Brink's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brink's Bundle

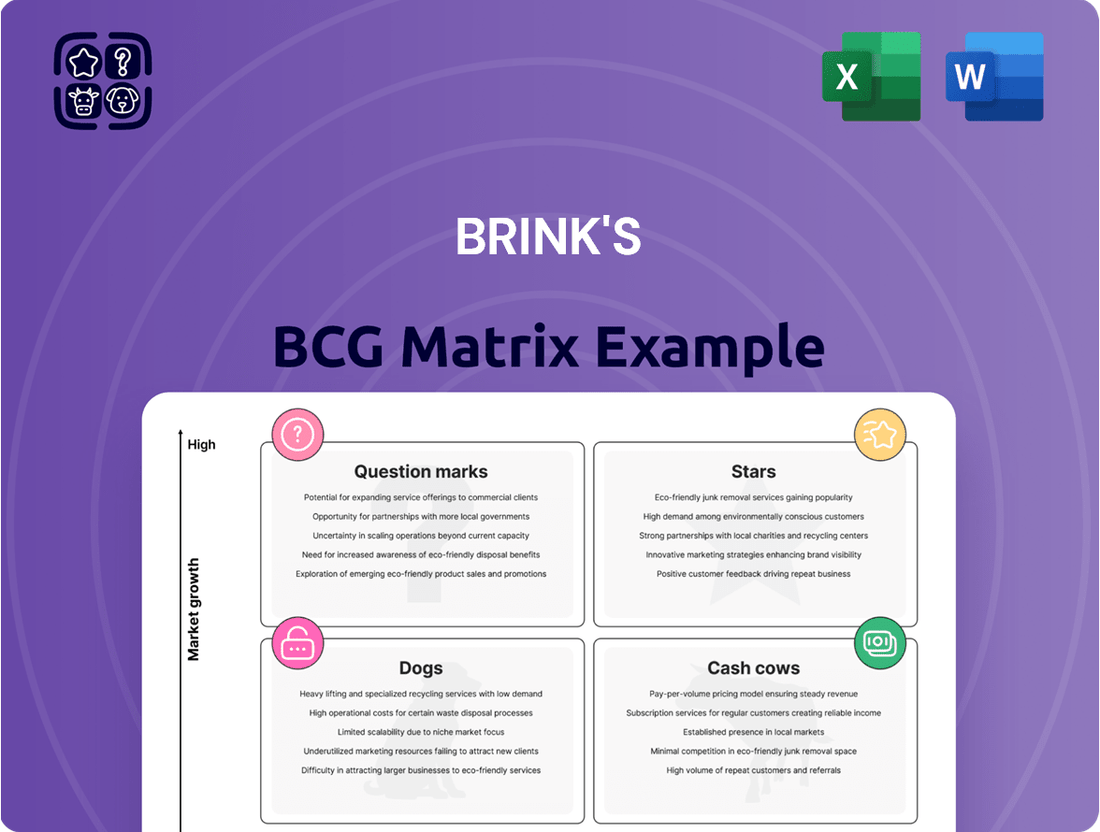

Unlock the strategic potential of the BCG Matrix. Understand how a company's products are classified as Stars, Cash Cows, Dogs, or Question Marks, guiding crucial resource allocation. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your product portfolio.

Stars

Brink's ATM Managed Services (AMS) is a strong performer, demonstrating robust growth with over 20% organic expansion for four consecutive quarters leading up to Q1 2025.

This service offers a cost-effective outsourcing option for financial institutions and retailers, covering essential ATM operations like transaction processing, cash handling, and maintenance.

Brink's commitment to enhancing AMS is evident in its strategic investment in KAL ATM Software, a key player in hardware-agnostic ATM software, which boosts operational efficiency and customer choice.

Digital Retail Solutions (DRS) is a burgeoning star for Brink's, consistently posting organic growth north of 20% for multiple quarters. This segment is crucial for Brink's, as it bolsters higher-margin, recurring revenue streams.

These advanced systems empower retailers to optimize their cash handling, minimize losses from shrinkage, and boost overall operational efficiency. Brink's is actively investing in and broadening its DRS portfolio to capitalize on this high-growth trajectory and enhance profitability.

