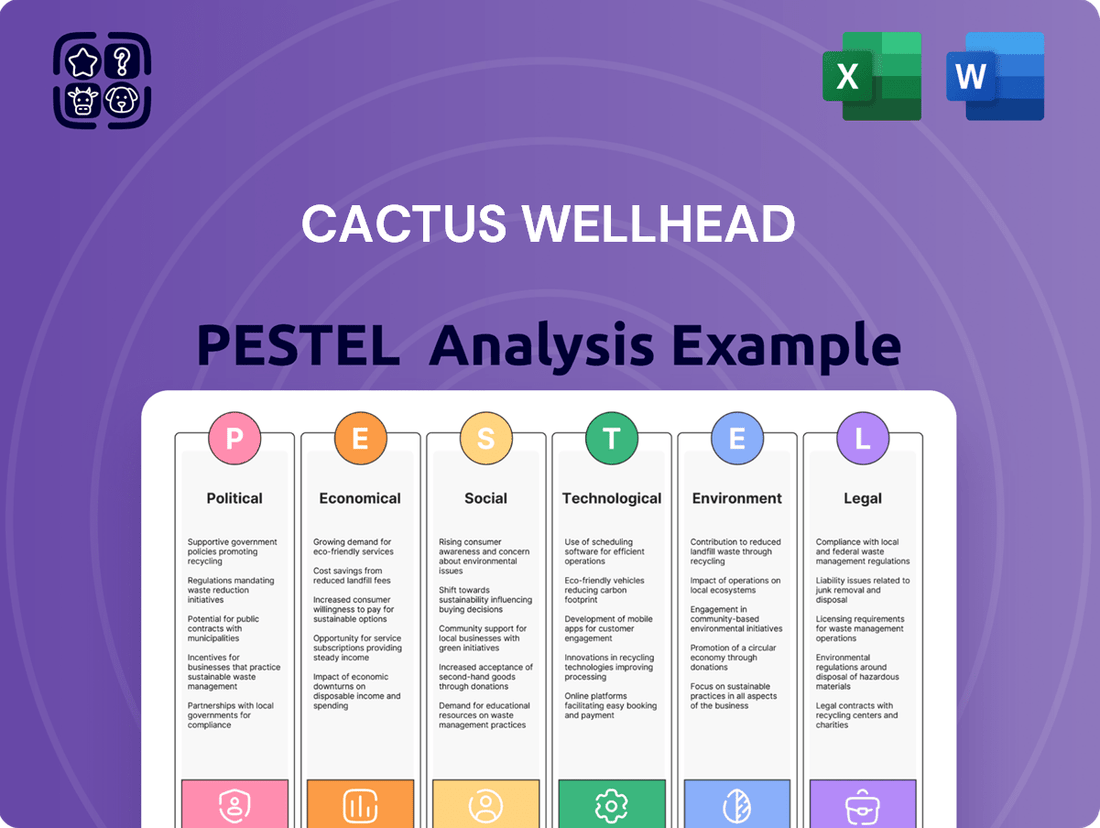

Cactus Wellhead PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cactus Wellhead Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Cactus Wellhead's trajectory. This comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a competitive edge.

Political factors

Government policies, including subsidies, taxes, and regulatory frameworks for oil and gas, directly shape Cactus Inc.'s operational landscape. For instance, the U.S. Inflation Reduction Act of 2022, while promoting clean energy, also includes provisions that could affect oil and gas production incentives. Changes in administration or energy policy, such as potential shifts in permitting processes or environmental regulations, can significantly impact drilling activity and the demand for wellhead equipment.

Global geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to create volatility in energy markets. These disruptions directly impact crude oil prices, which in turn influence investment decisions for new drilling projects. For instance, in early 2024, Brent crude oil prices fluctuated significantly, often trading above $80 per barrel, driven by these geopolitical tensions.

Regions experiencing high political instability present inherent risks for companies like Cactus Inc., affecting both operational continuity and the reliable supply of essential raw materials. This instability can lead to unexpected cost increases or delays, impacting project timelines and profitability.

Cactus Inc.'s business performance is intrinsically linked to the geopolitical stability of major oil-producing and consuming nations. Shifts in political landscapes or the imposition of sanctions in key regions can alter supply dynamics and demand forecasts, directly affecting the company's revenue streams and strategic planning for the 2024-2025 period.

The ease or difficulty in securing drilling permits and leases from federal and state governments significantly influences the pace of onshore oil and gas exploration and production. In 2024, for instance, the Bureau of Land Management (BLM) continued to manage federal oil and gas leases, with leasing activity and the number of permits issued subject to ongoing policy shifts and environmental reviews, impacting the pipeline of new projects.

More stringent permitting requirements or temporary bans on new drilling operations directly curtail the demand for essential wellhead and pressure control equipment, a core business for companies like Cactus. For example, delays in permit approvals can lead to extended project timelines, affecting revenue forecasts for equipment manufacturers and service providers.

