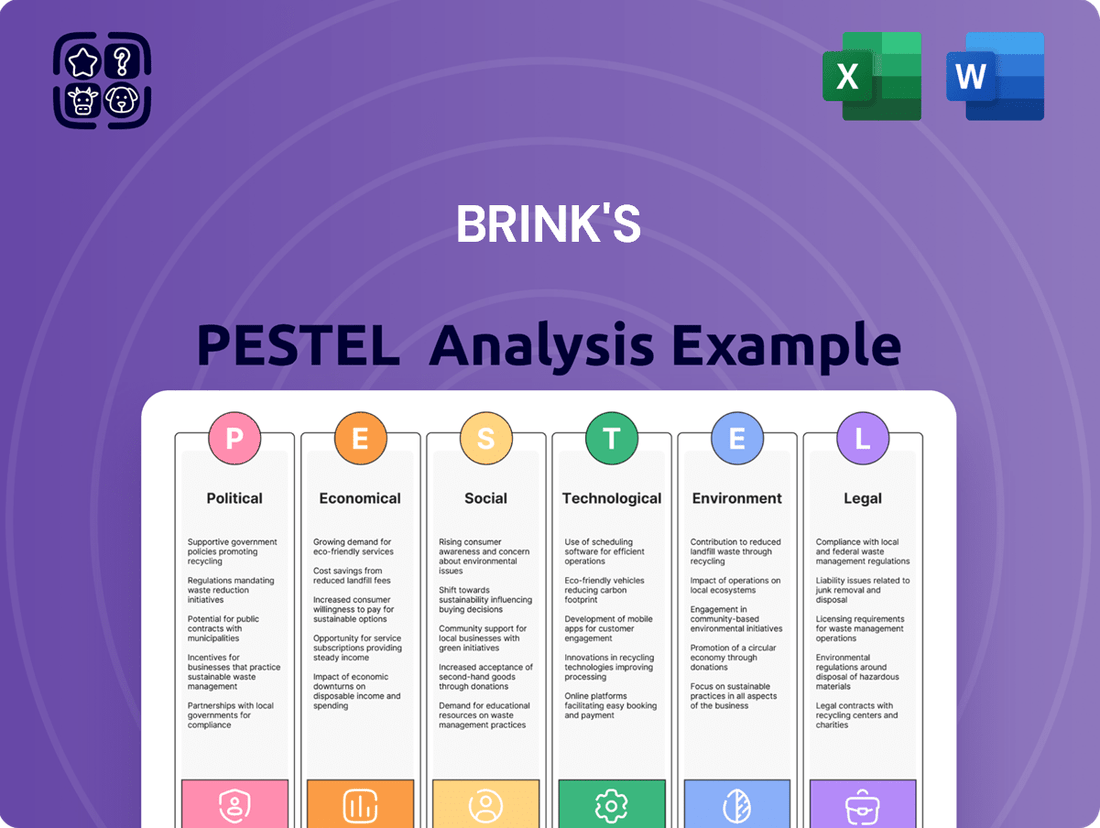

Brink's PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brink's Bundle

Navigate the complex external forces impacting Brink's with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and societal shifts are shaping the security and logistics landscape. Gain a competitive edge by leveraging these critical insights.

Our expertly crafted PESTLE analysis for Brink's provides a deep dive into technological advancements, environmental regulations, and legal frameworks that influence operations. Equip yourself with the knowledge to anticipate challenges and seize opportunities.

Don't get left behind – our PESTLE analysis offers actionable intelligence for strategic planning and investment decisions related to Brink's. Download the full version now to unlock a clearer understanding of the external environment and secure your future success.

Political factors

Brink's operates within a heavily regulated sector, facing evolving state and federal laws that directly influence security service providers. These mandates frequently introduce stricter requirements for background checks, standardized training for personnel, and robust data protection measures, all of which Brink's must adhere to.

For instance, in the United States, the Department of Homeland Security (DHS) and various state licensing boards continuously update operational guidelines and personnel vetting processes. Compliance with these regulations, such as those impacting the handling of sensitive client data or the deployment of advanced surveillance technologies, is paramount for maintaining operational integrity and avoiding penalties.

