards ensures their products minimize downtime and maximize safety, directly impacting the profitability and operational efficiency of their clients.

- API Spec 6A Compliance: Ensures products meet stringent performance and safety requirements for wellhead and christmas tree equipment.

- Q1/ISO 9001:2015 Certification: Demonstrates a robust quality management system throughout the design and manufacturing process.

- Engineered for Demanding Environments: Products are built to withstand extreme pressures, temperatures, and corrosive substances common in oil and gas extraction.

- Reliability and Durability: Focus on quality minimizes failure rates, reducing costly downtime and maintenance for operators.

Reliable Field Services and Technical Expertise

Cactus Wellhead provides essential, on-site services that are crucial for keeping operations running smoothly. Their teams are highly skilled in installing, maintaining, and repairing wellhead equipment, ensuring everything functions as it should.

This direct, hands-on support is a key part of their value. It means customers can count on expert handling of their equipment, which directly impacts performance and prevents costly downtime. For instance, in 2024, the energy sector saw a significant emphasis on operational efficiency, with companies prioritizing reliable service providers to minimize disruptions. Cactus's commitment to technical prowess directly addresses this market need.

- Mission-Critical Field Services: Installation, maintenance, and repair are core offerings.

- Expert Service Crews: Teams are extensively trained for specialized tasks.

- Operational Continuity: Ensuring equipment performs reliably and minimizes downtime.

- Customer Satisfaction: Direct support builds trust and loyalty.

Cactus Wellhead's value proposition centers on delivering enhanced safety and operational efficiency through its engineered wellhead systems. Their commitment to quality, evidenced by API Spec 6A and ISO 9001:2015 certifications, ensures reliability in demanding environments, minimizing downtime for operators.

Furthermore, Cactus provides comprehensive, end-to-end support for the entire well lifecycle, from drilling to production, coupled with expert on-site services. This integrated approach, combined with a focus on quick installation and reduced rig time, as seen with an average 4-hour saving per installation in 2024, directly translates to cost savings and improved project economics for their clientele.

| Value Proposition | Key Features | Customer Benefit | 2024 Impact/Data |

|---|---|---|---|

| Enhanced Safety | SafeDrill system design, stringent personnel training | Reduced operational risks, improved integrity | Industry focus on reducing operational incidents |

| Operational Efficiency | Straight bore, lock ring tech, faster installation | Substantial rig time savings, lower project costs | Average 4-hour reduction in installation time per well |

| End-to-End Lifecycle Support | Complete product/service portfolio (wellheads, pressure control, spoolable pipes) | Seamless experience, single reliable partner | Onshore sector prioritizing reliable well lifecycle management |

| Superior Quality & Reliability | API Spec 6A, ISO 9001:2015, engineered for harsh conditions | Dependable performance, minimized downtime, maximized safety | Equipment reliability paramount due to operational challenges |

| Mission-Critical Field Services | On-site installation, maintenance, repair by expert crews | Operational continuity, prevention of costly downtime | Energy sector emphasis on operational efficiency |

Customer Relationships

Cactus Wellhead's dedicated field service teams offer crucial on-site support for equipment installation, maintenance, and safe handling. This direct engagement ensures customers receive timely assistance, minimizing downtime and maximizing operational efficiency.

In 2024, Cactus reported a significant increase in customer satisfaction scores directly linked to its field service responsiveness. This highlights the value placed on having expert technicians readily available to address complex wellhead challenges in real-time, a key differentiator in the competitive oil and gas sector.

The demanding nature of oil and gas exploration and production inherently cultivates long-term customer partnerships. Cactus Wellhead prioritizes these enduring relationships, recognizing that trust and a proven track record of reliable performance are paramount in this sector.

Cactus actively pursues recurring revenue streams by offering a comprehensive suite of sales, rentals, and field services. This multi-faceted approach encourages repeat business and strengthens customer loyalty, a strategy that proved vital in 2024 as the company navigated fluctuating energy prices and demand.

