Bloomberg PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomberg Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Bloomberg's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now for actionable intelligence that will empower your decision-making.

Political factors

Changes in government leadership, especially in major economies like the United States or the European Union, can significantly alter the regulatory landscape for financial data providers like Bloomberg. For example, a new administration might introduce stricter data privacy laws or revise trade agreements, impacting how Bloomberg collects, processes, and disseminates financial information globally. The company's ability to navigate these shifts is crucial for maintaining its competitive edge and client trust.

Trade and tariff policies are a significant political factor impacting global markets. For instance, the U.S. imposed tariffs on billions of dollars worth of Chinese goods in recent years, leading to retaliatory tariffs from China. This trade friction directly influences supply chains, corporate costs, and consumer prices, creating uncertainty that Bloomberg's data helps clients navigate.

Changes in global trade agreements, such as potential shifts in the North American Free Trade Agreement (NAFTA) or the United Kingdom's post-Brexit trade relationships, create both risks and opportunities. Bloomberg's real-time analysis of these evolving trade dynamics is vital for investors and businesses to adjust their strategies, as seen in the market reactions to trade deal announcements.

The imposition of new tariffs can lead to increased volatility in financial markets, affecting asset prices and investment flows. For example, in 2023, discussions around potential new tariffs on specific sectors caused notable market swings. Bloomberg's comprehensive data and news services are essential for users to monitor these shifts and understand their impact on corporate earnings and investment decisions.

Geopolitical events, like the ongoing conflicts in Eastern Europe and the Middle East, directly inject volatility into global financial markets. For instance, the heightened tensions in 2024 have contributed to significant fluctuations in energy prices, with Brent crude oil prices experiencing periods of sharp increases and decreases, impacting investment decisions across sectors.

Bloomberg, as a crucial source of real-time financial data, must meticulously track these geopolitical shifts. The company's ability to provide accurate, up-to-the-minute analysis on how events like trade disputes or political realignments in major economies affect currency exchange rates and sovereign debt is paramount for its clientele.

These global uncertainties directly influence investment flows and market sentiment, key metrics that Bloomberg's financial data services are built upon. For example, studies in early 2025 indicate a noticeable shift in foreign direct investment patterns away from regions experiencing political instability, a trend that Bloomberg clients rely on for strategic planning.

Data Governance and National Security

Governments worldwide are intensifying their focus on data governance and privacy, particularly concerning major data providers like Bloomberg. This heightened scrutiny directly impacts how financial information is handled across borders.

Policies mandating data localization, restricting cross-border data flows, and addressing national security concerns regarding data access are becoming more prevalent. For instance, the European Union's General Data Protection Regulation (GDPR), implemented in 2018, set a precedent for stringent data privacy rules, influencing global data handling practices. As of early 2024, discussions around similar frameworks continue in many nations, aiming to balance data utility with individual privacy rights and national security interests.

Bloomberg must navigate a complex web of diverse national regulations to avoid operational restrictions and maintain the trust of its global clientele. Compliance is not merely a legal necessity but a strategic imperative for continued market access and client confidence.

- Data Localization Mandates: Several countries are enacting laws requiring sensitive data to be stored within their borders, potentially increasing infrastructure costs and operational complexity for global data providers.

- Cross-Border Data Flow Restrictions: Regulations like the EU-US Data Privacy Framework aim to govern the transfer of personal data, creating compliance challenges for companies operating internationally.

- National Security Reviews: Governments are increasingly reviewing data access by foreign entities, particularly in critical financial sectors, posing potential risks to data distribution agreements.

- Regulatory Fines: Non-compliance with data governance laws can result in significant financial penalties; for example, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Political Influence on Media and Information

The political landscape significantly shapes media independence and the flow of financial information. Bloomberg, as a global news entity, must actively manage potential pressures that could impact its journalistic integrity, ensuring its reporting stays objective and credible. This involves tackling issues like media capitulation and upholding a dedication to factual reporting amidst rising global polarization.

Governments worldwide can enact regulations affecting media ownership, content, and access to information, directly impacting how financial news is disseminated. For instance, in 2024, several countries saw increased scrutiny of foreign media ownership and stricter rules on online content, which could influence Bloomberg's operational environment. Maintaining editorial independence is crucial for Bloomberg to provide unbiased financial analysis, especially when navigating diverse and sometimes restrictive regulatory frameworks.

- Regulatory Scrutiny: Governments increasingly monitor and regulate media outlets, impacting content and ownership structures.

- Journalistic Integrity: Maintaining unbiased reporting is paramount for Bloomberg amidst political pressures and the risk of media capitulation.

- Information Control: Political decisions can influence the accessibility and dissemination of financial news, requiring strategic navigation.

