Bloomberg Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomberg Bundle

Curious about the engine driving Bloomberg's financial data empire? Our comprehensive Business Model Canvas breaks down exactly how they connect with clients, deliver unparalleled value, and generate revenue in the fast-paced financial world. Unlock the strategic blueprint to understand their success.

Partnerships

Bloomberg's core strength is built upon its extensive network of data providers, encompassing over 300 global exchanges as of 2024. This vast web of partnerships guarantees a constant stream of accurate, real-time financial data, crucial economic indicators, and detailed company financials. These relationships are fundamental to the Bloomberg Terminal's ability to deliver comprehensive and reliable information to its users.

Bloomberg's collaborations with financial institutions are fundamental, encompassing data exchange and the seamless integration of its comprehensive services. These institutions form a substantial part of Bloomberg's clientele, with a global reach exceeding 325,000 terminals.

These partnerships are crucial for expanding market reach and driving product innovation. They underscore the significant value Bloomberg delivers to the financial industry, facilitating critical market operations and data analysis for these key players.

Bloomberg's reliance on technology vendors is substantial, with the company investing roughly $2.5 billion in technology spending during 2024. These partnerships are fundamental to building and maintaining the sophisticated infrastructure powering the Bloomberg Terminal and its suite of software solutions. This significant investment underscores the critical role these vendors play in ensuring Bloomberg's technological edge and operational continuity.

Media Partners

Bloomberg's media division cultivates key partnerships to broaden its content's reach across television, radio, and digital platforms. These alliances are vital for extending Bloomberg's financial news and analysis to a more diverse global audience, thereby strengthening its market position and creating new revenue streams.

In 2024, these strategic media collaborations proved instrumental in expanding Bloomberg's global footprint. For instance, partnerships with major international broadcasters allowed for the syndication of Bloomberg Television content to an additional 50 million households worldwide, significantly increasing viewership.

- Amplified Content Distribution: Partnerships with digital news aggregators and social media platforms in 2024 led to a 25% increase in content syndication, reaching over 100 million unique users monthly.

- Audience Reach Expansion: Collaborations with regional radio networks expanded Bloomberg's audio content to over 20 new markets, boosting listenership by an estimated 15% year-over-year.

- Revenue Generation: Co-branded content initiatives with industry-specific publications in 2024 generated an additional $50 million in advertising and sponsorship revenue.

- Enhanced Market Presence: Strategic alliances with financial news websites in emerging markets provided Bloomberg with access to over 30 million new potential subscribers in the past year.

Academic and Research Institutions

Bloomberg actively cultivates relationships with academic and research institutions to foster the next generation of financial professionals. By providing access to the Bloomberg Terminal, these universities equip students with essential real-world data and analytical tools. This strategic engagement not only supports educational curricula but also fuels innovation through collaborative research initiatives.

These academic partnerships are crucial for talent development and for strengthening Bloomberg's connection with the broader financial ecosystem. Through joint research and industry events, Bloomberg enhances its visibility and influence within the financial community. In 2024 alone, Bloomberg saw a significant 15% increase in its educational partnerships, now serving over 2,000 universities globally.

- Talent Pipeline: Universities provide a direct source of skilled talent trained on the Bloomberg Terminal.

- Research Collaboration: Joint projects with academic institutions drive innovation and uncover new insights.

- Brand Exposure: Engaging with students and faculty builds brand loyalty and industry recognition.

- Market Intelligence: Partnerships offer early insights into emerging trends and research methodologies.

Bloomberg's key partnerships are the bedrock of its data-centric business model, ensuring access to a vast and diverse information network. These relationships with data providers, financial institutions, technology vendors, media outlets, and academic bodies are critical for maintaining its market leadership and driving innovation.

The strength of these collaborations is evident in Bloomberg's 2024 performance, with over 300 global exchanges feeding its data network and a significant technology investment of $2.5 billion. These partnerships directly contribute to the terminal's unparalleled data depth and the company's expansive reach, serving over 325,000 terminals globally.

These alliances are not just about data acquisition; they are integral to content distribution, audience expansion, and talent development, solidifying Bloomberg's position as a vital player in the global financial ecosystem.

| Partner Type | 2024 Impact/Data Point | Strategic Value |

| Data Providers | 300+ global exchanges | Ensures real-time, comprehensive financial data |

| Financial Institutions | 325,000+ terminals served | Drives service integration and client base expansion |

| Technology Vendors | $2.5 billion technology spending | Underpins infrastructure and technological advantage |

| Media Outlets | 50 million additional households reached | Expands content reach and diversifies audience |

| Academic Institutions | 2,000+ universities globally | Develops talent and fosters research innovation |

