Bloomberg Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomberg Bundle

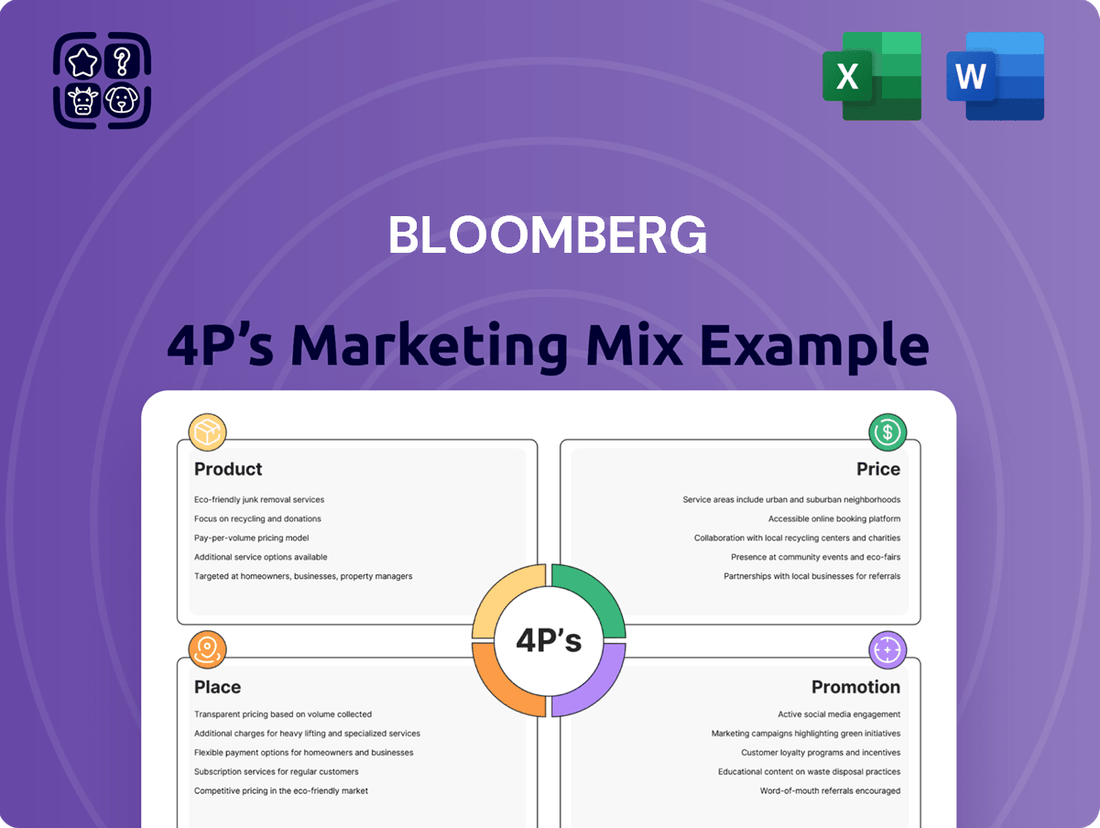

Unlock the secrets behind Bloomberg's market dominance with our comprehensive 4Ps Marketing Mix Analysis. Discover how their innovative product development, strategic pricing, extensive distribution, and impactful promotion create a winning formula.

Go beyond the basics and gain actionable insights into each element of Bloomberg's marketing strategy. This ready-made analysis is perfect for business professionals, students, and consultants seeking a competitive edge.

Save hours of valuable research time. Our editable, presentation-ready report provides a deep dive into Bloomberg's Product, Price, Place, and Promotion, offering structured thinking and real-world examples.

Get instant access to a professionally written, fully editable 4Ps analysis of Bloomberg. Elevate your understanding of their market positioning and communication mix for both business and academic success.

Product

The Bloomberg Terminal is the cornerstone offering, providing unparalleled real-time financial data, breaking news, and sophisticated analytics. It's a deeply integrated software platform giving users access to a colossal universe of market information, solidifying its status as an essential resource for finance professionals worldwide.

