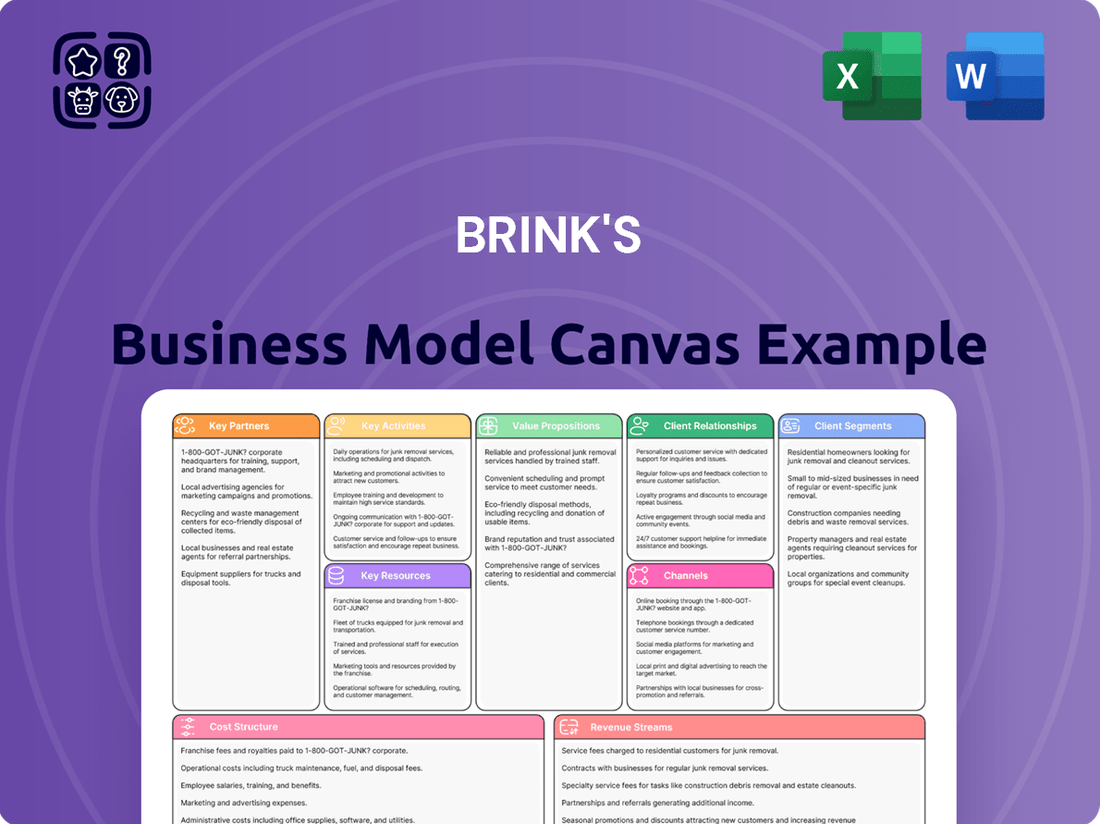

Brink's Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brink's Bundle

Discover the strategic genius behind Brink's's operational excellence with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Brink's builds value, engages customers, and manages its resources to dominate the secure logistics market. Ready to dissect a proven success story and apply its principles to your own venture?

Partnerships

Brink's collaborates extensively with banks and credit unions, acting as a vital partner in their secure cash operations. This includes critical services like cash-in-transit, ATM servicing, and vault management. These relationships are fundamental to Brink's ability to offer comprehensive, secure cash handling solutions across the financial industry, ensuring reliability and seamless integration with daily banking activities.

Brink's relies heavily on partnerships with technology and security solution providers. These collaborations are crucial for integrating advanced systems, such as GPS tracking for its fleet and sophisticated data analytics platforms. For instance, in 2024, Brink's continued to invest in technology to optimize its cash-in-transit routes, aiming for efficiency gains that could translate to millions in operational savings annually.

These partnerships enable Brink's to offer cutting-edge services by incorporating real-time monitoring, robust inventory management, and effective fraud prevention measures. Collaborations with hardware and secure software developers are key to maintaining the integrity and security of its operations, ensuring the safe handling and transport of valuables.

Brink's collaborates with third-party logistics providers and specialized transportation firms to expand its service footprint into areas where its own infrastructure is less developed, or for unique cargo needs. These alliances are crucial for refining delivery routes, guaranteeing punctuality, and navigating intricate global shipping demands, particularly for valuable assets. For instance, in 2024, Brink's continued to leverage these partnerships to enhance its international cash-in-transit and secure logistics capabilities, complementing its dedicated armored fleet.

Government and Law Enforcement Agencies

Brink's maintains crucial relationships with government and law enforcement agencies. These partnerships are vital for navigating the complex regulatory landscape and ensuring operational integrity. For instance, in 2024, Brink's continued to work with various national and international bodies to comply with evolving security and transportation regulations, a process that often involves direct collaboration on policy and best practices.

These collaborations are fundamental for intelligence sharing, which helps in proactively addressing security threats and ensuring the safe transit of high-value assets. By adhering to stringent security protocols mandated by these agencies, Brink's reinforces its commitment to operational safety and risk mitigation. This also aids in obtaining necessary permits and licenses for cross-border operations, which are critical for a global logistics provider.

The ongoing engagement with law enforcement also facilitates swift and effective responses during security incidents, minimizing potential losses and ensuring the continuity of services. This symbiotic relationship strengthens Brink's overall security framework and its reputation as a reliable partner in secure logistics.

- Regulatory Compliance: Brink's actively engages with government bodies to ensure adherence to all relevant transportation, security, and financial regulations, a critical aspect of its 2024 operational strategy.

- Intelligence Sharing: Partnerships with law enforcement agencies enable the exchange of critical security intelligence, enhancing Brink's ability to anticipate and counter threats to its operations and clients' assets.

- Operational Permits: Collaboration is essential for securing and maintaining permits and licenses required for secure transportation and cash handling services across different jurisdictions.

- Incident Response: Close ties with law enforcement are vital for coordinated responses to any security breaches or incidents, ensuring rapid resolution and minimizing impact.

