Bloomberg Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomberg Bundle

Bloomberg's competitive landscape is shaped by powerful forces, from intense rivalry to the ever-present threat of substitutes. Understanding these dynamics is crucial for anyone looking to navigate or invest in this complex market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bloomberg’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bloomberg's proprietary data sources, including its extensive global news organization and direct feeds from financial exchanges, significantly diminish its reliance on external data suppliers. This exclusivity grants Bloomberg considerable leverage, as the number of entities capable of providing such specialized, real-time financial information is inherently limited. For instance, Bloomberg's news division, employing thousands of journalists worldwide, generates unique content that differentiates its terminal offering.

For Bloomberg, the cost and complexity of switching data suppliers, especially for unique datasets, are substantial. This integration process involves significant technical challenges, including adapting to new data formats and ensuring accuracy, which can lead to considerable disruption and expense.

The high switching costs empower current suppliers, particularly those providing specialized or critical information, by giving them leverage. This situation is exacerbated by the fact that some of Bloomberg's data sources are proprietary or highly specialized, making direct replacement difficult and costly.

Bloomberg, while a tech giant, still needs specialized hardware and networking infrastructure. Suppliers of high-performance or custom solutions can wield some power because these components are unique and hard to replace. For instance, a provider of advanced data center cooling systems essential for Bloomberg's massive data processing might have significant leverage.

The difficulty in finding direct substitutes for highly specialized technological components means these suppliers can command better terms. This is particularly true if the supplier's technology is proprietary or deeply integrated into Bloomberg's operations, making switching costs prohibitively high.

However, Bloomberg's sheer size and purchasing volume likely provide substantial counter-leverage. In 2023, Bloomberg reported revenues exceeding $10 billion, giving it considerable negotiating power with even the most specialized suppliers, potentially mitigating their bargaining strength.

Content Contributors and Journalists

Bloomberg's reliance on a broad base of journalists and analysts means that individual content contributors typically hold limited bargaining power. While specialized expertise or exclusive access can offer some leverage, the vast pool of available talent and Bloomberg's established platform generally keep this power in check.

The bargaining power of suppliers, in the context of Bloomberg's content contributors, is relatively low. Bloomberg's extensive global network and its ability to attract a large number of skilled professionals mean that it is not overly dependent on any single contributor or small group of contributors. This abundance of resources allows Bloomberg to maintain favorable terms for its content sourcing.

- Low Supplier Bargaining Power: Bloomberg's vast network of journalists and analysts limits the power of individual content contributors.

- Expertise as a Differentiator: Highly specialized or unique expertise can grant some contributors limited leverage.

- Platform Strength: Bloomberg's established brand and reach reduce reliance on any single external source.

- Content Volume: The sheer volume of content generated internally and sourced externally dilutes the bargaining power of individual suppliers.

Limited Dependence on Commodity Suppliers

Bloomberg's core business revolves around providing information and software solutions, not physical products. This significantly reduces its reliance on traditional commodity suppliers. For instance, in 2023, Bloomberg's revenue was primarily driven by its terminal subscriptions and data services, with minimal direct costs associated with raw materials.

The suppliers Bloomberg does engage with are typically in specialized sectors like technology and information services. These relationships are often strategic and long-term, fostering a more balanced power dynamic. For example, Bloomberg's partnerships with data providers and technology infrastructure firms are crucial for its operations, and the specialized nature of these services limits the bargaining power of individual suppliers.

- Information Services: Bloomberg's reliance on specialized data feeds means suppliers in this niche have some leverage, but Bloomberg's scale often mitigates this.

- Technology Infrastructure: While dependent on cloud providers or hardware manufacturers, Bloomberg's diversified IT strategy limits the power of any single technology supplier.

- Software Development: Outsourced software development, if used, would involve suppliers whose power depends on their unique skill sets and the availability of comparable talent.

The bargaining power of suppliers for Bloomberg is generally low due to the company's significant scale and its ability to generate much of its critical data internally. However, for highly specialized data feeds or unique technological components, certain suppliers can exert more influence.

