Bloomberg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomberg Bundle

Understand the strategic positioning of a company's products with the Bloomberg BCG Matrix, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This foundational analysis is crucial for informed decision-making. Purchase the full BCG Matrix for a comprehensive breakdown, including detailed quadrant placements and actionable strategic insights to optimize your portfolio.

Stars

Bloomberg's ESG data and solutions, including its new CSRD data offering launched in June 2024, are strategically placed within a rapidly expanding market. This segment is experiencing significant growth, fueled by a surge in regulatory mandates and a heightened investor appetite for sustainability-focused insights.

Leveraging their vast data infrastructure, Bloomberg provides financial professionals with comprehensive ESG information. This extensive coverage is crucial for navigating the increasing complexity of sustainability reporting and investment analysis.

The company's ongoing investment in and enhancement of these capabilities underscores a clear ambition to secure market leadership in the burgeoning ESG sector. This proactive approach positions Bloomberg to capitalize on the evolving demands for transparent and actionable sustainability data.

Bloomberg's commitment to AI is evident in its substantial investments, highlighted by the late 2024 debut of BloombergGPT and the April 2025 release of AI-Powered Document Insights. These advancements position Bloomberg squarely within the burgeoning financial AI sector, aiming to transform data interaction for finance professionals.

These AI-driven tools are designed to streamline how financial experts glean insights and inform their decisions, marking a significant shift in data analysis. The company's proactive innovation in this high-growth area underscores its strategy to secure and expand market leadership.

Bloomberg is making significant strides in enterprise data management and workflow integration, offering solutions that embed its vast data and analytics directly into client systems. This strategic pivot addresses the growing demand for seamless data flow, crucial for operational efficiency in financial institutions.

The market for these integrated solutions is booming, with financial firms actively investing in optimizing their data infrastructure to harness advanced analytics. Bloomberg's flexible data licensing and management tools are key to capturing this expanding segment of the enterprise financial data market.

In 2024, Bloomberg’s focus on enterprise solutions is evident in its continued development of APIs and data feeds designed for deep integration. This strategy is resonating with clients who are looking to consolidate their data sources and streamline analytics, thereby enhancing decision-making processes and operational agility.

Cloud-Based Financial Technology Offerings

The financial industry's pivot to cloud-native solutions for data, analytics, and trading is a major trend. Bloomberg's investment in its cloud-based offerings, delivered via scalable architectures, positions it in a high-growth area.

This strategic emphasis allows Bloomberg to lead in technological innovation, appealing to clients who value flexible and efficient financial technology. For instance, the global cloud computing market in financial services was projected to reach over $50 billion in 2024, highlighting the significant opportunity.

- Bloomberg's cloud strategy addresses the increasing demand for agile data management.

- The company's focus on modern architectures supports scalable analytics and trading platforms.

- This segment represents a key growth driver as financial institutions adopt cloud-first strategies.

Custom AI Chip Design and Networking Equipment for Finance

While Bloomberg doesn't directly manufacture custom AI chips or networking equipment, its deep understanding of financial market infrastructure positions it to capitalize on the burgeoning demand for specialized hardware supporting AI in finance. This area represents a potential "Star" in a BCG-like analysis, given the rapid growth in AI adoption by financial institutions.

The increasing complexity of AI models used in trading, risk management, and fraud detection necessitates high-performance computing and low-latency networking. For instance, the global AI chip market is projected to reach hundreds of billions of dollars in the coming years, with finance being a significant driver of this growth. Bloomberg's potential to influence or participate in this ecosystem, perhaps through strategic partnerships or by providing insights into hardware requirements, could unlock substantial future revenue streams.

Consider the following points supporting this classification:

- High Growth Potential: The market for specialized AI hardware and high-speed financial networking is expanding rapidly, driven by the increasing adoption of AI in financial services.

- Strategic Alignment: Bloomberg's existing expertise in financial data and technology provides a strong foundation for engaging with this hardware-focused segment.