This powerful system is continuously evolving, with significant upgrades planned. Notably, by the close of 2025, users will benefit from advanced AI-driven capabilities designed to streamline document search and analysis, enabling quicker extraction of crucial insights from diverse reports and internal communications.

Bloomberg's Enterprise Solutions extend far beyond its iconic Terminal, offering robust financial data management and trading platforms. These comprehensive offerings include real-time market data feeds, advanced portfolio management tools, and sophisticated data analytics services designed for institutional clients.

In April 2025, Bloomberg launched its Real-Time Events Data solution, a significant advancement in processing unstructured data. This innovative product extracts and standardizes information from various sources, delivering critical market event feeds with enhanced speed and accuracy, a key differentiator in today's fast-paced markets.

Bloomberg's news and media offerings are a cornerstone of its 4Ps marketing mix, providing essential financial and business intelligence. They operate a vast global news network, generating over 5,000 articles daily from roughly 2,200 journalists across the globe.

This extensive content is disseminated through multiple channels, including Bloomberg News, Bloomberg Television, Bloomberg Radio, and prominent digital and print publications such as Bloomberg Businessweek and Bloomberg Markets. These platforms deliver timely and in-depth analysis crucial for informed decision-making.

In 2024, Bloomberg continued to be a primary source for market-moving information, with its digital platforms attracting millions of unique visitors seeking financial data and insights. The breadth and depth of their reporting solidify their position as a leader in financial media.

Industry-Specific Intelligence

Bloomberg's Industry-Specific Intelligence is a key part of its product strategy, offering tailored solutions beyond its core financial data. This approach recognizes that different sectors have unique information requirements, driving demand for specialized platforms.

For instance, Bloomberg Law provides professionals with access to comprehensive legal databases, case law, and regulatory updates. Similarly, Bloomberg Tax delivers in-depth analysis of tax codes and strategies. Bloomberg Government offers critical insights into legislative activity and policy changes.

These dedicated services allow Bloomberg to capture significant market share within niche professional communities. By catering to these specific needs, Bloomberg enhances its value proposition and customer loyalty. In 2024, the legal tech market was valued at approximately $20 billion, with Bloomberg Law being a significant player.

- Bloomberg Law: Access to over 80 million court documents and 1.5 million filings annually.

- Bloomberg Tax: Features over 100,000 tax forms and instructions, updated regularly.

- Bloomberg Government: Tracks over 10,000 federal and state legislative bills in real-time.

Sustainability and ESG Data

Bloomberg's commitment to sustainability is evident through its 2024 product enhancements. They launched solutions offering data and analytics on nature-related impacts and dependencies for more than 50,000 companies globally.

This expansion includes financial tools designed to help clients evaluate their exposure to climate change's economic consequences and seamlessly integrate sustainability data into their investment and risk management strategies.

These advancements underscore Bloomberg's dedication to providing increasingly critical Environmental, Social, and Governance (ESG) information, supporting informed decision-making for a diverse range of financial stakeholders.

- Nature-Related Data: Coverage for over 50,000 companies.

- Climate Risk Assessment: Enhanced financial solutions for exposure analysis.

- ESG Integration: Tools for incorporating sustainability into investment processes.

Bloomberg's product strategy centers on its integrated data and analytics ecosystem, led by the Bloomberg Terminal. This offering is continuously enhanced with advanced AI capabilities, aiming to improve data extraction and analysis efficiency for finance professionals. The company also provides specialized industry solutions like Bloomberg Law and Bloomberg Tax, catering to specific professional needs and capturing niche market segments.

| Product Offering | Key Feature | 2024/2025 Data Point |

|---|---|---|

| Bloomberg Terminal | Real-time financial data, analytics, news | AI-driven enhancements by end of 2025 for document search |

| Enterprise Solutions | Data management, trading platforms | Real-Time Events Data launched April 2025 |

| Industry-Specific Intelligence | Tailored legal, tax, government data | Bloomberg Law: 80M+ court documents; Bloomberg Government tracks 10K+ bills |

| Sustainability Data | ESG and climate risk analytics | Nature-related data for 50K+ companies |

What is included in the product

This analysis provides a comprehensive breakdown of Bloomberg's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Eliminates the confusion of complex marketing strategies by presenting the 4Ps in a clear, actionable framework.