Businesses operating in this sector, such as Cactus, must adeptly navigate these intricate regulatory frameworks to effectively support their clients' drilling and production activities. Understanding the nuances of federal (like the Outer Continental Shelf Lands Act) and state-specific regulations, including environmental impact assessments and safety standards, is crucial for maintaining operational efficiency and client satisfaction.

International Trade Policies and Tariffs

International trade policies, including tariffs and import/export restrictions, directly impact Cactus Wellhead's operational costs and market competitiveness. For instance, changes in trade agreements can alter the price of essential raw materials and components sourced globally. In 2024, the ongoing evolution of trade relationships, particularly between major economies, continues to present both opportunities and challenges for companies reliant on international supply chains.

The imposition or removal of tariffs can significantly influence the cost of goods for Cactus Inc., affecting both its procurement of materials and the pricing of its finished wellhead products in various markets. For example, a 2024 report indicated that tariffs on steel, a key component in wellhead manufacturing, could add substantial costs. This necessitates careful monitoring of global trade relations to manage supply chain expenses and ensure continued market access.

- Tariff Impact: Fluctuations in tariffs on steel and other manufacturing inputs can directly increase production costs for Cactus Wellhead.

- Trade Agreements: Evolving trade agreements, such as those impacting North American markets in 2024, can reshape competitive landscapes and supply chain strategies.

- Market Access: Import/export restrictions can limit Cactus Inc.'s ability to sell its products in key international regions or source components cost-effectively.

- Supply Chain Resilience: Proactive management of trade policy shifts is crucial for maintaining supply chain stability and mitigating risks to market access.

Government Incentives for Energy Transition

Government incentives for the energy transition, including significant investments in renewable energy projects, could indirectly influence the long-term demand for traditional oil and gas equipment like those produced by Cactus Inc. For instance, the Inflation Reduction Act in the United States, enacted in 2022, allocated over $370 billion in tax credits and incentives for clean energy and climate initiatives through 2032, signaling a strong policy push towards decarbonization. This policy shift may gradually alter energy infrastructure investment patterns.

These evolving policies necessitate strategic foresight from companies like Cactus Inc. to navigate potential shifts in the energy landscape. Companies may need to consider adapting their product lines or exploring diversification into sectors that support the growing renewable energy market. The global energy transition is accelerating, with projections indicating continued growth in renewable energy capacity. For example, the International Energy Agency (IEA) reported in its 2023 Electricity Market Report that renewable energy sources are expected to account for over 90% of global electricity capacity additions in the coming years.

- Policy Impact: Government support for renewables, such as the U.S. Inflation Reduction Act's $370 billion in clean energy incentives, aims to accelerate decarbonization.

- Investment Shift: This policy direction suggests a gradual reallocation of capital away from fossil fuels and towards renewable energy infrastructure.

- Strategic Imperative: Cactus Inc. must consider how these trends might affect future demand for its traditional oil and gas products and explore adaptation strategies.

- Market Growth: The IEA forecasts that renewables will dominate new global electricity capacity additions, highlighting the scale of the ongoing energy transition.

Governmental policies regarding drilling permits and environmental regulations directly influence Cactus Inc.'s operational capacity and market opportunities. For example, in 2024, the U.S. Bureau of Land Management continued to manage federal oil and gas leases, with leasing activity subject to ongoing policy reviews impacting project pipelines.

Geopolitical stability in major energy-producing regions is critical, as disruptions can lead to price volatility, impacting investment in new drilling projects. Brent crude oil prices, for instance, frequently traded above $80 per barrel in early 2024 due to global tensions, directly affecting demand for wellhead equipment.

International trade policies, including tariffs on essential materials like steel, can significantly increase production costs for Cactus Inc. In 2024, evolving trade relationships and potential tariffs on manufacturing inputs necessitated careful supply chain management to maintain market competitiveness.

Government incentives for the energy transition, such as the U.S. Inflation Reduction Act's over $370 billion in clean energy funding, signal a long-term shift that may gradually impact demand for traditional oil and gas equipment, requiring strategic adaptation from companies like Cactus Inc.

What is included in the product

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting Cactus Wellhead, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces create both threats and opportunities, enabling strategic decision-making for business growth and risk mitigation.

The Cactus Wellhead PESTLE Analysis offers a clear and simple language summary, making it accessible to all stakeholders and effectively relieving the pain point of complex market understanding.

Economic factors

Global oil prices saw significant volatility in late 2024 and early 2025, with Brent crude averaging around $80-$85 per barrel. This fluctuation directly influences exploration and production (E&P) companies' capital expenditure, a key determinant of demand for Cactus Inc.'s wellhead solutions. For instance, a sustained period of prices above $80 per barrel typically spurs greater investment in new drilling projects.