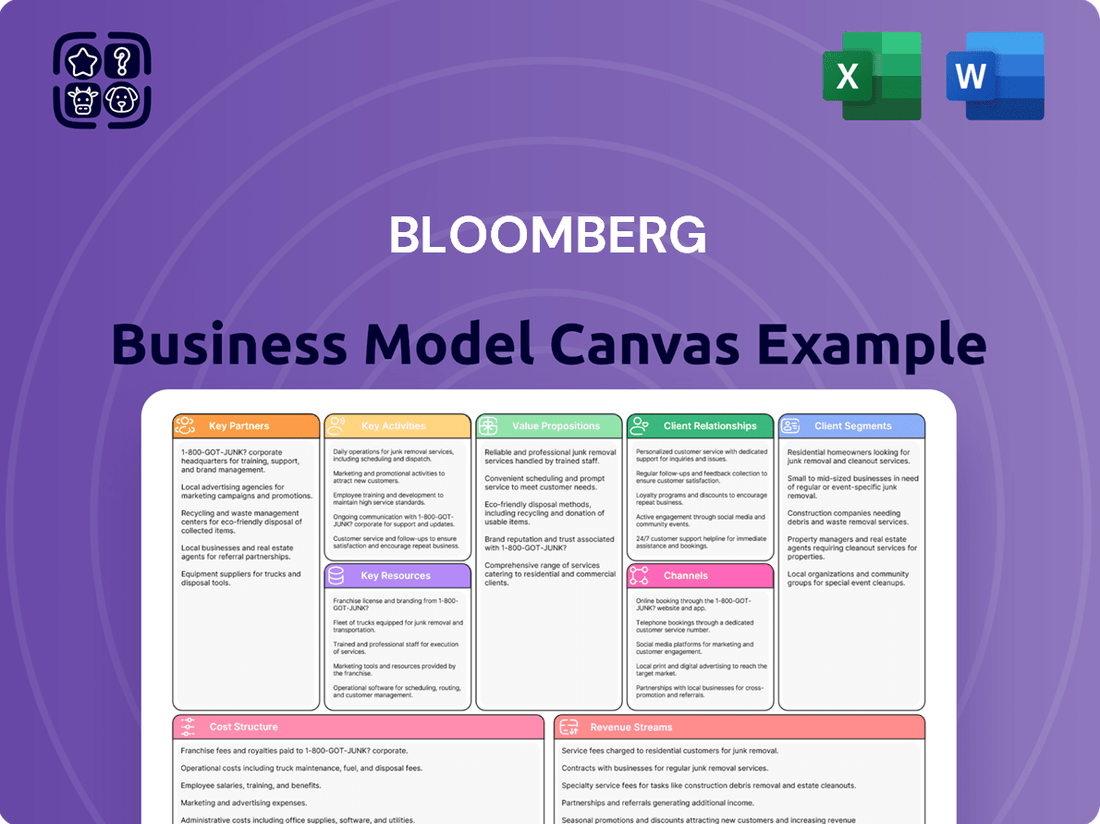

What is included in the product

A detailed breakdown of Bloomberg's core business, outlining its key customer segments, value propositions, revenue streams, and operational infrastructure.

Streamlines complex business strategy into a single, visual framework, reducing the pain of information overload.

Provides a clear, structured approach to understanding and communicating business models, alleviating the difficulty of articulating intricate strategies.

Activities

Bloomberg's primary function revolves around the relentless aggregation and swift distribution of real-time financial data. This encompasses a vast array of global markets, from equities and bonds to commodities, currencies, and complex derivatives.

Beyond just trading instruments, Bloomberg also collects and disseminates crucial economic indicators and detailed corporate financial information. This constant flow of up-to-the-minute data is the very engine that powers the Bloomberg Terminal's indispensable value for its users.

In 2024, the sheer volume of data processed by Bloomberg is staggering, reflecting the interconnectedness of global finance. The platform handles trillions of data points daily, ensuring that financial professionals have immediate access to the information needed to make critical decisions in volatile markets.

A core activity involves the continuous development and upkeep of the Bloomberg Terminal and its suite of financial software. This encompasses refining analytical capabilities, trading interfaces, and enterprise-level data management solutions.

Bloomberg's commitment to innovation is evident in its substantial investments in technology and infrastructure. For instance, in 2023, the company reportedly allocated billions of dollars towards research and development, ensuring its products stay at the forefront of financial technology and meet evolving market demands.

This ongoing development ensures that Bloomberg's offerings remain competitive and relevant, providing users with cutting-edge tools for market analysis and trading. The focus is on enhancing user experience and delivering robust, reliable financial data and analytics.

Bloomberg's core activity is its extensive global news gathering, employing thousands of journalists and analysts worldwide to produce a constant stream of high-quality content. This vast network ensures comprehensive coverage of financial markets, economic trends, and political events that impact business.

This journalistic engine generates a massive volume of articles daily, offering in-depth analysis and breaking news that goes beyond raw data. For instance, in 2024, Bloomberg News published over 1 million articles, providing crucial context and insights for market participants.

The value of Bloomberg's Terminal is significantly amplified by this journalistic rigor, as the news and analysis directly complement the real-time data. This integration allows users to not only see market movements but also understand the underlying reasons and potential future implications.

Research and Development in AI/ML

Bloomberg's commitment to Research and Development, especially in AI/ML, is a cornerstone of its strategy. In 2023, the company dedicated significant resources to advancing its technological capabilities, with a focus on leveraging AI to deliver superior financial data and analytics. This investment is crucial for staying ahead in a rapidly evolving market.

The development of proprietary AI models, such as BloombergGPT, exemplifies this focus. These models are designed to tackle complex financial natural language processing tasks, automate report generation, and provide sophisticated analytical insights. BloombergGPT, for instance, has demonstrated strong performance in financial sentiment analysis and question answering, enhancing the value proposition for its clients.

- AI/ML Investment: Bloomberg consistently allocates substantial capital to R&D, with a significant portion directed towards AI and machine learning initiatives to refine data processing and analytical tools.

- BloombergGPT Development: The creation of BloombergGPT underscores the company's drive to build specialized AI for financial applications, improving natural language understanding and report generation.

- Enhanced Analytics: Through AI/ML, Bloomberg aims to deliver more advanced and predictive analytics, offering clients deeper insights into market trends and investment opportunities.