Bloomberg's extensive internal news gathering and data analysis capabilities, employing thousands of journalists globally, reduce its dependence on external content providers. This internal strength means that individual content contributors often have limited leverage, as Bloomberg can readily substitute or generate similar information.

Suppliers of unique, real-time financial data or specialized technological infrastructure that is deeply integrated into Bloomberg's operations can possess moderate bargaining power. The high costs and technical complexities associated with switching these specialized providers, particularly for proprietary data, can give them an advantage.

Despite some leverage held by specialized suppliers, Bloomberg's considerable purchasing power, evidenced by its reported revenues exceeding $10 billion in 2023, often allows it to negotiate favorable terms, thereby mitigating supplier strength.

| Supplier Type | Potential Bargaining Power | Reasoning |

|---|---|---|

| Internal Content Contributors (Journalists, Analysts) | Low | Vast pool of talent, Bloomberg's internal generation of content. |

| Specialized Data Feed Providers | Moderate | Unique, real-time data, high switching costs for Bloomberg. |

| Technology Infrastructure Providers (e.g., Data Centers) | Moderate | Essential, highly specialized components, difficult to replace. |

| General IT Hardware/Software Suppliers | Low | Availability of substitutes, Bloomberg's scale provides negotiation leverage. |

What is included in the product

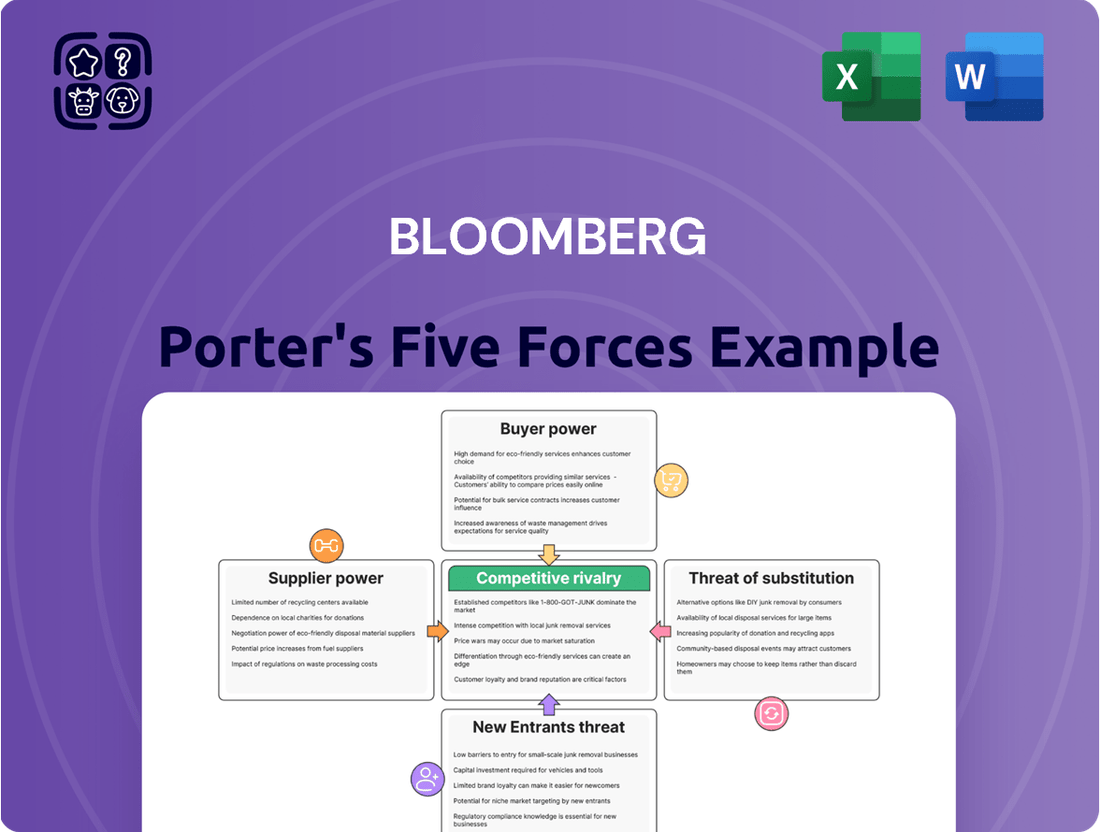

Bloomberg's Porter's Five Forces Analysis dissects the competitive landscape by examining threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry, providing strategic insights into its market position.