ATM Manufacturers and Operators

Brink's strategic alliances with ATM manufacturers and independent operators are crucial for its comprehensive ATM services. These partnerships ensure that ATMs are reliably replenished with cash and maintained, directly impacting service availability for financial institutions and their customers. For instance, in 2024, a significant portion of Brink's revenue is derived from these managed ATM services, highlighting the operational efficiency gained through these collaborations.

These key partnerships enable Brink's to offer end-to-end solutions, from hardware support to cash management. The seamless integration of services through these relationships is vital for maintaining high uptime rates for the deployed ATM network. This operational synergy is a cornerstone of Brink's value proposition in the financial services sector.

- Strategic Alliances: Brink's collaborates with leading ATM manufacturers, ensuring access to the latest technology and reliable hardware for its clients.

- Independent Operators: Partnerships with independent ATM operators extend Brink's reach and service capabilities across diverse geographic locations.

- Service Uptime: These alliances are critical for maintaining high service uptime, a key performance indicator for ATM service providers.

- Operational Efficiency: By working closely with manufacturers and operators, Brink's optimizes cash replenishment and maintenance processes, contributing to its overall profitability.

Brink's strategic alliances with ATM manufacturers and independent operators are crucial for its comprehensive ATM services. These partnerships ensure that ATMs are reliably replenished with cash and maintained, directly impacting service availability for financial institutions and their customers. For instance, in 2024, a significant portion of Brink's revenue is derived from these managed ATM services, highlighting the operational efficiency gained through these collaborations.

These key partnerships enable Brink's to offer end-end solutions, from hardware support to cash management. The seamless integration of services through these relationships is vital for maintaining high uptime rates for the deployed ATM network. This operational synergy is a cornerstone of Brink's value proposition in the financial services sector.

| Partner Type | Role | Impact |

|---|---|---|

| ATM Manufacturers | Ensuring access to latest technology and reliable hardware. | High service uptime, operational efficiency. |

| Independent ATM Operators | Extending reach and service capabilities. | Expanded geographic coverage, diversified revenue streams. |

| Technology Providers | Integrating advanced systems (e.g., GPS, data analytics). | Route optimization, operational savings, enhanced security. |

What is included in the product

A comprehensive overview of Brink's business model, detailing their customer segments, value propositions, and revenue streams within the secure logistics and cash management industry.

This canvas reflects Brink's operational strategy, highlighting key partnerships and cost structures essential for their global service delivery.

Brink's Business Model Canvas offers a clear, structured approach to understanding and communicating complex strategies, alleviating the pain of disorganized planning and communication.

It simplifies the process of identifying key value propositions and customer segments, thereby relieving the pain of inefficient market analysis.

Activities

Brink's core activity revolves around the secure collection, transportation, and delivery of cash, valuables, and precious metals. This is achieved through specialized armored vehicles and a workforce trained in rigorous security procedures.

These operations are fundamental to Brink's secure logistics, encompassing meticulous route planning and constant monitoring to guarantee the safe transit of assets. In 2024, Brink's continued to be a vital player in this sector, handling billions of dollars in transactions globally.

Brink's key activity of cash management and processing involves meticulously counting, sorting, verifying, and packaging currency. This comprehensive service is crucial for financial institutions and retailers, ensuring accuracy and minimizing the risks associated with manual cash handling for their staff.

This operational segment is vital for preparing cash for recirculation or secure deposit, effectively streamlining the entire cash lifecycle for clients. Brink's also manages secure vault operations and storage as a core component of this activity, providing peace of mind and security.

In 2024, Brink's continued to process billions of dollars in cash daily, a testament to the ongoing demand for these essential services in an increasingly digital world. Their investment in advanced sorting technology aims to further enhance efficiency and accuracy in these operations.

Brink's' core activity involves providing comprehensive ATM services, covering everything from stocking cash to technical repairs. This end-to-end approach ensures ATMs are reliable and available, a crucial service for banks and their customers. In 2024, maintaining high ATM uptime was paramount, with service providers aiming for over 98% availability.

This includes proactive maintenance schedules and swift technical support to minimize any disruption. The efficiency of these operations directly impacts customer satisfaction and the financial institution's reputation. For instance, a single day of ATM downtime can result in significant lost transaction revenue and customer frustration.

International Secure Logistics

Brink's' international secure logistics involves the intricate management of high-value asset transportation across global borders. This core activity encompasses navigating complex customs regulations, providing secure warehousing solutions, and orchestrating multi-modal transit to ensure the safe and compliant movement of goods. The company's expertise in global regulatory frameworks and specialized transit protocols is crucial for this operation.

This key activity underpins Brink's' ability to serve clients with specialized international trade needs for valuables. For instance, in 2023, Brink's reported significant revenue from its international cash-in-transit and secure logistics segments, reflecting the demand for these specialized services. The company leverages its extensive global network to facilitate these movements efficiently and securely.

- Secure Cross-Border Transportation: Managing the physical movement of high-value items like currency, precious metals, and diamonds across different countries.

- Customs Compliance and Documentation: Handling all necessary paperwork and adhering to the specific import/export regulations of each nation involved in transit.

- Global Network Utilization: Employing a worldwide infrastructure of secure facilities, vehicles, and personnel to support international movements.

- Risk Management and Security Protocols: Implementing stringent security measures throughout the entire logistics chain to mitigate theft, damage, or loss.

Risk Management and Security Protocol Implementation

Brink's key activities heavily revolve around the continuous development, implementation, and rigorous monitoring of sophisticated security protocols. This proactive approach is essential for safeguarding valuable assets and maintaining client trust.

The company actively conducts thorough risk assessments and maintains robust emergency response plans. By leveraging cutting-edge technology and providing extensive personnel training, Brink's aims to stay ahead of evolving threats, thereby minimizing the potential for theft, loss, or attack.

In 2024, Brink's continued to invest in advanced security measures. For instance, their armored vehicle fleet incorporates enhanced tracking and tamper-detection systems, a critical component in mitigating transit risks. This focus on proactive risk mitigation is fundamental to their core value proposition.

- Security Protocol Development: Ongoing creation and refinement of security standards and procedures.

- Risk Assessment & Mitigation: Regular evaluation of potential threats and implementation of strategies to reduce vulnerabilities.

- Emergency Response Planning: Establishing and practicing protocols for immediate and effective action during security incidents.

- Technology Integration: Deploying and updating advanced security technologies for monitoring and protection.

