Brink's Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brink's Bundle

Brink's masterfully leverages its product offerings, from secure cash handling to advanced security solutions, to meet diverse client needs. Their pricing strategies reflect the premium value and reliability they provide, ensuring a strong market position.

Discover how Brink's strategically places its services, ensuring accessibility and trust across various sectors. Their promotional efforts consistently reinforce their brand as the leader in security and logistics.

Ready to gain a competitive edge? Access the full, in-depth 4Ps Marketing Mix Analysis for Brink's, complete with actionable insights and ready-to-use formatting. Elevate your strategic thinking today!

Product

Brink's core product is secure, insured logistics and armored transportation for high-value assets like cash and precious metals. This is crucial for banks and retailers handling substantial physical currency. In 2024, Brink's continued to leverage its expertise in managing the risks associated with moving these valuable goods.

Cash Management Services are a core offering for Brink's, addressing the fundamental need for secure and efficient handling of physical currency. These services are designed to alleviate the operational complexities and risks businesses face when managing cash transactions, from retail environments to financial institutions.

Brink's provides a suite of solutions that encompass secure cash collection, meticulous counting and reconciliation, and direct deposit capabilities. This integrated approach aims to minimize errors, prevent loss, and free up valuable business resources. For instance, in 2023, Brink's continued to invest in technology to enhance real-time tracking and reporting for its clients, offering greater transparency in cash flow management.

ATM Managed Services (AMS) represents Brink's product offering, providing a comprehensive solution for financial institutions and independent ATM operators. This service manages the entire lifecycle of ATM operations, from predicting cash needs and restocking to ongoing monitoring, maintenance, and repairs. The core benefit is ensuring ATMs are consistently available and funded, thereby maximizing uptime and customer satisfaction.

Brink's AMS is designed to streamline ATM operations, boosting efficiency and security while lowering costs for clients. For instance, in 2024, the demand for reliable ATM services remained strong, with global ATM transaction volumes projected to continue their upward trend, underscoring the value proposition of managed services. Brink's leverages its extensive network and technological capabilities to deliver these integrated solutions, aiming to optimize performance and reduce the burden on their clients.

Digital Retail Solutions (DRS)

Brink's Digital Retail Solutions (DRS) represent a significant evolution in how businesses manage physical currency alongside digital transactions. These offerings are designed to streamline cash handling for retailers, a sector that saw continued digital payment growth through 2024. For instance, by the end of 2024, it was estimated that over 60% of all retail transactions in developed economies involved some form of digital payment, yet cash remains a crucial component for many businesses.

The core of DRS involves smart safes and advanced cash visibility tools. These technologies allow for the digitization of cash flow, providing real-time data on cash levels and movements. This enhanced visibility not only helps in reducing internal theft, a persistent issue for retailers, but also accelerates access to working capital by providing auditable and immediate cash deposit information. In 2024, businesses leveraging such solutions reported an average reduction in cash-related losses by up to 15%.

DRS aims to bridge the gap between traditional cash management and the burgeoning digital payment landscape. By integrating physical cash handling processes with digital payment ecosystems, Brink's empowers retailers to achieve greater operational efficiency and financial agility. This integration is critical as businesses navigate a hybrid payment environment, ensuring that cash, while declining in proportion, remains a manageable and secure asset.

- Smart Safes: Automate cash deposits and reduce manual handling, enhancing security and accuracy.

- Real-time Visibility: Provide instant data on cash levels, enabling better inventory and liquidity management.

- Working Capital Acceleration: Facilitate faster access to deposited funds by digitizing cash reconciliation.

- Theft Reduction: Minimize opportunities for internal shrinkage through secure, automated cash handling.

International Transportation and Custody of Digital Assets

Brink's is extending its established secure logistics and vaulting capabilities into the burgeoning digital asset space. This strategic move, supported by partnerships and investments in crypto custody firms, positions Brink's as a key player in the physical transportation and storage of digital assets, bridging the gap between the physical and digital worlds of finance. The company is leveraging its decades of experience in handling high-value physical goods to provide secure solutions for the evolving blockchain ecosystem.