Place

The direct subscription model is the cornerstone of Bloomberg Terminal's distribution strategy. Financial professionals and institutions lease the service directly from Bloomberg, ensuring a controlled product delivery and robust customer relationships. This direct channel is crucial for maintaining the premium nature of the terminal.

Bloomberg's subscription leases are typically structured in two-year cycles, reinforcing customer commitment and predictable revenue streams. This model allows for consistent product development and support, vital for a service relied upon for critical financial data and analytics. As of recent reports, Bloomberg continues to command a significant share of the financial data terminal market, underscoring the effectiveness of its direct subscription approach.

Bloomberg's global reach is a cornerstone of its marketing mix, with journalists and analysts stationed in over 100 countries. This vast network allows for the real-time collection and dissemination of financial data from markets across the globe. For instance, their radio broadcasts originate from key hubs including New York, Washington D.C., London, and Hong Kong, ensuring comprehensive international coverage.

Bloomberg extends its reach beyond the exclusive Terminal through robust online platforms and digital access. Bloomberg.com serves as a primary gateway, offering a wealth of financial news, market data, and analysis to a wider audience. This digital presence is crucial for engaging users who may not subscribe to the full Terminal service.

The company also provides digital versions of its renowned publications, such as Bloomberg Businessweek, making in-depth articles and investigative journalism readily available online. This strategy broadens Bloomberg's brand visibility and information dissemination, catering to a diverse user base seeking financial insights on the go.

In 2024, Bloomberg Media reported significant growth in its digital advertising revenue, driven by increased traffic to its online properties. This highlights the effectiveness of their online strategy in capturing a larger market share of digital financial content consumers.

Affiliate Partnerships and Syndication

Bloomberg extends its reach significantly through strategic affiliate partnerships and content syndication, a key component of its marketing mix. This strategy ensures its valuable news and information penetrate diverse media channels, amplifying its brand presence and audience engagement.

Over 400 newspapers and magazines license Bloomberg's content, allowing them to integrate its data and reporting into their own publications. Furthermore, Bloomberg Radio programs and reports are broadcast on more than 500 radio stations nationwide, with a national presence on SiriusXM satellite radio, demonstrating a broad distribution network.

- Content Licensing: Over 400 newspapers and magazines license Bloomberg's news and information.

- Radio Reach: Bloomberg Radio is accessible on over 500 U.S. radio stations and SiriusXM.

- Syndication Value: This broad syndication strategy enhances brand visibility and information dissemination.

Bloomberg Anywhere and Remote Access

Bloomberg Anywhere and Remote Access represent a significant evolution in how financial professionals interact with market data. The Bloomberg Terminal, once tethered to dedicated hardware, now operates as a web-based software accessible from any personal computer. This shift dramatically increases user flexibility, allowing for seamless access from virtually any location.

This enhanced accessibility, branded as Bloomberg Anywhere, directly addresses the need for mobility in today's fast-paced financial world. Professionals can now conduct critical analysis and execute trades whether they are in the office, at home, or traveling. This capability is crucial for maintaining a competitive edge, as market-moving events can occur at any time.

- Increased Productivity: Bloomberg Anywhere allows users to stay connected and productive regardless of their physical location.

- Enhanced Collaboration: Remote access facilitates easier collaboration among team members who may be distributed geographically.

- Cost Efficiency: Transitioning to a web-based model can potentially reduce hardware and maintenance costs for firms.

By mid-2024, a significant percentage of Bloomberg Terminal users leverage remote access capabilities, underscoring its importance in daily workflows. This trend is expected to continue growing as hybrid and remote work models become more ingrained in the financial industry.