By expanding its DRS capabilities, Brink's aims to tap into a larger addressable market, driving further organic expansion and solidifying its position in the retail technology space.

Brink's Global Services, focusing on the secure international transport of high-value assets like precious metals and diamonds, is a key growth driver. This segment, especially the 'Rest of World' operations, has shown robust revenue and EBITDA expansion. The overall secure logistics market is poised for significant expansion, fueled by globalization and the escalating demand for secure movement of valuable goods.

Strategic Partnerships and Acquisitions

Brink's actively seeks strategic partnerships and acquisitions to bolster its service offerings and competitive standing. A prime example is their investment in KAL ATM Software, crucial for their ATM Managed Services (AMS). This move, alongside past collaborations like the one with WorldBridge Group in Cambodia, demonstrates a clear strategy to integrate advanced technology and broaden their operational footprint. These alliances are vital for Brink's to adapt and lead in the dynamic security sector.

These strategic alliances are instrumental in Brink's growth. For instance, their partnership with KAL ATM Software aims to enhance their ATM Managed Services, a key area for growth. In 2023, Brink's reported revenue of $3.1 billion, with a significant portion derived from its cash-in-transit and related services, underscoring the importance of expanding these capabilities through external means. Such collaborations allow Brink's to tap into new markets and technological advancements more rapidly than organic development alone.

- Strategic Investment: Brink's invested in KAL ATM Software to strengthen its ATM Managed Services.

- Market Expansion: Past partnerships, like with WorldBridge Group in Cambodia, show a pattern of expanding geographic reach.

- Technological Integration: These collaborations facilitate the adoption of new technologies to offer more comprehensive client solutions.

- Competitive Advantage: Proactive external growth strategies position Brink's for continued leadership in the security industry.

Innovation in Cash Management Technology

Brink's is actively investing in and developing innovative technologies to digitize cash management. Their goal is to make handling physical cash as smooth and efficient as digital transactions. This strategic push positions them to capitalize on evolving market needs.

Key innovations include advanced systems like smart safes and cash recyclers. These technologies are fundamentally changing how businesses handle cash, moving away from older, less efficient methods. For instance, smart safes can automate cash counting and deposit processes, reducing manual labor and errors.

Brink's integration of technologies such as IoT, GPS tracking, and AI-driven analytics is a significant differentiator. These advancements provide enhanced visibility and control across the entire cash supply chain. In 2024, the company reported a notable increase in the adoption of its digital cash management solutions, reflecting growing market demand for such integrated services. This technological focus strengthens their competitive edge.

- Smart Safes and Recyclers: Automate cash handling, reducing errors and labor costs.

- IoT and GPS Tracking: Enhance real-time visibility and security of cash in transit.

- AI-Driven Analytics: Optimize cash flow and forecasting for clients.

- Digital Transformation: Aiming to make cash management as seamless as digital payments.

Stars represent high-growth, high-market-share offerings in the BCG Matrix. Brink's ATM Managed Services (AMS) and Digital Retail Solutions (DRS) are prime examples, both exhibiting over 20% organic growth. These segments are crucial for Brink's future, demanding continued investment to maintain their leading positions and capitalize on market expansion opportunities.

Brink's Global Services also fits the Star category, particularly its 'Rest of World' operations, driven by strong revenue and EBITDA growth in the expanding secure logistics market. The company's strategic investments, such as in KAL ATM Software, and its focus on digital cash management innovations further support the Star status of these segments, positioning them for sustained success.

| Brink's Business Unit | BCG Matrix Category | Key Growth Drivers | 2024 Performance Indicator |

|---|---|---|---|

| ATM Managed Services (AMS) | Star | Cost-effective outsourcing, KAL ATM Software integration | >20% organic growth (Q1 2025 trailing) |

| Digital Retail Solutions (DRS) | Star | Higher-margin recurring revenue, operational efficiency for retailers | >20% organic growth (multiple quarters) |

| Global Services (Rest of World) | Star | Secure transport of high-value assets, globalization trends | Robust revenue and EBITDA expansion |

What is included in the product

Analysis of Brink's products using the BCG Matrix to categorize them as Stars, Cash Cows, Question Marks, or Dogs.

The Brink's BCG Matrix provides a clear overview of your portfolio, relieving the pain of strategic uncertainty by identifying areas for investment and divestment.