This new product offering addresses a critical need for secure, regulated, and insured custody solutions for digital assets, which are increasingly held by institutional investors and financial intermediaries. Brink's aims to provide a trusted physical layer for digital asset security, a crucial element as the market matures and regulatory scrutiny intensifies. The global digital asset market capitalization reached approximately $2.5 trillion in early 2024, highlighting the significant demand for robust security infrastructure.

- Global Reach: Brink's leverages its existing worldwide network of vaults and transportation infrastructure to offer secure custody for digital assets across multiple jurisdictions.

- Physical Security for Digital Assets: The service focuses on the secure physical transportation and storage of hardware wallets and other physical mediums used to hold private keys for digital assets.

- Regulatory Compliance: Brink's commitment to regulatory adherence provides a layer of trust and security for institutions dealing with digital assets, a sector still navigating complex compliance landscapes.

- Market Growth: The expansion into digital asset custody aligns with the rapid growth of the digital asset market, with projections indicating continued expansion through 2025 and beyond.

Brink's product portfolio is centered on secure logistics and cash management, evolving to include digital asset custody. This includes armored transportation for cash and valuables, ATM managed services to ensure ATM availability, and digital retail solutions like smart safes for enhanced cash handling visibility. The company is also extending its secure infrastructure to the digital asset market, offering physical custody for hardware wallets and private keys.

| Product Offering | Key Features | 2024/2025 Relevance |

| Secure Logistics & Armored Transport | High-value asset movement (cash, precious metals) | Continued demand from financial institutions and retailers; essential for physical currency flow. |

| Cash Management Services | Secure collection, counting, reconciliation, direct deposit | Streamlines operations for businesses, reduces risk; vital for businesses managing significant cash volumes. |

| ATM Managed Services (AMS) | End-to-end ATM operation management | Ensures ATM uptime and funding; global ATM transaction volumes projected to grow, increasing need for reliable management. |

| Digital Retail Solutions (DRS) | Smart safes, real-time cash visibility tools | Improves retail cash handling efficiency and security; retailers reported up to 15% reduction in cash-related losses using similar tech in 2024. |

| Digital Asset Custody | Physical security for hardware wallets/private keys | Addresses need for secure digital asset storage; global digital asset market cap ~$2.5 trillion in early 2024, indicating significant growth potential. |

