Bloomberg SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomberg Bundle

Bloomberg's dominance in financial data is undeniable, but understanding the nuances of their competitive landscape requires a deeper dive. Our comprehensive SWOT analysis reveals the strategic advantages and potential vulnerabilities that shape their market position.

Want the full story behind Bloomberg's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bloomberg's market dominance, particularly with its Bloomberg Terminal, is a cornerstone of its strength. This terminal is an indispensable tool for over 325,000 financial professionals globally, as reported in early 2024. This widespread adoption translates into unparalleled brand recognition and a sticky customer base.

This established market position provides a formidable competitive advantage, making Bloomberg a de facto standard for financial data and analytics. The company's consistent revenue growth, consistently exceeding billions annually, underscores its robust performance and reinforces its leadership in the financial information sector.

Bloomberg's strength lies in its incredibly comprehensive and real-time data. It covers a vast array of asset classes, news, and analytical tools, making it indispensable for financial professionals. For instance, as of early 2024, the terminal provides access to over 70 million data points, updated constantly.

This depth allows users to conduct thorough research and manage portfolios with precision. The platform's ability to integrate sustainability data and climate solutions, a growing area of interest, further solidifies its position as a go-to resource for informed decision-making in 2024 and beyond.

Bloomberg's extensive global news organization, staffed by thousands of journalists and analysts, provides unparalleled daily financial content and insights. This vast network ensures timely and authoritative coverage, solidifying Bloomberg's reputation as a leading source of financial information.

Beyond its core terminal, Bloomberg's media reach extends across television, radio, and magazines, amplifying its influence. This multi-platform approach allows Bloomberg to deliver thought leadership and reach influential audiences globally, effectively complementing its data services and reinforcing its brand.

Technological Leadership and AI Integration

Bloomberg's commitment to technological leadership, particularly in AI and machine learning, is a significant strength. They've consistently invested in applying these technologies to financial data, as seen with solutions like AI-Powered Document Insights. This focus is crucial for staying ahead in an evolving market.

This dedication to innovation aims to redefine the Bloomberg Terminal experience for the AI era, enhancing capabilities such as search, summarization, and complex data analysis. By improving user productivity and efficiency, Bloomberg solidifies its position as a vital tool for financial professionals.

For instance, Bloomberg reported a substantial increase in the use of its AI-powered features in early 2024, with clients leveraging these tools for faster data extraction and analysis. This adoption rate underscores the perceived value and effectiveness of their technological advancements.

Key AI-driven enhancements include:

- Enhanced Search Functionality: Allowing users to find information more quickly and accurately.

- Automated Summarization: Providing concise overviews of lengthy financial documents.

- Advanced Data Analysis: Uncovering deeper insights from complex datasets.

- Productivity Gains: Streamlining workflows and reducing manual effort for users.

Strong Client Base and Ecosystem

Bloomberg's strength lies in its deeply entrenched, high-value client base within the financial sector. Institutions like major investment banks, active hedge funds, large corporations, and government bodies rely heavily on its services. This strong foundation ensures consistent demand and revenue streams.

The Bloomberg Terminal, coupled with its enterprise data management and trading solutions, creates an integrated ecosystem. This synergy makes Bloomberg an essential, often irreplaceable, tool for its users, fostering extremely sticky client relationships. For instance, in 2024, Bloomberg reported that over 99% of its terminal clients renewed their subscriptions, a testament to its indispensability.

This robust ecosystem and loyal client base translate into significant competitive advantages. The network effect is powerful, as more users and data on the platform enhance its value for everyone. By 2025, Bloomberg's terminal user base is projected to exceed 350,000, reinforcing its market dominance.

- Dominant Market Share: Bloomberg holds a commanding position in the financial data and analytics market.

- High Client Retention: Over 99% of terminal clients renew subscriptions annually, showcasing extreme stickiness.

- Integrated Ecosystem: The Terminal, data, and trading solutions create a comprehensive and indispensable platform.

- Valuable Network Effect: Increased user adoption and data availability enhance the platform's utility for all participants.

Bloomberg's strengths are rooted in its unparalleled market dominance, driven by the indispensable Bloomberg Terminal, used by over 325,000 financial professionals globally as of early 2024. This widespread adoption creates a formidable competitive advantage and brand recognition. The platform offers incredibly comprehensive, real-time data across numerous asset classes, news, and analytics, with over 70 million data points updated constantly as of early 2024, making it a de facto standard for financial professionals.