Bloomberg's distribution strategy, centered on the Bloomberg Terminal, emphasizes direct sales and leasing to financial institutions. This approach ensures control over product delivery and fosters strong client relationships, maintaining the premium positioning of their core offering. The terminal's availability is further broadened through Bloomberg Anywhere, a web-based platform that allows access from any personal computer, enhancing user flexibility and productivity in a mobile-first financial environment.

Same Document Delivered

Bloomberg 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the final version of the Bloomberg 4P's Marketing Mix Analysis you’ll receive upon purchase.

This comprehensive document, detailing Product, Price, Place, and Promotion strategies, is ready for immediate download and use.

You are viewing the exact, finished analysis you'll get instantly after completing your order, ensuring no surprises.

Promotion

Bloomberg's marketing strategy heavily emphasizes direct sales and cultivating robust client relationships, a crucial element given the high-value and specialized nature of its offerings like the Bloomberg Terminal. Their sales force directly engages with key decision-makers in financial institutions, corporations, and government entities.

This hands-on approach allows Bloomberg to effectively showcase the comprehensive capabilities and tangible value of its products. For instance, in 2023, Bloomberg continued to invest in its global sales force, aiming to deepen relationships with its existing client base, which includes over 360,000 terminal users across more than 170 countries.

Bloomberg's extensive news and media platforms, including Bloomberg News and Bloomberg Television, serve as a cornerstone of its content marketing strategy. By providing real-time financial news, market data, and in-depth analysis, Bloomberg cultivates its image as a definitive source of financial information.

This approach positions Bloomberg as a thought leader, attracting a diverse audience of financial professionals and investors. For instance, in 2024, Bloomberg's digital platforms saw continued growth in user engagement, with millions of daily active users seeking its expert insights and timely reporting on global economic trends.

Bloomberg actively participates in and hosts significant industry events and conferences worldwide, including its flagship Bloomberg Invest series. These gatherings are crucial for fostering connections, demonstrating innovative product developments, and engaging directly with key figures in the financial industry. For instance, Bloomberg Invest 2024 saw record attendance, with over 3,000 financial professionals discussing market trends and technological advancements, highlighting the platform's value in driving industry dialogue and showcasing Bloomberg's latest offerings.

Digital Marketing and Online Presence

Bloomberg’s digital marketing strategy is central to its outreach, leveraging a robust online presence across its websites, social media platforms, and extensive content distribution networks. This digital ecosystem is crucial for connecting with a global audience of financial professionals and investors, effectively showcasing its comprehensive news, in-depth analysis, and diverse product suite.

The company actively uses online channels to disseminate critical financial information and foster user engagement, ensuring timely updates and interactive experiences. For instance, Bloomberg's website and terminals provide real-time market data and news, a core component of its value proposition. In 2024, Bloomberg reported over 350,000 terminal subscriptions, highlighting the significant reach of its digital platforms.

Their online content strategy includes a wealth of articles, videos, and podcasts, all optimized for search engines and social sharing. This approach allows Bloomberg to not only inform but also to attract and retain users seeking financial intelligence. By consistently updating and promoting their digital offerings, they solidify their position as a leading source of financial information.

- Website Traffic: Bloomberg.com attracts millions of unique visitors monthly, serving as a primary gateway for news and product information.

- Social Media Engagement: Bloomberg's active presence on platforms like X (formerly Twitter) and LinkedIn drives significant traffic and brand visibility among financial professionals.

- Content Reach: Their digital content, including articles and videos, is shared widely, amplifying their reach and influence in the financial community.

- Product Promotion: Online channels are vital for introducing and detailing Bloomberg's financial data terminals, software solutions, and training programs.