Global trade policies and the imposition of tariffs can directly impact Brink's operational costs, especially concerning technology and equipment sourced from international markets. For instance, a 25% tariff on steel, implemented in 2018, affected various industries, and similar measures on electronics could influence Brink's investment in new security systems or fleet upgrades.

While Brink's core business of secure transportation and logistics is relatively shielded from direct tariff impacts on its services, shifts in international trade relations can indirectly affect its operating environment. For example, increased trade friction between major economies might lead to broader economic slowdowns, impacting the volume of goods transported and thus demand for Brink's services.

In 2024, ongoing trade negotiations, particularly concerning supply chain resilience and national security considerations, could lead to adjustments in import/export regulations. Brink's will need to monitor these developments to ensure its technology procurement remains cost-effective and its supply chains are not disrupted by sudden policy changes.

Brink's global operations, spanning over 100 countries, are inherently susceptible to geopolitical instability and regional conflicts. These factors can directly impact the security and efficiency of their core services, such as secure logistics and cash management. For instance, heightened tensions in Eastern Europe in early 2024 led to increased insurance premiums for transporting high-value goods in affected zones, a direct cost implication for Brink's.

Political unrest in key markets can create significant operational challenges, potentially disrupting supply chains and increasing the risk to personnel and assets. The company's ability to maintain its extensive global footprint relies on its capacity to adapt to and mitigate these evolving political landscapes, ensuring continuity of service delivery despite localized disruptions.

Government Spending and Infrastructure Projects

Government spending on infrastructure, particularly in emerging economies, can indirectly benefit Brink's by increasing economic activity and the demand for secure logistics services. For instance, the US government allocated $1.2 trillion to infrastructure in the Infrastructure Investment and Jobs Act of 2021, with a significant portion dedicated to transportation networks. This increased economic flow means more goods and potentially more cash and valuables needing secure transit.

Conversely, austerity measures or reduced government spending could lead to a decrease in the overall volume of cash and valuables requiring secure transportation. If governments cut back on public works or economic stimulus, it can dampen business activity, leading to lower transaction volumes. This was seen in some European countries during post-2008 fiscal consolidation periods, which saw a slowdown in commercial activity.

- Increased Infrastructure Spending: The US Infrastructure Investment and Jobs Act of 2021, valued at $1.2 trillion, aims to boost economic activity, potentially increasing demand for Brink's services.

- Emerging Market Focus: Government investment in infrastructure in developing nations can spur economic growth, creating greater need for secure cash and valuables transportation.

- Austerity Impact: Reductions in government spending or fiscal tightening can slow economic momentum, potentially reducing the volume of transactions handled by logistics firms like Brink's.

- Global Economic Sensitivity: Brink's business is sensitive to the overall health of economies, which is heavily influenced by government fiscal policies and spending priorities.

Anti-Money Laundering (AML) and Financial Crime Regulations

Brink's, a major player in cash and valuables management, operates under a strict global framework of anti-money laundering (AML) and financial crime regulations. These rules are designed to prevent illicit funds from entering the financial system. Recent actions highlight the importance of robust compliance, as Brink's settled investigations concerning past cross-border currency shipments and adherence to federal money-transmitting laws, resulting in substantial financial penalties. For instance, in 2023, the company reported significant expenses related to legal and compliance matters, underscoring the financial impact of regulatory scrutiny.

The company's commitment to enhancing its compliance programs is crucial for managing ongoing risks and preserving its reputation with banks and governmental bodies. Failure to adapt to evolving AML requirements can lead to further fines, operational disruptions, and damage to stakeholder confidence. Staying ahead of these regulations is not just a legal necessity but a strategic imperative for sustained business operations.

- Regulatory Scrutiny: Brink's faces ongoing oversight from financial regulators worldwide.

- Historical Settlements: Past investigations into currency shipments and money-transmitting laws have led to significant financial costs.

- Compliance Investment: Strengthening AML and anti-financial crime programs is a priority to mitigate future risks.