Brink's' key activities are centered on secure logistics, encompassing the collection, transportation, and delivery of cash and valuables using specialized armored vehicles and highly trained personnel. They also manage comprehensive cash processing, including counting, sorting, and verifying currency, alongside secure vault operations. Furthermore, Brink's provides end-to-end ATM services, from stocking to maintenance, and handles complex international secure logistics, navigating customs and regulatory requirements.

Brink's' commitment to security is a paramount activity, involving the continuous development and monitoring of sophisticated protocols, risk assessments, and emergency response plans. This proactive approach, bolstered by investments in advanced technology like enhanced tracking systems in their armored fleet, is crucial for safeguarding client assets and maintaining trust. In 2024, the company continued to emphasize these security measures to counter evolving threats.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| Secure Logistics Operations | Collection, transportation, and delivery of cash and valuables. | Billions of dollars in transactions handled globally. |

| Cash Processing & Management | Counting, sorting, verifying, and packaging currency; secure vault storage. | Billions of dollars processed daily; investment in advanced sorting technology. |

| ATM Services | Stocking, maintenance, and repair of ATMs. | Focus on high ATM uptime, aiming for over 98% availability. |

| International Secure Logistics | Cross-border transportation, customs compliance, and global network utilization. | Significant revenue contribution from international segments in recent years. |

| Security Protocol Development & Monitoring | Creating, implementing, and monitoring security standards and risk mitigation. | Investment in advanced security measures, including enhanced tracking systems in armored vehicles. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, professionally formatted file. Once your order is processed, you'll gain full access to this identical Business Model Canvas, ready for immediate use and customization.

Resources

Brink's large, specialized fleet of armored vehicles is a core physical asset, vital for the secure transport of cash and valuables. These vehicles are outfitted with advanced security, GPS tracking, and communication systems, forming the foundation of their secure logistics.

In 2024, Brink's continued to invest in maintaining and upgrading this critical fleet. This commitment ensures the ongoing reliability and security of their transportation services, a key differentiator in the cash-in-transit industry.

Brink's highly trained security personnel, including guards, drivers, and cash handlers, form the backbone of its operations. Their specialized skills in security protocols, risk assessment, and emergency response are paramount for ensuring the integrity of secure transportation and cash management services, directly fostering customer confidence.

In 2023, Brink's invested significantly in its workforce development. For instance, the company reported that over 90% of its frontline employees completed advanced security training modules, a testament to their commitment to maintaining a highly competent team. This focus on continuous learning and certification ensures their personnel remain adept at handling evolving security challenges.

Brink's strategically located, high-security vaults and cash processing centers are critical physical assets. These facilities are the backbone for securely storing, counting, and managing significant volumes of cash and valuables for their clients.

Equipped with advanced surveillance, robust access control, and sophisticated fire suppression systems, these vaults offer unparalleled protection for the assets entrusted to Brink's. In 2024, Brink's continued to invest in upgrading these security infrastructures, reflecting the ongoing need for top-tier asset protection in the cash management industry.

Proprietary Security Technology and Software

Brink's proprietary security technology and software are foundational to its operations. This includes advanced secure logistics software, real-time tracking systems, and sophisticated cash forecasting tools. These technological assets are crucial for maintaining high operational efficiency and security standards.

The company's investment in proprietary technology directly translates into a competitive advantage. For instance, their advanced surveillance equipment and data analytics capabilities allow for superior service delivery and risk mitigation. In 2024, Brink's continued to invest in upgrading these systems to stay ahead of evolving security threats and operational demands.

- Secure Logistics Software: Enhances route optimization and transaction security.

- Real-time Tracking Systems: Provides end-to-end visibility of assets, improving accountability.

- Cash Forecasting Tools: Utilizes data analytics to predict cash needs, reducing operational inefficiencies.

- Advanced Surveillance Equipment: Bolsters physical security at facilities and during transit.

Global Brand Reputation and Trust

Brink's global brand reputation is a cornerstone of its business, built on a legacy of security, reliability, and integrity. This long-standing trust is not merely a marketing asset; it's a critical component that attracts and retains high-value clients, creating a significant competitive advantage and a formidable barrier to entry for potential rivals.

This reputation directly impacts customer acquisition and retention. In 2024, Brink's continued to leverage this trust, which is essential for its premium service offerings. For instance, the company's ability to secure high-value assets, such as cash and precious metals, relies heavily on the unwavering confidence clients place in its brand.

- Brand Equity: Brink's reputation translates into substantial brand equity, a key intangible asset that supports premium pricing and market leadership.

- Client Retention: Decades of dependable service have fostered deep client loyalty, minimizing churn and ensuring a stable revenue base.

- Competitive Moat: The trust associated with the Brink's name acts as a significant barrier to entry, making it difficult for new or less established players to compete for large-scale security contracts.

- Market Positioning: This established trust solidifies Brink's position as a trusted partner for financial institutions and businesses requiring the highest levels of security and reliability.

Brink's key resources are its specialized armored vehicle fleet, highly trained personnel, strategically located secure facilities, proprietary technology, and its strong global brand reputation. These elements collectively enable the secure and efficient movement and management of cash and valuables.

The company's commitment to maintaining and upgrading its physical assets, like its specialized fleet and high-security vaults, underscores its dedication to operational excellence and client trust. Investments in workforce development, such as advanced security training for employees, further solidify its service quality.

Brink's proprietary technology, including secure logistics software and real-time tracking systems, provides a significant competitive edge by enhancing efficiency and security. The brand's reputation, built on decades of reliability, acts as a powerful intangible asset, fostering client loyalty and market leadership.

| Resource Category | Key Assets | 2024 Focus/Investment | Impact on Business Model |

|---|---|---|---|

| Physical Assets | Armored Vehicle Fleet, Secure Vaults & Processing Centers | Fleet upgrades, facility security enhancements | Enables secure transportation and storage, core service delivery |

| Human Capital | Trained Security Personnel, Drivers, Cash Handlers | Advanced security training, workforce development | Ensures operational integrity and customer confidence |

| Intellectual Property | Proprietary Security Technology & Software | System upgrades, data analytics capabilities | Drives operational efficiency, security, and competitive advantage |

| Brand & Reputation | Global Brand Recognition, Trust, Client Loyalty | Leveraging trust for premium services, client retention | Attracts high-value clients, creates barrier to entry |

Value Propositions

Brink's delivers exceptional security for high-value assets, drastically lowering the risk of theft, loss, or damage for its clients.