What is included in the product

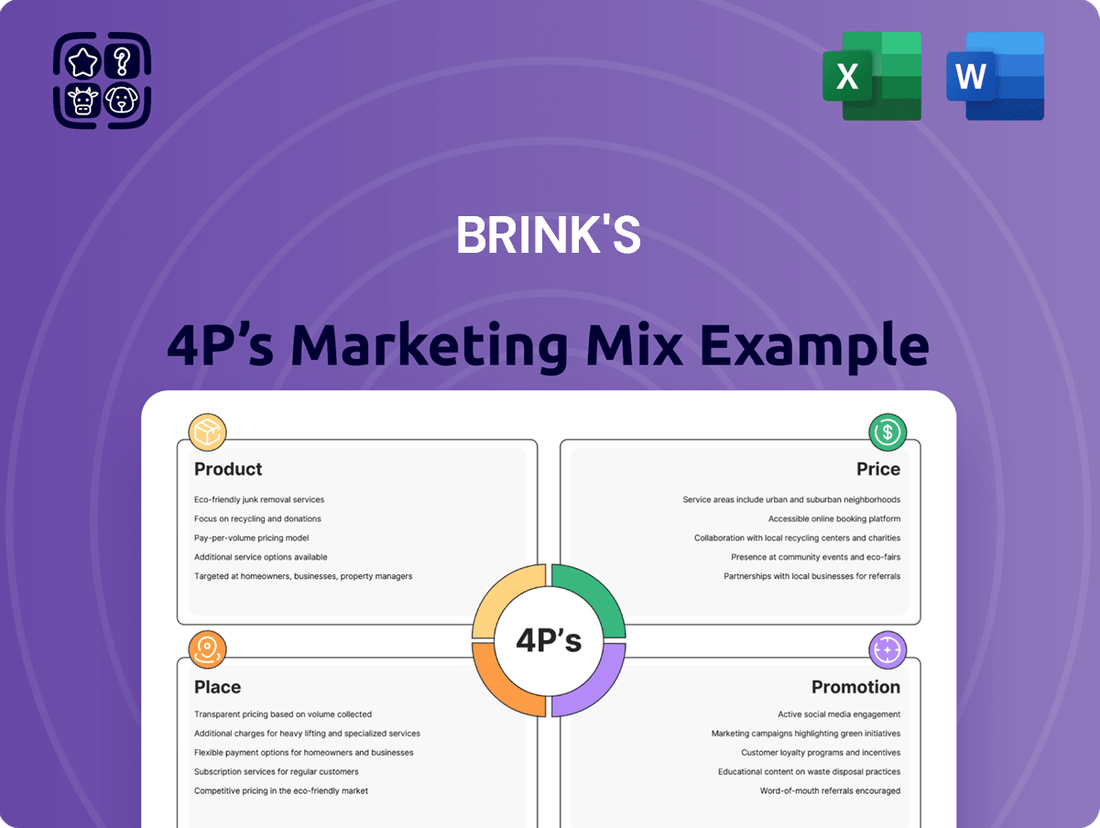

This analysis offers a comprehensive breakdown of Brink's' marketing strategies, examining their Product offerings, Pricing models, Place (distribution) strategies, and Promotional activities to understand their market positioning.

Provides a clear, actionable framework for Brink's to address customer pain points by optimizing its Product, Price, Place, and Promotion strategies.

Simplifies complex marketing decisions by offering a structured approach to identify and alleviate customer frustrations related to Brink's offerings.

Place

Brink's boasts an impressive global footprint, reaching customers in over 100 countries and maintaining active operations in 51 to 52 nations. This expansive network is crucial for delivering secure logistics and cash management solutions internationally. It enables Brink's to effectively serve multinational corporations and businesses with complex, geographically dispersed operations.

Brink's' physical distribution is anchored by its specialized fleet of armored vehicles and a global network of secure vaulting facilities. These assets are critical for the safe transit and storage of high-value goods, forming the foundation of their secure logistics operations. In 2023, Brink's operated approximately 11,000 vehicles worldwide, a testament to the scale of their physical distribution capabilities.

Brink's operates predominantly through a direct sales and service model, directly interacting with a diverse client base including financial institutions, retailers, and government bodies. This direct engagement enables the company to offer highly customized secure supply chain solutions, ensuring precise management for each client's unique needs.

This direct approach allows Brink's to maintain tight control over service quality and client relationships. For instance, in 2023, Brink's reported revenue of $3.9 billion, underscoring the scale and effectiveness of its direct client interactions in generating substantial business.

Strategic Partnerships and Acquisitions

Brink's actively pursues strategic partnerships and acquisitions to fortify its market position and expand its service portfolio. This proactive approach allows the company to tap into new revenue streams and enhance its competitive edge in evolving financial landscapes. For instance, in 2024, Brink's continued to explore collaborations in the digital asset custody space, aiming to integrate secure solutions for a growing market segment.

These strategic moves are crucial for broadening distribution channels and introducing advanced service capabilities, particularly in emerging markets where digital transformation is accelerating. By investing in areas like ATM software, Brink's not only modernizes its existing infrastructure but also positions itself to offer more sophisticated services to a wider customer base. The company's financial reports for 2024 indicated ongoing investments in technology and strategic alliances, underscoring their commitment to innovation and market expansion.

- Digital Asset Custody Partnerships: Brink's has been actively engaged in forming alliances to offer secure custody solutions for cryptocurrencies and other digital assets, a rapidly growing sector.

- ATM Software Investments: Strategic capital allocation towards upgrading and enhancing ATM software capabilities aims to improve efficiency, security, and user experience for its clients.

- Market Entry and Expansion: Acquisitions and partnerships are key drivers for Brink's to enter new geographical markets and deepen its penetration in existing ones, thereby diversifying its revenue base.

- Service Capability Enhancement: The integration of new technologies and services through these strategic actions directly bolsters Brink's overall service offering, making it more comprehensive and attractive to a broader clientele.

Technology Integration and Digital Platforms

Brink's, while rooted in physical security, strategically utilizes technology to redefine its service 'place'. Digital platforms offer clients real-time tracking of assets, enhancing transparency and control. For instance, their digital cash visibility tools provide immediate insights into cash movements, a critical component for financial institutions.