- Maintaining Trust: Robust compliance is essential for continued partnerships with financial institutions and government agencies.

Political stability and government policies significantly shape Brink's operating environment, influencing everything from security regulations to economic growth. Geopolitical tensions in regions where Brink's operates can lead to increased insurance costs and operational disruptions, as seen with higher premiums in Eastern Europe during early 2024. Furthermore, government infrastructure spending, like the $1.2 trillion allocated in the US Infrastructure Investment and Jobs Act of 2021, can stimulate economic activity, indirectly boosting demand for secure logistics services.

What is included in the product

This PESTLE analysis of Brink's examines how political, economic, social, technological, environmental, and legal factors shape its operating landscape, identifying key external influences for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering clear insights into Brink's external environment to inform strategic decisions and alleviate concerns about market volatility.

Economic factors

Global economic growth is a key driver for Brink's, as a healthier economy typically means more transactions and a greater need for cash handling and secure transport services. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, indicating a stable environment for businesses that rely on physical currency and secure logistics.

Inflation also plays a crucial role. While moderate inflation can sometimes accompany economic expansion, persistently high inflation, as seen in many economies throughout 2023 and into 2024, can lead to shifts in payment preferences away from cash. This could potentially impact demand for certain Brink's services if consumers and businesses increasingly opt for digital transactions.

Conversely, a slowdown in global economic activity or a recession would likely dampen demand for Brink's core offerings. Reduced consumer spending and business investment directly translate to fewer cash transactions and a lower volume of goods needing secure transportation, thereby affecting Brink's revenue streams and operational efficiency.

Interest rates significantly impact Brink's financial health, particularly due to its existing debt obligations. As of early 2024, the Federal Reserve maintained a target range for the federal funds rate between 5.25% and 5.50%, a level that increases borrowing costs for companies like Brink's. This directly affects the expense of servicing its debt and influences the pricing of its services for clients who may also face higher financing costs.

Fluctuations in interest rates also shape Brink's strategic decisions regarding capital allocation. For instance, if rates rise, the hurdle rate for new investments, such as technology upgrades or international expansion, also increases, potentially slowing down growth initiatives. Conversely, a favorable interest rate environment can make it more cost-effective for Brink's to secure the capital needed for ambitious projects and potential acquisitions, thereby enhancing its competitive positioning.

While digital payments are rapidly expanding, cash continues to be a vital medium for billions globally, especially in developing nations. Brink's recognizes this duality, investing in digital retail solutions (DRS) and ATM managed services (AMS) that are increasingly contributing to its revenue. For example, in 2023, Brink's reported that its digital retail solutions segment saw significant growth, reflecting a strategic shift towards supporting both physical and digital currency transactions.

E-commerce Growth and Supply Chain Security

The e-commerce boom continues to reshape global logistics, with online sales projected to reach \$2.0 trillion in the US by 2026, according to Statista. This surge in digital transactions directly translates to a heightened demand for secure transportation and storage of a wider array of high-value goods, from electronics to luxury items.

Brink's is well-positioned to capitalize on this trend by leveraging its expertise in secure logistics. The company's established infrastructure and reputation for safeguarding assets can be extended to meet the evolving needs of e-commerce businesses seeking to protect their inventory throughout the supply chain.

- E-commerce Sales Growth: Global e-commerce sales are expected to exceed \$7.0 trillion by 2024, underscoring the increasing volume of goods requiring secure handling.

- Demand for Secure Logistics: The rise in high-value goods transported via e-commerce necessitates advanced security measures to mitigate risks like theft and damage.

- Brink's Opportunity: Expansion into securing e-commerce supply chains offers Brink's a significant growth avenue beyond traditional cash-in-transit services.

Outsourcing Trends in Cash Management

Businesses, especially banks and retailers, are increasingly handing over tasks like cash management to experts such as Brink's. This frees them up to concentrate on their main business, while still getting the benefits of secure cash handling and movement. This trend is a significant boost for the cash logistics industry.