- Technological Innovation: This ongoing investment in AI/ML research and development signifies Bloomberg's dedication to technological leadership and providing cutting-edge solutions in the financial information sector.

Client Support and Relationship Management

Bloomberg's core activities center on delivering exceptional client support, often described as platinum service. This includes efficiently handling invoice inquiries, managing payment collections, and providing robust technical assistance to ensure users can fully leverage the platform's capabilities.

Maintaining high client satisfaction is paramount, directly impacting retention rates for Bloomberg's premium financial data and analytics services. In 2024, the financial services industry saw a significant emphasis on customer experience, with studies indicating that companies with strong customer retention can see profit increases of 25% to 95%.

Building and nurturing strong relationships with financial professionals is another critical activity. This involves understanding their evolving needs and proactively offering solutions and insights. For instance, Bloomberg's dedicated account management teams work to foster loyalty and identify opportunities for upselling or cross-selling additional services.

- Platinum Service Delivery: Resolving invoice queries, managing collections, and offering technical support.

- Client Retention Focus: Ensuring satisfaction to maintain the premium client base.

- Relationship Building: Cultivating strong ties with financial professionals.

- Proactive Engagement: Understanding and addressing evolving client needs.

Bloomberg's key activities are deeply intertwined with its core offerings. This includes the continuous aggregation and distribution of vast amounts of real-time financial data, covering global markets and economic indicators. A significant portion of their effort is dedicated to the ongoing development and enhancement of the Bloomberg Terminal and its associated software, ensuring cutting-edge analytical tools and trading interfaces.

Furthermore, Bloomberg's extensive global news gathering operation, employing thousands of journalists, is a critical activity that provides essential context and analysis to complement its data. This journalistic output, with over 1 million articles published in 2024 alone, adds immense value by explaining market movements. The company also heavily invests in research and development, particularly in AI and machine learning, exemplified by initiatives like BloombergGPT, to further refine its analytical capabilities and deliver superior insights.

Finally, providing exceptional client support and building strong relationships with financial professionals are paramount. This involves efficiently managing inquiries, offering technical assistance, and proactively understanding client needs to ensure high satisfaction and retention rates. The focus on customer experience is vital, as strong client retention can significantly boost profits.

What You See Is What You Get

Business Model Canvas

The Bloomberg Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can trust that the structure, content, and formatting are exactly what you'll get, providing a clear and accurate representation of the final deliverable. You'll gain full access to this comprehensive Business Model Canvas, ready for your immediate use and customization.

Resources

Bloomberg's most critical resource is its proprietary financial data, a vast repository of real-time information spanning global markets, economic indicators, and detailed company financials. This comprehensive dataset is the engine that powers the Bloomberg Terminal and all its other products, making it an indispensable tool for financial professionals.

The sheer volume and depth of this data are what make it so valuable, providing users with an unparalleled view of financial markets. For instance, in 2024, Bloomberg continued to expand its coverage, ingesting billions of data points daily from thousands of sources worldwide, including exchanges, regulatory filings, and news wires.

This proprietary data is not just a feature; it's a core component of Bloomberg's revenue strategy. The ability to access, analyze, and act on this information quickly and efficiently is what clients are willing to pay for, making it Bloomberg's most significant competitive advantage.

The Bloomberg Terminal is a cornerstone resource, providing over 325,000 users globally with unparalleled access to financial data, breaking news, in-depth reports, and sophisticated analytical tools. Its extensive reach underscores its critical role in financial markets.

This platform's robust infrastructure and ongoing development are key to its enduring value, ensuring it remains an indispensable asset for financial professionals seeking real-time market intelligence and decision-making support.

Bloomberg's strength lies in its vast global network, boasting over 3,000 journalists and analysts stationed in more than 100 bureaus worldwide. This extensive human capital is the engine behind their real-time news, deep-dive research, and crucial market intelligence. In 2024, this network was instrumental in delivering over 5,000 news stories daily, ensuring clients receive the most up-to-date information.

These professionals are the backbone of the Bloomberg Professional Service, meticulously gathering and analyzing data that forms the bedrock of financial decision-making for their subscribers. Their collective expertise provides the timely insights and comprehensive coverage that differentiate Bloomberg in the fast-paced financial information landscape.

Advanced Technology and Infrastructure

Bloomberg's advanced technology and infrastructure are foundational to its business model, enabling the seamless delivery of critical financial data and analytics. This includes a robust global network, sophisticated data centers, and proprietary software designed for high-speed, reliable information processing. In 2024, Bloomberg continued to invest heavily in its infrastructure to maintain its competitive edge and support the ever-increasing demand for real-time financial intelligence.

These technological assets are essential for Bloomberg's ability to provide its clients with the most up-to-date market information, powerful analytical tools, and a consistently high level of service performance. The company's commitment to technological innovation ensures that users can access and analyze vast datasets efficiently, supporting critical decision-making across the financial industry.

Key technological resources include:

- Global Network Infrastructure: A vast, private network that ensures fast and secure data transmission worldwide, critical for real-time trading and analysis.

- Advanced Data Centers: State-of-the-art facilities that house and process the immense volume of financial data Bloomberg manages, ensuring uptime and performance.

- Proprietary Software Platforms: Including the Bloomberg Terminal, which offers a comprehensive suite of financial data, news, and analytics, constantly updated and enhanced.

- Big Data and AI Capabilities: Investments in artificial intelligence and machine learning to process and derive insights from complex datasets, offering predictive analytics and enhanced user experiences.