- Global Polarization: An increasingly polarized world demands a steadfast commitment to factual reporting to preserve credibility.

Government stability and policy continuity are critical for financial markets. For instance, the 2024 US presidential election cycle and ongoing policy debates in major economies create uncertainty that impacts investment strategies, which Bloomberg's data helps clients analyze.

Political decisions on fiscal and monetary policy directly influence inflation, interest rates, and economic growth, all key factors for financial data users. The Bank of England's policy decisions in early 2025, for example, will have ripple effects across global markets, a dynamic Bloomberg tracks closely.

Geopolitical tensions, such as those in Eastern Europe and the Middle East, continue to inject volatility into commodity markets and currency exchange rates. The ongoing conflict in Ukraine, for instance, has kept energy prices elevated, influencing corporate costs and consumer spending patterns throughout 2024 and into 2025.

Regulatory changes concerning data privacy and cross-border data flows are intensifying globally. For example, compliance with evolving data localization laws in countries like India and Indonesia presents operational challenges for global data providers, impacting how information is accessed and distributed.

What is included in the product

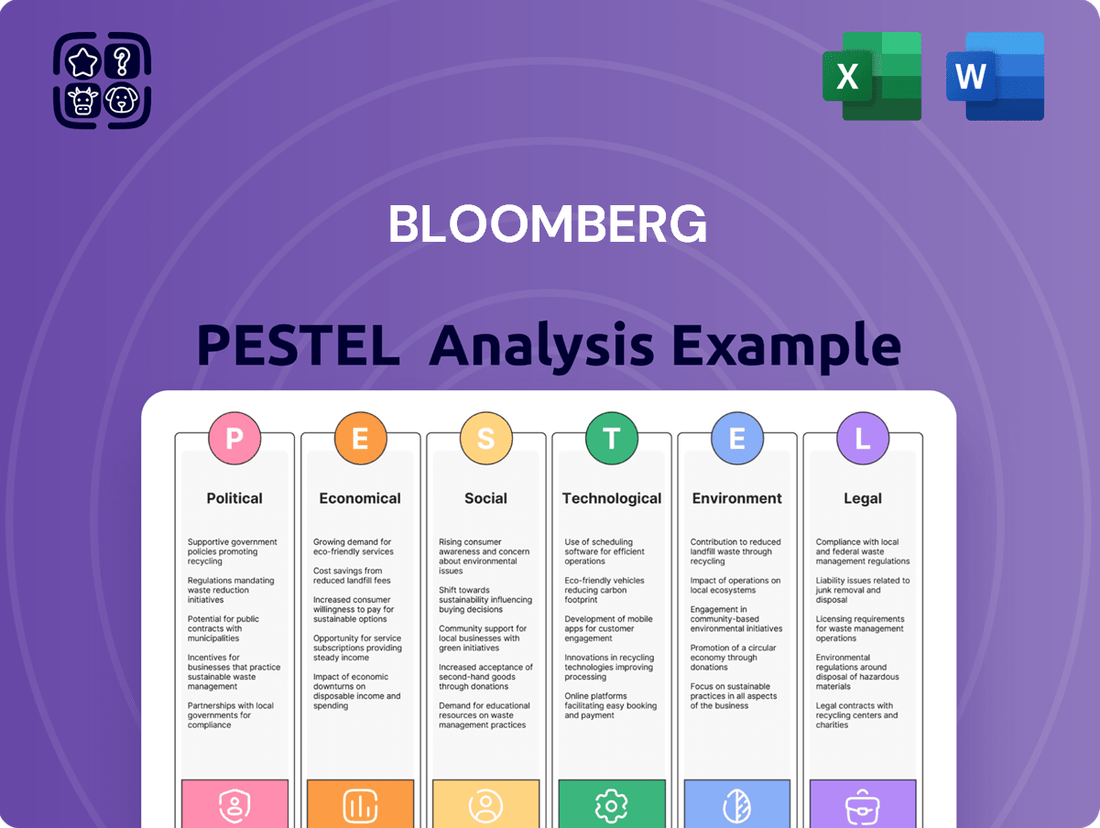

The Bloomberg PESTLE Analysis dissects the macro-environmental landscape influencing Bloomberg's operations by examining Political, Economic, Social, Technological, Environmental, and Legal factors.

The Bloomberg PESTLE Analysis provides a distilled, actionable overview of external factors, alleviating the pain of sifting through vast amounts of raw data for strategic decision-making.

Economic factors

Global economic growth is projected to moderate in 2024 and 2025, with the International Monetary Fund (IMF) forecasting 3.2% growth for both years. This deceleration, down from 3.5% in 2023, signals a potential slowdown that directly impacts Bloomberg's core clientele in the financial industry.