Targeted Advertising in Financial Publications

Bloomberg likely leverages targeted advertising within specialized financial publications and professional journals. This strategy focuses on reaching a precise audience of financial professionals, investment bankers, and corporate decision-makers, who represent their core customer base. For instance, in 2024, financial media spending by B2B companies saw a significant shift towards digital channels, with platforms like Bloomberg's own terminals and website being key destinations. This precision ensures that promotional messages resonate directly with the individuals most likely to engage with Bloomberg's services, maximizing the efficiency of their marketing investment.

Bloomberg's promotional efforts are multifaceted, combining direct engagement with a powerful digital content strategy. Their sales force actively builds relationships, while their news and media platforms establish thought leadership. Industry events further amplify their reach and showcase innovations.

Digital channels are paramount for connecting with a global audience, disseminating financial intelligence, and driving user engagement. This includes their website, social media, and the extensive content available on their terminals, reinforcing their position as a leading financial information provider.

Targeted advertising in financial publications and professional journals ensures their message reaches key decision-makers. This precision in promotion maximizes the impact of their marketing investments, particularly as B2B spending increasingly favors digital platforms.

| Promotional Channel | Key Activities | 2024/2025 Focus/Data |

|---|---|---|

| Direct Sales | Personalized engagement with financial institutions, corporations, and government entities. | Continued investment in global sales force to deepen client relationships; over 360,000 terminal users in 2023. |

| Content Marketing | Bloomberg News, Television, digital platforms providing real-time data, analysis, and insights. | Millions of daily active users on digital platforms seeking expert insights; continued growth in user engagement. |

| Industry Events | Hosting and participating in conferences like Bloomberg Invest to foster connections and showcase products. | Bloomberg Invest 2024 saw over 3,000 financial professionals attending, discussing market trends. |

| Digital Marketing | Website, social media, content distribution networks for global outreach and user engagement. | Over 350,000 terminal subscriptions in 2024; millions of monthly unique visitors to Bloomberg.com. |

| Targeted Advertising | Advertising in specialized financial publications and professional journals. | Key destination for B2B digital media spending, reaching finance professionals directly. |

Price

Bloomberg's premium pricing strategy underscores the exceptional value and comprehensive data delivered through its services, most notably the Bloomberg Terminal. This approach targets serious financial professionals who require an all-encompassing platform for market analysis and trading.

The annual subscription cost for a single Bloomberg Terminal is significant, typically falling between $20,000 and $32,000. While this represents a substantial investment, it reflects the depth of real-time data, advanced analytics, and trading capabilities provided, which are crucial for informed decision-making in fast-paced financial markets.

Volume discounts are available for organizations requiring multiple terminals, making the service more accessible to larger financial institutions. This tiered pricing structure allows Bloomberg to cater to a range of client needs while maintaining its position as a high-end, essential tool for industry professionals.

Bloomberg's core strategy revolves around a subscription-based revenue model, primarily driven by the Bloomberg Terminal. This terminal, a vital tool for financial professionals, generates over 85% of Bloomberg L.P.'s annual revenue. This consistent and predictable income stream is crucial, enabling substantial and ongoing investments in cutting-edge product enhancements and the robust infrastructure required to deliver real-time market data.

Bloomberg's pricing strategy reflects a tiered structure, acknowledging that the base cost of a Bloomberg Terminal is substantial. This approach is designed to make the service more accessible and cost-effective for organizations requiring multiple units.

For clients committing to more than one Terminal, Bloomberg implements volume discounts. This means the per-unit monthly cost decreases as the number of subscriptions increases, directly incentivizing larger financial institutions and corporations to expand their Terminal footprint.

For example, while a single Terminal might carry a higher individual monthly charge, a package of five Terminals would likely have a lower aggregate monthly cost per Terminal than if each were purchased separately, encouraging deeper client engagement and commitment.

Inflation-Linked Adjustments

Bloomberg implements inflation-linked adjustments to its pricing, ensuring its services remain competitive and profitable amidst rising costs. This approach directly ties price changes to observable economic trends.

Recent price adjustments reflect the weighted global inflation over the preceding two years. For instance, two-year subscriptions commencing or renewing on or after January 1, 2025, will experience a 6.5% price increase. This strategic move allows Bloomberg to offset increased operational expenses and continue investing in its data and analytics platforms.