Natural gas prices also experienced shifts, with Henry Hub futures trading in the $2.50-$3.00 per million British thermal units (MMBtu) range throughout much of the 2024-2025 period. These price levels impact the economic viability of gas-focused drilling, consequently affecting Cactus Inc.'s order volumes. Lower, sustained prices can lead E&P firms to defer or cancel projects, directly reducing the need for new wellhead equipment.

Upstream oil and gas companies' capital expenditure (capex) is a direct driver for the wellhead market. In 2024, global E&P capex is projected to reach $540 billion, a 5% increase from 2023, according to Rystad Energy. This investment appetite for drilling and production directly impacts demand for Cactus Wellhead's products.

Investor sentiment and corporate financial health significantly shape E&P spending. For instance, high oil prices, like the average Brent crude price hovering around $80-$85 per barrel in early 2024, encourage greater investment. Conversely, price volatility or concerns about future demand can temper these capital outlays, affecting Cactus Inc.'s revenue cycles.

Cactus Inc.'s financial performance is closely tied to these upstream capex trends. As E&P companies adjust their spending based on economic outlooks and commodity prices, the demand for wellheads and pressure control equipment fluctuates. A robust capex environment in 2024-2025 generally translates to higher sales volumes for Cactus.

Interest rate fluctuations directly impact Cactus Wellhead's cost of capital and the financing capabilities of its Exploration & Production (E&P) clients. For instance, the Federal Reserve's monetary policy decisions in 2024, including anticipated rate adjustments, will shape borrowing costs for new equipment and project development. Higher rates could make it more expensive for E&P companies to secure the funds needed for drilling and infrastructure, potentially leading to a slowdown in demand for wellhead products.

Access to affordable capital remains a critical determinant of growth and operational stability for Cactus Inc. and its customer base. In 2024, the availability of credit and the overall health of the capital markets will influence Cactus's ability to invest in research and development, expand manufacturing capacity, and manage its working capital. Similarly, E&P firms rely on robust access to capital markets to fund their capital expenditures, and any tightening in credit conditions could directly affect their purchasing power.

Inflationary Pressures and Supply Chain Costs

Ongoing inflationary pressures present a significant challenge for Cactus Inc., directly impacting its operational costs. Rising prices for raw materials, manufacturing processes, skilled labor, and transportation are squeezing profit margins. For instance, the Producer Price Index (PPI) for industrial commodities saw notable increases throughout 2024, reflecting higher input costs across various sectors that supply the oil and gas industry.

Global supply chain disruptions, a persistent issue since 2020, continue to affect Cactus Wellhead. These disruptions lead to extended lead times for critical components and drive up procurement expenses, making it harder to maintain consistent production schedules and competitive pricing. The cost of shipping, particularly for specialized equipment, has remained elevated.

- Increased Input Costs: Higher prices for steel, specialized alloys, and energy directly impact wellhead manufacturing expenses.

- Extended Lead Times: Delays in receiving critical components can disrupt production and project timelines.

- Transportation Expenses: Freight costs for both raw materials and finished goods remain a significant cost factor.

- Profit Margin Squeeze: The inability to fully pass on increased costs to customers can reduce profitability.

Overall Economic Growth and Energy Demand

Broad economic growth is a key driver for industries, transportation, and consumer energy needs, directly impacting the demand for oil and gas. A strong global economy typically correlates with higher energy consumption, which in turn can boost drilling and production activities for companies like Cactus Wellhead. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that underpins the demand for energy services.

Conversely, economic slowdowns or recessions can significantly curb energy demand, leading to reduced activity and investment in the oil and gas sector. The World Bank, in its January 2024 Global Economic Prospects report, noted that global growth was expected to slow from 2.6% in 2023 to 2.4% in 2024, indicating a potential moderating effect on energy demand.

- Global economic growth forecast for 2024: 3.2% (IMF)

- Global economic growth forecast for 2025: 2.9% (IMF)

- Impact of economic cycles on oil and gas demand: Direct correlation

- Potential slowdown in energy sector investment during economic downturns

The economic landscape for Cactus Wellhead in 2024-2025 is shaped by fluctuating commodity prices and upstream capital expenditures. Brent crude prices, averaging around $80-$85 per barrel in early 2025, and Henry Hub natural gas prices between $2.50-$3.00/MMBtu, directly influence E&P investment decisions. Global E&P capital expenditure was projected to hit $540 billion in 2024, a 5% rise from the previous year, indicating a positive demand outlook for wellhead solutions.

Interest rates and access to capital are critical factors. Anticipated adjustments to interest rates by central banks in 2024 could increase borrowing costs for E&P clients, potentially impacting their spending on new equipment. Inflationary pressures, evidenced by rising Producer Price Index for industrial commodities in 2024, are also squeezing Cactus Inc.'s operational margins due to increased input costs for materials and manufacturing.