- Market Demand: Financial firms are actively seeking solutions to accelerate AI computations and improve data processing speeds, creating a clear need for custom chip designs and advanced networking.

- Future Opportunities: Potential ventures could include providing consulting on hardware needs, developing specialized software optimized for financial AI workloads, or forming alliances with hardware manufacturers.

Stars in the Bloomberg BCG Matrix represent high-growth, high-market-share business areas. For Bloomberg, the burgeoning market for specialized AI hardware and high-speed financial networking aligns with this classification. This segment is experiencing rapid expansion due to the increasing adoption of AI in financial services, creating a clear demand for advanced computing solutions.

Bloomberg's existing expertise in financial data and technology provides a strong foundation to engage with this hardware-focused segment. Financial firms are actively seeking solutions to accelerate AI computations and improve data processing speeds, underscoring the market need for custom chip designs and advanced networking technologies.

The global AI chip market, a key component of this "Star" category, is projected to reach hundreds of billions of dollars in the coming years, with finance being a significant driver. Bloomberg's potential to influence or participate in this ecosystem, perhaps through strategic partnerships or by providing insights into hardware requirements, could unlock substantial future revenue streams.

| Category | Growth Rate | Market Share | Bloomberg Relevance | Potential |

|---|---|---|---|---|

| AI Hardware & Financial Networking | Very High | Emerging/Growing | High (indirect influence/insight) | Significant future revenue |

| AI Chip Market Growth (Finance Driven) | Projected to reach hundreds of billions USD | N/A (component market) | Key enabler for AI adoption | Strategic partnerships |

| Demand for Accelerated AI Computations | High | High | Directly addresses client needs | Consulting, optimized software |