Bloomberg's extensive global news organization, with thousands of journalists and analysts, ensures timely and authoritative financial content, reinforcing its reputation. Furthermore, its commitment to technological leadership, particularly in AI and machine learning, as demonstrated by AI-Powered Document Insights, is a key differentiator, enhancing user productivity and data analysis capabilities. Early 2024 saw a substantial increase in the use of these AI features, highlighting their value.

The company boasts a deeply entrenched, high-value client base, including major financial institutions and corporations, ensuring consistent revenue. Its integrated ecosystem of the Terminal, enterprise data, and trading solutions creates sticky client relationships, evidenced by over 99% terminal client renewal rates in 2024. Projections for 2025 indicate the user base will exceed 350,000, further solidifying its market position.

| Strength Category | Key Metric/Fact | Impact |

|---|---|---|

| Market Dominance | 325,000+ Terminal Users (Early 2024) | Indispensable tool, high barrier to entry |

| Data Comprehensiveness | 70 Million+ Data Points (Early 2024) | Enables precise research and portfolio management |

| Client Retention | 99%+ Terminal Renewal Rate (2024) | Stable revenue, sticky customer base |

| Technological Innovation | AI Feature Adoption Increase (Early 2024) | Enhanced user productivity, competitive edge |

What is included in the product

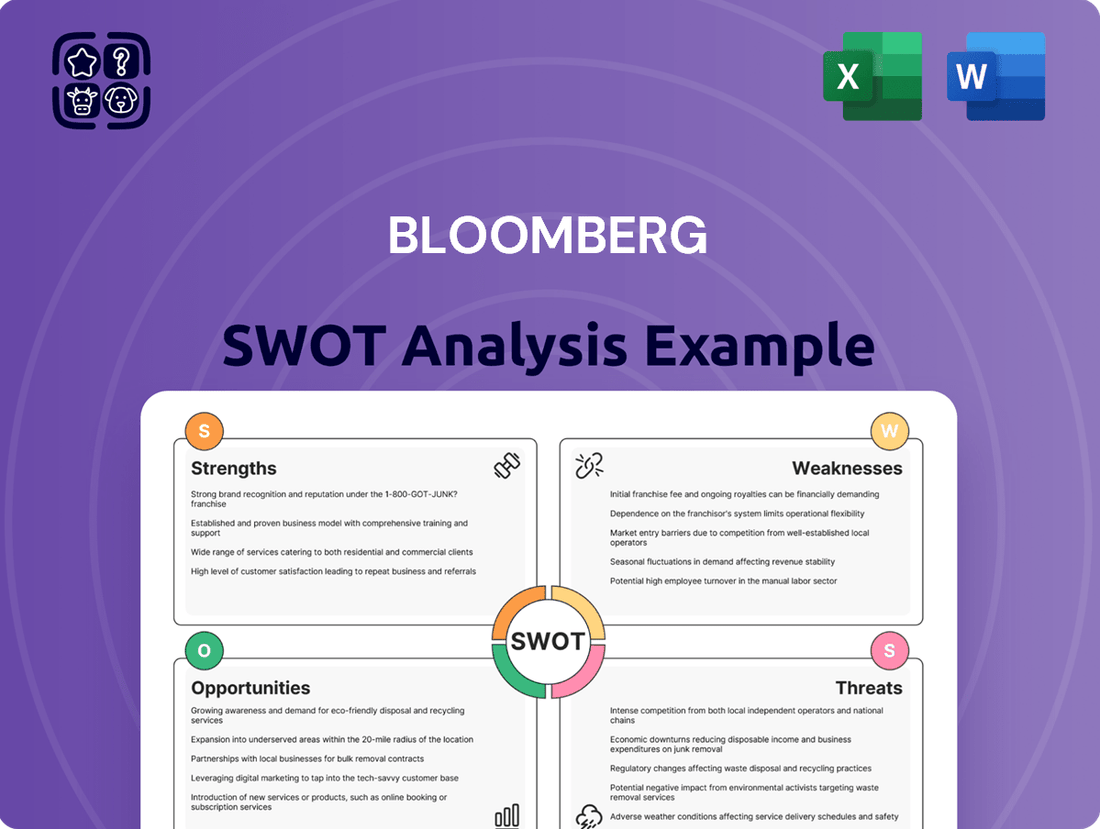

Delivers a strategic overview of Bloomberg’s internal and external business factors, highlighting its competitive advantages and potential challenges.