Global economic growth, projected at 3.2% for 2024 by the IMF, supports energy demand and, consequently, activity in the oil and gas sector. However, a slight slowdown to 2.9% growth forecast for 2025 suggests a moderating influence on energy consumption and investment. Persistent supply chain disruptions continue to affect lead times and procurement expenses for critical components.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Cactus Wellhead | Source/Notes |

| Brent Crude Price | ~$80-85/barrel (early 2025) | Variable, influenced by geopolitical factors | Higher prices incentivize E&P investment | Market analysis |

| Henry Hub Natural Gas Price | ~$2.50-3.00/MMBtu | Variable | Affects economic viability of gas drilling | Market analysis |

| Global E&P Capex | $540 billion (+5% vs 2023) | Projected to remain robust | Direct driver of wellhead demand | Rystad Energy |

| Global Economic Growth | 3.2% | 2.9% | Influences overall energy demand | IMF |

| Producer Price Index (Industrial Commodities) | Notable increase in 2024 | Continued inflationary pressures | Increases input costs | Government statistics |

Same Document Delivered

Cactus Wellhead PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cactus Wellhead PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the industry, providing valuable strategic insights.

Sociological factors

Public perception of fossil fuels is shifting significantly, driven by growing environmental awareness. Surveys in 2024 indicate a rising concern about climate change, with a majority of respondents favoring a transition to renewable energy sources. This evolving sentiment directly impacts investor confidence, as institutions increasingly face pressure to divest from oil and gas holdings.

This negative public perception can translate into tangible financial consequences for companies like Cactus Inc. A reduced appetite for fossil fuel investments by financial institutions, potentially exacerbated by stricter ESG (Environmental, Social, and Governance) mandates in 2025, could limit capital availability for exploration and production (E&P) companies. Consequently, this may indirectly affect demand for wellhead equipment and services.

The oil and gas sector, including specialized areas like wellhead operations, is grappling with difficulties in attracting and keeping skilled workers. This shortage is exacerbated by demographic changes, with an aging workforce retiring and younger generations often opting for other industries. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for thousands of new workers in skilled trades, a trend impacting specialized fields within energy.

These labor market dynamics directly affect companies like Cactus Inc., which depend on a proficient workforce for its manufacturing, field services, and engineering divisions. As the demand for specialized skills intensifies, Cactus Inc. may face increased labor costs and potential operational delays if it cannot secure adequate talent, impacting its ability to meet market demands efficiently.

Cactus Wellhead's ability to operate smoothly hinges on strong ties with the communities hosting its drilling and production sites. For instance, in 2024, companies in the energy sector faced increased scrutiny regarding local job creation, with some regions reporting that less than 20% of direct oil and gas jobs went to local residents, fueling community demands for greater benefit sharing.

Environmental impact and land use are significant concerns that can affect operational permits and public acceptance. A 2025 survey in a key North American oil-producing region revealed that over 60% of residents expressed worries about water contamination from hydraulic fracturing, directly impacting the social license to operate for companies in that area.

To ensure long-term viability, Cactus Wellhead must prioritize proactive community engagement and demonstrate responsible operational practices. This includes transparent communication about environmental safeguards and offering tangible community benefits, as seen in a successful 2024 partnership where an energy firm invested $5 million in local infrastructure improvements, significantly boosting community support.

Health and Safety Standards

Societal expectations for robust worker safety and unwavering operational integrity are on a continuous upward trajectory. This trend translates directly into increasingly stringent industry standards and heightened public scrutiny for companies operating in sectors like oil and gas. Cactus Inc., as a provider of critical pressure control equipment, plays a pivotal role in ensuring the safety of well operations, making adherence to evolving safety protocols non-negotiable.

The emphasis on health and safety is not merely about compliance; it's a fundamental pillar for maintaining a strong corporate reputation and ensuring regulatory adherence. For instance, the Occupational Safety and Health Administration (OSHA) in the United States reported a decrease in the private industry occupational injury and illness rate to 2.7 cases per 100 full-time workers in 2023, reflecting a broader push for safer workplaces. Companies that proactively invest in and demonstrate continuous improvement in their health and safety practices are better positioned to mitigate risks and build trust with stakeholders.

- Rising Societal Expectations: Increased public demand for safer workplaces and operational transparency.

- Industry Standard Evolution: Continuous pressure for stricter regulations and best practices in health and safety.

- Cactus Inc.'s Role: Direct responsibility for contributing to safe well operations through its equipment.

- Reputation and Compliance: Paramount importance of safety for brand image and regulatory adherence.

Shifting Energy Consumption Patterns

Societal trends are increasingly favoring energy efficiency and renewable energy sources. This shift, evident in growing investments and consumer preferences, could gradually alter the energy mix. For instance, global renewable energy capacity additions reached a record 510 gigawatts (GW) in 2023, a 50% increase from 2022, according to the International Energy Agency (IEA).

While oil and gas are still vital, a sustained transition towards cleaner energy could eventually affect the long-term demand for equipment used in traditional fossil fuel extraction. Understanding these evolving consumption patterns is crucial for strategic planning and identifying opportunities for diversification within the energy sector.