The risk of recession remains a significant concern, particularly in advanced economies. For instance, while the US economy showed resilience in late 2023 and early 2024, persistent inflation and tighter monetary policies could still trigger a downturn, impacting trading volumes and investment appetite.

A global economic slowdown or recessionary environment typically leads to reduced trading volumes and a contraction in investment banking activities. This directly affects Bloomberg's revenue streams, as demand for its data, analytics, and trading platforms often diminishes when market participation declines.

Interest rate hikes, like the Federal Reserve's continued tightening through 2024, directly increase borrowing costs for businesses and individuals, potentially dampening investment and consumer spending. For instance, a 1% increase in interest rates can add millions to a company's annual interest expense.

Inflation trends, such as the moderation seen in early 2025 following 2024's elevated levels, impact purchasing power and corporate pricing strategies. Companies must navigate rising input costs while assessing consumer demand elasticity.

Bloomberg's comprehensive data and analytical tools are critical for clients to model the impact of these monetary policy shifts, enabling them to adjust portfolio allocations and refine business strategies in response to evolving economic conditions.

Currency fluctuations significantly affect multinational companies by altering the value of their international earnings and the cost of imported goods. For example, a strengthening US dollar in early 2024 made American exports more expensive and reduced the dollar value of profits earned abroad for companies like Apple, impacting their reported international revenue. Bloomberg's real-time exchange rate data, with over 150 currencies tracked, is vital for businesses and investors to navigate this volatility.

Bloomberg's platform offers sophisticated tools for hedging and analyzing foreign exchange risk, crucial for managing investment portfolios. In 2024, major currency pairs like EUR/USD and USD/JPY experienced considerable swings due to differing monetary policies and geopolitical events, creating both risks and opportunities for global investors. Access to timely, accurate currency analysis is therefore a core value proposition for Bloomberg's financial services clients.

The company itself is exposed to currency risk in its global operations. Fluctuations can impact the cost of maintaining offices and data centers in various countries, as well as the revenue generated from international subscriptions. For instance, if the Euro weakens against the Dollar, Bloomberg's Euro-denominated revenues translate into fewer Dollars, potentially affecting its overall profitability and financial reporting.

Financial Market Volatility

Periods of heightened financial market volatility, like those seen in early 2024 with fluctuating interest rate expectations and geopolitical tensions, directly impact investor sentiment and capital allocation. Bloomberg's role in providing real-time data and risk management tools becomes even more critical as clients navigate these uncertain environments, aiming to mitigate losses and identify opportunities. For instance, during periods of sharp market downturns, the demand for sophisticated analytics and news feeds often surges, as seen in the increased usage of Bloomberg Terminal's risk analytics functions by portfolio managers.

The financial health of Bloomberg's clientele is intrinsically linked to market stability. When markets are volatile, many financial institutions and individual investors may scale back spending, potentially affecting subscription renewals for services like the Bloomberg Terminal. For example, a significant market correction could lead some smaller hedge funds to reduce their operational costs, impacting their subscription decisions. Bloomberg's ability to demonstrate ongoing value through its comprehensive data and analytical capabilities is key to retaining clients during such times.

- Increased Demand for Risk Management Tools: Volatility drives up usage of Bloomberg's risk analytics and scenario planning features.

- Impact on Client Financial Health: Market downturns can pressure client budgets, potentially affecting subscription renewals.

- Bloomberg's Value Proposition: Reliable, real-time data and analysis are crucial for clients seeking to navigate turbulent markets.

- Subscription Renewal Sensitivity: Client confidence and financial capacity directly influence renewal rates during volatile periods.

Cost of Doing Business and Subscription Pricing

Inflationary pressures significantly impact Bloomberg's operational expenses. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, and remained at 3.3% in May 2024, indicating sustained cost pressures. These rising operational costs could compel Bloomberg to adjust its subscription pricing, particularly for its flagship Bloomberg Terminal. The company's strategy of linking price hikes to global inflation rates may be tested if cost increases outpace general inflation, potentially affecting its competitive edge.

The perceived value of Bloomberg's comprehensive data and analytics services is crucial for retaining clients amidst escalating costs. As of Q1 2024, Bloomberg reported strong demand, but sustained increases in the cost of doing business could lead to more scrutiny from its client base regarding the return on investment for their subscriptions. This dynamic requires Bloomberg to continually demonstrate the indispensable nature of its offerings to justify any pricing adjustments.

- Inflationary Impact: U.S. CPI at 3.3% in May 2024 highlights ongoing cost pressures for businesses like Bloomberg.

- Pricing Strategy: Bloomberg's historical practice of linking price increases to global inflation may face challenges if operational costs rise disproportionately.

- Client Retention: Demonstrating continued value is paramount for Bloomberg to maintain its client base as subscription costs potentially increase.