The global cash-in-transit (CIT) market, a key segment of cash management outsourcing, was valued at approximately $20 billion in 2023 and is projected to grow. For instance, North America, a major market for Brink's, saw continued demand for CIT services in 2024 as businesses optimized operational costs.

This outsourcing allows companies to leverage specialized knowledge and technology for cash processing, storage, and transportation, leading to greater efficiency and reduced risk. The market for these services is expected to expand further as more organizations recognize the strategic advantages.

- Increased Focus on Core Competencies: Businesses can dedicate more resources to their primary revenue-generating activities by outsourcing cash management.

- Cost Efficiencies: Specialized providers often achieve economies of scale, leading to lower operational costs for clients compared to in-house management.

- Enhanced Security and Compliance: Outsourcing partners like Brink's offer advanced security measures and ensure adherence to evolving regulatory requirements in cash handling.

- Technological Advancements: Clients benefit from the latest technology in cash processing, tracking, and reporting without direct capital investment.

The economic landscape directly influences Brink's operational environment. Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports increased transaction volumes, a positive for Brink's. However, persistent inflation, a concern in 2023-2024, could shift payment preferences away from cash, potentially impacting demand for some services.

Interest rates are a key financial factor. The Federal Reserve's target range of 5.25%-5.50% in early 2024 increases Brink's borrowing costs. This affects debt servicing expenses and influences capital allocation decisions, potentially slowing growth initiatives if rates remain elevated.

The continued growth of e-commerce, with US sales projected to hit \$2.0 trillion by 2026, creates a demand for Brink's secure logistics expertise. Brink's can leverage its infrastructure to safeguard high-value goods within the e-commerce supply chain, expanding beyond traditional cash services.

The trend of businesses outsourcing cash management to specialists like Brink's is a significant driver. The global cash-in-transit market was valued at approximately \$20 billion in 2023, with North America showing continued demand in 2024 as companies optimize costs.

Preview Before You Purchase

Brink's PESTLE Analysis

The content and structure shown in this Brink's PESTLE Analysis preview is the same document you’ll download after payment.

You'll receive this fully detailed analysis, covering Political, Economic, Social, Technological, Legal, and Environmental factors affecting Brink's, exactly as presented here.

This preview accurately reflects the comprehensive PESTLE analysis you will obtain, ensuring you know precisely what you are purchasing.

Sociological factors

Brink's reputation as a trusted provider of security services is absolutely critical. Public perception of safety and security, especially when it comes to valuable assets, directly impacts how confident clients are and how much they want Brink's services. For instance, a strong track record of reliability and integrity is essential for maintaining the company's brand image in a sector where trust is everything.

Consumer payment preferences are rapidly evolving, with a notable surge in digital and cashless transactions across many developed nations. This trend presents a dynamic landscape for Brink's, requiring adaptation to maintain relevance and capture new market opportunities.

For instance, in 2024, a significant portion of retail transactions in countries like the UK and Sweden are expected to be cashless, impacting the demand for traditional cash handling services. Brink's strategic diversification into digital retail solutions and ATM managed services directly addresses this shift, aiming to mitigate potential declines in legacy services while capitalizing on emerging digital payment ecosystems.

Brink's success hinges on its ability to secure and maintain a skilled workforce for its critical security and transportation services. Demographic shifts, such as an aging workforce or a shrinking pool of qualified candidates, can directly affect operational capacity and the quality of service provided. For instance, in 2024, the U.S. Bureau of Labor Statistics projected continued demand for security guards, highlighting the competitive landscape for talent acquisition and retention.

Attracting and retaining experienced personnel is paramount, especially given the specialized nature of Brink's operations. Factors like competitive wages, benefits, and a safe working environment are crucial for employee satisfaction and loyalty. In 2025, companies across the logistics and security sectors are increasingly focusing on employee well-being and professional development to combat turnover, a trend Brink's must also navigate.

Furthermore, Brink's must remain compliant with evolving labor laws and ensure fair compensation practices. Changes in minimum wage regulations or employee benefit mandates can influence operating costs and the company's ability to offer attractive employment packages. Adherence to these regulations is not only a legal necessity but also a key component of maintaining a positive corporate reputation and a stable workforce.

