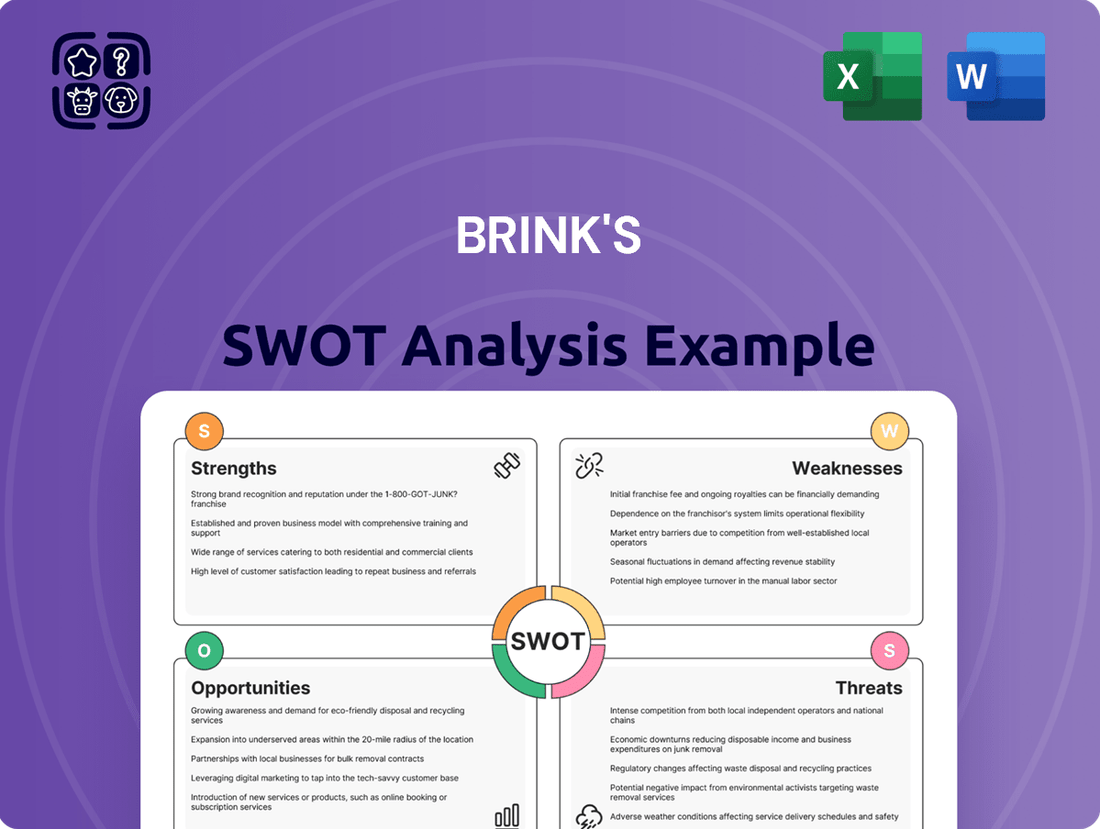

Brink's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brink's Bundle

Brink's, a leader in secure logistics, leverages its strong brand reputation and extensive global network as key strengths. However, the company faces significant challenges from evolving technology and increased competition in the payment processing sector.

Want the full story behind Brink's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Brink's boasts a formidable global leadership position, operating in over 100 countries. This expansive reach is a significant strength, allowing them to cater to a diverse international clientele, from major banks to retail chains.

Their extensive network translates into a dominant market presence, with Brink's consistently holding the #1 or #2 spot in most of the geographies they serve. This market share underscores their operational efficiency and established reputation in the security services sector.

Brink's is experiencing impressive organic growth, especially in its ATM managed services (AMS) and digital retail solutions (DRS). In the first quarter of 2025, these areas saw over 20% organic growth.

These higher-margin, recurring revenue services now account for more than 25% of Brink's overall revenue. This signifies a successful pivot towards more profitable service offerings.

This expansion is driven by strong market penetration and the company's ability to convert existing clients to these advanced solutions.