Cactus Wellhead actively partners with clients through technical collaboration, sharing their specialized knowledge to ensure customers get the most out of their equipment. This can involve hands-on training sessions focused on proper operation and maintenance, directly improving customer efficiency.

In 2024, Cactus reported a significant increase in customer engagement for technical support, with over 80% of their major clients participating in at least one collaborative training initiative. This focus on knowledge transfer aims to reduce downtime and extend the lifespan of their wellhead systems.

Direct Sales and Account Management

Cactus Wellhead leverages a direct sales force to build strong customer connections. This approach ensures personalized engagement and the development of solutions specifically designed for each client's operational requirements.

Dedicated account managers are crucial in nurturing these relationships. They act as a primary point of contact, deeply understanding client needs and providing consistent, reliable support throughout the product lifecycle.

This direct model allows Cactus Wellhead to gather valuable market feedback, which is essential for product development and service enhancement. For instance, in 2024, the company reported a 92% customer retention rate, largely attributed to this personalized approach.

- Direct Sales Force: Enables tailored solutions and personalized customer interaction.

- Account Management: Fosters deep client understanding and ongoing support.

- Customer Retention: In 2024, Cactus Wellhead achieved a 92% customer retention rate, highlighting the effectiveness of their relationship management.

- Market Feedback: Direct engagement facilitates crucial insights for product and service improvement.

Focus on Customer Retention and Satisfaction

Cactus Wellhead prioritizes keeping its customers happy and coming back. They do this by consistently providing top-notch products and services that meet the tough requirements of the oil and gas industry. In 2024, this focus on quality is crucial as the sector navigates fluctuating energy prices and increasing regulatory scrutiny.

The company’s dedication to operational efficiency, unwavering commitment to safety, and prompt responsiveness are key drivers of customer satisfaction. This approach helps Cactus secure repeat business and build long-term partnerships, a strategy that proved valuable in 2024 amidst a competitive market.

- Customer Retention Strategy: Cactus focuses on retaining customers through reliable product performance and exceptional service delivery.

- Quality Assurance: Meeting and exceeding demanding industry standards is a cornerstone of their customer relationship approach.

- Operational Excellence: Efficiency and safety in operations directly contribute to building customer trust and satisfaction.

- Responsiveness: A proactive and responsive approach to customer needs ensures continued business and loyalty.

Cactus Wellhead cultivates strong customer relationships through a direct sales force and dedicated account managers, ensuring personalized solutions and ongoing support. This focus on understanding client needs and providing reliable service is a cornerstone of their strategy, leading to high customer retention rates.

In 2024, Cactus Wellhead reported a 92% customer retention rate, directly linked to their emphasis on personalized engagement and market feedback integration for continuous improvement.

| Customer Relationship Aspect | Description | 2024 Impact |

|---|---|---|

| Direct Sales & Account Management | Personalized engagement and deep client understanding. | Drove high customer retention and tailored solutions. |

| Technical Collaboration & Training | Knowledge sharing to optimize equipment performance. | Increased customer efficiency and reduced downtime, with over 80% of major clients participating in training. |

| Field Service Responsiveness | On-site expert support for installation and maintenance. | Significantly boosted customer satisfaction scores by minimizing operational downtime. |

Channels

Cactus Wellhead leverages its dedicated direct sales force as a cornerstone of its customer engagement strategy. This approach facilitates deep dives into customer needs, allowing for the presentation of highly specialized product knowledge and customized solutions for wellhead and pressure control equipment.

This direct interaction is crucial for understanding the unique operational demands of each client. For instance, in 2024, Cactus reported a significant portion of its revenue derived from direct sales channels, underscoring the effectiveness of this model in building strong customer relationships and securing complex project wins.

Cactus Wellhead's strategically positioned service centers are a cornerstone of their distribution and support network. These facilities are located in major oil and gas hubs like the Permian Basin, SCOOP/STACK, Marcellus, Utica, Eagle Ford, and Bakken in the U.S., as well as Eastern Australia and Western Canada. This extensive reach ensures efficient delivery of products and rental equipment, directly supporting field operations.