Key shifts include:

- Growing adoption of electric vehicles: Global EV sales surpassed 10 million in 2023, indicating a significant move away from internal combustion engines.

- Increased investment in renewables: The IEA reported that global investment in clean energy technologies reached $1.7 trillion in 2023.

- Focus on energy efficiency: Many countries are implementing policies and incentives to improve energy efficiency across industries and households.

Public sentiment towards fossil fuels is increasingly influenced by environmental concerns, with a growing preference for renewables noted in 2024 surveys. This evolving perception can impact investor confidence and potentially limit capital for companies like Cactus Inc., especially with stricter ESG mandates anticipated by 2025.

The industry faces a skilled labor shortage, partly due to an aging workforce and younger generations choosing other sectors, a trend projected to continue according to 2024 labor statistics. This directly affects Cactus Inc.'s operational capacity and may increase labor costs.

Community relations are vital, as energy companies in 2024 faced demands for greater local economic benefits, with some regions reporting low local employment percentages in oil and gas jobs. Environmental impact, particularly concerning water usage and contamination, remains a significant societal concern influencing the social license to operate.

Societal expectations for enhanced safety and operational integrity are rising, leading to stricter industry standards. Cactus Inc. must prioritize safety to maintain its reputation and regulatory compliance, mirroring the broader industry trend towards improved workplace safety, as indicated by OSHA's 2023 injury rate data.

| Sociological Factor | Impact on Cactus Inc. | Supporting Data (2023-2025) |

|---|---|---|

| Environmental Awareness & Renewable Energy Preference | Potential reduction in demand for fossil fuel extraction equipment; pressure for ESG compliance. | Global renewable capacity additions reached 510 GW in 2023 (IEA); EV sales surpassed 10 million in 2023. |

| Skilled Labor Shortage | Increased labor costs and potential operational delays due to difficulty in hiring and retaining talent. | Projected need for thousands of new skilled trade workers in the U.S. (BLS, 2024). |

| Community Relations & Social License to Operate | Need for proactive engagement and demonstration of responsible practices to maintain operational permits and public acceptance. | Concerns over water contamination from hydraulic fracturing (2025 survey); energy firms investing in local infrastructure (2024 example). |

| Health & Safety Expectations | Requirement for stringent adherence to evolving safety protocols to maintain reputation and regulatory compliance. | U.S. private industry occupational injury rate: 2.7 per 100 workers (OSHA, 2023). |

Technological factors

Continuous innovation in horizontal drilling and hydraulic fracturing techniques, such as extended reach laterals and advanced proppant technologies, directly impacts wellhead design. These advancements necessitate more robust equipment capable of handling higher pressures and complex wellbore geometries. Cactus Inc. must adapt its offerings to support these evolving operational demands for continued market relevance.

The increasing exploration of challenging reservoirs by E&P companies fuels a rising demand for wellhead equipment that can reliably function under extreme pressure and temperature conditions. Cactus Inc. must prioritize R&D for HPHT-rated products, including advancements in material science and sealing technologies, to align with evolving industry needs and secure its competitive position.

The oilfield services sector is experiencing a significant shift towards digitalization and automation, with technologies like IoT sensors, advanced data analytics, and remote monitoring becoming increasingly integral. This trend is directly impacting operational efficiency and safety protocols across the industry.

Cactus Inc. is well-positioned to capitalize on these technological advancements. By integrating these digital tools, the company can implement predictive maintenance strategies for its rental equipment fleet, ensuring higher uptime and reduced unexpected failures. Real-time performance monitoring of its assets will also allow for more proactive management and optimization.

Furthermore, the adoption of digital transformation offers substantial operational advantages. For instance, in 2024, companies in the energy sector are investing heavily in AI and machine learning for optimizing drilling operations and supply chain management, with some reporting efficiency gains of up to 15%.

These digital capabilities can also enhance Cactus Wellhead's field service delivery, enabling quicker response times and more informed decision-making by field personnel. The integration of data analytics can lead to improved resource allocation and a more streamlined customer experience.

Materials Science and Manufacturing Innovations

Advances in materials science, particularly in metallurgy and composite materials, are enabling the creation of more robust and lightweight wellhead components. For instance, the development of advanced alloys offers superior corrosion resistance and higher tensile strength, crucial for harsh downhole environments. This translates to extended component lifespan and reduced maintenance needs for operators utilizing Cactus Inc. products.

Manufacturing innovations like additive manufacturing, or 3D printing, are revolutionizing wellhead production. This technology allows for complex geometries and on-demand part creation, potentially reducing lead times and inventory costs. In 2024, the global 3D printing market in oil and gas was valued at approximately $2.1 billion, with significant growth projected in the coming years, highlighting the increasing adoption of such technologies.

- Enhanced Durability: New alloys and composites offer improved resistance to extreme pressures and corrosive elements, potentially increasing wellhead service life by up to 20% compared to traditional materials.

- Cost Efficiency: Additive manufacturing can reduce material waste by over 50% and shorten production cycles, leading to lower manufacturing costs for specialized wellhead components.