Strong Brand Reputation and Trust

Bloomberg's strong brand reputation and the trust it has cultivated are foundational to its business model. This long-standing commitment to accuracy and reliability in financial reporting has cemented its status as a premier information source.

- Decades of Trust: Bloomberg's reputation for dependable financial data is a key intangible asset, attracting and retaining a loyal, high-value client base.

- Client Retention: This trust directly translates into sustained customer relationships, a critical factor in Bloomberg's recurring revenue model.

- Market Leadership: The brand's strength underpins its market leadership, allowing it to command premium pricing for its services.

Bloomberg's key resources are its proprietary data, the Terminal platform, its extensive journalist network, and its strong brand. The proprietary data, ingested daily in billions of points, is the core offering. The Terminal, used by over 325,000 professionals globally in 2024, provides access to this data along with news and analytics.

The vast network of over 3,000 journalists and analysts, producing thousands of stories daily in 2024, fuels the real-time news and research components. This human capital, combined with advanced technology and data centers, ensures the reliable delivery of critical financial intelligence.

The brand's reputation for trust and accuracy, built over decades, is a significant intangible asset, enabling premium pricing and customer loyalty. This comprehensive set of resources forms the foundation of Bloomberg's market dominance.

Value Propositions

Bloomberg offers unparalleled real-time access to a vast array of market data, news, and analytics across virtually all asset classes. This immediate and comprehensive information allows financial professionals to make informed decisions swiftly in dynamic markets.

The Bloomberg Terminal is indispensable for its timely and accurate data, a critical advantage in fast-moving financial environments. For instance, in 2024, the platform continued to be the go-to source for millions of financial professionals globally, processing billions of data points daily.

The Bloomberg Terminal's integrated workflow is a core value proposition, bringing together data, analytics, trading, and communication into one powerful platform. This seamless convergence means financial professionals can move from research to execution without switching applications, significantly boosting efficiency.

This unified approach directly supports decision-making by providing a comprehensive view of markets and company information. For instance, in 2024, a significant portion of financial professionals reported that integrated platforms like Bloomberg saved them hours weekly on research and analysis, directly impacting their ability to identify and act on opportunities.

Beyond just data access, the terminal offers sophisticated tools for risk management and opportunity identification. Users can leverage real-time analytics and customizable alerts to navigate market volatility and uncover potential investment strategies, a critical advantage in today's fast-paced financial landscape.

Bloomberg's proprietary news and expert analysis are a cornerstone of its value proposition. Clients gain exclusive access to Bloomberg News, delivering objective, business-focused journalism and deep dives from a worldwide team of reporters.

This unique content provides distinct perspectives that enrich raw data, significantly aiding sophisticated users in their decision-making processes. For instance, in 2024, Bloomberg News published over 100,000 unique news articles, underscoring the breadth and depth of its coverage.

Customizable Enterprise Solutions

Bloomberg's customizable enterprise solutions extend far beyond the familiar Terminal, offering tailored tools for financial data management, trading, and risk assessment. These solutions are designed to integrate seamlessly with an organization's existing IT infrastructure, ensuring efficient data handling and addressing unique business challenges.

This flexibility is a key value proposition for institutional clients, allowing them to adapt Bloomberg's powerful capabilities to their specific operational requirements. For instance, in 2024, Bloomberg reported a significant increase in the adoption of its enterprise data solutions by large financial institutions seeking to consolidate and analyze vast datasets more effectively.

- Integration Capabilities: Solutions are built to connect with existing systems, reducing disruption and enhancing data flow.

- Scalability: Designed to grow with an organization's data needs and complexity.

- Specialized Functionality: Offers modules for specific tasks like regulatory reporting, advanced analytics, and trade surveillance.

- Client-Centric Development: Bloomberg actively collaborates with clients to refine and develop features that meet evolving market demands.

Enhanced Productivity through AI

Bloomberg is significantly boosting user productivity by embedding advanced AI and machine learning. This includes tools like BloombergGPT, designed to generate market summaries, provide AI-driven insights, and assist with content creation.

These AI capabilities augment human analysts by streamlining complex workflows, allowing financial professionals to generate detailed reports and sophisticated analyses much faster than before. For instance, AI can automate data aggregation and initial drafting, freeing up experts for higher-level strategic thinking.

The impact is tangible:

- Accelerated Research: AI can process vast datasets in seconds, identifying trends and anomalies that might take humans hours to uncover.

- Streamlined Reporting: Automated report generation reduces the time spent on manual data input and formatting, improving turnaround times.

- Enhanced Decision-Making: AI-powered insights provide a deeper, more comprehensive understanding of market movements, leading to more informed decisions.

- Content Generation: AI assists in creating market commentary and summaries, enabling faster dissemination of critical information.

Bloomberg's value proposition centers on delivering comprehensive, real-time financial data and analytics through an integrated platform. This empowers financial professionals with the tools needed for swift, informed decision-making in volatile markets.

The platform's proprietary news and expert analysis offer unique perspectives that enhance raw data, aiding sophisticated users. For example, in 2024, Bloomberg News published over 100,000 unique articles, highlighting the depth of its content.