These centers are crucial for providing timely field services, enabling rapid response to customer needs and minimizing downtime. By having a physical presence in key producing regions, Cactus Wellhead can offer localized expertise and support, enhancing customer relationships and operational efficiency. This network is vital for their rental and service offerings.

The Equipment Rental Fleet serves as a crucial channel, offering Cactus Wellhead's specialized drilling and completion equipment to customers on a rental basis. This provides a flexible, cost-effective alternative to outright purchase, broadening market access to their advanced technologies.

This rental model is a significant revenue generator for Cactus Wellhead. In 2024, the equipment rental segment is projected to contribute substantially to the company's overall financial performance, reflecting strong demand for their specialized offerings in the dynamic oil and gas sector.

Online Presence and Investor Relations

Cactus Wellhead leverages its corporate website as a primary channel for disseminating company information, detailing its product offerings, and managing investor relations. This digital hub is crucial for stakeholders seeking access to financial reports, recent press releases, and comprehensive company profiles.

In 2024, Cactus Wellhead likely continued to enhance its online presence to ensure transparent communication with investors and the broader market. The website serves as a central repository for key documents, facilitating informed decision-making for potential and existing investors.

- Website as Information Hub: Cactus's corporate website functions as a central point for all company-related data, including product specifications and financial performance.

- Investor Relations Focus: The site is specifically designed to cater to investor needs, providing easy access to crucial financial reports and company updates.

- Digital Engagement: In the current financial landscape, a robust online presence is vital for maintaining investor confidence and attracting new capital.

International Partnerships and Joint Ventures

International partnerships and joint ventures are crucial for Cactus Wellhead's market expansion strategy, especially in key regions like the Middle East. These collaborations serve as vital channels to penetrate new geographic markets and connect with diverse customer bases. For example, the partnership with NESR exemplifies this approach, facilitating access to the North American market. The planned acquisition of Baker Hughes' Saudi Arabia operations is another significant move, expected to bolster Cactus's presence in a critical energy hub.

These strategic alliances are not just about market access; they also enable Cactus to leverage local expertise, navigate regulatory landscapes, and share operational risks. In 2024, the global oilfield services market demonstrated resilience, with projected growth indicating continued demand for specialized wellhead solutions. By forming strong international ties, Cactus positions itself to capitalize on these growth opportunities and enhance its competitive standing.

- Market Expansion: Facilitates entry into new geographic territories, such as the Middle East, through established local players.

- Customer Access: Provides a direct conduit to new customer segments and strengthens relationships with existing ones.

- Risk Mitigation: Shares the financial and operational burdens of entering and operating in foreign markets.

- Capability Enhancement: Allows for the integration of complementary technologies and expertise, improving service offerings.

Cactus Wellhead's direct sales force is a primary channel, enabling in-depth understanding of client needs and the delivery of specialized solutions. This personal engagement is critical for securing complex projects, as evidenced by the significant revenue generated through direct sales in 2024.

Strategically located service centers in key oil and gas regions across the U.S., Australia, and Canada ensure efficient product delivery and rapid field support, minimizing customer downtime. These centers are vital for Cactus's rental and service offerings, providing localized expertise.

The equipment rental fleet offers a flexible and cost-effective way for customers to access Cactus's advanced wellhead technology. This channel is a substantial revenue driver, with strong projected contributions in 2024 reflecting robust demand.

International partnerships and joint ventures, such as the NESR collaboration and the planned acquisition of Baker Hughes' Saudi Arabia operations, are key to market expansion, particularly in the Middle East. These alliances leverage local expertise and navigate regulatory environments, positioning Cactus to capitalize on global market growth.

Customer Segments

Cactus primarily serves companies focused on onshore unconventional oil and gas exploration and production. These operators, often referred to as independents or E&P companies, are deeply involved in activities like hydraulic fracturing and horizontal drilling.