Brink's is strategically evolving beyond its traditional cash-in-transit roots, aiming to become a significant player in the wider payments landscape. This pivot emphasizes digital cash payment solutions, a move that positions them to capitalize on evolving consumer and business transaction preferences.

A key element of this transformation is investment in advanced technology, exemplified by BLUbeem™ by Brink's®. This innovative platform seamlessly connects with non-cash digital payment systems and point-of-sale technology, offering a distinct competitive edge and unlocking new avenues for higher-margin revenue growth.

Consistent Financial Performance and Shareholder Returns

Brink's has demonstrated a history of consistent financial performance, which is a significant strength. For instance, in the first quarter of 2025, the company reported revenues of $1.247 billion, surpassing analyst expectations. This strong top-line growth was complemented by an expansion in their operating profit margin, indicating efficient cost management.

Furthermore, Brink's has shown a robust ability to generate free cash flow, a key indicator of financial health and operational efficiency. This cash generation supports the company's commitment to shareholder returns.

The company actively returns value to its shareholders through various initiatives. These include accelerated share repurchase programs, which can boost earnings per share by reducing the number of outstanding shares, and consistent dividend payouts, providing regular income to investors.

- Consistent Revenue Growth: Q1 2025 revenue of $1.247 billion.

- Improved Profitability: Expansion of operating profit margin.

- Strong Cash Flow Generation: Significant free cash flow reported.

- Shareholder Value Focus: Accelerated share repurchases and consistent dividends.

Operational Excellence and Efficiency

Brink's is dedicated to achieving operational excellence, driven by its Brink's Business System. This system is designed to make operations smoother, cut down on expenses, and boost efficiency throughout all of Brink's business areas.

This commitment to efficiency has resulted in tangible productivity improvements, notably within their North American operations. The company has also benefited from a more favorable revenue mix, which directly supports better profitability and stronger cash flow generation.

- Productivity Gains: Significant improvements in output per employee, especially in North America, demonstrating the effectiveness of operational streamlining.

- Cost Reduction: Initiatives within the Brink's Business System have led to measurable reductions in operating expenses across various segments.

- Revenue Mix Improvement: A strategic focus on higher-margin services has contributed to a more profitable revenue stream.

- Enhanced Cash Flow: Operational efficiencies directly translate into improved cash flow, providing greater financial flexibility.

Brink's possesses a powerful global presence, operating in over 100 countries and consistently ranking as a top player in its markets. This extensive network, coupled with a strong focus on higher-margin services like ATM managed services and digital retail solutions, fuels impressive organic growth, with these segments experiencing over 20% growth in Q1 2025. The company's strategic pivot towards digital cash payment solutions and investment in technology like BLUbeem™ positions them well for future expansion.

Financially, Brink's demonstrates robust performance. Q1 2025 revenues reached $1.247 billion, exceeding expectations, with an expanding operating profit margin. The company also generates substantial free cash flow, enabling consistent shareholder returns through share repurchases and dividends.

Operational excellence is a core strength, driven by the Brink's Business System, which enhances efficiency and reduces costs, leading to tangible productivity gains, particularly in North America. This focus on efficiency, combined with a favorable revenue mix, directly contributes to improved profitability and stronger cash flow.

| Metric | Q1 2025 Data | Significance |

|---|---|---|

| Global Operations | 100+ countries | Extensive market reach and diversification |

| Organic Growth (AMS/DRS) | >20% | Strong performance in high-margin services |

| Revenue (Q1 2025) | $1.247 billion | Exceeded analyst expectations |

| Operating Profit Margin | Expanding | Improved cost management and efficiency |

| Free Cash Flow | Strong generation | Financial health and capacity for shareholder returns |

What is included in the product

Analyzes Brink's ’s competitive position through key internal and external factors, detailing its strengths in global reach and brand recognition against weaknesses in operational efficiency and technological adoption, while exploring opportunities in emerging markets and threats from digital payment solutions.

Provides a clear, actionable framework for identifying and leveraging Brink's competitive advantages and mitigating potential threats.