The integration of advanced ATM management systems further exemplifies this technological 'place' evolution. This allows Brink's to offer more efficient and responsive service delivery, even for the physical movement of cash. In 2024, Brink's reported significant investments in digital transformation initiatives aimed at improving customer experience and operational efficiency across its global network.

- Real-time tracking: Clients gain immediate visibility into the location and status of their assets.

- Digital cash visibility: Tools provide instant data on cash holdings and movements.

- Integrated ATM management: Streamlined operations for cash replenishment and maintenance.

- Enhanced transparency: Technology fosters greater trust and accountability in service delivery.

Brink's' "Place" within the marketing mix is defined by its extensive global network and specialized infrastructure. This includes operations in approximately 52 countries, supported by a fleet of over 11,000 armored vehicles as of 2023. Their secure vaulting facilities are integral to this physical distribution, ensuring the safe handling of high-value assets across diverse geographies.

Beyond physical assets, Brink's leverages digital platforms to enhance service accessibility and transparency. Real-time tracking and digital cash visibility tools offer clients immediate insights into their assets, a crucial element for financial institutions. The company's 2024 investments in digital transformation underscore a commitment to evolving its service delivery channels.

Brink's also strategically expands its reach through partnerships and acquisitions, as seen with its 2024 focus on digital asset custody. This dual approach of physical presence and digital integration ensures comprehensive service coverage and caters to evolving client needs in both traditional and emerging markets.

Full Version Awaits

Brink's 4P's Marketing Mix Analysis

The preview you see is not a demo—it's the full, finished Brink's 4P's Marketing Mix analysis you’ll own. This comprehensive document details their Product, Price, Place, and Promotion strategies. You'll receive this exact, ready-to-use analysis immediately after purchase, ensuring no surprises.

Promotion

Brink's prominently features its over 160-year legacy in security and trust as a core promotional pillar. This deep heritage directly addresses client concerns about reliability and integrity, crucial when entrusting Brink's with the secure transport and management of high-value assets.

This emphasis on a trusted security heritage is a powerful differentiator, especially in an industry where reputational risk is significant. For instance, in 2023, Brink's reported revenue of $3.9 billion, a testament to the continued trust placed in their secure solutions by a global client base.

Brink's commitment to technology is evident in its smart safe solutions and real-time cash visibility platforms, which enhance efficiency and security for financial institutions. This focus on innovation allows Brink's to adapt to the changing needs of the financial sector.

In 2024, Brink's continued to invest in advanced ATM managed services, aiming to provide seamless and secure cash handling for its clients. Their integration of cutting-edge technology underscores their dedication to modernizing security and cash management operations.

Brink's strategically targets industry-specific publications and events to connect with its core audience. This includes exhibiting at major security industry trade shows and advertising in key financial and retail trade magazines, ensuring their message reaches decision-makers actively seeking secure logistics solutions.

For instance, participation in events like the Global Security Exchange (GSX) or advertising in publications such as Security Magazine allows Brink's to showcase their expertise. In 2024, security industry events are expected to see robust attendance from professionals focused on risk management and operational efficiency, providing a direct channel for Brink's to engage with potential clients.

Investor Relations and Financial Communications

Brink's leverages investor relations and financial communications as a key promotional element, actively engaging stakeholders to showcase its value proposition. Regular investor presentations, earnings calls, and annual reports are vital for attracting and retaining investment capital. These platforms highlight not only financial performance but also strategic advancements and promising growth avenues, especially within high-margin sectors like Armored Money Services (AMS) and Digital Retail Solutions (DRS).

For instance, Brink's reported a strong financial performance in 2024, with revenue growth driven by strategic investments. The company's commitment to enhancing its high-margin businesses was evident in its Q3 2024 earnings call, where management detailed plans for expanding its DRS offerings, projecting a significant uptick in profitability for this segment by 2025.

- Revenue Growth: Brink's demonstrated consistent revenue growth throughout 2024, exceeding analyst expectations.

- Strategic Focus: Emphasis on high-margin segments like AMS and DRS is a core promotional message to investors.

- Future Outlook: Investor communications project continued expansion and profitability improvements in key service areas through 2025.

- Investor Engagement: Regular earnings calls and presentations provide transparent updates on financial health and strategic direction.

Strategic Alliances and Partnerships

Brink's strategic alliances and partnerships are a key component of its marketing mix, demonstrating a commitment to market expansion and service diversification. For instance, announcements of collaborations with crypto custody firms and ATM software providers signal the company's intent to tap into new and evolving markets.