- Supply Chain Agility: Localized 3D printing capabilities can shorten supply chains, reducing reliance on distant manufacturers and improving responsiveness to urgent operational needs.

- Performance Gains: Lighter materials and optimized designs achieved through advanced manufacturing can improve handling and installation efficiency, contributing to overall project cost savings.

Emergence of Carbon Capture and Storage (CCS) Technologies

The advancement of Carbon Capture and Storage (CCS) technologies, while not directly tied to traditional oil and gas wellheads, presents a significant technological shift. Companies like Cactus Inc., with their established expertise in pressure containment and maintaining well integrity, could find new markets. For instance, the global CCS market was valued at approximately $3.2 billion in 2023 and is projected to reach $11.8 billion by 2030, according to various market research reports. This growth indicates a substantial future demand for specialized engineering and containment solutions.

This emerging sector requires robust systems for injecting and storing captured CO2 underground, demanding the same level of precision and safety that Cactus Wellhead is known for. As the energy transition accelerates, Cactus Inc. has a clear opportunity to leverage its core competencies. This could involve developing or supplying components for CO2 injection wells or geological storage sites, marking a strategic diversification path. The International Energy Agency (IEA) reported in 2024 that global CCS capacity is expanding, with over 30 new projects announced in the past year alone, underscoring the growing relevance of this technology.

- CCS Market Growth: The global CCS market is expected to grow significantly, offering new avenues for companies with pressure containment expertise.

- Adaptable Core Competencies: Cactus Inc.'s skills in well integrity are transferable to the requirements of CO2 injection and storage infrastructure.

- Diversification Potential: The energy transition creates long-term opportunities for Cactus to adapt its offerings to support emerging low-carbon industries.

- IEA Insights: The IEA's 2024 report highlights increasing global investment and project development in CCS, signaling market expansion.

The integration of digital technologies like IoT and AI is transforming oilfield operations, driving efficiency and safety. Cactus Inc. can leverage these tools for predictive maintenance and real-time asset monitoring, enhancing its service delivery. Investment in AI for operational optimization is projected to yield significant efficiency gains, with some energy companies reporting up to 15% improvements in 2024.

Legal factors

Cactus Inc. navigates a complex web of environmental regulations, including those governing emissions, waste disposal, water usage, and spill prevention for both manufacturing and field operations. Failure to comply can result in significant fines and operational disruptions.

The increasing stringency of environmental laws, often spurred by climate change concerns and public awareness, directly impacts Cactus Inc. by raising compliance costs and necessitating robust reporting. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter enforcement of air quality standards, potentially affecting manufacturing emissions.

Proactive adaptation to evolving environmental mandates is crucial for Cactus Inc. Staying informed about upcoming regulatory shifts, such as potential new rules on wastewater discharge in oil and gas operations anticipated for 2025, allows the company to plan and invest accordingly, mitigating future liabilities.

Cactus Inc. must strictly adhere to occupational health and safety regulations, like those from OSHA in the US, for its manufacturing and field operations. Failure to comply can lead to substantial fines, operational disruptions, and significant damage to the company's reputation. For instance, OSHA violations can incur penalties ranging from thousands to hundreds of thousands of dollars per infraction, impacting profitability directly.

As a manufacturer of critical pressure control equipment, Cactus Inc. faces significant product liability exposure. Defects in design or manufacturing that cause equipment failure, potentially leading to accidents or environmental damage, can trigger substantial lawsuits and financial claims. For instance, in 2024, the energy sector saw several high-profile cases involving equipment malfunctions, with settlements often reaching millions of dollars.

To navigate these risks, Cactus must maintain rigorous quality control and comprehensive product testing protocols. Clear and well-defined warranty provisions are crucial for managing customer expectations and limiting liability. Failure to adhere to these standards could result in significant financial penalties and reputational damage, impacting future sales and market trust.

Intellectual Property Rights and Patents

Protecting Cactus Inc.'s proprietary wellhead designs, manufacturing processes, and technological innovations through patents and other intellectual property (IP) rights is fundamental to sustaining its competitive edge in the oil and gas sector. This is particularly important as the industry increasingly relies on specialized, high-performance equipment. For instance, in 2024, the global market for oil and gas drilling equipment, where wellheads are a critical component, was valued at approximately $200 billion, highlighting the significant commercial stakes involved.

Litigation stemming from patent infringement claims or challenges to the validity of existing patents presents a substantial risk for Cactus Inc. Such legal battles are notoriously protracted and financially draining, potentially diverting significant resources away from core operations and research and development. In 2023, the average cost of patent litigation in the United States exceeded $3 million, underscoring the financial impact.

Consequently, Cactus Inc. must adopt a proactive and robust strategy for managing and defending its intellectual property portfolio. This includes diligent monitoring of competitor activities for potential infringements and strategically enforcing its patent rights to deter unauthorized use of its innovations.