Weaknesses

Brink's faces a significant weakness in its continued reliance on physical cash, despite efforts to diversify. While cash remains a dominant payment method in many emerging markets, the accelerating global shift towards digital and cashless transactions presents a long-term threat to its core cash-in-transit and cash management services. For instance, in 2023, while digital payments saw substantial growth globally, cash still accounted for a notable percentage of transactions in many regions, highlighting the ongoing, albeit potentially diminishing, demand.

Brink's extensive global footprint exposes it to the unpredictable nature of macroeconomic shifts. For instance, in 2023, the company navigated significant foreign exchange headwinds, particularly in Latin America, which directly impacted its reported revenues and overall profitability. This sensitivity means that economic downturns or currency devaluation in key operating regions can create substantial challenges.

Beyond currency, broader economic instability, including fluctuating interest rates and rising inflation, poses a threat. These conditions can dampen client demand for Brink's core services, such as cash handling and security logistics, while simultaneously driving up operational expenses. The company must constantly adapt its strategies to mitigate the impact of these external economic forces.

Brink's carries a substantial amount of long-term debt, a factor that might concern some investors. As of the first quarter of 2024, the company reported total debt of approximately $1.5 billion. While current operational improvements have made this debt manageable, a high leverage ratio could potentially restrict financial agility for future strategic investments or acquisitions if not carefully overseen.

Competitive Landscape

Brink's faces significant competition from major players like Loomis, GardaWorld, and G4S. This crowded market means Brink's must constantly innovate and find ways to stand out to keep its customers and market share. Intense rivalry can also lead to pressure on pricing, potentially impacting profit margins.

The competitive environment necessitates strategic differentiation to maintain market leadership. For instance, while Brink's reported strong revenue growth in recent periods, such as its first quarter of 2024, where revenue increased by 10% year-over-year to $1.1 billion, the ongoing competitive pressures require careful management of operational efficiencies and service offerings.

- Established Rivals: Loomis, GardaWorld, and G4S are significant competitors.

- Pricing Pressure: Intense competition can lead to reduced pricing power and lower profit margins.

- Market Share Defense: Continuous innovation and strategic differentiation are crucial for retaining market share.

- Operational Efficiency: Maintaining strong operational performance is key to navigating a competitive landscape.

Operational Risks and Security Concerns

Brink's' core business, which involves the secure transportation and handling of high-value assets, exposes it to significant operational risks. These include the potential for theft, fraud, and sophisticated security breaches that could compromise the integrity of its services. For instance, in 2023, the global cash-in-transit market, a key segment for Brink's, continued to face challenges from organized crime, impacting operational efficiency and security budgets.

The continuous need to invest in and maintain cutting-edge security protocols and technologies to mitigate these inherent risks presents a substantial and ongoing cost. Failure to adequately manage these threats not only leads to financial losses but also poses a severe reputational risk, potentially eroding customer trust and market share. The company's commitment to security is paramount, but the financial burden of staying ahead of evolving threats is a constant challenge.

- Theft and Fraud: Brink's operates in a sector inherently vulnerable to criminal activity, requiring constant vigilance and robust internal controls.

- Security Breaches: Technological advancements by adversaries necessitate continuous investment in cybersecurity and physical security measures to prevent data or asset compromise.

- High Operational Costs: Maintaining a secure and reliable service involves significant expenditure on personnel, technology, and infrastructure, impacting profitability.

- Reputational Damage: Any security incident can severely damage Brink's reputation, leading to loss of business and increased scrutiny from regulators and clients.

Brink's faces a significant weakness in its continued reliance on physical cash, despite efforts to diversify. While cash remains a dominant payment method in many emerging markets, the accelerating global shift towards digital and cashless transactions presents a long-term threat to its core cash-in-transit and cash management services. For instance, in 2023, while digital payments saw substantial growth globally, cash still accounted for a notable percentage of transactions in many regions, highlighting the ongoing, albeit potentially diminishing, demand.

Brink's extensive global footprint exposes it to the unpredictable nature of macroeconomic shifts. For instance, in 2023, the company navigated significant foreign exchange headwinds, particularly in Latin America, which directly impacted its reported revenues and overall profitability. This sensitivity means that economic downturns or currency devaluation in key operating regions can create substantial challenges.