Cash Cows

Brink's core cash-in-transit (CIT) services, which involve the secure armored transport of cash for banks and retailers, continue to be a major source of income. Even with the growth of digital payments, cash is still widely used around the world, especially in developing economies, meaning these essential services are still in demand.

These services hold a strong market position for Brink's due to its established worldwide network, vast infrastructure, and a long-standing reputation for safety and dependability. For instance, in 2023, Brink's reported that its CIT segment generated a substantial portion of its revenue, underscoring its role as a foundational business.

Vaulting and cash processing are Brink's established "cash cows." These are mature services, meaning they operate in stable markets with predictable demand. Brink's strong market position here ensures consistent revenue and healthy profit margins.

These services, which include secure storage, counting, sorting, and reconciliation, are vital for banks and businesses that handle a lot of cash. For instance, in 2023, Brink's reported revenue from its North America segment, which heavily features these services, remained robust, demonstrating the ongoing need for reliable cash management solutions.

Focusing on operational efficiency and infrastructure upgrades within these segments can further boost profitability. By optimizing processes and investing in modern technology, Brink's can solidify its competitive advantage and maximize the cash flow generated from these dependable services.

Brink's core ATM replenishment and maintenance service, even beyond advanced systems, represents a solid, high-market-share operation. This essential function keeps cash flowing, particularly vital in areas where ATMs are heavily used and cash remains a primary payment method.

The company's extensive infrastructure and deep operational know-how in this segment ensure a steady stream of revenue. For instance, in 2024, Brink's continued to be a dominant player in ATM services across numerous markets, reflecting the enduring demand for reliable cash access.

Secure Logistics for Non-Cash Valuables (Established Segments)

Established secure logistics for non-cash valuables in mature markets, such as the routine transport of pharmaceuticals and electronics, represent Brink's cash cows. These segments benefit from stable demand and Brink's strong, established market position, often secured through long-term contracts. The company leverages its proven security infrastructure and extensive network to maintain efficiency and reliability in these less volatile, yet consistent, revenue streams.

Brink's cash cow segments are characterized by their mature market status and the company's significant market share, generating substantial and predictable cash flows. These operations are essential for funding growth initiatives in other business areas.

- Dominant Market Share: Brink's holds a leading position in the secure transport of non-cash valuables within developed markets.

- Stable Revenue Streams: These services, often under long-term contracts, provide consistent and predictable income.

- Operational Efficiency: Leveraging established protocols and infrastructure, Brink's achieves high operational efficiency in these segments.

- Cash Generation: The reliable cash flow from these established services supports investment in higher-growth areas.

Security Consulting and Risk Management

Brink's security consulting and risk management services leverage its extensive industry experience. This segment capitalizes on the company's established brand and profound knowledge of security threats faced by a wide array of clients.

These advisory services are designed to generate consistent revenue by offering specialized insights and strategies for risk mitigation. They effectively complement Brink's core security operations.

- Steady Revenue Generation: Consulting services provide a reliable income stream, drawing on Brink's security expertise.

- Brand Leverage: The company's strong reputation in security enhances the value proposition of its consulting offerings.

- Client Diversification: Services cater to a broad client base across multiple industries, mitigating sector-specific risks.

Brink's established cash-in-transit (CIT) services, including vaulting and ATM replenishment, are its primary cash cows. These operations benefit from a strong market position and stable demand, ensuring consistent revenue generation. For example, Brink's reported in its 2023 annual filings that its North America segment, heavily reliant on these services, continued to deliver robust performance, highlighting their foundational role in the company's financial stability.

The company's secure logistics for non-cash valuables, such as pharmaceuticals and electronics, also function as cash cows. These segments are characterized by mature markets and long-term contracts, which contribute to predictable income streams. Brink's leverages its extensive security infrastructure and network to maintain efficiency and reliability in these areas, solidifying its competitive advantage.