Urbanization and Infrastructure Development

Global urbanization continues to reshape demand for secure logistics. As more people move to cities, new commercial hubs and retail spaces emerge, directly increasing the need for efficient cash management and secure transportation of valuables. For instance, by 2050, it's projected that 68% of the world's population will reside in urban areas, a significant jump from 56% in 2021, according to UN data.

This concentration of economic activity in urban centers fuels a greater requirement for specialized services. Brink's, as a provider of cash management and logistics, benefits from this trend as businesses in these growing areas need reliable ways to handle physical currency and secure assets. The expansion of e-commerce also plays a role, creating demand for secure last-mile delivery solutions even within densely populated urban environments.

- Urban Population Growth: The UN projects 68% global urbanization by 2050, up from 56% in 2021, creating concentrated demand centers.

- Emerging Commercial Centers: The rise of new business districts and retail infrastructure in growing cities directly correlates with increased needs for secure cash handling.

- E-commerce Impact: Urban density amplifies the demand for secure logistics and cash-in-transit services to support online retail fulfillment.

Security Concerns and Crime Rates

Rising security concerns among corporations and banks, particularly around cargo theft and financial crimes, directly fuel the demand for secure logistics services. Brink's is instrumental in helping clients navigate these risks, positioning its services as vital in areas experiencing higher crime rates.

For instance, the U.S. Department of Justice reported that in 2023, financial crimes, including fraud and cyber-enabled theft, continued to pose a significant threat to businesses, leading to substantial financial losses. This environment underscores the necessity of robust security measures that Brink's provides.

- Increased demand for secure transport: As financial institutions and retailers face growing threats of cargo theft and internal fraud, the need for specialized secure logistics solutions escalates.

- Brink's value proposition: The company's expertise in secure cash handling, armored transportation, and risk mitigation becomes paramount for businesses operating in high-risk environments.

- Impact of crime statistics: Elevated crime rates, such as the reported rise in certain types of property crime impacting commercial establishments in major metropolitan areas during 2024, directly correlate with increased client reliance on Brink's protective services.

Societal attitudes towards cash usage and the increasing reliance on digital payments significantly shape Brink's operational landscape. As more consumers opt for cashless transactions, the demand for traditional cash handling services may decline, necessitating strategic adjustments.

Public perception of safety and security is paramount for Brink's, as trust is a cornerstone of its business. Any negative sentiment regarding security breaches or mishandled assets could severely impact client confidence and market share.

The company's ability to attract and retain a skilled workforce is also a critical sociological factor, influenced by labor market dynamics and employee expectations regarding compensation and working conditions.

Brink's must also consider the impact of demographic shifts, such as an aging population or changing workforce participation rates, on its ability to staff essential security and logistics roles effectively.

Technological factors

Technological advancements are significantly reshaping secure logistics. Innovations such as real-time GPS tracking, advanced tamper-evident packaging, and sophisticated biometric authentication are bolstering the safety and efficiency of transporting high-value assets. RFID technology further streamlines inventory management and security protocols within secure warehousing facilities.

Brink's actively integrates these cutting-edge technologies to enhance its service portfolio and operational performance. For instance, their investment in advanced tracking systems allows for continuous monitoring, reducing transit risks. This commitment to technological adoption is crucial for maintaining a competitive edge in the secure logistics sector.

Brink's is heavily investing in Digital Retail Solutions (DRS) and ATM Managed Services (AMS), reflecting a strategic shift towards technology-enabled cash management. These services digitize cash handling, offering real-time data and improved security for businesses.

By reducing manual processes, Brink's aims to increase efficiency and lower operational costs for its clients. This focus on technology is crucial as the retail and financial sectors continue to embrace digital transformation, with many businesses seeking integrated solutions for cash and payment management.

Automation is reshaping cash management, with corporate payments and reconciliation seeing significant advancements. Brink's is actively integrating AI and IoT to enhance its operations, demonstrating a clear commitment to technological efficiency.