Beyond currency, broader economic instability, including fluctuating interest rates and rising inflation, poses a threat. These conditions can dampen client demand for Brink's core services, such as cash handling and security logistics, while simultaneously driving up operational expenses. The company must constantly adapt its strategies to mitigate the impact of these external economic forces.

Brink's carries a substantial amount of long-term debt, a factor that might concern some investors. As of the first quarter of 2024, the company reported total debt of approximately $1.5 billion. While current operational improvements have made this debt manageable, a high leverage ratio could potentially restrict financial agility for future strategic investments or acquisitions if not carefully overseen.

Brink's faces significant competition from major players like Loomis, GardaWorld, and G4S. This crowded market means Brink's must constantly innovate and find ways to stand out to keep its customers and market share. Intense rivalry can also lead to pressure on pricing, potentially impacting profit margins.

The competitive environment necessitates strategic differentiation to maintain market leadership. For instance, while Brink's reported strong revenue growth in recent periods, such as its first quarter of 2024, where revenue increased by 10% year-over-year to $1.1 billion, the ongoing competitive pressures require careful management of operational efficiencies and service offerings.

Brink's' core business, which involves the secure transportation and handling of high-value assets, exposes it to significant operational risks. These include the potential for theft, fraud, and sophisticated security breaches that could compromise the integrity of its services. For instance, in 2023, the global cash-in-transit market, a key segment for Brink's, continued to face challenges from organized crime, impacting operational efficiency and security budgets.

The continuous need to invest in and maintain cutting-edge security protocols and technologies to mitigate these inherent risks presents a substantial and ongoing cost. Failure to adequately manage these threats not only leads to financial losses but also poses a severe reputational risk, potentially eroding customer trust and market share. The company's commitment to security is paramount, but the financial burden of staying ahead of evolving threats is a constant challenge.

Brink's operates in a sector inherently vulnerable to criminal activity, requiring constant vigilance and robust internal controls to combat theft and fraud. Technological advancements by adversaries necessitate continuous investment in cybersecurity and physical security measures to prevent data or asset compromise. Maintaining a secure and reliable service involves significant expenditure on personnel, technology, and infrastructure, impacting profitability. Any security incident can severely damage Brink's reputation, leading to loss of business and increased scrutiny.

Same Document Delivered

Brink's SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis for Brink's, providing a clear overview of their strategic positioning. The full, detailed report will be yours immediately after purchase, offering comprehensive insights.

Opportunities

Brink's has a prime opportunity to grow its ATM Managed Services (AMS) and Digital Retail Solutions (DRS). These areas are already seeing strong organic growth and provide more profitable, ongoing revenue, letting Brink's use its skills and tech to offer complete packages to banks and retailers.

Emerging markets, where cash remains dominant despite digital growth, offer substantial opportunities for Brink's. The expanding financial inclusion initiatives and the increasing ATM network in these regions, projected to see continued growth through 2025, directly translate to a higher demand for secure cash handling and replenishment services.

The logistics and cash management sectors are rapidly evolving due to technological progress. Brink's has a significant opportunity to leverage AI in its operations, alongside real-time monitoring, GPS tracking, and advanced security features like smart locks and biometric authentication. These technologies can boost efficiency and security, paving the way for innovative service offerings.

For instance, the global AI in logistics market was valued at approximately $4.5 billion in 2023 and is projected to reach over $20 billion by 2030, indicating substantial growth potential. Brink's can integrate these advancements to offer enhanced value, such as predictive analytics for cash demand or optimized routing, further solidifying its market position.

Strategic Partnerships and Acquisitions

Brink's has a proven track record of leveraging strategic acquisitions and partnerships to broaden its market reach and improve its service portfolio. A key opportunity lies in continuing this strategy, particularly by forging alliances with digital payment providers. These collaborations can seamlessly embed Brink's services into the evolving digital payments landscape.

Further strengthening its competitive edge involves making targeted investments. For instance, Brink's investment in KAL ATM Software in 2023 demonstrates a move to enhance its technological capabilities and integration within the broader financial ecosystem. This focus on digital integration is crucial for staying ahead in the rapidly changing payments industry.

Opportunities for Brink's include:

- Expanding digital payment integrations: Partnering with fintech firms to offer more comprehensive digital payment solutions.