What is included in the product

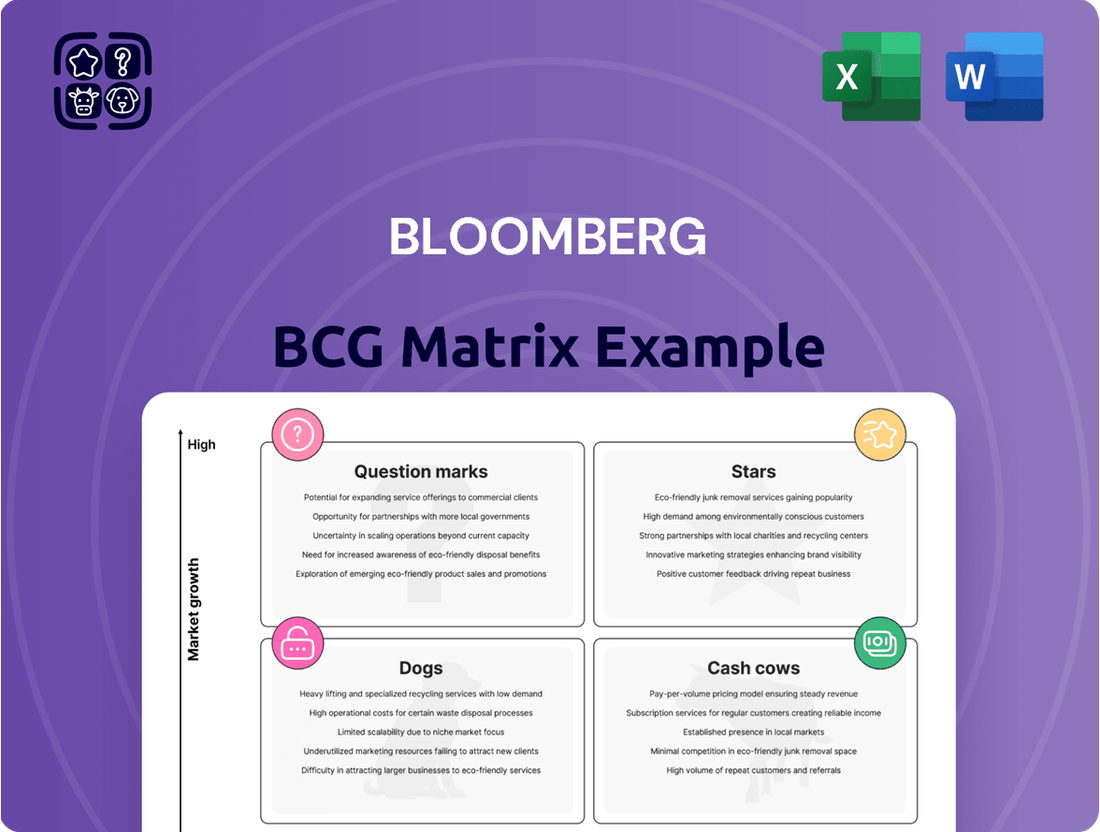

The Bloomberg BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

A clear, visual representation of your portfolio's strengths and weaknesses, simplifying complex strategic decisions.

Cash Cows

The Bloomberg Terminal is a quintessential cash cow for Bloomberg L.P. As of 2024, with roughly 350,000 terminals deployed, it dominates the financial data and analytics sector. This established product consistently generates robust and predictable cash flow.

Bloomberg's Data License Services are a prime example of a Cash Cow within their business portfolio. These services go beyond the well-known Bloomberg Terminal, offering direct access to the company's immense datasets for clients to integrate into their own systems. This allows financial institutions to leverage Bloomberg's unparalleled data infrastructure and content for their specific needs.

This segment thrives on providing consistent, high-margin revenue by catering to large financial institutions that demand customized data feeds. The sheer breadth and quality of Bloomberg's financial data give it a dominant market share, making this a stable and mature business line.

In 2023, Bloomberg's data licensing revenue was a significant contributor, reflecting the ongoing demand for its comprehensive financial datasets. While specific figures for this segment alone are often bundled, the overall growth of Bloomberg's data solutions underscores the strength of this Cash Cow.

Bloomberg's news and media divisions, encompassing Television, Radio, Businessweek, and Markets, act as vital complements to its core Terminal business. While not the primary profit engine, these outlets generate consistent subscription and advertising income, contributing to Bloomberg's strong brand recognition and market presence.

These media assets are instrumental in delivering the real-time news and in-depth analysis that underpins the value of the Bloomberg Terminal. Their steady revenue streams, bolstered by advertising and subscriptions, reinforce the company's financial stability and extensive reach within the financial media sphere.

Bloomberg's Foreign Exchange (FX) Trading Platform

Bloomberg's Foreign Exchange (FX) trading platform is a prime example of a Cash Cow within the Bloomberg BCG Matrix. It operates in the mature, high-volume FX market, a segment where Bloomberg has consistently held a substantial market share and established a strong presence.

The platform serves as a crucial independent venue for interbank transactions, providing essential electronic connectivity and contributing significantly to market liquidity and execution efficiency. This consistent role in a stable, large market ensures reliable and substantial revenue generation for Bloomberg.

- Market Dominance: Bloomberg's FX platform is a leading venue for global currency trading, facilitating a significant portion of daily FX volumes.

- Stable Revenue Stream: The high-volume, mature nature of the FX market provides a predictable and consistent revenue source through transaction fees and platform subscriptions.

- Liquidity Provision: By offering robust electronic connectivity and a deep pool of liquidity, the platform attracts and retains key market participants, reinforcing its Cash Cow status.

Bloomberg Industry Group Products (Law, Tax, Government)

Bloomberg Law, Tax, and Government are considered Cash Cows within the Bloomberg BCG Matrix. These specialized platforms serve distinct professional markets, leveraging Bloomberg's robust data and analytics capabilities. Their established market share and consistent revenue generation solidify their position as stable, high-performing assets.

These products are designed for professionals in legal, tax, and government affairs, offering critical data, news, and analytical tools. For instance, Bloomberg Law provides comprehensive legal research, while Bloomberg Tax delivers essential tax information and compliance tools. Bloomberg Government focuses on legislative tracking and regulatory analysis.