Instantly identify and quantify competitive pressures with a visual breakdown of each force, simplifying complex market dynamics for strategic advantage.

Customers Bargaining Power

Customers of the Bloomberg Terminal experience exceptionally high switching costs. The Terminal is so deeply embedded in daily financial operations that moving to another platform necessitates extensive retraining, complex data transfers, and a complete overhaul of established workflows.

This substantial investment and disruption involved in switching significantly curtails the bargaining power of customers. Even when alternative data providers are available, the sheer effort and expense of migration make it impractical for many firms to consider a change, thereby strengthening Bloomberg's position.

The Bloomberg Terminal's status as an industry standard significantly bolsters its position against customer bargaining power. Its widespread adoption creates powerful network effects; the more professionals using Bloomberg, the more valuable it becomes for everyone, making switching costly.

A substantial portion of financial professionals are trained on and deeply familiar with the Bloomberg ecosystem. This deep entrenchment means customers are less likely to seek alternatives, reducing their leverage in price negotiations or feature demands.

Bloomberg's extensive and integrated platform, offering real-time data, news, analytics, and communication, creates a significant barrier for customers seeking to switch or replicate its capabilities. This comprehensive suite, featuring proprietary analytics and functions, locks in clients by providing a unique and difficult-to-match value proposition. For instance, in 2024, Bloomberg Terminal subscriptions represent a substantial investment for financial institutions, underscoring the high switching costs and the difficulty customers face in finding a comparable, consolidated solution.

Price Insensitivity for Core Users

For its core clientele, including investment banks, hedge funds, and major corporations, the Bloomberg Terminal is an indispensable, mission-critical component of their daily operations. The significant annual cost, ranging from $25,000 to over $31,980 per terminal, often represents a minor expense relative to their overall operational budgets. This makes them largely price-insensitive for a service that delivers a crucial competitive advantage and essential functionalities.

This price insensitivity is further amplified by the terminal's role in facilitating high-value transactions and providing real-time data that directly impacts revenue generation. For instance, the ability to access and analyze market-moving information instantly can translate into millions of dollars in trading profits or risk mitigation. Consequently, the perceived value and the necessity of the terminal's capabilities far outweigh its substantial price tag for these sophisticated users.

- Mission-Critical Functionality: Bloomberg Terminal is essential for trading, research, and analytics for financial institutions.

- High Annual Cost: Prices can exceed $31,980 per user annually.

- Small Budget Share: For large financial firms, terminal costs are a fraction of their total operating expenses.

- Competitive Edge: The data and tools provided offer a significant advantage in fast-paced financial markets.

Limited Customer Concentration

Bloomberg's extensive global reach, serving a diverse financial professional clientele, significantly dilutes individual customer influence. This broad user base, spanning numerous institutions, prevents any single entity or small cluster from wielding substantial power to dictate pricing or terms.

The sheer volume and variety of Bloomberg's customers, from individual traders to large asset management firms, mean that the loss of any one client has a minimal impact on overall revenue. This lack of customer concentration is a key factor in limiting their bargaining power.

For instance, in 2024, Bloomberg reported serving hundreds of thousands of users across over 170 countries, with its terminal subscriptions representing a critical, albeit diversified, revenue stream. This wide distribution inherently caps the leverage any single customer group can exert.

- Diverse Client Base: Bloomberg’s customer base is highly fragmented, with no single client accounting for a material portion of its revenue.

- Global Reach: Serving financial professionals in over 170 countries minimizes the impact of any regional or individual client's purchasing decisions.

- Subscription Model: The recurring revenue from a vast number of terminal subscriptions creates a stable income stream, reducing reliance on any specific customer segment.

- Limited Price Sensitivity: For many financial professionals, the value derived from Bloomberg's comprehensive data and tools outweighs minor price fluctuations, further diminishing customer bargaining power.