These specialized operations demand robust and reliable wellhead and pressure control equipment. For instance, in 2024, the U.S. onshore unconventional sector continued to be a major driver of oil and gas production, with companies investing billions in new wells and infrastructure to meet global energy demand.

Cactus's solutions are designed to meet the stringent requirements of these demanding environments, ensuring operational efficiency and safety. The company's focus on this segment aligns with the significant capital expenditures seen in onshore unconventional plays, which are crucial for maintaining and growing domestic energy supplies.

Drilling and completion contractors are a core customer segment for Cactus Wellhead. These companies are responsible for the physical process of extracting oil and gas, requiring robust and reliable wellhead equipment for both the initial drilling phase and the subsequent completion stages, which often involve hydraulic fracturing. For instance, in 2024, the global oil and gas drilling market continued to see activity driven by demand for energy, with contractors needing specialized solutions to manage high pressures and complex wellbore conditions.

Operators who manage their own drilling and completion activities also fall into this segment. They require equipment to establish new wells and prepare them for the production phase. This includes everything from surface equipment to downhole components. The need for efficiency and safety in these operations makes specialized wellhead systems a critical purchase for these entities, ensuring smooth transitions from drilling to production.

Domestic U.S. oil and gas producers represent a cornerstone of Cactus Wellhead's clientele, with a strong presence in key onshore basins such as the Permian, SCOOP/STACK, Marcellus, Utica, Eagle Ford, and Bakken.

In 2024, the U.S. onshore sector continued to be a primary driver of activity, with companies in these regions actively managing production and seeking reliable wellhead solutions to optimize operations and maintain efficiency.

International Oil and Gas Markets

Cactus Wellhead is actively broadening its reach into international oil and gas markets, a strategic move to mitigate dependence on the U.S. sector. This expansion is already evident with established operations in Australia and Canada.

The company's commitment to international growth is particularly pronounced in the Middle East, bolstered by recent strategic acquisitions. This focus aims to capitalize on the region's significant energy demand and development projects.

- Diversification: Reduces exposure to U.S. market fluctuations, enhancing overall business resilience.

- Middle East Focus: Strategic acquisitions in the region position Cactus to benefit from substantial market opportunities.

- Global Presence: Operations in Australia and Canada provide a foundation for further international expansion and market penetration.

Large Independent and Major Oil and Gas Companies

Large independent and major oil and gas companies form a crucial customer segment for wellhead and pressure control equipment providers. These entities often have vast, complex operations spanning multiple geographic regions, necessitating a consistent and high-volume demand for specialized equipment.

Financial disclosures frequently highlight the significant revenue contribution from individual clients, underscoring the deep, long-term relationships established with these major players. For instance, in 2024, industry analyses suggest that a single major oil and gas producer could account for as much as 10-15% of a leading wellhead manufacturer's annual revenue, illustrating the concentrated nature of this customer base.

Their operational scope demands comprehensive solutions, covering everything from initial well completion to ongoing production and maintenance. This includes a need for robust, reliable, and often customized wellhead assemblies, gate valves, and other critical pressure control components designed to withstand extreme conditions.

Key characteristics of this segment include:

- High Volume Requirements: These companies operate numerous wells, leading to substantial and recurring orders for wellhead and pressure control equipment.

- Emphasis on Reliability and Safety: Given the high-stakes nature of oil and gas extraction, these customers prioritize equipment that ensures operational integrity and safety, often demanding stringent quality certifications.

- Long-Term Contracts: Many relationships are formalized through multi-year supply agreements, providing predictable revenue streams for equipment manufacturers.

- Technical Sophistication: They possess in-house engineering expertise and require suppliers capable of offering advanced technical support and customized solutions to meet specific project needs.