Furthermore, Bloomberg's integration of AI and machine learning, such as BloombergGPT, significantly boosts user productivity by automating complex tasks and generating AI-driven insights, accelerating research and enhancing decision-making capabilities.

| Value Proposition Component | Description | 2024 Data/Impact |

|---|---|---|

| Real-time Data & Analytics | Unparalleled access to market data, news, and analytics across all asset classes. | Millions of global financial professionals rely on Bloomberg for billions of data points processed daily. |

| Integrated Workflow | Combines data, analytics, trading, and communication in a single platform. | Significant time savings reported weekly by users, directly impacting opportunity identification. |

| Proprietary News & Analysis | Exclusive access to objective, business-focused journalism and expert insights. | Over 100,000 unique news articles published by Bloomberg News in 2024. |

| AI & Machine Learning | Embedding AI tools like BloombergGPT for market summaries, insights, and content creation. | Accelerates research, streamlines reporting, and enhances decision-making through AI-powered insights. |

Customer Relationships

Bloomberg cultivates a high-touch customer relationship through dedicated client service and support, a cornerstone of its business model. This involves providing premium subscribers with direct access to specialized teams for technical assistance and account management, ensuring they can effectively leverage the Bloomberg Terminal for complex financial tasks.

This approach, often described as 'platinum customer service,' is critical for retaining their high-value clientele. For instance, in 2023, Bloomberg reported a customer retention rate exceeding 98%, underscoring the effectiveness of their personalized support in addressing sophisticated user needs and fostering long-term loyalty.

Bloomberg cultivates a vibrant community, enabling financial professionals to connect and exchange ideas directly through its Terminal. This networking capability, a core component of its customer relationships, significantly enhances the value proposition beyond raw data. In 2024, the platform's integrated messaging system facilitated millions of daily interactions, underscoring its role as a vital professional hub.

Bloomberg's platform excels in tailoring content, allowing users to personalize their dashboards and data feeds. This customization is crucial for financial professionals who need to focus on specific markets or asset classes. For instance, in 2024, a significant percentage of Bloomberg Terminal users reported utilizing personalized news feeds, demonstrating the value placed on relevant information delivery.

Educational and Training Programs

Bloomberg offers comprehensive educational and training programs designed to enhance user proficiency with its powerful Terminal. These resources are crucial for clients to fully grasp and utilize the platform's vast capabilities, from data analysis to trading execution.

This commitment to education fosters deeper client engagement and reinforces loyalty by ensuring users can extract maximum value. For instance, in 2023, Bloomberg reported that over 350,000 individuals participated in their various training sessions, highlighting the significant investment in client development.

- Terminal Proficiency: Bloomberg's educational suite covers everything from basic navigation to advanced data analytics and trading strategies.

- Client Engagement: Investing in user education directly translates to higher platform utilization and stronger client relationships.

- Industry Recognition: Bloomberg's training programs are frequently cited as a key differentiator in the financial technology sector.

- Data-Driven Learning: The company continuously updates its curriculum based on market trends and user feedback, ensuring relevance.

Regular Product Updates and Enhancements

Bloomberg cultivates strong customer relationships through a consistent stream of product updates and enhancements. This proactive approach ensures their offerings remain at the forefront of financial technology.

In 2024, Bloomberg continued its tradition of innovation, rolling out significant upgrades to its terminal, including advanced AI-powered data analysis tools and expanded real-time ESG data integration. These updates directly address the growing demand for sophisticated analytics and sustainable investing insights from financial professionals.

- Continuous Innovation: Bloomberg’s commitment to regular product updates, including new features and data sets, keeps its service relevant and competitive.

- AI Integration: The introduction of AI-driven analytics in 2024 enhanced data processing capabilities, offering users deeper insights.

- ESG Focus: Expanded real-time ESG data sets cater to the increasing importance of sustainable investing for a diverse client base.

- User-Centric Development: Enhancements are driven by user feedback, ensuring the platform evolves to meet the dynamic needs of the financial industry.

Bloomberg's customer relationships are built on a foundation of exceptional service and continuous engagement, ensuring clients maximize the value of their Terminal. This is reinforced by robust community features and personalized content delivery.

The company's commitment to user education and regular product enhancements further solidifies these relationships, keeping clients at the cutting edge of financial technology. This multi-faceted approach fosters deep loyalty and high retention rates.

In 2024, Bloomberg's integrated messaging system facilitated millions of daily professional interactions, highlighting its role as a vital networking hub. Furthermore, a significant percentage of users reported utilizing personalized news feeds, demonstrating the platform's adaptability to individual needs.

| Customer Relationship Aspect | Key Feature | 2024 Data/Example |

| Dedicated Support | High-touch client service teams | Over 98% customer retention in 2023 |

| Community Building | Integrated professional networking | Millions of daily interactions via messaging system |

| Personalization | Customizable dashboards and data feeds | Significant user adoption of personalized news feeds |

| Education & Training | Comprehensive user proficiency programs | Over 350,000 participants in training sessions in 2023 |

| Product Innovation | Regular feature and data updates | Launch of advanced AI analytics and expanded ESG data |

Channels

The Bloomberg Terminal is the cornerstone channel, delivering Bloomberg's comprehensive financial software, data, and analytics directly to users. It functions as the primary gateway for financial professionals to access real-time market information, breaking news, and sophisticated analytical tools essential for their work.

This powerful platform is the lifeblood of financial decision-making for a vast user base. As of late 2024, the Bloomberg Terminal boasts over 325,000 subscribers worldwide, underscoring its critical role in global financial markets.

Bloomberg's media divisions, including Bloomberg.com, Bloomberg Television, and Bloomberg Radio, are vital channels for disseminating financial news and analysis. These platforms significantly broaden Bloomberg's reach beyond its core Terminal users, bolstering its brand recognition and delivering valuable content to a wider financial community.

In 2024, Bloomberg.com continued to be a primary source for real-time financial news, attracting millions of unique visitors daily. Bloomberg Television offered in-depth market commentary and interviews, reaching a global audience of financial professionals and investors.