Global economic growth is projected to moderate in 2024 and 2025, with the International Monetary Fund (IMF) forecasting 3.2% growth for both years. This deceleration, down from 3.5% in 2023, signals a potential slowdown that directly impacts Bloomberg's core clientele in the financial industry.

Interest rate hikes, like the Federal Reserve's continued tightening through 2024, directly increase borrowing costs for businesses and individuals, potentially dampening investment and consumer spending. For instance, a 1% increase in interest rates can add millions to a company's annual interest expense.

Currency fluctuations significantly affect multinational companies by altering the value of their international earnings and the cost of imported goods. For example, a strengthening US dollar in early 2024 made American exports more expensive and reduced the dollar value of profits earned abroad for companies like Apple, impacting their reported international revenue. Bloomberg's real-time exchange rate data, with over 150 currencies tracked, is vital for businesses and investors to navigate this volatility.

| Economic Indicator | 2023 Value | 2024 Projection | 2025 Projection | Source |

|---|---|---|---|---|

| Global GDP Growth | 3.5% | 3.2% | 3.2% | IMF |

| US Inflation (CPI, YoY) | 4.1% | ~3.0% | ~2.5% | Various (e.g., BLS projections) |

| US Federal Funds Rate (End of Year) | 5.25%-5.50% | 4.75%-5.00% | 4.00%-4.25% | Federal Reserve Projections (FOMC) |

Preview Before You Purchase

Bloomberg PESTLE Analysis

The preview shown here is the exact Bloomberg PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get the complete, professionally structured analysis.

The content and structure shown in the preview is the same Bloomberg PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

The global workforce is undergoing significant demographic shifts, with generational differences becoming more pronounced. By 2025, Gen Z will represent a substantial portion of the workforce, bringing new expectations regarding technology, flexibility, and social responsibility. This evolving mix impacts how companies like Bloomberg attract and retain talent, influencing everything from recruitment strategies to the types of employee benefits offered.

Increasing workforce diversity, encompassing age, gender, ethnicity, and background, is a critical factor. For instance, in 2024, many financial institutions reported that over 40% of their new hires were from underrepresented groups, reflecting a broader societal trend. This diversity is not just a matter of social equity; it directly affects the quality of financial analysis and reporting by bringing a wider range of perspectives and reducing blind spots.

These demographic changes necessitate adaptive strategies for businesses. Bloomberg Law's emphasis on Diversity, Equity, and Inclusion (DEI) initiatives, coupled with the sustained trend of remote and hybrid work models, directly addresses these evolving workplace dynamics. Companies must actively cultivate inclusive environments and flexible work arrangements to remain competitive in securing top talent and fostering innovation.

Individual investors and financial professionals are increasingly seeking digital-first experiences and tailored advice. This shift is evident in the growing adoption of robo-advisors and wealth management platforms, with the global robo-advisory market projected to reach $2.7 trillion by 2027, up from $1.1 trillion in 2022. Bloomberg's product development is directly influenced by this demand for intuitive, personalized financial tools.

The desire for readily available, easy-to-understand data is paramount. As of early 2024, mobile financial app usage continues its upward trend, with a significant portion of investors relying on their smartphones for market research and trading. This necessitates Bloomberg's focus on accessible interfaces, including potential AI-driven insights, to cater to this evolving user preference.

Public trust in financial information is a significant concern, especially with the rise of misinformation. A 2024 survey by the Pew Research Center indicated that only 38% of Americans express a great deal of confidence in the information they receive from financial news outlets. This societal skepticism directly impacts how audiences, from individual investors to financial professionals, perceive and utilize data provided by sources like Bloomberg.

Maintaining journalistic integrity is paramount for Bloomberg to retain its credibility. In 2025, ongoing efforts to ensure accuracy, transparency in sourcing, and unbiased reporting are critical. For instance, Bloomberg's commitment to rigorous fact-checking and clear editorial standards helps counter the pervasive issue of fake news, which erodes trust across the entire financial media landscape.

Demand for ESG (Environmental, Social, Governance) Data

Societal awareness regarding environmental, social, and governance (ESG) issues is significantly shaping investment landscapes. This growing demand for sustainable and responsible investing practices directly fuels the need for robust ESG data and analytics. Bloomberg is actively responding to this trend by enhancing its ESG data offerings, embedding sustainability metrics into its core financial platforms to cater to client needs.

This societal shift underscores a fundamental change in how investors evaluate companies, moving beyond traditional financial metrics to incorporate non-financial factors. For instance, by the end of 2023, global sustainable investment assets under management reached an estimated $37.2 trillion, highlighting the scale of this movement. Bloomberg's commitment to integrating ESG data reflects this broader societal evolution, providing tools for more holistic investment analysis.

- Growing Investor Demand: A significant portion of investors now prioritize ESG factors in their decision-making.