The bargaining power of customers for the Bloomberg Terminal is notably low due to several key factors. The terminal's deep integration into financial workflows, coupled with high switching costs, significantly limits customers' ability to move to alternative platforms. In 2024, the annual subscription cost for a Bloomberg Terminal, often exceeding $31,980 per user, represents a substantial investment, but for major financial institutions, this cost is a small fraction of their overall operational budget, making them largely price-insensitive.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Switching Costs | Lowers bargaining power due to high retraining, data transfer, and workflow overhaul expenses. | Terminal cost: $25,000 - $31,980+ per user annually. |

| Industry Standard & Network Effects | Reduces leverage as widespread adoption makes alternatives less attractive and switching costly. | Hundreds of thousands of users globally. |

| Mission-Critical Functionality | Diminishes power as the terminal is indispensable for trading, research, and analytics. | Essential for high-value transactions and revenue generation. |

| Customer Concentration | Weakens influence as the broad, global user base dilutes individual customer impact. | Users in over 170 countries; no single client dominates revenue. |

Same Document Delivered

Bloomberg Porter's Five Forces Analysis

This preview showcases the complete Bloomberg Porter's Five Forces Analysis you will receive. The document displayed here is the exact, professionally formatted report, ready for immediate download and use after purchase. You can be confident that what you see is precisely what you'll get, providing a thorough examination of competitive forces within the industry.

Rivalry Among Competitors

Bloomberg faces intense competition from entrenched rivals such as LSEG Data & Analytics, FactSet, and S&P Capital IQ. These established players offer a comprehensive suite of financial data, analytics, and news, directly competing for the same sophisticated financial professional customer base. In 2024, the market for financial data terminals remains highly concentrated, with these key providers holding significant market share.

The financial data and analytics sector demands substantial investment in data acquisition, technology, and robust infrastructure. These high fixed costs mean companies need a broad customer base to spread expenses and achieve profitability, fueling fierce competition for market share.

This cost structure often drives industry consolidation. For instance, in 2023, the financial data services market was valued at approximately $32 billion, with significant M&A activity as larger players acquired smaller ones to gain scale and expand their offerings, thereby increasing competitive intensity.

Competitors in the financial data space are locked in a fierce battle for differentiation. They are constantly rolling out unique features, intuitive user interfaces, and specialized data sets to capture market share. For instance, in 2024, many platforms are heavily investing in integrating generative AI to provide more sophisticated analytical tools and personalized insights, aiming to stand out from the crowd.

This relentless innovation race is particularly evident in the adoption of advanced analytics. Companies are pouring resources into AI and predictive modeling to offer clients a competitive edge. Bloomberg itself has been a leader in this, with its terminal continuously evolving to incorporate new data streams and analytical capabilities, setting a high bar for rivals to match.

Pricing Pressure from Alternatives

Bloomberg's premium pricing faces pressure from a growing number of alternatives. Many competitors, such as Refinitiv (now LSEG), FactSet, and S&P Capital IQ, offer comparable data and analytics, often at a lower price point. For instance, LSEG's Workspace aims to provide a comprehensive suite of tools that can be more cost-effective for certain user segments.

These alternatives frequently emphasize their cost-effectiveness as a primary advantage. In 2024, the financial data and analytics market is highly competitive, with providers constantly innovating to offer value. Some platforms are also developing more modern, user-friendly interfaces, appealing to a younger generation of financial professionals who may find Bloomberg's legacy interface less intuitive.

- Competitive Pricing: Competitors like LSEG and FactSet often position themselves as more budget-friendly options, directly challenging Bloomberg's premium.

- User Interface Innovation: Newer platforms are investing in modern, intuitive designs to attract users accustomed to contemporary software experiences.

- Market Share Dynamics: While Bloomberg maintains a dominant position, the growth of these alternatives signifies a shift in user preferences and a need for competitive pricing strategies.

Global Market Reach and Regulatory Landscape

Competitive rivalry is intensifying as companies aggressively expand their global footprints to secure market share across diverse regions. For instance, in 2024, major tech firms continued their international expansion, with significant investments in emerging markets in Asia and Africa, aiming to capture new customer bases.