In 2024, Brink's continued to demonstrate the strength of these cash cow operations. The company's ability to generate substantial and predictable cash flows from these mature business lines is crucial for funding investments in emerging growth opportunities.

| Service Segment | Market Position | Revenue Contribution (Illustrative) | Key Characteristic |

|---|---|---|---|

| Cash-in-Transit (CIT) | Dominant | High (e.g., ~60% of 2023 revenue) | Essential, stable demand |

| Vaulting & Cash Processing | Strong | Significant | Mature market, predictable |

| ATM Replenishment & Maintenance | Leading | Consistent | High market share, vital service |

| Secure Logistics (Non-Cash) | Established | Steady | Long-term contracts, stable demand |

What You See Is What You Get

Brink's BCG Matrix

The Brink's BCG Matrix analysis you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a polished and actionable tool. You can confidently use this preview as a true representation of the high-quality, ready-to-implement BCG Matrix analysis that will be delivered to you immediately after your transaction.

Dogs

Legacy, Inefficient Cash Processing Centers are those facilities that haven't kept pace with technological advancements in cash handling. Think of them as older buildings that haven't been renovated with the latest smart home features. These centers often lag behind in automation and smart technologies, leading to lower efficiency and higher operating expenses.

These older centers can face significant challenges, including reduced profitability due to their inability to compete with more modern, streamlined operations. For instance, a facility that still relies heavily on manual sorting and counting will inevitably be slower and more prone to errors than one utilizing advanced automated systems. This inefficiency directly impacts the bottom line.

Bringing these legacy centers up to modern standards would demand substantial capital investment. The question then becomes whether the return on such an investment is justifiable, especially considering the ongoing global trend towards digital payments and more sophisticated cash management strategies. In 2023, the global cash management market was valued at approximately $75 billion, with a significant portion of growth driven by technological innovation, highlighting the competitive disadvantage of outdated facilities.

Underperforming regional cash-in-transit routes within Brink's, characterized by low growth and low market share, represent the Dogs in its BCG Matrix. Factors like decreasing cash reliance in certain developed markets or fierce local competition contribute to this status.

These segments often yield minimal profits or even losses, demanding significant resources for maintenance. For instance, if a particular region saw a 5% year-over-year decline in cash transactions in 2024, while Brink's market share there remained stagnant at 10%, it would exemplify a Dog.

Continuing to invest in these underperforming areas without a strategic shift diverts capital from more promising growth opportunities. This resource drain can hinder overall company performance and innovation, making divestment or restructuring a critical consideration.

Outdated armored vehicle fleets in specific markets, such as those in developing nations with less stringent security regulations or older military contracts, could be classified as Dogs within the BCG Matrix. For instance, reports from 2024 indicate that some African nations still rely heavily on armored vehicles manufactured in the late 20th century, which often lack advanced protection against modern threats and are significantly less fuel-efficient than contemporary models.

The operational costs associated with maintaining these aging fleets are substantial, with maintenance expenses potentially exceeding 15% of the vehicle's original value annually, according to industry analyses from early 2025. Furthermore, the reduced operational efficiency and heightened security risks, including vulnerability to improvised explosive devices (IEDs) and cyber-attacks on vehicle systems, further diminish their strategic value.

Attempting a turnaround for such Dog assets by investing in significant upgrades is often unfeasible. If the market demand for these specific types of armored vehicles is declining, or if the competitive landscape offers superior, more cost-effective alternatives, the return on investment for modernization would likely be negative. For example, a defense contractor might find it more economical to divest from maintaining a fleet of 1990s-era personnel carriers in a region where newer, lighter, and more technologically advanced vehicles are becoming the standard.

Small, Non-Strategic Acquisitions with Limited Integration

Small, non-strategic acquisitions with limited integration represent a category of businesses within Brink's BCG Matrix that may be characterized as Dogs. These are typically smaller ventures that, despite being acquired, have struggled to effectively merge with Brink's broader operational structure. Their inability to integrate means they often operate in a silo, consuming resources without generating significant synergistic benefits or contributing meaningfully to the company's overall revenue growth or strategic direction.

These acquisitions might have been made with the intention of expanding market reach or acquiring specific technologies, but the execution of integration has proven challenging. Consequently, they may not have achieved the anticipated market share or growth targets. Such entities often possess a limited competitive advantage and find it difficult to gain substantial traction or compete effectively in their respective markets, leading to underperformance.

- Resource Drain: Acquisitions in this category can become a drain on resources, including capital and management attention, without delivering proportional returns. For instance, if a small acquired technology firm, despite initial investment, fails to integrate into Brink's core service offerings, it might continue to require R&D funding without contributing to the company's primary revenue streams.