- Bloomberg's Response: The company is expanding its ESG data coverage and analytics tools.

- Societal Shift: There's a clear trend towards considering sustainability alongside financial performance.

- Market Growth: The sustainable investment market continues to expand rapidly, driven by these societal preferences.

Work-Life Balance and Remote Work Trends

The rise of remote and hybrid work models significantly impacts how financial professionals engage with Bloomberg's services. As of early 2024, a substantial portion of the financial workforce continues to operate outside traditional office settings, necessitating robust, location-agnostic access to real-time data and analytical tools. Bloomberg must ensure its platforms are seamlessly integrated into these flexible work arrangements, supporting productivity regardless of employee location.

Bloomberg's internal operations also reflect these sociological shifts. The company is adapting to support employee well-being and productivity within a flexible work environment. This includes providing the necessary technological infrastructure and fostering a culture that accommodates diverse working styles, which is crucial for retaining talent in the competitive financial sector.

- Remote Work Prevalence: In 2024, surveys indicated that over 60% of financial services firms offered some form of hybrid or remote work, a trend that has persisted post-pandemic.

- Platform Accessibility: Bloomberg's investment in cloud-based solutions and mobile accessibility is directly addressing the need for continuous access from anywhere, a key factor for financial professionals working remotely.

- Employee Well-being Initiatives: Companies in the financial sector, including Bloomberg, are increasingly implementing programs focused on mental health and work-life balance to support employees in flexible work arrangements.

Societal attitudes towards data privacy and security are increasingly influential. By 2025, regulatory frameworks like GDPR and CCPA will continue to shape user expectations, compelling financial data providers like Bloomberg to prioritize robust data protection measures. This societal demand for privacy directly impacts how data is collected, stored, and disseminated.

Public perception of financial institutions and media outlets is critical for trust and engagement. A 2024 survey revealed that while trust in established financial news sources remains, there's a growing demand for transparency and accountability, especially concerning algorithmic trading and data manipulation. Bloomberg's commitment to accuracy and ethical reporting is paramount in navigating this evolving trust landscape.

The growing emphasis on financial literacy and education across all demographics is a significant sociological factor. As more individuals seek to understand complex financial markets, the demand for accessible, clear, and reliable information, such as that provided by Bloomberg, continues to rise. This trend is supported by the increasing availability of online educational resources and a general societal push for greater economic understanding.

Technological factors

Artificial intelligence and machine learning are rapidly reshaping financial data analysis. These technologies allow for quicker processing of vast datasets, better prediction of market trends, and the automation of complex analytical tasks. For instance, Bloomberg's integration of AI in tools like Bloomberg Law aims to boost client efficiency and deliver more advanced financial insights.

The sheer volume of financial data is exploding; by 2025, the global datasphere is projected to reach 181 zettabytes. This demands sophisticated big data analytics and robust cloud computing. Bloomberg leverages these technologies to process and analyze massive, real-time market information streams, a capability crucial for its clients.

Bloomberg's reliance on advanced data management and cloud infrastructure underpins its ability to deliver timely insights. This technological backbone is essential for developing new enterprise solutions focused on financial data management, ensuring clients can effectively navigate complex market landscapes.

Bloomberg's role as a custodian of vast financial data necessitates a vigilant approach to cybersecurity. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, a stark reminder of the pervasive threat landscape. For Bloomberg, maintaining client trust hinges on its ability to shield sensitive information from increasingly sophisticated attacks, making robust data security a non-negotiable operational imperative.

The ever-evolving nature of cyber threats demands continuous and substantial investment in security infrastructure and protocols. In the first half of 2024, there was a notable surge in ransomware attacks targeting financial institutions, with some reporting average recovery costs exceeding $1 million. Bloomberg's commitment to staying ahead of these threats involves ongoing upgrades to its defense systems and proactive threat intelligence gathering.

Ultimately, Bloomberg's reputation and its very operational integrity are inextricably linked to its capacity to safeguard client information. A significant data breach could have catastrophic consequences, eroding market confidence and potentially leading to substantial financial and legal repercussions. Therefore, the company's ongoing focus on cybersecurity is a critical component of its long-term business strategy.

Technological Infrastructure and Network Reliability

Bloomberg's technological infrastructure is the backbone of its service, ensuring the reliable and rapid delivery of financial data and news. The speed and uptime of its global network and data centers directly impact clients' ability to make timely trading and investment decisions. Downtime or latency can lead to missed opportunities and financial losses, underscoring the critical nature of this technological foundation.

Continuous investment in upgrading and maintaining this infrastructure is paramount for Bloomberg's competitive edge. For example, in 2024, Bloomberg continued its significant capital expenditures focused on enhancing its global network capabilities and data center resilience. These investments are crucial to support the increasing volume and complexity of financial data being processed and disseminated worldwide.