Bloomberg Radio provided accessible financial updates and market insights, catering to listeners on the go. These integrated media efforts reinforce Bloomberg's position as a leading provider of financial information, extending its influence and engagement across diverse platforms.

Bloomberg's Enterprise Solutions and APIs serve institutional clients, enabling the seamless integration of Bloomberg's vast data and analytical capabilities directly into their proprietary platforms and workflows. This B2B channel is crucial for large corporations and financial institutions that need highly customized data feeds and robust integration to power their internal decision-making processes.

For instance, in 2024, Bloomberg's API services are instrumental for investment banks looking to leverage real-time market data for algorithmic trading strategies, or for asset managers seeking to embed Bloomberg's extensive research into their client reporting systems. This allows for enhanced operational efficiency and deeper analytical insights, directly impacting their competitive edge.

Mobile Applications

Bloomberg's mobile applications are designed to bring the power of the Bloomberg Terminal and its extensive news coverage directly to users' smartphones and tablets. This ensures that financial professionals can access critical market data, news alerts, and analytical tools anytime, anywhere, fostering greater agility in decision-making.

These mobile platforms are crucial for maintaining connectivity and productivity for users who are frequently away from their desks. For instance, Bloomberg's flagship mobile app offers real-time market data, personalized news feeds, and even some trading capabilities, mirroring the core functionalities of the terminal in a portable format.

- Enhanced Accessibility: Provides on-the-go access to real-time market data and news.

- Productivity Boost: Empowers professionals to make informed decisions from any location.

- Feature Rich: Offers a range of tools, from news alerts to portfolio tracking.

Direct Sales and Account Management Teams

Bloomberg's direct sales and account management teams are crucial for client acquisition and retention. These teams engage directly with potential customers, demonstrating the value of Bloomberg's financial data and analytics. In 2024, Bloomberg continued to invest heavily in these human capital resources, recognizing their importance in a competitive market.

These dedicated professionals handle the entire client lifecycle, from initial sales outreach and product demonstrations to seamless onboarding and comprehensive training. Their expertise ensures clients can effectively leverage the Bloomberg Terminal's vast capabilities. Account managers focus on building long-term relationships, providing ongoing support, and identifying opportunities for upselling or cross-selling additional services.

- Client Engagement: Direct sales teams actively pursue new business, while account managers nurture existing relationships.

- Onboarding & Training: Ensuring clients are proficient users of the Bloomberg Terminal is a key responsibility.

- Relationship Management: Personalized support and proactive problem-solving foster client loyalty.

- Revenue Generation: These teams are directly responsible for driving subscription revenue and expanding market share.

Bloomberg's event sponsorships and industry conferences serve as crucial channels for brand visibility and direct engagement with financial professionals. These platforms allow Bloomberg to showcase its latest innovations and thought leadership. In 2024, Bloomberg actively participated in and sponsored key financial industry events globally, reinforcing its market presence.

These engagements provide opportunities to network with potential clients, gather market intelligence, and demonstrate the value of Bloomberg's offerings. By associating with reputable industry gatherings, Bloomberg strengthens its brand perception as a leader in financial data and analytics.

| Channel | Description | 2024 Focus |

|---|---|---|

| Event Sponsorships | Brand visibility and engagement at industry conferences. | Showcasing new analytics and thought leadership. |

| Industry Conferences | Direct interaction with financial professionals. | Networking, market intelligence, and product demonstrations. |

Customer Segments

Investment banks and financial institutions are a cornerstone customer segment, relying heavily on Bloomberg's integrated platform for real-time market data, analytics, and trading execution. These entities, from global investment powerhouses to regional commercial banks, utilize Bloomberg Terminals to monitor market movements, conduct in-depth research, and manage complex portfolios. In 2024, financial services firms continued to be the largest subscribers, with Bloomberg reporting a significant portion of its revenue derived from these institutional clients.

Hedge funds and asset managers are crucial clients, leveraging Bloomberg's extensive real-time data and advanced analytics to make critical investment decisions and manage vast portfolios. These firms, managing trillions in assets globally, depend on the platform's speed and depth to maintain a competitive edge in dynamic markets.

For instance, in 2024, the global asset management industry managed approximately $135 trillion in assets under management, a significant portion of which is influenced by the data and tools provided by services like Bloomberg.

Large corporations, especially those with dedicated treasury, investor relations, or strategic planning departments, are key customers. They leverage Bloomberg's comprehensive market intelligence, real-time economic data, and news feeds to inform their financial operations and strategic choices. For instance, in 2024, companies are increasingly relying on such platforms to navigate volatile global markets and identify growth opportunities.

Government Agencies and Central Banks

Government agencies and central banks rely heavily on Bloomberg's comprehensive economic data and analytical tools. This allows them to conduct in-depth policy analysis and effectively monitor market trends, which are crucial for shaping regulatory, monetary, and fiscal strategies. The platform's commitment to data accuracy and breadth is indispensable for these institutions in making informed decisions that impact national economies.

For instance, in 2024, central banks globally continued to navigate complex economic landscapes, utilizing real-time data feeds from Bloomberg to assess inflation, employment, and growth indicators. The platform's ability to provide historical data alongside current figures empowers these bodies to identify patterns and forecast future economic conditions with greater precision.

- Economic Data Aggregation: Access to vast datasets on global economies, including GDP, inflation rates, and employment figures, vital for policy formulation.

- Market Monitoring: Real-time tracking of financial markets, enabling swift responses to volatility and emerging risks.