The dynamic regulatory landscape, particularly concerning data privacy and digital services, significantly shapes competitive strategies. In 2024, the implementation of new data protection laws in several countries, such as the updated Personal Data Protection Act in Singapore, presented both challenges and opportunities for market entry and operational adjustments for global players.

- Global Expansion: Companies are prioritizing international growth, with cross-border M&A activity in the tech sector reaching an estimated $250 billion in the first half of 2024.

- Regulatory Impact: Stricter data privacy regulations, like those enacted or updated in the EU and several Asian nations during 2024, are forcing companies to adapt their business models and compliance frameworks.

- Market Entry Barriers: Navigating varying national regulations and consumer data protection laws creates significant barriers for new entrants and requires substantial investment from incumbents seeking to expand into new territories.

Bloomberg faces fierce competition from established players like LSEG, FactSet, and S&P Capital IQ, all vying for the same sophisticated financial professional clientele. The financial data terminal market is highly concentrated, with these key providers holding substantial market share in 2024.

High fixed costs associated with data acquisition and technology infrastructure necessitate a broad customer base, intensifying the competition for market share. This dynamic often leads to industry consolidation, as seen in the approximately $32 billion financial data services market in 2023, which experienced significant M&A activity.

Competitors are actively differentiating themselves through unique features, intuitive interfaces, and specialized data sets, with many investing in generative AI in 2024 to offer advanced analytical tools and personalized insights.

The competitive landscape is characterized by a constant drive for innovation, particularly in advanced analytics and AI, as companies like Bloomberg continuously enhance their platforms to maintain a competitive edge.

Pricing pressure is significant, with alternatives like LSEG's Workspace offering comparable data and analytics at potentially lower price points, appealing to cost-conscious segments of the market.

Global expansion is a key strategy, with companies investing in emerging markets to capture new customers, while navigating a complex regulatory landscape that impacts data privacy and operational strategies, as seen with the implementation of new data protection laws in various countries during 2024.

| Competitor | Key Offerings | 2024 Competitive Focus |

|---|---|---|

| LSEG Data & Analytics | Comprehensive financial data, analytics, news | Cost-effectiveness, integrated workspace solutions |

| FactSet | Financial data, analytics, workflow solutions | Advanced analytics, AI integration, user experience |

| S&P Capital IQ | Company and market intelligence, analytics | Specialized data sets, industry-specific insights |

SSubstitutes Threaten

A significant threat to traditional financial data providers like Bloomberg comes from the proliferation of free and low-cost alternatives. Platforms such as Yahoo Finance, MarketWatch, and Investing.com offer readily accessible real-time data, news, and basic analytical tools. These resources, along with social media channels discussing market trends, can satisfy the needs of many individual investors and those with less complex information requirements.

Specialized niche platforms present a significant threat of substitution to broader financial data providers. Platforms like PitchBook, for instance, offer unparalleled depth in private market data, a segment where general terminals might provide less granular information. Similarly, Morningstar excels in investment research and fund analysis, catering to users who prioritize detailed fund performance metrics and sustainability ratings.

Large financial institutions, like JPMorgan Chase and Goldman Sachs, invest heavily in proprietary data systems and advanced financial models. These in-house capabilities can significantly reduce their dependence on external data terminals and analytical platforms such as Bloomberg for specific research and trading functions.

For instance, a significant portion of a large bank's trading desk might utilize custom-built algorithms and internal data feeds, bypassing some of Bloomberg's core offerings. This internal development acts as a direct substitute, particularly for real-time market data analysis and predictive modeling.

Open-Source Tools and APIs

The rise of open-source financial tools and APIs presents a significant threat of substitution. Tech-savvy individuals and smaller firms can now develop bespoke solutions, often at a fraction of the cost of traditional terminal services. This trend is further accelerated by the integration of artificial intelligence, making these alternatives more powerful and versatile.