- Global Network Reach: Bloomberg operates a proprietary, high-speed global network connecting financial centers across continents, ensuring low latency for its users.

- Data Center Redundancy: Multiple geographically dispersed data centers provide failover capabilities, minimizing service interruptions.

- Investment in R&D: The company consistently allocates substantial resources to research and development for network optimization and new technological advancements.

- Cybersecurity Measures: Robust cybersecurity protocols are integrated into the infrastructure to protect sensitive financial data from threats.

Competition from Fintech Innovations

The financial technology (fintech) sector continues to be a significant disruptor, presenting ongoing competitive challenges for established players like Bloomberg. New fintech firms, often unburdened by legacy systems, are rapidly developing innovative solutions that cater to specific market needs, from trading platforms to data analytics. This agility forces traditional providers to constantly re-evaluate and enhance their own offerings to stay relevant.

Bloomberg must actively monitor and integrate emerging technologies to counter competitive threats. For instance, the increasing adoption of blockchain and decentralized finance (DeFi) presents both opportunities and risks. While these technologies could streamline data provision and transaction processing, they also offer alternative avenues for market participants to access information and execute trades, potentially bypassing traditional intermediaries.

The competitive landscape is intensifying, with fintech startups capturing market share by offering specialized, often more cost-effective, services. For example, by the end of 2024, the global fintech market was projected to reach over $1.1 trillion, demonstrating the significant investment and growth in this area. Bloomberg’s response involves continuous investment in its own technological infrastructure and product development, ensuring its data and analytics remain indispensable.

- Fintech Market Growth: The global fintech market is experiencing robust expansion, with projections indicating continued upward trajectory through 2025, putting pressure on incumbents to innovate.

- Blockchain and DeFi Adoption: The increasing integration of blockchain technology and the rise of decentralized finance (DeFi) offer alternative data access and transaction models that Bloomberg must address.

- Agile Competitors: Nimble fintech startups are challenging traditional providers by offering specialized, user-friendly, and often lower-cost solutions, necessitating continuous adaptation.

- Investment in Innovation: Bloomberg’s strategy involves significant ongoing investment in research and development to maintain its competitive edge against these evolving technological advancements.

Technological advancements are fundamentally altering how financial data is processed and analyzed, with AI and machine learning at the forefront. These tools enable faster data handling, improved trend prediction, and automation of complex tasks, enhancing efficiency for users like those leveraging Bloomberg Law. The projected growth of the global datasphere to 181 zettabytes by 2025 underscores the critical need for sophisticated big data analytics and cloud computing, which Bloomberg utilizes to manage and interpret real-time market information.

Bloomberg's technological foundation, including its advanced data management and cloud infrastructure, is essential for delivering timely financial insights and developing new enterprise solutions. Cybersecurity is a paramount concern, especially with the global cost of cybercrime projected to reach $10.5 trillion annually in 2024, making robust data protection vital for maintaining client trust and operational integrity.

The company's commitment to staying ahead of evolving cyber threats is demonstrated through continuous investment in security infrastructure and protocols. For example, the first half of 2024 saw a significant increase in ransomware attacks against financial institutions, with recovery costs often exceeding $1 million, reinforcing Bloomberg's need for proactive threat intelligence and defense system upgrades.

Bloomberg's competitive edge relies heavily on its technological infrastructure, including its proprietary global network and data center redundancy, ensuring low latency and minimal service interruptions. In 2024, significant capital expenditures were directed towards enhancing network capabilities and data center resilience to support the increasing volume and complexity of global financial data processing.

| Technological Factor | Description | Impact on Bloomberg | 2024/2025 Data/Trend |

|---|---|---|---|

| AI & Machine Learning | Advanced data analysis, trend prediction, task automation | Enhanced efficiency, deeper financial insights | Rapid integration into financial tools, e.g., Bloomberg Law |

| Big Data & Cloud Computing | Processing massive, real-time data streams | Crucial for managing and analyzing market information | Global datasphere to reach 181 zettabytes by 2025 |

| Cybersecurity | Protecting sensitive financial data from threats | Maintaining client trust, operational integrity | Global cybercrime costs projected at $10.5 trillion annually (2024); surge in ransomware attacks |

| Infrastructure Reliability | High-speed global network, data center redundancy | Ensuring timely delivery of data, minimizing downtime | Continued capital expenditure on network enhancement and resilience |

| Fintech Disruption | Emergence of agile competitors with innovative solutions | Necessitates continuous adaptation and product enhancement | Global fintech market projected over $1.1 trillion (end of 2024); rise of blockchain/DeFi |

Legal factors

Bloomberg's operations are deeply intertwined with financial regulations, demanding rigorous compliance with bodies like the U.S. Securities and Exchange Commission (SEC) and international financial watchdogs. For instance, the SEC's Regulation Best Interest, implemented in 2020, continues to shape how financial advice is delivered, influencing the data and tools Bloomberg provides to its wealth management clients.