- Acquiring complementary technology: Investing in or acquiring companies that offer innovative software or hardware for cash management and payment processing.

- Strategic alliances in emerging markets: Forming partnerships to enter or expand presence in high-growth geographic regions.

Outsourcing Trends in Cash Management

The growing trend of businesses, retailers, and financial institutions outsourcing non-core functions like cash management is a significant opportunity for Brink's. By offloading these tasks to specialized logistics providers, companies aim to mitigate in-house risks and boost operational efficiency. This shift allows Brink's to leverage its extensive cash management services, encompassing collection, counting, sorting, vaulting, and reconciliation, to meet this expanding market demand.

The global cash management services market is projected to reach approximately $35.5 billion by 2027, growing at a compound annual growth rate of 7.2%, according to recent market analyses. This expansion is largely driven by the increasing need for secure and efficient handling of cash amidst rising transaction volumes and evolving regulatory landscapes. Brink's is well-positioned to capitalize on this growth by offering integrated solutions that reduce costs and enhance security for its clients.

- Market Growth: The outsourcing of cash management is a key driver in the expanding global market for these services.

- Efficiency Gains: Businesses are seeking to improve operational efficiency by entrusting cash handling to expert third-party providers.

- Risk Mitigation: Outsourcing reduces the inherent risks associated with managing cash internally, such as theft or errors.

- Brink's Advantage: Brink's comprehensive suite of cash management solutions offers a compelling value proposition to attract new clients in this growing segment.

Brink's has a significant opportunity to expand its ATM Managed Services (AMS) and Digital Retail Solutions (DRS) by offering integrated packages to banks and retailers, capitalizing on strong organic growth in these areas.

Emerging markets present a substantial growth avenue, with financial inclusion initiatives and expanding ATM networks driving demand for Brink's secure cash handling services through 2025.

The company can leverage advancements like AI and real-time monitoring in logistics and cash management, a sector projected for significant growth, with the global AI in logistics market expected to exceed $20 billion by 2030.

Strategic acquisitions and partnerships, such as its 2023 investment in KAL ATM Software, allow Brink's to enhance technological capabilities and integrate into the evolving digital payments ecosystem.

| Opportunity Area | Projected Growth/Value | Brink's Strategic Advantage |

|---|---|---|

| ATM Managed Services (AMS) & Digital Retail Solutions (DRS) | Strong organic growth | Leveraging existing skills and tech for complete packages |

| Emerging Markets Cash Handling | Continued ATM network expansion through 2025 | Meeting demand for secure cash services in financially inclusive regions |

| AI in Logistics & Cash Management | Global AI in logistics market to exceed $20B by 2030 | Boosting efficiency and security with advanced technologies |

| Digital Payment Integrations | Rapid evolution of the payments industry | Partnering with fintechs for comprehensive digital solutions |

Threats

The accelerating adoption of digital and cashless payment systems worldwide presents a substantial threat to Brink's core business. As more transactions move online or through mobile devices, the need for physical cash handling and armored transport services diminishes. For instance, in 2023, the global digital payments market was valued at over $9 trillion, with projections indicating continued strong growth, directly impacting the volume of physical cash in circulation.

The security and logistics sector is seeing rapid changes, with both existing players and newcomers introducing groundbreaking services. This dynamic environment means Brink faces the threat of established rivals and agile startups alike, all vying for market dominance.

Competitors employing aggressive pricing or leveraging advanced technology could significantly impact Brink's market position and financial performance. For instance, in 2024, the global logistics market saw increased investment in AI and automation, with companies like Amazon and FedEx heavily investing in these areas, potentially setting new benchmarks for efficiency and customer service that Brink must match.

Brink's faces increasing scrutiny from evolving regulatory landscapes, particularly in the financial and security sectors. These changes, such as updated data privacy laws or new anti-money laundering directives, can necessitate significant investments in compliance technology and personnel, directly impacting operational costs. For instance, the global push for enhanced financial transparency in 2024 and 2025 means companies like Brink's must continually adapt their systems to meet diverse international standards.