For instance, the Python ecosystem, with libraries like Pandas for data manipulation and NumPy for numerical operations, has become a robust alternative for financial analysis. Many of these tools are free to use and benefit from continuous community development. In 2024, the adoption of cloud-based open-source platforms for data analytics in finance saw a notable increase, with many firms reporting cost savings of over 30% compared to proprietary solutions.

- Growing Accessibility: Open-source libraries like QuantLib and Zipline offer advanced financial modeling capabilities without licensing fees.

- AI Integration: AI-powered open-source platforms are increasingly capable of performing complex tasks previously exclusive to high-end terminals.

- Cost-Effectiveness: Smaller firms and individual investors can leverage these tools to build sophisticated analytical capabilities, reducing reliance on expensive subscriptions.

- Customization: The flexibility of open-source solutions allows for tailored workflows and analysis, meeting specific user needs more effectively than off-the-shelf products.

Consulting Services and Manual Research

For businesses with less demanding data requirements or those operating on tighter budgets, traditional financial consulting services can act as a viable substitute for platforms like Bloomberg. These services, especially for historical data or less time-sensitive analyses, can offer a more tailored approach. For instance, a boutique investment firm might find a specialized consulting engagement more cost-effective than a full Bloomberg subscription for a specific project.

Manual research, while more labor-intensive, also presents a substitute, particularly for niche markets or when only a limited dataset is needed. Smaller firms or individual investors might leverage publicly available filings, industry reports, and specialized databases to gather necessary information. This approach can be significantly cheaper, though it lacks the speed and breadth of integrated financial data terminals.

- Cost Savings: Manual research and consulting can offer significant cost reductions compared to high-tier data subscriptions, especially for infrequent or specific data needs.

- Tailored Solutions: Consulting services can provide customized analysis and insights directly addressing a firm's unique challenges, which a broad platform might not offer.

- Accessibility: Publicly available data and basic research tools are often more accessible to smaller entities or individual investors than expensive, comprehensive terminals.

- Niche Focus: Specialized consultants or databases might possess deeper expertise or data for very specific industries or asset classes where general platforms are less detailed.

The threat of substitutes for comprehensive financial data terminals remains significant, driven by the increasing availability of free and low-cost alternatives. Platforms like Yahoo Finance and MarketWatch offer real-time data and news, catering to a broad audience. Furthermore, specialized niche providers, such as PitchBook for private markets and Morningstar for fund analysis, deliver deeper insights in specific areas, directly competing with broader terminals.

Proprietary systems developed by large financial institutions, like JPMorgan Chase and Goldman Sachs, also act as substitutes, reducing their reliance on external data providers. The growing accessibility of open-source tools, enhanced by AI integration, empowers tech-savvy users and smaller firms to build custom solutions, often at a fraction of the cost. For instance, in 2024, many firms reported over 30% cost savings by adopting cloud-based open-source analytics platforms.

Manual research and specialized consulting services also present viable substitutes, particularly for firms with less demanding data needs or tighter budgets. These alternatives can offer cost savings and tailored solutions, especially for niche markets or specific analytical projects.

| Substitute Type | Key Features | Target User | Cost Advantage |

|---|---|---|---|

| Free/Low-Cost Platforms | Real-time data, news, basic tools | Individual investors, less complex needs | Minimal to none |

| Niche Data Providers | Deep expertise in specific markets (e.g., private equity, funds) | Specialized analysts, researchers | Potentially lower for specific data needs |

| Proprietary Systems | Customized algorithms, internal data feeds | Large financial institutions | Reduced external dependency |

| Open-Source Tools & AI | Bespoke solutions, advanced analytics | Tech-savvy individuals, smaller firms | Significant (e.g., 30%+ savings reported in 2024) |

| Manual Research/Consulting | Targeted information, tailored analysis | Smaller firms, specific project needs | High, especially for infrequent use |

Entrants Threaten

The financial data and analytics sector presents a formidable barrier to entry due to its significant capital requirements. Companies need to invest heavily in robust technological infrastructure, secure vast datasets, and continuously develop advanced analytical capabilities, including cutting-edge AI. For instance, major data providers in 2024 are channeling billions into cloud computing and AI research to stay competitive.