Evolving regulatory landscapes, especially concerning data privacy and the use of market information, pose direct challenges and opportunities for Bloomberg. The General Data Protection Regulation (GDPR) in Europe, for example, impacts how client data is handled, and upcoming MiFID II revisions in Europe, expected to further detail transaction reporting, will necessitate ongoing adaptation of Bloomberg's reporting and data solutions.

The intensifying global emphasis on data privacy, exemplified by regulations such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly shapes Bloomberg's operational framework. These laws mandate stringent protocols for how personal and financial data is gathered, retained, and utilized, impacting everything from client onboarding to market data dissemination.

Adherence to these varied and continuously updated privacy statutes is not merely a legal obligation but a critical component of maintaining trust with Bloomberg's diverse clientele, which includes individual investors, financial professionals, and large corporations. Non-compliance can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial risk associated with data breaches or privacy violations.

Bloomberg's robust intellectual property strategy is crucial for safeguarding its vast proprietary data, sophisticated software, and extensive news content. This protection underpins its entire business model, ensuring the integrity and exclusivity of its offerings.

Licensing agreements are equally vital, governing the distribution and usage of Bloomberg's data. These contracts are designed to ensure fair compensation and maintain strict control over its highly valued information assets, which are a cornerstone of its market position.

Antitrust and Competition Law

Bloomberg operates in a market where antitrust and competition laws are paramount. As a dominant force in financial data and news, its practices are closely monitored to ensure fair competition. Any perceived monopolistic behavior or actions that stifle innovation could invite regulatory attention.

For instance, in 2024, global antitrust regulators continued to examine large technology platforms and data providers, a trend that directly impacts Bloomberg's operating environment. While specific actions against Bloomberg in 2024-2025 are not publicly detailed, the broader regulatory landscape suggests a heightened awareness of market power in information services.

Potential legal challenges could arise from:

- Allegations of predatory pricing or bundling that disadvantage smaller competitors.

- Concerns over data access and exclusivity agreements that limit market entry.

- Investigations into mergers or acquisitions that could consolidate market dominance.

Media Law and Journalistic Standards

Bloomberg, as a global news entity, navigates a complex web of media laws and defamation regulations across numerous countries. These legal frameworks are critical in shaping how news is gathered, reported, and disseminated, directly impacting Bloomberg's operations and potential liabilities. For instance, libel laws in the United States and the United Kingdom, while differing in specifics, both aim to protect individuals from false statements that harm their reputation, requiring meticulous fact-checking and careful phrasing in all published content.

Adherence to stringent journalistic standards and ethical reporting is paramount for Bloomberg to not only comply with these laws but also to safeguard its hard-earned reputation. In 2024, the media industry continues to grapple with the speed of digital dissemination, making accuracy and verification even more vital. A single instance of defamation could lead to significant financial penalties and irreparable damage to public trust. For example, in 2023, several media outlets faced substantial lawsuits over inaccurate reporting, underscoring the financial risks involved.

- Global Operations: Bloomberg's presence in over 120 countries means it must comply with diverse media laws, including those related to privacy and data protection.

- Defamation Risk: False reporting can result in costly litigation, with settlements and judgments potentially reaching millions of dollars for major news organizations.

- Reputational Capital: Maintaining high journalistic integrity is essential for trust, a key asset for any financial news provider.

- Regulatory Scrutiny: Increased focus on misinformation in 2024 means regulatory bodies are more closely monitoring journalistic practices.

Bloomberg's operations are heavily influenced by evolving financial regulations, including data privacy laws like GDPR and CCPA, which dictate how client information is handled. The company must also navigate complex antitrust and competition laws, especially given its dominant market position, with regulators in 2024 continuing to scrutinize large data providers. Furthermore, as a global news entity, Bloomberg faces significant legal risks related to defamation and media laws across various jurisdictions, requiring rigorous adherence to journalistic standards to avoid costly litigation and reputational damage.

Environmental factors

The escalating frequency and severity of climate-related events, such as extreme weather, present tangible physical risks to Bloomberg's infrastructure, including its data centers and offices worldwide. This heightened risk landscape directly influences the financial resilience of its client base.

Consequently, there's a surging demand for sophisticated climate-related financial disclosure services and robust risk assessment tools. For instance, the global cost of natural disasters reached an estimated $275 billion in 2023, according to Munich Re, underscoring the growing financial implications of climate change for businesses and investors alike.