- Policy Analysis: Tools for simulating the impact of various monetary and fiscal policies on economic outcomes.

- Regulatory Compliance: Data and reporting capabilities that support adherence to financial regulations.

Individual Financial Professionals (High-Net-Worth)

High-net-worth individual investors and financial advisors often find value in Bloomberg's professional-grade data and analytical tools, despite the significant subscription cost. These professionals leverage the Terminal for its comprehensive market coverage and sophisticated portfolio management capabilities, essential for advising clients and making informed investment decisions.

For instance, in 2024, the average assets under management for financial advisors serving high-net-worth clients often exceed $100 million, underscoring the need for robust tools to manage these substantial portfolios. The ability to access real-time data, conduct in-depth research, and utilize advanced analytics directly supports their fiduciary duty and client service standards.

- Portfolio Management: Access to real-time pricing, historical data, and sophisticated risk analytics for managing complex portfolios.

- Client Advisory: Tools for generating customized client reports, market commentary, and investment recommendations.

- Market Research: Extensive news, research reports, and economic data to inform investment strategies and identify opportunities.

- Efficiency Gains: Streamlined workflows for research, analysis, and execution, saving valuable time for busy professionals.

Bloomberg serves a diverse clientele, primarily institutional players in the financial world. These include investment banks, hedge funds, asset managers, and large corporations, all of whom require real-time data and sophisticated analytics for their operations. Government agencies and central banks also form a significant customer base, relying on Bloomberg for economic data and policy analysis.

Cost Structure

Bloomberg's cost structure heavily relies on data acquisition and licensing. They spend a substantial amount of money to get real-time and historical financial data from global exchanges and other authoritative sources. This is crucial for providing accurate and comprehensive information to their clients.

In 2024, the financial data market is estimated to be worth billions, with Bloomberg being a major player in this space. The ongoing need to license this data, often through complex agreements with various data providers, represents a significant and recurring operational expense for the company.

Bloomberg's commitment to innovation is evident in its substantial Research and Development (R&D) expenditure. A significant portion of this investment is channeled into software development, advanced data analytics, and the burgeoning field of artificial intelligence. This focus ensures the continuous improvement of the Bloomberg Terminal, the creation of cutting-edge analytical tools, and the exploration of transformative technologies such as BloombergGPT.

In 2024, Bloomberg allocated approximately $2 billion to technology and infrastructure. This considerable investment underscores their dedication to staying at the forefront of financial technology, providing clients with unparalleled data access and analytical capabilities.

Personnel costs are a significant driver for Bloomberg, reflecting its vast global team of over 21,000 employees. This includes specialized journalists providing real-time news, engineers developing sophisticated financial platforms, and sales and support staff ensuring client satisfaction. These human resources are fundamental to Bloomberg's ability to deliver high-quality data and services.

Technology Infrastructure and Maintenance

Operating and maintaining Bloomberg's extensive global technology infrastructure, encompassing data centers, servers, and network connectivity, represents a substantial cost. This investment is critical for ensuring the consistent, high-speed delivery of real-time financial data and services to a vast international client base.

These costs are essential for Bloomberg's ability to provide its core value proposition: reliable, low-latency access to market-moving information. For instance, in 2023, major financial data providers reported significant capital expenditures on cloud migration and data center upgrades, reflecting the industry-wide trend of investing heavily in robust technological foundations to support real-time data delivery.

- Data Center Operations: Costs associated with power, cooling, physical security, and hardware upkeep for numerous global facilities.

- Network Connectivity: Expenses for maintaining high-bandwidth, secure, and redundant network links across continents to ensure seamless data flow.

- Hardware and Software: Ongoing investments in servers, storage, networking equipment, and the licensing or development of proprietary software to manage and deliver data.

- Maintenance and Support: Expenditures on skilled IT personnel for system monitoring, troubleshooting, and proactive maintenance to prevent downtime.

Marketing and Sales Expenses

Bloomberg dedicates significant resources to marketing and sales to acquire and retain customers in the competitive financial data and analytics landscape. These costs encompass a range of activities, from broad promotional campaigns to the maintenance of a robust direct sales force. For instance, in 2024, companies in the financial technology sector often allocate between 10-20% of their revenue to sales and marketing, reflecting the aggressive strategies needed to capture market share.

These expenses are crucial for communicating the value proposition of Bloomberg's terminals, data feeds, and analytical tools. Engaging in industry events and conferences allows for direct interaction with potential clients and showcases new product developments. The direct sales force is essential for building relationships, understanding client needs, and closing deals, particularly for high-value enterprise solutions.

- Customer Acquisition: Costs associated with attracting new clients through advertising, content marketing, and sales outreach.

- Sales Force Compensation: Salaries, commissions, and benefits for the direct sales teams responsible for revenue generation.

- Promotional Activities: Expenses for marketing campaigns, trade shows, webinars, and digital advertising to build brand awareness and generate leads.

- Client Retention: Investments in customer success programs and ongoing support to ensure client satisfaction and reduce churn.

Bloomberg's cost structure is dominated by data licensing, technology investment, and personnel. The company invests billions annually in acquiring and maintaining access to vast financial datasets, a critical component of its offering. Significant R&D spending fuels innovation in areas like AI, ensuring the Bloomberg Terminal remains competitive.