These technologies are instrumental for Brink's in optimizing delivery routes, pinpointing energy inefficiencies within warehouses, and streamlining the overall supply chain. This focus on automation directly translates to reduced reliance on manual labor, a decrease in operational errors, and ultimately, lower costs.

For instance, in 2024, companies adopting AI-powered treasury solutions reported an average reduction in manual reconciliation tasks by up to 40%. Brink's investment in these areas positions them to capitalize on these efficiency gains, improving their service delivery and cost structure in the competitive cash management landscape.

Cybersecurity and Data Protection

As Brink's continues to expand its digital service offerings and manage significant volumes of sensitive financial information, the importance of strong cybersecurity and data protection cannot be overstated. The company faces increasing pressure to comply with evolving global data privacy laws, such as GDPR and CCPA, which mandate strict handling of personal and financial data. Failure to do so can result in substantial fines and reputational damage.

Brink's must therefore prioritize ongoing investment in advanced cybersecurity technologies and protocols. This includes safeguarding against sophisticated cyber threats like ransomware and data breaches, ensuring the integrity and confidentiality of client data. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the significant financial implications of security failures.

Key technological considerations for Brink's in this area include:

- Implementing multi-factor authentication across all digital platforms to prevent unauthorized access.

- Regularly updating and patching software systems to address known vulnerabilities.

- Investing in employee training programs focused on cybersecurity best practices and threat awareness.

- Developing and testing comprehensive incident response plans to effectively manage potential breaches.

Blockchain Technology for Supply Chain Transparency

Blockchain technology is rapidly advancing within logistics, promising greater transparency and traceability across supply chains. This innovation could significantly enhance the security and verification of high-value asset movements, a key area for Brink's operations.

While Brink's current adoption isn't detailed, the potential for blockchain is substantial. For instance, a 2023 report indicated that the global blockchain in supply chain market was valued at approximately $1.1 billion and is projected to reach $10.5 billion by 2028, demonstrating significant growth and potential for secure transactions.

- Enhanced Security: Blockchain's distributed ledger technology makes tampering with records extremely difficult.

- Improved Traceability: Real-time tracking of goods from origin to destination becomes more reliable.

- Reduced Fraud: The immutable nature of blockchain transactions can help mitigate counterfeit goods and theft.

- Operational Efficiency: Streamlined processes and reduced paperwork can lead to cost savings.

Technological advancements are central to Brink's strategy, with significant investments in Digital Retail Solutions and ATM Managed Services driving efficiency and security in cash management. Automation, powered by AI and IoT, is streamlining operations, reducing manual tasks by up to 40% as seen in treasury solutions in 2024, and lowering costs.

Brink's must also prioritize robust cybersecurity, with the global average cost of a data breach reaching $4.45 million in 2023. Implementing multi-factor authentication, regular software updates, and employee training are key to protecting sensitive data against threats like ransomware.

The potential of blockchain technology in logistics, with the market valued at $1.1 billion in 2023 and projected to reach $10.5 billion by 2028, offers enhanced security and traceability for high-value asset movements.

Brink's integration of real-time tracking, tamper-evident packaging, and biometric authentication directly addresses the evolving needs of secure logistics, ensuring greater safety and efficiency in asset transportation.

Legal factors

Brink's navigates a complex regulatory landscape, requiring adherence to diverse international and local security laws. This involves securing licenses and certifications for its security workforce, alongside meeting stringent operational standards for armored transport and secure storage of high-value assets.

The company's global operations mean it must continuously adapt to evolving security mandates. For instance, new compliance measures introduced in the 2024-2025 period, such as updated data protection regulations impacting customer information handling, demand ongoing investment in training and technology to maintain adherence.

Brink's, operating in the critical sector of cash management, faces stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations across its global operations. Failure to adhere to these laws can result in substantial financial penalties and severe damage to its reputation. For instance, in 2023, financial institutions worldwide faced billions in AML fines, underscoring the high stakes involved.

The company has previously navigated investigations concerning past compliance lapses, emphasizing the continuous need for strong internal controls and meticulous reporting. This history reinforces the importance of proactive measures and ongoing vigilance in its compliance framework to prevent future issues and maintain stakeholder trust.