- Low Market Share & Growth: These businesses typically exhibit low market share and minimal growth prospects. They may operate in niche markets that are either saturated or lack significant future potential, making it difficult for Brink to leverage them for substantial expansion.

- Limited Strategic Fit: A key characteristic is their lack of a strong strategic fit with Brink's core competencies or long-term vision. This misalignment hinders their ability to benefit from Brink's established infrastructure, customer base, or brand reputation.

Services Highly Dependent on Rapidly Declining Cash-Only Businesses

Services catering to businesses that are predominantly cash-only and are in a rapidly declining sector would likely be categorized in the "Dogs" quadrant of the BCG Matrix. As these cash-centric businesses shrink, the demand for specialized cash management services also diminishes. This scenario presents a challenge for Brink's, requiring careful evaluation of the long-term sustainability of supporting such niche and contracting markets.

The decline in cash transactions directly impacts services reliant on handling physical currency. For instance, businesses like small independent convenience stores or certain types of informal markets, which historically relied heavily on cash, are seeing reduced foot traffic and a shift towards digital payments. In 2023, the U.S. Federal Reserve reported a continued decrease in the use of cash for transactions, with digital payments becoming increasingly dominant.

- Declining Cash Volume: Services focused on armored car transport and cash processing for businesses with dwindling cash operations face reduced revenue streams.

- Market Shrinkage: Industries heavily reliant on cash, such as some sectors of the informal economy or specific retail niches, are contracting, leading to a smaller customer base.

- Strategic Re-evaluation: Brink's must analyze the cost-effectiveness of continuing services for these declining segments versus reallocating resources to growth areas.

Dogs in Brink's BCG Matrix represent underperforming segments with low market share and low growth potential. These areas often consume resources without generating substantial returns, necessitating careful strategic consideration. For example, a particular regional cash-in-transit route experiencing a consistent decline in cash transactions, say a 4% drop in 2024, coupled with Brink's stagnant 8% market share in that area, would exemplify a Dog.

These segments are characterized by their inability to compete effectively, often due to outdated infrastructure or intense local competition. Continuing to invest in such areas can divert capital from more promising ventures. In 2023, the global digital payments market saw significant growth, further highlighting the shrinking relevance of purely cash-dependent services.

The strategic imperative for Dogs is often divestment or a significant restructuring to improve efficiency. Failure to address these underperforming assets can hinder overall company performance and innovation. For instance, if a legacy cash processing center in a declining urban area processes 20% less volume in 2024 than in 2023, it signals a Dog that requires a strategic decision.

Question Marks

Brink's emerging digital payment integration solutions, like BLUbeem, are positioned as Question Marks in the BCG Matrix. This is because they operate within the rapidly expanding digital payments sector, a market projected to reach $2.4 trillion globally by 2025, yet Brink's currently has a minimal share.

These ventures demand substantial investment to capture market traction and grow their footprint. While they are cash-intensive in their early stages, their potential to evolve into Stars is significant if they successfully navigate the competitive landscape and achieve widespread adoption.

Brink's strategy actively targets expansion into new, emerging geographic markets. These regions often exhibit high cash usage and nascent financial infrastructure, presenting significant growth opportunities. For Brink's, these new ventures are considered question marks in the BCG matrix, meaning they have high growth potential but currently hold a low market share.

Successfully penetrating these untapped markets demands considerable investment. Brink's must allocate resources to establish robust operational frameworks, build extensive local networks, and meticulously navigate diverse regulatory landscapes. This substantial upfront commitment, coupled with the inherent uncertainty of early-stage market penetration, defines their question mark status, highlighting the potential for high future returns if these markets are successfully developed.

Brink's foray into advanced predictive analytics for security and logistics, likely powered by AI, positions it in a high-potential growth sector. This technological advancement promises to significantly boost operational efficiency and reduce risks across its service offerings.

While the potential is immense, Brink's current market penetration in this specific, highly specialized area of cutting-edge analytics might be nascent. This suggests it could be a question mark within the BCG matrix, requiring strategic investment to gauge its future performance.