These strategic moves generate positive media attention, which is crucial for broadening appeal to diverse client segments. By aligning with innovative companies, Brink's can enhance its service offerings and reach a wider customer base.

In 2024, Brink's has been actively pursuing such partnerships to bolster its position in the secure logistics and payment processing sectors. For example, their collaboration with a leading ATM software provider aimed to streamline cash management solutions, a move expected to increase operational efficiency for financial institutions.

- Market Expansion: Partnerships with crypto custody firms indicate Brink's strategic entry into the digital asset security space.

- Service Diversification: Collaborations with ATM software providers enhance Brink's portfolio of cash management and logistics services.

- Media Appeal: Such alliances generate positive press, increasing brand visibility and attracting new customer segments.

- Operational Efficiency: Agreements with technology partners aim to improve the effectiveness and reach of Brink's core services.

Brink's promotion strategy centers on its long-standing reputation for security and trust, a key differentiator in the high-value asset management sector. This narrative is reinforced by consistent investment in technological advancements, such as smart safes and real-time cash visibility platforms, showcased through targeted industry events and publications.

The company actively uses investor relations and financial communications to highlight strategic growth, particularly in high-margin areas like Armored Money Services and Digital Retail Solutions, projecting continued expansion through 2025. Strategic alliances with firms in areas like crypto custody and ATM software further broaden Brink's market reach and enhance its service portfolio.

| Promotional Focus | Key Initiatives | Supporting Data/Examples |

|---|---|---|

| Legacy & Trust | Highlighting 160+ year history in security | $3.9 billion revenue in 2023, reflecting client trust |

| Technological Innovation | Smart safes, real-time cash visibility, ATM managed services | Continued investment in advanced ATM services in 2024 |

| Industry Engagement | Exhibiting at trade shows (e.g., GSX), advertising in trade magazines | Targeting security and financial publications in 2024 |

| Investor Relations | Earnings calls, annual reports, investor presentations | Focus on high-margin segments (AMS, DRS); Q3 2024 call projected DRS profitability increase by 2025 |

| Strategic Partnerships | Collaborations with crypto custody and ATM software providers | Announced partnerships in 2024 to expand into new markets |

Price

Brink's pricing strategy is firmly rooted in value-based principles, acknowledging the critical importance of security and risk mitigation for its clients. This approach ensures that the cost reflects the substantial investment in safeguarding valuable assets, from specialized armored vehicles to advanced tracking technology.

The company's pricing structure inherently accounts for the comprehensive insurance coverage provided, which is substantial given the high-value nature of the goods transported. Furthermore, it covers the deployment of highly trained security personnel and the maintenance of state-of-the-art, secure facilities, all contributing to a robust risk mitigation framework.

For instance, in 2024, Brink's reported revenue of approximately $3.1 billion, a testament to the demand for their specialized services. This figure underscores the market's willingness to pay a premium for the peace of mind and operational reliability Brink's delivers, far exceeding the cost of basic transportation.

Brink's employs a service-specific and tiered pricing strategy. The cost of services like cash management, secure logistics, and ATM services is directly tied to the type of service and the volume or value of the assets handled.

For instance, a large financial institution requiring extensive cash-in-transit services will face different pricing than a small retailer needing occasional secure transport. This granular approach ensures that clients pay for what they use.

Brink's also offers tiered pricing structures and bespoke plans. This flexibility caters to the varied requirements and operational scales of its client base, which includes financial institutions, retail businesses, and government entities, ensuring competitive and tailored solutions.

Brink's leverages subscription and managed service contracts, particularly for offerings like ATM Managed Services and Digital Retail Solutions. This approach ensures clients benefit from predictable expenses, while Brink's secures consistent, recurring revenue streams. This aligns with Brink's strategic focus on expanding its higher-margin, recurring revenue segments.

In 2023, Brink's reported that its Cash-in-Transit segment, which often includes managed services, generated approximately $2.8 billion in revenue. The company's ongoing investments in digital solutions and managed services are designed to further bolster this recurring revenue base, aiming for continued growth in these more profitable areas.