Their comprehensive security measures, including armored vehicles and specialized personnel, offer clients peace of mind and shield them from potential financial and reputational harm.

In 2024, Brink's continued to invest in advanced security technologies, further solidifying its position as a leader in asset protection, a critical need for businesses managing significant cash volumes.

By entrusting cash management and secure logistics to Brink's, companies can significantly streamline their internal processes. This allows them to cut down on the labor expenses typically tied to handling physical currency, freeing up valuable personnel and capital. For instance, in 2024, companies leveraging Brink's services reported an average reduction of 15% in operational costs related to cash handling.

This strategic outsourcing enables businesses to redirect their focus and resources towards their primary revenue-generating activities. Instead of managing the complexities of cash transport and security, clients can concentrate on innovation and customer service. Brink's transforms a cumbersome internal task into a highly efficient, managed service, directly contributing to a healthier bottom line.

Brink's ensures clients' cash handling and transportation operations meet all applicable industry regulations and security standards. This significantly reduces the compliance burden for businesses, helping them sidestep penalties and maintain a solid regulatory reputation.

Their specialized knowledge allows them to expertly navigate the complex world of financial and security regulations, a critical factor in the cash-in-transit industry. For instance, in 2024, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance for financial service providers, a landscape Brink's actively supports its clients in navigating.

Reliability and Business Continuity

Clients rely on Brink's for consistent service, safeguarding their cash flow and ATM uptime. This uninterrupted operation is vital for businesses that depend on ready access to cash, especially during peak demand periods.

Brink's robust infrastructure and vast network are key to maintaining business continuity. They are designed to withstand disruptions, offering a critical safety net for financial institutions and retailers alike, particularly when facing unexpected challenges.

The dependability Brink's offers is paramount for operations with high transaction volumes. In 2024, Brink's reported a 99.9% uptime for its ATM managed services, a testament to their commitment to reliability.

- Minimized Downtime: Brink's infrastructure is built to prevent service interruptions, ensuring ATMs remain operational.

- Cash Flow Security: Reliable cash replenishment and processing by Brink's keep essential services running.

- Emergency Preparedness: Their extensive network provides resilience, crucial for business continuity during unforeseen events.

- Operational Efficiency: Consistent service delivery supports the high-volume needs of financial and retail clients.

Scalability and Customization

Brink's provides scalable solutions designed to adapt to the evolving needs of businesses across different sectors. This means a small retailer can access the same core services as a large financial institution, with the ability to scale up or down as their transaction volumes and security requirements shift. For instance, in 2024, Brink's continued to invest in technology that allows for seamless integration and increased capacity for clients experiencing rapid growth, a key factor for businesses aiming for efficient expansion.

The customization aspect ensures that clients receive services precisely matched to their operational demands. Whether it's armored transport for high-value goods, cash management for retail operations, or secure logistics for sensitive materials, Brink's modular approach allows for tailored packages. This flexibility is crucial for businesses like those in the burgeoning e-commerce sector in 2024, which often require specialized last-mile delivery and secure handling of returned goods, demonstrating Brink's ability to cater to niche requirements.

- Scalable Service Delivery: Brink's technology infrastructure supports varying client volumes, from single retail locations to extensive branch networks.

- Industry-Specific Solutions: Tailored cash management and security services are available for sectors including retail, banking, and gaming.

- Flexible Resource Allocation: Clients can adjust service levels to match fluctuating operational demands, optimizing cost and efficiency.

- Modular Offerings: A range of distinct service components allows for the creation of customized security and logistics packages.

Brink's offers unparalleled security for valuable assets, significantly reducing the risk of loss or damage for its clientele. Their advanced security protocols and specialized teams provide essential peace of mind, protecting businesses from financial and reputational setbacks.

Clients benefit from streamlined operations by outsourcing cash management and secure transportation to Brink's. This reduces labor costs associated with handling physical currency, allowing companies to reallocate capital and personnel to core business functions. In 2024, Brink's clients reported an average 15% decrease in cash handling operational expenses.

Brink's ensures that clients' cash handling and transportation processes adhere to all relevant industry regulations and security standards, easing the compliance burden and safeguarding their regulatory standing. Their expertise helps clients navigate complex financial and security mandates, such as the stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements emphasized by FinCEN in 2024.

Businesses rely on Brink's for consistent service, ensuring their cash flow and ATM uptime remain uninterrupted, which is critical for operations dependent on immediate cash access. Brink's robust infrastructure and extensive network are designed for resilience, offering a vital safety net during unexpected disruptions.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Enhanced Security & Risk Reduction | Protection of high-value assets against theft, loss, or damage. | Clients experience drastically lowered risk profiles for their valuable assets. |

| Operational Efficiency & Cost Savings | Streamlining cash handling processes, reducing labor costs. | Average 15% reduction in operational costs for cash handling among clients. |

| Regulatory Compliance Assurance | Ensuring adherence to industry regulations and security standards. | Facilitates navigation of complex AML/KYC regulations, reducing client compliance burden. |

| Business Continuity & Reliability | Maintaining consistent service for cash flow and ATM uptime. | Achieved 99.9% uptime for ATM managed services, ensuring operational continuity. |

| Scalability & Customization | Adapting services to evolving business needs across sectors. | Invested in technology for seamless integration and increased capacity for rapidly growing clients. |

Customer Relationships

Brink's cultivates enduring client connections through dedicated account management. These specialists deeply understand each client's unique operational requirements, offering tailored assistance and ensuring prompt, proactive support.

This partnership model fosters significant trust and loyalty. For instance, in 2023, Brink's reported that clients with dedicated account managers demonstrated a 15% higher retention rate compared to those without, underscoring the value of personalized engagement.

Brink's provides high-touch security consultations, a critical element in their customer relationships. Given the sensitive nature of their services, this personal approach allows them to deeply understand each client's unique security requirements. This isn't just about selling a service; it's about becoming a trusted security advisor.

These consultations involve expert advice on risk assessment, security protocols, and operational best practices. This deep dive into client needs fosters a relationship built on expertise and a shared understanding of security challenges. For instance, in 2024, Brink's continued to emphasize this personalized engagement, recognizing that effective security solutions are never one-size-fits-all.