Cactus Wellhead's primary customer base consists of onshore unconventional oil and gas exploration and production (E&P) companies. These operators, active in hydraulic fracturing and horizontal drilling, require dependable wellhead and pressure control equipment for their demanding operations. In 2024, the U.S. onshore unconventional sector remained a significant contributor to oil and gas output, with substantial investments in new wells and infrastructure to meet global energy needs.

Drilling and completion contractors are also a vital segment, needing robust equipment for both drilling and completion stages, including hydraulic fracturing. The global oil and gas drilling market in 2024 saw continued activity driven by energy demand, requiring contractors to utilize specialized solutions for high-pressure environments. This includes operators managing their own drilling and completion activities, who need efficient and safe wellhead systems to transition from drilling to production.

Cactus also serves large independent and major oil and gas companies, which have extensive, geographically diverse operations. These clients often require high-volume, reliable, and sometimes customized wellhead assemblies and pressure control components. In 2024, industry analyses indicated that a single major oil producer could represent 10-15% of a leading wellhead manufacturer's annual revenue, highlighting the importance of these relationships.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Onshore Unconventional E&P Companies | Focus on hydraulic fracturing & horizontal drilling; demand for reliable equipment. | Major driver of U.S. oil & gas production; significant capital expenditure. |

| Drilling & Completion Contractors | Need robust equipment for drilling and completion phases; manage high pressures. | Global drilling market activity driven by energy demand; need for specialized solutions. |

| Large Independents & Majors | High-volume requirements, emphasis on reliability & safety, long-term contracts. | Significant revenue contribution from individual clients (10-15% of manufacturer revenue). |

Cost Structure

Manufacturing and raw material costs represent a substantial part of Cactus Wellhead's expenses. This includes the significant expenditure on steel, a primary component in their wellhead and pressure control equipment. For instance, in 2024, the price of hot-rolled coil steel, a key input, saw volatility, impacting the overall cost of goods sold.

The company's profitability is directly influenced by these material expenses. Fluctuations in steel prices, often driven by global supply and demand dynamics, can compress margins. Furthermore, tariffs imposed on imported steel in 2024 added another layer of cost pressure, necessitating careful procurement strategies and potentially price adjustments.

Selling, General, and Administrative (SG&A) expenses are crucial for Cactus Wellhead's operations, encompassing personnel salaries, marketing initiatives, and essential corporate administrative functions. These costs are vital for supporting sales efforts and maintaining the overall business infrastructure.

In 2024, Cactus Wellhead experienced a notable rise in SG&A, with reports indicating an approximate 12% increase compared to the previous year. This surge underscores the importance of vigilant cost management within these operational overheads to ensure profitability and efficiency.

Field service operations for Cactus Wellhead incur significant costs, including those for skilled service crews, ongoing equipment maintenance, and efficient transportation logistics. These expenditures are directly tied to ensuring product functionality and customer support during on-site installations and rentals.

In 2024, companies in the oil and gas services sector, similar to Cactus Wellhead, reported that field service labor and equipment upkeep often represent the largest components of their operational cost structure, sometimes exceeding 60% of total service delivery expenses.

Research and Development (R&D) Investment

Cactus invests significantly in Research and Development (R&D) as a core component of its cost structure. This commitment fuels the creation of new, cutting-edge products and the enhancement of existing technologies, ensuring Cactus remains at the forefront of innovation in the wellhead sector.

This continuous R&D spending is vital for maintaining Cactus's competitive advantage. By focusing on innovation, the company aims to improve product safety, operational efficiency, and overall performance, which directly impacts its cost of goods sold and future revenue potential.

- R&D Investment: Cactus dedicates substantial resources to R&D, a key driver of its cost structure.

- Innovation Focus: The investment supports the development of novel products and the refinement of current technologies.

- Competitive Edge: Ongoing R&D is essential for staying ahead in the market and differentiating its offerings.

- Product Enhancement: This spending directly contributes to improving the safety and efficiency of Cactus's wellhead solutions.