Beyond financial outlay, the industry demands specialized expertise. Aspiring entrants must possess deep knowledge of financial markets, intricate regulatory landscapes, and sophisticated data science skills. This combination of high upfront costs and the need for specialized talent significantly deters new competitors from entering the market.

Bloomberg's formidable brand recognition and deeply ingrained trust represent a significant barrier for new entrants. Financial professionals, accustomed to Bloomberg's decades of reliable data and analytical tools, are hesitant to switch to unproven platforms for critical decision-making. This established credibility, built over years of consistent performance and accuracy, makes it incredibly difficult for newcomers to gain a foothold.

Bloomberg's Terminal thrives on powerful network effects; its value grows as more users join and engage with its integrated suite of news, chat, and trading tools. This creates a significant barrier for newcomers. For instance, in 2023, Bloomberg reported over 325,000 professional users globally, underscoring the scale of its entrenched user base.

New entrants face immense difficulty in replicating Bloomberg's vast and interconnected ecosystem. The substantial investment required to build a comparable platform, coupled with the existing lock-in of current users who rely on its established workflows and data, makes market entry exceptionally challenging.

Data Sourcing and Licensing Challenges

The threat of new entrants to the financial data and analytics market is significantly influenced by the formidable challenges associated with data sourcing and licensing. Acquiring and maintaining access to the sheer volume and diversity of real-time market data, historical datasets, and crucial news feeds that underpin services like Bloomberg is an incredibly complex and costly endeavor. New players often struggle to establish the necessary infrastructure and secure the rights to these essential data streams, creating a substantial barrier to entry.

For instance, in 2024, the global financial data market was valued at approximately $35 billion, with a significant portion attributed to the licensing of proprietary and aggregated data. New entrants must navigate intricate agreements with exchanges, data vendors, and content providers, often requiring substantial upfront investment and ongoing fees.

- Data Acquisition Costs: Securing licenses for real-time feeds from major exchanges like the NYSE and Nasdaq can run into millions of dollars annually.

- Infrastructure Investment: Building and maintaining the technology to ingest, process, and distribute this data reliably requires significant capital expenditure.

- Regulatory Compliance: Adhering to data privacy and security regulations adds further complexity and cost for new entrants.

- Establishing Trust and Reliability: New entrants need to prove the accuracy and timeliness of their data to gain credibility against established players.

Regulatory Hurdles and Compliance Costs

The financial data and software sector faces substantial barriers to entry due to extensive regulatory oversight. Companies must navigate complex compliance frameworks, such as those mandated by the Securities and Exchange Commission (SEC) in the United States or the European Securities and Markets Authority (ESMA) in Europe. These regulations often require significant investment in technology, legal expertise, and ongoing monitoring to ensure adherence.

These compliance costs can be prohibitive for new players. For instance, the implementation of robust data security protocols and anti-money laundering (AML) systems, critical for financial data providers, can run into millions of dollars. Such substantial upfront and ongoing expenses act as a powerful deterrent, making it difficult for smaller or less capitalized firms to compete with established entities that have already absorbed these costs.

- High Compliance Burden: Financial data providers must comply with numerous regulations, including data privacy laws like GDPR and financial reporting standards.

- Significant Cost of Entry: Meeting regulatory requirements necessitates substantial investment in legal, technological, and operational infrastructure, estimated to be in the millions for comprehensive compliance.

- Deterrent to New Entrants: The complexity and cost of regulatory adherence create a significant barrier, protecting incumbent firms from new competition.

- Example: In 2024, fintech companies seeking to offer investment advisory services faced increased scrutiny and capital requirements, with some startups struggling to secure funding due to these regulatory demands.

The threat of new entrants in the financial data and analytics sector is considerably low, primarily due to the immense capital required for infrastructure, data acquisition, and technological development. Companies like Bloomberg invest billions annually in AI and cloud computing, creating a high financial hurdle for newcomers. The need for specialized expertise in financial markets, regulations, and data science further compounds these barriers.

Porter's Five Forces Analysis Data Sources

Our Bloomberg Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company financial statements, industry-specific market research reports, and regulatory filings to provide a comprehensive view of competitive pressures.