Failure to adhere to these increasingly stringent requirements poses substantial risks. Non-compliance can lead to hefty financial penalties, as seen in various industries where regulatory breaches have resulted in multi-million dollar fines. Furthermore, legal challenges, including potential investigations into anti-competitive practices, could not only drain financial resources but also inflict lasting reputational damage, affecting customer trust and market position.

Cybersecurity Risks and Data Breaches

As Brink's enhances its digital offerings and manages significant financial information, the risk of cyber threats and data breaches escalates. A major security incident could expose client data, halt business activities, result in substantial financial penalties, and erode trust in Brink's commitment to safeguarding sensitive information.

The increasing reliance on digital platforms means Brink's faces a heightened vulnerability to sophisticated cyberattacks. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report, highlighting the significant financial implications for companies.

- Increased attack surface: Digital integration expands potential entry points for malicious actors.

- Reputational damage: A breach can severely undermine customer confidence and brand image.

- Regulatory fines: Non-compliance with data protection laws, such as GDPR or CCPA, can lead to substantial penalties.

- Operational disruption: Cyberattacks can cripple essential business functions, impacting service delivery.

Economic Downturns and Geopolitical Instability

Global economic downturns and recessions pose a significant threat to Brink's operations. For instance, the International Monetary Fund (IMF) projected a global growth slowdown to 2.9% in 2024, down from 3.5% in 2023, indicating a weaker demand environment. This can directly reduce the volume of cash and valuables needing secure transport and management, impacting Brink's revenue streams.

Geopolitical instability further exacerbates these risks. Increased tensions and conflicts in various regions can disrupt international trade routes, leading to higher transportation costs and operational complexities for Brink. The ongoing geopolitical conflicts, such as the war in Ukraine and heightened tensions in the Middle East, have already demonstrated their capacity to impact global supply chains and economic sentiment, potentially dampening demand for logistics services.

- Reduced Demand: Economic slowdowns typically lead to decreased consumer spending and business investment, directly impacting the volume of cash and valuables Brink handles.

- Increased Operational Costs: Geopolitical instability can result in higher insurance premiums, fuel surcharges, and security expenses in affected regions.

- Supply Chain Disruptions: Conflicts and trade disputes can interrupt global logistics networks, affecting Brink's ability to move assets efficiently and reliably.

- Currency Fluctuations: Economic instability often brings volatile currency markets, which can impact the value of assets Brink transports and the profitability of international operations.

The ongoing shift towards digital and cashless transactions poses a significant threat to Brink's traditional cash handling services. As global digital payment volumes continue to surge, with the market projected to exceed $15 trillion by 2027, the demand for physical cash logistics is expected to decline, directly impacting Brink's revenue streams.

Intensifying competition from both established logistics providers and innovative fintech startups employing advanced technology and aggressive pricing strategies presents a formidable challenge. Companies leveraging AI and automation, as seen in the significant investments made by major players in 2024, are setting new operational efficiency benchmarks that Brink must strive to meet to remain competitive.

Brink's faces increasing regulatory burdens and compliance costs due to evolving global financial and security laws. Failure to adapt to new directives on data privacy and anti-money laundering, which saw significant updates in 2024 and 2025, could result in substantial fines and reputational damage.

The escalating risk of cyber threats and data breaches, amplified by Brink's digital transformation, could lead to severe financial penalties and a loss of customer trust. In 2023, the average cost of a data breach was $4.45 million, underscoring the critical need for robust cybersecurity measures.

| Threat Category | Specific Threat | Impact on Brink's | Supporting Data/Trend |

|---|---|---|---|

| Market Shift | Decline in physical cash usage | Reduced demand for armored transport and cash management services | Global digital payments market projected to exceed $15 trillion by 2027. |

| Competition | Technologically advanced competitors | Loss of market share due to superior efficiency and customer service | Significant investments in AI and automation by logistics giants in 2024. |

| Regulatory Environment | Evolving compliance requirements | Increased operational costs and risk of penalties for non-compliance | Global push for enhanced financial transparency in 2024-2025. |

| Cybersecurity | Data breaches and cyberattacks | Financial losses, reputational damage, and operational disruption | Average cost of a data breach in 2023 was $4.45 million. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide a robust and accurate strategic overview.