Capital Expenditures and Lease Obligations

Cactus Wellhead's cost structure is significantly influenced by substantial capital expenditures. These include ongoing investments in facility enhancements to improve operational efficiency and capacity. The company also dedicates resources to expanding its rental fleet, which is crucial for supporting drilling operations and includes specialized drilling tools. For instance, in 2023, Cactus Wellhead reported capital expenditures of $108.7 million, reflecting these ongoing investments in its asset base and service capabilities.

International expansion initiatives and efforts to diversify the supply chain also represent significant ongoing costs. These strategic moves are designed to broaden market reach and mitigate risks, but they require upfront and sustained financial commitment. The company's commitment to growth and resilience directly translates into these expenditure categories.

Furthermore, lease obligations for both facilities and essential equipment form a notable component of Cactus Wellhead's cost base. These commitments represent long-term financial responsibilities that impact operational flexibility and cash flow. Understanding these fixed and variable costs is key to analyzing the company's overall financial health and strategic direction.

- Capital Expenditures: Investments in facility upgrades, rental fleet expansion (including drilling tools), and international market entry are key cost drivers.

- Supply Chain Diversification: Costs associated with building a more robust and varied supply chain contribute to the overall expenditure.

- Lease Obligations: Commitments for facility leases and equipment rentals represent ongoing operational expenses.

- 2023 CapEx: Cactus Wellhead invested $108.7 million in capital expenditures during 2023, underscoring the scale of these investments.

Cactus Wellhead's cost structure is heavily weighted towards manufacturing and raw materials, particularly steel. In 2024, the company navigated fluctuating steel prices and the impact of tariffs, directly affecting its cost of goods sold and profit margins.

Selling, General, and Administrative (SG&A) expenses, including personnel and marketing, are also significant. These costs saw an approximate 12% increase in 2024, highlighting the need for efficient overhead management.

Field service operations, encompassing labor, equipment maintenance, and logistics, represent a substantial operational cost, often exceeding 60% of service delivery expenses for similar companies in 2024.

Cactus also invests heavily in Research and Development (R&D) to maintain its competitive edge through product innovation and enhancement, which is crucial for future revenue and cost efficiency.

Capital expenditures, including facility upgrades and rental fleet expansion, alongside international expansion and supply chain diversification, are major cost drivers. Lease obligations for facilities and equipment also form a notable part of the cost base.

| Cost Category | Key Components | 2024 Impact/Notes |

| Manufacturing & Raw Materials | Steel, other components | Volatile steel prices, tariffs increased costs. |

| SG&A | Personnel, marketing, administration | Approx. 12% increase in 2024. |

| Field Service Operations | Labor, maintenance, logistics | Can exceed 60% of service delivery costs. |

| R&D | New product development, tech enhancement | Essential for competitive advantage. |

| Capital Expenditures | Facilities, rental fleet, international expansion | $108.7 million invested in 2023. |

| Lease Obligations | Facilities, equipment | Ongoing operational expenses. |

Revenue Streams

Cactus Wellhead's core revenue generation stems from the direct sale of its specialized wellhead and pressure control equipment. This includes critical components like the Cactus SafeDrill systems, vital for the safe and efficient operation of onshore unconventional oil and gas wells throughout their drilling and completion phases.

Cactus Wellhead generates substantial revenue through the rental of its specialized drilling and completion equipment. This offering provides customers with a flexible and cost-effective solution, particularly beneficial during periods of fluctuating operational demands.

This rental segment is a key contributor to Cactus's recurring income, demonstrating resilience and adaptability within the dynamic energy sector. For instance, in the first quarter of 2024, rental revenue played a crucial role in supporting the company's financial performance amidst evolving market conditions.

Cactus Wellhead generates revenue from essential field services that go hand-in-hand with their equipment sales and rentals. These services are crucial for ensuring operational efficiency and safety for their clients.

The company's field service offerings encompass a range of activities, including the installation of wellhead and pressure control equipment, ongoing maintenance to prevent downtime, and prompt repair services when issues arise. They also handle the logistics and management of this specialized equipment.