- Bloomberg Law: Offers extensive legal research, case law, and regulatory information.

- Bloomberg Tax: Provides in-depth tax analysis, news, and compliance solutions.

- Bloomberg Government: Delivers insights into legislative processes, lobbying, and federal contracts.

These segments benefit from Bloomberg's strong brand recognition and deep integration into the workflows of their target audiences, ensuring continued demand and profitability. In 2024, the demand for specialized, accurate data in these sectors remained exceptionally high, driven by evolving regulations and complex market dynamics.

Bloomberg's asset management arm, particularly its index and ETF products, functions as a cash cow. These offerings tap into the vast demand for passive investment vehicles, benefiting from Bloomberg's established brand and data infrastructure. The steady inflows into these products generate consistent revenue.

The company's suite of fixed income analytics and trading solutions also represents a significant cash cow. Serving a mature market with high transaction volumes, these tools provide essential data and execution capabilities for bond market participants. This reliability ensures a predictable income stream.

Bloomberg's extensive historical financial data archives are a critical asset, underpinning many of its products. Access to and licensing of this deep well of information is a consistent revenue generator, particularly for quantitative analysts and researchers. The enduring need for historical context in financial analysis solidifies this position.

Bloomberg's commitment to data accuracy and breadth in these areas, especially in fixed income where data granularity is paramount, ensures its continued relevance. In 2024, the demand for sophisticated fixed income analytics remained robust, driven by interest rate volatility and evolving credit markets.

What You’re Viewing Is Included

Bloomberg BCG Matrix

The Bloomberg BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no incomplete sections, and no demo content – just the comprehensive strategic analysis ready for your business planning needs. You can trust that the insights and visualizations presented here are exactly what you'll be working with to make informed decisions about your product portfolio. This preview ensures complete transparency, so you know precisely the value you are acquiring for your strategic endeavors.

Dogs

Within the vast Bloomberg Terminal, some older analytical tools or specialized functions see very little use. These legacy features, though part of the extensive platform, consume maintenance resources that far outweigh their current utility or revenue generation.

For instance, while specific historical data retrieval functions might still exist, their adoption rate among the millions of daily users is likely negligible, potentially representing less than 0.1% of total terminal interactions for certain niche modules as of late 2024.

These components can be classified as Dogs in the BCG Matrix framework because they exhibit minimal growth prospects and have limited current market relevance, despite the ongoing cost to support them.

Bloomberg's extensive data catalog includes highly specialized feeds for niche markets. Some of these, designed for past specific demands or with limited broader appeal, may see low subscriber numbers and minimal new revenue generation. For instance, a data feed focused on historical commodity pricing for a single, now-defunct mining operation might fall into this category.

These specialized data products, while part of Bloomberg's comprehensive offering, can be characterized as low-growth assets. Their market share is typically small when contrasted with Bloomberg's widely adopted data streams covering major asset classes or global economic indicators. This positioning places them in the Dogs quadrant of the BCG Matrix, indicating limited current and future potential.

Certain niche or regional print publications within Bloomberg's portfolio might be classified as Dogs in the BCG Matrix. These publications often operate in shrinking print media markets where readership is declining, directly impacting their revenue generation. For instance, while the overall print advertising revenue in the U.S. saw a slight increase in some sectors in 2023, niche publications catering to very specific, often older, demographics continue to face headwinds.

Underutilized or Obsolete Third-Party Integrations

Bloomberg's extensive platform relies on a network of third-party integrations, connecting users to a vast array of applications and data. However, as technology evolves, some of these connections can become outdated or less utilized, impacting efficiency and resource allocation.

These underutilized or obsolete integrations can represent a drag on the platform, consuming valuable development and maintenance resources without yielding proportional benefits. For instance, if a particular data feed integration sees a significant drop in user queries, it might be a candidate for re-evaluation. In 2024, companies across the financial technology sector are increasingly scrutinizing their integration portfolios to optimize operational costs.