Offers a clear, visual representation of market position, simplifying complex competitive landscapes for actionable insights.

Weaknesses

The Bloomberg Terminal's significant cost remains a major hurdle, with annual subscriptions projected to reach approximately $32,000 per user in 2025. This substantial investment effectively prices out many individual investors and smaller financial firms who may not fully utilize its extensive capabilities.

The Bloomberg Terminal's interface, while incredibly powerful, is often criticized for its complexity and unintuitive design. This steep learning curve means users need substantial time and training to become proficient, which can be a significant hurdle for smaller teams or those new to financial data platforms. In 2024, many users still report spending weeks, if not months, mastering its full capabilities.

While Bloomberg excels in public market data, its extensive capabilities are often tailored more towards trading and portfolio management. This focus can be a disadvantage for users needing in-depth research, meticulous due diligence, or extensive analysis of private markets. For instance, while Bloomberg Terminal data coverage for public equities is vast, its depth for private company valuations or niche sector research might not always meet the granular requirements of specialized investors.

Dependence on the Terminal for Revenue

Bloomberg's significant revenue is still heavily tied to its iconic Terminal. While this demonstrates the Terminal's enduring value, it also presents a potential vulnerability. If the financial industry's data consumption habits were to drastically change, or if more affordable, competitive solutions emerged and gained widespread adoption, this concentration could pose a risk to Bloomberg's financial stability.

The reliance on the Terminal means that any disruption to its service or a significant decline in its perceived value could directly impact Bloomberg's bottom line. For instance, while specific 2024/2025 revenue breakdowns are proprietary, industry reports consistently highlight the Terminal as the primary revenue driver, often accounting for the vast majority of the company's income.

- Revenue Concentration: The Bloomberg Terminal is the company's flagship product and its primary source of revenue.

- Market Shift Risk: A substantial shift in how financial professionals access data or the rise of compelling, lower-cost alternatives could threaten this revenue stream.

- Dependence Vulnerability: This heavy reliance makes Bloomberg susceptible to changes in market demand for its core offering.

Exposure to Economic Crises and Market Volatility

Bloomberg's business model, heavily reliant on its terminal subscriptions, makes it inherently susceptible to economic downturns. During periods of financial stress, clients, including financial institutions, may cut discretionary spending, directly impacting Bloomberg's revenue streams. For instance, a significant recession could lead to a contraction in the number of active terminals or increased price sensitivity among its customer base, which predominantly consists of high-value financial services firms.

Market volatility, while sometimes driving demand for real-time data, can also exacerbate economic crises. This turbulence can lead to reduced trading volumes and lower asset values, indirectly affecting the profitability and spending capacity of Bloomberg's core clientele. The firm's revenue, which is largely recurring, could face headwinds if widespread budget cuts are implemented across the financial sector in response to market instability.

- Exposure to Economic Downturns: Financial crises can shrink client budgets for premium data services.

- Pricing Pressure: Market turbulence may force Bloomberg to offer discounts, impacting profit margins.

- Reduced Demand: Economic slowdowns can lead to fewer new terminal subscriptions and potential cancellations.

Bloomberg's reliance on its high-priced Terminal creates a significant barrier to entry for many potential users. This exclusivity means that individual investors and smaller firms often cannot afford the service, limiting its reach. Furthermore, the Terminal's complexity demands extensive training, with many users in 2024 still reporting weeks of dedicated effort to achieve full proficiency.

While Bloomberg offers a vast array of data, its primary focus on public markets and trading can be a drawback for those requiring deep dives into private markets or niche sectors. This specialization might not cater to every analytical need, especially for due diligence or specialized investment strategies. The firm's revenue model, heavily anchored to the Terminal, also presents a vulnerability; a significant shift in data consumption habits or the emergence of disruptive, lower-cost alternatives could pose a substantial risk to Bloomberg's financial stability.

| Weakness | Description | Impact |

|---|---|---|

| High Cost | Annual subscriptions are projected around $32,000 per user in 2025, limiting accessibility. | Excludes individual investors and smaller firms, reducing market penetration. |

| Complexity & Learning Curve | The interface requires significant time and training for users to master. | Hinders adoption by new users and smaller teams, impacting efficiency. |

| Focus on Public Markets | Less emphasis on granular private market data or niche sector research. | May not meet the detailed needs of specialized investors focused outside public equities. |

| Revenue Concentration | Over-reliance on Terminal subscriptions for the majority of revenue. | Makes the company vulnerable to market shifts or competitive pressures on its core product. |

Preview the Actual Deliverable

Bloomberg SWOT Analysis

The preview you see is the actual Bloomberg SWOT analysis document you'll receive upon purchase. There are no hidden surprises; you get the full, professionally crafted report. This ensures you know exactly what you're buying.