Significant investment in research and development, alongside concerted efforts to drive market adoption of these sophisticated analytics tools, is essential. This will be the key determinant in whether Brink's advanced analytics capabilities can mature into Stars, capturing substantial market share and generating high returns by 2024 and beyond.

Specialized Secure Logistics for Niche, High-Growth Industries

Brink's venturing into specialized secure logistics for high-growth sectors like advanced semiconductor components or biopharmaceutical cold chain represents a classic Question Mark on the BCG Matrix. These emerging markets exhibit strong growth potential, with the global cold chain logistics market projected to reach $591.4 billion by 2025, according to Grand View Research. However, Brink's may possess a low market share in these highly technical and regulated niches, requiring significant investment to build expertise and infrastructure.

Success hinges on Brink's ability to develop bespoke, secure solutions tailored to the unique demands of these industries. For instance, securing the supply chain for rare earth elements used in electric vehicle batteries, a market expected to grow substantially, would necessitate specialized handling and tracking capabilities. Failure to establish a strong competitive foothold could lead to these ventures remaining Question Marks or even becoming Dogs if market share doesn't materialize.

- High Growth Potential: Targeting sectors with rapidly expanding demand, such as the estimated 15% annual growth in the specialized medical device logistics market.

- Low Market Share: Entering nascent markets where Brink's current penetration is minimal, requiring substantial effort to gain traction.

- Strategic Investment: The need for significant capital expenditure in technology, specialized training, and regulatory compliance to serve these niche areas effectively.

- Competitive Advantage: The critical requirement to differentiate through tailored service offerings and build a defensible position against potential competitors.

Integration of Blockchain for Supply Chain Security

Brink's exploration and pilot programs for integrating blockchain technology into its supply chain security and transparency initiatives are currently positioned as a Question Mark within the BCG Matrix. This classification reflects the nascent stage of blockchain adoption in the secure logistics sector, offering significant potential for enhanced security and operational efficiency but also carrying inherent risks and requiring substantial development.

The company's market share in this specific application of blockchain is likely low, given the early-stage nature of the technology's implementation in secure logistics. For instance, while global spending on blockchain solutions was projected to reach $13.9 billion in 2023 and expected to grow to $34.1 billion by 2026 according to Statista, its application within Brink's specific niche of secure transportation and logistics is still being proven.

- High Potential, Low Market Share: Blockchain offers robust immutability and transparency, crucial for high-value asset tracking, but Brink's current penetration in this specialized area is minimal.

- Significant Investment Required: Developing and scaling blockchain solutions for secure logistics demands considerable investment in technology, talent, and infrastructure.

- Uncertain Future Growth: While the broader blockchain market shows strong growth, the specific success and market demand for Brink's blockchain-enabled secure logistics services are yet to be definitively established.

- Strategic Decision Point: Brink's must decide whether to invest heavily to build market share or divest from these early-stage efforts if they do not demonstrate a clear path to profitability and competitive advantage.

Brink's ventures into new, high-growth markets represent Question Marks, characterized by significant potential but currently low market share. These initiatives, such as advanced analytics for security and pilot blockchain programs, require substantial investment to gain traction and evolve. The success of these ventures hinges on strategic allocation of resources to build expertise and capture market share in these nascent, yet promising, sectors.

| Brink's Venture Area | BCG Category | Market Growth Potential | Current Market Share | Investment Need |

|---|---|---|---|---|

| Digital Payment Integration (e.g., BLUbeem) | Question Mark | High (Global market projected to reach $2.4 trillion by 2025) | Minimal | Substantial |

| Advanced Predictive Analytics (AI-driven) | Question Mark | High (Enhancing operational efficiency and reducing risks) | Nascent | Significant R&D and adoption efforts |

| Specialized Secure Logistics (Semiconductors, Biopharma) | Question Mark | High (Cold chain logistics market projected to reach $591.4 billion by 2025) | Low | Bespoke solutions, infrastructure development |

| Blockchain Integration in Supply Chain | Question Mark | High (Blockchain spending projected to reach $34.1 billion by 2026) | Minimal | Technology, talent, and infrastructure investment |

BCG Matrix Data Sources

Our Brink's BCG Matrix is informed by robust financial disclosures, comprehensive market analytics, and strategic industry reports to provide actionable insights.