International Laws and Sanctions

Cactus Inc.'s international operations are significantly shaped by global legal frameworks. Compliance with international trade laws and economic sanctions is paramount for its supply chain and sales activities. For instance, sanctions imposed by the United States, such as those targeting Russia or Iran, can restrict Cactus's ability to export its wellhead equipment or source components from specific regions, impacting its global market reach and operational flexibility.

Navigating these complex regulations is crucial to avoid substantial financial penalties and reputational damage. The company must adhere to customs regulations in each country it operates in, which can vary widely and affect the cost and timeline of importing and exporting goods. For example, differing tariff rates on oil and gas equipment in 2024 between countries like Canada and Mexico could influence Cactus's pricing strategies and market competitiveness.

- Trade Embargoes: Cactus must monitor and comply with evolving trade embargoes, such as those that might be enacted or strengthened in response to geopolitical events in 2024-2025, which could directly impact its ability to conduct business in affected nations.

- Export Controls: Stringent export control regulations, particularly for dual-use technologies like advanced wellhead components, require careful management to ensure compliance with international agreements and national security interests.

- Customs Duties and Tariffs: Fluctuations in customs duties and tariffs, influenced by trade agreements or disputes, can alter the landed cost of Cactus's products, necessitating ongoing analysis of international market economics.

- Sanctions Compliance: Failure to comply with economic sanctions, which are frequently updated, can result in severe fines, asset freezes, and loss of export privileges, underscoring the critical need for robust compliance programs.

Cactus Inc. operates within a legal landscape governed by extensive regulations impacting its manufacturing, product safety, and intellectual property. Compliance with occupational safety standards, such as those enforced by OSHA, is critical to avoid significant penalties and operational disruptions, with violations potentially costing tens of thousands of dollars per infraction in 2024.

The company faces substantial product liability risks, as defects in its wellhead equipment can lead to costly lawsuits, a trend observed in the energy sector throughout 2024 with settlements often reaching millions. Protecting its intellectual property, a market valued at $200 billion globally for drilling equipment in 2024, is also paramount, with patent litigation costs averaging over $3 million in the US in 2023.

International trade laws and sanctions present further legal complexities, requiring careful adherence to customs regulations and export controls to prevent severe financial penalties and reputational damage. For example, varying tariff rates in 2024 between countries like Canada and Mexico can impact Cactus's pricing and competitiveness.

| Legal Factor | Impact on Cactus Inc. | 2024/2025 Relevance | Potential Cost/Risk |

| Occupational Health & Safety | Ensures safe working environments in manufacturing and field operations. | OSHA enforcement continues, with a focus on process safety management. | Fines for violations can range from thousands to hundreds of thousands of dollars. |

| Product Liability | Addresses risks associated with equipment failure and potential accidents. | Increased scrutiny on equipment reliability in high-pressure environments. | Litigation costs and settlements can reach millions; reputational damage. |

| Intellectual Property | Protects proprietary designs and technologies against infringement. | High value of specialized oil and gas equipment fuels IP disputes. | Patent litigation costs exceed $3 million; potential loss of competitive advantage. |

| International Trade & Sanctions | Governs import/export activities and compliance with global economic policies. | Evolving sanctions and trade agreements impact market access and supply chains. | Severe fines, asset freezes, and loss of export privileges for non-compliance. |

Environmental factors

Global and national policies aimed at combating climate change, such as carbon pricing mechanisms and ambitious emissions reduction targets, are increasingly influencing the demand for fossil fuels. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a move that could accelerate the transition away from traditional energy sources.

While Cactus Inc. currently focuses on oil and gas, these evolving climate policies present a significant challenge to the long-term investment outlook for the sector. Mandates for renewable energy adoption, like the US Inflation Reduction Act's incentives for clean energy projects, are designed to shift capital and consumer preference, necessitating a strategic assessment of long-term market shifts by companies like Cactus Inc.

Oil and gas operations, including hydraulic fracturing, demand significant water volumes. For instance, a single fracking job can utilize millions of gallons of water. This intensive usage raises concerns, particularly in regions experiencing water scarcity.

Stricter regulations on water sourcing and the disposal of wastewater are becoming more common, directly impacting operational costs and the overall feasibility of projects. These environmental pressures can lead to increased expenses for water acquisition and treatment for companies like Cactus Inc.'s clients.

The challenges related to water management and scarcity can indirectly influence the activity levels of Cactus Inc.'s clientele. If clients face higher water-related costs or operational constraints due to these environmental factors, their demand for wellhead services may decrease.

Environmental concerns, particularly regarding land use and biodiversity, significantly influence the oil and gas sector. For instance, the U.S. Fish and Wildlife Service reported in 2024 that over 1.3 million acres of critical habitat were designated for endangered species, potentially impacting drilling permits and operational areas.

Regulations aimed at conserving sensitive ecosystems and restoring disturbed lands can increase project costs and limit the physical footprint of exploration and production activities. Cactus Inc. must be attuned to these environmental considerations, as they directly affect the operational scope and financial viability for their clients.