Opportunities

Bloomberg can capitalize on the burgeoning AI and machine learning landscape by embedding these technologies across its platform. This includes leveraging generative AI to offer sophisticated search functionalities, automate report summarization, and provide more accurate predictive analytics, directly addressing the evolving needs of financial professionals.

By integrating advanced AI, Bloomberg can unlock new revenue streams through specialized analytical tools and enhanced data insights. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the significant demand for AI-powered solutions that can improve efficiency and decision-making in complex financial environments.

The surge in sustainable finance presents a significant opportunity for Bloomberg. As investor focus intensifies on environmental, social, and governance (ESG) factors, Bloomberg can bolster its offerings in this domain. This includes expanding data sets, analytics tools, and platforms designed to help clients navigate climate risks and integrate sustainability into their investment strategies.

By enhancing its sustainable finance products, Bloomberg can cater to the growing demand for ESG insights. For instance, the increasing adoption of ESG investing, with global sustainable investment assets projected to reach $50 trillion by 2025, underscores the market's potential. Bloomberg's ability to provide robust data and analytics in this area positions it to capture a larger share of this expanding market.

Bloomberg can expand its market by creating more affordable, scaled offerings for mid-market firms and individual investors. This strategy moves beyond its traditional institutional focus, potentially tapping into a significant, underserved segment of the financial community.

For instance, a tiered subscription model offering access to specific data modules or analytical tools could appeal to smaller investment teams. Consider that in 2024, the wealth management sector saw substantial growth, with assets under management for independent advisors reaching record highs, indicating a strong demand for accessible, high-quality financial data.

By developing simplified interfaces and potentially even a dedicated retail platform, Bloomberg could attract a new wave of users. This approach mirrors trends seen in other software industries where freemium or tiered access models have successfully broadened customer bases, with many fintech platforms reporting double-digit user growth in the past year.

Leveraging Data for Broader Enterprise Solutions

Bloomberg possesses a significant opportunity to broaden its enterprise solutions beyond traditional financial data and trading platforms. By leveraging its vast data resources and analytical capabilities, the company can develop specialized data services tailored to diverse industries.

This expansion could target critical business areas such as enhancing supply chain stability, bolstering enterprise-wide risk management frameworks, and enabling hyper-personalization in customer engagement strategies. The company's existing infrastructure and data science expertise provide a strong foundation for these ventures.

For instance, in 2024, the global big data and business analytics market was projected to reach $374.3 billion, indicating a substantial demand for advanced data solutions across sectors. Bloomberg can capitalize on this by offering:

- Industry-specific data analytics platforms for sectors like healthcare, manufacturing, and retail.

- Enhanced supply chain visibility tools that integrate real-time data for improved resilience and efficiency.

- Advanced customer analytics to drive personalized marketing and service offerings.

- Integrated risk management solutions that go beyond financial markets to cover operational and strategic risks.

Strategic Partnerships and Acquisitions

Bloomberg can significantly bolster its market position by forging strategic partnerships and pursuing acquisitions within the fintech and specialized data sectors. This approach allows for the rapid integration of cutting-edge technologies and the expansion of services into high-growth areas such as alternative data analytics and private market intelligence. For instance, in 2024, Bloomberg continued its focus on acquiring smaller firms to enhance its data capabilities, a trend that has historically proven effective in keeping pace with market evolution.

These strategic moves are crucial for maintaining Bloomberg's competitive edge in the fast-paced financial technology landscape. By absorbing innovative solutions and expanding its data reach, Bloomberg can offer more comprehensive and sophisticated tools to its diverse client base, from individual investors to large financial institutions.

- Acquiring fintech startups can bring in novel technologies and user interfaces.

- Partnering with specialized data providers expands access to niche market information, such as alternative data sets.

- Targeting companies with expertise in AI and machine learning can enhance data processing and predictive analytics capabilities.