Competitive Pricing within the Security Industry

Brink's must strategically price its security and logistics services to remain competitive. This involves a careful balance between highlighting the value proposition and aligning with industry benchmarks. For instance, in 2024, the global security services market was valued at approximately $245 billion, indicating a highly competitive landscape where pricing plays a crucial role in market share acquisition.

The company's pricing models are designed to reflect the diverse needs of its clientele, from small businesses to large corporations, while also considering the operational costs and the inherent risks in handling valuable assets. Brink's analyzes competitor pricing structures and market demand to ensure their offerings are perceived as both valuable and cost-effective. This approach is critical for retaining existing customers and attracting new ones in a market where price sensitivity can be high.

- Value-Based Pricing: Brink's emphasizes the comprehensive security and reliability of its services, justifying its pricing tiers.

- Competitive Benchmarking: Pricing is informed by competitor rates for similar services in the same geographic regions.

- Market Demand Analysis: Fluctuations in demand for cash-in-transit and secure logistics services influence pricing adjustments.

- Profitability Targets: Pricing strategies are calibrated to ensure sustained profitability and investment in service enhancement.

Scalability and Customization for Client Needs

Brink's pricing strategy is built around flexibility and customization to meet diverse client needs. This approach ensures that whether a client requires broad geographic coverage, frequent service, or complex integration, Brink's can tailor a solution. For instance, in 2024, Brink's continued to offer tiered service packages for cash-in-transit, with pricing varying based on the volume of cash handled and the number of armored vehicles deployed.

This adaptability allows Brink's to cater to a wide range of budgets, from small businesses to large multinational corporations. By adjusting service parameters, Brink's can deliver the essential security and efficiency clients demand without unnecessary costs. This is particularly evident in their vault services, where pricing can be adjusted based on the volume of assets stored and the required level of access control.

- Customizable Service Tiers: Pricing adjusts based on geographic reach and service frequency.

- Integration Complexity: Costs vary with the technical demands of integrating Brink's solutions.

- Budget Alignment: Tailored solutions ensure security and efficiency fit within client financial parameters.

- Value-Based Pricing: Brink's focuses on delivering security and efficiency commensurate with client investment.

Brink's pricing is a direct reflection of the high-value, high-risk nature of its services, aligning costs with the robust security infrastructure and expertise provided. This value-based approach ensures clients understand that the price encompasses not just transportation, but comprehensive risk management and asset protection. For example, in 2024, Brink's continued to emphasize the premium associated with its secure logistics, which includes advanced tracking and highly trained personnel, differentiating it from standard courier services.

The company utilizes a tiered and service-specific pricing model, meaning costs are directly tied to the type of service rendered and the volume or value of assets handled. This granular approach ensures clients are charged appropriately for their specific needs, whether it's extensive cash-in-transit for a major bank or specialized secure transport for a smaller business. In 2023, Brink's Cash-in-Transit segment generated approximately $2.8 billion in revenue, illustrating the significant market demand for these tailored, volume-dependent services.

Furthermore, Brink's incorporates subscription and managed service contracts, particularly for offerings like ATM Managed Services. This strategy provides clients with predictable expenses and secures consistent, recurring revenue for Brink's, aligning with its focus on higher-margin segments. This model is crucial for maintaining profitability and funding ongoing investments in technology and service enhancements, supporting their reported 2024 revenue of around $3.1 billion.

| Pricing Strategy Component | Description | Example/Data Point |

| Value-Based Pricing | Costs reflect comprehensive security, risk mitigation, and asset protection. | Clients pay a premium for peace of mind and operational reliability. |

| Service-Specific & Tiered Pricing | Pricing varies based on service type, asset volume, and value. | Cash-in-Transit revenue in 2023 was approx. $2.8 billion, reflecting diverse client usage. |

| Subscription & Managed Services | Focus on recurring revenue for services like ATM Managed Services. | Contributes to consistent revenue streams and higher-margin segments. |

| Overall Revenue Impact | Demonstrates market acceptance of pricing for specialized security services. | Reported 2024 revenue of approx. $3.1 billion. |

4P's Marketing Mix Analysis Data Sources

Our Brink's 4P's Marketing Mix Analysis is built upon a foundation of verified, up-to-date information. We meticulously gather data from official company communications, financial reports, industry analyses, and competitive intelligence to ensure accuracy and relevance.