- Resource Drain: Maintaining legacy integrations diverts engineering and support staff from developing new, high-impact features.

- Opportunity Cost: Resources spent on underperforming integrations could be reinvested in more promising areas, such as AI-driven analytics or enhanced user experience features.

- Security Risks: Outdated integrations may carry unpatched vulnerabilities, posing potential security threats to the broader platform.

- Declining Relevance: As newer, more efficient alternatives emerge, user engagement with older integrations naturally wanes, diminishing their strategic value.

Infrequently Updated Proprietary Software Modules

Within Bloomberg's extensive software suite, certain proprietary modules might be infrequently updated. These could represent legacy tools that are no longer central to current market demands or user workflows. For instance, a module designed for a niche financial product that has seen declining trading volumes might fall into this category.

Such modules, if they cater to a stagnant or shrinking market and exhibit low adoption rates, can be classified as Dogs in the Bloomberg BCG Matrix context. They consume valuable maintenance resources and internal development attention without contributing significantly to new revenue streams or enhancing Bloomberg's competitive edge. In 2024, financial technology firms are increasingly focusing on agile development and sunsetting underutilized products to optimize R&D spending.

- Low Market Attractiveness: Modules serving niche or declining financial instruments.

- Low Relative Market Share: Tools with minimal user engagement or integration into core client workflows.

- Resource Drain: Continued maintenance costs without corresponding revenue generation.

- Strategic Re-evaluation: Potential for sunsetting or replacement with more modern, integrated solutions.

Dogs in the Bloomberg BCG Matrix represent products or services with low market share and low growth prospects. These offerings often consume resources without generating significant returns, similar to how legacy data feeds for very niche markets might see minimal user interaction. For example, a data product focused on historical trading volumes for a defunct cryptocurrency could be a prime candidate for the Dog quadrant.

Maintaining these underperforming assets can divert valuable development and support resources from more promising ventures. In 2024, many financial technology firms are actively reviewing their product portfolios to identify and divest or sunset such Dog-like offerings to optimize operational efficiency and reinvest in growth areas.

The strategic implication is to either divest these Dogs or find ways to minimize their cost to maintain, freeing up capital for investments in Stars or Question Marks with higher potential. For instance, Bloomberg might transition a low-usage data feed to an on-demand model rather than continuous maintenance.

These elements are characterized by their low market attractiveness and low relative market share, leading to a drain on resources without strategic upside. Their continued existence often represents an opportunity cost, as resources could be better allocated elsewhere.

Question Marks

Bloomberg's expansion into emerging markets for specialized financial products fits the profile of a question mark in the BCG matrix. These ventures target regions with high growth potential, such as parts of Southeast Asia and Africa, where financial infrastructure is developing. For instance, in 2024, Bloomberg launched enhanced data services tailored for the Indonesian and Nigerian stock exchanges, aiming to capture early market share in these rapidly evolving financial landscapes.

Bloomberg's advanced wealth management technology solutions, while primarily serving institutional finance, are positioned to address the evolving needs of the high-growth wealth tech sector. Beyond its core data provision, Bloomberg's potential lies in integrating sophisticated analytics and client engagement tools tailored for this dynamic market. The wealth management technology sector is experiencing rapid expansion, with a surge in new entrants and a significant shift in client demands towards personalized digital experiences.

Capturing a substantial share in this competitive landscape would necessitate considerable investment from Bloomberg, despite the sector's robust growth prospects. For instance, the global wealth management market is projected to reach $100 trillion by 2025, with technology playing a pivotal role in this expansion. New entrants are often agile, leveraging AI and machine learning to offer innovative solutions, requiring Bloomberg to enhance its own offerings to remain competitive.

The blockchain and DLT data sector represents a dynamic, high-growth area within finance. While Bloomberg's overall market presence is strong, its share in highly specialized blockchain and DLT data and analytics is likely still in its nascent stages of development. This means new offerings in this space, despite their considerable potential, would initially command a low market share.