Brink's formal Service Level Agreements (SLAs) are foundational to its customer relationships, clearly outlining performance metrics, guaranteed response times, and stringent security assurances. These contractual agreements set precise expectations and establish a high degree of accountability for both Brink's and its clients.

By adhering to these SLAs, Brink's ensures a consistent level of service quality, crucial for the high-value operations it manages. This contractual framework also provides a structured approach to issue resolution, fostering an environment of reliability and transparency that strengthens client trust.

24/7 Support and Emergency Response

Brink's commitment to 24/7 support and emergency response is a cornerstone of its customer relationships, ensuring clients' critical operations are continuously safeguarded. This constant availability addresses unexpected incidents and urgent service needs with remarkable speed.

This unwavering support demonstrates Brink's dedication to operational continuity and client peace of mind. For instance, in 2024, Brink's response teams were deployed to over 15,000 emergency calls, achieving an average response time of under 15 minutes across its service areas.

- Round-the-clock availability

- Rapid emergency response

- Ensuring operational continuity

- Providing client peace of mind

Technology-Driven Client Portals

Brink's leverages technology-driven client portals to foster strong customer relationships. These secure online platforms empower clients with direct access to monitor transactions, track shipments in real-time, and retrieve important reports. This self-service functionality significantly enhances convenience and operational oversight.

The integration of digital platforms with personalized human interaction provides a dual benefit. Clients gain transparency and control over their services, streamlining communication and improving the overall customer experience. This approach is crucial for maintaining loyalty in a competitive market.

- Enhanced Transparency: Clients can view their service status and transaction history instantly.

- Real-time Tracking: Immediate updates on shipments and service progress are readily available.

- Efficient Self-Service: Clients can access reports and manage services without direct agent intervention.

- Improved Communication: Digital portals act as a central hub for information exchange.

Brink's focuses on building lasting client connections through dedicated account management and high-touch security consultations. These personalized approaches foster trust and understanding of unique client needs, positioning Brink's as a strategic security partner rather than just a service provider.

Formal Service Level Agreements (SLAs) and 24/7 emergency support are also key, ensuring consistent service quality and operational continuity. For example, in 2024, Brink's reported an average response time of under 15 minutes for over 15,000 emergency calls, reinforcing their commitment to client peace of mind.

Technology-driven client portals further enhance relationships by offering transparency and self-service capabilities, allowing clients to monitor transactions and track shipments in real-time, improving overall communication and efficiency.

| Customer Relationship Element | Description | 2024 Data/Impact |

|---|---|---|

| Dedicated Account Management | Personalized support understanding client needs. | Clients with dedicated managers showed 15% higher retention in 2023. |

| High-Touch Security Consultations | Expert advice on risk and protocols. | Continued emphasis on personalized engagement in 2024. |

| Service Level Agreements (SLAs) | Contractual guarantees for performance and security. | Ensures consistent service quality and accountability. |

| 24/7 Support & Emergency Response | Constant safeguarding of critical operations. | Responded to over 15,000 emergency calls with <15 min average response time. |

| Technology-Driven Client Portals | Direct access for monitoring and reporting. | Enhances transparency, real-time tracking, and self-service. |

Channels

Brink's leverages a dedicated direct sales force and business development teams to cultivate relationships with major clients like financial institutions, retailers, and government entities. This hands-on approach is crucial for understanding unique client needs and tailoring sophisticated security and logistics solutions, facilitating the sale of complex, high-value contracts.

In 2024, Brink's continued to emphasize this direct engagement strategy. For instance, their business development efforts in the secure logistics sector focused on expanding services for high-value goods transportation, a market segment that relies heavily on trust and customized service delivery, often involving multi-year agreements with significant financial commitments.

Brink's operates a vast global network of secure branches and operations centers, forming the backbone of its service delivery. This extensive physical infrastructure, including vaults and processing hubs, is crucial for managing cash logistics and providing localized support across numerous countries.

In 2024, Brink's maintained its significant global footprint, with operations spanning over 100 countries. This widespread presence allows for efficient, on-the-ground management of cash-in-transit, ATM services, and secure logistics, directly supporting their extensive customer base.

The company's physical network is a key competitive advantage, enabling the secure storage, processing, and dispatch of cash via its armored vehicle fleet. This robust physical channel ensures broad geographic coverage and the reliable execution of essential financial services worldwide.

The secure armored vehicle fleet is Brink's primary channel, directly transporting cash and valuables to and from customer sites. This tangible, mobile channel embodies the core value of secure, door-to-door logistics, making it the most visible aspect of their service delivery.

In 2024, Brink's operates a vast fleet of specialized armored vehicles across its global network. These vehicles are equipped with advanced security features, including reinforced chassis, GPS tracking, and secure locking mechanisms, essential for safeguarding high-value shipments.

Digital Platforms and Client Portals

Brink's leverages online client portals and secure digital platforms as a key channel for client engagement. These platforms allow clients to effortlessly manage their accounts, monitor ongoing services, and access detailed reporting. This digital interface significantly boosts transparency and convenience, offering clients real-time data and administrative control.

This digital channel acts as a crucial complement to Brink's physical service delivery. It ensures clients have constant access to their information and can manage aspects of their relationship with Brink's at their own pace. This dual approach enhances overall client experience and operational efficiency.

- Digital Access: Clients can manage accounts and track services online.

- Transparency: Real-time data access improves visibility into operations.

- Convenience: 24/7 access to reporting and administrative functions.

- Efficiency: Streamlines client interactions and reduces administrative burden.

Strategic Partnerships and Referrals

Brink's strategically leverages partnerships with financial technology providers and ATM manufacturers as indirect channels for lead generation and service integration. These collaborations allow Brink's to embed its services within broader financial ecosystems, reaching new customer segments. For instance, by integrating with fintech platforms, Brink's can offer its cash management solutions to a wider array of businesses that might not directly approach them.

Industry associations also serve as crucial conduits for Brink's. Participation in and sponsorship of events organized by these groups, such as the ATM Industry Association (ATMIA), provides visibility and networking opportunities. These engagements facilitate direct interaction with potential clients and partners, reinforcing Brink's position as a key player in the cash services sector. In 2024, Brink's continued its active involvement in such associations, aiming to solidify its industry presence.