Brink's faces significant legal hurdles with data privacy. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the US impose strict rules on how companies handle personal and financial data. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

As Brink's increasingly relies on digital platforms for cash handling and logistics, safeguarding sensitive customer and transaction data is paramount. This necessitates robust cybersecurity protocols and transparent data governance frameworks to ensure adherence to these complex legal mandates and maintain customer trust in their financial operations.

Labor Laws and Employment Regulations

Brink's, a significant employer, navigates a complex web of labor laws and employment regulations. These include adherence to minimum wage requirements, which saw a federal increase to $7.25 per hour in 2009, though many states and cities now mandate higher rates, impacting Brink's direct labor costs. Working hour regulations, overtime pay, and provisions concerning unionization rights are also critical compliance areas that can influence operational efficiency and employee relations.

Shifts in these legal frameworks directly affect Brink's bottom line and human resource strategies. For instance, a mandated increase in the minimum wage or stricter overtime rules can elevate payroll expenses. Furthermore, changes in laws governing collective bargaining or employee benefits can necessitate adjustments to Brink's compensation and benefits packages, potentially altering its competitive standing in the labor market.

- Minimum Wage Compliance: Brink's must track and adhere to federal, state, and local minimum wage laws, which vary significantly and are subject to periodic increases.

- Working Hour Regulations: Adherence to laws concerning standard workweeks, overtime pay, and break times is crucial for avoiding penalties and maintaining employee morale.

- Unionization Rights: Brink's operations may be influenced by labor laws protecting employees' rights to organize and bargain collectively, impacting negotiation strategies and potential labor disputes.

- Workplace Safety Standards: Compliance with Occupational Safety and Health Administration (OSHA) regulations, including those specific to cash-in-transit operations, is paramount to employee well-being and avoiding fines.

Contractual Obligations and Client Liability

Brink's navigates a complex web of contractual obligations with its clientele, which includes major financial institutions and government bodies. These agreements are the bedrock of service delivery, meticulously outlining service parameters, stringent security measures, and crucially, the extent of liability should any loss or damage occur. For instance, in 2023, Brink's reported that a significant portion of its revenue was derived from long-term contracts with established clients, underscoring the importance of these legal frameworks.

Effectively managing these contractual duties is paramount for Brink's operational integrity and robust risk management strategy. The company's ability to adhere to and enforce these terms directly impacts client trust and financial stability. Failure to meet these obligations could lead to substantial financial penalties or reputational damage.

- Contractual Scope: Agreements detail specific services, such as cash-in-transit, vault services, and secure logistics, defining precise operational boundaries.

- Liability Clauses: Contracts clearly stipulate liability limits and responsibilities in the event of theft, damage, or operational failures.

- Client Diversity: Brink's serves a broad spectrum of clients, from major banks to government agencies, each with unique contractual requirements and regulatory oversight.

- Risk Mitigation: Proactive legal review and management of these contracts are essential for mitigating potential financial and operational risks.

Brink's must comply with stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations globally, facing significant penalties for non-compliance. The company also grapples with data privacy laws like GDPR and CCPA, with potential fines reaching up to 4% of global annual revenue for violations, necessitating robust data protection measures.

Environmental factors

The logistics sector, including Brink's armored transportation, is a major source of greenhouse gas emissions, facing growing pressure to decarbonize. For instance, the EU aims to cut emissions by 55% by 2030 compared to 1990 levels, directly impacting transportation operations.

Brink's must invest in cleaner fuels, such as electric or hydrogen-powered vehicles, and advanced route optimization technologies to meet these evolving environmental regulations and targets.

Brink's is increasingly expected to integrate sustainable logistics, a trend driven by growing environmental awareness. This involves adopting greener practices such as utilizing electric or alternative fuel vehicles and optimizing delivery routes with advanced AI to minimize emissions.

Energy-efficient warehousing and the use of eco-friendly packaging are also becoming crucial components of these sustainable supply chains. These initiatives are not only vital for reducing Brink's environmental footprint but also for aligning with customer preferences for environmentally responsible services.