This pricing strategy is designed to maintain Bloomberg's financial health and capacity to innovate, particularly in the face of fluctuating economic conditions. Such adjustments are crucial for businesses that rely on continuous investment in technology and data acquisition to serve their clients effectively.

- Inflation Impact: Global inflation rates directly influence Bloomberg's pricing structure.

- 2025 Adjustment: A 6.5% increase applies to two-year subscriptions starting or renewing from January 1, 2025.

- Profitability Maintenance: The adjustments help sustain profitability and investment in service enhancements.

Value-Driven Justification

Despite its substantial cost, the Bloomberg Terminal is widely perceived by its users as offering exceptional value, often described by industry insiders as the indispensable "only game in town." This perception stems from the terminal's unparalleled ability to deliver real-time, high-quality financial information, extensive global market coverage, and sophisticated analytical tools. For financial professionals in 2024 and 2025, this integrated ecosystem is critical for maintaining a competitive edge in rapidly evolving markets.

The justification for the terminal's premium pricing is deeply rooted in its comprehensive feature set, which includes:

- Real-time Data: Access to instantaneous market data across all asset classes, crucial for timely trading decisions.

- Advanced Analytics: Sophisticated tools for portfolio analysis, risk management, and economic forecasting.

- Global Reach: Comprehensive coverage of markets worldwide, providing a holistic view of global financial activity.

- Dedicated Support: 24/7 customer service and technical assistance, ensuring uninterrupted workflow for users.

In 2024, the Bloomberg Terminal continues to be a benchmark for financial data and analytics, with ongoing investments in AI and machine learning enhancing its predictive capabilities. This commitment to innovation reinforces its value proposition, making the high subscription fees a necessary investment for many in the financial sector aiming for superior performance and market insights.

Bloomberg's pricing strategy, centered on its Terminal, reflects a premium value proposition for financial professionals. The cost, often between $20,000 and $32,000 annually per terminal, is justified by its comprehensive real-time data, advanced analytics, and global market coverage, making it an essential tool for competitive trading and analysis in 2024 and 2025.

To address the significant cost, Bloomberg offers volume discounts for multiple terminal subscriptions, making it more accessible for larger institutions. This tiered approach encourages deeper client engagement and a wider adoption within organizations. For instance, a commitment to five terminals would likely reduce the per-unit cost compared to individual purchases.

Bloomberg also incorporates inflation adjustments into its pricing. For two-year subscriptions starting or renewing on or after January 1, 2025, a 6.5% price increase will be implemented, reflecting global inflation trends and ensuring continued investment in service enhancements and infrastructure.

The perception of value remains exceptionally high, with many users viewing the Terminal as indispensable. This is due to its unparalleled real-time data, sophisticated analytical tools, extensive global reach, and 24/7 dedicated support, all crucial for maintaining a competitive edge in the dynamic financial landscape of 2024-2025.

| Pricing Component | Estimated Annual Cost (per Terminal) | Key Value Drivers | Target Audience Segment | 2025 Price Adjustment Context |

|---|---|---|---|---|

| Bloomberg Terminal Subscription | $20,000 - $32,000 | Real-time Data, Advanced Analytics, Global Market Coverage, 24/7 Support | Investment Banks, Hedge Funds, Asset Managers, Financial Advisors | 6.5% increase for two-year subscriptions from Jan 1, 2025 |

| Volume Discounts | Variable (decreases with quantity) | Cost-effectiveness for multiple users within an organization | Larger Financial Institutions, Corporations with multiple trading desks | Encourages broader adoption and deeper client commitment |

| Data & Analytics Enhancements | Included in subscription | AI/ML integration, predictive capabilities, new analytical tools | All terminal users | Justifies premium pricing through continuous innovation |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a comprehensive suite of data, including official company filings, investor relations materials, and direct product information. We also incorporate proprietary market research and competitive intelligence to provide a holistic view.