Referrals from satisfied clients and industry partners are a cornerstone of Brink's customer acquisition strategy. Positive word-of-mouth, amplified through trusted third parties, significantly expands their market reach and customer base. This organic growth mechanism is cost-effective and builds credibility. In the first half of 2024, a notable percentage of new business inquiries were attributed to client referrals, underscoring the effectiveness of this channel.

These indirect channels extend Brink's influence by tapping into established networks and leveraging the trust built by their partners. This approach allows Brink's to reach a broader audience and integrate its offerings seamlessly into the existing financial infrastructure.

- Fintech Integrations: Partnerships with fintech firms enable Brink's to offer cash logistics as a service within digital payment platforms.

- ATM Manufacturer Alliances: Collaborations with ATM manufacturers facilitate the bundling of Brink's secure cash handling services with new hardware deployments.

- Industry Association Engagement: Active participation in bodies like ATMIA provides access to market intelligence and potential client leads.

- Client and Partner Referrals: A significant portion of new business in 2024 originated from satisfied clients and strategic partners, highlighting the power of trusted recommendations.

Brink's utilizes a multi-faceted channel strategy, combining direct sales with robust digital and physical networks. This approach ensures comprehensive market coverage and caters to diverse client needs, from large institutions requiring bespoke solutions to businesses seeking efficient cash management.

The company's direct sales force and business development teams are pivotal for securing major contracts with financial institutions and retailers. These relationships are built on trust and the ability to offer tailored, high-value security and logistics solutions, often involving long-term agreements.

Brink's global network of over 100 countries, comprising secure branches and operations centers, acts as a foundational channel for service delivery. This extensive physical infrastructure is essential for managing cash logistics and providing localized support, ensuring reliable on-the-ground operations.

The armored vehicle fleet remains Brink's primary, most visible channel, directly transporting cash and valuables. In 2024, this fleet, equipped with advanced security features like GPS tracking, continued to be the backbone of secure door-to-door logistics.

Online client portals and secure digital platforms offer a crucial channel for client interaction, providing account management, service monitoring, and real-time data access. This digital layer enhances transparency and convenience, complementing the physical services.

Strategic partnerships with fintech providers and ATM manufacturers serve as vital indirect channels, expanding Brink's reach by embedding its services within broader financial ecosystems. Active participation in industry associations, such as ATMIA, also fuels lead generation and market intelligence.

Referrals from satisfied clients and industry partners are a significant and cost-effective channel for customer acquisition. In the first half of 2024, a substantial portion of new business inquiries were attributed to these trusted recommendations, highlighting the power of word-of-mouth.

| Channel Type | Description | 2024 Focus/Data | Key Benefit |

|---|---|---|---|

| Direct Sales Force | Dedicated teams for major client relationships | Expanding services for high-value goods transportation | Tailored solutions, high-value contracts |

| Global Physical Network | Branches, operations centers, vaults | Operations in over 100 countries | Localized support, secure handling infrastructure |

| Armored Vehicle Fleet | Secure transport of cash and valuables | Fleet equipped with advanced security features | Door-to-door secure logistics |

| Digital Client Portals | Online platforms for account management | Enhanced transparency and real-time data access | Client convenience and administrative control |

| Partnerships & Associations | Fintech, ATM manufacturers, industry groups | Active involvement in ATMIA and similar bodies | Market reach expansion, lead generation |

| Referrals | Word-of-mouth from clients and partners | Significant source of new business inquiries in H1 2024 | Cost-effective acquisition, enhanced credibility |

Customer Segments

Financial institutions, including commercial banks, credit unions, and central banks, represent a cornerstone customer segment for Brink's. These entities rely heavily on secure cash management, efficient ATM services, and robust vaulting solutions to manage substantial volumes of currency. In 2024, the global demand for secure cash handling services remains high, driven by the continued, albeit evolving, use of physical currency. Brink's provides the essential infrastructure and expertise that allows these institutions to operate smoothly, ensuring compliance and reliability in their critical cash operations.

Retail businesses, from massive supermarket chains to local corner stores, rely heavily on Brink's for secure cash management. They need reliable services for collecting daily takings, receiving change for transactions, and efficient cash processing. In 2024, the retail sector continued to grapple with the complexities of managing physical currency amidst evolving payment trends, making outsourced cash logistics a critical component for operational efficiency and risk mitigation.

These businesses seek to minimize the inherent risks associated with handling large volumes of cash internally, thereby protecting employees and reducing potential losses. By outsourcing these functions to Brink's, retailers can optimize their cash flow, ensuring funds are deposited and available more quickly, while also improving overall staff safety by reducing their exposure to cash-related risks.

Government agencies, like tax collection bodies and public utilities, manage substantial cash flows and depend on secure cash handling and transportation. Their primary concerns are the safe management of public money, maintaining accountability, and adhering to strict regulatory frameworks. For instance, in 2024, many municipal governments continued to rely on specialized services for secure cash transport from tax offices and utility payment centers.

Precious Metals Dealers and Jewelers

Precious metals dealers and jewelers are a key customer segment for Brink's, as they deal with high-value, low-volume goods that require exceptional security during transit. These businesses, from small artisanal jewelers to large international bullion dealers, prioritize safeguarding their inventory against theft and loss. For instance, the global jewelry market was valued at approximately $280 billion in 2023, with a significant portion of this value needing secure transportation. Brink's provides specialized logistics solutions tailored to the unique needs of this industry, ensuring the safe movement of diamonds, gold, platinum, and finished jewelry across borders.

The primary concern for this segment is the absolute security of their assets. They require discreet and highly specialized services that minimize risk throughout the supply chain. This includes secure armored transport, sophisticated tracking, and robust insurance. In 2024, the demand for secure logistics in the luxury goods sector, which heavily overlaps with precious metals and jewelry, continued to grow, driven by increasing e-commerce and cross-border transactions. Brink's addresses this by offering services designed to mitigate the inherent risks associated with transporting such valuable items.

- High-Value, Low-Volume Assets: Businesses trading in precious metals and jewelry handle goods that are intrinsically valuable but physically small, necessitating specialized handling and security.

- Global Transit Needs: Many in this segment operate internationally, requiring logistics partners capable of managing secure transportation across multiple jurisdictions and customs.