In 2024, the demand for specialized oilfield services remained robust, with reports indicating a significant increase in activity for companies like Cactus Wellhead due to renewed exploration and production efforts. This directly translates to higher revenue from their field service segment.

Sales of Spoolable Pipe Technologies

Following its acquisition of FlexSteel, Cactus Wellhead's Spoolable Technologies segment generates revenue through the design, manufacture, and sale of advanced spoolable pipe systems and their associated end fittings. These innovative products are crucial for the efficient transportation of oil, gas, and other liquids, particularly during the post-completion phase of well operations.

This revenue stream is directly tied to the demand for reliable and flexible pipeline solutions in the energy sector. For instance, in 2023, the market for flexible pipes, a key component of spoolable technologies, saw significant growth driven by offshore exploration and production activities and the need for cost-effective infrastructure. Cactus Wellhead's offering directly addresses this market need.

- Design and Manufacturing: Revenue is generated from the specialized engineering and production of spoolable pipe, which offers advantages like faster installation and corrosion resistance compared to traditional steel pipes.

- Product Sales: Direct sales of the spoolable pipe and its proprietary end fittings to oil and gas operators constitute the primary revenue source.

- Market Demand: The segment's financial performance is influenced by upstream capital expenditure cycles and the increasing adoption of composite materials in pipeline infrastructure.

International Sales and Service Revenue

Cactus Wellhead's international sales and service revenue is a significant and expanding component of its business model. This growth is fueled by strategic international expansion, including the acquisition of Baker Hughes' SPC business. This move broadened their operational footprint and customer base in key global markets.

The company has established a strong presence in several vital international regions. These include Australia, Canada, and the Middle East. This geographic diversification is crucial for stabilizing revenue streams, as it reduces reliance on any single market and helps cushion the impact of regional economic downturns or industry-specific cycles.

For instance, in 2023, international markets contributed a substantial portion to Cactus Wellhead's overall revenue, demonstrating the increasing importance of this segment. This global reach allows them to capitalize on diverse opportunities and maintain a more resilient financial profile.

- Expanding Global Footprint: The acquisition of Baker Hughes' SPC business significantly enhanced Cactus Wellhead's international presence.

- Key Market Penetration: Established operations in Australia, Canada, and the Middle East are crucial revenue generators.

- Revenue Stabilization: Geographic diversification through international sales helps mitigate risks associated with market-specific downturns.

- 2023 Performance: International sales played a vital role in the company's financial performance during 2023, highlighting its growing significance.

Cactus Wellhead's revenue is multifaceted, encompassing direct equipment sales, rental services, and essential field support. The company also generates significant income from its Spoolable Technologies segment, particularly following the FlexSteel acquisition, and from its expanding international operations.

| Revenue Stream | Description | Key Drivers | 2023/2024 Impact |

|---|---|---|---|

| Equipment Sales | Direct sale of wellhead and pressure control equipment. | Drilling and completion activity levels. | Core revenue driver, supported by robust E&P spending. |

| Equipment Rentals | Leasing of specialized drilling and completion equipment. | Operational demand fluctuations, cost-effectiveness for clients. | Provides recurring income, showed resilience in Q1 2024. |

| Field Services | Installation, maintenance, and repair of equipment. | Operational efficiency and safety needs, increased activity. | Demand robust in 2024 due to renewed exploration. |

| Spoolable Technologies | Design, manufacture, and sale of spoolable pipe systems. | Demand for flexible pipeline solutions, composite material adoption. | Grew significantly, addressing market needs for cost-effective infrastructure. |

| International Sales | Revenue from operations in key global markets. | Strategic expansion, geographic diversification. | Substantial contributor in 2023, mitigating market-specific risks. |

Business Model Canvas Data Sources

The Cactus Wellhead Business Model Canvas is built upon a foundation of industry-specific market research, operational efficiency data, and detailed financial performance metrics. These diverse data sources ensure a comprehensive and accurate representation of the business's strategic landscape.