- Expansion into emerging markets through local partnerships can tap into new revenue streams and client bases.

Bloomberg can leverage the growing demand for AI and machine learning by integrating these technologies across its platform. This includes enhancing search functionalities, automating report summaries, and improving predictive analytics to better serve financial professionals. The global AI market's projected growth past $200 billion in 2024 highlights the significant opportunity for AI-powered financial solutions.

The increasing focus on sustainable finance presents another key opportunity. By expanding its ESG data sets and analytics tools, Bloomberg can cater to investors integrating environmental, social, and governance factors into their strategies. With sustainable investment assets projected to reach $50 trillion by 2025, Bloomberg is well-positioned to capture a substantial share of this expanding market.

Bloomberg can also broaden its market reach by developing more accessible, scaled offerings for mid-market firms and individual investors. This strategic move, potentially including tiered subscription models, could tap into an underserved segment of the financial community, mirroring the success of fintech platforms in attracting new user bases.

Furthermore, Bloomberg can expand its enterprise solutions beyond finance by offering specialized data services to diverse industries. Targeting areas like supply chain management, risk management, and customer engagement, Bloomberg can capitalize on the projected $374.3 billion global big data and business analytics market in 2024.

Strategic partnerships and acquisitions in fintech and specialized data sectors are also crucial for maintaining Bloomberg's competitive edge. By integrating cutting-edge technologies and expanding its data reach, Bloomberg can offer more comprehensive tools to its diverse client base.

| Opportunity Area | Key Action | Market Context/Data |

|---|---|---|

| AI & Machine Learning | Embed AI for enhanced analytics and search | Global AI market projected >$200B in 2024 |

| Sustainable Finance | Expand ESG data and analytics offerings | Sustainable investment assets projected $50T by 2025 |

| Market Expansion | Develop scaled offerings for mid-market/retail | Growth in wealth management sector for independent advisors (2024) |

| Enterprise Solutions | Offer industry-specific data analytics | Global Big Data & Business Analytics market projected $374.3B in 2024 |

| Strategic Growth | Acquire fintech startups and partner with data providers | Continued focus on acquisitions for data enhancement (2024 trend) |

Threats

Bloomberg faces significant pressure from a rising tide of alternative data providers. Companies like Refinitiv (now part of LSEG), FactSet, and S&P Global's Capital IQ Pro are increasingly offering robust financial data and analytics, often at more competitive price points. This intensified competition challenges Bloomberg's long-held dominance in the market.

Newer financial research and market intelligence tools are increasingly built on cloud-native architectures with modern user interfaces. This approach offers greater agility and a more intuitive user experience, potentially drawing clients away from Bloomberg's more established, though less flexible, platform.

This technological shift means that clients accustomed to seamless, browser-based or app-driven workflows might find the Bloomberg Terminal's reliance on dedicated hardware and its interface less appealing. In 2024, the demand for integrated, cloud-based solutions that offer real-time data and analytics across multiple devices continues to grow, posing a direct challenge to legacy systems.

Bloomberg, like all major financial data providers, faces escalating threats to data security and privacy. In 2024, the financial services sector experienced a notable increase in cyberattacks, with ransomware and phishing attempts becoming more sophisticated. A significant data breach for Bloomberg could erode client trust, which is paramount in its business model. For instance, reports from late 2023 and early 2024 highlighted the growing financial impact of data breaches, with average costs for financial organizations exceeding $5 million per incident, a figure that underscores the gravity of these threats for Bloomberg.

Economic Slowdowns and Regulatory Changes

Global economic slowdowns, persistent inflation, and the prospect of 'higher for longer' interest rates pose a significant threat. These factors could lead to budget tightening among Bloomberg's clientele, potentially dampening demand for its high-value data and analytics services. For instance, a prolonged economic downturn might see financial institutions scaling back on discretionary spending for premium market intelligence tools.

Evolving regulatory landscapes present another considerable challenge. New rules concerning financial data privacy, market conduct, or even capital adequacy for financial firms could necessitate substantial investments in compliance and system adaptations for Bloomberg. Such changes might also impact the accessibility or cost of certain data streams, requiring strategic adjustments.

- Economic Headwinds: Projections for global GDP growth in 2024 and 2025 indicate a moderating pace compared to previous years, potentially impacting client spending.