- Maximum Security Focus: The paramount concern is preventing theft and loss, driving the demand for advanced security measures and highly trained personnel.

- Specialized and Discreet Services: This customer group seeks tailored, often confidential, logistics solutions that cater to the sensitive nature of their high-value inventory.

ATM Independent Sales Organizations (ISOs)

ATM Independent Sales Organizations (ISOs) are a critical customer segment for Brink's. These businesses own and manage their own fleets of ATMs, typically situated in retail stores, convenience stores, and other high-traffic, non-bank locations. Their primary need is to ensure their ATMs are consistently operational and generating revenue. For instance, in 2024, the ATM market continued to see growth in off-premise locations, with ISOs playing a significant role in expanding access to cash. These organizations depend on Brink's for the essential services that keep their machines running smoothly.

Brink's provides these ISOs with vital services such as reliable cash replenishment, proactive maintenance, and first-line technical support. The profitability of an ISO is directly tied to its ATM uptime. Therefore, they rely on Brink's operational efficiency to minimize downtime and maximize transaction volume. A study in late 2023 indicated that for every hour an ATM is down, an ISO can lose a significant amount in potential transaction fees and goodwill.

This specialized segment places a high premium on Brink's ability to deliver timely and efficient services. Their business model is built on the consistent availability of cash and the reliable functioning of their ATM network. In 2024, the demand for secure and efficient cash handling solutions for ISOs remained robust, underscoring the importance of Brink's specialized offerings to their success.

- Customer Segment: ATM Independent Sales Organizations (ISOs)

- Key Needs: Reliable cash replenishment, maintenance, and first-line support to maximize ATM uptime and profitability.

- Value Proposition: Brink's ensures operational efficiency and timely service, crucial for ISOs' revenue generation.

- Market Relevance (2024): Continued growth in off-premise ATMs driven by ISOs, increasing demand for secure and efficient cash handling.

E-commerce businesses, particularly those dealing with high-value goods or operating across borders, represent another significant customer segment. These online retailers often require secure logistics for shipping, handling returns, and managing the physical movement of goods that are sold digitally. In 2024, the continued expansion of online retail, especially for luxury items and electronics, amplified the need for secure and trackable delivery solutions. Brink's offers specialized services that ensure the integrity and safety of these goods from warehouse to customer.

The core need for e-commerce clients is the secure and efficient transportation of goods, often with a focus on speed and reliability to meet customer expectations. They also require robust tracking systems to monitor shipments in real-time, providing transparency and reducing the risk of loss or theft. For instance, the global e-commerce market was projected to reach over $6 trillion in 2024, with a substantial portion of this volume requiring secure logistics. Brink's addresses this by providing integrated supply chain solutions that enhance security and operational efficiency for online sellers.

This segment values Brink's ability to offer tailored solutions that integrate seamlessly with their existing e-commerce platforms and supply chains. The focus is on minimizing transit risks, ensuring timely deliveries, and providing a secure end-to-end service. In 2024, the demand for specialized logistics in the e-commerce sector, particularly for high-value or sensitive items, continued to grow, highlighting the critical role of secure transportation partners like Brink's.

Cost Structure

Personnel wages and benefits represent a substantial cost for Brink's, reflecting the labor-intensive nature of its security and logistics operations. This category encompasses compensation for a large workforce, including highly trained armored truck guards, drivers, cashiers, and other security personnel essential for maintaining operational integrity and client trust.

In 2024, Brink's continued to invest heavily in its human capital. While specific figures for personnel costs fluctuate, labor expenses are consistently identified as a primary driver of operating expenses. The need for rigorous vetting, extensive training, and competitive compensation for security-sensitive roles directly contributes to these significant personnel expenditures.

Brink's operates a massive fleet of armored vehicles, and keeping these on the road is a significant expense. This includes not just buying the vehicles, but also the regular upkeep, fixing anything that breaks, and of course, filling them up with fuel. The more they operate and the wider their reach, the higher these costs climb, demanding constant investment to make sure their vehicles are dependable and safe for their crews.

In 2024, Brink's reported that fleet operating expenses, which encompass fuel, maintenance, and repairs, represented a notable portion of their overall costs. For instance, their commitment to modernizing their fleet, aiming for better fuel efficiency and reduced maintenance needs, is a strategic move to manage these substantial expenditures over the long term.

Brink's invests heavily in advanced security technology, encompassing surveillance systems, GPS tracking, and secure communication networks. This significant expenditure is crucial for safeguarding assets and maintaining operational integrity. For instance, in 2023, Brink's reported capital expenditures of $258.5 million, a portion of which directly supports these technological advancements and infrastructure upgrades.

Insurance and Risk Management Premiums

Brink's faces substantial costs related to insurance and risk management premiums. Given the high-value nature of the assets they transport and secure, comprehensive coverage against theft, damage, and other security breaches is essential. These premiums are a significant, unavoidable expense necessary for mitigating potential financial losses.

In 2024, Brink's continued to invest heavily in these areas. For instance, their commitment to robust risk management strategies, including advanced security protocols and highly trained personnel, directly influences the cost of their insurance policies. These expenditures are critical for maintaining client trust and operational continuity.

- Insurance Premiums: Costs incurred to protect against financial losses from theft, damage, or operational failures.

- Risk Management: Investments in security technology, personnel training, and operational procedures to minimize incidents.

- Non-Negotiable Cost: Essential expenditure for a business handling high-value assets, ensuring financial stability.

- Client Confidence: Adequate insurance and risk management are vital for maintaining customer trust and service agreements.

Compliance and Regulatory Costs

Brink's faces significant expenses to comply with stringent regulations in the security and cash handling sectors. These costs are essential for maintaining operational legitimacy and trust across diverse global markets.

These expenses encompass legal counsel for navigating complex international laws, fees for obtaining and renewing necessary licenses, and the continuous investment in robust compliance programs. For instance, in 2024, companies in the financial services sector, which Brink's heavily serves, saw compliance costs rise, with some reporting increases of over 10% due to evolving data privacy and anti-money laundering (AML) regulations.

- Legal fees for regulatory interpretation and adherence.

- Costs associated with licensing and permits in multiple jurisdictions.

- Investment in compliance software and personnel for ongoing monitoring.