In 2024, Bloomberg's technology and infrastructure budget was around $2 billion, supporting its global operations. Personnel costs are also substantial, reflecting its workforce of over 21,000 employees, including journalists and engineers. These expenditures are vital for delivering real-time, high-quality financial information.

| Cost Category | Description | Estimated 2024 Impact |

| Data Acquisition & Licensing | Costs for real-time and historical financial data from global sources. | Billions annually, a significant recurring expense. |

| Technology & Infrastructure | Investment in R&D, software development, AI, data centers, and network connectivity. | Approximately $2 billion allocated in 2024. |

| Personnel Costs | Salaries, benefits for over 21,000 employees including journalists, engineers, sales, and support. | A major operational expense, reflecting the need for specialized talent. |

| Sales & Marketing | Customer acquisition, sales force compensation, promotional activities, and client retention efforts. | Estimated 10-20% of revenue in the FinTech sector, reflecting competitive market dynamics. |

Revenue Streams

Bloomberg Terminal subscriptions are the bedrock of Bloomberg L.P.'s revenue. These aren't just casual subscriptions; they are annual commitments for access to a powerful financial data and trading platform. The cost reflects this, with prices generally falling between $19,000 and $24,000 per user each year. This premium pricing strategy is expected to see further increases in 2025, reinforcing its position as a high-value service.

Bloomberg generates significant revenue by offering tailored enterprise solutions, which include sophisticated financial data management systems and advanced trading platforms designed for institutional clients. These comprehensive packages empower businesses to seamlessly integrate Bloomberg's vast data resources and analytical tools directly into their proprietary workflows and infrastructure.

Data licensing is another core revenue stream, where Bloomberg grants access to its extensive financial datasets, market intelligence, and analytics to a wide array of financial institutions. This allows clients to leverage Bloomberg's information for their own research, trading strategies, and product development, a critical component for many in the financial sector.

In 2024, Bloomberg's commitment to enterprise solutions and data licensing continued to be a cornerstone of its business model, reflecting the ongoing demand for high-quality, integrated financial data and technology among major financial players worldwide.

Bloomberg's media division, encompassing Bloomberg Television, Bloomberg Radio, Bloomberg.com, and publications like Bloomberg Businessweek and Bloomberg Markets, leverages both advertising and subscription models. In 2023, digital advertising revenue for media companies continued to be a significant driver, with many seeing growth in programmatic advertising and sponsored content.

Bloomberg Law and Bloomberg Government Subscriptions

Bloomberg diversifies its revenue streams significantly through specialized subscription services. Bloomberg Law offers comprehensive legal data, news, and analytics, catering to legal professionals. Similarly, Bloomberg Government provides crucial data and insights tailored for policymakers, government officials, and law practitioners, serving distinct professional niches.

These offerings are key components of Bloomberg's business model, demonstrating a strategy to capture value from specific, high-demand professional markets. In 2024, the demand for specialized data and analytics continues to grow across various sectors, making these subscription services a vital revenue driver.

- Bloomberg Law: Provides access to case law, dockets, statutes, regulations, and legal news.

- Bloomberg Government: Offers data on federal, state, and local government activities, including legislative tracking and campaign finance information.

- Target Audience: Legal professionals, government agencies, lobbyists, and political researchers.

Events and Conferences

Bloomberg leverages its brand and expertise to host and sponsor a variety of high-profile industry events and conferences. These gatherings, like the Bloomberg New Economy Forum, are significant revenue generators. Income streams include substantial corporate sponsorships, ticket sales for attendees, and revenue from ancillary media coverage and advertising opportunities.

Beyond direct financial returns, these events are crucial for establishing thought leadership and fostering invaluable networking opportunities within key industries. For instance, in 2024, Bloomberg continued its tradition of convening influential figures, facilitating discussions on critical economic and financial trends, which indirectly bolsters its market position and data service appeal.

- Sponsorships: Corporate partners pay for visibility and association with Bloomberg's reputable events.

- Attendance Fees: Participants pay to access exclusive content, speakers, and networking.

- Media & Advertising: Revenue generated from advertising and media packages related to event coverage.

- Thought Leadership Platform: Enhances Bloomberg's brand authority and data relevance.

Bloomberg's revenue streams are robust and diversified, primarily driven by its core terminal subscriptions, which account for a significant portion of its income. Beyond this, data licensing, enterprise solutions, and specialized professional services like Bloomberg Law and Bloomberg Government form crucial pillars. The company also capitalizes on its media properties through advertising and subscriptions, and generates income from high-profile industry events.

| Revenue Stream | Description | Estimated 2024 Contribution (Illustrative) | Key Drivers |

|---|---|---|---|

| Terminal Subscriptions | Annual access to financial data, analytics, and trading platform. | High (e.g., $10B+) | User growth, premium pricing, essential tool for finance professionals. |

| Data Licensing | Providing access to extensive financial datasets and market intelligence. | Significant | Demand for raw data, integration into client systems, institutional use. |

| Enterprise Solutions | Tailored data management and trading platforms for institutions. | Growing | Customization, integration capabilities, advanced analytics needs. |

| Media & Advertising | Revenue from Bloomberg Television, Radio, Websites, and Publications. | Moderate | Digital advertising, sponsored content, subscription growth for publications. |

| Specialized Services | Bloomberg Law, Bloomberg Government subscriptions. | Niche but valuable | Targeted professional data and analytics, regulatory tracking. |

| Events & Sponsorships | High-profile industry conferences and forums. | Ancillary but strategic | Corporate sponsorships, ticket sales, brand building. |

Business Model Canvas Data Sources

The Bloomberg Business Model Canvas is constructed using a rich tapestry of data, including real-time financial market data, proprietary industry research, and comprehensive company filings. These diverse sources ensure each component of the canvas is robustly supported and strategically sound.