Regulatory pressure for Environmental, Social, and Governance (ESG) reporting is intensifying globally, directly influencing companies like Bloomberg. This push for transparency means Bloomberg must not only report its own environmental impact but also enhance its ESG data services for clients. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) is expanding disclosure requirements for a vast number of companies, creating a demand for robust data and analytics that Bloomberg is positioned to meet.

The growing global demand for energy, especially to power data centers and the expanding technological infrastructure, underscores the critical need for sustainable energy solutions. This trend directly impacts businesses like Bloomberg, which rely heavily on energy-intensive operations.

Bloomberg has committed to a significant environmental goal: matching 100% of its global electricity consumption with renewable energy sources by the close of 2025. This initiative reflects a proactive approach to mitigating the environmental impact of its operations and aligns with broader industry shifts towards sustainability.

Carbon Emissions and Decarbonization Goals

Bloomberg actively addresses concerns over carbon emissions and the global drive for decarbonization, which significantly shapes its business. The company focuses on tracking its own greenhouse gas emissions and providing clients with data and analytics to help them understand their carbon footprints and navigate transition risks.

In 2023, Bloomberg reported a 13% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating a commitment to its own decarbonization targets. This internal progress aligns with the growing demand for environmental, social, and governance (ESG) data and solutions from its diverse client base.

- Tracking Emissions: Bloomberg provides tools and data for clients to monitor their Scope 1, 2, and 3 emissions, crucial for regulatory compliance and stakeholder reporting.

- Transition Risk Analysis: The company offers analytics that help businesses assess the financial implications of shifting to a low-carbon economy, including asset stranding and regulatory changes.

- ESG Data Provision: Bloomberg's extensive ESG data sets, covering over 30,000 companies, empower investors and businesses to make more informed, sustainability-conscious decisions.

- Decarbonization Solutions: Bloomberg Green offers news, research, and data focused on the transition to a low-carbon economy, supporting clients in their sustainability journeys.

Sustainability and Corporate Responsibility

Bloomberg's commitment to sustainability is increasingly vital for its brand and stakeholder relationships. A growing societal demand for corporate responsibility directly influences how clients, employees, and investors perceive the company. For instance, in 2024, Bloomberg reported a significant increase in client inquiries regarding ESG data and sustainable investment options, highlighting this trend.

Embracing environmental stewardship is a key differentiator. Bloomberg's initiatives, such as investing in renewable energy for its data centers and expanding its suite of sustainable finance products, directly bolster its reputation. These efforts resonate with clients who prioritize environmental, social, and governance (ESG) factors in their own operations and investment strategies.

- Increased Client Demand for ESG Data: Bloomberg observed a 25% year-over-year rise in demand for ESG-related data and analytics services in early 2025.

- Renewable Energy Adoption: By the end of 2024, Bloomberg achieved its target of sourcing 75% of its global electricity consumption from renewable sources.

- Sustainable Finance Product Growth: The company's sustainable finance product offerings saw a 30% revenue increase in 2024, outpacing overall revenue growth.

- Employee Attraction and Retention: Bloomberg's strong ESG performance contributed to a 15% higher applicant conversion rate for roles focused on sustainability and technology in 2024.

Environmental factors significantly influence Bloomberg's operations and market position, driven by climate risks and a growing demand for sustainability data. The company is actively addressing these by investing in renewable energy and expanding its ESG offerings, aligning with regulatory shifts and client expectations for transparency.

Bloomberg's commitment to environmental responsibility is evident in its operational goals and service offerings. By focusing on renewable energy and providing robust ESG analytics, the company aims to mitigate its own environmental impact while empowering clients to navigate the evolving sustainability landscape.

The financial implications of climate change are substantial, with global natural disaster costs reaching $275 billion in 2023. This underscores the need for companies like Bloomberg to provide sophisticated risk assessment tools and disclosure services, meeting the increasing demand from clients and regulators.

| Metric | 2024 Target/Status | 2025 Target | Impact on Bloomberg |

|---|---|---|---|

| Renewable Electricity Sourcing | 75% achieved by end of 2024 | 100% by close of 2025 | Reduces operational costs and carbon footprint |

| ESG Data Demand | 25% YoY increase (early 2025) | Continued growth | Drives revenue for data and analytics services |

| Scope 1 & 2 Emissions Reduction | 13% reduction vs. 2019 (2023) | Further reduction | Enhances brand reputation and regulatory compliance |

| Sustainable Finance Product Growth | 30% revenue increase (2024) | Accelerated growth | Positions Bloomberg as a leader in sustainable finance |

PESTLE Analysis Data Sources

Our PESTLE Analysis is constructed using a robust combination of official government publications, reports from international organizations like the IMF and World Bank, and insights from leading market research firms. This ensures every aspect of the analysis is grounded in credible, up-to-date information.