- Inflationary Pressures: Persistent inflation can increase operating costs for Bloomberg while simultaneously pressuring clients to reduce expenses.

- Interest Rate Environment: Higher interest rates can increase the cost of capital for Bloomberg and its clients, potentially affecting investment and spending decisions.

- Regulatory Uncertainty: Increased scrutiny and potential new regulations in key markets could require significant compliance investments and operational changes.

Emergence of Open Banking and Data Democratization

The accelerating trend of open banking, driven by regulations like PSD2 in Europe and similar initiatives globally, is democratizing access to financial data. This means essential market information, once exclusively available through premium terminals, is becoming more accessible through APIs and integrated platforms.

This shift poses a threat to Bloomberg's traditional model, as the perceived exclusivity and unique value proposition of its comprehensive terminal could diminish if critical data points become commoditized and widely available elsewhere. For instance, by mid-2024, over 50% of EU banks were expected to be API-enabled under PSD2, facilitating data sharing.

Consequently, Bloomberg must continuously innovate to maintain its competitive edge. This includes offering advanced analytics, unique data sets, and integrated workflows that go beyond simple data access. The challenge lies in demonstrating continued value in an environment where basic financial data is increasingly democratized.

- Open Banking Regulations: Mandates like PSD2 are forcing financial institutions to open up customer data via APIs, increasing data accessibility.

- Data Commoditization: As more data becomes readily available, the premium pricing for basic financial information may face pressure.

- Competitive Landscape: New fintech entrants and existing financial data providers can leverage open banking to offer competing services, potentially fragmenting market share.

- Value Proposition Shift: Bloomberg's future success hinges on its ability to offer superior analytical tools, proprietary insights, and integrated solutions that complement, rather than compete with, democratized data.

Bloomberg faces intense competition from established players like Refinitiv and FactSet, as well as emerging fintechs offering specialized data and analytics. These competitors often provide more cost-effective solutions with modern, cloud-native interfaces, challenging Bloomberg's traditional terminal model. The increasing demand for integrated, agile, and intuitive financial tools in 2024 means Bloomberg must continually adapt to retain its market leadership.

Data security is a paramount concern, with cyberattacks escalating in sophistication. A significant breach could severely damage Bloomberg's reputation and client trust, a critical asset in the financial data industry. The average cost of a data breach for financial organizations in early 2024 was reported to be over $5 million, highlighting the substantial financial and reputational risks involved.

Global economic uncertainty, including moderating GDP growth projections for 2024-2025 and persistent inflation, could lead clients to reduce spending on premium data services. Furthermore, evolving regulatory landscapes, particularly around data privacy and market conduct, necessitate ongoing compliance investments and potential operational adjustments for Bloomberg.

The rise of open banking, exemplified by PSD2 in Europe, is democratizing access to financial data. By mid-2024, over half of EU banks were expected to be API-enabled, making previously proprietary data more accessible. This trend pressures Bloomberg's premium pricing model and requires a strategic focus on proprietary insights and advanced analytics to maintain its value proposition.

| Threat Category | Specific Threat | Impact on Bloomberg | 2024-2025 Data/Trend |

|---|---|---|---|

| Competition | Alternative Data Providers & Modern Platforms | Loss of market share, pressure on pricing | Continued growth of cloud-native fintechs; Refinitiv, FactSet, S&P Capital IQ Pro expanding offerings. |

| Cybersecurity | Data Breaches & Sophisticated Attacks | Erosion of client trust, reputational damage, financial penalties | Average financial sector data breach cost >$5 million (early 2024); increased ransomware and phishing sophistication. |

| Economic Factors | Slowdowns, Inflation, Interest Rates | Reduced client spending, increased operating costs | Projected moderating global GDP growth (2024-2025); persistent inflation impacting budgets. |

| Regulatory Environment | Data Privacy & Market Conduct Rules | Compliance costs, potential data access limitations | Ongoing evolution of financial regulations globally, requiring constant adaptation. |

| Data Accessibility | Open Banking & Data Commoditization | Diminished perceived value of basic data, need for enhanced analytics | Over 50% of EU banks API-enabled under PSD2 by mid-2024, increasing data sharing. |

SWOT Analysis Data Sources

This Bloomberg SWOT analysis is built upon a robust foundation of real-time financial data, comprehensive market intelligence, and expert industry analysis. These sources provide the depth and accuracy necessary for informed strategic evaluation.