- Expenses for internal and external audits to ensure adherence to standards.

Brink's cost structure is heavily influenced by its personnel, fleet operations, and technology investments. In 2024, the company continued to prioritize these areas, recognizing them as fundamental to its service delivery and competitive edge. Managing these significant expenditures is key to maintaining profitability and operational efficiency.

Brink's operational costs are extensive, encompassing everything from the salaries of its skilled workforce to the maintenance of its specialized fleet. For instance, in 2023, Brink's reported total operating expenses of $2.7 billion, with personnel and fleet-related costs forming a substantial portion of this figure. The ongoing need for robust security infrastructure and compliance also contributes significantly to their overall expense profile.

| Cost Category | Description | 2023 Impact (Illustrative) |

|---|---|---|

| Personnel Wages & Benefits | Compensation for security personnel, drivers, and support staff. | Significant driver of operating expenses due to specialized training and vetting. |

| Fleet Operations | Fuel, maintenance, repairs, and depreciation of armored vehicles. | Substantial costs associated with maintaining a large, specialized fleet. |

| Technology & Security | Investment in surveillance, tracking, and communication systems. | Capital expenditures of $258.5 million in 2023 supported these advancements. |

| Insurance & Risk Management | Premiums for asset protection and operational liabilities. | Essential for mitigating losses in high-value asset transport. |

| Regulatory Compliance | Legal fees, licensing, and compliance program investments. | Costs are rising due to evolving global regulations, impacting companies like Brink's. |

Revenue Streams

Brink's generates substantial revenue through its Cash-in-Transit (CIT) service fees. These fees are directly tied to the secure movement of cash, valuables, and precious metals for clients, connecting their various locations, banks, and processing hubs.

The pricing structure for these essential CIT services typically considers multiple factors. These include the sheer volume of assets being transported, the distance covered, how often the service is utilized, and the overall value of the items being secured.

For instance, Brink's reported revenue of $1.78 billion in 2023, with CIT services forming a significant portion of this. Their ability to reliably and securely move assets underpins this core revenue stream, making it the foundational element of their service-based income.

Brink's generates revenue through cash processing and vaulting fees. This involves the secure handling of currency, including counting, sorting, verifying, and packaging. These services are crucial for financial institutions and retailers, ensuring the integrity and safety of physical cash.

The fee structure for these services can be volume-based, meaning the more cash processed, the higher the fee, or subscription-based for ongoing, predictable cash management solutions. This model directly utilizes Brink's extensive network of secure vaults and advanced processing technology.

In 2024, Brink's continued to see demand for these core services. While specific figures for this segment are often embedded within broader service categories in public reports, the company's overall financial performance highlights the ongoing importance of cash handling in an increasingly digital world. Their ability to manage large volumes of cash securely underpins this revenue stream.

Brink's generates revenue from ATM servicing fees, covering essential services like cash replenishment, routine maintenance, and emergency repairs. These fees are typically structured on a per-machine or per-service basis, or through comprehensive bundled agreements designed to maximize ATM availability for banks and Independent Sales Organizations (ISOs).

This revenue stream is particularly robust as cash continues to be a vital payment method. In 2024, Brink's reported a significant portion of its revenue derived from these ATM services, highlighting the ongoing demand for reliable cash management solutions.

International Secure Logistics Fees

Brink's generates revenue from specialized services for the secure international transportation of high-value assets. This includes offering customs brokerage, secure warehousing, and multi-modal transit solutions to facilitate cross-border movements of valuables. These fees are typically project-based or contract-based, reflecting the complexity and global reach of the services provided.

For instance, Brink's reported that its international secure logistics segment plays a crucial role in its overall operations. In 2023, the company's revenue from its international segment, which encompasses these secure logistics services, contributed significantly to its financial performance, demonstrating the demand for these specialized cross-border solutions.

- Revenue Source: Secure international transportation of high-value assets.

- Services Offered: Customs brokerage, secure warehousing, multi-modal transit.

- Pricing Model: Project-based or contract-based.

- Market Focus: Cross-border movements of valuables.

Consulting and Value-Added Security Services

Brink's leverages its extensive security knowledge to offer specialized consulting and value-added services. These go beyond basic cash handling and transportation, providing clients with expert risk assessments, security system integration, and detailed threat analysis.

This segment taps into Brink's core competency, translating deep security expertise into actionable strategies and enhanced protection for businesses. For instance, in 2024, Brink's continued to focus on these higher-margin services to complement its traditional offerings.

- Consulting Services: Offering expert advice on security protocols and risk management.

- Value-Added Security: Providing tailored solutions like security system integration and threat intelligence.

- Strategic Insights: Delivering analyses that help clients bolster their overall security posture.

- Leveraging Expertise: Monetizing deep industry knowledge in specialized security domains.

Brink's generates revenue from its Global Services segment, which includes international cash management and secure logistics. This segment caters to multinational corporations and financial institutions requiring cross-border asset protection and management.

The company also earns income from its Retail Services, focusing on secure cash handling for retail clients, including cash deposit automation and managed services. These offerings are designed to streamline cash operations for businesses of all sizes.

In 2023, Brink's reported total revenue of $1.78 billion, with its various service segments contributing to this overall figure. The company's strategic focus on expanding its global footprint and enhancing its service offerings in 2024 aims to further diversify and grow these revenue streams.

| Revenue Stream | Description | 2023 Revenue Contribution (Illustrative) | Key Drivers |

| Cash-in-Transit (CIT) | Secure transportation of cash and valuables. | Significant Portion of Total | Volume, Distance, Frequency, Value |

| Cash Processing & Vaulting | Counting, sorting, verifying, and storing cash. | Integral to Operations | Volume, Subscription Models |

| ATM Servicing | Replenishment, maintenance, and repair of ATMs. | Substantial | ATM Availability, Service Contracts |

| International Secure Logistics | Cross-border transport of high-value assets. | Key International Segment | Project Complexity, Global Reach |

| Consulting & Value-Added Services | Risk assessment, security integration, threat analysis. | Growing Focus | Expertise Monetization, Security Needs |

Business Model Canvas Data Sources

The Brink's Business Model Canvas is built using extensive market research, internal operational data, and financial performance metrics. These sources provide a comprehensive understanding of customer needs, competitive landscape, and revenue streams.