Consequently, blockchain and DLT data offerings would likely be categorized as Question Marks within the Bloomberg BCG Matrix. This classification signifies that these ventures require significant investment to cultivate market leadership and capitalize on their high-growth potential. For instance, the global blockchain market size was projected to reach $10.45 billion in 2023 and is expected to grow substantially in the coming years.

Hyper-Niche AI Applications Beyond Core Financial Analytics

Bloomberg is likely positioning hyper-niche AI applications, like predictive models for emerging asset classes or nuanced behavioral finance insights, as Question Marks within their BCG Matrix. These areas represent significant growth potential, mirroring the characteristics of a nascent market with low current adoption but high future promise.

These specialized AI tools require substantial investment in research and development to refine their accuracy and market fit. For instance, AI models predicting price movements in the rapidly evolving decentralized finance (DeFi) sector, which saw total value locked (TVL) fluctuate significantly in 2024, represent such a niche.

- Predictive analytics for nascent digital asset markets: AI models forecasting trends in tokenized real estate or specific DeFi protocols.

- Behavioral finance insights for retail investors: AI analyzing sentiment and trading patterns to predict individual investor reactions to market events.

- AI-driven compliance for emerging financial regulations: Tools designed to navigate the complexities of new regulatory frameworks in specialized financial products.

Partnerships and Investments from Bloomberg Beta

Bloomberg Beta, Bloomberg's venture capital arm, actively invests in early-stage startups driving financial innovation and new technologies. For instance, in 2024, Bloomberg Beta continued its focus on areas like AI in finance and data analytics, though specific investment figures for individual startups are not publicly disclosed.

Any new product or service emerging from these investments would initially be classified as a 'Question Mark' within the Bloomberg BCG Matrix. These are ventures in potentially high-growth sectors but currently possess a low market share relative to Bloomberg's established offerings.

These 'Question Mark' initiatives demand significant capital investment and strategic development to mature. Their success hinges on their ability to capture market share and become sustainable revenue streams for Bloomberg.

- Bloomberg Beta's focus: Early-stage startups in financial technology and new tech.

- 'Question Mark' classification: New products/services from these investments, high growth potential, low current market share.

- Investment needs: Substantial capital and strategic nurturing for scaling.

- 2024 context: Continued emphasis on AI and data analytics within financial services.

Question Marks in the Bloomberg BCG Matrix represent new ventures with high growth potential but currently low market share. These often include emerging technologies or expansion into underdeveloped markets. Bloomberg's investment in specialized AI for predicting trends in nascent digital asset markets, like tokenized real estate, exemplifies this category. These initiatives require substantial investment to gain traction and compete effectively.

The classification of these ventures as Question Marks underscores the need for strategic resource allocation. For example, the global AI in finance market was projected to grow significantly, with specific niche applications demanding focused development. Bloomberg's venture capital arm, Bloomberg Beta, actively seeks out such disruptive technologies, indicating a strategic push into these uncertain but potentially lucrative areas.

Success for these Question Marks hinges on their ability to transition into Stars or Cash Cows, requiring careful management and market penetration strategies. The blockchain and DLT data sector, for instance, shows immense promise, with market size projections indicating substantial future growth, but Bloomberg's current share in this specialized data is minimal, necessitating investment to capture this potential.

| Venture Area | BCG Classification | Growth Potential | Market Share | Investment Need |

|---|---|---|---|---|

| Emerging Markets Data Services | Question Mark | High | Low | High |

| Wealth Tech Solutions | Question Mark | High | Low | High |

| Blockchain & DLT Data | Question Mark | High | Low | High |

| Niche AI Applications (e.g., DeFi) | Question Mark | High | Low | High |

| Bloomberg Beta Investments | Question Mark (new ventures) | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, drawing from company financial reports, industry growth statistics, and competitive analysis to provide a clear strategic overview.