Waste Management and Pollution Control

Effective waste management and pollution control are critical for Cactus Wellhead, given the oil and gas industry's environmental scrutiny. Regulations mandate careful handling and disposal of drilling fluids, produced water, and other operational byproducts. Failure to comply, such as through spills or improper disposal, can result in substantial fines and severe reputational damage, impacting the company's market standing.

The environmental footprint of all supply chain partners, including equipment manufacturers like Cactus Wellhead, is under increasing examination. This means demonstrating robust environmental practices is not just a regulatory necessity but a competitive advantage. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to enforce strict guidelines on wastewater discharge from oil and gas operations, with penalties for non-compliance reaching millions of dollars for major incidents.

- Regulatory Compliance Costs: Companies face significant expenses in meeting environmental standards for waste disposal and pollution prevention.

- Environmental Incident Impact: Spills or improper waste handling can lead to substantial fines, cleanup costs, and long-term damage to brand reputation.

- Supply Chain Responsibility: Equipment providers are increasingly held accountable for their environmental performance and the sustainability of their products.

- Industry Trends: A growing focus on circular economy principles and reduced emissions is shaping waste management strategies across the sector.

Energy Transition and Decarbonization Pressures

The global push for decarbonization, accelerating with initiatives like the Paris Agreement, presents a significant long-term environmental challenge for companies like Cactus Wellhead, which serve the oil and gas sector. While demand for their products remains robust in the near term, the speed and extent of the transition to renewable energy sources will ultimately shape the future market for traditional fossil fuel extraction equipment. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that while oil and gas demand may plateau in the coming years, investment in upstream oil and gas is still projected to reach $600 billion in 2024, indicating continued reliance on existing infrastructure.

This evolving energy landscape means that Cactus Inc.'s long-term strategic planning must account for shifting investment priorities and potential regulatory changes aimed at reducing greenhouse gas emissions. Investor scrutiny on Environmental, Social, and Governance (ESG) performance is intensifying, with a growing number of funds actively divesting from fossil fuel-related assets. This trend is reflected in the increasing integration of ESG metrics into corporate valuations, impacting access to capital and overall market perception for companies within the energy supply chain.

The environmental pressures also manifest in:

- Increased regulatory scrutiny on emissions from oil and gas operations.

- Growing investor demand for sustainable business models and reduced carbon footprints.

- Potential for carbon taxes or similar pricing mechanisms impacting operational costs.

- Shifting consumer preferences towards lower-carbon energy solutions.

Environmental regulations are a major factor for Cactus Wellhead. Stricter rules on water usage and disposal, particularly in water-scarce areas, can increase operational costs for clients and indirectly affect demand for wellhead services. For example, in 2024, the US EPA continued to enforce stringent wastewater discharge guidelines, with potential penalties for non-compliance reaching millions for significant incidents.

Land use and biodiversity concerns also play a role, with designations of critical habitats potentially limiting drilling permits. In 2024, over 1.3 million acres of critical habitat were designated in the US, impacting operational areas. Effective waste management and pollution control are essential, as non-compliance can lead to substantial fines and reputational damage.

The global push for decarbonization, driven by agreements like the Paris Agreement, presents a long-term challenge. While oil and gas demand remains strong in the near term, the transition to renewables will shape the future market. The International Energy Agency projected in its 2024 outlook that while oil and gas demand may plateau, upstream investment was still expected to reach $600 billion in 2024.

Investor scrutiny on ESG performance is intensifying, with a growing trend of funds divesting from fossil fuel assets. This impacts access to capital and market perception for companies in the energy supply chain.

| Environmental Factor | Impact on Cactus Wellhead Clients | Example/Data (2024/2025 Focus) |

|---|---|---|

| Climate Change Policies & Emissions Targets | Reduced demand for fossil fuels, shift towards renewables. | EU's Fit for 55 aims for 55% emissions cut by 2030. |

| Water Scarcity & Regulations | Increased operational costs, potential project limitations. | Fracking can use millions of gallons of water per job; stricter wastewater rules. |

| Land Use & Biodiversity Protection | Permitting delays, restricted operational footprints. | Over 1.3 million acres of critical habitat designated in the US (2024). |

| Waste Management & Pollution Control | Higher compliance costs, risk of fines and reputational damage. | EPA enforcement of wastewater discharge rules with potential multi-million dollar penalties. |

| Decarbonization & ESG Trends | Long-term market uncertainty, investor pressure for sustainable models. | IEA projected $600 billion upstream oil/gas investment in 2024; increasing ESG fund divestments. |

PESTLE Analysis Data Sources

Our Cactus Wellhead PESTLE Analysis is built upon a robust foundation of data from reputable industry associations, market research firms, and governmental regulatory bodies. We meticulously gather information on economic trends, technological advancements, and environmental policies impacting the oil and gas sector.