For instance, the global green logistics market was valued at approximately $23.5 billion in 2023 and is projected to grow significantly, indicating a strong market push towards these practices. Companies investing in these areas, like Brink's, are better positioned to meet evolving regulatory requirements and consumer expectations.

Brink's can enhance its sustainability by focusing on waste reduction and recycling, especially for packaging and operational waste. This aligns with growing environmental consciousness and regulatory pressures. For instance, in 2023, the global waste management market was valued at over $1.1 trillion, indicating a significant economic driver for efficient waste handling.

Implementing biodegradable, recyclable, or reusable packaging options is a key strategy. This not only reduces landfill burden but can also lead to cost savings through reduced material consumption and disposal fees. The company can also optimize reverse logistics to facilitate the efficient return and recycling of materials, fostering a more circular economy.

Energy Consumption and Renewable Energy Adoption

Brink's warehousing and operational facilities are significant energy consumers. The company can enhance its environmental sustainability by increasing its adoption of renewable energy sources, such as solar power installations at its sites. Furthermore, implementing energy-efficient technologies, like upgrading to LED lighting across its global network, will play a crucial role in reducing its carbon footprint and operational expenses.

The push towards renewable energy is a growing trend in the logistics sector. For instance, many companies in 2024 and 2025 are setting ambitious targets for renewable energy procurement and onsite generation. Brink's investment in these areas not only addresses environmental concerns but also offers a pathway to cost savings through reduced energy bills and potential government incentives for green energy adoption.

- Energy Efficiency Investments: Brink's can detail specific investments in energy-efficient upgrades, such as smart HVAC systems and advanced insulation for its facilities, aiming for a measurable reduction in energy consumption per square foot.

- Renewable Energy Targets: The company could set clear, quantifiable targets for the percentage of its energy needs to be met by renewable sources by a specific date, such as 2030, aligning with global sustainability goals.

- Operational Cost Reduction: By reducing energy consumption through efficiency measures and renewable adoption, Brink's can expect to see a direct positive impact on its operational costs, potentially improving profit margins in the 2024-2025 fiscal periods.

- Supply Chain Sustainability: Embracing renewable energy and efficiency in its own operations also positions Brink's as a more sustainable partner for its clients, many of whom have their own environmental, social, and governance (ESG) mandates.

Climate Change Impact on Operations

Climate change poses significant operational risks for Brink's. Extreme weather events, like the increased frequency of hurricanes and severe storms observed in recent years, can directly impede transportation routes vital for cash-in-transit and secure logistics services. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that the 2023 Atlantic hurricane season was the fourth most active on record, with 20 named storms. This level of disruption directly impacts Brink's ability to maintain its delivery schedules and secure its operations.

To mitigate these impacts, Brink's must invest in building more resilient logistics networks. This includes developing robust contingency plans to reroute services during weather emergencies and potentially diversifying transportation methods. The company's financial performance can be significantly affected by delays and disruptions; therefore, proactive adaptation strategies are crucial for ensuring continuous service delivery and minimizing potential financial losses stemming from climate-related events.

Key considerations for Brink's include:

- Assessing vulnerability of key transit routes to extreme weather patterns.

- Developing and testing alternative transportation and security protocols.

- Investing in weather-resilient infrastructure and fleet upgrades.

- Enhancing real-time weather monitoring and communication systems for operational teams.

Environmental factors are increasingly shaping the logistics landscape, pushing companies like Brink's towards greater sustainability. Growing regulatory pressures, such as the EU's 2030 emissions reduction targets, necessitate investments in cleaner fleets and optimized routing. The global green logistics market, valued at approximately $23.5 billion in 2023, underscores a significant market shift towards eco-friendly practices, which Brink's must embrace to remain competitive and meet client ESG mandates.

PESTLE Analysis Data Sources

Our Brink's PESTLE Analysis draws from a comprehensive blend of official government publications, reputable financial news outlets, and authoritative industry reports. This ensures a robust understanding of political stability, economic trends, and market dynamics affecting Brink's operations globally.